Tencent has partnered with China’s leading bank-card service provider UnionPay and its subsidiary UnionPay International to offer cross-border mobile payment services for WeChat Pay HK users in Mainland China, starting October 1.

WeChat Pay in HK and Mainland China are separate services in which WeChat Pay for Mainland China is linked to users’ local bank accounts while the Hong Kong version of the app is linked to users’ credit cards or bank accounts in HK. Till now, WeChat Pay HK could not be used in Mainland China or vice-versa, but after this partnership with UnionPay, WeChat Pay HK can be used to make payments in Mainland China in HKD and the app will convert the payments made from RMB to HKD using Union Pay’s real-time exchange rate. Payments will be deducted directly from users’ WeChat Pay HK accounts in HKD.

WeChat Pay HK Users Can Now Shop in Mainland China Much More Easily

Earlier, Hong Kong residents who traveled to mainland China needed to get their HKD exchanged for RMB because WeChat pay HK was not accepted as a payment method. Now, this new development will enable WeChat Pay HK users to pay in HKD using their e-wallets.

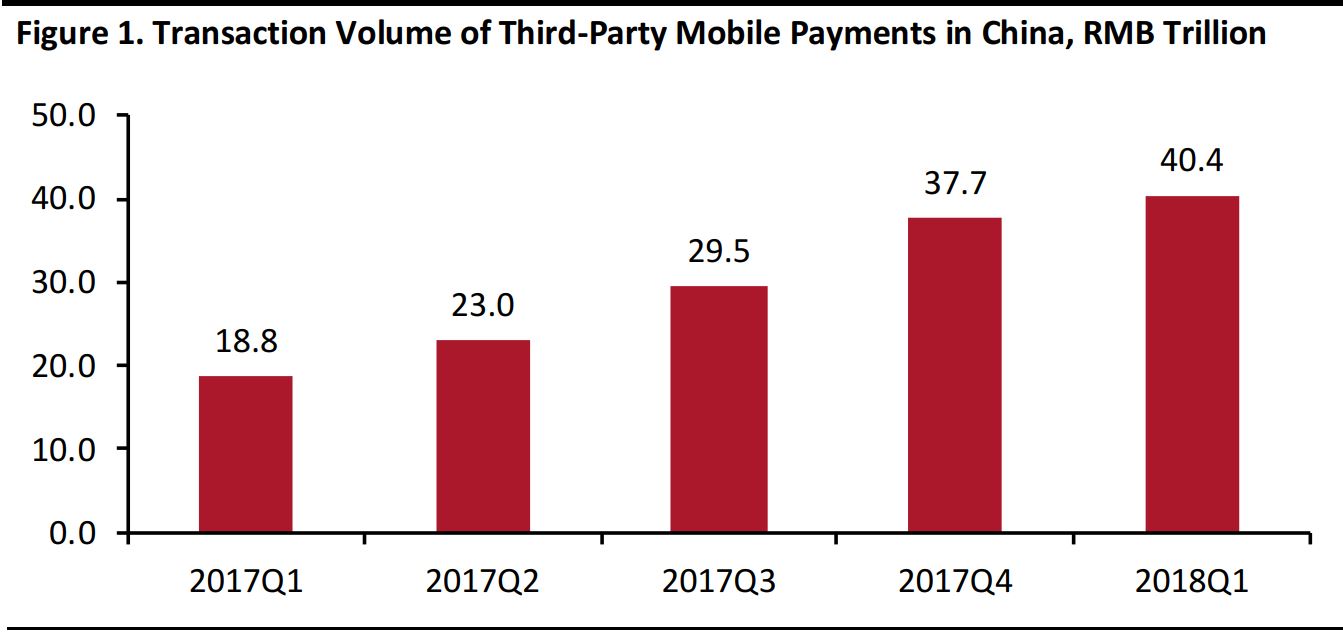

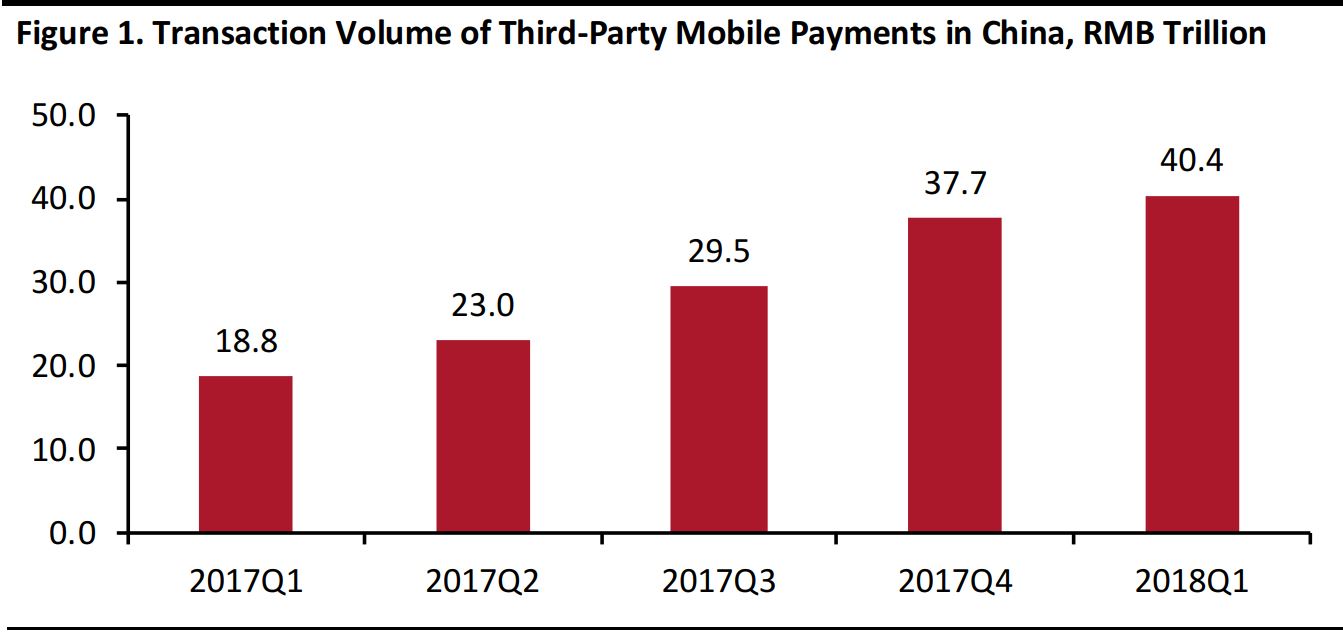

This development fits well with the present payments scenario in China where cashless payments are widely accepted and popular mobile payment apps, such as WeChat Pay and Alipay, allow Chinese consumers to make payments using their smartphones. The transaction volume of third-party mobile payments had reached RMB 40.36 trillion in the first quarter of 2018 (Figure 1), and as the penetration of mobile payments increases in China, this partnership between WeChat Pay and UnionPay will help travelers from Hong Kong shop much more conveniently in the country.

Source: Yiguan Analysys

Source: Yiguan Analysys

Four Merchants in the Pilot Launch, and Full Launch will Benefit Both Businesses in China and Consumers from Hong Kong

WeChat Pay HK has started this service with four merchants, which are: Didi Chuxing—car hailing platform; Groupon-like Meituan-Dianping; Dazhong-Dianping—restaurant review app; and, railway ticket platform www.12306.cn.

