Source: Analysys Mason

From the Desk of Deborah Weinswig

Top Takeaways from the 2017 NACDS Annual Meeting

This week, the Fung Global Retail & Technology team attended the 2017 National Association of Chain Drug Stores (NACDS) Annual Meeting in Scottsdale, Arizona. Below are our key takeaways from the event.

1. The Store of the Future Will Build a Sense of Community

Retailers have been talking recently about stores needing to fill a bigger purpose than just selling merchandise. New store formats will be set up accordingly, with more space that allows for social interaction as well as the provision of various services, as many consumers today find themselves craving human contact in retail communities.

2. Building Social: A Startup that Builds on the Concept of Community

Building Social is a startup that connects office and apartment building owners and managers with amenities ranging from experiences to events to perks and community management programs. Building Social is also leveraging the wellness trend by offering a turnkey wellness program with yoga classes, guided meditation and nutrition experts, among other things. Ultimately, the program is a tool that landlords and building managers can use to curate a building’s community.

3. Stores as a Platform

Retailers are looking for ways to use their stores as a platform to drive in-store traffic, which can, in turn, drive add-on and impulse purchases and higher spending. Offering a “buy online, pick up in store” service is one way to do that, as it gives customers the convenience they desire while also getting them into stores. Some retailers are even offering discounts for customers to use the service.

4. Wellness: The New Luxury

The popularity of the health and wellness trend has been visible across consumer groups in the US, and it differs significantly from the various food and exercise trends that influenced particular demographics in previous decades. Eating healthily, exercising regularly and monitoring one’s health have become a lifestyle choice, and one that looks to represent a permanent change in terms of consumer preferences.

5. The CMO’s Role Is Increasingly Complex

The role of Chief Marketing Officer (CMO) is becoming increasingly complex and difficult as retailers and other companies try to reach different demographics and cohorts that shop, live and behave differently.

6. Growing Senior Population Underpins Demand for Higher Healthcare Spending

The growth of the senior population is being driven by “older seniors,” those aged 75 and older, and that group is projected to grow even faster than the total senior population in coming years. At the same time, more and more seniors are expressing a preference for aging in place: they increasingly prefer to stay in their own homes rather than move into an assisted-living or long-term care facility, even when they need assistance with the basic tasks of everyday life.

7. Amazon Is Curating and Supporting Startups with Amazon Launchpad

Amazon Launchpad is a platform that enables consumers to find innovative products from vetted startups. It also offers services and resources for startups that enable them to differentiate themselves from bigger competitors. Launchpad vendors are given special treatment and receive support via Amazon’s services hub, where vendors can seek help from more established service providers.

8. Mobile Is Underdeveloped as a Channel

Low friction is critical to both the online and mobile experience. Mobile offerings need to be tailored to the mobile experience, rather than just looking and functioning like downsized desktop sites. Mobile sites are not only about transacting, but also about inspiring people by presenting them with products they may want to buy in the future.

9. VR to Gain Traction in 2017

Although it looks like the technology still has a ways to go before VR devices and applications become commonplace, more retailers are likely to experiment with and deploy VR shopping solutions in 2017. Consumers are looking for more experiential shopping, and gamification has proven to be an effective tool to attract and retain customers.

10. One Word Sums Up Retailers’ Current Sentiment: Enlightened

Our sense is that many industry leaders and startups came away from the conference feeling enlightened and better prepared to adapt to the changes and the new environment. Most industry insiders agree that retail has not seen this pace of change in years, if not decades, given the current performance of and recent results reported by major retailers. On a year-to-date basis, closings have been announced for 3,296 stores for 2017, almost twice as many as the same period last year, and more than the average in the past ten years.

The Fung Global Retail & Technology team looks forward to attending and reporting on future key industry events.

