FROM THE DESK OF DEBORAH WEINSWIG

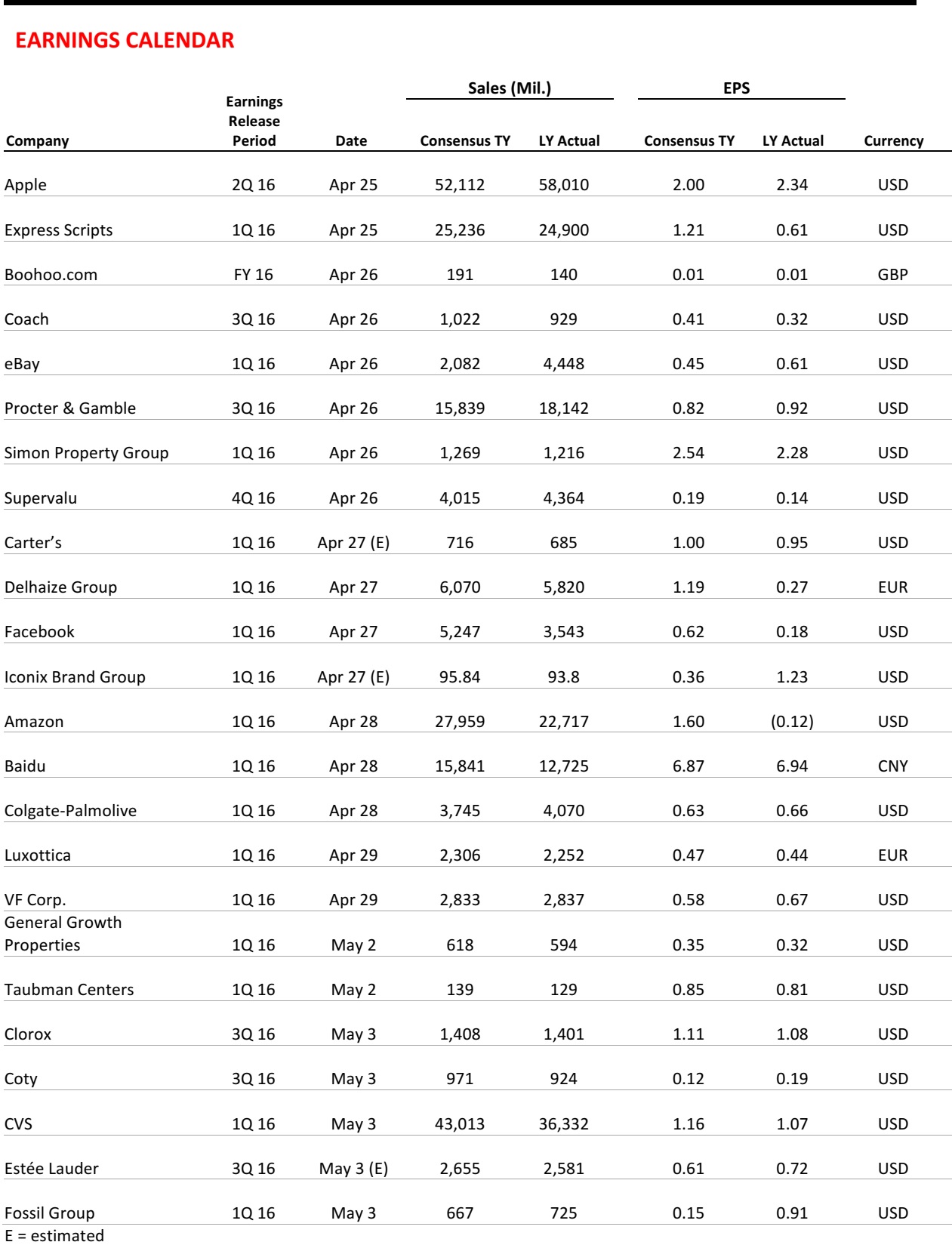

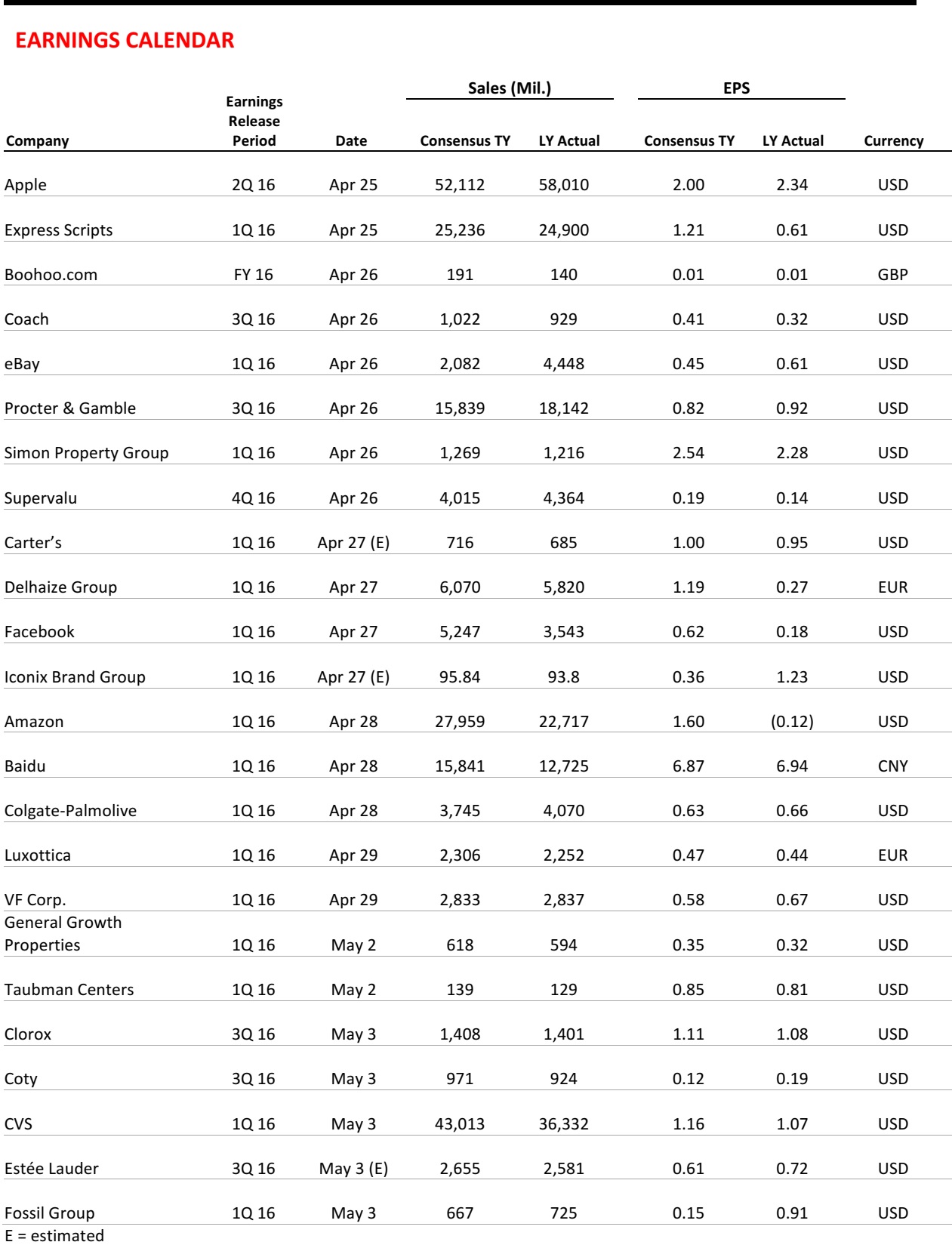

We recently attended a three-year planning meeting for Li & Fung, an affiliated company within the Fung Group, which got us thinking about how the retail industry will look in 2020. To gain insight, we looked at data from market research firm Euromonitor International, which, although fairly conservative, is quite valuable. According to Euromonitor, the US retail industry will report total sales of slightly more than $3.2 trillion in 2020, up from $3.0 trillion this year, for a 1.8% CAGR. For context, consider that the US Congressional Budget Office forecasts US annual GDP growth of 3.9%–4.0% over the 2016–2020 period, and that the National Retail Federation forecasts US retail sales growth of 3.1% in 2016.

Euromonitor’s 2020 retail sales estimates are shown in the figure below.

Source: Euromonitor International/Fung Global Retail & Technology

Euromonitor breaks retail sales into two major categories:

store (which accounts for 82% of projected 2020 sales) and

non-store (which accounts for 18%).

The largest store category is non-grocery specialists, which include (in order of decreasing size)

home and garden, health and beauty, apparel and footwear, leisure and personal goods, electronics and appliances and

other. Together, these are expected to represent nearly $1.2 trillion in sales and a CAGR of 0.5%. All of these categories except

electronics and appliances and

other are expected to grow during the 2016–2020 period (electronics and appliances and other are expected to decline). The apparel and footwear market is expected to total more than $275 billion in 2020, and to grow at a 0.7% CAGR from 2016–2020.

The second-largest store category and the largest category overall is

grocery. The US retail grocery market is expected to exceed $1 trillion in 2020, growing at a 0.7% CAGR from 2016–2020; that figure roughly accords with the US Census Bureau’s projection of 0.8% annual population growth during those years.

