From the Desk of Deborah Weinswig

The Reports of Retail’s Death Are Greatly Exaggerated [1]

We are being hit with a deluge of negative headlines about US retailers—in this publication and elsewhere—which would lead the reader to believe that retail is on the brink of extinction. This is not the case. Although many retailers are currently suffering from negative same-store sales, leading them to close stores, they remain, at least at present, largely profitable. And although the continuing and growing encroachment by e-commerce remains a serious threat, let us counter the hysteria with a few facts.

- US retail sales are fairly healthy, but some have been postponed by tax-refund delays. US retail sales (excluding food services and automobile parts) in 2016 grew by a solid 2.6%, which was one full percentage point faster than the rate at which GDP grew last year. Retail sales have been somewhat anemic thus far in 2017, growing by 0.1% in February on the heels of 0.6% growth in January. Sales have been weaker at electronics and appliance stores, apparel outlets and car dealers, possibly because there was a temporary delay in the processing of income tax refunds this year. Economists expect the data to show that spending picked up in March, though, as more tax filers received their refunds.

- E-commerce still accounts for less than 10% of quarterly retail sales in the US. In its fourth-quarter 2016 report, the US Census Bureau said that e-commerce grew by 14.3% on both an unadjusted and adjusted basis in the quarter. The report also said that e-commerce accounted for 9.5% of US retail sales on an unadjusted basis that quarter and for 8.3% of retail sales on an adjusted basis. Thus, a solid 90.5% of US retail sales did not arise from e-commerce in the fourth quarter of 2016. If we look at the Census Bureau’s unadjusted figures for the year, they indicate that nearly $4.5 trillion of US retail sales (or nearly 92%) did not stem from e-commerce in 2016.

- Retailers are closing some, but not all, stores. Major retailers such as Macy’s and JCPenney have announced closures, and Payless ShoeSource’s recent bankruptcy filing will also result in store closures. In addition, Bloomberg reports that teen clothing retailer Rue21 is preparing to file for bankruptcy and iconic US retailer Sears said in an SEC filing that there was doubt that it could remain a going concern. Many industry leaders have commented about a bubble in the US retail space. For example, the CEO of Urban Outfitters recently said that the US now has six times the amount of retail space per capita as Japan and Europe, and that this bubble is now bursting. Unfortunately, this correction in the amount of retail space and the number of stores in operation has negative consequences for retail employees. Nearly 30,000 retail jobs were eliminated in March, in addition to more than 60,000 since January.

