FROM THE DESK OF DEBORAH WEINSWIG

Dubai: A Leader in Retail Experience

This week, the Fung Global Retail & Technology team is attending the World Retail Congress 2016 in Dubai. We have published individual flash reports following each day of the three-day conference, so please see those for highlights of the event’s many presentations. Here, we focus not on the content of the conference, but on our experience of Dubai retail outside the conference.

At the end of the second day of the event, we were given a guided tour of the impressive Mall of the Emirates, courtesy of its owners, Majid Al Futtaim. Several World Retail Congress attendees had already noted the uniquely experience-rich nature of Dubai retail, and we certainly witnessed it during our mall visit. Here are a few of our observations.

Kids’ Products Appear to Be a Route to Shoppers’ Wallets

Heritage luxury brands such as Gucci, Dior and Burberry were in abundance at the Mall of the Emirates. And more contemporary, premium lifestyle brands such as Cath Kidston and Tommy Hilfiger were present, too, although they were not as prominent. Childrenswear and other kids’ products were heavily featured in both segments: many of these luxury and premium brands put children’s goods front and center in their stores. And, in many cases, they were operating dedicated kids’ stores.

Investment in the Latest Entertainment Technology

The Mall of the Emirates is about more than shopping; it offers a host of leisure services complementing the retail offering. A flagship leisure venue is the 24-screen Vox movie theater, which incorporates 4D technology that brings physical motion and sensations to film watching. Since September 2015, the cinema has also featured a restaurant from celebrity chef Gary Rhodes; dishes are delivered to the (deluxe) seats of cinema-goers for them to enjoy while watching their movie. Four of the 24 screens offer this premium dine-at-seat service.

Bringing Snow to the Desert

The mall’s second major leisure venue is the indoor ski slope, Ski Dubai. This features an 85-meter-high slope, with five different runs of varying difficulty. It is equipped with a ski lift and a lodge-style Avalanche Café.

And Penguins, Too!

Even more unique than a ski slope in the middle of the desert is Ski Dubai’s penguin colony. Visitors can view and touch some of the 29 penguins housed in the complex (we were lucky enough to meet three of them, including a king penguin). The penguins are trained to recognize their names, come when they are called and pose alongside visitors for photographs. It is a unique experience, especially in a desert city.

Lessons Learned

The Mall of the Emirates is impressive for the breadth of its retail and leisure options. To a large extent, the innovation that marks this and other malls in Dubai is a result of the environment: in a hot, desert climate, there is little to do outdoors and few people are willing to do much in the scorching heat.

But that uniqueness does not mean that elements featured in the mall cannot be incorporated elsewhere, including in the struggling malls of the US. The American Dream Mall, due to open in New Jersey in 2017, is one mall that is putting leisure services at its heart. We expect others to follow.