The third category within stores, the

mixed category, includes (in order of decreasing size)

warehouse clubs, department stores, mass merchandisers and

variety stores.

Together, these stores’ sales are expected to total more than $400 billion in 2020, and to grow at a 0.6% CAGR. All of these categories are expected to grow except

mass merchandisers, which is expected to post a modest decline.

The

non-store category is dominated by Internet sales, which are expected to comprise 82% of this category and amount to more than $475 billion in 2020. Euromonitor expects

Internet retail to grow at a 12.0% CAGR through 2020. By way of comparison, the US Census Bureau reported that year-over-year e-commerce growth in the fourth quarter of 2015 was 14.5%.

So, although these Euromonitor forecasts appear quite conservative, they are still extremely helpful in terms of understanding the US retail industry, and we look forward to analyzing these data in greater detail in the future.

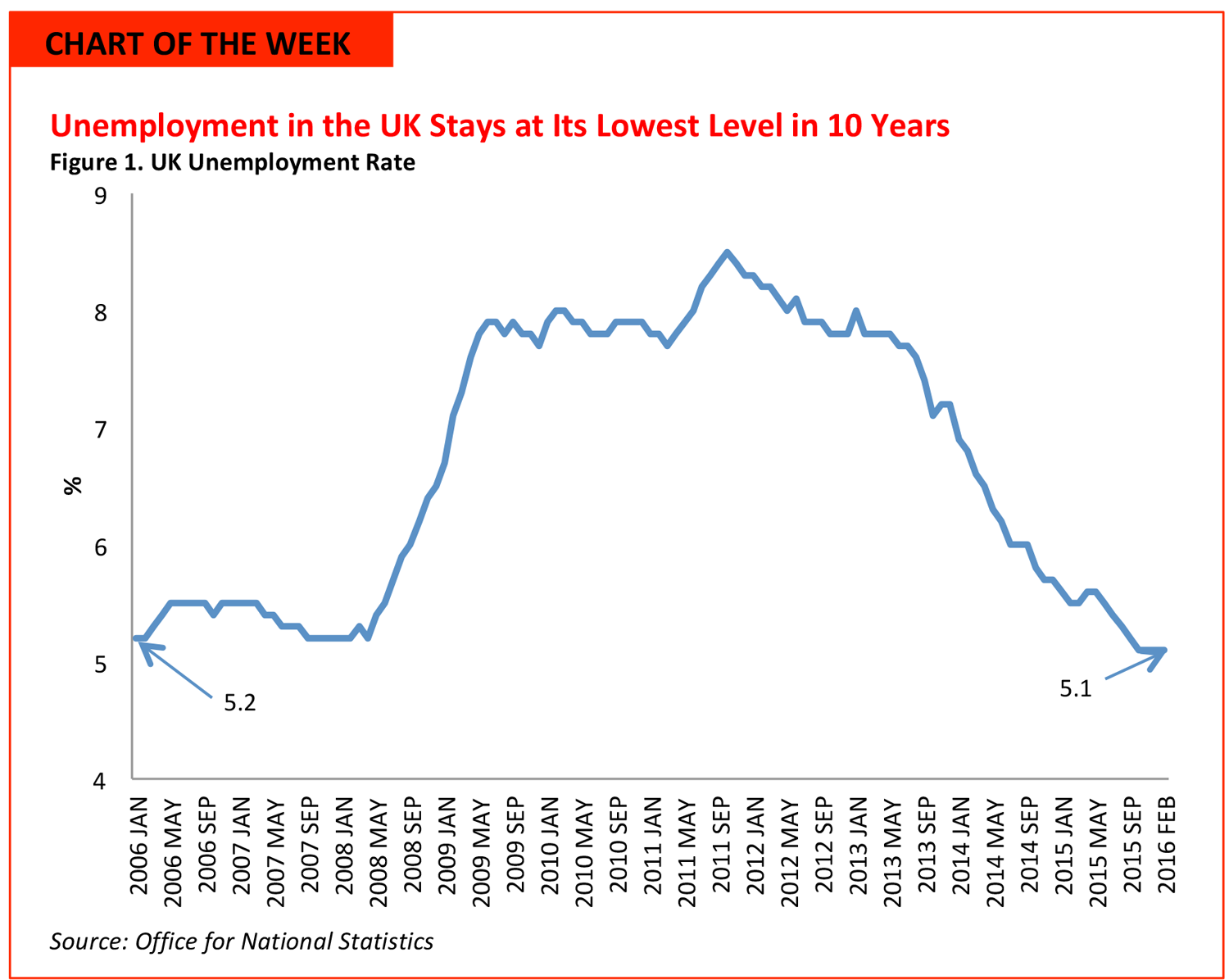

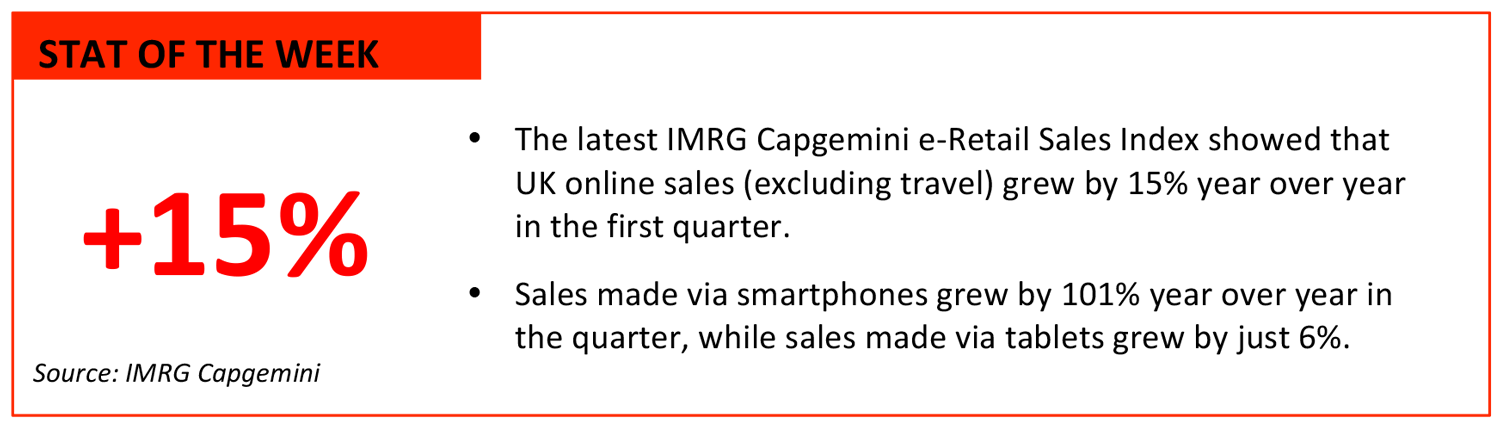

- The UK unemployment rate stood at 5.1% in February 2016, the Office for National Statistics announced this week. The level is a 10-year low, and has now stayed the same for five consecutive months.

- In February 2016, 1.7 million people were unemployed, 142,000 fewer than one year earlier.

