Source: Prosper Insights & Analytics

From the Desk of Deborah Weinswig

For the Brits, it is election time again! Prime Minister Theresa May announced this week that the UK will go to the polls in a general election on June 8—not even one year since the country’s referendum on EU membership and barely two years since the last UK general election, when the Conservative Party won a surprise majority. The next general election had not been scheduled to take place until 2020. British consumers may well feel a sense of voter fatigue, but will the election impact their spending habits? We address that question in this week’s note, and consider the state of the British consumer more broadly.

Impact on the Consumer

Political uncertainty is never good for consumer sentiment—and, in turn, the retail sector—because many shoppers are tempted to postpone discretionary purchases until they have greater clarity and confidence. So, in theory, a general election may soften discretionary consumer spending in the UK.

In practice, however, any impact from the 2017 election will be very limited, in our view, for three reasons:

- First, the opinion polls leave little scope for doubt about the results of this election, having consistently pointed to a substantial majority for the ruling Conservative Party. This eliminates much uncertainty as to future policies.

- Second, the UK has already been through the bigger shock of the EU referendum and its result, with no detrimental effect on consumer spending. In fact, the Brexit vote was followed by a mini boom.

- Third, with just seven weeks until Election Day, any impact from the early election would likely be brief.

What Is the State of the British Consumer?

The election may well mark a shift from a period of buoyant consumer spending to one of slightly squeezed discretionary spending. In the past year, British consumers have enjoyed robust economic growth, record employment levels, low inflation and sustained, though modest, wage growth.

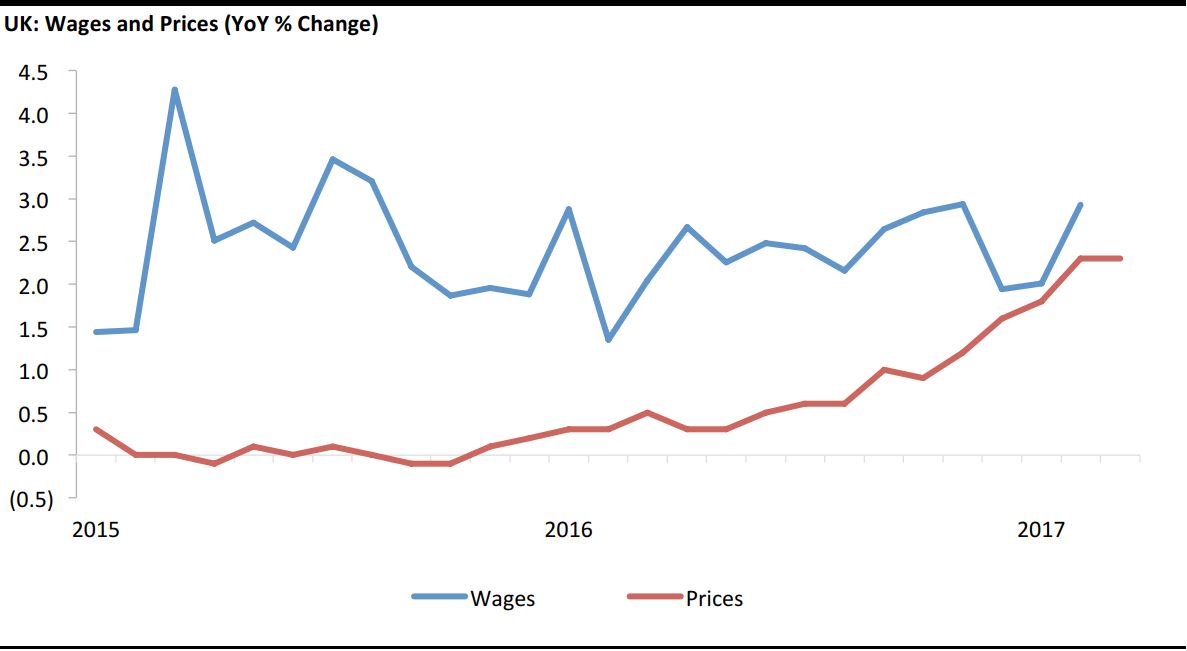

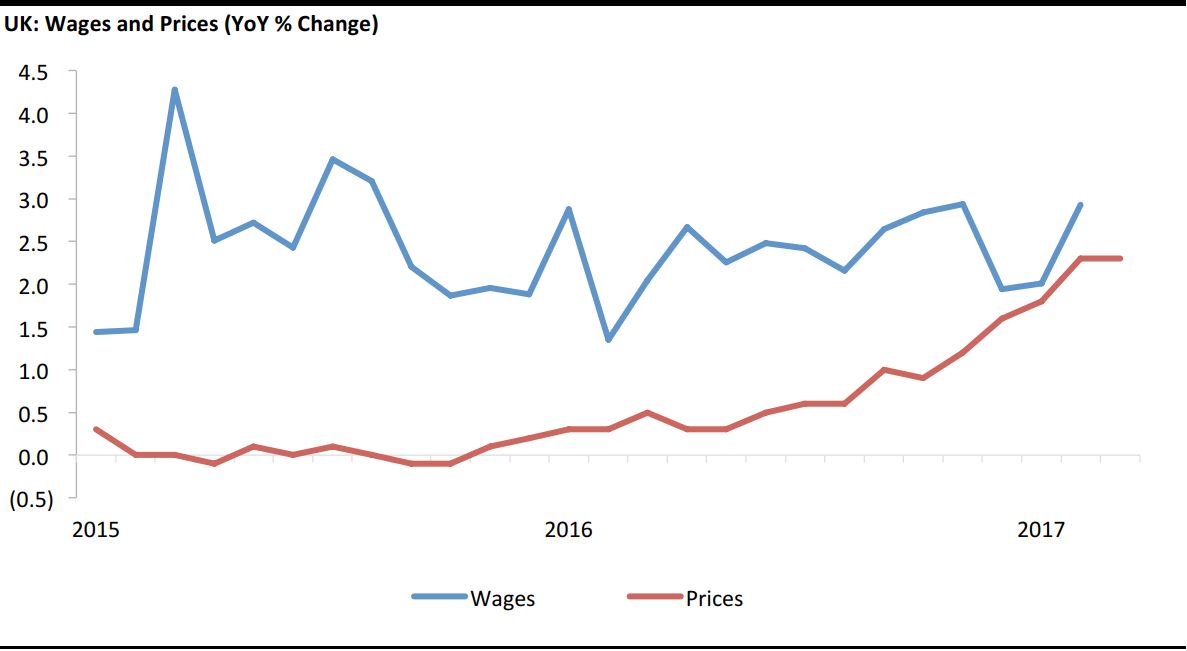

As we chart below, however, the gap between price inflation and wage increases has narrowed sharply as automotive fuel prices have jumped and the pound’s depreciation has partly fed through to shop prices. Any continuation of the trend will erode shoppers’ spending power.

Wages through February 2017; prices through March 2017

Source: Office for National Statistics/Fung Global Retail & Technology

Despite the possibility that the trend will continue, we are not pessimistic on the consumer-spending outlook for this year, for two primary reasons. First, ultralow interest rates mean consumer credit remains exceptionally cheap, and British shoppers have long been willing to borrow in order to spend. Second, the impact on prices from the depreciation of the pound is a one-off rather than a sustained upward pressure. In addition, it is possible that the increase in fuel prices will slow as global oil prices move closer to leveling off.

So, although 2017 may be a tougher year for UK retail than 2016 was, we are optimistic that most British consumers will be able to ride out any temporary hit to their spending power.

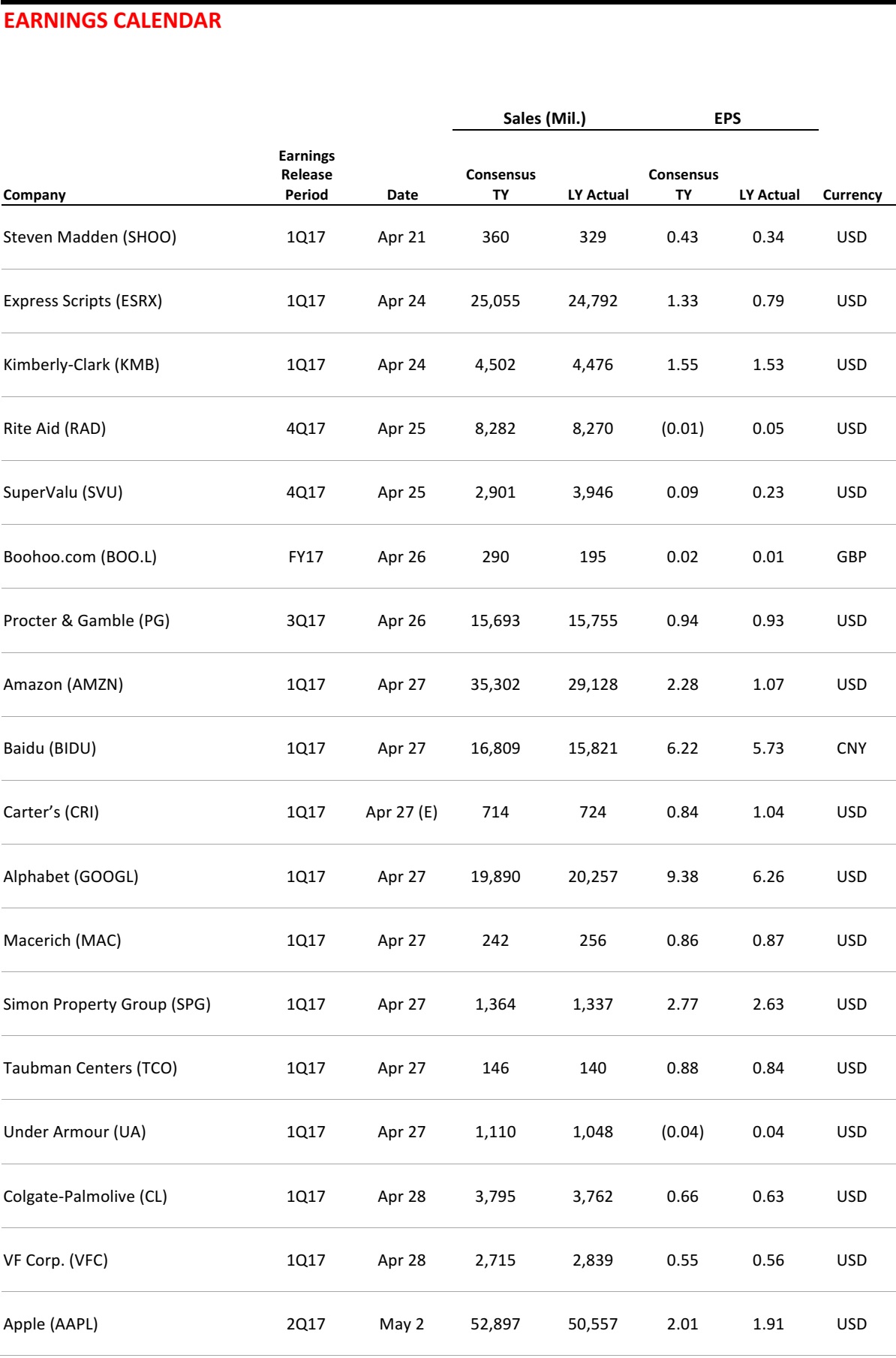

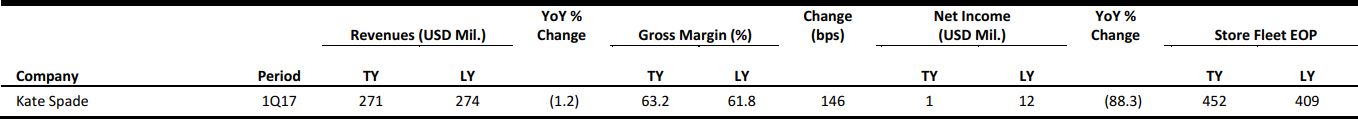

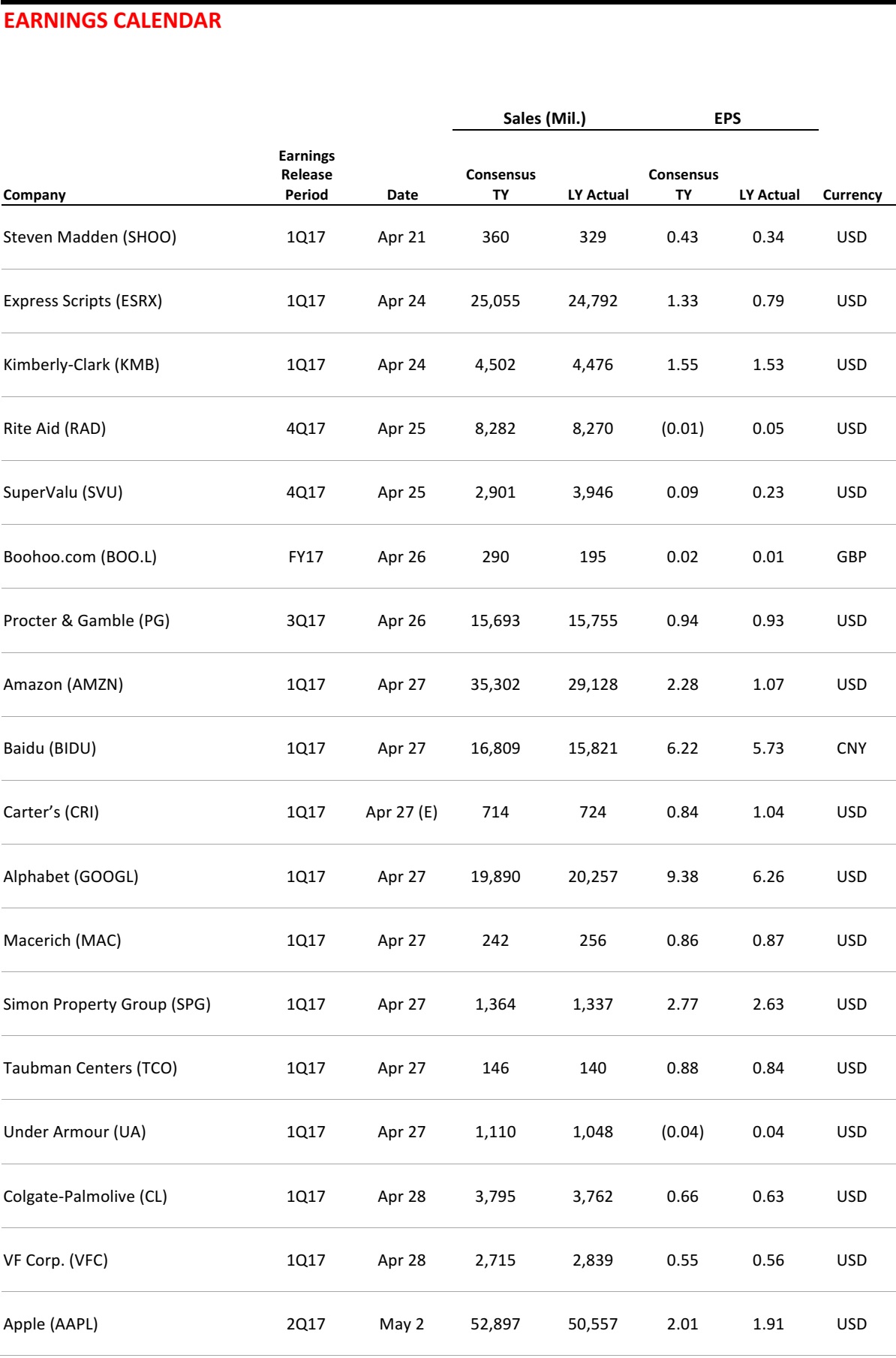

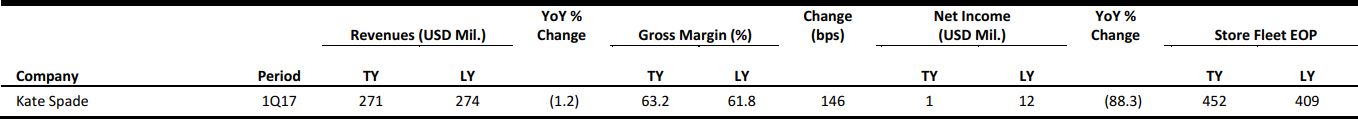

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

MasterCard Launches Fast Payments on Facebook Messenger

(April 19) The Wall Street Journal

MasterCard Launches Fast Payments on Facebook Messenger

(April 19) The Wall Street Journal

- MasterCard is adding a new payments option to Facebook Messenger, the social-media company’s messaging service. The card network added its digital wallet, Masterpass, on Tuesday, allowing consumers to place online orders on Facebook’s service with just a few clicks.

- The rollout is in the early stages, with the service currently available for a handful of merchants, including FreshDirect and Subway. The move follows a separate announcement by PayPal on Tuesday that it will make its offerings available on Alphabet’s Android Pay, marking one of the payment company’s biggest steps to bringing its digital wallet to physical stores.

Walmart in Talks with Bonobos

(April 18) The Wall Street Journal

Walmart in Talks with Bonobos

(April 18) The Wall Street Journal

- Walmart is in talks to buy men’s clothing retailer Bonobos for about $300 million, according to people familiar with the situation. The move is the latest in a string of deals aimed at attracting wealthier shoppers and more fashion-forward brands than Walmart’s own website does.

- The acquisition would be Walmart’s fourth purchase of a small, online-focused retailer since it bought Jet.com for $3.3 billion last September. Last month, Jet founder Marc Lore led the purchase of hipster clothing website ModCloth. In February, Walmart bought outdoor specialty retailer Moosejaw and the month before, it bought online shoe seller ShoeBuy.

Teen Retailer Rue21 Closing Its Money-Losing Stores

(April 18) USA Today

Teen Retailer Rue21 Closing Its Money-Losing Stores

(April 18) USA Today

- Teen fashion retailer Rue21 is the latest chain to say that it is shuttering some of its stores. The company said in a statement, “As part of our ongoing business transformation into a more cost-efficient operator, we are closing unprofitable stores across our fleet in order to focus on our many hundreds of highly profitable locations. The exact number and timing of these closings will be determined in the coming weeks.”

- Rue21, with storefronts in strip malls and shopping centers across the US, is likely suffering from the declining foot traffic that is hobbling so many retailers as shoppers increasingly do their buying online. The store chain is also competing with fast-fashion giants such as Zara and H&M, which cater to the same trend-focused youthful shopper, although Rue21 stands out with its offerings of plus-size clothing.

US Retail Sales Fell by 0.2% in March vs. the 0.1% Drop Expected

(April 14) Reuters.com

US Retail Sales Fell by 0.2% in March vs. the 0.1% Drop Expected

(April 14) Reuters.com

- US retail sales fell for a second straight month in March amid softening demand for automobiles, suggesting that economic growth slowed abruptly in the first quarter. The US Commerce Department said that retail sales dropped by 0.2% last month. February’s retail sales were revised down to show a 0.3% decrease instead of the previously reported 0.1% gain.

- Economists polled by Reuters had forecast that retail sales would slip 0.1% last month. Compared with March last year, retail sales increased by 5.2%. Excluding automobiles, gasoline, building materials and food services, retail sales rebounded by 0.5% after a downwardly revised 0.2% decline in February.

BJ’s Wholesale Club Up for Sale and Amazon May Be Interested

(April 14) New York Post

BJ’s Wholesale Club Up for Sale and Amazon May Be Interested

(April 14) New York Post

- BJ’s Wholesale Club is putting itself up for sale, and Amazon has expressed modest internal interest in the chain. BJ’s, a Northeast regional warehouse retailer owned by private equity firms, has recently scrapped ambitions for an initial public offering because of Wall Street’s growing worries over the retail sector, sources said.

- Instead, CVC Capital Partners and Leonard Green & Partners, the buyout firms that took BJ’s private for $2.8 billion six years ago, are pressing ahead for an outright sale that could fetch more than $4 billion, according to people close to the situation.

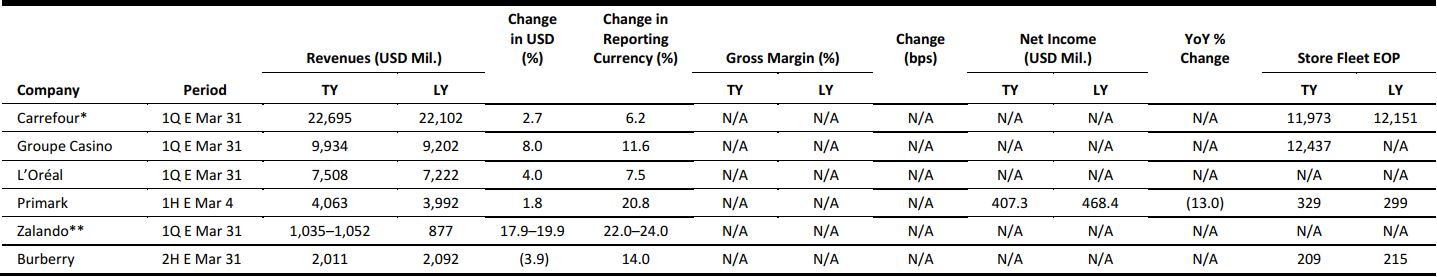

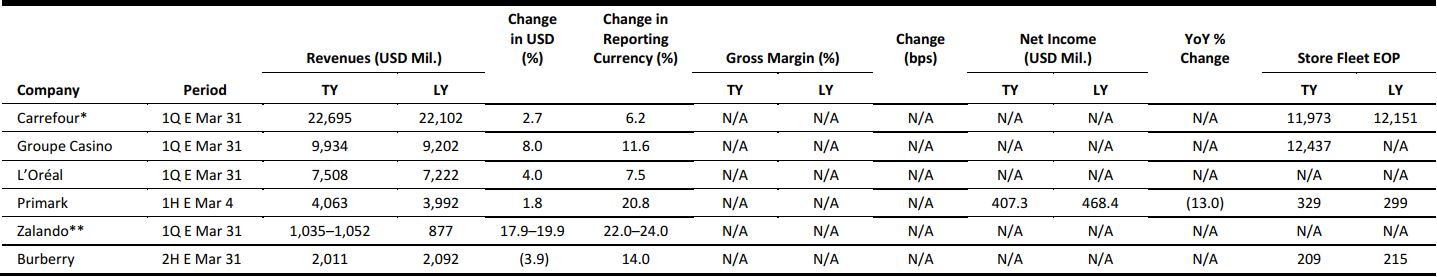

EUROPE RETAIL EARNINGS

* Carrefour revenues include sales tax.

** Zalando provides a range for revenues in its preliminary update.

Source: Company reports/Fung Global Retail & Technology

EUROPE RETAIL HEADLINES

House of Fraser Reports Full-Year Results: Profit Before Tax Jumps 162%

(April 18) Company press release

House of Fraser Reports Full-Year Results: Profit Before Tax Jumps 162%

(April 18) Company press release

- Premium British department store group House of Fraser reported full-year total gross transaction value of £1.3 billion (US$1.6 billion), flat versus last year. Comps were up 0.9%, and profit before tax grew by 162%, to £3.4 million (US$4.3 million).

- The company’s branded sales grew by 3.6%, while concession sales growth was flat and own-brand sales declined by 2.1%. All categories posted sales growth except for womenswear, which saw sales drop by 0.6%. The beauty category performed the best, with sales up 4.1%.

X5 to Open at Least 1,000 Stores Across Russia over the Next Three Years

(April 15) ESMMagazine.com

X5 to Open at Least 1,000 Stores Across Russia over the Next Three Years

(April 15) ESMMagazine.com

- X5 Retail Group, one of the largest food retailers in Russia, has announced that it will open at least 1,000 new stores across the country over the next three years as part of a deal with Russian consumer societies group Centrosoyuz.

- The agreement aims to “encourage the development of retail trade in Russia…and secure the supply of affordably priced staples and other high-quality products to remote rural areas.” The project will see X5 open its stores at Centrosoyuz’s existing consumer cooperatives and will be implemented mainly through franchising.

Sainsbury’s Reveals Next Stage of Plans for Argos and Habitat

(April 13) Company press release

Sainsbury’s Reveals Next Stage of Plans for Argos and Habitat

(April 13) Company press release

- British grocery retailer Sainsbury’s has opened 50 Argos digital stores across its supermarkets and intends to open a total of 250 over the next three years. The retailer also plans to update 60 existing Argos stores to a new digital format. Sainsbury’s has opened seven Mini Habitat concessions so far and intends to open 10 more this fiscal year.

- The company said that it has noticed “a clear uplift of 1%–2% on sales from Argos customers shopping for Sainsbury’s food, general merchandise and clothing products,” suggesting that the move to open Argos stores within the grocer’s supermarkets has been welcomed by its customers.

Dunelm Group Comps Decline by 2.2% in Fiscal 3Q17

(April 12) Company press release

Dunelm Group Comps Decline by 2.2% in Fiscal 3Q17

(April 12) Company press release

- British homewares and furniture retailer Dunelm Group reported total sales of £255.1 million (US$323.2 million) for the third quarter of 2017, up 11.4% year over year. Excluding Worldstores, which Dunelm recently acquired, the group’s retail sales rose by 1.0%, to £231.3 million (US$293.1 million). Comps declined by 2.2% in the quarter.

- The group said that it has outperformed the homewares market, which is in decline, that it is trading in a volatile environment and that its outlook for the full year remains unchanged. The company will report full-year results on September 13, 2017.

Farfetch Unveils Store of the Future Project

(April 12) Bloomberg.com

Farfetch Unveils Store of the Future Project

(April 12) Bloomberg.com

- Online luxury fashion pure play Farfetch has unveiled a project called “The Store of the Future,” which employs software and devices to help its luxury brand partners serve their in-store and online customers better.

- In-store technologies include a scanner that enables customers to “log in” with a smartphone when they are at a store, so store staff can assist them better, and a holographic display that enables customers to create and order customized shoes. The technologies will be launched in Browns in London and the Thom Browne store in New York later this year.

ASIA TECH HEADLINES

Alibaba’s Ant Financial May Have Won the Bidding War for MoneyGram After Upping Its Offer to $1.2 Billion

(April 17) TechCrunch.com

Alibaba’s Ant Financial May Have Won the Bidding War for MoneyGram After Upping Its Offer to $1.2 Billion

(April 17) TechCrunch.com

- After increasing its bid to $1.2 billion, Ant Financial—the Alibaba affiliate company focused on financial services—appears to have finally won its battle with Euronet to acquire MoneyGram, the US-based cross-border payments service.

- Ant Financial’s new offer followed its initial bid of $880 million and represents a 64% premium to MoneyGram’s average share price prior to the announcement of the first offer. The new offer was unanimously approved by MoneyGram’s board, and a collection of shareholders who own 46% of voting rights also gave it the nod.

Robot Tutor Musio Makes Its Retail Debut in Japan

(April 14) TechCrunch.com

Robot Tutor Musio Makes Its Retail Debut in Japan

(April 14) TechCrunch.com

- A robotic language tutor called Musio has made it from crowdfunding campaign to full-fledged product with a debut in Japanese stores this week. Priced at ¥98,000 (about US$900), Musio is now sold online through SoftBank’s marketplace and Amazon Japan, and through a handful of brick-and-mortar stores.

- Musio’s parent company, artificial-intelligence venture AKA, is the latest startup from Raymond Jung, a cofounder of the massively successful South Korean test-prep venture Hackers Education Group. So far, AKA has raised US$10.7 million in seed and series A funding.

Foxconn Seeks Apple’s Backing for Toshiba Memory Business Bid

(April 17) FT.com

Foxconn Seeks Apple’s Backing for Toshiba Memory Business Bid

(April 17) FT.com

- Taiwan’s Foxconn, officially know as Hon Hai Precision Industry, has sought the backing of Apple to strengthen its position in a bidding war for Toshiba’s memory business that has evoked strong national pride and a backlash against Japanese technology falling into the hands of foreign rivals.

- The sale of Toshiba’s NAND flash memory business, valued at $18 billion or more, is considered critical to the survival of the loss-making Japanese industrial conglomerate. Doubts have risen about Toshiba’s future as a going concern after its US nuclear unit, Westinghouse, filed for Chapter 11 bankruptcy protection last month.

E-Sports Is Coming to the Asian Olympics, Thanks to Alibaba

(April 18) TechinAsia.com

E-Sports Is Coming to the Asian Olympics, Thanks to Alibaba

(April 18) TechinAsia.com

- Alisports, the sports affiliate of e-commerce giant Alibaba, announced that it is partnering with the Olympic Council of Asia to bring e-sports (competitive computer gaming) to the 2018 and 2022 Asian Games, to be held in Jakarta and Hangzhou, respectively.

- According to research from Newzoo, the global e-sports economy will grow by 41% year over year, to hit $696 million in revenue in 2017, with China and South Korea accounting for 22% of global revenue. The firm says that the Asia-Pacific region will account for 51% of e-sports enthusiasts in 2017.

LATAM RETAIL AND TECH HEADLINES

Retailer Casino’s Sales Growth Impacted by Signs of Weakness in France and Brazil

(April 18) DailyMail.com

Retailer Casino’s Sales Growth Impacted by Signs of Weakness in France and Brazil

(April 18) DailyMail.com

- French retail group Casino kept its full-year profit growth goals on Tuesday, although it reported that first-quarter sales growth had slowed due to signs of weakness at the Géant Casino hypermarkets in France and that lower inflation had impacted its Brazilian business.

- Casino, which also controls Brazil’s GPA, posted first-quarter sales of €9.321 billion (US$9.92 billion). Shares in the company, which have risen by about 13% so far in 2017, dipped 0.7%.

Brazilian Retailer Netshoes Raises $148.5 Million in US IPO

(April 12) Law360.com

Brazilian Retailer Netshoes Raises $148.5 Million in US IPO

(April 12) Law360.com

- Latin American e-commerce company Netshoes raised $148.5 million after pricing its shares at the bottom of its range, guided by Simpson Thacher & Bartlett, marking the second Brazilian issuer to tap US public capital markets last week.

- The fast-growing company plans to spend the funds on capital needs, including developing software and acquiring property and equipment for its distribution centers. Netshoes operates in Brazil, Argentina and Mexico.

Sharp Revision to Brazil’s Retail Data Fuels Recovery Hopes

(April 12) Reuters.com

Sharp Revision to Brazil’s Retail Data Fuels Recovery Hopes

(April 12) Reuters.com

- Recently released government data showed that retail sales in Brazil started the year in much better shape than previously thought, after an extraordinary upward revision for the January results offset a small drop in February.

- In January, sales rose by 5.5% from the previous month, after originally being reported to have dropped by 0.7%. The surprisingly good performance of Brazil’s commerce in the beginning of 2017, despite record-high unemployment and double-digit interest rates, underpins hopes that the economy is about to exit its worst recession on record.

7-Eleven Mexico, Miroglio and Konzum Deploy Oracle Solutions

(April 12) RetailTouchPoints.com

7-Eleven Mexico, Miroglio and Konzum Deploy Oracle Solutions

(April 12) RetailTouchPoints.com

- Three major international retailers, 7-Eleven Mexico, Miroglio Fashion and Croatian grocery retailer Konzum, recently selected solutions from Oracle Retail to help them better manage their brick-and-mortar stores and improve omnichannel integration.

- 7-Eleven Mexico, which operates 1,950 convenience stores across 15 Mexican states, has deployed Oracle Retail Merchandise Operations Management solutions that are designed to automate best practices, improve communication among stores and provide more complete data to empower associates.

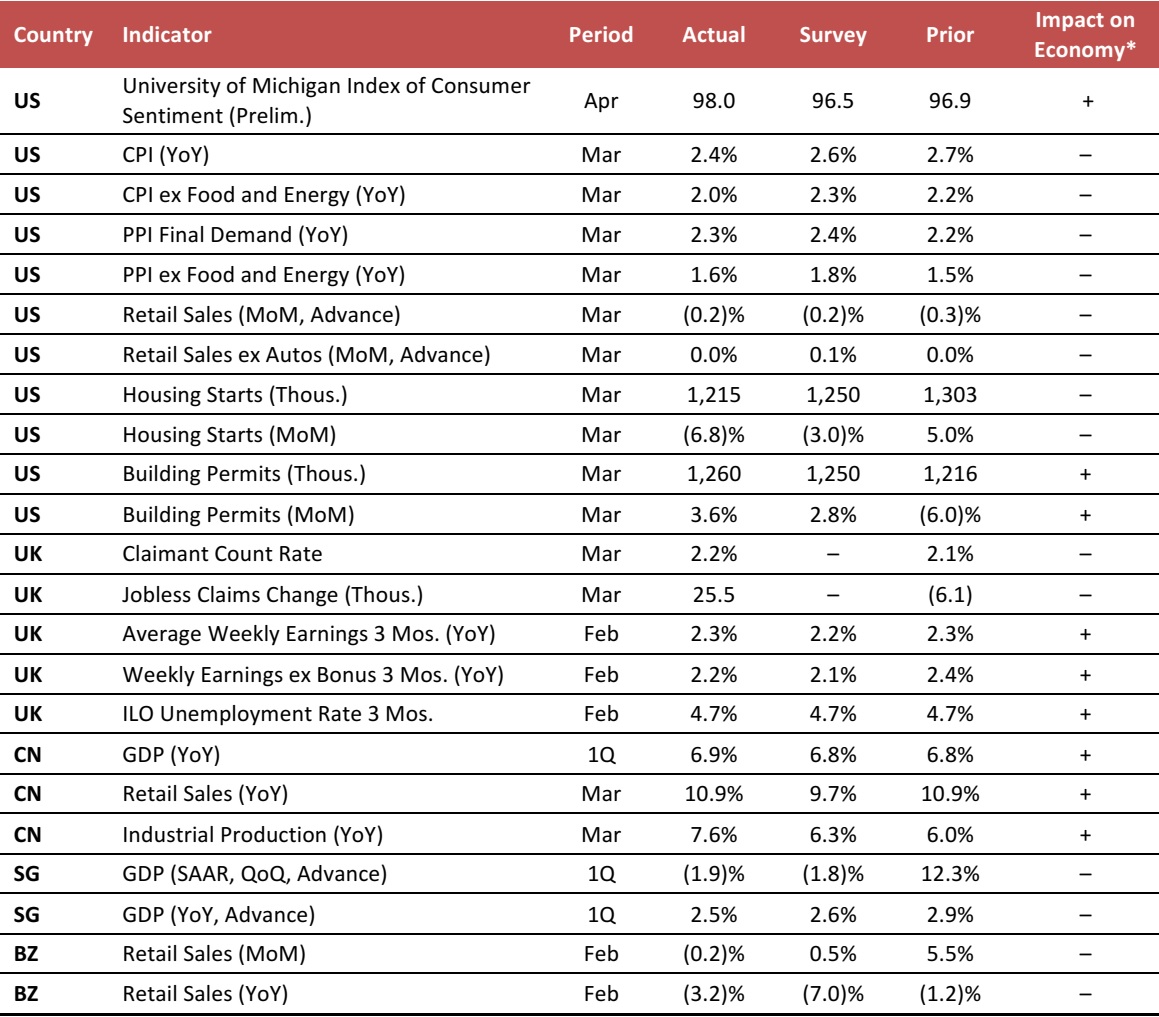

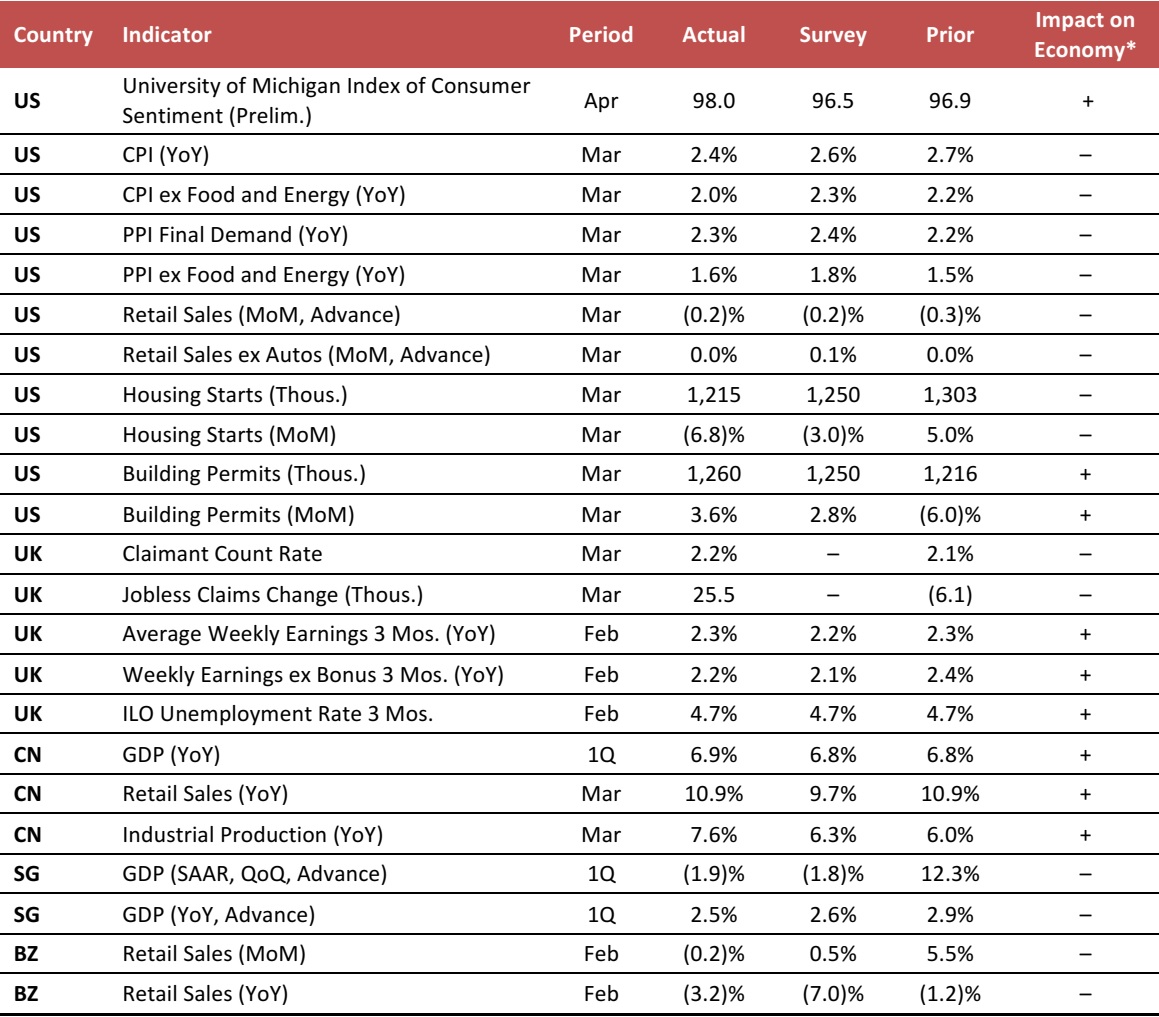

MACRO UPDATE

The following are key insights from global macro indicators released April 12–19, 2017:

- US: Hard data released during the week reflected weakness in the US economy, despite the improved sentiment suggested by soft data. Both the Consumer Prices Index (CPI) and Producer Prices Index (PPI) saw slower inflation. Retail sales declined and housing starts dropped sharply in March.

- Europe: In the UK, the claimant count rate nudged up and jobless claims increased significantly in March. Average earnings in the UK increased modestly in February, while the unemployment rate remained unchanged.

- Asia-Pacific: In China, first-quarter GDP growth was better than expected and March retail sales and industrial production saw solid growth. In Singapore, first-quarter GDP growth was weaker than expected.

- Latin America: In Brazil, retail sales came in below expectations in February. The sales figure dropped slightly month over month following an upward revision of January’s data.

* Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: University of Michigan/US Bureau of Labor Statistics/US Census Bureau/US Federal Reserve/UK Office for National Statistics/China National Bureau of Statistics/Singapore Ministry of Trade and Industry/Instituto Brasileiro de Geografia e Estatística/Fung Global Retail & Technology