FROM THE DESK OF DEBORAH WEINSWIG

Dollar Stores and the Fragmentation of Grocery Spend

The success of the dollar stores has been one element of the recent discount boom in US retail. This week, we have crunched some numbers on the biggest dollar stores to assess how much share they have taken in the core grocery category. Our figures show that this segment remains niche. But, coupled with grocery discounters and Internet-only retailers, the dollar stores threaten to splinter spend away from the big, established grocery stores.

Here, we focus on the four biggest dollar store chains. In order of decreasing sales, they are Dollar General, Dollar Tree, Family Dollar (acquired by Dollar Tree in 2015) and 99 Cents Only Stores. The 2015 data we discuss below include some estimates, including estimates from partial-year data for Family Dollar and 99 Cents Only.

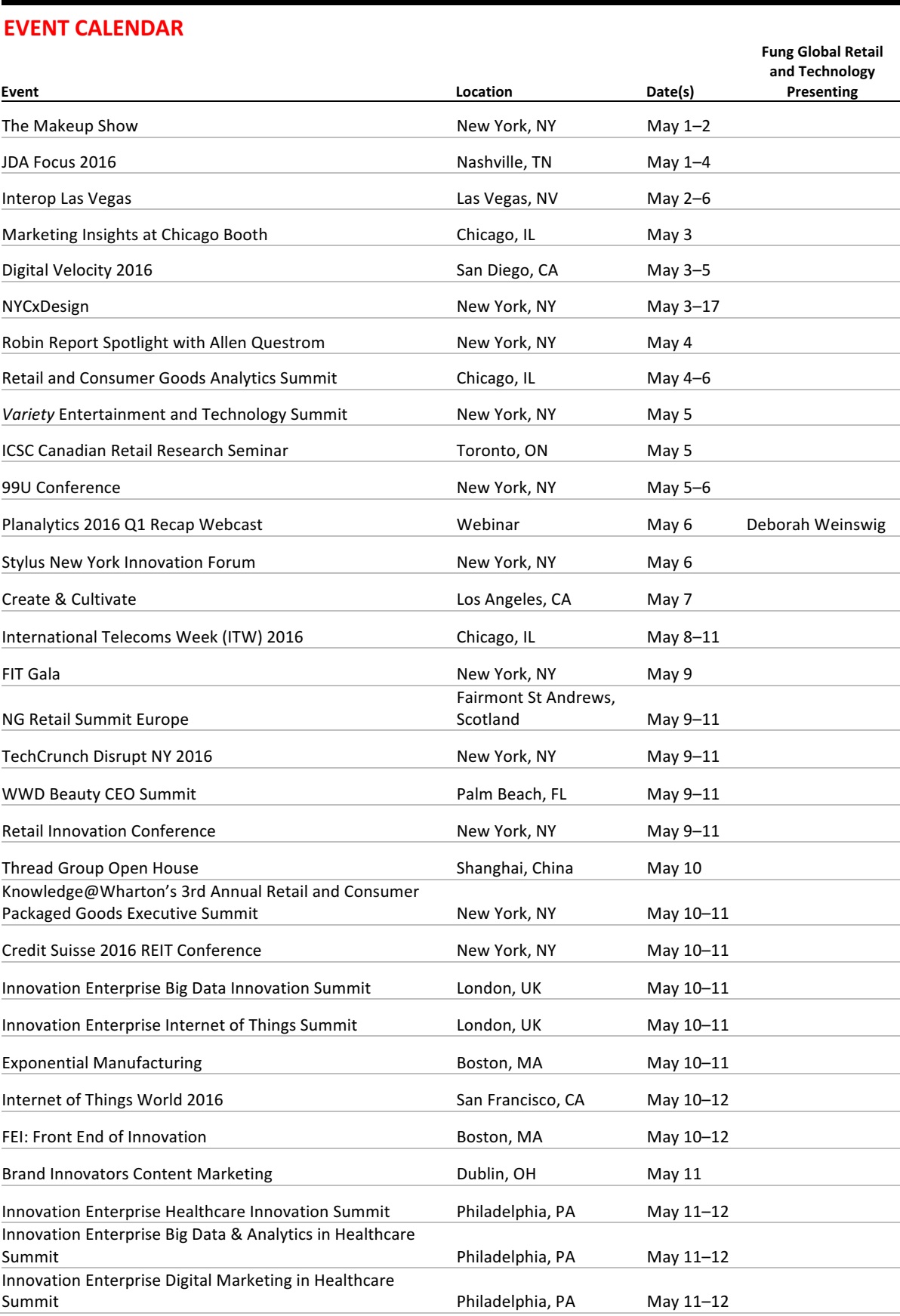

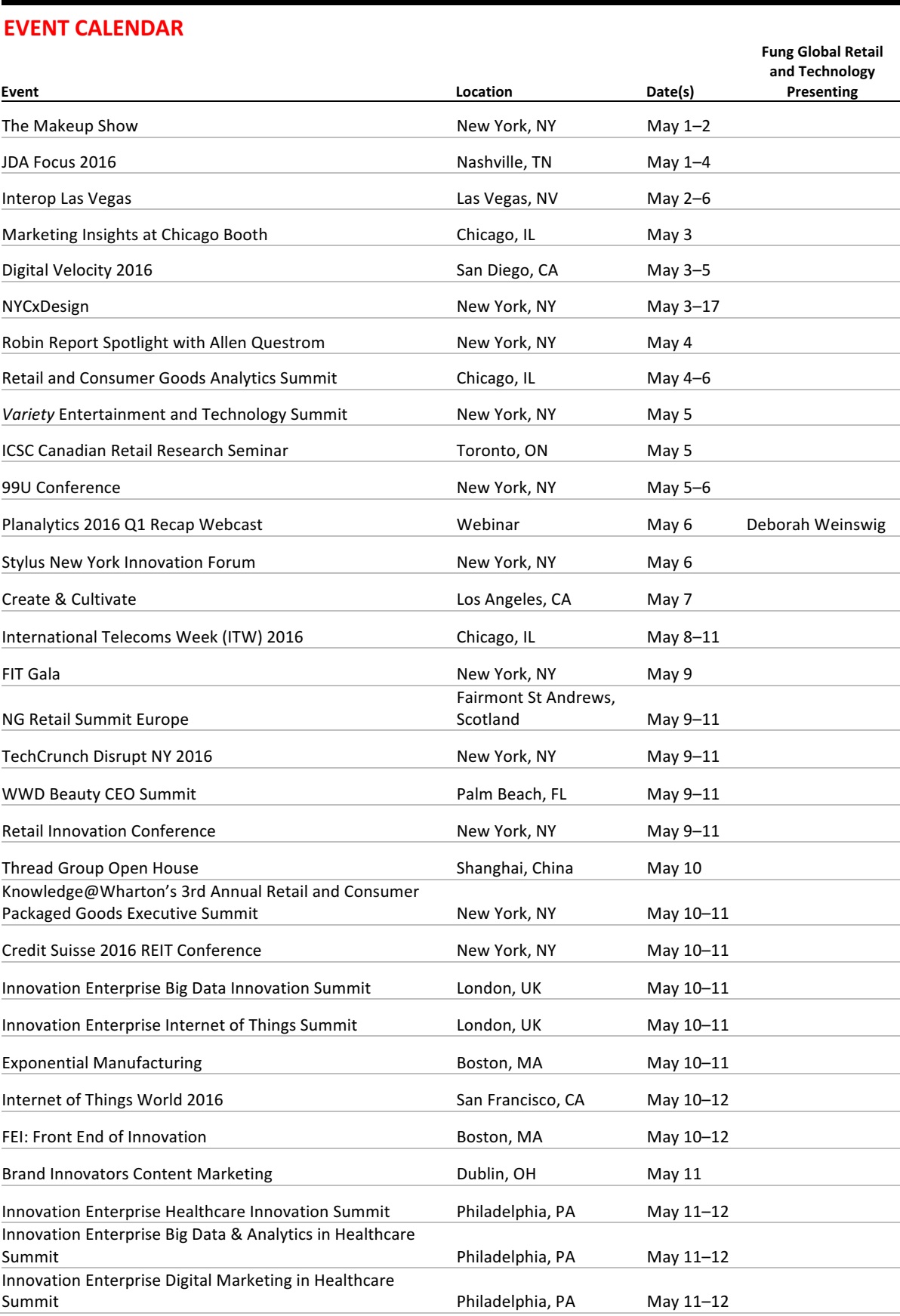

Top Four Dollar-Store Players Grow Sales to $42 Billion

The dollar stores have grown revenues fast. From 2010 through 2015, the top four chains grew their combined total annual revenues from $28 billion to an estimated $42 billion, representing a compound annual growth rate (CAGR) of 8.5%.

Groceries, or “consumables,” which are typically defined by these companies as food, tobacco, health and beauty, and household paper and cleaning products, have driven this growth. Based on company filings, we estimate that these four chains grew their combined annual grocery category sales by just over $10 billion from 2010 through 2015, from $18.3 billion to around $28.6 billion, representing a CAGR of 9.3%.

Consumables have become a more important part of the sector; the category’s contribution to these retailers’ sales increased by approximately three percentage points during the five-year period we looked at. Consumables accounted for 64.8% of total sales at these retailers in 2010 and for an estimated 67.4% of aggregate sales in 2015.