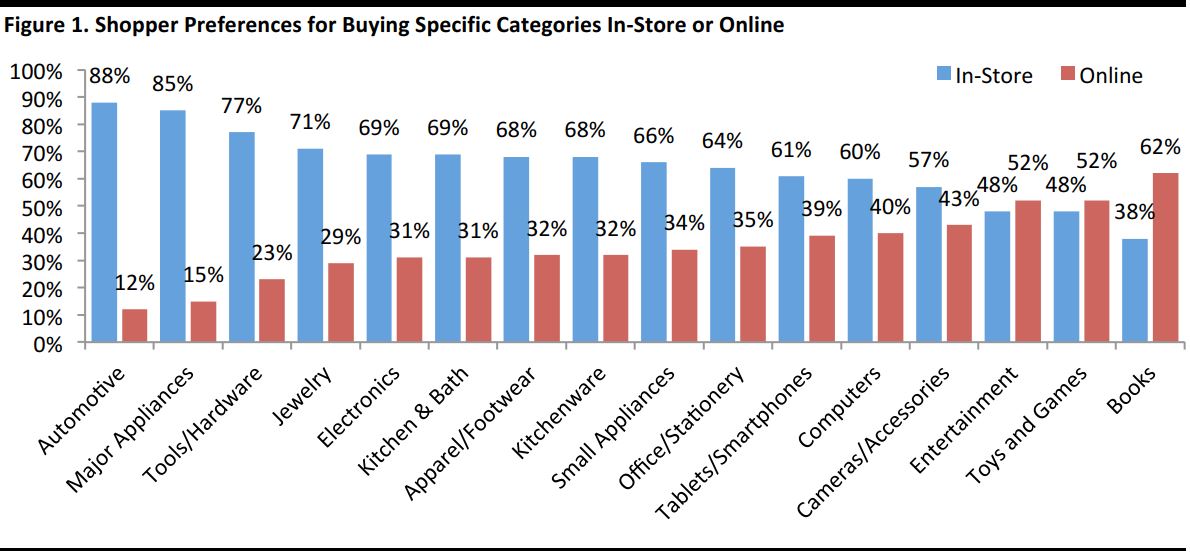

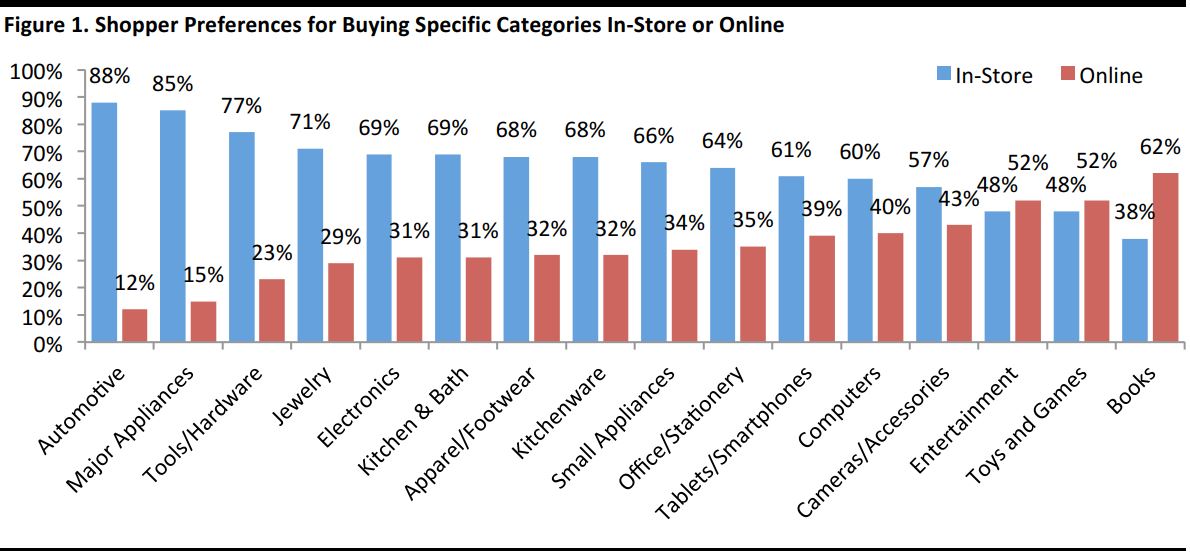

- Consumers still like to visit physical stores. In a recent survey of 1,200 shoppers conducted by Market Track, a majority of those polled said they still prefer to shop for most items (except entertainment, toys and games, and books) in a store, as the figure below illustrates.

Source: Market Track

[1]With apologies to Mark Twain, whom we have misquoted in a popular fashion.

US RETAIL & TECH HEADLINES

US Retail Group SuperValu to Buy Wholesaler Unified Grocers for $375 Million

(April 11) FoodBev Media

US Retail Group SuperValu to Buy Wholesaler Unified Grocers for $375 Million

(April 11) FoodBev Media

- American retail group SuperValu has agreed to acquire grocery wholesaler Unified Grocers for around $375 million. The deal will create one of the leading grocery wholesale companies in the US. The companies’ combined sales in 2016 totaled approximately $16 billion.

- Together, SuperValu and Unified Grocers will operate 24 distribution centers and supply customers in 46 states, with a combined customer base of more than 3,000 stores. SuperValu expects to leverage Unified Grocers’ specialty and ethnic food offerings, while Unified Grocers will, in turn, benefit from SuperValu’s professional services portfolio.