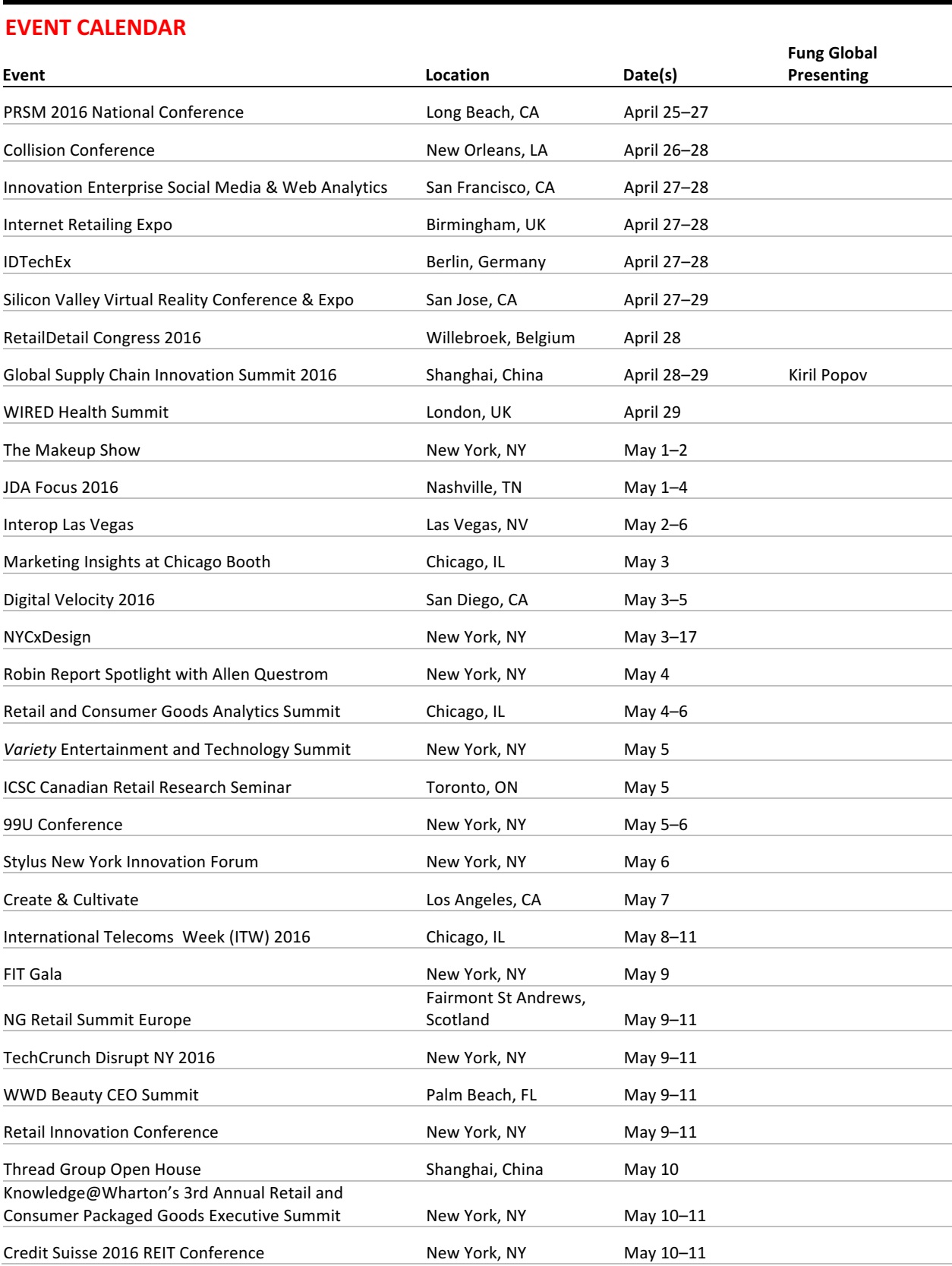

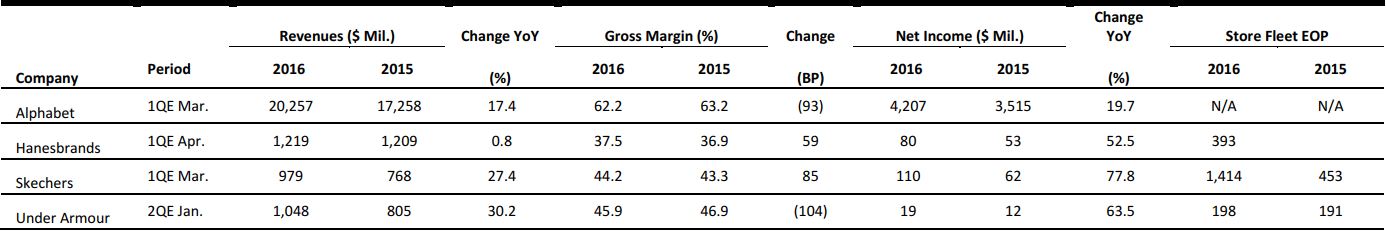

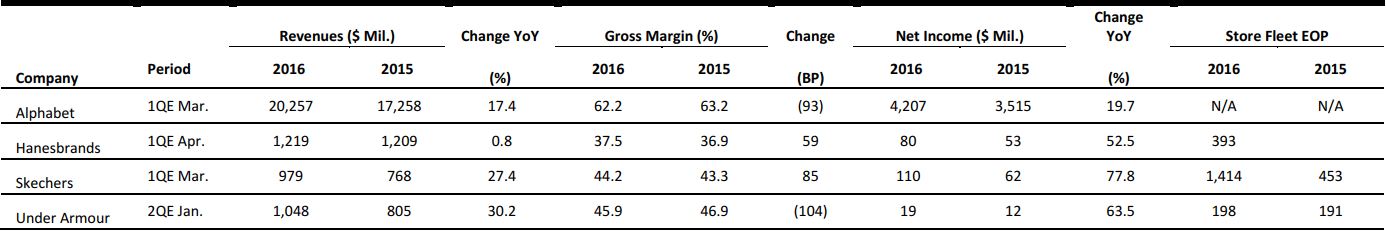

US RETAIL EARNINGS

Source: Company reports

US RETAIL HEADLINES

Why Authenticity Matters for Female Shoppers

(April 19) Women’s Wear Daily

Why Authenticity Matters for Female Shoppers

(April 19) Women’s Wear Daily

- Women increasingly demand more authenticity from brands, across channels, and millennials are more likely to buy from a brand that offers less “sales-y” and more relatable content.

- Social media and other online content is particularly important, as it can make consumers feel more connected and loyal to a brand. User-generated content is a powerful tool brands can use as they seek to create an authentic image, and women respond particularly strongly to content created by other women.