Source: Company reports/Fung Global Retail & Technology

Putting These Billions in Context

That $28.6 billion worth of grocery sales seems huge, unless we look at it relative to the entire US grocery market. Here is some context for our dollar store figures:

- Total sales by grocery retailers stood at exactly $1.0 trillion in 2015, according to Euromonitor International. Our 2015 dollar store grocery estimate is equivalent to just 2.9% of this sector size, up from 2.0% in 2010.

- Based on data from the US Bureau of Economic Analysis, we calculate that total consumer spending on core grocery categories (excluding tobacco and over-the-counter drugs) stood at $1.1 trillion in 2015. Our 2015 dollar store grocery estimate is equivalent to just 2.6% of this market, up from 1.9% in 2010.

So, the dollar stores remain a niche segment. But this does not mean their threat can be overlooked. Grocery is a volume-sensitive business, with high fixed costs and low margins, so any chipping away at volumes threatens the established grocery chains. Moreover, the apparently minor share of the dollar-store retailers must be added to other seemingly niche segments—including grocery discounters such as Aldi and Internet pure plays such as AmazonFresh—that have grown share at the expense of conventional grocery stores.

What This Adds Up To

We see dollar stores as one element in the potential fragmentation of consumer spending away from the biggest grocery-focused retailers and toward more specialized retailers. This is a trend that is not unique to grocery, with US department stores having lost share to targeted clothing specialists over the long term, for instance. As participation in online shopping increases and as discount options grow, including with the entry of Lidl into the US market by 2018, grocery could be just the latest sector to see big generalists come under threat from more niche rivals.