In the future, we see WeChat Pay HK including more merchants in this service to offer a wider variety of services, which will include hotels, restaurants, supermarkets, and stores. The service’s full launch will make it much more convenient for consumers from Hong Kong to spend in Mainland China and benefit retailers and businesses in China.

WeChat Pay’s Overseas Expansion with Cross-Border Payment

Outbound tourists from China make up one of the biggest spending segments globally.In 2017, the total overseas spending by Chinese tourists was an impressive US$258 billion, according to United Nations World Tourism Organization World Tourism Barometer.

The depth of international penetration of WeChat Pay China can be gauged from the fact that localized versions of WeChat Pay was launched in Hong Kong in January 2016 and in Malaysia in June 2018. As of 2017, WeChat has 20 million active users throughout Malaysia out of a total population of 31 million, according to the company.

Prior to this agreement with UnionPay, WeChat Pay China was already accepted in over 40 countries and regions where it allowed Chinese tourists to make cross-border payments, and we see this latest move by WeChat Pay a key move in the company’s overseas expansion plans.

As the first step of its overseas expansion, WeChat Pay China was made available for Chinese tourists to make overseas payments. We believe the next step should be to launch more localized versions of WeChat Pay in overseas markets and allow cross-border payments in those versions. Making WeChat Pay HK an instrument of payments made in Mainland China is one such step in the company’s plan of becoming a global payment gateway by enabling seamless cross-border transactions globally.

Key Takeaways

WeChat Pay HK has launched cross-border mobile payment services that will allow its users in Hong Kong to make payments in Mainland China in HKD. We believe this strategic move will benefit both consumers from Hong Kong and businesses in China, and as WeChat Pay HK becomes widely accepted in China, it will be a key step in WeChat Pay’s global expansion plans.

Source: Yiguan Analysys

Source: Yiguan Analysys