Payless the Latest Big Retailer to Announce Closings, but There Is Good Retail News, Too

(April 11) REJournals.com

Payless the Latest Big Retailer to Announce Closings, but There Is Good Retail News, Too

(April 11) REJournals.com

- Payless ShoeSource is the latest brand-name retailer to announce bankruptcy. The company filed for Chapter 11 protection last week and announced plans to close about 400 stores in the US. It would seem that this is a terrible time for traditional brick-and-mortar retail.

- However, Chicago-based Quantum Real Estate Advisors says that the US retail market continued to grow, albeit slowly, in the first quarter of 2017, despite the growing presence of e-commerce and a wave of big-box closings. In addition, Quantum expects average retail rents to rise throughout 2017, as a lack of new space should continue to drive retail rents higher.

Amazon Will Make Up 50% of All US E-Commerce by 2021

(April 10) Fortune.com

Amazon Will Make Up 50% of All US E-Commerce by 2021

(April 10) Fortune.com

- Brick-and-mortar retailers should expect no relief from Amazon.com’s relentless march to e-commerce dominance. The online retailer, which accounts for about 34% of US online sales, should see that market share grow to about 50% by 2021, helped by the popularity of its Prime membership program and its marketplaces, Wall Street firm Needham & Company said in a research note on Monday.

- The firm upgraded its rating on the stock to buy from hold and set a price target of $1,100 on the already soaring shares. “We believe Amazon’s established dominance in the US is sustainable with Prime, mobile penetration and third-party growth,” Needham analyst Kerry Rice wrote.

The Retail Sector Is Shedding Jobs Like It Is a Recession

(April 7) MarketWatch.com

The Retail Sector Is Shedding Jobs Like It Is a Recession

(April 7) MarketWatch.com

- The US retail industry is shedding jobs at an unparalleled pace outside of recession and stands to lose many more, as the industry continues to shrink its physical footprint in response to consumers shifting away from purchasing in stores and malls in favor of e-commerce.

- The US retail sector lost 60,600 jobs in February and March, the worst two months for the sector since the tail end of 2009, according to data from the US Department of Labor. The category called general merchandise stores—which includes Target, JCPenney and the like—has shed jobs for five consecutive months.

America’s Retailers Are Closing Stores Faster than Ever

(April 7) Bloomberg.com

America’s Retailers Are Closing Stores Faster than Ever

(April 7) Bloomberg.com

- The battered American retail industry took a few more lumps this week, with stores at both ends of the price spectrum announcing that they are preparing to close their doors. At the bottom, the seemingly ubiquitous Payless ShoeSource chain filed for bankruptcy and announced plans to shutter hundreds of locations. Meanwhile, Ralph Lauren said it will close its flagship Fifth Avenue Polo store—a symbol of old-fashioned luxury that no longer resonates with shoppers. its flagship Fifth Avenue Polo store—a symbol of old-fashioned luxury that no longer resonates with shoppers.

- Teen-apparel retailer Rue21 could be the next casualty. The chain, which has about 1,000 stores, is preparing to file for bankruptcy as soon as this month, according to people familiar with the situation. Just a few years ago, it was sold to private equity firm Apax Partners for about a billion dollars.

EUROPE RETAIL HEADLINES

Disappointing UK Sales Growth, but Results Distorted by Easter Timing

(April 11) Press release

Disappointing UK Sales Growth, but Results Distorted by Easter Timing

(April 11) Press release

- UK retail sales fell by 1% on a comparable basis in March, according to the British Retail Consortium (BRC). Total sales were down 0.2%, their first decline since August last year.

- The figures were impacted by Easter falling in March last year but in April this year. BRC CEO Helen Dickinson suggested that the “timing of Easter always makes spring a tricky period to assess and the later timing of the holiday this year certainly detracted from last month’s performance.”

Argos Launches Own-Brand Ranges

(April 6) RetailGazette.co.uk

Argos Launches Own-Brand Ranges

(April 6) RetailGazette.co.uk

- General-merchandise retailer Argos revealed new plans to launch own-brand product ranges in order to gain market share in electrical goods, gadgets and homewares.