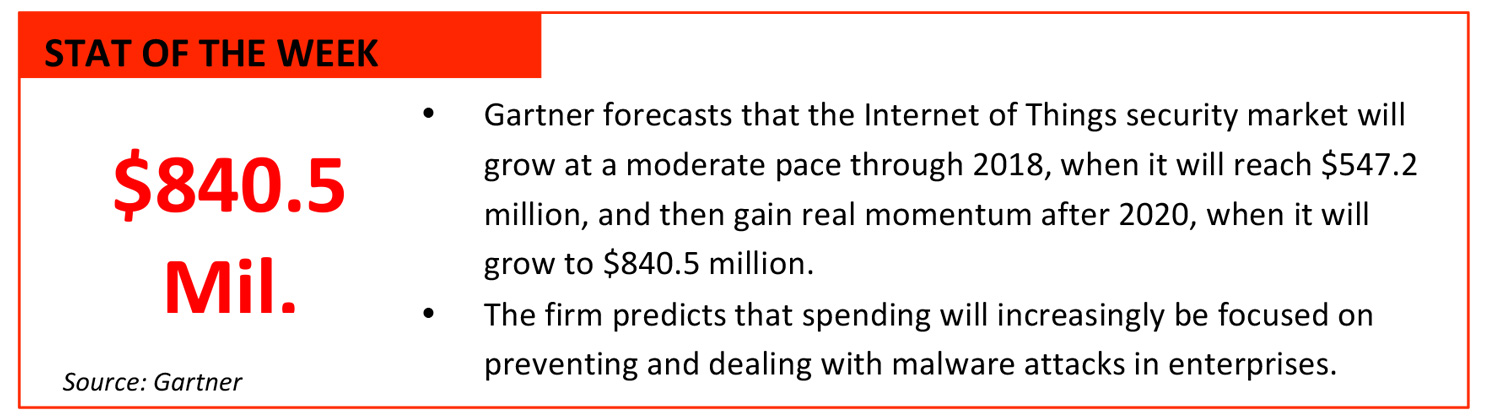

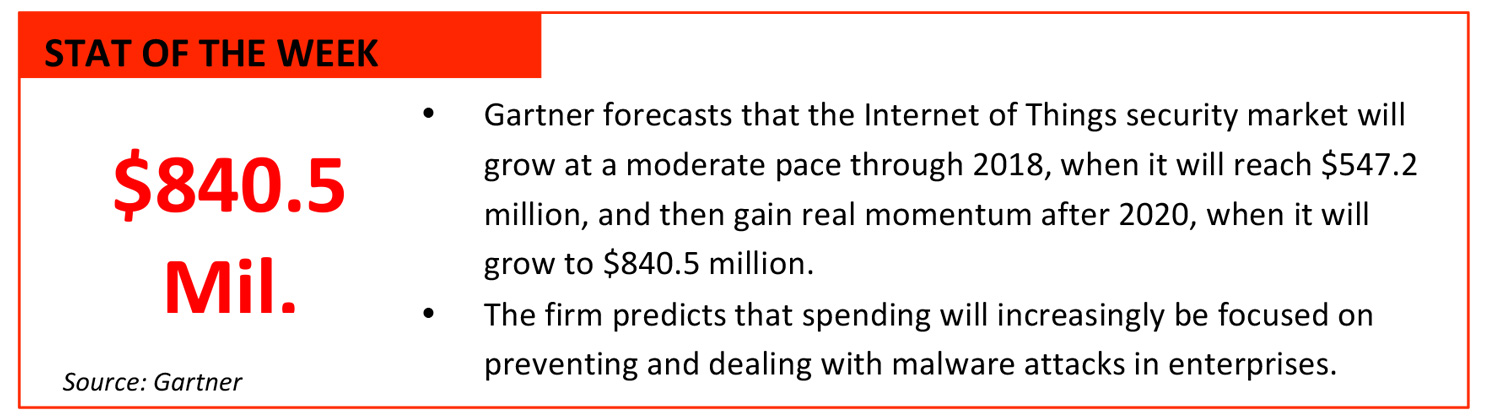

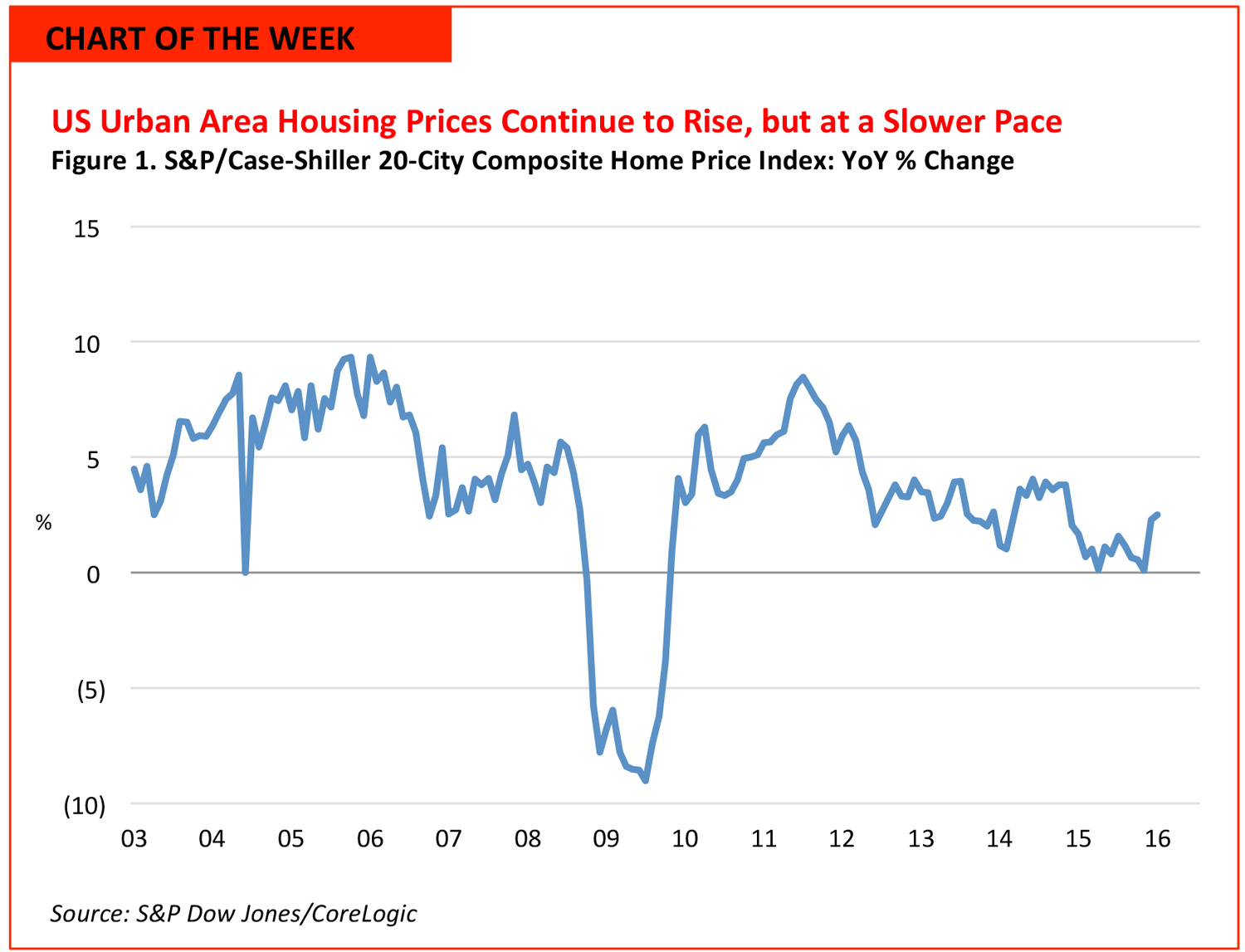

- The S&P/Case-Shiller 20-City Composite Home Price Index increased by 5.4% year over year in February, decelerating from its 5.7% increase in January.

- Portland, Seattle and Denver reported the biggest increases, and 13 of the 20 cities grew at slower rates year over year than they had in the previous month.

- While financing is less of a problem for home buyers, rising home prices are a primary concern, as housing supply is near a five-month low and new housing construction has not yet recovered from the recession.