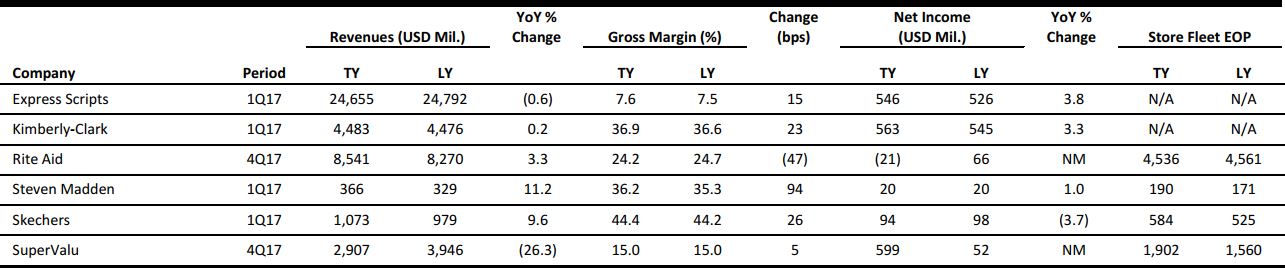

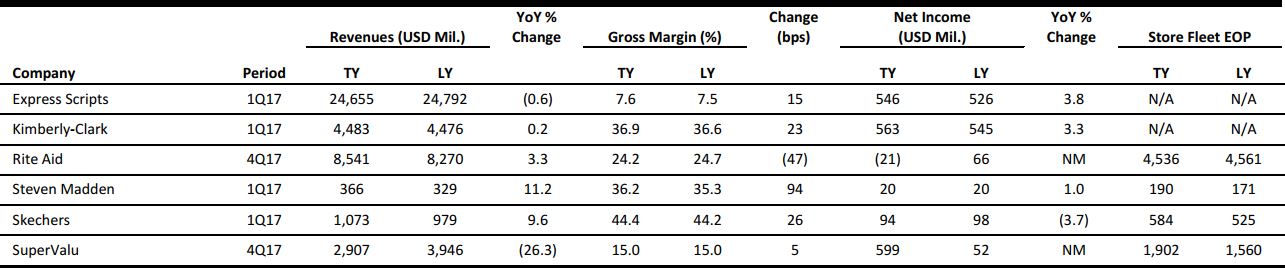

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Moody’s: Retail Industry Stable Despite Weaknesses, but Profits Will Be Lean

(April 26) RetailDive.com

Moody’s: Retail Industry Stable Despite Weaknesses, but Profits Will Be Lean

(April 26) RetailDive.com

- Once again, department stores got the brunt of an analysis by Moody’s. In addition to forecasting a 1% decline in sales, Moody’s has forecast a 7%–8% decrease in operating profits for department store retailers this year, not even counting struggling Sears.

- The faint growth outlook is the consequence of reticent American consumers, according to the recent Moody’s report. “Consumer spending remains subdued, with gains in household wealth due to improved housing and equity markets a positive, although lower-income households are benefiting less than those with greater discretionary income,” said Mickey Chadha, Moody’s Vice President and Senior Credit Officer, in a statement.

Brick-and-Mortar Stores Are Shuttering at a Record Pace

(April 21) The Wall Street Journal

Brick-and-Mortar Stores Are Shuttering at a Record Pace

(April 21) The Wall Street Journal

- American retailers are closing stores at a record pace this year as they feel the fallout from decades of overbuilding and the rise of online shopping. Just last week, women’s apparel chain Bebe said it would close its remaining 170 shops and sell only online, while teen retailer Rue21 announced plans to close about 400 of its 1,100 locations.

- Through April 6, closings have been announced for 2,880 retail locations this year, including hundreds of locations being shut by national chains such as Payless ShoeSource and RadioShack. Based on the pace of closures so far, brokerage Credit Suisse estimates that retailers will close more than 8,600 locations this year, which would eclipse the number of closings during the 2008 recession.

Two Years After Launching, Amazon Dash Shows Promise

(April 25) Fortune.com

Two Years After Launching, Amazon Dash Shows Promise

(April 25) Fortune.com

- The small, thumb-sized Dash devices that let customers reorder paper towels, laundry detergent and toilet paper by merely clicking a button debuted on March 31, 2015. The public’s initial reaction was that Amazon was playing a massive prank that was timed to coincide with April Fools’ Day.

- Two years later, Dash is among Amazon’s fastest-growing services, albeit from a very low baseline. Orders via Dash button are placed more than four times a minute, compared with once a minute a year ago, according to Amazon. That equates to around 5,760 orders daily. Still, that number is insignificant when compared with Amazon overall, which, at peak times, handles hundreds of orders a second and raked in $136 billion in sales in 2016 alone.

US Retailers Face Growing Hostility from Suppliers

(April 21) Bloomberg.com

US Retailers Face Growing Hostility from Suppliers

(April 21) Bloomberg.com

- When a group of disgruntled shoe manufacturers assembled in China earlier this year, they put up signs with messages in English, hoping they would be seen by Americans 7,000 miles away. The footwear suppliers had lost patience with the soon-to-be-bankrupt Payless ShoeSource chain, which they said owed them hundreds of millions of dollars.

- Bankruptcies at Payless, Gordmans Stores, Wet Seal and RadioShack’s ill-fated successor, General Wireless, have rocked the industry this year. Chains such as Bebe have made plans to shut their brick-and-mortar locations. And Sears, once the world’s largest retailer, warned investors last month that there was “substantial doubt” about its ability to keep operating.

