albert Chan

[caption id="attachment_77885" align="aligncenter" width="680"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

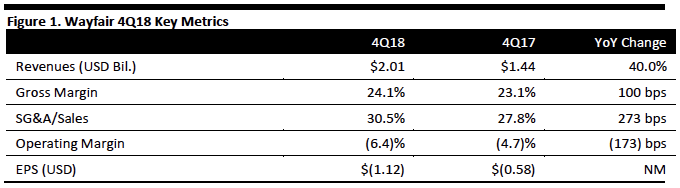

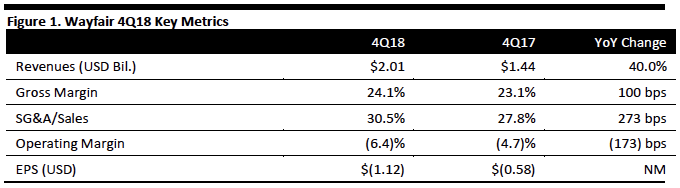

Wayfair reported 4Q18 revenues of $2.01 billion, up 40.0% and slightly beating the $1.97 billion consensus.

While gross margins increased 100 bps, the gain was more than offset by a 273 bps increase in the SG&A/sales ratio, driving operating margins down 173 bps.

Adjusted EBITDA was $(53.8) million, compared to $(21.1) million in the year-ago quarter.

Adjusted EPS was $(1.12), beating the $(1.28) consensus estimate. GAAP EPS was $(1.59), compared to $(0.83) in the year-ago quarter. GAAP figures exclude stock compensation as well as a resulting income-tax adjustment.

FY18 Results

FY18 revenues were $6.8 billion, up 43.6%.

FY18 adjusted EBITDA was $(215.0) million, compared to $(67.0) million the prior year.

Adjusted EPS was $(4.09), compared to $(1.97) the prior year. GAAP EPS was $(5.63), compared to $(2.81) the prior year.

Results by Segment

Direct Retail

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Wayfair reported 4Q18 revenues of $2.01 billion, up 40.0% and slightly beating the $1.97 billion consensus.

While gross margins increased 100 bps, the gain was more than offset by a 273 bps increase in the SG&A/sales ratio, driving operating margins down 173 bps.

Adjusted EBITDA was $(53.8) million, compared to $(21.1) million in the year-ago quarter.

Adjusted EPS was $(1.12), beating the $(1.28) consensus estimate. GAAP EPS was $(1.59), compared to $(0.83) in the year-ago quarter. GAAP figures exclude stock compensation as well as a resulting income-tax adjustment.

FY18 Results

FY18 revenues were $6.8 billion, up 43.6%.

FY18 adjusted EBITDA was $(215.0) million, compared to $(67.0) million the prior year.

Adjusted EPS was $(4.09), compared to $(1.97) the prior year. GAAP EPS was $(5.63), compared to $(2.81) the prior year.

Results by Segment

Direct Retail

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Wayfair reported 4Q18 revenues of $2.01 billion, up 40.0% and slightly beating the $1.97 billion consensus.

While gross margins increased 100 bps, the gain was more than offset by a 273 bps increase in the SG&A/sales ratio, driving operating margins down 173 bps.

Adjusted EBITDA was $(53.8) million, compared to $(21.1) million in the year-ago quarter.

Adjusted EPS was $(1.12), beating the $(1.28) consensus estimate. GAAP EPS was $(1.59), compared to $(0.83) in the year-ago quarter. GAAP figures exclude stock compensation as well as a resulting income-tax adjustment.

FY18 Results

FY18 revenues were $6.8 billion, up 43.6%.

FY18 adjusted EBITDA was $(215.0) million, compared to $(67.0) million the prior year.

Adjusted EPS was $(4.09), compared to $(1.97) the prior year. GAAP EPS was $(5.63), compared to $(2.81) the prior year.

Results by Segment

Direct Retail

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Wayfair reported 4Q18 revenues of $2.01 billion, up 40.0% and slightly beating the $1.97 billion consensus.

While gross margins increased 100 bps, the gain was more than offset by a 273 bps increase in the SG&A/sales ratio, driving operating margins down 173 bps.

Adjusted EBITDA was $(53.8) million, compared to $(21.1) million in the year-ago quarter.

Adjusted EPS was $(1.12), beating the $(1.28) consensus estimate. GAAP EPS was $(1.59), compared to $(0.83) in the year-ago quarter. GAAP figures exclude stock compensation as well as a resulting income-tax adjustment.

FY18 Results

FY18 revenues were $6.8 billion, up 43.6%.

FY18 adjusted EBITDA was $(215.0) million, compared to $(67.0) million the prior year.

Adjusted EPS was $(4.09), compared to $(1.97) the prior year. GAAP EPS was $(5.63), compared to $(2.81) the prior year.

Results by Segment

Direct Retail

- US Direct Retail revenue was $1.71 billion, up 39.2%.

- International Direct Retail Revenue was $287.1 million, up 49.8%.

- The number of active customers in the Direct Retail business at the end of the quarter reached 15.2 million, up 37.9% year over year.

- 51.8% of total orders delivered for Direct Retail were placed via a mobile device, compared to 47.3% a year ago.

- Other retail revenue was $18.2 million, down from $19.8 million a year ago.

- The quarter represented the largest year-over-year dollar growth in company history.

- Revenue growth in Europe exceeded the 49.8% growth in international. Canada accounts for 60% of international revenues and the company faces challenges in products being shipped there from the U.S., however, a new facility in Ontario should enable suppliers to ship directly from within Canada.

- The company sized the total addressable market in Canada and Europe at $300 billion.

- Direct retail sales increased 58% during the Cyber 5 period (Thanksgiving through Cyber Monday), which is traditionally driven by physical retail.

- Gross margins increased 100 bps despite giving suppliers twice as many discounts as a year ago.

- Management outlined indoor lighting as an opportunity, and the company has doubled the size of its lighting team over the past two years, offering more than 120,000 SKUs.

- Lighting accounts for half of the $1 billion run rate in international revenue.

- The company has also focused on visual merchandising in 80 house brands in lighting, and private-label revenue has increased to 74% of sales in 4Q18, up from 57% in FY17.

- Wayfair has simplified its shopping experience by offering visual filters so customers can find products without knowing their names.

- The company has also collaborated with suppliers to build out its library of 3D product images, which help customers visualize the products inside their homes.

- At the end of 2018, the company had approximately 12 million square feet of space in North America and Europe in its CastleGate and WDN facilities, and as part of its logistics buildout expects to add another five million square feet of space in 2019, with three million square feet at U.S. CastleGate facilities, one million square feet at CastleGate internationally and one million square feet at the WDN last-mile delivery facilities.

- As of the end of 4Q18, the company operated 35 of its own last-mile delivery facilities in North America, up from 27 at the end of 3Q18, with the addition of Phoenix, Milwaukee, Columbus, Austin, San Antonio, Las Vegas, Kansas City and Cincinnati. These facilities give Wayfair coverage of 74% of its U.S. large parcel home deliveries.

- Direct Retail net revenue of $1.86-1.90 billion (up 34–37%), comprising U.S. growth of 33%–36% and international growth of 35-40%.

- Other revenue of $10-15 million.

- Total net revenue of $1.87-1.91 billion, in line with the $1.89 billion consensus estimate.

- A U.S. adjusted EBITDA margin of (1.5)-2%.

- A consolidated adjusted EBITDA margin of (5.2)-(5.5)%, due to expected negative EBITDA of $70-75 million for the international business.