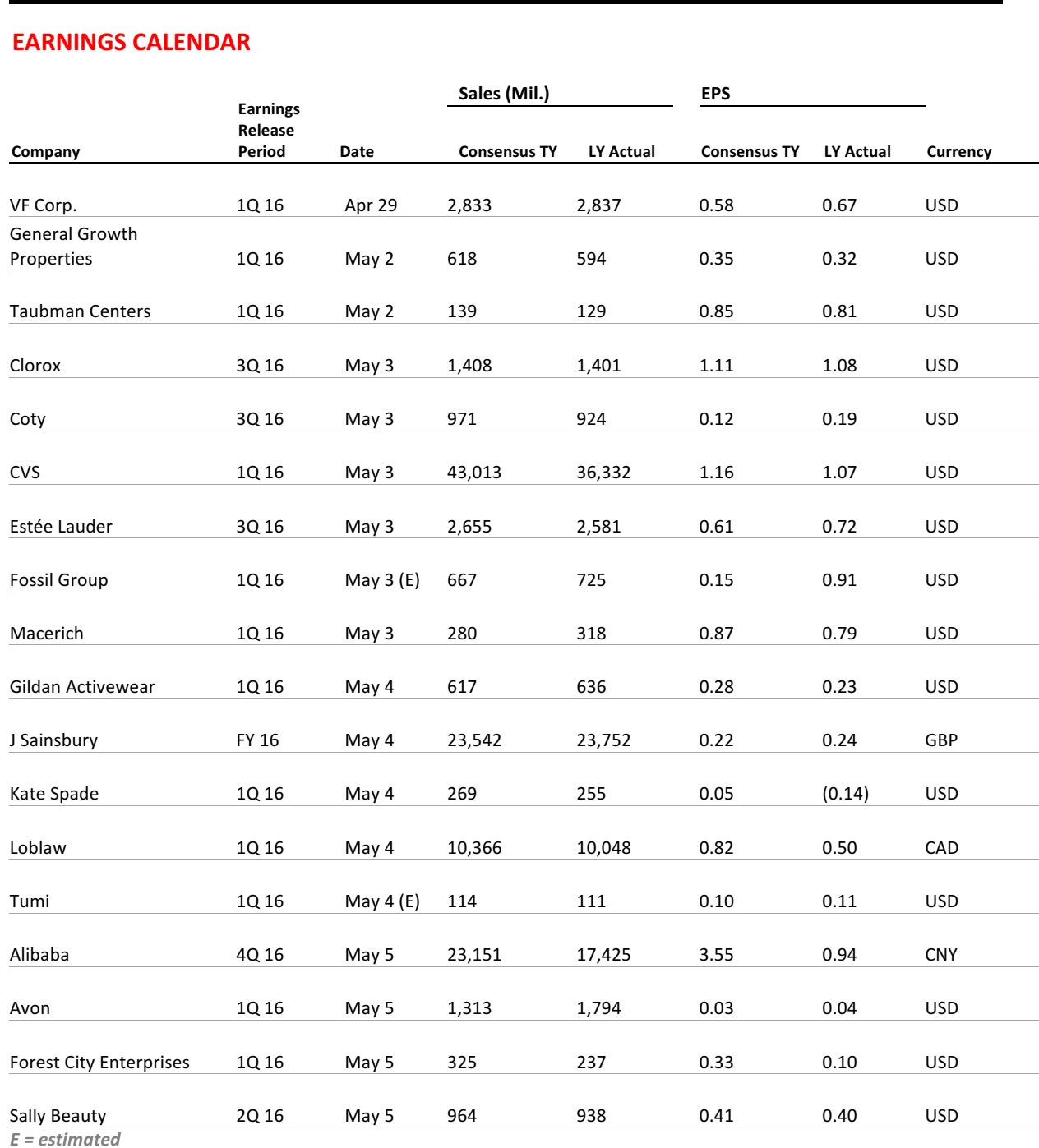

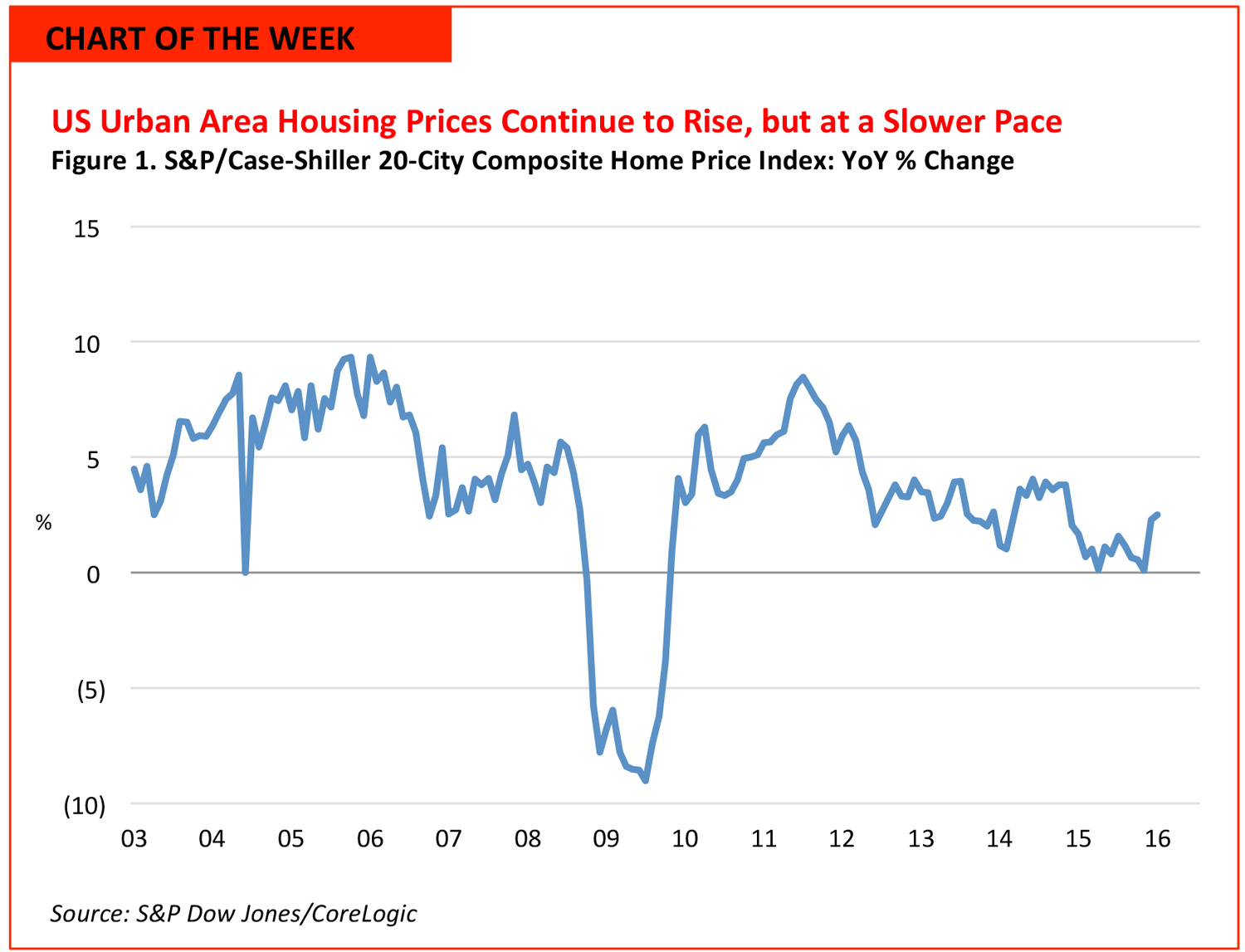

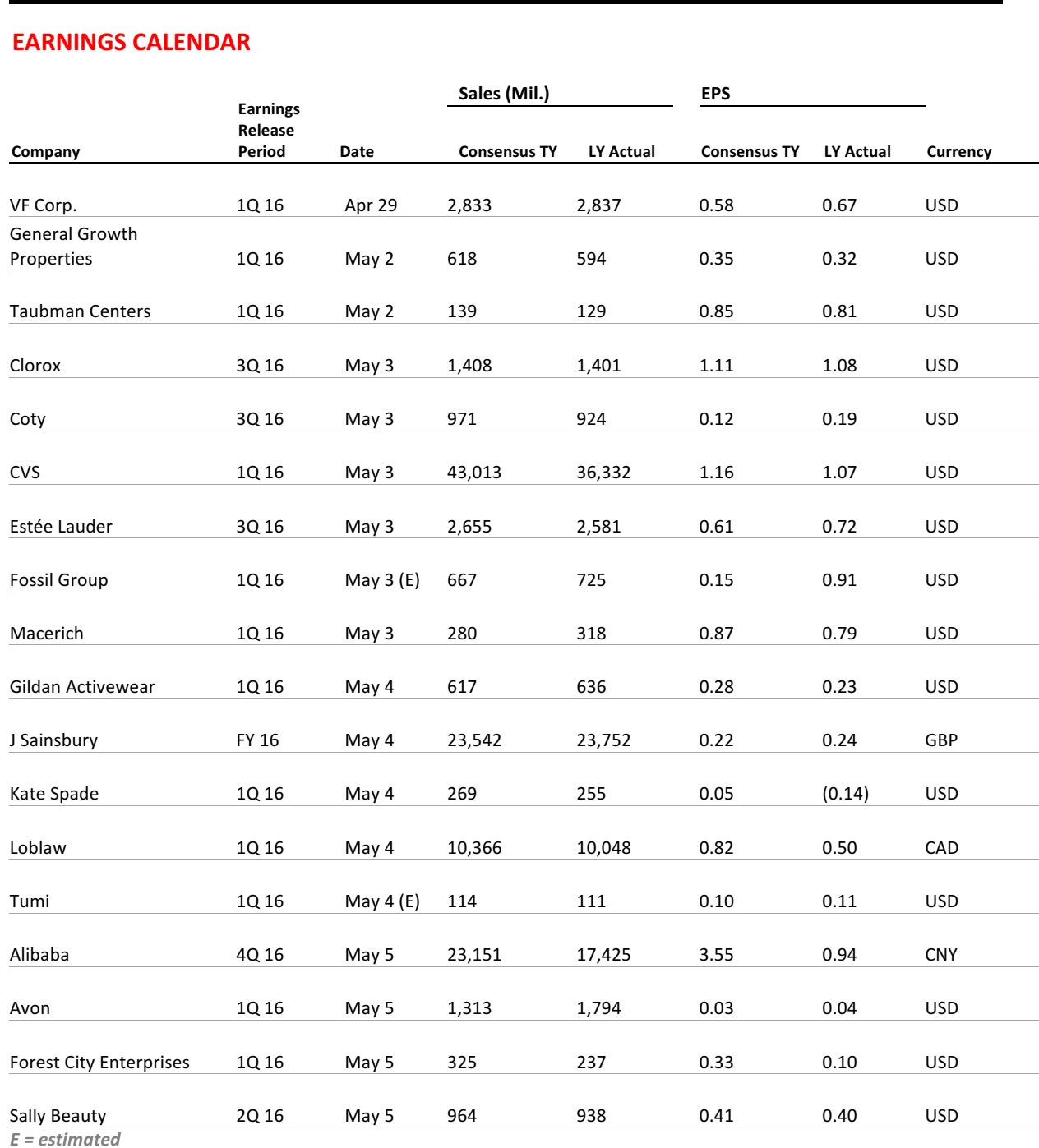

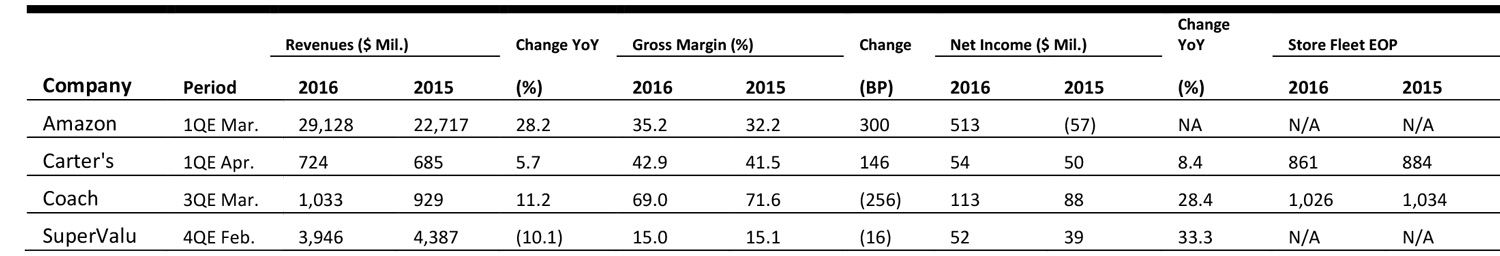

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

At One Year Old, Is Apple’s Watch a Flop? Not Exactly.

(April 25) Fortune

At One Year Old, Is Apple’s Watch a Flop? Not Exactly.

(April 25) Fortune

- The Apple Watch turned one on Sunday, and many have criticized it, citing slow speeds and unoriginal features. However, in terms of units sold, the Apple Watch actually outperformed the iPhone in its first year on the market, with 12 million units sold versus the iPhone’s 6 million.

- Compared to the more than 200 million iPhones sold in 2015, the Apple Watch’s sales do seem less impressive, but the iPhone has had nine years to build a loyal fan base and improve its features.

JCPenney Expanding Its 10-Year Relationship with Sephora

