Source: Company reports/Coresight Research

3Q18 Results

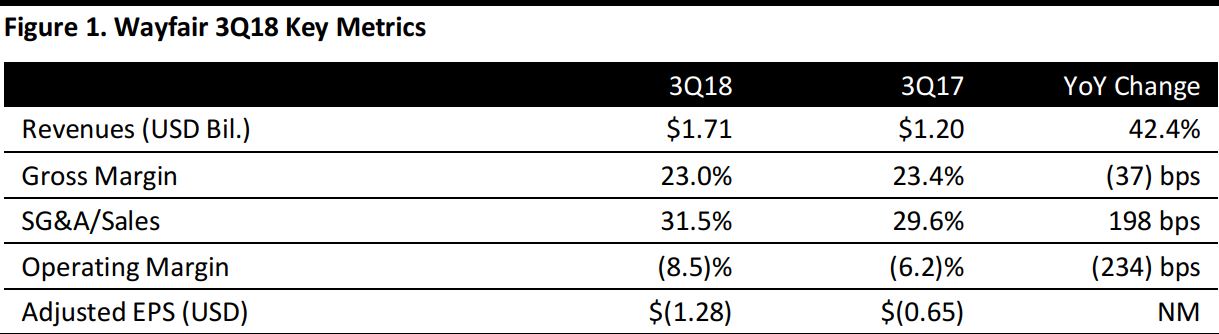

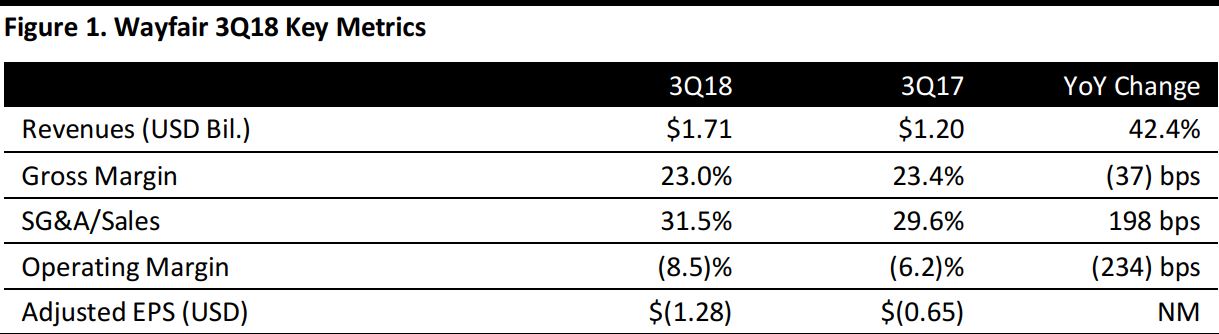

Wayfair reported 3Q18 revenues of $1.71 billion, up 42.4% year over year and beating the consensus estimate of $1.67 billion.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) was $(76.4) million, compared to $(22.7) million in the year ago quarter. The adjusted EBITDA margin was (4.5)%, below the consensus estimate of (3.7)% and guidance of (3.7)%–(4.0)%.

Adjusted EPS was $(1.28), below the $(1.09) consensus estimate. GAAP EPS was $(1.69), compared to $(0.88) in the year ago quarter.

Details from the Quarter

Management commented that it was pleased with the 43% Direct Retail revenue growth and with market share gains. Moreover, customer key performance indicators (KPIs) continue to strengthen. Management further commented that it is taking a long-term approach in building the business and investing in logistics, in international regions and in increasing headcount to enhance its consumer offering in under-penetrated products and services.

Other highlights:

- Last twelve-month (LTM) net revenue per active customer was $443 at the end of the quarter, up 8.6% year over year.

- There were 1.84 orders per customer (defined as number of LTM orders divided by number of active customers) at the end of the quarter, up from 1.75 a year ago.

- Repeat customers placed 4.6 million orders in the quarter, up 59.7% year over year, and accounted for 66.3% of total orders place, compared to 61.0% a year ago.

- There were 6.9 million orders delivered in the quarter, up 47.0% year over year.

- The average order value was $244 in the quarter, compared to $250 a year ago.

- Management outlined three key investment areas—the proprietary logistics network, the international business and headcount—and cited penetration at CastleGate and attractive conversion and repeat rates in Germany.

- The business in Germany is currently running at a loss. However the unit is currently at an inflection point with dedicated teams of category managers. The company cited recent spending on TV advertising as a sign of its confidence in suppliers and customers.

- In the US, the company is widening its range of services in a bid to win increased wallet share, with the launch of design services. The company has added a couple dozen people in cross-functional roles.

- Canada has shown rapid growth since the launch of the Canadian website, and advertising spending has targeted Canadian customers. The Canadian business has effectively leveraged the US catalog and logistics infrastructure and accounts for about 60% of international revenue. Aided brand awareness in the country is now 80%.

- Today, the company’s UK and German businesses are growing faster than its Canada business, yet this growth is off a smaller base.

Results by Segment

Direct Retail

- US Direct Retail revenue was $1.46 billion, up 41.2%.

- International Direct Retail Revenue was $232.4 million, up 57.5%.

- The number of active customers in the Direct Retail business at the end of the quarter reached 13.9 million,up 35.2% year over year.

- 4% of total orders delivered for Direct Retail were placed via a mobile device, compared to 45.4% a year ago.

Other

- Other retail revenue was $13.2 million, down from $17.0 million a year ago.

Outlook

Management offered the following guidance for the fourth quarter:

- Total net revenue of $1.92–$1.97 billion, in line with the consensus estimate of $1.94 billion. This figure comprises:

- Direct Retail revenue of $1.905–1.950 billion, representing growth of approximately 34%–37% year-over-year. This includes US Direct Retail growth of 32%–35% and international Direct Retail growth of 50%–55%.

- Other revenue of $15–$18 million.

- Adjusted EBITDA margins of (3.8)%–(4.1)%, below the consensus estimate of (2.2)%.