Introducing WeChat Wallet

Introducing WeChat Wallet

WeChat says it is the world’s fastest-growing social app. The app was first released in 2011 as an easy-to-use social platform offering free chat, voice messages, photo sharing and gaming. Its core functions are similar to those of US-based chat app WhatsApp, but WeChat also offers a social-networking element. Tencent, WeChat’s parent company, has now added options to make mobile payments through the app.

WeChat Wallet was introduced in 2014, first as an online-only mobile payment platform. The process to link one’s bank account to make e-payments was straightforward. Some of the first functions the platform offered were:

- Taxi ordering

- Booking cinema tickets using the user’s location

(the app would find the nearest cinema)

- Delivery of geo-targeted coupons

- Person-to-person transactions

- Ability to make utilities payments

Now, WeChat Wallet allows users to pay for items in stores via QR code/barcode scanning. The system works by generating a new QR code every 60 seconds (for security reasons), which the user then shows to a cashier, who scans the code to process the payment.

Users are currently able to use WeChat Wallet for in-store purchases from only a limited number of partner companies. 7-Eleven and Dairy Queen are among the names that have signed up to participate in the in-store payment system. However, Tencent is focusing on growing the number of partner companies that will accept its “Quick Pay” method.

WeChat Wallet can also be used to pay at thousands of vending machines. To make a vending machine purchase, users scan a unique QR code, just as they would to make an in-store purchase. However, with vending machines, users first scan the code of the item they wish to purchase and then make the payment on WeChat Wallet before the vending machine pops out the product. Often, drinks in the machines are offered with a discount.

At first, only Chinese users were able to create a WeChat Wallet account. Later, international users were also allowed to register with the “pocket money” service, as long as they had a Chinese bank card WeChat Wallet seized the opportunity of 2015’s Lunar New Year to launch a major promotional campaign. Its Red Envelope gift initiative involved sending roughly a billion virtual red envelopes to its WeChat users. According to

Forbes, Tencent and its partners offered $128 million in these envelopes over the festive season that users could win by using WeChat’s “shake” function. Traditionally, red envelopes containing money are sent to family and friends to wish them good luck at Chinese New Year. The centuries-old tradition is still hugely popular, and with WeChat Wallet, users were also able to send red envelopes to other people who had a WeChat account. The campaign resulted in fully 200 million new users linking their bank accounts with WeChat Wallet.

How Big Is the Opportunity?

WeChat has a huge and fast-growing user base that it can convert to its payment option. The app’s monthly active user numbers reached 600 million in the first half of 2015, according to Tencent. The number of mobile payment users overall in China is also huge and still growing. Some 580 million Chinese users took advantage of mobile payment options in 2014, according to iResearch, and that number is expected to increase to 660 million in 2015.