(April 26) Retailing Today

JCPenney Expanding Its 10-Year Relationship with Sephora

(April 26) Retailing Today

- JCPenney announced that it will open 60 additional Sephora shops in its department stores, including a 3,000-square-foot Sephora flagship set to open inside the Salinas, CA J C Penney in November. The partnership began in 2006 and was later extended to include e-commerce. Sephora is now a significant presence on JCPenney’s website.

- Almost half of the new Sephora shops will open on April 29 and most will be open by June 17, as the retailers aim to capture greater market share before the key back-to-school and holiday shopping periods.

The Future Is the Trust Economy

(April 24) TechCrunch

The Future Is the Trust Economy

(April 24) TechCrunch

- The sharing economy is underscored not only by the technology that enables it, but also by the premium its participants place on trust. The sharing economy’s rating systems have created a “codification of reputation” that makes it possible to trust someone we know little about.

- Reputation, even for individuals, has been digitized. LinkedIn connections can determine if you get a particular job, and your social media presence can affect how you date. Trust is becoming a commodity that consumers want from both brands and other people, and these kinds of digital measures will increasingly influence our “trust score.”

Genetics Startup Twist Bioscience Is Working with Microsoft to Store the World’s Data in DNA

(April 27) TechCrunch

Genetics Startup Twist Bioscience Is Working with Microsoft to Store the World’s Data in DNA

(April 27) TechCrunch

- Startup Twist Bioscience has partnered with Microsoft and the University of Washington to make and use synthetic DNA to store vast amounts of digital data. Big data is big business, but storage costs can be huge.