Consumer Spending, While Slowed, Seen Boosting GDP

(April 18) Women’s Wear Daily

Consumer Spending, While Slowed, Seen Boosting GDP

(April 18) Women’s Wear Daily

- Consumer spending growth was lackluster in the first quarter. Improved weather patterns may help boost consumer spending in the home improvement segment, but fashion apparel sales are not likely to rise. Consumer spending growth is expected to be 1.9% for the first quarter.

- Christ Christopher, Director of US and Global Economics at IHS Economics, told clients he expects “weak GDP growth to persist into the first quarter,” with GDP likely increasing by just 1.1%.

Smart IoT Tags Coming to 10 Billion Clothing Items in Next Three Years

(April 19) eWeek

Smart IoT Tags Coming to 10 Billion Clothing Items in Next Three Years

(April 19) eWeek

- RFID company Avery Dennison and IoT smart products platform vendor Evrything have entered a three-year deal that could connect 10 billion pieces of clothing. These apparel and footwear products, from some of the world’s largest fashion and performance brands, will be made and labeled with “unique digital identities.”

- The companies said placing IoT identifications in the clothing items will allow consumers, clothing manufacturers and retailers to gain new insights into purchases and their connections with other products.

Second-Tier Malls Have Their Fans

(April 19) The Wall Street Journal

Second-Tier Malls Have Their Fans

(April 19) The Wall Street Journal

- A diverse group of investors is making big bets on beaten-down shopping centers as mall owners such as Simon Property Group and General Growth Properties shift their focus to prime properties in desirable locations that generate heavy foot traffic.

- These investors believe the value of second-tier malls has fallen too far amid growing worries about e-commerce and the supply of retail space. The buyers argue that brick-and-mortar malls serve as community hubs in smaller markets, even if those malls do not generate the same sales as their rivals in wealthy suburbs.

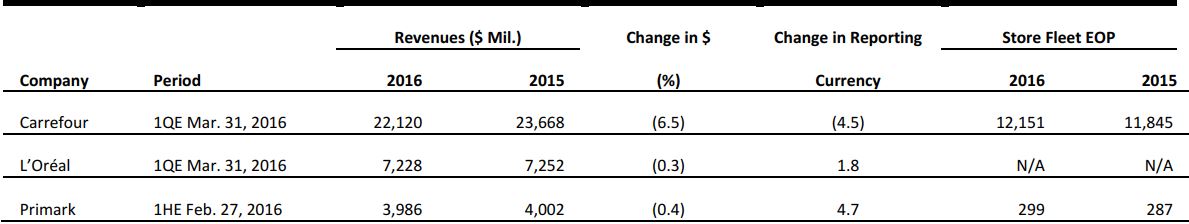

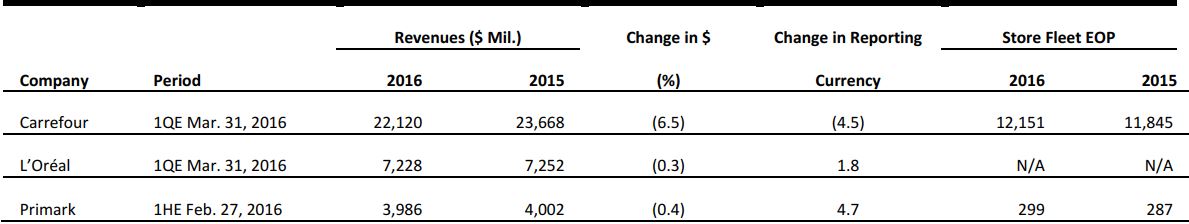

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Auchan to Invest in Russia

(April 19) Retailanalysis.igd.com

Auchan to Invest in Russia

(April 19) Retailanalysis.igd.com

- French retail group Auchan is investing RUB 17 billion (US$223 million) to expand its operations in Russia, according to its director of hypermarkets. The investment is expected to drive store expansion, with the majority of stores opening under the Atak banner. The company will also open four Auchan hypermarkets and four Auchan City stores.

- Auchan also plans to open a new logistics center in the country for the nonfood products it sells online. The site will be expanded to handle fresh produce later. Reportedly, Auchan intends to increase production of its private label ranges in Russia and export these to its other markets.

Wesfarmers to Lay Off 149 Homebase Head Office Staff

(April 19) Retail-week.com

Wesfarmers to Lay Off 149 Homebase Head Office Staff

(April 19) Retail-week.com

- Australian retail group Wesfarmers, the new owner of the Homebase DIY chain, is expected to lay off 149 head office staff as it attempts to restructure support functions at Homebase. This move follows Wesfarmers’ dismissal of the Homebase board in order to bring in its own directors.