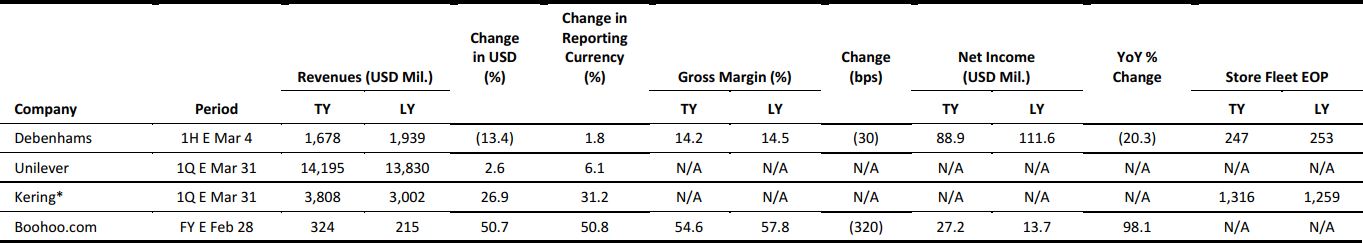

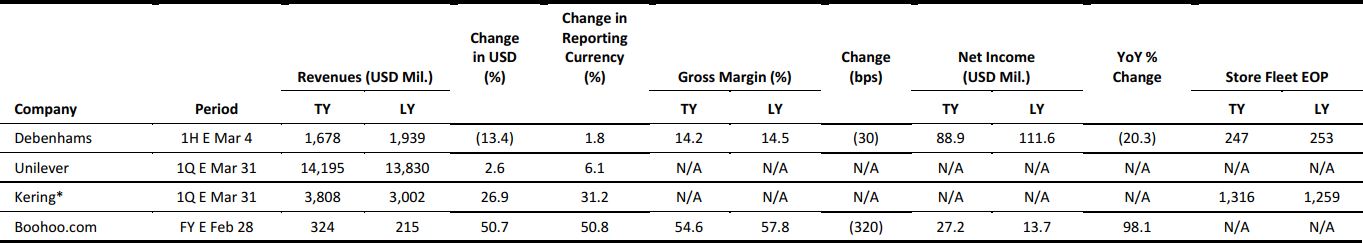

EUROPE RETAIL EARNINGS

*Store fleet numbers include only directly operated stores; they do not include franchises and concessions.

Source: Company reports

EUROPE RETAIL HEADLINES

UK Retail Sales Grow by 3.3% in March

(April 21) Press release

UK Retail Sales Grow by 3.3% in March

(April 21) Press release

- UK retail sales grew by 3.3% in March, following a 4.7% rise in February, according to the Office for National Statistics. Growth came despite Easter falling in April this year versus March last year.

- Grocery sales growth was modestly positive, at 1.4% year over year. Clothing specialists saw sales growth strengthen to 7.3%. Online-only retailers again drove growth, with sales rising by 24% in the month.

Jimmy Choo Puts Itself Up for Sale

(April 24) Company press release

Jimmy Choo Puts Itself Up for Sale

(April 24) Company press release

- British luxury footwear brand Jimmy Choo has put itself up for sale. The company is valued at £682 million (US$872 million).

- In a statement released by group, the brand is conducting a “review of the various strategic options open to the company to maximize value for its shareholders and it is seeking offers for the company.”

Sainsbury’s Launches Branded Athleisure Clothing Range

(April 19) Company press release

Sainsbury’s Launches Branded Athleisure Clothing Range

(April 19) Company press release

- British supermarket Sainsbury’s has launched a new alliance with American sportswear brand Russell Athletic, marking the first time that the store has offered branded clothing for female customers. Sainsbury’s has previously focused on its Tu private-label range.

- The partnership comes as the athleisure trend continues to grow, with Sainsbury’s attempting to gain market share by offering customers branded styles and quality at supermarket prices.

Boden to Open Concessions in John Lewis Stores

(April 24) Retail-Week.com

Boden to Open Concessions in John Lewis Stores

(April 24) Retail-Week.com

- British clothing retailer Boden is set to open concessions in five John Lewis department stores by October. Boden currently has one physical store, but primarily operates online and through catalogs.

- John Lewis’s Buying Director of Fashion, Christine Kasoulis, said, “The introduction of Boden builds on our continued strategy to provide our customers with an inspiring selection of unique brands that they cannot find anywhere else on the high street.”

Debenhams Announces New Strategy to Drive Growth

(April 20) Company press release

Debenhams Announces New Strategy to Drive Growth

(April 20) Company press release

- British department store Debenhams announced a new strategy called Debenhams Redesigned through which it will focus on “becoming a destination, digital and different” and on “driv[ing] efficiency by simplifying and focusing [its] business.”

