Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

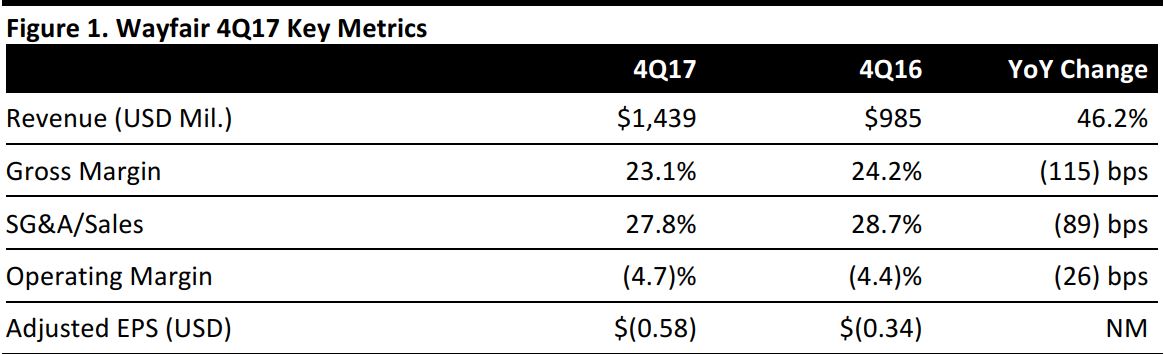

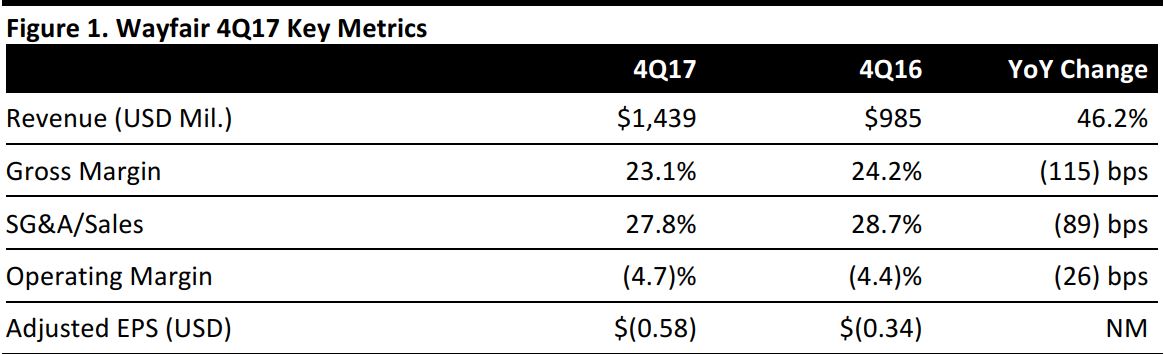

4Q17 Results

Wayfair reported 4Q17 net revenue of $1.44 billion, up 46.2% year over year and beating the $1.36 billion consensus estimate.

Adjusted EPS was $(0.58), compared with $(0.34) in the year-ago quarter and missing the $(0.53) consensus estimate. GAAP EPS was $(0.83), compared with $(0.51) in the year-ago quarter.

Adjusted EBITDA was $(21.2) million, compared with $(12.0) million in the year-ago quarter. Free cash flow was $1.4 million, compared with $48.7 million in the year-ago quarter.

Details from the Quarter

Prior to the earnings report, Wayfair’s board authorized the repurchase of up to $200 million of common stock with no expiration date.

During the quarter:

- The number of active Direct Retail customers reached 11.0 million, up 33.2% year over year.

- There were 1.77 orders per customer, compared with 1.71 in the year-ago quarter.

- Repeat customers placed 62.4% of total orders, compared with 58.0% in the year-ago quarter.

- There were 6.2 million orders delivered, up 31.3% year over year.

- The average order value was $229, compared with $203 in the year-ago quarter.

- Mobile devices accounted for 47.3% of total Direct Retail orders placed, compared with 43.3% in the year-ago quarter.

Other details:

- Net revenue per active customer over the past 12 months was $422, up 6.8% year over year.

- Over the last 18 months, the company has focused on three main investment areas: building out its international capabilities, developing its proprietary logistics network and increasing penetration of categories within its total addressable market.

- Wayfair is seeing success in its spending on advertising activities in the US and internationally and will continue to invest behind this strength.

- One example of an early initiative is design services: Wayfair has a team of product, engineering and marketing professionals working on this program. It’s not yet generating revenue, but management is very excited about its potential.

- While interior designers typically address the luxury market, mass-market customers often find that option out of reach. Wayfair can, through its combination of smart and creative use of technology and leveraging of scale and business processes, create compelling designs for a customer’s room or whole house.

- Building on international market-share gains in 2017, the company will continue to invest in the customer experience, advertising and its teams in order to capture the sizable market opportunity that management sees in these regions over the long term.

Full-Year Results

Wayfair reported 2017 revenues of $4.72 billion, up 39.7%.

Adjusted EPS was $(1.97), compared with $(1.67) in the prior year. GAAP EPS was $(2.81), versus $(2.29) in the prior year.

For the year, adjusted EBITDA was $67.0 million, versus $88.7 million in the prior year. Free cash flow was $(113.2) million, worse than the $(65.3) million reported in the prior year.

Outlook

The company’s 1Q18 guidance included the following:

- Direct Retail revenue of $1.315–$1.345 billion, up approximately 40%–43% year over year.

- This includes Direct Retail growth of 34%–37% and international Direct Retail growth of 85%–95% year over year.

- Other revenue of $13–$17 million.

- Total net revenue of approximately $1.33–$1.36 billion, above the consensus estimate of $1.28 billion.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research