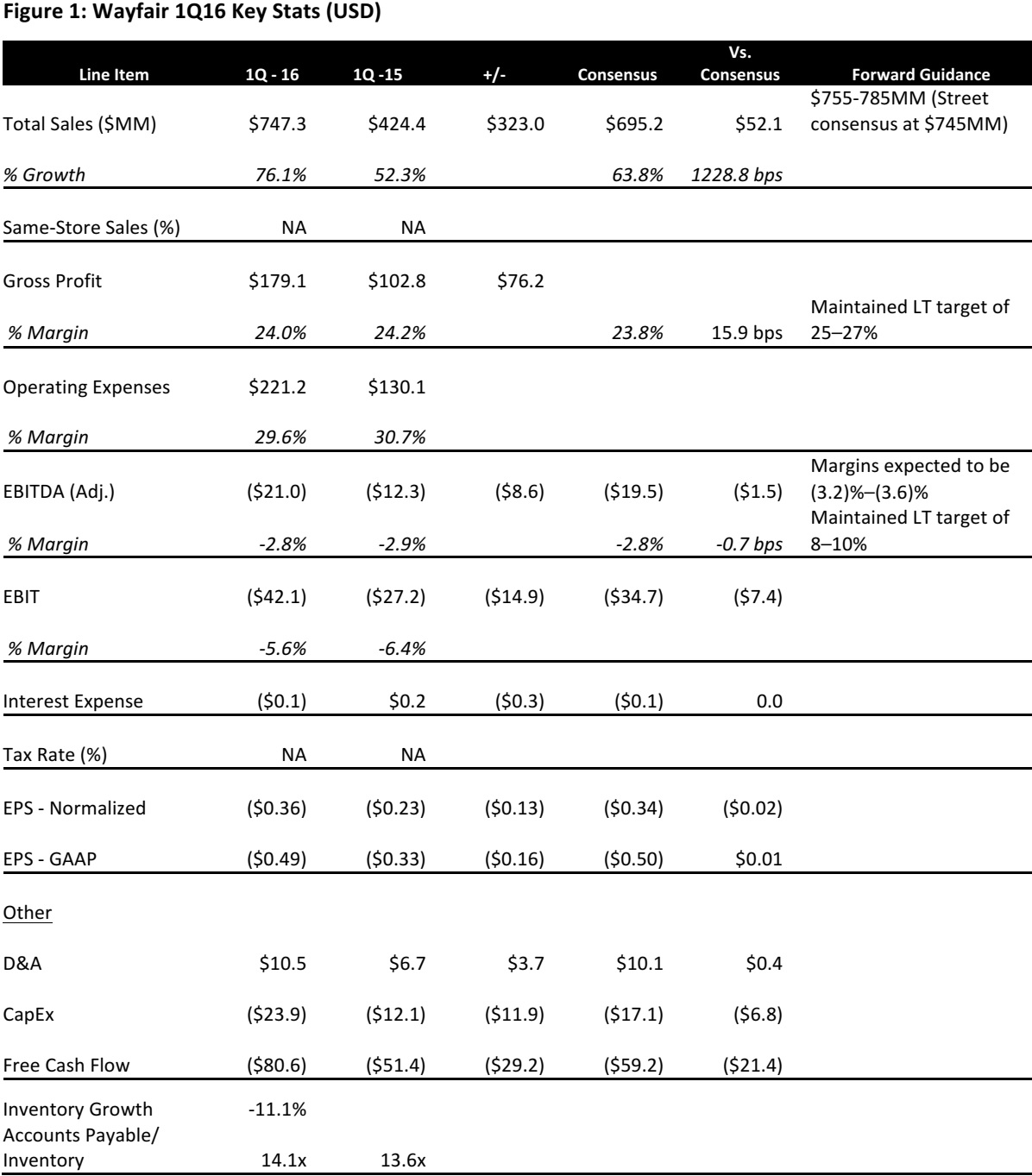

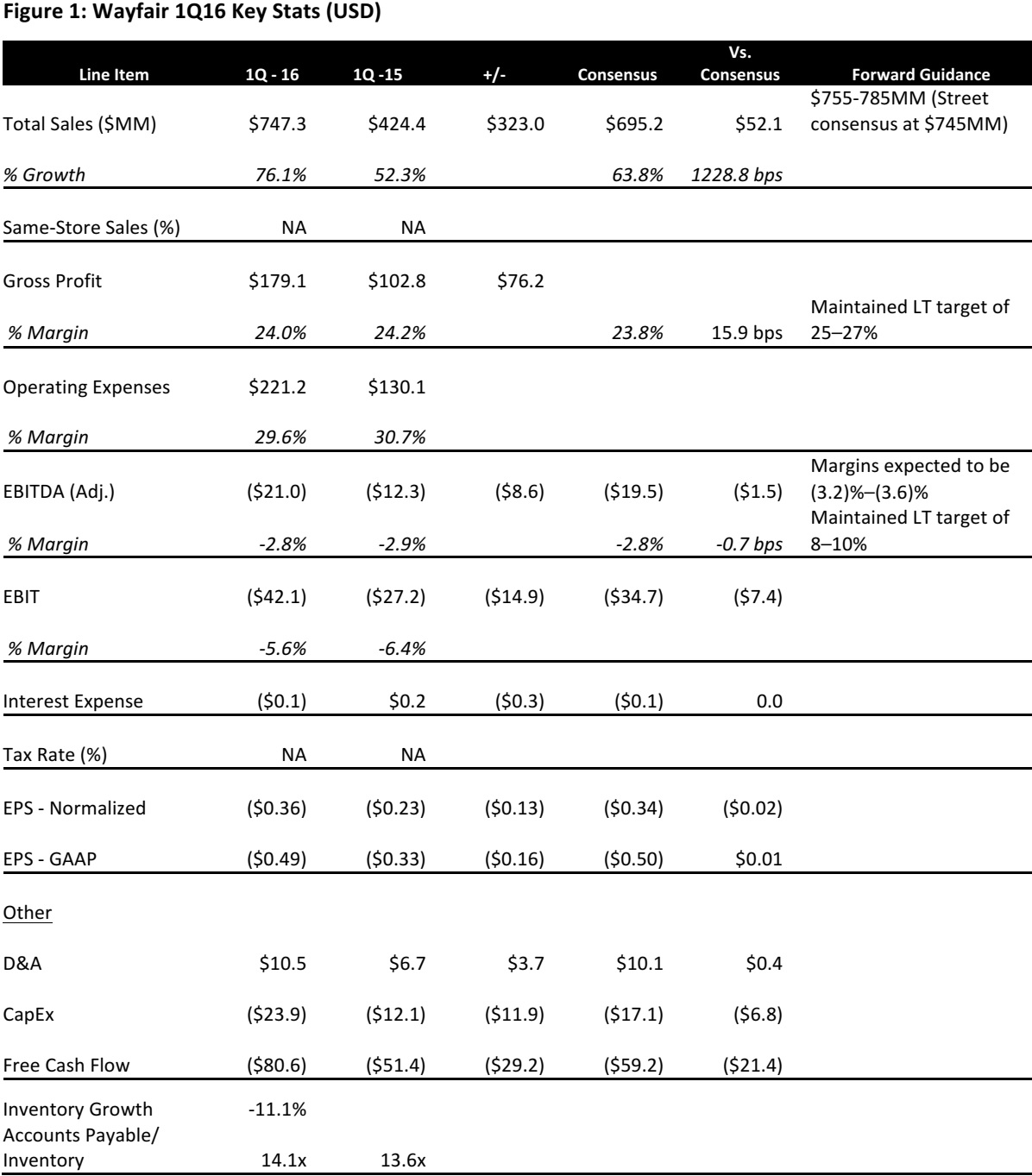

1Q16 RESULTS

Wayfair reported adjusted FY1Q16 EPS of ($0.36) versus consensus of ($0.34).

Total revenue was $747.3 million versus consensus of $695.2 million. Direct Retail revenues were $711.8 million versus consensus of $658.5 million and Other revenues were $35.5 million versus consensus of $33.8 million.

Orders totaled 3.0 million, below consensus of 3.06 million. Average order value was $238 versus consensus of $219.30. Ending active customers were 6.07 million versus consensus of 5.99 million and compared to 5.36 million a quarter ago. LTM net revenue per active customer was up +13.3% to $392, while repeat customers placed 55.4% of orders, and mobile orders were 38.6% of the total.

2016 GUIDANCE

Management provided 2Q16 guidance for revenues of $755–$785 million versus consensus of $744.6 million. Direct Retail revenue is expected to be in the range of $725–$750 million up 65% to 70% year over year on comp basis versus consensus of $707.7 million. Quarter to date, comp growth has been in the high 70% range. Other Revenue is expected to be in the range of $30–$35 million versus consensus of $34.0 million.

2Q adjusted EBITDA margins are expected to be in the range of (3.2)%–(3.6)%. Adjusted EBITDA is expected to be breakeven or positive by 4Q.

The company also maintained its long term targets for gross margins of 25%–27%, total operating expenses to be 15%–19% of revenues and adjusted EBITDA to be 8%–10% of sales.

Source: Company Reports