- DNA can store information for thousands of years, and a single gram can hold about 700 terabytes’ worth of data. This means “you could fit all the knowledge in the whole world inside the trunk of your car,” according to Twist Bioscience CEO Emily Leproust.

EUROPE RETAIL HEADLINES

Austin Reed Falls into Administration

(April 26) Retail-week.com

Austin Reed Falls into Administration

(April 26) Retail-week.com

- British formalwear retailer Austin Reed formally entered administration on April 26, and AlixPartners has been appointed as administrator. The company was already familiar with AlixPartners, as it had appointed the business advisors to assess its financial position about two weeks ago.

- AlixPartners stated that “cash flow difficulties arising from challenging retail market conditions” caused Austin Reed to enter administration. Reportedly, plans for redundancies or store closures are not yet in the offing, but there has been considerable interest in acquiring all or parts of the business. Currently, Austin Reed is part-owned by Wells Fargo and Alteri Investors.

British Home Stores (BHS) in Administration

(April 25) Company press statement

British Home Stores (BHS) in Administration

(April 25) Company press statement

- British department store chain BHS went into administration on April 25, after attempts to secure a buyer for the group failed. A statement on its website indicated that financial advisory firm Duff & Phelps has been appointed as a joint administrator to oversee the process. The statement added that property sales by BHS did not materialize as anticipated, which resulted in a low cash balance and an inability to fulfill payments. Stores and the website will continue to operate as usual while the administrators try to sell the company as a going concern, i.e., a business that is not under threat of liquidation.

- News reports indicate that the company also has a pension fund deficit of £571 million (US$797 million). The two pension programs at BHS have been under assessment since March for rescue by the Pension Protection Fund, a UK body that ensures pensioners are paid even if their employer is in administration.

Fnac Ups Bid for Darty and Surpasses Conforama’s Offer

(April 25) FT.com

Fnac Ups Bid for Darty and Surpasses Conforama’s Offer

(April 25) FT.com

- French retailer Fnac has made a final bid of 170p (US$0.237) per share to acquire electronics retailer Darty. Last week, Fnac and Conforama (which is owned by South African retailer Steinhoff) were embroiled in a succession of bids.

- After revising its initial offer of 138p (US$0.193) twice, Conforama made a third offer of 160p (US$0.223) per share last week. According to a statement, Conforama had urged Darty shareholders to hold off on further action while it was “considering its options.”

Hema’s Turnover Increases by 5.8% in 2015

(April 21) Retaildetail.eu

Hema’s Turnover Increases by 5.8% in 2015

(April 21) Retaildetail.eu

- Dutch retail chain Hema posted a turnover of €1.14 billion (US$1.59 billion) in fiscal year 2015, an increase of 5.8% from 2014, and its comparable sales grew by 3.2% during the year. France saw the highest growth, with turnover of 31%. Turnover grew by 11.5% in Germany and by 4.7% in the Netherlands, but fell by 0.4% in Belgium and Luxembourg.

- Despite the growth, Hema incurred a net loss of €72.5 million (US$101.2 million) in 2015, which was lower than 2014’s net loss of €189.2 million (US$264.0 million). The company’s CEO stated that Hema has now seen four straight quarters of comparable sales growth and that it is on course to achieve its short-term goals.

Leclerc Returns to Paris

(April 20) Retailanalysis.igd.com

Leclerc Returns to Paris

(April 20) Retailanalysis.igd.com

- French supermarket chain Leclerc has returned to Paris, which it exited 25 years ago. Its new 21,528-square-foot store, which opened on April 20, is located in the city’s burgeoning Rosa Parks neighborhood.

- Ever since Leclerc left Paris, Carrefour, Casino, Intermarché Express and U Express have controlled the city’s supermarket sector.

ASIA TECH HEADLINES

Retail Giant Central Group Is Buying Zalora’s Businesses in Thailand and Vietnam

(April 25) TechCrunch

Retail Giant Central Group Is Buying Zalora’s Businesses in Thailand and Vietnam

(April 25) TechCrunch

- Zalora, a fashion-focused e-commerce site backed by Rocket Internet, is selling its businesses in Thailand and Vietnam to retailer Central Group, according to multiple sources. The deal is said to be agreed on in principle and currently subject to paperwork and red tape.

- Low levels of online commerce have challenged Rocket Internet’s e-commerce startups. The company’s latest financial results show that Zalora’s revenue rose by 78%, to €208 million (US$234 million), in 2015, and that its net loss increased by 36%, to €93.5 million (US$105 million).

Singaporean Bank Puts Your iPhone’s Fingerprint Scanner to Good Use

(April 25) TechinAsia

Singaporean Bank Puts Your iPhone’s Fingerprint Scanner to Good Use

(April 25) TechinAsia

- OCBC Bank’s Business Mobile Banking app is the first banking app to use biometric authentication to verify the rightful owner of the account, according to the bank. It uses Apple’s Touch ID technology to verify the fingerprints of account owners.

- The authentication method, OneTouch, works on all Touch ID–enabled iPhones, from iPhone 5s onward, that run iOS 8 or later. The app is also available for Android phones running Android 4.0 or later, but it does not use Android’s own fingerprint sensor feature, relying instead on two-step authentication through a customer’s security token or SMS.