- Furthermore, the retailer aims to become a destination for social shopping by offering more unified channels that offer new products, services and experiences.

Despar Italia to Invest €200 Million in Stores in 2017

(April 20) RetailAnalysis.IGD.com

Despar Italia to Invest €200 Million in Stores in 2017

(April 20) RetailAnalysis.IGD.com

- Despar Italia, a supermarket group made up of six companies under the SPAR banner, announced that it will invest €200 million (US$217 million) in new store openings and store renovations in 2017 in order to maintain its upturn in performance.

- The company also said that it will invest in its private-label ranges as it seeks to grow their share of sales. The retailer plans to expand its private-label offering with the addition of 290 SKUs.

ASIA TECH HEADLINES

Alibaba Cloud Announces Expansion of Startup Accelerator Program

(April 26) Company press release

Alibaba Cloud Announces Expansion of Startup Accelerator Program

(April 26) Company press release

- Alibaba Cloud announced that it will expand its global startup program, Create@Alibaba Cloud, to cover Mainland China and 12 overseas markets, enabling small local enterprises in those regions to benefit from its growing coverage and increasing support.

- The program is aimed at empowering startups around the globe through Alibaba’s comprehensive support network and innovative suite of cloud-computing infrastructure services. Participants gain access to sophisticated computing resources to innovate and accelerate their business growth.

JD.com Creates New Unit for Its Logistics Services

(April 25) TechCrunch.com

JD.com Creates New Unit for Its Logistics Services

(April 25) TechCrunch.com

- com, China’s second-largest e-commerce company after Alibaba, will create a new business group called JD Logistics, which will take advantage of JD.com’s existing delivery and warehouse infrastructure.

- Establishing the company’s logistics operation as its own business unit will allow JD.com to speed up the development of its infrastructure and give it more flexibility to explore business opportunities.

Alibaba’s Ant Financial Invests in Chinese Bike-Sharing Startup Unicorn Ofo

(April 23) TechCrunch.com

Alibaba’s Ant Financial Invests in Chinese Bike-Sharing Startup Unicorn Ofo

(April 23) TechCrunch.com

- Ofo, a Chinese bike-sharing startup that recently claimed unicorn status, announced that it has added Ant Financial as an investor. Ofo said that it will work with Ant Financial, an Alibaba affiliate, on Internet and credit card payments and its international expansion plan.

- Having Ant Financial as an ally strengthens Ofo’s position against its chief rival, Mobike. Both companies are eager to expand beyond China and have been busy lining up strategic partners and investors.

Tencent Takes Stake in Game Developer Seasun Group

(April 21) Financial Times

Tencent Takes Stake in Game Developer Seasun Group

(April 21) Financial Times

- Chinese Internet group Tencent, the world’s biggest video game company by revenue, will pay $142 million for a 9.9% stake in game developer Seasun. Image Frame Investment, a wholly owned subsidiary of Hong Kong–listed Tencent, agreed to pay Seasun parent company Kingsoft $62.2 million for 4.3% of the total issued shares of Seasun.

- Seasun makes mobile games, including Brave Cross, Go Titans and Ships of Fury, as well as the massively multiplayer online role-playing game JX Online 3. Tencent is already a substantial shareholder of Cheetah Mobile, a Kingsoft subsidiary.

LATAM RETAIL AND TECH HEADLINES

Brazil’s Embraer to Partner with Uber to Develop Electric Vehicles

(April 26) Reuters.com

Brazil’s Embraer to Partner with Uber to Develop Electric Vehicles

(April 26) Reuters.com

- Embraer, a Brazilian planemaker, annouced that it has signed a partnership with Uber to develop and implement small electric vehicles with vertical takeoff and landing capabilities.

- The partnership stems from Embraer’s newly established innovation center based in Melbourne, Florida, according to a securities filing. Embraer announced last month that it would establish research teams in Silicon Valley and Boston to collaborate on research with startup companies, academics and others.

BBVA Buys Mexican Payments Startup Openpay

(April 25) BankingTech.com

BBVA Buys Mexican Payments Startup Openpay

(April 25) BankingTech.com

- BBVA Bancomer, a fully owned subsidiary of BBVA, has acquired Mexico-based payments startup Openpay in order to tap into Openpay’s network of more than 15,000 payment reception points across the country.

- Openpay offers a platform for physical and electronic payments for businesses via its real-time Paynet network. The startup manages more than a million transactions a month and its platform is used by more than 1,000 businesses in Mexico, such as startups, SMEs and corporate clients.