- The retailer will utilize designers from its new parent company, Sainsbury’s, which acquired Argos last year. The news coincides with an announcement from department store chain John Lewis that it also intends to push to increase sales of its own-brand items.

Valentino Strikes Deal with Yoox Net-A-Porter to Expand E-Commerce

(April 7) FT.com

Valentino Strikes Deal with Yoox Net-A-Porter to Expand E-Commerce

(April 7) FT.com

- Italian fashion house Valentino has agreed to launch a new omnichannel business called New Era in collaboration with Yoox Net-A-Porter. Valentino will integrate the inventories of all its brick-and-mortar boutiques, warehouses and online store Valentino.com with Yoox Net-A-Porter.

- New Era will launch in early 2018 and will provide customers with a more extensive product assortment, in-store mobile features and faster delivery.

Optics Chain Hans Anders Gets New Owner

(April 10) RetailDetail.eu

Optics Chain Hans Anders Gets New Owner

(April 10) RetailDetail.eu

- Investment firm 3i has paid about €200 million (US$212 million) to acquire Dutch optics chain Hans Anders from Alpha and AlpInvest.

- 3i partner Robert Van Goethem said about the transaction, “We want to keep growing in our existing markets and open new markets, either through our own means or through acquisition.”

British Clothing Chain Jaeger Collapses into Administration

(April 10) BBC.co.uk

British Clothing Chain Jaeger Collapses into Administration

(April 10) BBC.co.uk

- British fashion retailer Jaeger has fallen into administration after failing to find a suitable buyer, putting 700 jobs at risk.

- Jaeger has 46 stores, 63 concessions, a head office in London and a logistics center in King’s Lynn. Last year, it reported a pretax loss of £17 million (US$21 million) on sales that were down 4%, to £78 million (US$97 million).