- Wesfarmers plans to rebrand the Homebase stores under the Bunnings banner, and said that it is “not simply making across-the-board changes.” A Homebase spokesperson confirmed the move. Wesfarmers is expected to release its third-quarter trading update on April 21.

Footfall in Britain Declines in March

(April 18) British Retail Consortium

Footfall in Britain Declines in March

(April 18) British Retail Consortium

- UK retail footfall in March declined by 2.7% year over year, according to the British Retail Consortium (BRC) and Springboard Footfall and Vacancies Monitor. In February, footfall declined by 1.1%.

- Year over year in March, footfall at high-street stores declined by 3.9% and it fell by 3.7% at shopping centers. On the other hand, retail park footfall rose by 1.6% during the month. The chief executive of the BRC said the timing of Easter partially distorted year-over-year changes.

Metro to Launch Convenience Stores in China

(April 18) Retailanalysis.igd.com

Metro to Launch Convenience Stores in China

(April 18) Retailanalysis.igd.com

- German retail giant Metro Group plans to introduce MyMart, its convenience store brand, to China this year. It intends to open two MyMart stores in Shanghai first and later open stores in other cities across the country.

- The head of Metro China, Jeroen De Groot, added that the company would like to advance its franchise businesses by seeking out experienced local partners and growing further. The company currently runs 84 stores across 57 cities in China.

Vente-privee.com Buys Privalia, a Spanish Fashion E-Commerce Site

(April 18) Ecommercenews.eu

Vente-privee.com Buys Privalia, a Spanish Fashion E-Commerce Site

(April 18) Ecommercenews.eu

- French flash-sales retailer Vente-privee.com bought Privalia, a Spanish flash-sales website. The value of the deal was not disclosed, but it is widely speculated that the French company paid €500 million (US$546 million).

- The acquisition marks further consolidation in the flash-sales sector. Vente-privee.com acquired its Belgian competitor, Vente-Exclusive, in September last year, in a move to expand its operations in Northern Europe.

ASIA TECH HEADLINES

WeChat’s Competitor to Slack Has Arrived

(April 18) TechinAsia

WeChat’s Competitor to Slack Has Arrived

(April 18) TechinAsia

- WeChat launched version 1.0 of its long-anticipated office chat app, WeChat Enterprise, which is available in Chinese via apps for iOS, Android, Windows and OS X.

- The service can replace group email and make quick chats between colleagues easier. Useful add-ons let employees mark when they are on a break and hold group voice/text chats. The app also has work-specific features, such as automated forms for reimbursement and vacation requests.

News Corp Just Led a Seed Round in This Australian Augmented-Reality Startup

(April 18) TechinAsia

News Corp Just Led a Seed Round in This Australian Augmented-Reality Startup

(April 18) TechinAsia

- Plattar, an Australian startup that enables users to make, manage and distribute augmented-reality (AR) content, has just announced the completion of a US$843,000 seed round led by News Corp Australia.

- Plattar consists of two parts: an app builder that comes with customizable templates and a content management system for AR content. The startup plans to charge customers a monthly fee to use the product, and provides bespoke services for larger projects.

Alibaba Confirms US$1.25 Billion Investment in Food Delivery Service Ele.me

(April 18) TechCrunch

Alibaba Confirms US$1.25 Billion Investment in Food Delivery Service Ele.me

(April 18) TechCrunch

- Following a deal with Rocket Internet’s Lazada, e-commerce giant Alibaba confirmed a US$1.25 billion investment in Ele.me, a leading food delivery service in China, as part of its online to offline efforts.

- Ele.me remains an independent company, although Alibaba Executive Vice Chairman Joe Tsai has joined the company’s board. Alibaba has the potential to acquire Ele.me outright further down the line; it could not do that with Dianping-Meituan, as Tencent was also a stakeholder, and so sold its shares in that company earlier this year.

Japan’s TagCast Bags US$457,000 Series A from Angel Group Gukuedo

(April 18) e27.co

Japan’s TagCast Bags US$457,000 Series A from Angel Group Gukuedo

(April 18) e27.co

- Tagcast is offering three products: the battery-powered and easy-to-use TagCastBeacon; the lightbulb-unified LEDBeacon, which is most suitable for home use; and the PaperBeacon, which the company claims has had a “big impact” on online-to-offline and omni-channel operations in Japan.

- Apart from IoT devices, TagCast also provides a cloud service that enables clients to manage information effectively. The service utilizes Big Data to analyze user behavior in both outdoor and indoor locations, allowing stores and restaurants to send coupons and rewards points to visitors’ smartphones based on their actual visit history.

