Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

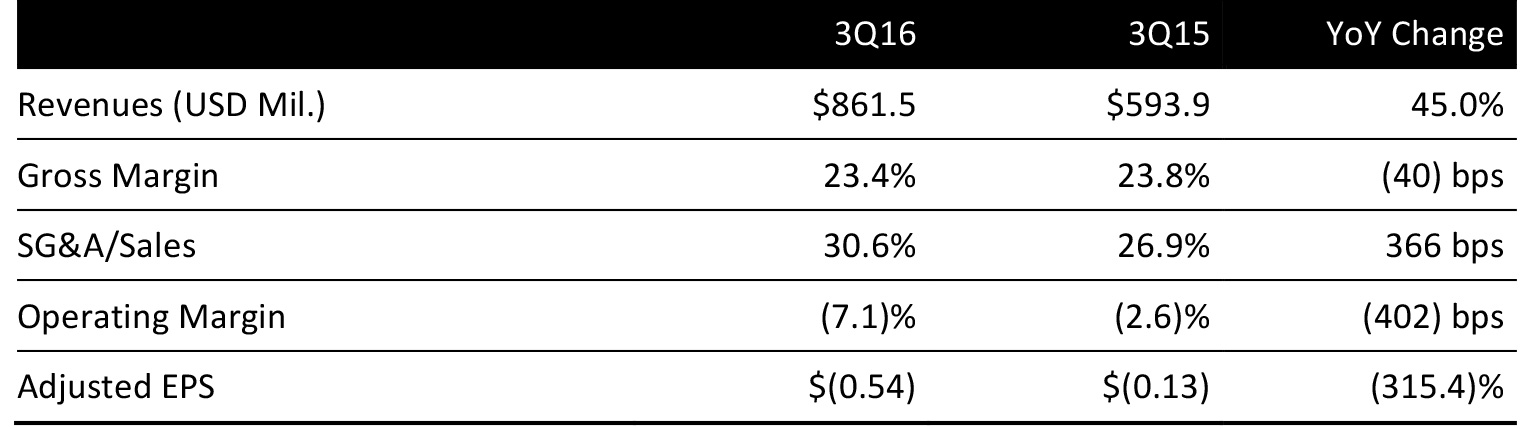

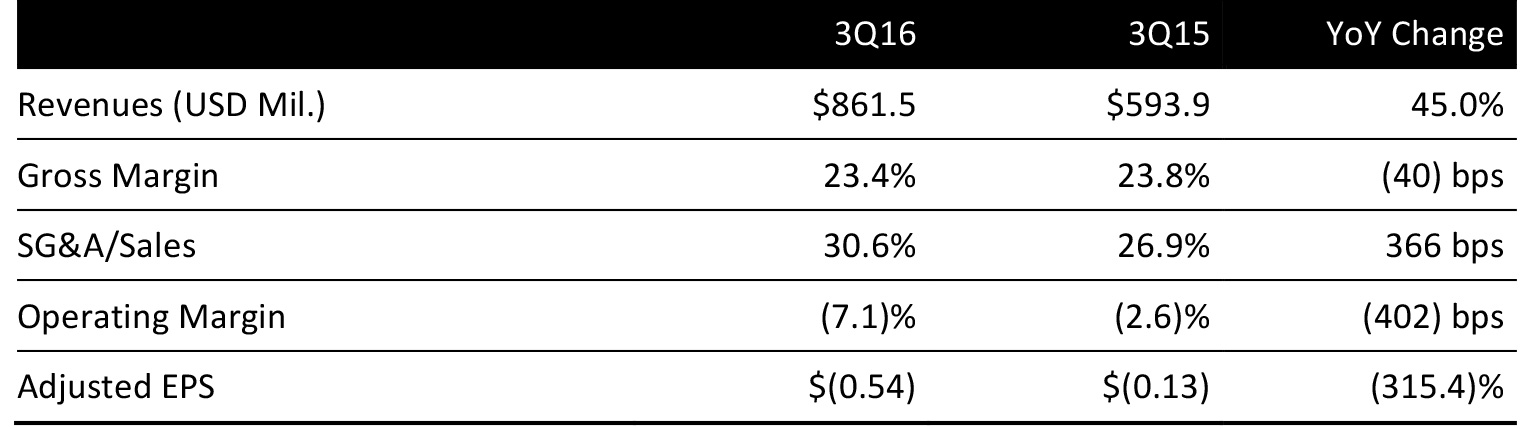

Boston-based online home goods retailer Wayfair reported 3Q16 revenues of $861.5 million, up 45.0% year over year and above the consensus estimate. Direct retail revenue rose by 52.7% year over year, to $832.4 million (96% of total sales), while the number of active customers in the company’s direct retail business increased by 60.4% year over year, to 7.4 million.

Direct retail revenue consists of sales generated primarily through the sites of the company’s brands, which include Wayfair, Joss & Main, AllModern, DwellStudio and Birch Lane.

Average order value was $244, up from $235 during the year-ago period. Total orders delivered in the third quarter were 3.4 million, an increase of 47.1% year over year. Repeat customers placed 56.9% of total orders, compared with 55.2% in the year-ago quarter. Mobile orders accounted for 40.3% of the total, up from 35.1% in the year-ago quarter.

Despite beating analysts’ estimates and posting strong revenue growth, Wayfair is moving in the opposite direction of profitability. Operating expenses, driven by increased costs in customer service, marketing and logistics, increased by 64.5% year over year, growing faster than revenue. Gross margin declined slightly, dropping 40 basis points year over year, to 23.4%. The company’s free cash flow fell from a gain of $35.3 million to a loss of $13.97 million.

Adjusted EPS came in at $(0.54), down from $(0.13) in the prior-year period, but was $0.05 higher than the consensus estimate.

Wayfair executives remarked that they are pleased with third quarter results and will stay focused on taking market share from online and traditional retailers into 2017 as the company focuses on marketing and expands into countries that include Canada, the UK and Germany.

The company continues to invest in three key categories: international expansion, warehousing and logistics infrastructure, and rolling out new products such seasonal décor.

OUTLOOK

For 4Q16, Wayfair expects:

- Revenue of $920–$960 million, short of $1.03 billion consensus estimate.

- Direct retail revenue in the range of $890–$925 million, below the $995 million consensus estimate.

- Other revenue of $30–$35 million versus the consensus estimate of $35 million.

- Full-year capital expenditures are expected to be ~4% of net revenue, unchanged from prior guidance.

Wayfair did not provide sales guidance for 2017. Company executives noted that softer consumer spending is pressuring sales growth and, thus, the company is being conservative in its guidance.