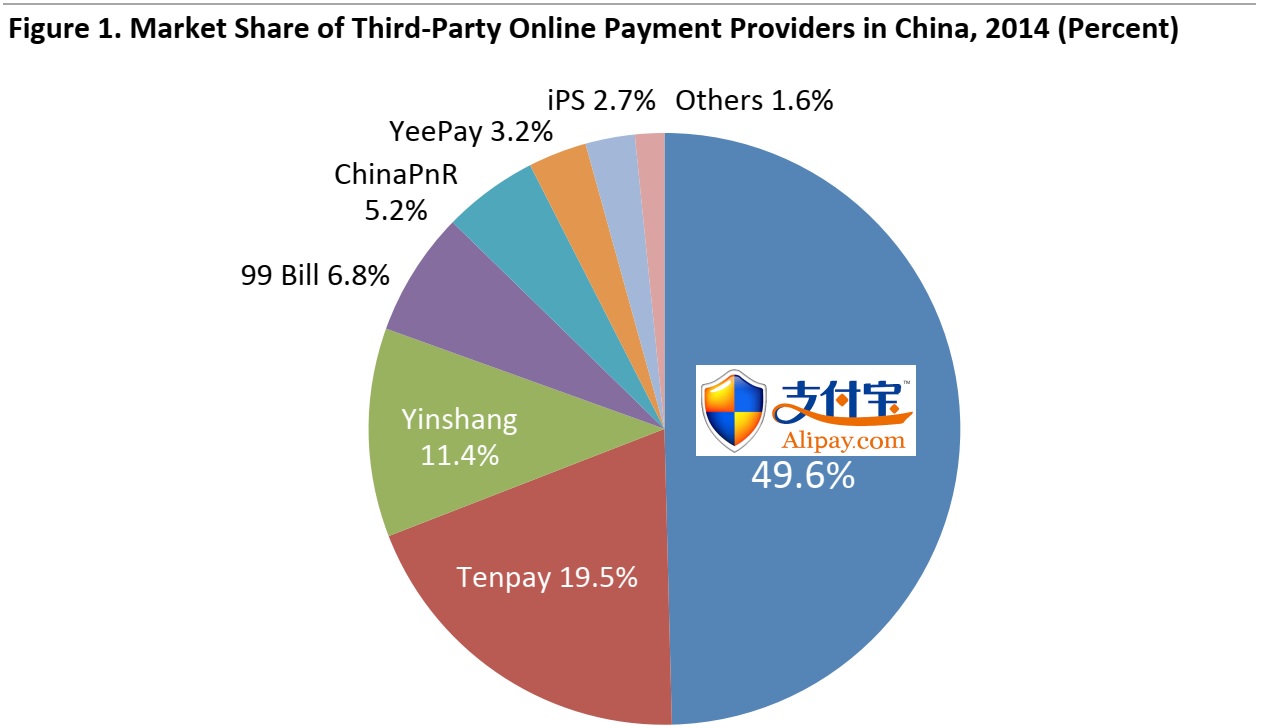

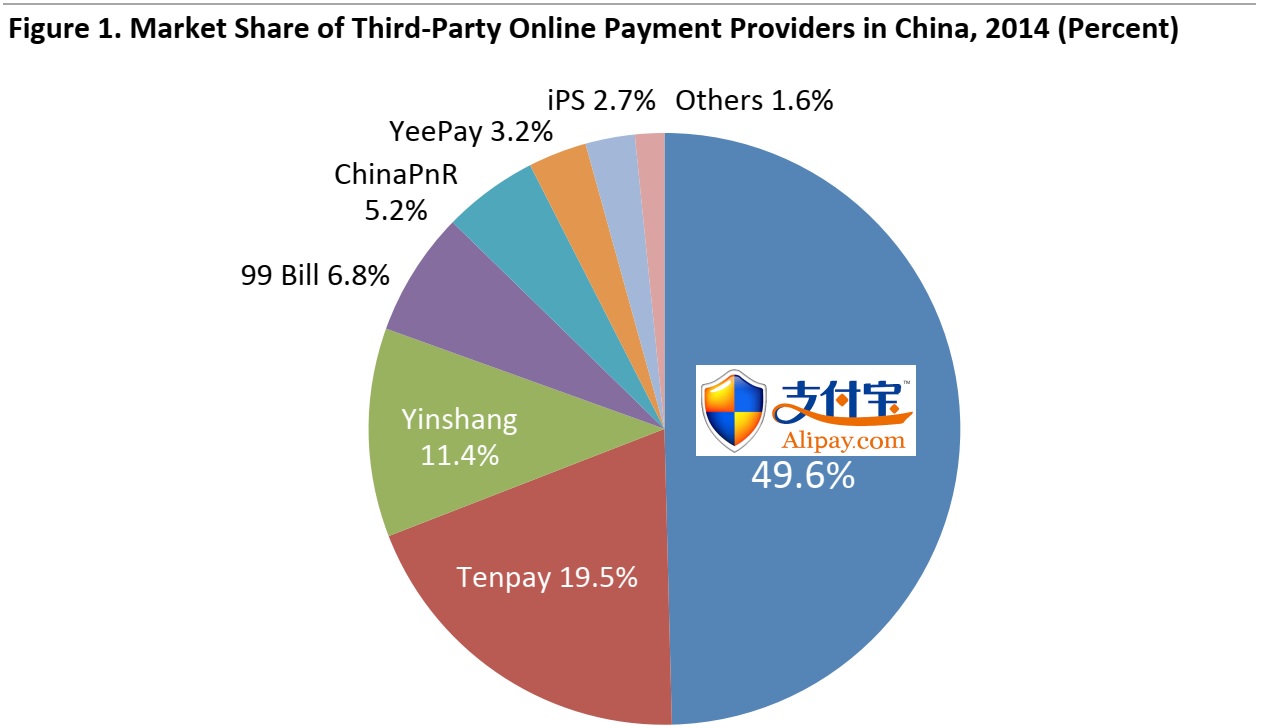

Tencent already has a foothold in payment platforms. Its integrated payment platform, Tenpay, had an online payment market share of 19.5% in 2014, iResearch says. This puts Tenpay far behind Alipay, the current market leader in third-party payments, which enjoys a 49.6% share.