ASIA TECH HEADLINES

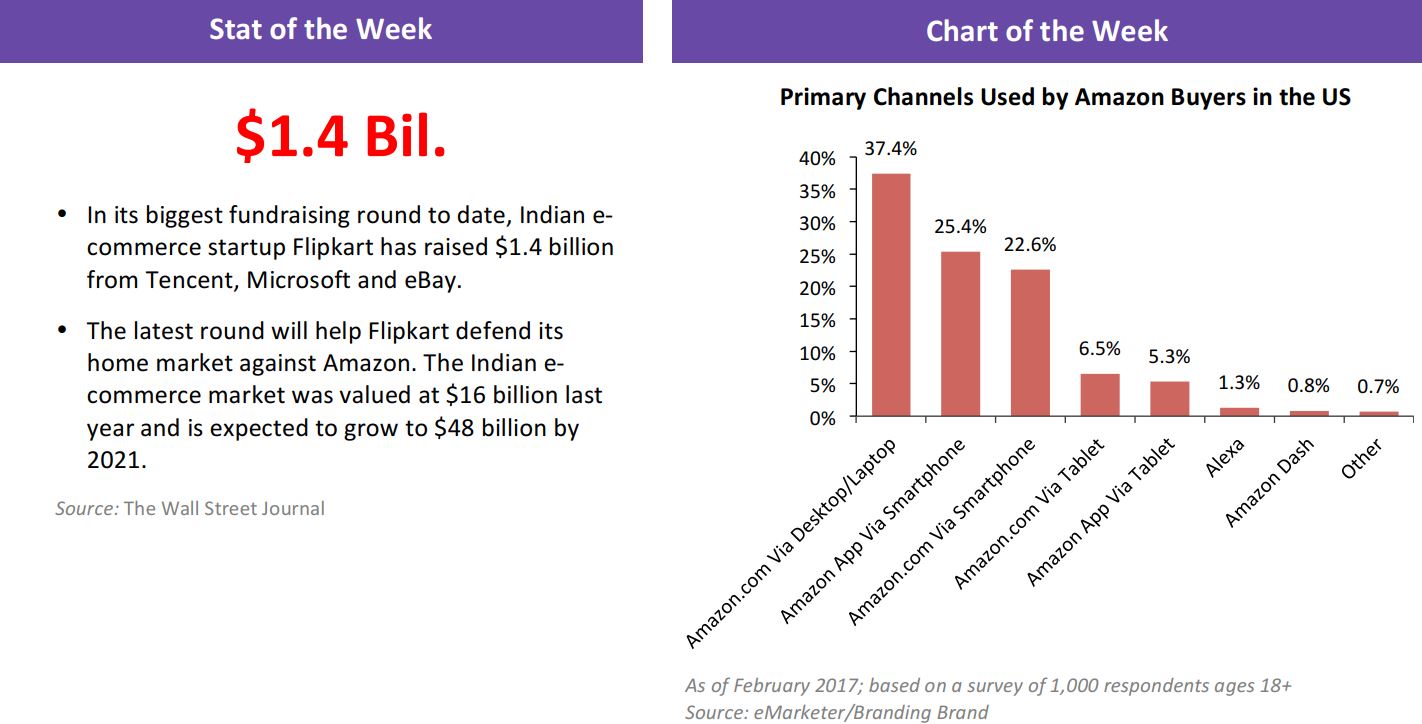

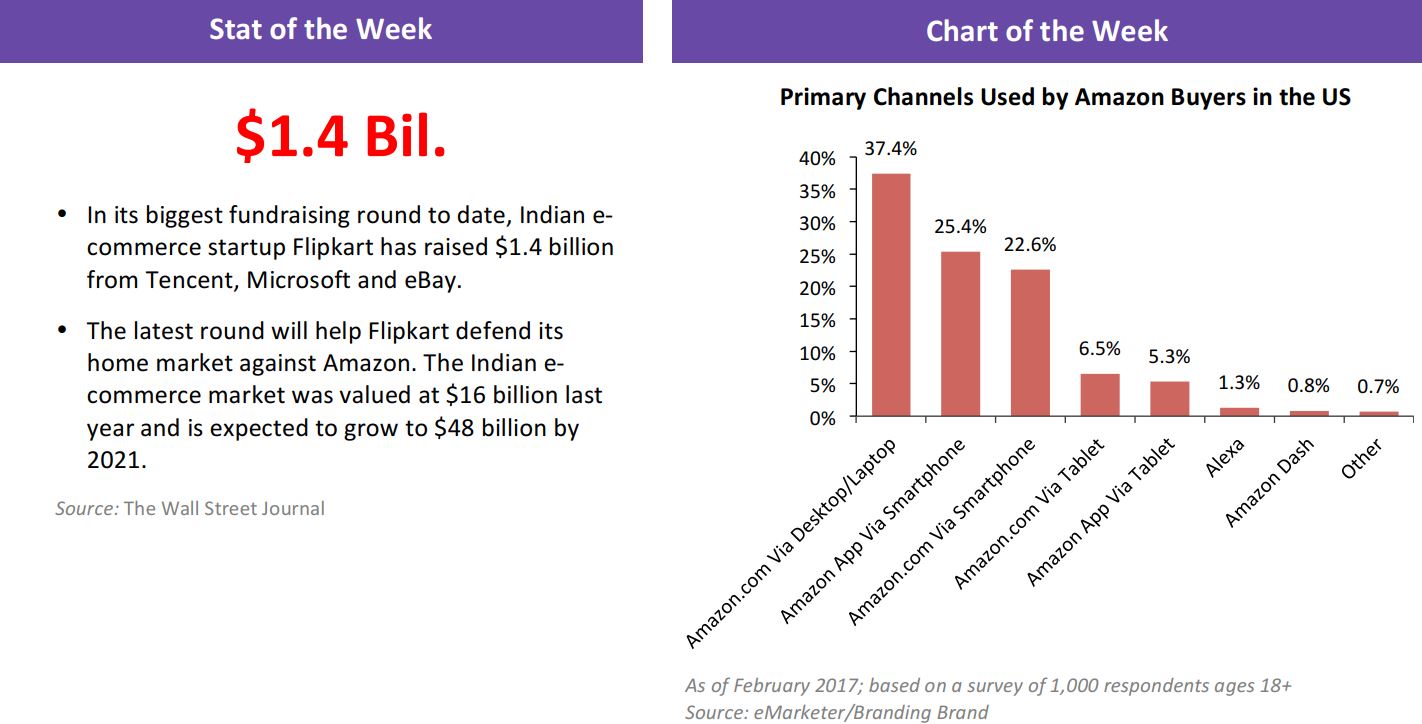

Flipkart Raises $1.4 Billion from eBay, Microsoft and Tencent at an $11.6 Billion Valuation