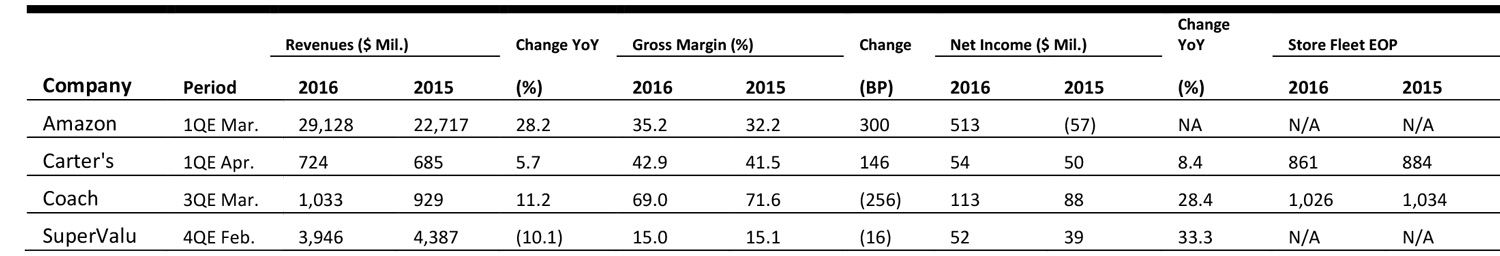

Yahoo Japan and East Ventures Want Code Republic to Be the Y Combinator of Japan

(April 25) TechinAsia

Yahoo Japan and East Ventures Want Code Republic to Be the Y Combinator of Japan

(April 25) TechinAsia

- Yahoo Japan, home to Japan’s most popular web portal, and East Ventures, a pan-Asian venture capital firm, teamed up to create a new accelerator in Tokyo called Code Republic. The accelerator is the brainchild of Ryu Hirayama, Managing Director of YJ Capital, and Batara Eto, Co-founder of East Ventures.

- Aside from the typical acclerator offerings such as high-profile mentors and speakers, dinners and individualized support, Code Republic also offers participants a wide door into Southeast Asia. East Ventures’ portfolio includes Tokopedia, RedMart, Traveloka and 99.co as well as Mercari, Gumi and FreakOut in the Japanese market.

China Makes a Play at Personal Robots

(April 25) ZDNet

China Makes a Play at Personal Robots

(April 25) ZDNet

- NXROBO debuted a new robotic butler called BIG-i recently at a Pepcom event. It was designed to be fully mobile and able to navigate complex environments, recognize faces and perform automated smart home tasks.

- Currently, more than 75% of China’s robots are purchased overseas. BIG-i was developed by Chinese roboticist Dr. Tin Lun Lam, a research fellow at The Chinese University of Hong Kong, and is a challenger to companies such as Aldebaran Robotics, Jibo and Robotbase.

Gamification Startup Raises Series A to Boost Training and Engagement at Work

(April 25) TechinAsia

Gamification Startup Raises Series A to Boost Training and Engagement at Work

(April 25) TechinAsia

- Knolskape, a Singapore- and Bangalore-based startup that focuses on gamification for use in employee education and engagement, announced that it raised a series A round of funding. The amount was undisclosed. The funding came from US-India venture firm Inventus Capital Partners and The HR Fund, an India-based private investment company.

- The company’s products include simulations for different scenarios, training games and videos, and an analytics platform for assessment and communication. Knolskape will serve a market that Gartner predits will be worth about US$5.5 billion by the end of 2018.

LATAM RETAIL HEADLINES

Cuba: Huge Opportunity, but Obstacles Persist

(April 26) WWD.com

Cuba: Huge Opportunity, but Obstacles Persist

(April 26) WWD.com

- A recent study published by Boston Consulting Group concludes that Cuba will need to undergo comprehensive changes, including improvements to existing infrastructure, in order for foreign companies to fully realize opportunities in the Cuban marketplace.

- The report estimates that Cuba’s GDP will grow by 2%–4% over the next five years, which would be slower than in recent years, due to decaying infrastructure and an aging population.

Fashion Week Mexico Sees New Partnerships, Locations

(April 25) WWD.com

Fashion Week Mexico Sees New Partnerships, Locations

(April 25) WWD.com

- Mercedes-Benz Fashion Week Mexico partnered with rival show Nook and Mexico’s Fashion Film Festival to create a larger, more well-rounded event that bolstered the show in comparison to regional competitors such as Colombiamoda and São Paulo Fashion Week.

- The event featured 25 runway shows and was attended by 30 local buyers and four international buyers. It also garnered an estimated 100 million Facebook, Twitter and Instagram mentions.

Weaker Peso Fails to Boost Mexican Exports

(April 26) WSJ.com

Weaker Peso Fails to Boost Mexican Exports

(April 26) WSJ.com

- The Mexican peso weakened by 24% against the US dollar in the past 18 months, which was expected to help boost Mexican goods and make them more competitive. However, manufacturing exports have not increased, due to the close relationship of US and Mexican supply chains.

- Exports of manufactured goods, the primary export of Mexico, fell by 6.5% year over year in March, and auto industry exports fell by 10%.

Public Sector Will Work Only Two Days a Week in Venezuela

(April 26) WSJ.com

Public Sector Will Work Only Two Days a Week in Venezuela

(April 26) WSJ.com

- As Venezuela finds itself plagued by a deepening energy crisis, President Nicolás Maduro has ordered that public employees work only on Mondays and Tuesdays in order to save energy. The move is said to last only a few weeks.

- Maduro is expected to seek help from the United Nations, as power rationing has caused riots and looting across the country, and as shops and bakeries have been unable to stock enough food.

Mexico Senate Committee Okays Air Transport Deal with US

(April 21) Reuters

Mexico Senate Committee Okays Air Transport Deal with US

(April 21) Reuters

- The Mexican Senate ratified a deal with the US that will boost competition in air travel, helping to expand the world’s second-largest cross-border market. The deal will open up new routes and allow for unlimited flights.

- The move will also help Delta Airlines and Aeromexico close a deal that will allow the two companies to better coordinate flight connection times as well as prices.

Hema’s Turnover Increases by 5.8% in 2015

(April 21) Retaildetail.eu

Hema’s Turnover Increases by 5.8% in 2015

(April 21) Retaildetail.eu