Source: iResearch/Statista

Facing Competition from Alipay Wallet

Launched by Alibaba Group, Alipay Wallet is the biggest rival to WeChat Wallet in the mobile payment market in China. Alipay enables its users to easily make online payments. Its Alipay Wallet product focuses on mobile payments, and its functions include:

- Easy shopping at Alibaba’s e-commerce retail platforms

- Bill payment

- In-store (offline) payments via QR code scanning

Alipay has been developing technology that is similar to Apple Pay’s fingerprint-scanning functionality. Alipay’s Smile To Pay function, commonly referred to as “pay with a selfie,” relies on facial recognition to allow customers to pay for items by taking a picture of themselves.

Globally, Apple Pay Is a Big-Name Rival to WeChat Wallet

Apple launched Apple Pay in the US and the UK in 2015, but the mobile payment app is currently not available in China. The company’s CEO, Tim Cook, has openly expressed that Apple is interested in introducing Apple Pay there, according to Reuters. So far, there has been no official announcement on a launch in China, but Cook has confirmed that the company has been in talks with Alibaba over introducing Apple Pay in the country.

There are significant differences in the technology that the mobile payment apps employ. Apple Pay uses near field communication, whether the user pays in-store or elsewhere (for example, underground, for a subway or rail ticket). This is similar to contactless payment cards. Alipay Wallet and WeChat Wallet, on the other hand, rely on the in-store use of QR code/barcode scanning.

Looking Ahead

WeChat Wallet has benefited from WeChat’s huge user base, and this is expected to drive further mobile payment market share gains for the company. A potential challenge facing WeChat is a partnership between domestic rival Alibaba and global giant Apple.

Looking ahead, we think there are three possible future shapes for the mobile payment market in China:

Source: Cybersource

Source: Cybersource

- Alipay builds on its substantial market share in online payments to become a dominant force in mobile payments

- Mobile payment usage fragments into a growing body of providers

- Two or three big names emerge to dominate the market, with share split principally among them.

Given the growth of WeChat Wallet, and its opportunities to use WeChat’s substantial user base as a springboard to market share gains, we see the third possibility as the most likely. Big players such as Alipay Wallet, WeChat Wallet and, possibly, Apple look likely to carve up this large and growing market between them.

Introducing WeChat Wallet

Introducing WeChat Wallet

Launched by Alibaba Group, Alipay Wallet is the biggest rival to WeChat Wallet in the mobile payment market in China. Alipay enables its users to easily make online payments. Its Alipay Wallet product focuses on mobile payments, and its functions include:

Launched by Alibaba Group, Alipay Wallet is the biggest rival to WeChat Wallet in the mobile payment market in China. Alipay enables its users to easily make online payments. Its Alipay Wallet product focuses on mobile payments, and its functions include:

Apple launched Apple Pay in the US and the UK in 2015, but the mobile payment app is currently not available in China. The company’s CEO, Tim Cook, has openly expressed that Apple is interested in introducing Apple Pay there, according to Reuters. So far, there has been no official announcement on a launch in China, but Cook has confirmed that the company has been in talks with Alibaba over introducing Apple Pay in the country.

There are significant differences in the technology that the mobile payment apps employ. Apple Pay uses near field communication, whether the user pays in-store or elsewhere (for example, underground, for a subway or rail ticket). This is similar to contactless payment cards. Alipay Wallet and WeChat Wallet, on the other hand, rely on the in-store use of QR code/barcode scanning.

Apple launched Apple Pay in the US and the UK in 2015, but the mobile payment app is currently not available in China. The company’s CEO, Tim Cook, has openly expressed that Apple is interested in introducing Apple Pay there, according to Reuters. So far, there has been no official announcement on a launch in China, but Cook has confirmed that the company has been in talks with Alibaba over introducing Apple Pay in the country.

There are significant differences in the technology that the mobile payment apps employ. Apple Pay uses near field communication, whether the user pays in-store or elsewhere (for example, underground, for a subway or rail ticket). This is similar to contactless payment cards. Alipay Wallet and WeChat Wallet, on the other hand, rely on the in-store use of QR code/barcode scanning.

Source: Cybersource

Source: Cybersource