(April 10) TechCrunch.com

Flipkart Raises $1.4 Billion from eBay, Microsoft and Tencent at an $11.6 Billion Valuation

(April 10) TechCrunch.com

- As it works to battle Amazon and Alibaba, Indian e-commerce giant Flipkart confirmed that it has raised $1.4 billion in new funding at a post-money valuation of $11.6 billion. The deal includes big-name strategic investors Tencent, eBay and Microsoft, which join existing Flipkart backers Tiger Global, Naspers, Accel and DST Global.

- The investment will also see Flipkart take control of eBay India, a second-tier e-commerce player in India, which will remain an independent site. Separately, eBay, which is a minor investor in Flipkart rival Snapdeal, has inked an international deal with Flipkart to cross-promote products.

Singapore’s Saleswhale, Which Uses AI to Automate Sales Emails, Raises $1.2 Million

(April 10) TechCrunch.com

Singapore’s Saleswhale, Which Uses AI to Automate Sales Emails, Raises $1.2 Million

(April 10) TechCrunch.com

- Saleswhale, a Singapore-based startup that uses artificial intelligence (AI) to let companies automate their sales emails, has raised $1.2 million in a seed round. The capital was provided by venture capital firms Monk’s Hill Ventures, Gree Ventures and Wavemaker Partners, and a number of angel investors.

- The company’s product, called Engage, allows companies to set up virtual email accounts that send communications containing sales prospects the same way a human employee would. The seed money will go toward expansion and hiring efforts.

Virtual Gaming Items Marketplace Itemku Raises $1.2 Million

(April 10) TechinAsia.com

Virtual Gaming Items Marketplace Itemku Raises $1.2 Million

(April 10) TechinAsia.com

- Five Jack, a South Korea–based company that operates a marketplace called Itemku for virtual goods in Indonesia, announced it has raised $1.2 million in series A investment from 500 Startups and South Korean venture capital firm K-Run Ventures.

- Itemku, which was started in 2015, enables people to buy and sell items that exist or are used in games, and takes a cut of the sale. Itemku now has 200,000 virtual goods posted on its site, and its gross merchandise volume and revenue have been rising by an average of 30% per month.

Vietnam’s Appota Scores Series C Funding as Mobile Gaming Booms

(April 5) TechinAsia.com

Vietnam’s Appota Scores Series C Funding as Mobile Gaming Booms

(April 5) TechinAsia.com

- Vietnam-based Appota announced it has secured an undisclosed sum for its series C round from two prominent investment funds in South Korea, Korea Investment Partners and Mirae Asset Venture Investment.

- Appota is a big mobile games publisher in Vietnam, with a social gaming network and a gaming news media portal. The mobile games market in Vietnam has grown phenomenally, and now accounts for a third of the whole market in Southeast Asia.

LATAM RETAIL AND TECH HEADLINES

Brazilian Apparel Retailer Guararapes Creates E-Commerce Division

(April 11) ETRetail.com

Brazilian Apparel Retailer Guararapes Creates E-Commerce Division

(April 11) ETRetail.com

- Brazilian apparel retailer Lojas Riachuelo, which is controlled by Guararapes Confecções, will launch an e-commerce division later this month as a way to boost sales during Brazil’s worst recession in more than a century.

- Online channels have helped rival Brazilian apparel retailer Lojas Renner outperform the sector in recent years. Riachuelo’s late arrival to e-commerce has allowed the company to design a business model that is more likely to succeed.