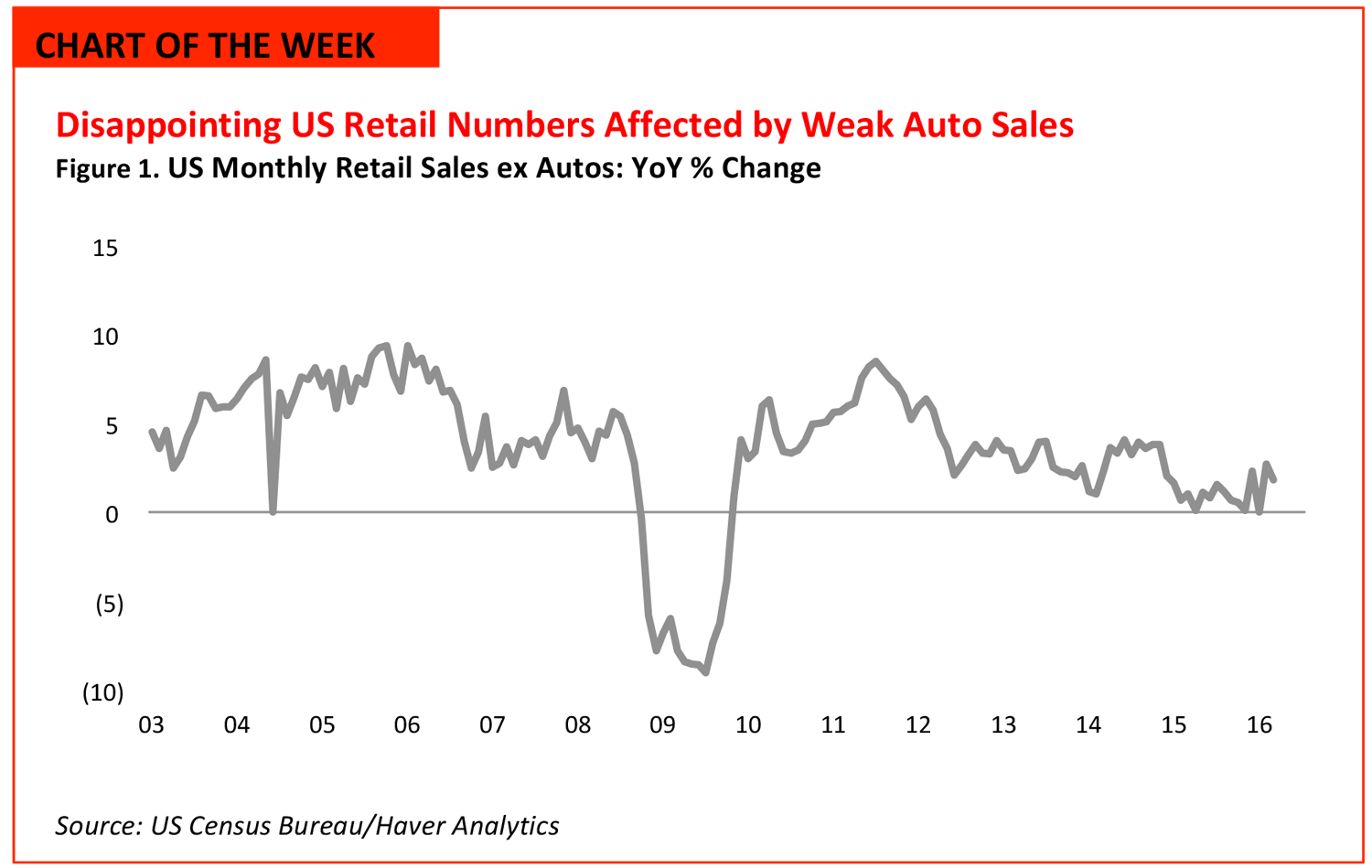

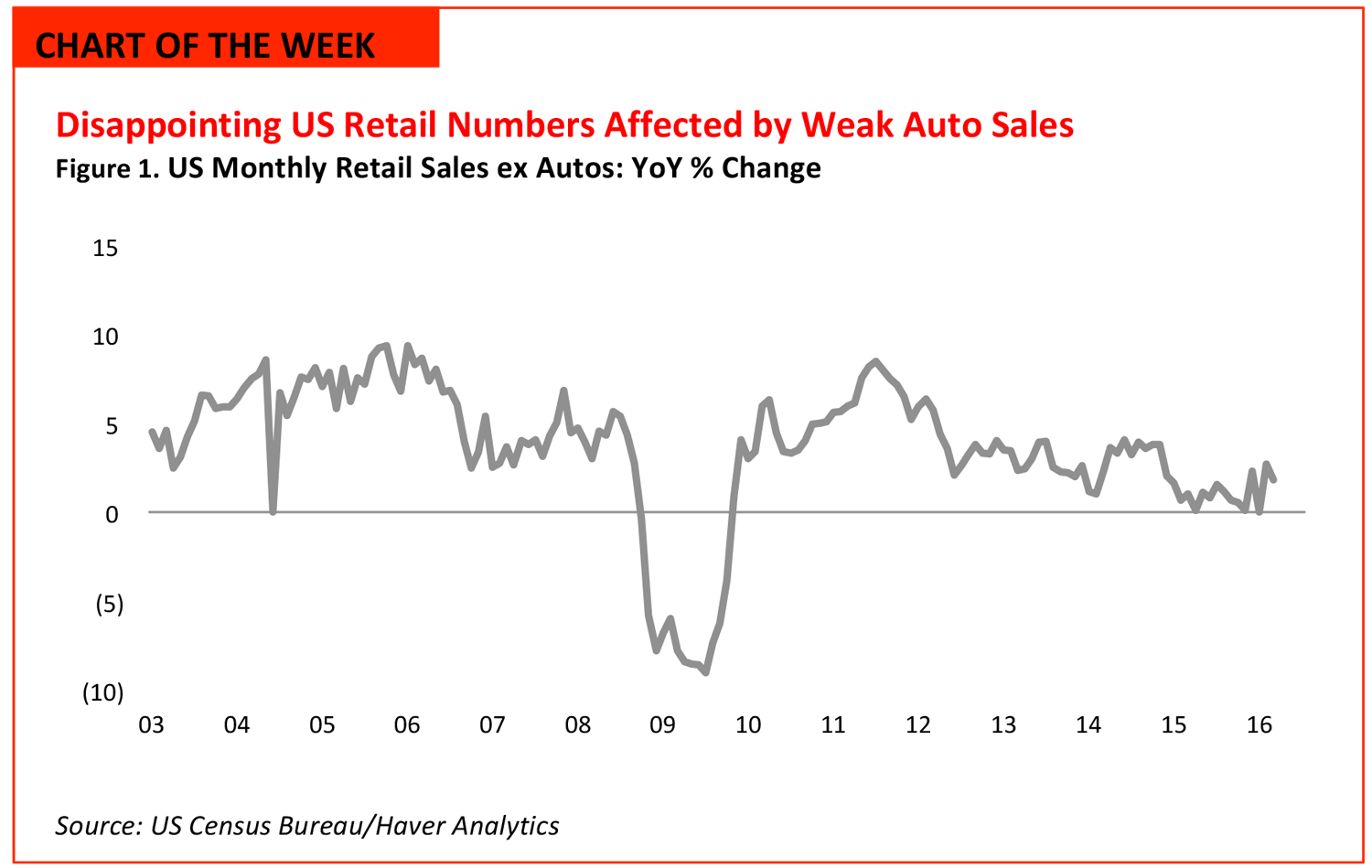

- US retail sales dipped in March 2016. Total retail sales dropped by 0.3% month over month, missing economists’ consensus of 0.1% growth. February’s sales figures were revised upward, to flat versus January’s. Retail sales excluding automobiles, gasoline, building materials and food services edged up by 0.1%, which was also lower than analysts expected; consensus was for 0.3% growth.

- Auto sales in March declined by 2.1% from February, representing their biggest drop in over a year. The disappointing auto sales were a major contributor to the total retail sales dip. Sales at clothing stores, department stores and online stores also posted declines. Consumers dined out less in March than they had in February, as evidenced by a 0.8% decrease in receipts at restaurants and bars.

- While the job market is getting stronger and wages are improving, many consumers are putting their extra income into savings instead of spending it on goods and services. “With employment gains still healthy and real incomes growing at a solid pace, we expect real consumption growth to rebound further over the first half of the

- year,” said Steve Murphy, US Economist at Capital Economics.

US RETAIL HEADLINES

More Startups Are Getting Lower Valuations than Joining the Billion-Dollar Club

(April 13) Bloomberg

More Startups Are Getting Lower Valuations than Joining the Billion-Dollar Club

(April 13) Bloomberg

- A new report from KPMG International and CB Insights shows that more startups have been taking lower valuations than have been earning the billion-dollar badge in 2016.

- In the first quarter of 2016, only five venture-capital-backed companies entered the $1 billion club, which is less than half the number from any quarter since the first quarter of 2015. However, during the first quarter of 2016, 19 “down events”—companies raising new money or being acquired at a lower valuation—occurred.

How Snapchat Killed the Homepage

(April 12) Business of Fashion

How Snapchat Killed the Homepage

(April 12) Business of Fashion

- Digital publishers are beginning to shift away from traditionally built websites and are focusing on publishing content directly on social media, as that is where young consumers are increasingly spending their time.

- For example, Clique Media Group’s recently launched Obsessee has a simple landing page that links to its 10 different social media platforms. The digital publisher offers content with a broader lifestyle focus than fashion blogs.

Softer Data Adds to Investor Concerns About Growth

(April 13) The Wall Street Journal

Softer Data Adds to Investor Concerns About Growth

(April 13) The Wall Street Journal

- In March, US retail sales and producer prices showed decreases of 0.3% and 0.1%, respectively, coming in below expectations by economists polled by The Wall Street Journal.

- These soft results are concerning investors who are looking for indicators of first-quarter performance, and the retail sales numbers in particular are not likely to improve the outlook.

Starbucks Rolls Out a More Personalized Mobile App Along with a Revamped Rewards Program

(April 12) TechCrunch

Starbucks Rolls Out a More Personalized Mobile App Along with a Revamped Rewards Program

(April 12) TechCrunch

- Starbucks launched its overhauled mobile app and loyalty program on Wednesday. The app offers more personalization and the revamped loyalty program now doles out rewards based on dollars spent rather than frequency of purchase.

- The company’s loyalty program is seen as one of the industry’s best in terms of traction, growth and technology innovation. Much of this success is due to the company’s mobile app, which implemented mobile payments well before other mainstream options, such as Apple Pay and Square, became available.

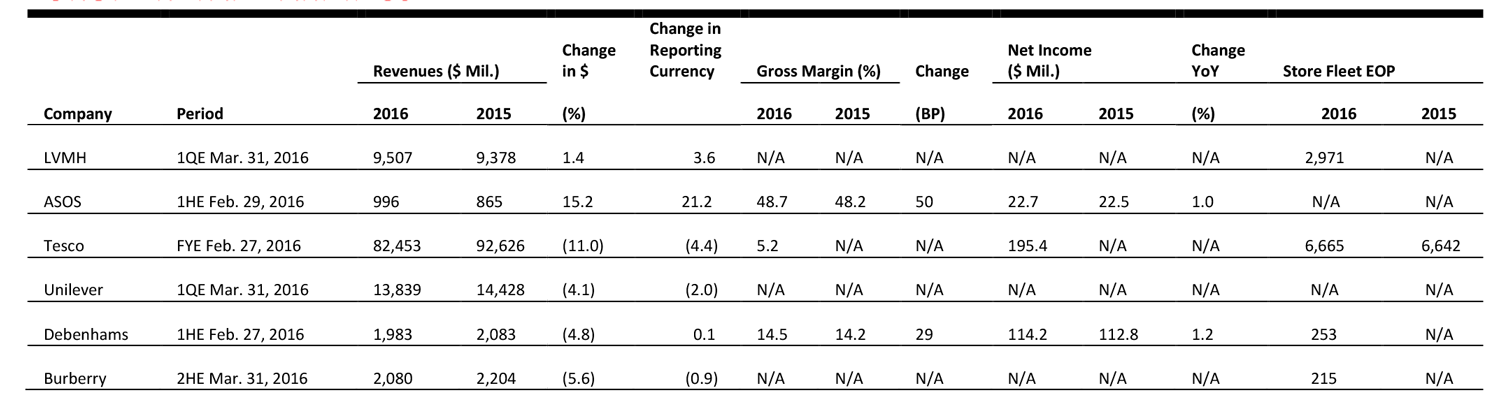

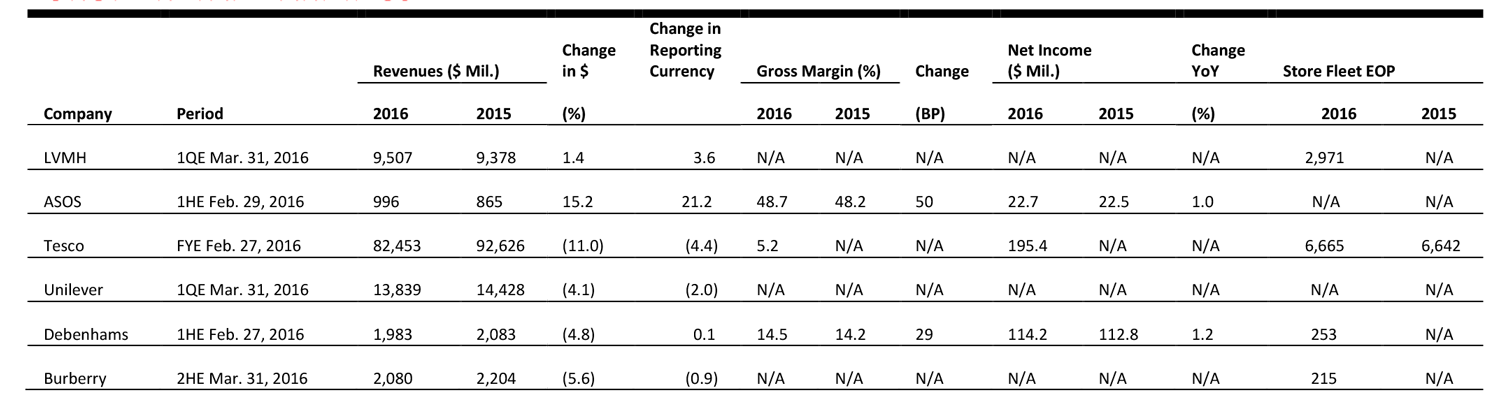

EUROPE RETAIL EARNINGS

Source: Company reports

Source: Company reports

EUROPE RETAIL HEADLINES

Suomen Lähikauppa Acquired by Kesko

(April 12) Retailanalysis.igd.com

Suomen Lähikauppa Acquired by Kesko

(April 12) Retailanalysis.igd.com

- Kesko, the second-largest grocery retailer in Finland, acquired Suomen Lähikauppa, a Finnish convenience retail chain, on April 11. The deal is valued at around €60 million (US$66 million) and is structured as a share purchase. The acquisition is expected to double Kesko’s convenience footprint, as the newly acquired stores will operate under Kesko’s convenience banner, K-market.

- The transaction synergies are expected to add at least €25–€30 million (US$27–US$33 million) to the company’s EBIT from 2018 onward. Kesko expects to incur approximately €30 million (US$33 million) in nonrecurring restructuring costs between 2016 and 2018. The deal’s approval by the Finnish Competition and Consumer Authority is conditional on Kesko selling 60 stores of Suomen Lähikauppa.

Tesco to Sell Off Harris + Hoole and Dobbies Garden Centres

(April 11) Retail-week.com

Tesco to Sell Off Harris + Hoole and Dobbies Garden Centres

(April 11) Retail-week.com

- British supermarket giant Tesco is expected to sell two of its businesses, the Harris + Hoole coffee shop chain and Dobbies Garden Centres, in a move to dispose of its loss-making assets. Tesco took full ownership of Harris + Hoole only in February.

- Dobbies was acquired by Tesco in 2008 and currently runs 35 garden centers across the UK. It incurred a loss of £48.4 million (US$52.9 million) in the last fiscal year after property write-downs. Tesco has reportedly enlisted Greenhill as its adviser to work on the sale of the Dobbies business. The company declined to comment ahead of announcing its full-year results on Wednesday, April 13.

Spar’s Net Sales Grow by 3.5% Year over Year

(April 11) Retailgazette.co.uk

Spar’s Net Sales Grow by 3.5% Year over Year

(April 11) Retailgazette.co.uk

- Supermarket chain Spar International’s full-year revenue for 2015 increased by 3.5%, to €33 billion (US$36 billion), which the company said was its “strongest sales growth in five years.” The growth was a result of the retailer’s global expansion strategy, supported by recovery in Europe, where Spar has its strongest presence.

- In Western Europe, the best-performing countries were Austria, Belgium and Hungary, where revenues rose by 2.4%, 6% and 2.9%, respectively. In the UK, sales grew by 2%. In Central and Eastern Europe, sales in Croatia and Poland grew the most, by 15% and 17%, respectively.

Amazon Adds Click-and-Collect Points with Barclays Tie-Up

Amazon Adds Click-and-Collect Points with Barclays Tie-Up

(

April 11) Retailgazette.co.uk

- Amazon UK customers may soon be able to use Barclays Bank branches as delivery collection points. According to reports, the bank has been trialing delivery lockers at a few sites across London, and a full rollout is expected should the initiative be a success.

- Amazon says it already operates over 13,000 pickup locations across the UK. Using the Barclays Bank branches as collection points could potentially add about 1,500 more, according to Retail Gazette.