Ola Co-Founders Invest in “Smart” Electric Motorcycle Startup Tork

(April 18) e27.co

Ola Co-Founders Invest in “Smart” Electric Motorcycle Startup Tork

(April 18) e27.co

- Tork Motorcycles is an Indian startup developing the country’s first smart electric motorcycle. The motorcycle will address riders’ pain points with features such as GPS, storage, cloud connectivity and phone charging.

- The T6X electric motorcycle is in the closing stages of prototyping and certification. It will offer IP over a battery management system, control systems, motor tuning, drive train and overall product integration.

What the Alibaba-Lazada Deal Means for Southeast Asia’s Startups

(April 13) TechinAsia

What the Alibaba-Lazada Deal Means for Southeast Asia’s Startups

(April 13) TechinAsia

- Alibaba’s US$1 billion controlling stake acquisition in e-commerce startup Lazada serves as “validation” that Southeast Asia is very attractive to strategic investors, and it will trigger many others to look at the region for investment and acquisition opportunities.

- Hanno Stegmann, Managing Director of Rocket Internet’s Asia Pacific Internet Group, refuted the idea that there would be no room for other players to compete, as the whole ecosystem is just developing and companies can look beyond e-commerce as the next-generation business model.

LATAM RETAIL HEADLINES

Mexico City’s Masaryk Street Revamp Hits Luxury Store Sales

(April 18) WWD.com

Mexico City’s Masaryk Street Revamp Hits Luxury Store Sales

(April 18) WWD.com

- Mexico’s most expensive luxury shopping street, Masaryk Street, has been suffering due to the decline in luxury good sales and an expensive, US$30 million remodeling project that has been laden with controversy and delays.

- The initiative was meant to replace sidewalks, light fixtures, gardens and traffic islands, but much remains unfinished despite the June 2015 deadline. Retailers are suffering as a result, and many have closed their doors altogether.

Chile’s Falabella to Enter Mexico with Soriana Joint Venture

(April 15) Reuters

Chile’s Falabella to Enter Mexico with Soriana Joint Venture

(April 15) Reuters

- Chilean retailer Falabella is entering Mexico in a joint venture with Mexican supermarket chain Soriana. The total investment of US$600 million in capital and real estate will be split 50/50 between the two companies over the next five years.

- The companies will finalize the agreement over the next 90 days, after which they expect to open 20 Sodimac stores in Mexico.

Expansion of India-Chile Preferential Trade Agreement

(April 20) Business Standard

Expansion of India-Chile Preferential Trade Agreement

(April 20) Business Standard

- India’s Union Cabinet, chaired by Prime Minister Narendra Modi, approved the expansion of the India-Chile Preferential Trade Agreement. The expansion is expected to immensely benefit both countries, as Chile offers concessions to India on 1,798 tariff lines, and India offers the same to Chile on 1,031 tariff lines.

- First signed in 2006, the agreement has been beneficial for both countries. Bilateral trade during 2014–2015 was US$3.65 billion, with exports at US$0.57 billion and imports at US$3.08 billion.

Seeking Growth, TCL Counts on Brazilians’ Mobile Phone Addiction

(April 18) Bloomberg

Seeking Growth, TCL Counts on Brazilians’ Mobile Phone Addiction

(April 18) Bloomberg

- Despite the shrinking Brazilian economy, TCL Communications Technology is hiring more employees and widening its distribution of Alcatel brand phones in Brazil. Although the economy is expected to shrink by 3.8% in 2016, TCL expects to sell 40 million devices during the year.

- Brazilians continue to buy cell phones despite the difficult economy, presenting an opportunity for the Chinese phonemaker to gain headway in the market, where it currently ranks fifth.

Brazil’s March Current Account Deficit Smallest in over Six Years

(April 20) Bloomberg

Brazil’s March Current Account Deficit Smallest in over Six Years

(April 20) Bloomberg

- Brazil’s March current account gap was the narrowest it had been since August 2009, as the country’s prolonged recession curbed imports. Brazilian imports were at six-year lows amid a deepening political crisis and continually decreasing consumer confidence.

- Foreign investment has remained at high levels despite uncertainties, though it fell during March, to US$5.6 billion from US$5.9 billion.

Wesfarmers to Lay Off 149 Homebase Head Office Staff

(April 19) Retail-week.com

Wesfarmers to Lay Off 149 Homebase Head Office Staff

(April 19) Retail-week.com

WeChat’s Competitor to Slack Has Arrived

(April 18) TechinAsia

WeChat’s Competitor to Slack Has Arrived

(April 18) TechinAsia

Expansion of India-Chile Preferential Trade Agreement

(April 20) Business Standard

Expansion of India-Chile Preferential Trade Agreement

(April 20) Business Standard