Web Developers

FROM THE DESK OF DEBORAH WEINSWIG

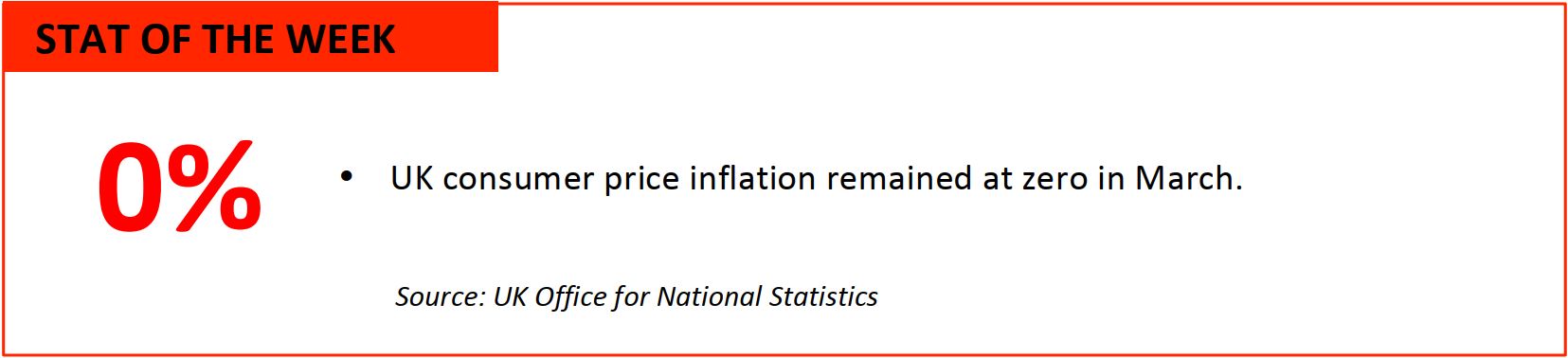

US retail sales achieved a lukewarm, 0.3% annual increase in March, but sporting goods retailers were a real standout, with a 5.1% gain; only spending at restaurants and on building materials and autos grew more rapidly. Eating out and working out: what a concept! What a lifestyle! And increasingly, it At the DICK’S Sporting Goods April 14 analyst meeting, management was very positive about the prospects for licensed and private brands (~$1 billion over the next few years) as well as about leading national brands in the in-store shops. Along with SKU rationalization, DICK’S has successfully reallocated selling space from golf and fitness to women’s and kids’, a strategy that drove its fourth-quarter 3.4% comp store sales gain and 17% earnings increase. In 2015, DICK’S will launch its first marketing campaign directed exclusively to women as it seeks to capture the millions of women who work out. It’s not as though there are only a few venues where women can buy their workout gear. lululemon athletica, lucy, Sweaty Betty and Fabletics all cater to female athletes. Target and Walmart also have ample workout offerings, as does Victoria’s Secret. And on a trip through the Saks Fifth Avenue flagship last week, I noticed a new assortment of athletic wear, mostly flowered capris and leggings at competitive price points of $68 to $88. Gone are the days of “shrink it and pink it,” to quote Under Armour’s founder and CEO Kevin Plank, alluding to the strategy of many successful men’s active sportswear brands as they approached the female market. Women tend to purchase outfits, and thus have a top or two for every bottom, driving sales and demand for differentiation and novelty. Under Armour, founded in 1996, has been pursuing the female athlete market since 2003. As part of a $15 million marketing campaign called I WILL WHAT I WANT, the company recently joined forces with ballerina Misty Copeland (soloist with the American Ballet Theatre) and model Gisele Bündchen to attract women beyond the traditional athlete demographic. FBIC Global Retail & Technology sees these two celebrities driving store traffic of both sexes, and creating excitement and buzz for the Under Armour brand. Under Armour is at the forefront of digital and connected fitness, too, but in a social way that draws on the strength of the brand and its connection with consumers. Recent and soon-to-close acquisitions expand the Under Armour digital community to approximately 120 million individuals, supporting Under Armour’s raison d’être, to make all athletes better. What Facebook is to social and LinkedIn is to business, Under Armour wants to be to health and fitness. With its core customers spending more and more time across different screens, platforms, networks and content providers, the challenge is how to be relevant and keep them engaged. Under Armour began working on this in November 2013 with its acquisition of MapMyFitness, an agnostic, open platform. There isn’t a device on the planet that doesn’t work with the MapMyFitness platform: Android and iOS, Jawbone, Fitbit and Garmin, and whatever the next latest and greatest wearable might be. They all work. And that is revolutionary. As Plank said, “We don’t have competitors in this world. We have partners.” Welcome to the app economy.