Mexican Convenience Store Empowers Associates with Information

(April 5) ChainStoreAge.com

Mexican Convenience Store Empowers Associates with Information

(April 5) ChainStoreAge.com

- By adding a retail platform that gives its workforce visibility into business data, 7-Eleven Mexico is empowering its associates to keep up with the changing demands of the market. The system gives store-level teams the ability to adopt a more aggressive business strategy to retain and attract customers.

- The convenience store chain deployed the Oracle Retail Merchandise Operations Management solution as part of a move to automate best practices, improve communication among stores and provide more complete data to associates.

Walmart de Mexico Sales Growth Sputters in First Quarter

(April 6) MarketWatch.com

Walmart de Mexico Sales Growth Sputters in First Quarter

(April 6) MarketWatch.com

- Mexico’s biggest retailer, Walmart de Mexico, saw first-quarter sales expand at their slowest pace in more than two years, held back by an incipient slowdown in consumption, protests and several negative calendar effects.

- Sales in the January–March period totaled MXN131.7 billion (US$7 billion), up 7.3% from the first quarter of 2016. It was the slowest growth rate since the fourth quarter of 2014, and below the 12% growth recorded for all of 2016. Same-store sales in the first quarter, which exclude stores opened in the past year, rose by 4.1% in Mexico and by 2.1% in Central America.

Apple to Build Multilevel Store in Mexico

(April 9) MarketExclusive.com

Apple to Build Multilevel Store in Mexico

(April 9) MarketExclusive.com

- Apple is enjoying its success in Mexico. To meet the growing demand in the country, the tech giant will build a new, multilevel flagship in Mexico City’s upscale Polanco district.

- Apple opened its first retail store in Mexico in September last year. In addition to its stores in Mexico, it also operates two brick-and-mortar outlets in Brazil, where rumors suggest the company is planning to open additional stores. Meanwhile, Apple is also looking to open stores in Argentina.