E-Commerce Is Seeing Steady Growth in Mexico

(April 20) MexicoNewsDaily.com

E-Commerce Is Seeing Steady Growth in Mexico

(April 20) MexicoNewsDaily.com

- Online sales in Mexico have increased significantly in the last five years as large retailers have strengthened their e-commerce strategies, looking to cash in on the digital market and increase their overall sales.

- According to the Mexican Association of Online Sales, e-commerce sales of large retailers such as Walmart, Sanborns, Sears, Liverpool and Palacio de Hierro accounted for just 1% of total sales five years ago, on average, but today the figure is closer to 20%.

CrowdStrike Expands into Latin America, Opens Office in Mexico City

(April 25) Company press release

CrowdStrike Expands into Latin America, Opens Office in Mexico City

(April 25) Company press release

- CrowdStrike, a leader in cloud-delivered, next-generation endpoint protection, announced the launch of its operations in Latin America as the company looks to expand regional sales and marketing and provide partner and business development support.

- The opening of CrowdStrike’s new office in Mexico City will accelerate its go-to-market strategy in the region and expand opportunities for new business development and partnerships. CrowdStrike’s customers include three of the 10 largest global companies by revenue.

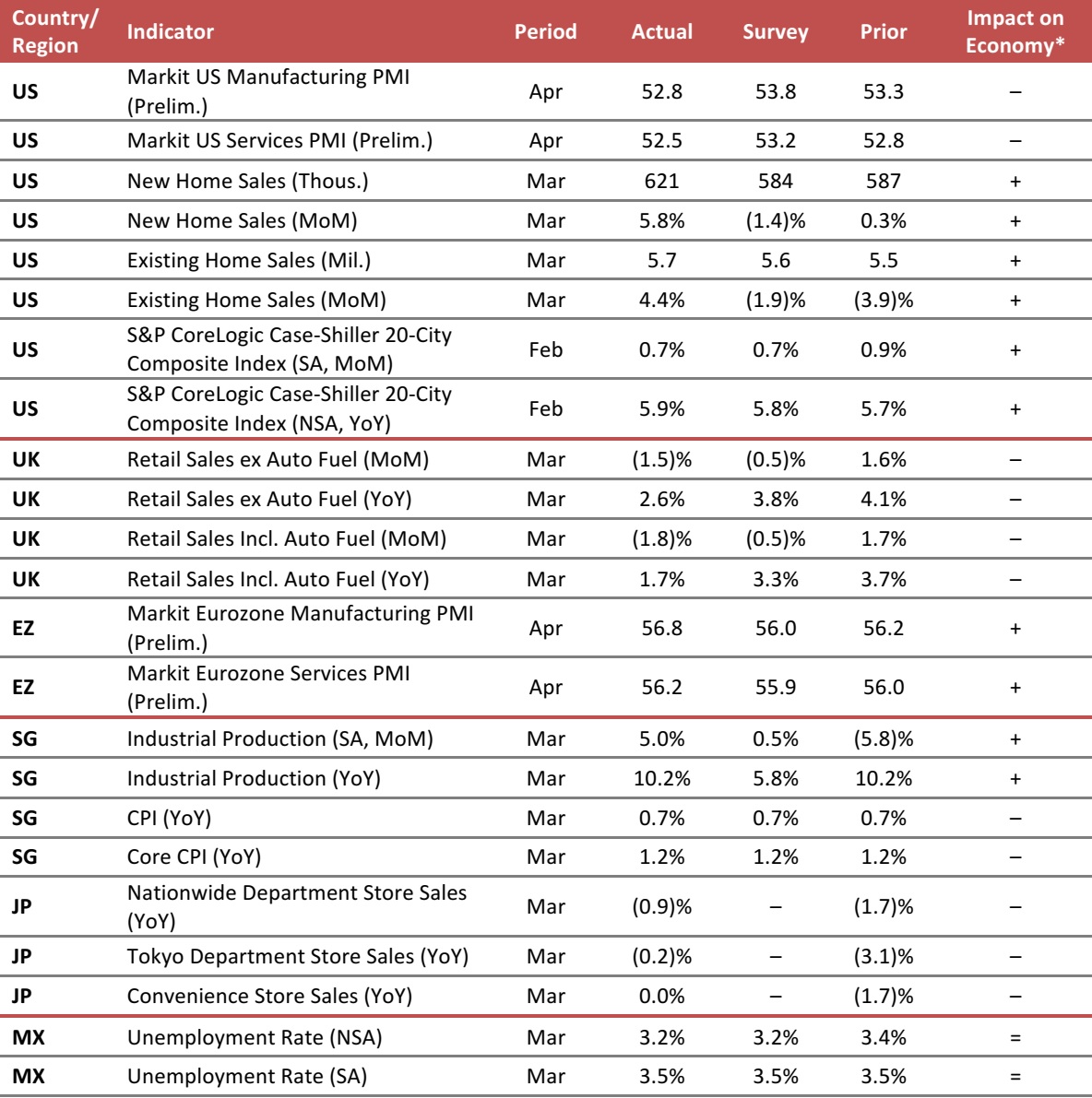

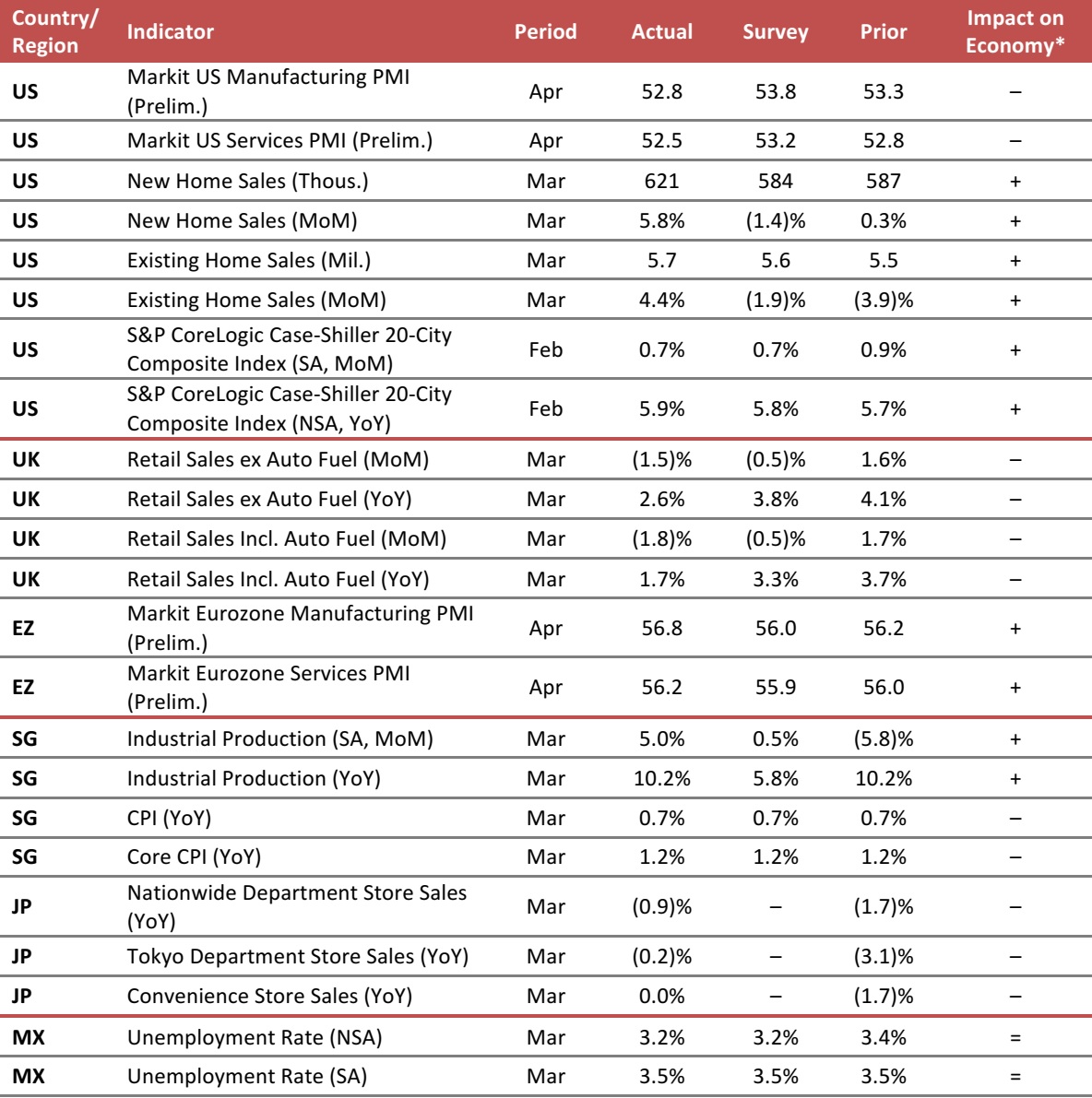

MACRO UPDATE

Key points from global macro indicators released April 19–26, 2017:

- US: The Markit Purchasing Managers’ Index (PMI) readings in April point to expansion for both the manufacturing sector and the services sector. March home sales came in better than expected and house prices were up modestly.

- Europe: In the UK, retail sales were lackluster in March. In the eurozone, manufacturing and services PMI readings in April suggest expansion in both sectors.

- Asia-Pacific: In Singapore, industrial production jumped in March, while inflation was low. In Japan, department store sales continued to decline, while convenience store sales were unchanged.

- Latin America: In Mexico, the unemployment rate remained at a low level in March.

*Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit Economics/US Census Bureau/National Association of Realtors/S&P Dow Jones Indices/UK Office for National Statistics/Singapore Economic Development Board/Monetary Authority of Singapore/Singapore Department of Statistics/Japan Franchise Association/Instituto Nacional de Estadística y Geografía (INEGI)/Fung Global Retail & Technology

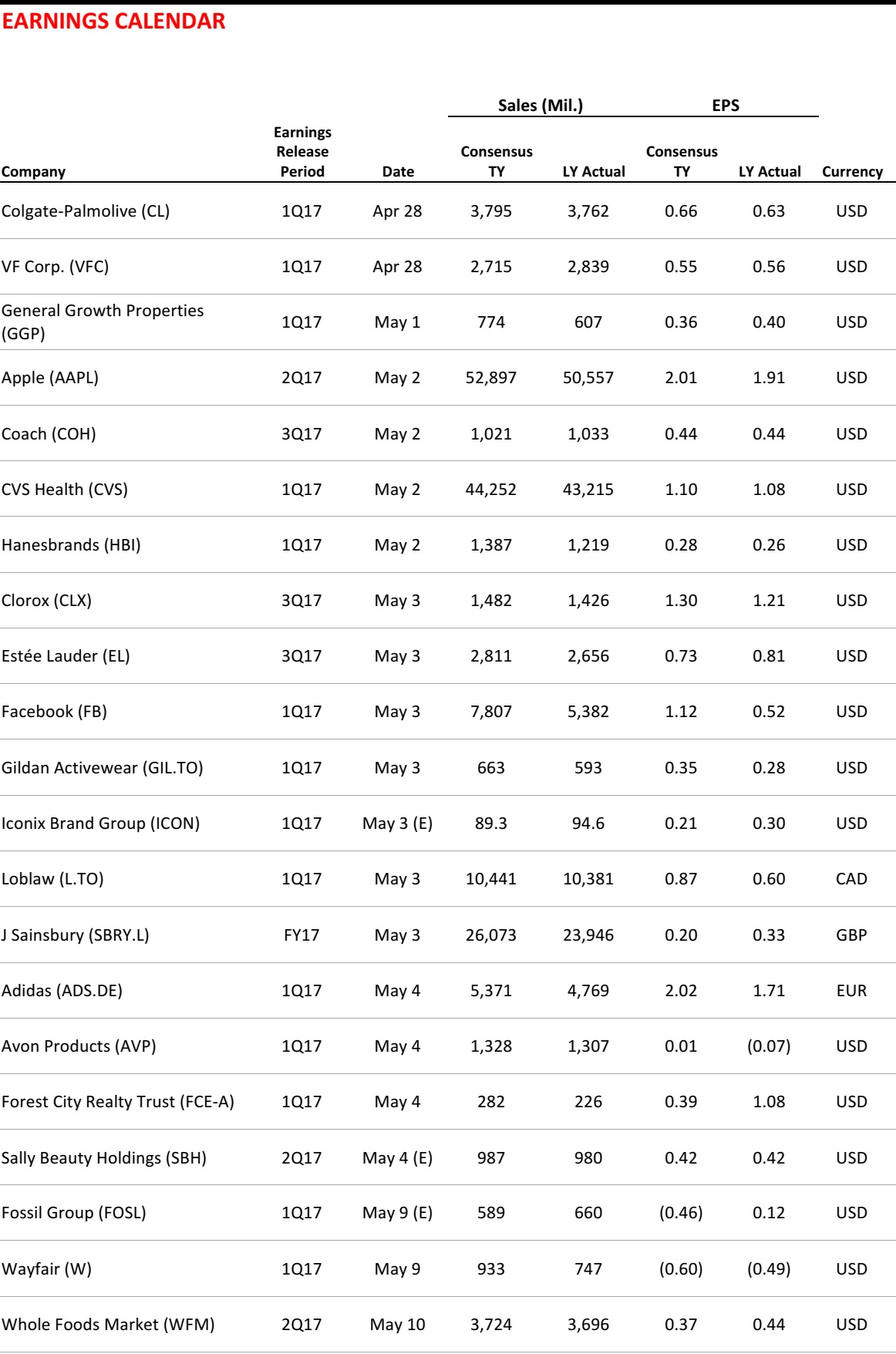

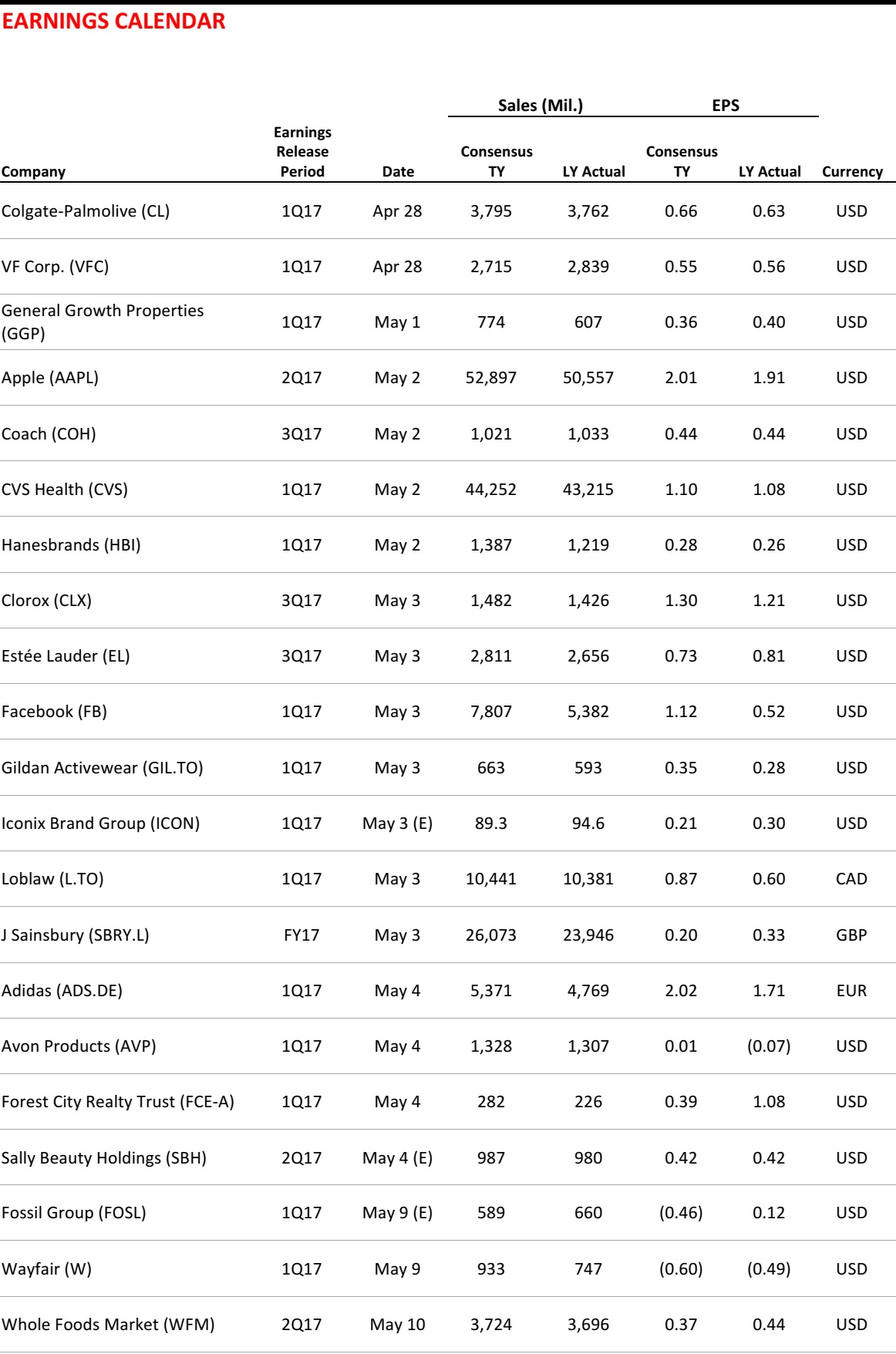

EARNINGS CALENDAR

EVENT CALENDAR

Brazil’s Embraer to Partner with Uber to Develop Electric Vehicles

(April 26) Reuters.com

Brazil’s Embraer to Partner with Uber to Develop Electric Vehicles

(April 26) Reuters.com

E-Commerce Is Seeing Steady Growth in Mexico

(April 20) MexicoNewsDaily.com

E-Commerce Is Seeing Steady Growth in Mexico

(April 20) MexicoNewsDaily.com

CrowdStrike Expands into Latin America, Opens Office in Mexico City

(April 25) Company press release

CrowdStrike Expands into Latin America, Opens Office in Mexico City

(April 25) Company press release