FBIC sees digital playing an increasingly bigger role in athletic performance, from tracking performance and body metrics to gamification, while building brand relationships. Ultimately, it could lead to selling more shirts and shoes. Lifestyle branding at work!

The next step after data collection is predictive analytics. Today’s digital technology and the Internet of Things allow for an average runner to get the same level of analysis that only an elite athlete would have gotten 15 years ago. And it’s free, instead of costing several hundreds of thousands of dollars. You can have a coach in your pocket, and it’s only a matter of time before the technology moves from wearable devices and smartphones to the apparel you’re wearing.

What Facebook is to social and LinkedIn is to business, Under Armour wants to be to health and fitness. With its core customers spending more and more time across different screens, platforms, networks and content providers, the challenge is how to be relevant and keep them engaged. Under Armour began working on this in November 2013 with its acquisition of MapMyFitness, an agnostic, open platform. There isn’t a device on the planet that doesn’t work with the MapMyFitness platform: Android and iOS, Jawbone, Fitbit and Garmin, and whatever the next latest and greatest wearable might be. They all work. And that is revolutionary. As Plank said, “We don’t have competitors in this world. We have partners.” Welcome to the app economy.

FBIC sees digital playing an increasingly bigger role in athletic performance, from tracking performance and body metrics to gamification, while building brand relationships. Ultimately, it could lead to selling more shirts and shoes. Lifestyle branding at work!

The next step after data collection is predictive analytics. Today’s digital technology and the Internet of Things allow for an average runner to get the same level of analysis that only an elite athlete would have gotten 15 years ago. And it’s free, instead of costing several hundreds of thousands of dollars. You can have a coach in your pocket, and it’s only a matter of time before the technology moves from wearable devices and smartphones to the apparel you’re wearing.

- Despite an early Easter that likely pulled apparel and food sales into March, retail sales rose a modest 0.3% year over year during the month as consumers continued to exercise caution.

- Shoppers spent on eating (and drinking) out and working out, as evidenced by the 7.7% and 5.1% year-over-year increases in sales at restaurants and sporting goods stores.

- Other retail categories worth noting were building materials (up 6.3% year over year) and furniture stores (up 3.8% year over year).

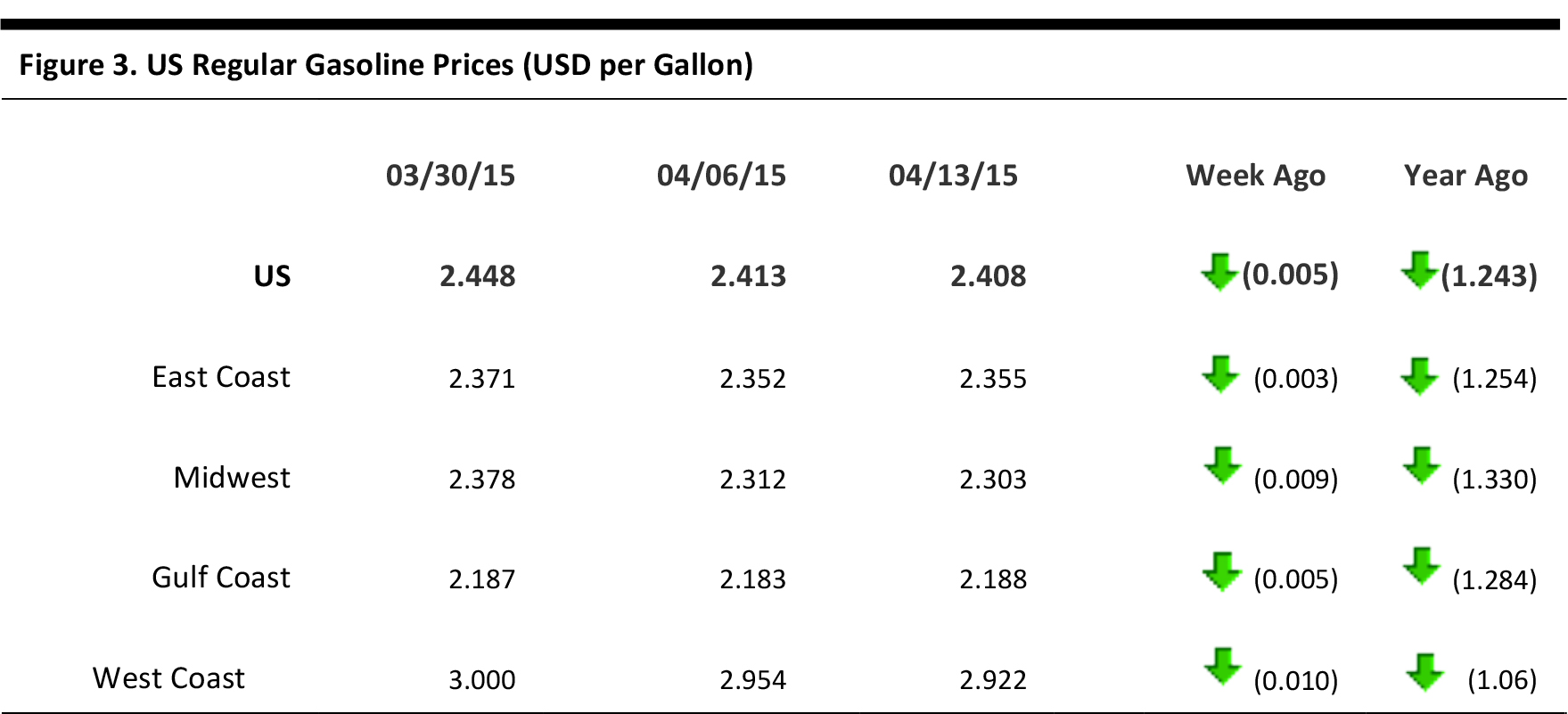

- It was no surprise that sales at gas stations dropped 22% year over year in tandem with a 32% year-over-year decline in the national average price of gas (down $1.12, to $2.35 a gallon).

- With consumer confidence rising along with payroll gains, we could see a retail rebound this spring.

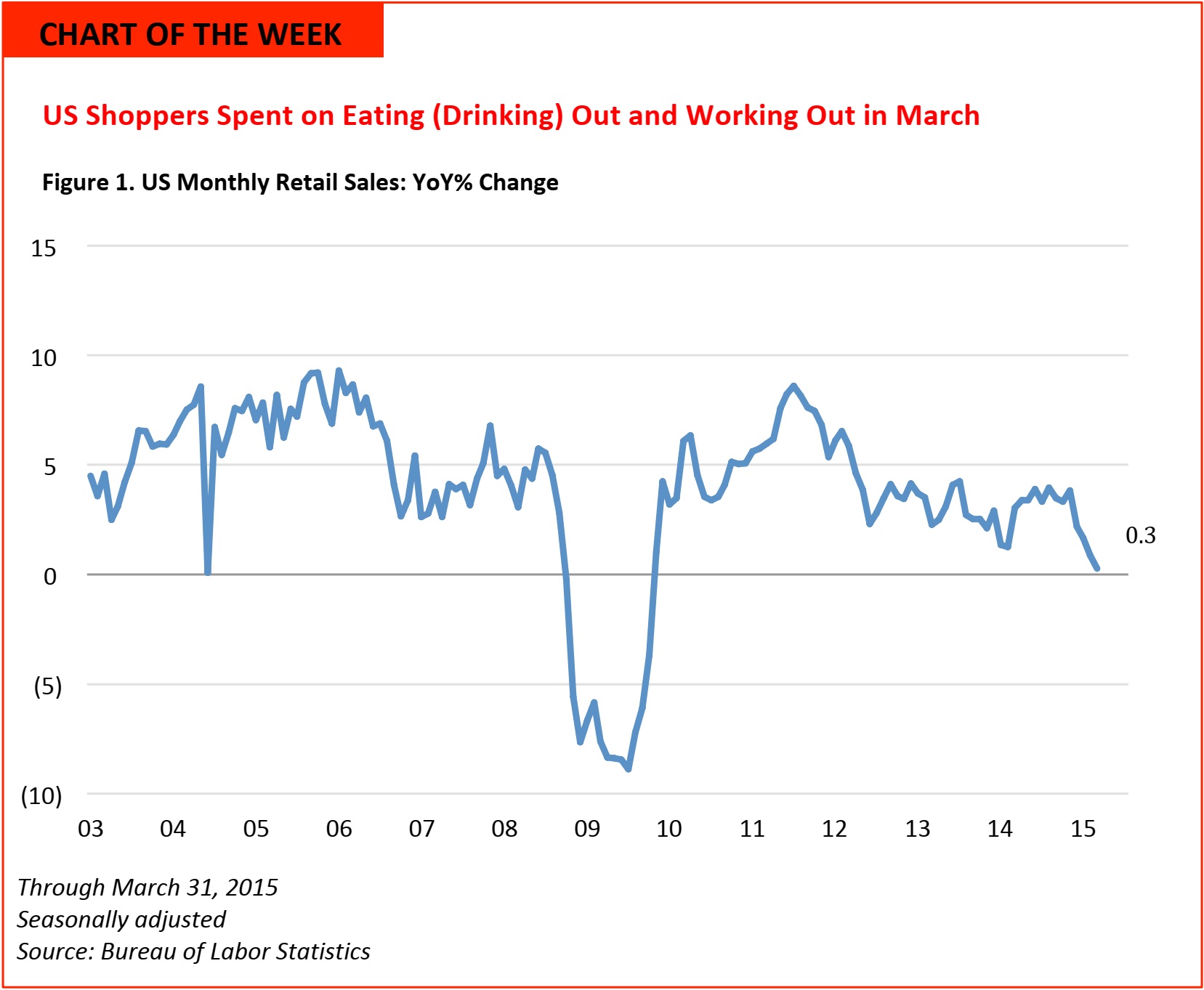

US RETAIL TRAFFIC

March Store Sales and Traffic Improved from Previous Months Despite Small Declines

Through March 31, 2015 Source: RetailNext

- While overall monthly traffic fell by 8.2%, store sales decreased by only 3.2% in March

- March saw strong gains in conversion rate of 0.9% and average transaction value (ATV) of 3.5%. The strongest SPS (sales per shopper) occurred in the first week of March

- The first weekend of March experienced the highest sales, traffic, transactions and conversion, as weather across regions began to improve. March 3 had the lowest traffic, sales and transactions

- Traffic in the West experienced a small decline but a sales jump of 8.3% due to favorable weather conditions. The Northeast stores traffic (7.3%) and sales (1.7%) took a hit from continued wintery weather