MACRO SECTION

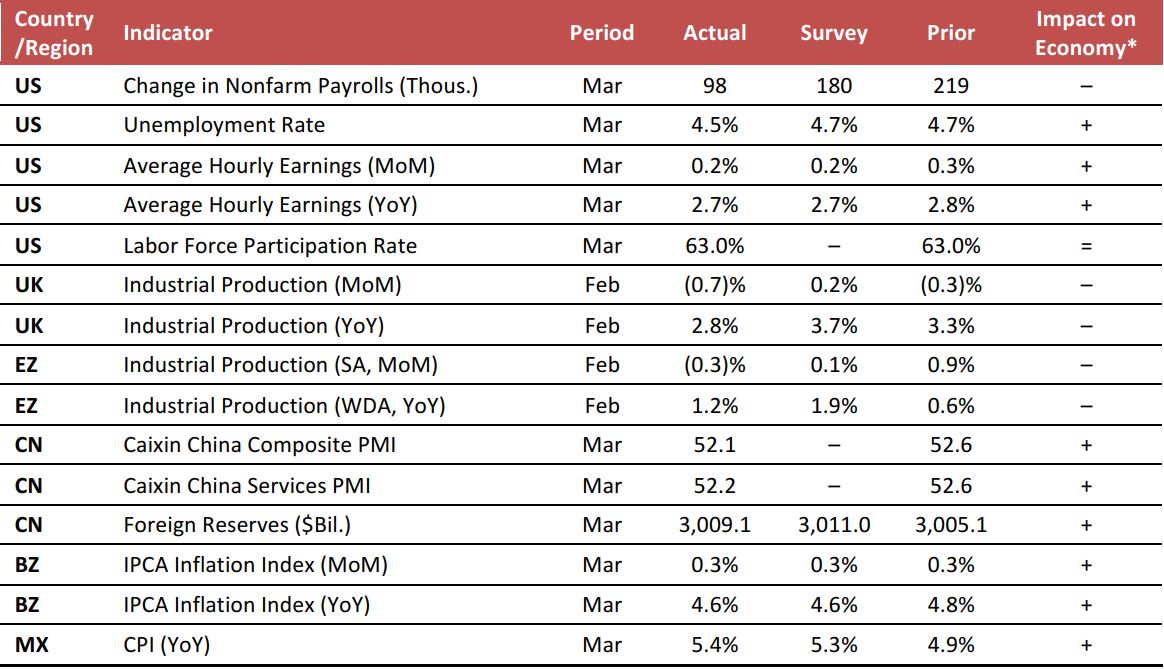

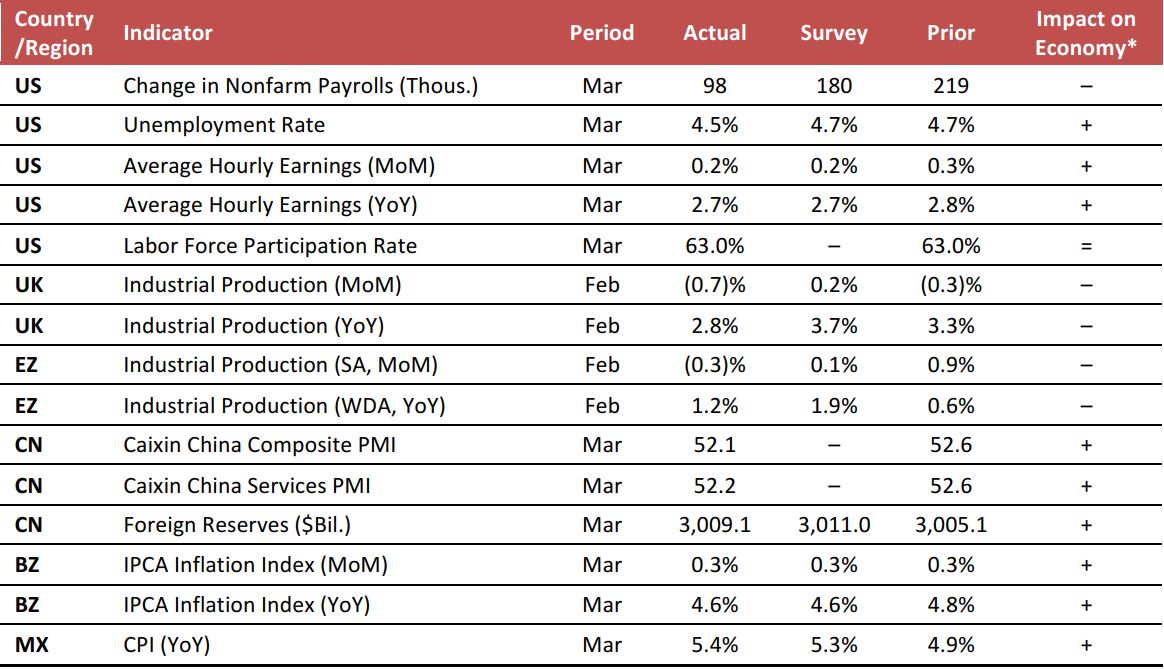

Starting this week, we are including a macro section in our weekly insights to cover the movements of key global economic indicators.

Global Macro Indicators Released April 5–12, 2017:

- US: US jobs data in March were mixed. The gain in nonfarm payrolls was significantly below the consensus estimate, due in part to a storm in the Northeast. Unemployment rate ticked down by 0.2% to 4.5%, and average hourly earnings showed modest increases.

- Europe: Industrial production in the UK and the eurozone both came in below their consensus estimates. Much of the fall was driven by weakness in energy demand due to weather effects, which do not reflect a deterioration of the state of the economies.

- Asia-Pacific: In China, the PMI readings in March were above the expansion threshold of 50.0, and the foreign reserves stayed above the $3 trillion mark, indicating easing worries on a slowdown and capital outflow.

- Latin America: In Brazil, inflation further edged down in March, which we perceive as a major positive sign for the economy. However, high unemployment remains a serious concern. Mexico showed modest inflation in March.

* Fung Global Retail & Technology’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Bureau of Labor Statistics/UK Office for National Statistics/Eurostat/Markit/Caixin/The People's Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía