Introduction

E-commerce has undoubtedly disrupted traditional retailing, but it has also enabled innovative ways for retailers to establish a market and transact within it.Shopping apps, Internet payments and digital wallets are now global mainstays.But in China, chat apps play a particularly important role in e-commerce, and WeChat, the most-used social media app in the country, has led development on this front.

In this report, we look at the ways in which WeChat Mini Programs, sometimes referred to as “mini apps,” have opened new paths for transacting. We also examine the role that social media influencers play in e-commerce in China and explore WeChat’s intentions to further develop commerce by encouraging its users to create and share content via Mini Programs.

In an

earlier report, we reviewed WeChat Mini Programs and discussed their functionality. We begin by recapping key points from that report.

What Are WeChat Mini Programs?

WeChat Mini Programs are low-memory mobile applications embedded in WeChat that users can open without having to download and install them separately. For example, multilingual online dictionary Youdao has a mini app that users can access directly within the WeChat messaging app, without having to download a separate Youdao app. If a WeChat user wanted to look up a word on Youdao, she could go to the “Discover” function within WeChat, then choose “Mini Programs” and then the Youdao program.Along with Youdao, the user would see a broad range of products and services, some free and some for sale, that are available through mini apps on WeChat.

Characteristics of Mini Programs

Developers must submit all Mini Programs they create to WeChat for approval before they are made available on WeChat’s platform (Apple’s App Store follows a similar approval process). According to WeChat’s Mini Programs developer guide,submissions must meet the following requirements, among others:

- Universal language: Mini Programs must be developed in accordance with WeUI, WeChat’s own programming language.

- Permitted categories: Mini Programs must be different from their Android and iOS versions. Certain categories, such as games and live broadcasting apps, are not permitted on WeChat.

- Size requirement: A Mini Program’s installation package cannot exceed 1,024 kilobytes.

How Mini Programs Fare Against Native Apps

The advantage of mini apps for WeChat users is that they have a simple and lightweight user interface. This allows users to try various apps across categories they are interested in without having to download and install a different app for each category and then have it take up space in their phone’s memory. With mini apps, users are also spared the hassle of having to register their personal details each time they want to use a new app.

For developers, it costs about 20% less to develop a WeChat Mini Program than it does to develop a full-fledged mobile app, according to digital services company Tolmao Group. Typically, developers need to create full-scale apps for two different platforms, iOS and Android, which can push costs higher. WeChat Mini Programs run on the WeUI system, meaning that developers need to comply with only one set of requirements—WeChat’s.

For retailers, Mini Programs offer features similar to those offered by native apps,but they take less time to develop. Retailers can measure the success of a mini app and deploy any necessary changes more quickly. For many small and medium-sized businesses, whose operations may not warrant a comprehensive app, it makes sense to reach customers through a simpler app.

WeChat Mini Programs do come with certain limitations. Due to their small size, they can carry only a limited number of features compared with native apps.Also, it can be challenging for WeChat users to discover mini apps on the platform, as they cannot subscribe to or share them on WeChat’s Moments feed (which is akin to Facebook’s News Feed). Users must search for a particular mini app when they are looking for information or scan a QR code shared by one of their contacts or by an official account. However, these limitations do not seem to have slowed adoption of Mini Programs, as they have gained considerable traction since their launch just over a year ago.

WeChat Mini Programs: One-Year Progress Report

WeChat Mini Programs were launched on January 9, 2017, and since they are still relatively new, there are few available statistics on them. However, at a January 2018 event called WeChat Open Class PRO 2018 in Guangzhou, China,the company reviewed the progress of Mini Programs over the year. Hu Renjie, General Manager of WeChat Open Platform, shared the following statistics at the event:

- There are 580,000 Mini Programs available on WeChat one year post launch. By comparison, Apple’s App Store launched only 500,000 apps in the years between 2008 and 2012.

- Approximately 170 million people use WeChat Mini Programs every day.

- About 30% of Mini Programs users are from first-tier cities and the remaining 70%are from other cities in China.

Renjie also discussed retail and e-commerce use cases for WeChat Mini Programs, noting that retailers have leveraged the mini apps in different ways to serve their customers:

- Yonghui Superstores uses Mini Programs to enable customers to scan QR codes, shop for products, pay via smartphone and leave the store without having to wait in a checkout line. The offering is similar to Amazon Go’sat its new, cashier less store in the US.

- Convenience store chain Meiyijia dispenses discount coupons through its Mini Program.

- FamilyMart uses its Mini Program primarily for gift cards,which users can share with their friends and family via chat.

In terms of e-commerce, Renjie said that WeChat has seen three business models evolve through Mini Programs:

- Platform e-commerce: Some 95% of e-commerce firms in China, including JD.com and Tencent-backed Pinduoduo, have created WeChat Mini Programs. Pinduoduo and other companies offer attractive deals and discounts through mini apps that have sparked a trend of social commerce. These discounts are offered on products bought in bulk or by a group of people,which has led users to set up chat groups to share stores’ pages that feature good products or deals in Mini Programs.

- Brand e-commerce: Mini Programs help open up membership and loyalty opportunities for brands. Some consumers may not be willing to download separate apps for different brands’ loyalty programs, but they can now access the same benefits through those brands’ mini apps. Shoppers can also buy, share or send gift cards through the mini apps.

- Content e-commerce: Social media influencers are a prominent aspect of WeChat. In the past, bloggers publishing on WeChat who wanted to include a shopping link promoting a particular product in their blog could add it only at the end of their post.In many cases,readers would then have to click through the link and go through several steps before reaching the website page featuring the product. With Mini Programs, bloggers are able to share a direct link to a merchant selling the product they are promoting, and users do not have to leave WeChat to purchase it. Bloggers can also embed their own store into the blog post.

Content e-commerce is a point of focus for WeChat owner Tencent as it competes against China’s retail leader,Alibaba. WeChat “will do more to help these companies find new revenue models and earn money on top of their good quality content,” Renjie said.

Several Chinese social media influencers have seen success by launching their stores with Mini Programs. Fashion blogger Becky Li, for example,launched her own line of products, which were created based on data collected from her followers, via a mini app on WeChat.In an interview with WeChat, Li said that having the store in the landing page of her official account has helped boost visitor numbers. She also said that links in her articles typically have a click-through rate of 15%–25%, but that her Mini Program button links have generated a click-through rate of almost 37%.

To better understand why Tencent is focusing on content e-commerce, we examined some of the factors that influence consumer shopping behavior in China and how owners of official accounts on WeChat generally run their e-commerce operations within the platform.

Consumer Shopping Behavior in China and WeChat Official Accounts

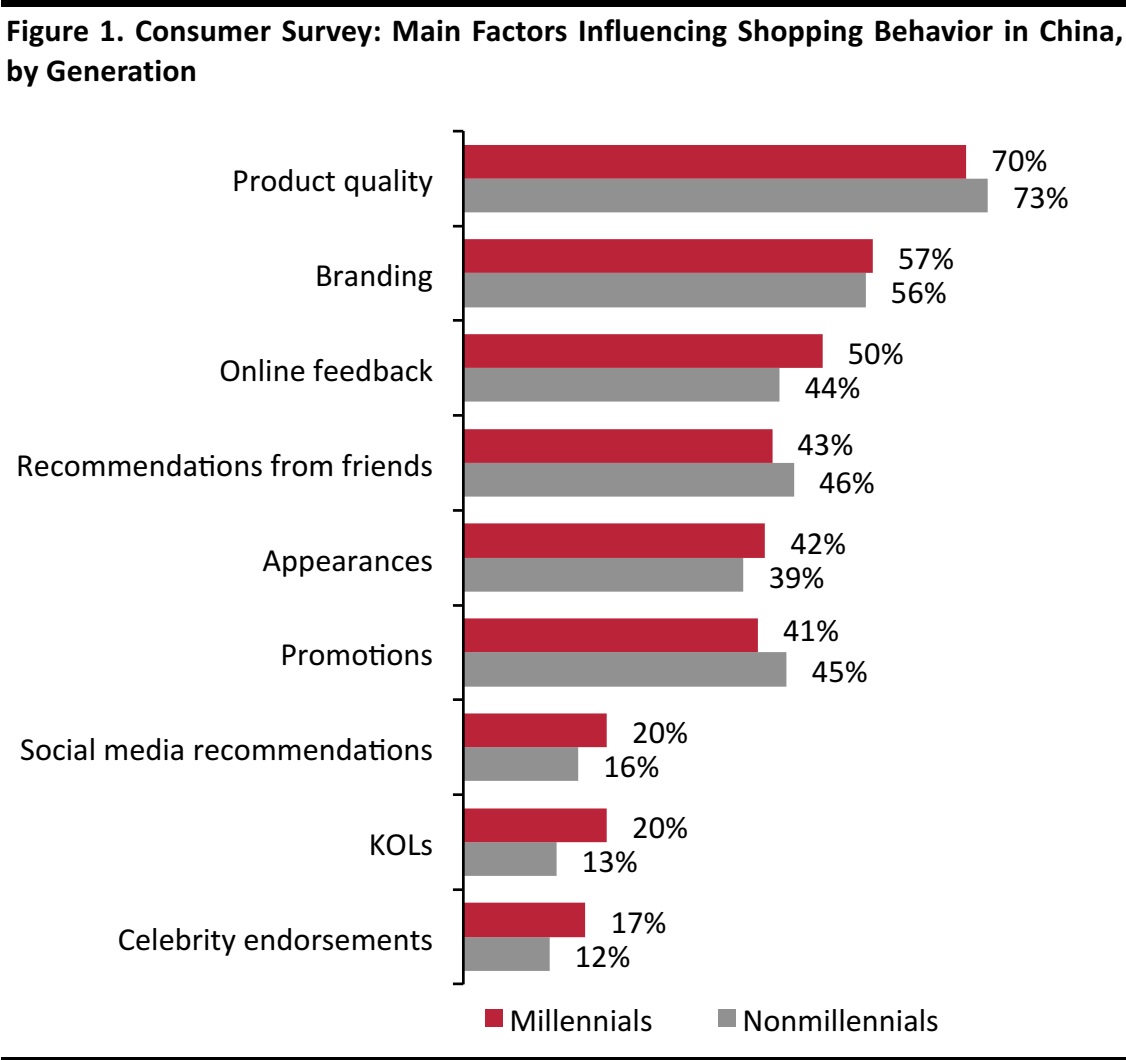

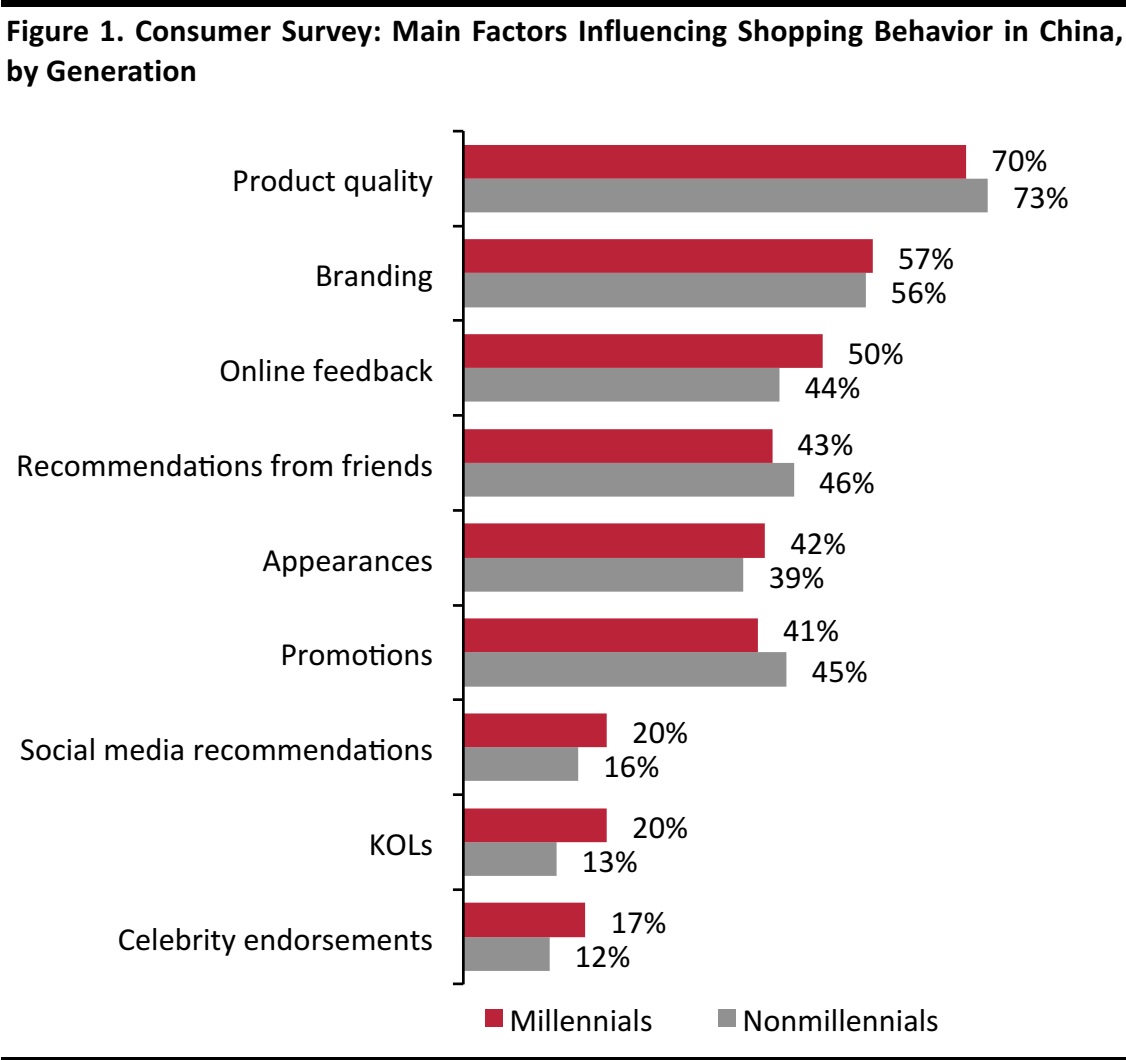

According to Chinese market measurement firm iResearch, mobile devices accounted for 80% of online shopping in China in 2017.A 2017 survey by market research firm Ipsos found that more than 70% of Chinese consumers are influenced by product quality, but that information and recommendations found online also significantly sway Chinese shoppers,and social media platforms are a significant source of such information.

Fully 50% of millennials and 44% of other age groups surveyed by Ipsos said that they consider online feedback while shopping, and 20% of millennials polled said that they seek out social media recommendations while shopping, versus 16% of nonmillennials. One-fifth of millennials surveyed also said that they follow key opinion leaders (KOLs) while shopping, versus 13% of nonmillennials.

Base: 3,004 consumers in Mainland China surveyed in September 2017; “millennials” refer to those born after 1985.

Source: Ipsos

Base: 3,004 consumers in Mainland China surveyed in September 2017; “millennials” refer to those born after 1985.

Source: Ipsos

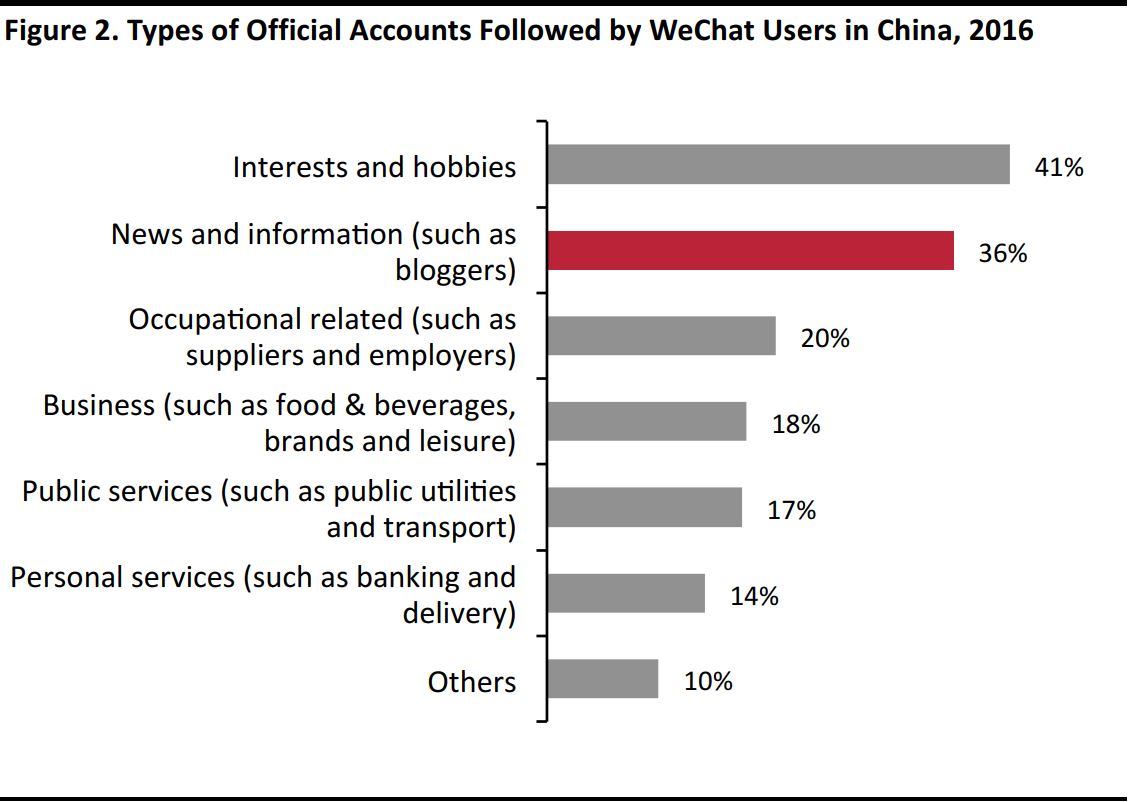

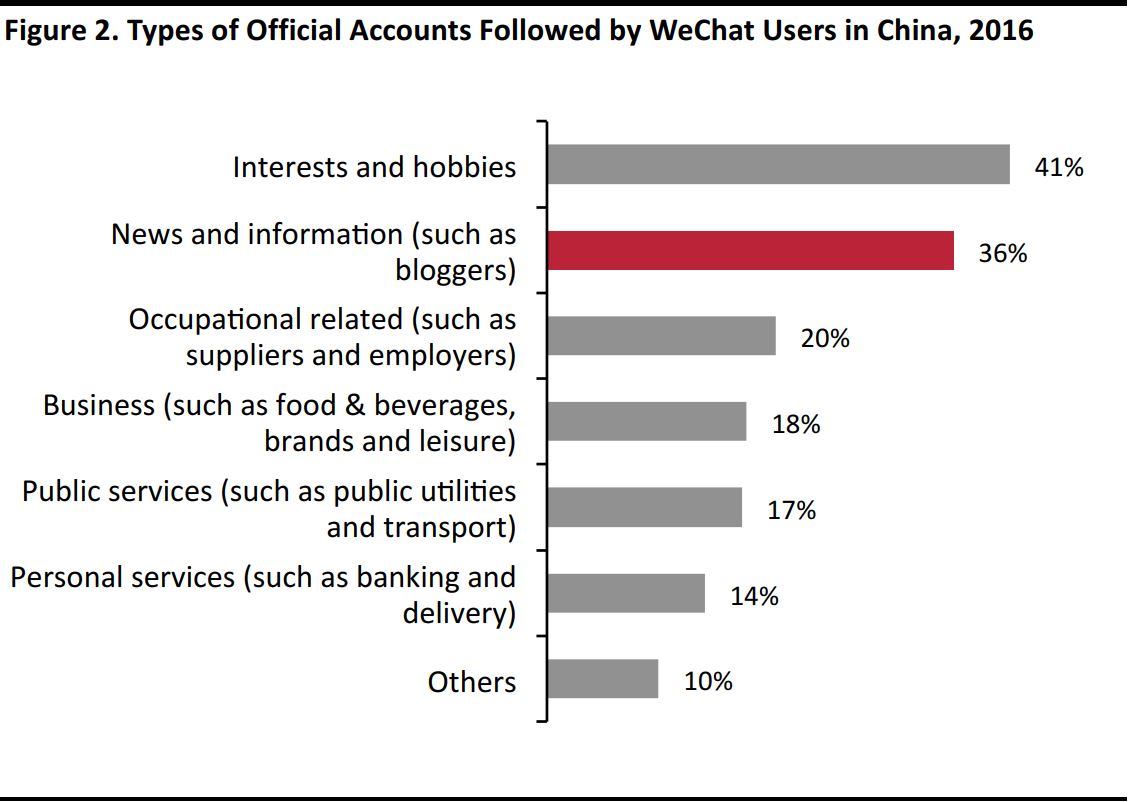

In February 2018, WeChat announced that it had approximately 1 billion monthly active users.According to data compiled by marketing agency We Are Social, that makes the platform the fifth-largest in the world, by user numbers. More than a third of WeChat users follow official accounts on the platform that are related to their interests and hobbies or news and information (including bloggers’ accounts), according to Tencent and China Academy of Information and Communications Technology (CAICT) data from 2016.

Source: Tencent/CAICT

Source: Tencent/CAICT

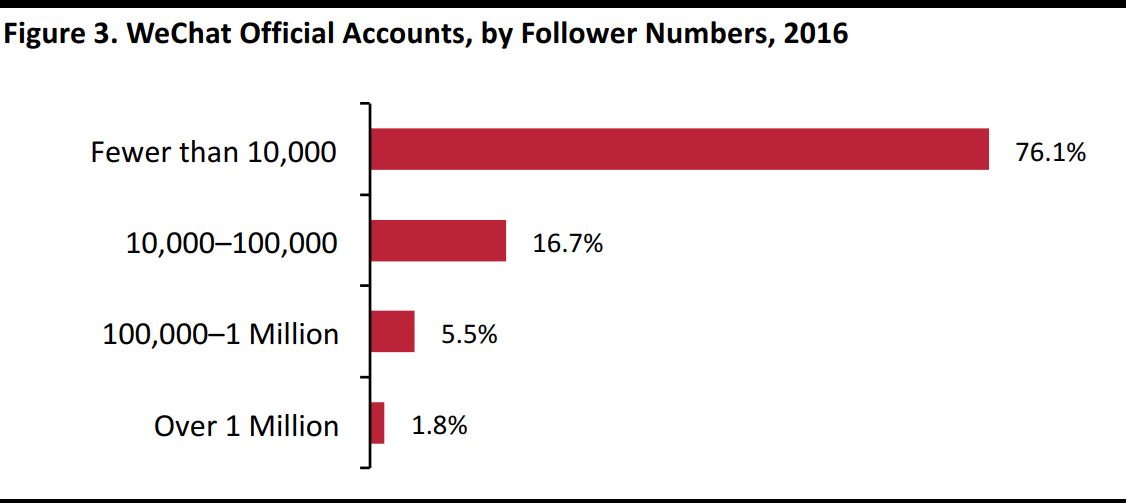

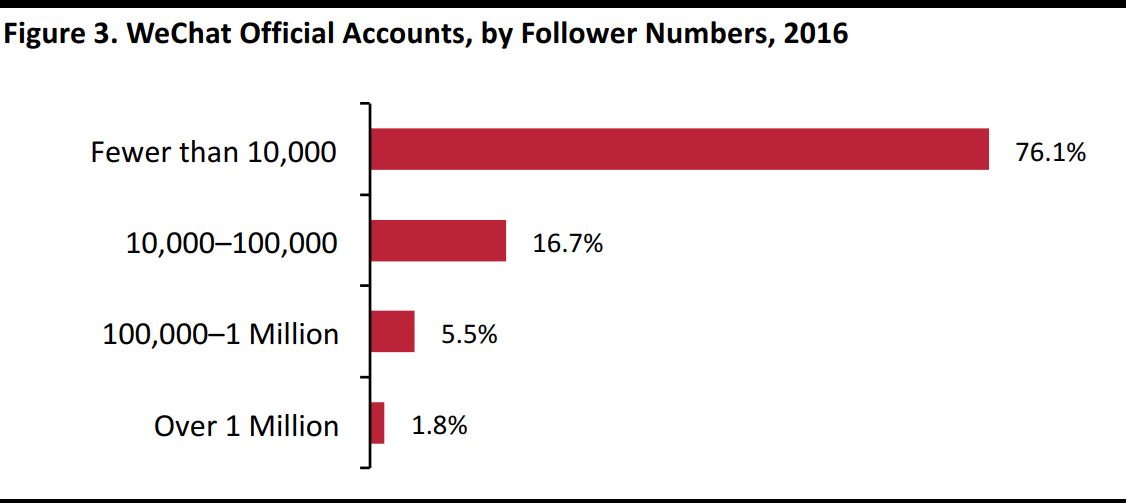

In terms of scale, in 2016, more than 75% of WeChat official accounts had fewer than 10,000 followers and only 1.8% of official accounts had more than 1 million followers. These figures imply that only a few accounts and users have a very wide reach on WeChat, which in turn suggests that only a limited number of Mini Programs are likely to see considerable traction.

Source: Tencent/CAICT

Source: Tencent/CAICT

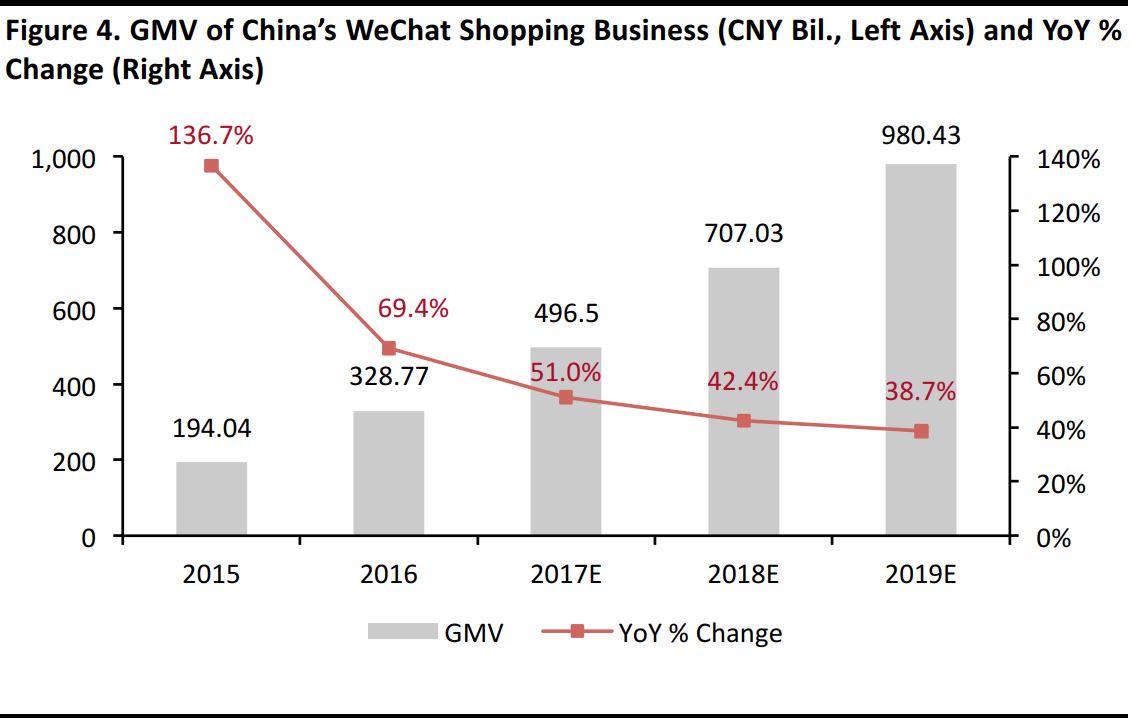

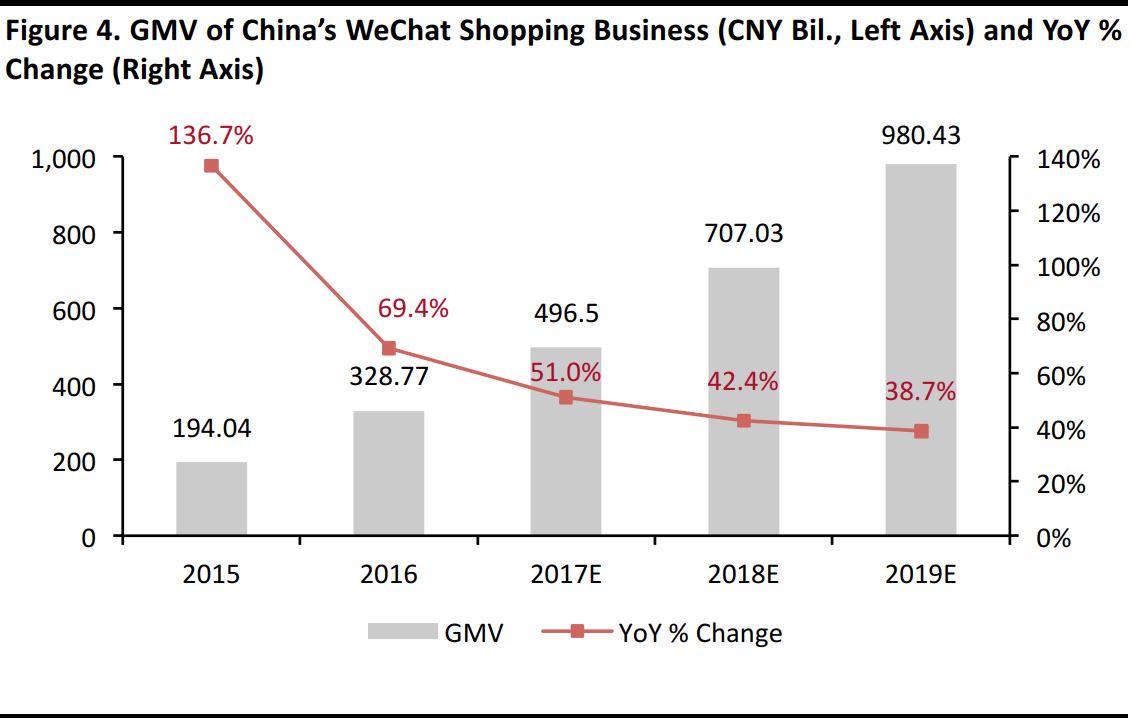

E-commerce is a formidable part of WeChat’s business in China, and the CAICT found that approximately 30% of official accounts on WeChat operate some form of e-commerce. iResearch estimates that WeChat’s shopping gross merchandise value (GMV) totaled approximately¥496.5 billion in 2017.The firm further estimates that the company’s GMV will grow by 42.4% in 2018, to ¥707.03 billion, and that it will reach nearly ¥1 trillion by the end of 2019.

The large number of official accounts that are already using WeChat to transact are likely to welcome the convenience provided by Mini Programs and, so, are likely to adopt them faster.These companies and others are looking at innovative ways to capitalize on this growth trend within WeChat e-commerce and push adoption of retailing through Mini Programs.

Source: iResearch

Source: iResearch

WeChat’s open architecture enables third-party developers, not just WeChat’s own developers, to develop Mini Programs. The open architecture also allows third parties an inside view of how the mini apps are assimilated among social circles within WeChat.

VivaVideo Influencer Platform: A New Way to Connect Brands and Consumers

We spoke with Han (Sam) Sheng of video content creation platform VivaVideo to understand a new tool the company developed, and is currently testing, to help content creators and social media bloggers sell more effectively and be rewarded for doing so. VivaVideo developed a mini app version of the tool for use via WeChat. The tool is pending deployment for public use.

What is it? The VivaVideo Influencer Platform is a feature that VivaVideo created for its native app and then adapted into a WeChat Mini Program. The platform enables users to create and edit videos related to products they use and share the videos on social media. Content creators are rewarded when their content leads to subsequent purchases by followers or viewers. If followers share the content and prompt further purchases, the followers are also rewarded. Rewards are provided in the form of virtual tokens, which creators and sharers of the content can collect and convert into money.

How doesit work? The VivaVideo Influencer Platform first identifies influencers with a high influence index rating, or determines users’ VivaVideo Influence Index,through an artificial intelligence engine developed specifically for the Mini Program. The index measures a social media influencer’s impact based on the quality of content generated and its reach in terms of number of active followers who consume the content and actively share it or interact with the account. Block chain technology is used to audit the trail of the content shared and identify the social media users who prompt purchases, in order to identify who should be rewarded. The virtual token rewards provide an incentive for people to share content and the technology allows brands to measure the effectiveness of their campaigns.

Why is it important? Han predicts that more than 80% of content in the future will be video-based, and he notes that traditional ad campaigns have lost steam. Most consumers dislike being interrupted by ads, and ads are expensive and time consuming to create—it can take several days to several weeks to create one.Another downside to traditional ad campaigns is that measuring their success is challenging, as it is difficult to identify the number of purchases or the revenue generated by a particular commercial.Han also noted that people are quicker to trust an influencer they follow on social media than a distant or unknown model in a traditional ad campaign.

Creating video content through VivaVideo’s platform is less expensive than using conventional filming and editing tools. And the company’s Mini Program allows better tracking of followers’ interactions with content and more accurate measuring of how shared content performed versus benchmarks.

Han said that it made sense for VivaVideo to develop its Viva Influencer Platform for both its native app and WeChat’s Mini Programs because WeChat has a huge user network and is prominent in e-commerce in China. He noted the growing adoption of Mini Programs and the ease with which users can share mini app content with their contacts as other reasons behind the company’s development of its mini app.

What We Think

The prospects for WeChat’s Mini Programs look promising, considering how fast the offering has grown in the first year post launch. WeChat’s large user base and the advantages Mini Programs provide for users, developers and retailers will certainly help push this growth further.

The persuasive influence that KOLs have on shopping behavior and the extent of mobile commerce in China will help drive the content e-commerce model in the country, as will WeChat’s resolve to develop that business model. WeChat Mini Programs that support content creation and sharing, such as the Viva Influencer Platform, will play a key role in the future of e-commerce in China.

Base: 3,004 consumers in Mainland China surveyed in September 2017; “millennials” refer to those born after 1985.

Source: Ipsos

Base: 3,004 consumers in Mainland China surveyed in September 2017; “millennials” refer to those born after 1985.

Source: Ipsos Source: Tencent/CAICT

Source: Tencent/CAICT Source: Tencent/CAICT

Source: Tencent/CAICT Source: iResearch

Source: iResearch