US REGULAR GASOLINE PRICES

Source: US Energy Information Administration

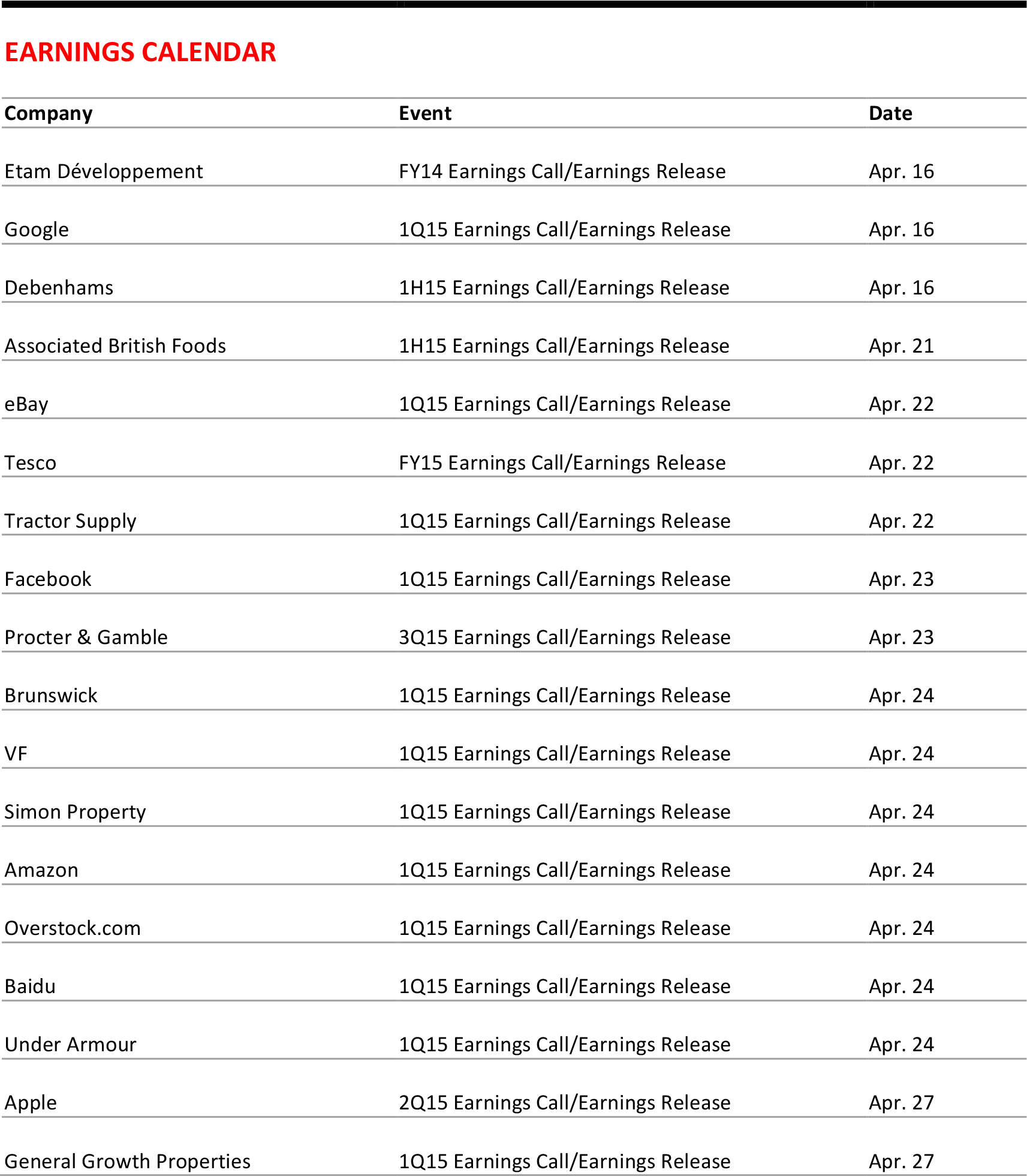

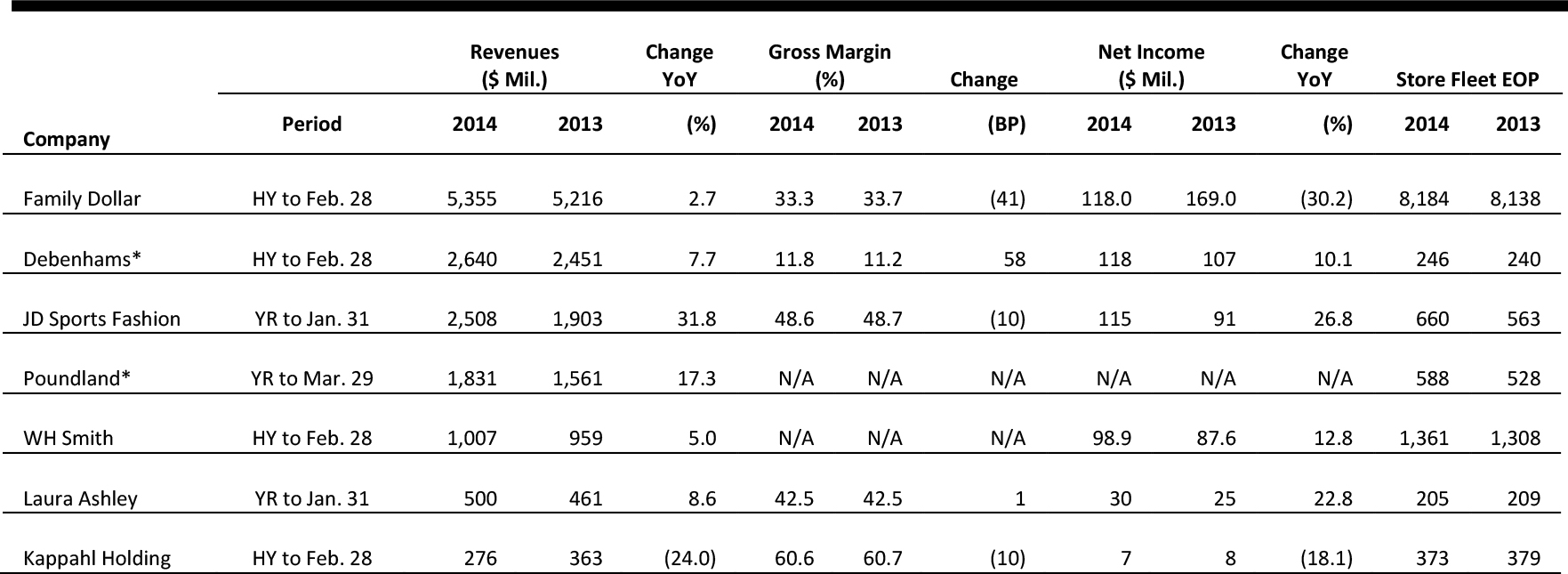

RETAIL EARNINGS

Source: Company reports *In GBP

US RETAIL HEADLINES

- Avon is exploring options to turn around its North America business, including sale of the company. The company’s sales in North America amount to $1.2 billion annually, which is half their level in 2007. Avon’s US market share was down from 10.2% in 2007 to 4.3% in 2014.

- The company cited increasing competition and the door-to-door model as factors behind falling sales figures. The current CEO, Sherilyn McCoy, was hired from Johnson & Johnson. An investor meeting to outline McCoy’s plans for the company was scheduled for next month, but was postponed until this fall.

- Adjusting for the Easter calendar shift, JCPenney expects its first-quarter same-store sales to rise by 3.5%–4.5%, beating its forecast of 3.2%. The same-store growth has slowed from the first quarter of 2014.

- A senior official accidentally e-mailed its 6% quarter-to-date same-store sales figure to an analyst. The company declined to comment on the executive involved.

- At a China National Resources Defense Council conference, Target’s global sourcing president said China is a priority for sustainable practices. This is part of the council’s new sustainabilityeffort, “Clean by Design.”

- The first phase of this effort has resulted in savings of $14.7 million since 2013. The next phase will roll out in Suzhou, Jiangsu province.

- In a new joint venture, Sears will contribute 10 properties valued at $228 million, while Simon will contribute $114 million. Sears will lease back properties at Simon Malls.

- This venture follows Simon’s agreement with General Growth Properties to contribute 12 properties in exchange for half ownership of a joint venture and $165 million in cash. Sears recently announced that it would spin off 254 properties into a separate REIT entity, Seritage Growth Properties.

ASIA TECH HEADLINES

- Alibaba Group has announced that its Tmall online pharmacy business will be integrated into Alibaba Health Information Technology, which is listed on the Hong Kong Stock Exchange, after the two companies reached a definitive agreement.

- Under the agreement, Alibaba Health will also become a consolidated subsidiary of Alibaba Group. Alibaba Group currently owns a 38% stake in Alibaba Health, but the move will increase the amount to approximately 53%.

- JD.com, China’s second-largest e-commerce player, launched its JD Worldwide cross-border online shopping platform, a challenger to Alibaba Group’s Tmall.

- JD Worldwide will allow Chinese shoppers to buy imports from US firms such as Nike, Starbucks and Ocean Spray Cranberries, as well as products from Australia, France, Germany, Japan, South Korea, New Zealand and the UK. No Sale for Apply Pay Support in China…Yet(April 14) ZDNet

- The latest version of Apple’s iOS, version 8.3, which was released just last week, doesn’t yet include support for cards from UnionPay, the sole company that handles interbank transactions in China, according to MarketWatch.

- Possible issues behind this include a Chinese central bank rule that requires electronic payment systems to comply with a technical standard called PBOC 3.0 and the fact that about 0.15% of every Apple Pay transaction goes to Apple.Me Girl Avatar Game Company

- Frenzoo, the Hong Kong–based gaming company behind the Me Girl mobile game series, announced that it had closed a US$1 million funding round from existing investors, including Fresco Capital, KS Ventures, Anshe Chung, and others, bringing the company’s total funding to US$3 million.

- Me Girl titles let users customize the fashion and appearance of personal avatars by playing games and purchasing virtual goods, which is how Frenzoo earns its revenue. It tries to appeal to women who mix a healthy dose of daydreaming into their online habits.

- Frenzoo, the Hong Kong–based gaming company behind the Me Girl mobile game series, announced that it had closed a US$1 million funding round from existing investors, including Fresco Capital, KS Ventures, Anshe Chung, and others, bringing the company’s total funding to US$3 million.

- Me Girl titles let users customize the fashion and appearance of personal avatars by playing games and purchasing virtual goods, which is how Frenzoo earns its revenue. It tries to appeal to women who mix a healthy dose of daydreaming into their online habits.

- Chinese restrictions on transferring data overseas would burden firms with having to build redundant data centers in China and hamper domestic companies expanding abroad, the American Chamber of Commerce in China said on Tuesday.

- The US chamber cited a study by the European Centre for International Political Economy that said localization could cause China’s gross domestic product to fall by 1.1%. US Secretary of Commerce Penny Pritzker said while visiting China that cybersecurity threats must be addressed without creating barriers to trade or investment.

- A recent CCTV report suggests that buying from WeChat is far from safe. An investigation found that many of the facial masks for sale on WeChat came from illegal workshops using low-end products and massive amounts of glucocorticosteroids.

- The issue underscores a larger problem with WeChat e-commerce: at the moment, it lacks the oversight of a traditional e-commerce platform. As one Sina commenter put it, “Taobao has fake products but at least there’s platform supervision. On WeChat you just have to trust that [the seller] has a conscience. It’s unreliable.”

- Chinese mainlanders made 47 million visits to Hong Kong last year, crossing the border between Shenzhen and Hong Kong. There are hundreds, even thousands, of grey market “visitors” from Shenzhen buying up products in Hong Kong and lugging them back over the border every day.

- Apple is losing sales due to delayed rollouts in China, but the ability for mainlanders to buy via Hong Kong in the interim helps buffer some of the company’s shortfall. If smugglers are cut off from the source, Apple will likely push even harder for simultaneous releases in the future.

- China’s Tencent broke new ground on Monday, when its stock closed at HK$170.50, bringing the company’s total market value above US$200 billion for the first time ever.

- The valuation ranks the Chinese company well above global giants Amazon (US$178 billion), eBay (US$70 billion) and Yahoo (US$42 billion), and puts it within striking distance of companies such as Facebook (US$231 billion).

- The Chiba District Court issued a preliminary injunction forcing Google to remove two anonymous reviews for an undisclosed medical clinic in the country, based on a defamation suit from the clinic.

- Google has run into a number of privacy and speech snafus in Japan recently. Last year, a Japanese court ordered it to delete search results that linked a man to a crime. Back in 2012, the company was ordered to amend its auto-complete feature after it was judged to infringe on Japanese privacy laws.

EUROPEAN RETAIL HEADLINES

- Luxury fashion brand Burberry posted a 10% increase in revenues at actual exchange rates (a 9% increase in revenues at constant rates), to $2.2 billion, for the six months through March 31.

- The company said retail sales rose 14% at actual exchange rates, to $1.64 billion. The firm noted that it saw double-digit same-store sales growth in the Americas, with a “strong performance” in the UK, France and Italy. Wholesale sales were down 1% at actual exchange rates, but Burberry grew revenues by 8% in wholesale beauty.

- Swedish fashion retailer H&M’s sales rose 10%, including VAT and in local currencies, year over year in March.

- Store count increased from 3,216 in March 2014 to 3,580 in March 2015.

- British electronics retailer Dixons Carphone is to sell its German phone retail business to telecom firm Drillisch for a combination of shares and future cash flows. The completion of the sale of Phone House Deutschland to Germany-based Drillisch is expected to take place by the end of May.

- Dixons Carphone will receive new shares equal to around 3% of Drillisch stock, with the prospect of further payments from “future excess cash flows.” Phone House operates 30 stores under its own brand and another 50 for Deutsche Telekom.

- French-domiciled grocery retailer Groupe Casino posted total sales that were up 5.3% for the quarter ending March 31. At the group level, organic sales growth was 2.7%.

- Organic sales growth in France was negative, down 1.3% amid price cutting. But international sales were up 3.7% in organic terms and 9.2% in total, helped by strong growth in Southeast Asia. E-commerce revenues, which include Cdiscount, were up 17.7%.

- French luxury group LVMH reported a 16% increase in first-quarter sales as growth in the Americas helped counter a downturn in China. The group’s revenue rose to €8.32 billion (US$8.8 billion), which was higher than analysts’ predictions of €8.13 billion.

- A renewed interest in Louis Vuitton handbags coupled with a weak euro has helped boost the value of the company’s shares by 30% this year. As of Monday, shares were trading at €172 (US$182) in Paris, resulting in a market value of €88 billion (US$93 billion).

- In the UK, consumer price inflation remained flat at 0% for the year through March, defying some expectations that deflation would emerge.

- In March, clothing and footwear prices fell 0.2% year over year, while food prices fell 3.0% year over year as grocery price wars continued to rage.

- Comps across Britain’s retail sector were up 3.2% in March, the British Retail Consortium said this week, as the month’s retail sales were helped by an early Easter.

- An improvement in food sales contributed to the increase, with total food sales up 1.8% for the three months ending March 31, although these were flattered by the early Easter weekend. Clothing stores experienced subdued demand as colder weather made spring/summer lines less appealing to consumers.

- Mexican oil output has declined to 2.9 million barrels per day (b/d), down from 3.9 million b/d in 2014 due to oil production problems and energy reforms instituted in 2013.

- Exports to the US have also declined, from 1.7 million b/d in 2006 to 842,000 b/d in 2014.

- Contrary to expectations of higher demand due to higher population, higher GDP and a larger vehicle fleet, oil demand per capita dropped 18% from 2000 through 2014, from 0.85 gallons per day to 0.70 gallons per day.

- Brazilian retail sales fell 3.1% year over year in February, the largest year-over-year decline in 12 years, according to the Brazilian Institute of Geography and Statistics (IBGE in Portuguese).

- The drop in sales was attributed to the high, 8.3% inflation rate, higher interest rates and declining incomes.

- The IBGE commented that incomes decreased 1.5% year over year and that credit had declined as well.

- Unifin plans to pursue an IPO in the second quarter of 2015 and raise about US$26 million (MXN$400 million).

- About half of the proceeds are expected from primary shares, to be offered domestically and internationally to accredited investors through a Rule 144A/Regulation S offering.

- A successful offering could encourage other Mexican nonbank financial institutions to go public.

- Brazil’s economy is expected to contract by 1% in 2015, according to a recent report from the International Monetary Fund.

- The softness in Brazil is expected to slow the economic growth rate in Latin America to 0.9%.

- Other factors dampening Latin America’s economy include lower worldwide oil and commodity prices.

- Ralph Lauren planned to open a store on April 14 in Cidade Jardim.

- The store will have more than 9,100 square feet of space and offer women’s and men’s wear, accessories, footwear and watches.

- Cidade Jardim is home to a 485,000 square foot mall that opened in 2008 and carries Brazilian and international luxury brands.

- Walmart de México y Centroamérica (Walmex) reported March 2015 sales of US$2.5 billion (MXN$38.249 billion), up 9.4% year over year.

- The figure was comprised of 25.8% growth in Central America (up 9.1% in constant currency) combined with 6.6% sales growth in Mexico.

- In March, Walmex opened one new store in Mexico City and one new store in San José, Costa Rica.

- Sales of toiletries, perfumes and cosmetics amounted to US$33.6 billion (R$101.7 billion) in 2014, an increase of 11%, according to the Brazilian Association of the Cosmetic, Toiletry and Fragrance Industry.

- Brazil is the third-largest market for cosmetics and beauty products, representing 9.4% of worldwide consumption and more than 1.8% of Brazil’s GDP.

- Brazil represents 53% of the market in Latin America for personal care products and is the leading consumer worldwide of hair care products for children.