Chanel Opens Up E-Commerce for Beauty Products to Customers in Belgium and the Netherlands

(April 8) Retaildetail.eu

Chanel Opens Up E-Commerce for Beauty Products to Customers in Belgium and the Netherlands

(April 8) Retaildetail.eu

- French luxury brand Chanel has expanded its e-commerce offering to customers in Belgium and the Netherlands. The online product range is limited to beauty products, and includes perfumes, skincare and makeup.

- Shoppers get free shipping for orders that exceed €100 (US$109), but orders below the limit will incur a delivery fee of €10 (US$11). The brand currently allows returns only through freepost/courier, not through existing physical Chanel stores and concessions.

ASIA TECH HEADLINES

China’s P2P Lending Industry Is in Serious Trouble as New Ponzi Scheme Allegations Emerge

(April 12) TechinAsia

China’s P2P Lending Industry Is in Serious Trouble as New Ponzi Scheme Allegations Emerge

(April 12) TechinAsia

- China’s online peer-to-peer (P2P) money-lending sector was rapidly growing in 2015 prior to the stock market crash. But in January 2016, a major P2P lender was found to be a Ponzi scheme, and by February, major banks had begun withdrawing their support for the sector.

- Another Chinese P2P startup, called Easy Richness, is now under investigation for being a Ponzi scheme. Data from P2P research firm WDZJ suggest that the number of “problematic” P2P lending platforms in China is on the rise, and that these might only be the tip of the iceberg.

KPMG Launches Digital Village to Fill a Crucial Gap in the Startup Ecosystem

(April 12) TechinAsia

KPMG Launches Digital Village to Fill a Crucial Gap in the Startup Ecosystem

(April 12) TechinAsia

- KPMG in Singapore has launched KPMG Digital Village to help startups grow to the next stage and to equip corporate clients with the latest innovation technology. Its goal is to facilitate the adoption of innovation and technology by Singapore businesses so they can better compete on an international level.

- Lyon Poh, Head of Digital + Innovation and CIO at KPMG in Singapore, commented that commercial innovation often lacks adequate management, and that companies are often too focused on achieving marketing benefits.

Chinese Startup Gets Funding to Help Low-Wage Workers Buy iPhones

(April 12) TechinAsia

Chinese Startup Gets Funding to Help Low-Wage Workers Buy iPhones

(April 12) TechinAsia

- Shanghai-based fintech firm Paymax offers loans to low-wage workers—such as construction workers, security guards and store staff—who would not normally be able to get credit through conventional channels, to enable them to buy mobile phones and laptops in installments, with interest.

- Paymax secured series A funding, led by Sequoia Capital, in October 2014. By mid-2015, it had series B funding from Renren. Its series C round, worth around US$50 million, was co-led by Shunwei Capital, JD Finance, Morningside Ventures, Renren and China Renaissance Partners. The company has raised a total of US$87 million.

In the Battle Against Uber, Didi’s Linkup with Lyft Goes Online

(April 12) TechinAsia

In the Battle Against Uber, Didi’s Linkup with Lyft Goes Online

(April 12) TechinAsia

- The link between Didi Kuaidi and Lyft goes online this week. Chinese travelers to the US can hail and pay for Lyft rides using the Didi Kuaidi app on their phones, and an in-app translation service facilitates communication between drivers and Chinese passengers who are not confident in their English abilities.

- Ultimately, the plan is for all of the allied apps—Ola, GrabTaxi, Didi and Lyft—to be linked, so that users can stick with the app interface, currency and payment system they are most comfortable with, even when traveling abroad.

Alibaba Extends Startup Cloud Program to Singapore

(April 11) ZDNet

Alibaba Extends Startup Cloud Program to Singapore

(April 11) ZDNet

- Alibaba has taken its cloud startup program global for the first time, launching the service in Singapore with a US$10,000 credit for selected startups. Valid for a year, the coupon can be used to purchase any service on the Chinese vendor’s Aliyun cloud platform.

- Foreign-owned cloud organizations are required to partner with local infrastructure companies to serve the Chinese market. Alibaba positions itself as “the only cloud player” able to help its customers deploy their services in China.

LATAM RETAIL HEADLINES

US Issues Colombia Labor Rights Progress Report

(April 11) WWD.com

US Issues Colombia Labor Rights Progress Report

(April 11) WWD.com

- On the fifth anniversary of the Colombian Action Plan Related to Labor Rights, the Office of the US Trade Representative and Department of Labor on Monday issued a progress report. Conditions have improved in some aspects: the number of labor inspectors in Colombia has increased and there has been a reduction in violence against labor unionists.

- Some forms of abusive subcontracting still exist in Colombia, though the plan has worked in many ways and has given Colombia the framework and resources to work with the US to combat labor issues.

South America Suffers from End of Commodities Boom

(April 12) WSJ.com

South America Suffers from End of Commodities Boom

(April 12) WSJ.com

- According to the World Bank, the economies of Latin America and the Caribbean are expected to shrink for the second consecutive year due to the slowdown in the commodity-reliant countries in South America.

- While Mexico, Central America and the Caribbean are expected to see 2.5% growth due to close ties with the US, South America’s economy will likely contract by 2%, with Brazil’s falling by 3.5% and Venezuela’s by 8.3%.

Cuba’s Evolution into a US Tourism Hot Spot and Fashion Apparel Hub to Take Time

(April 11) WWD.com

Cuba’s Evolution into a US Tourism Hot Spot and Fashion Apparel Hub to Take Time

(April 11) WWD.com

- Now that steps have been taken to strengthen the relationship between the US and Cuba, investors are looking for opportunities in the once closed-off country. While there is currently no open tourism, people from the US can visit Cuba for humanitarian work or cultural purposes.

- Cuba’s infrastructure is currently weak, from roads to clean water, and the embargo still exists. So, although it is opening more, there is still a long way to go before businesses will be able to enter the country freely.

Chilean Taxi Drivers Protest Against Uber as Regulations Remain Murky

(April 7) Reuters

Chilean Taxi Drivers Protest Against Uber as Regulations Remain Murky

(April 7) Reuters

- Taxi drivers blocked roads in downtown Santiago to protest Uber’s more than 10,000 drivers in Chile. There are no rules governing Uber drivers’ conduct in the country, and the ride-sharing service has resulted in depressed wages for registered taxi drivers.

- Uber has been operating in Chile since 2014, but the company’s conduct is currently unregulated in the country.

Louis Vuitton Is Hosting Cruise 2017 in Brazil’s Niterói Museum

(April 11) Racked

Louis Vuitton Is Hosting Cruise 2017 in Brazil’s Niterói Museum

(April 11) Racked

- Louis Vuitton is set to host its fashion house cruise at Brazil’s Niterói Museum on May 28. The fashion house announced the location over Instagram.

- The museum, which is shaped like a flying saucer, will be reopening after some remodeling for its 20th anniversary.

This week, the Fung Global Retail & Technology team is attending the World Retail Congress 2016 in Dubai. We have published individual flash reports following each day of the three-day conference, so please see those for highlights of the event’s many presentations. Here, we focus not on the content of the conference, but on our experience of Dubai retail outside the conference.

At the end of the second day of the event, we were given a guided tour of the impressive Mall of the Emirates, courtesy of its owners, Majid Al Futtaim. Several World Retail Congress attendees had already noted the uniquely experience-rich nature of Dubai retail, and we certainly witnessed it during our mall visit. Here are a few of our observations.

This week, the Fung Global Retail & Technology team is attending the World Retail Congress 2016 in Dubai. We have published individual flash reports following each day of the three-day conference, so please see those for highlights of the event’s many presentations. Here, we focus not on the content of the conference, but on our experience of Dubai retail outside the conference.

At the end of the second day of the event, we were given a guided tour of the impressive Mall of the Emirates, courtesy of its owners, Majid Al Futtaim. Several World Retail Congress attendees had already noted the uniquely experience-rich nature of Dubai retail, and we certainly witnessed it during our mall visit. Here are a few of our observations.

Source: Company reports

Source: Company reports US Issues Colombia Labor Rights Progress Report

(April 11) WWD.com

US Issues Colombia Labor Rights Progress Report

(April 11) WWD.com