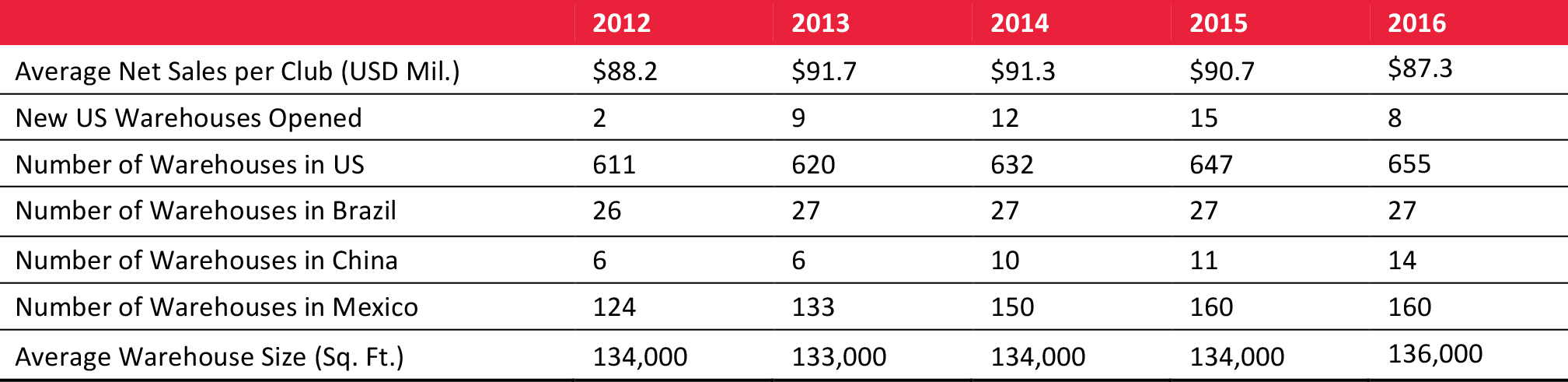

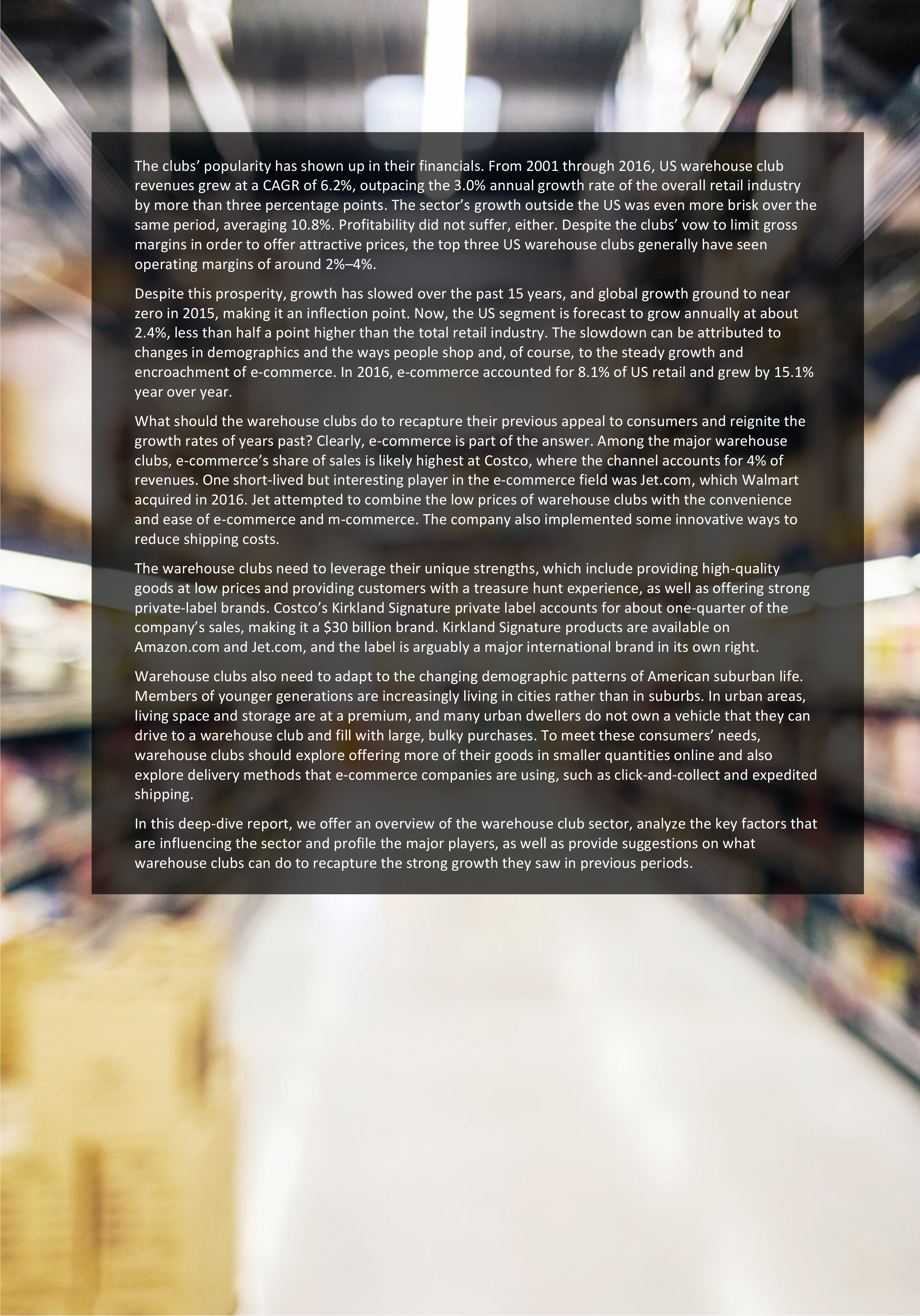

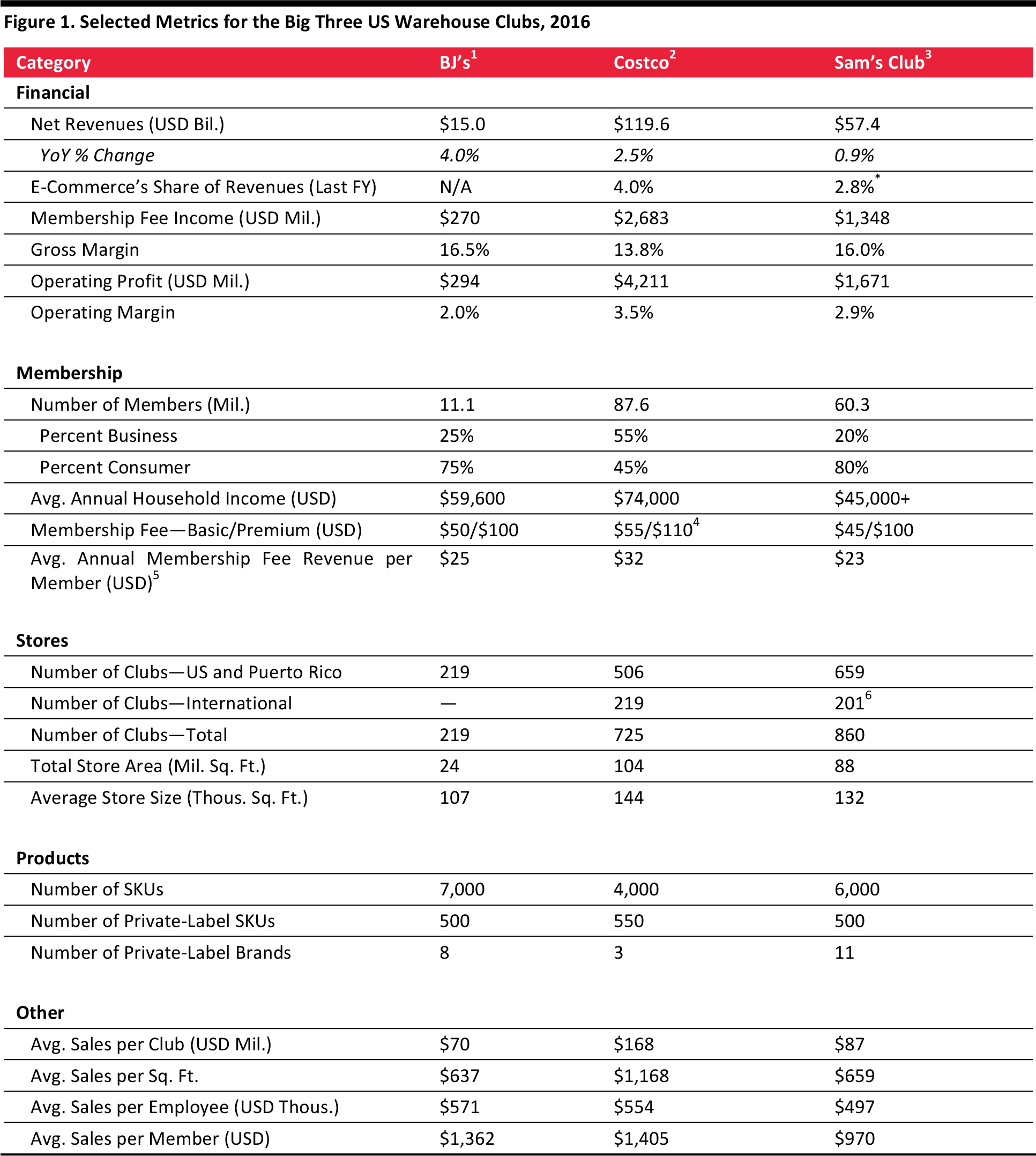

Warehouse Club Companies at a Glance

*For parent company Walmart

Source: Company reports/eMarketer/US Census Bureau/Fung Global Retail & Technology

In this section, we analyze the key topics that are influencing the warehouse club sector and explore how the warehouse clubs might best respond and position themselves in order to benefit from shifting trends.

The Changing Grocery Shopper

The Changing Grocery Shopper

Demographic Shifts Alter Consumer Behavior

Demographic Shifts Alter Consumer Behavior

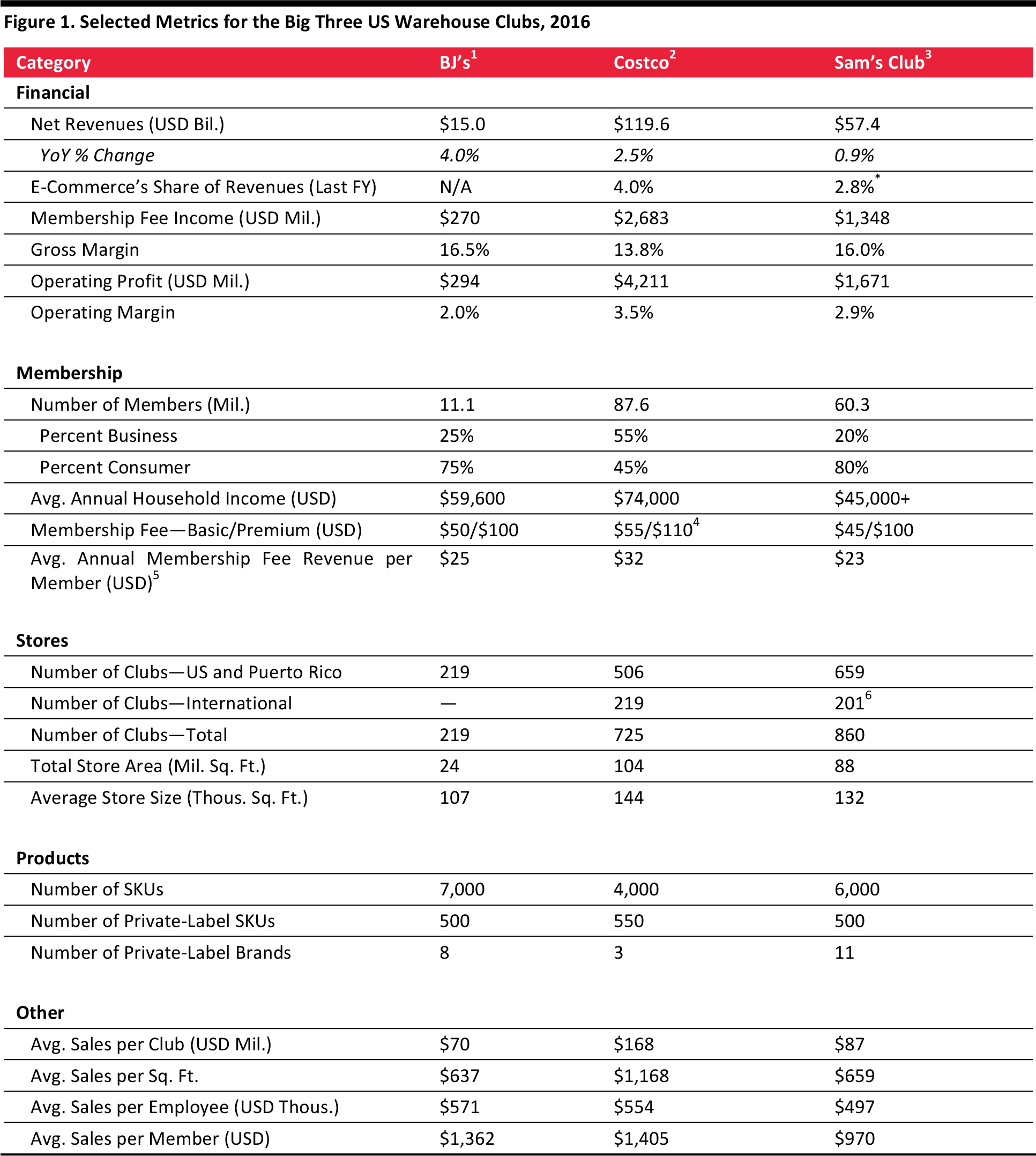

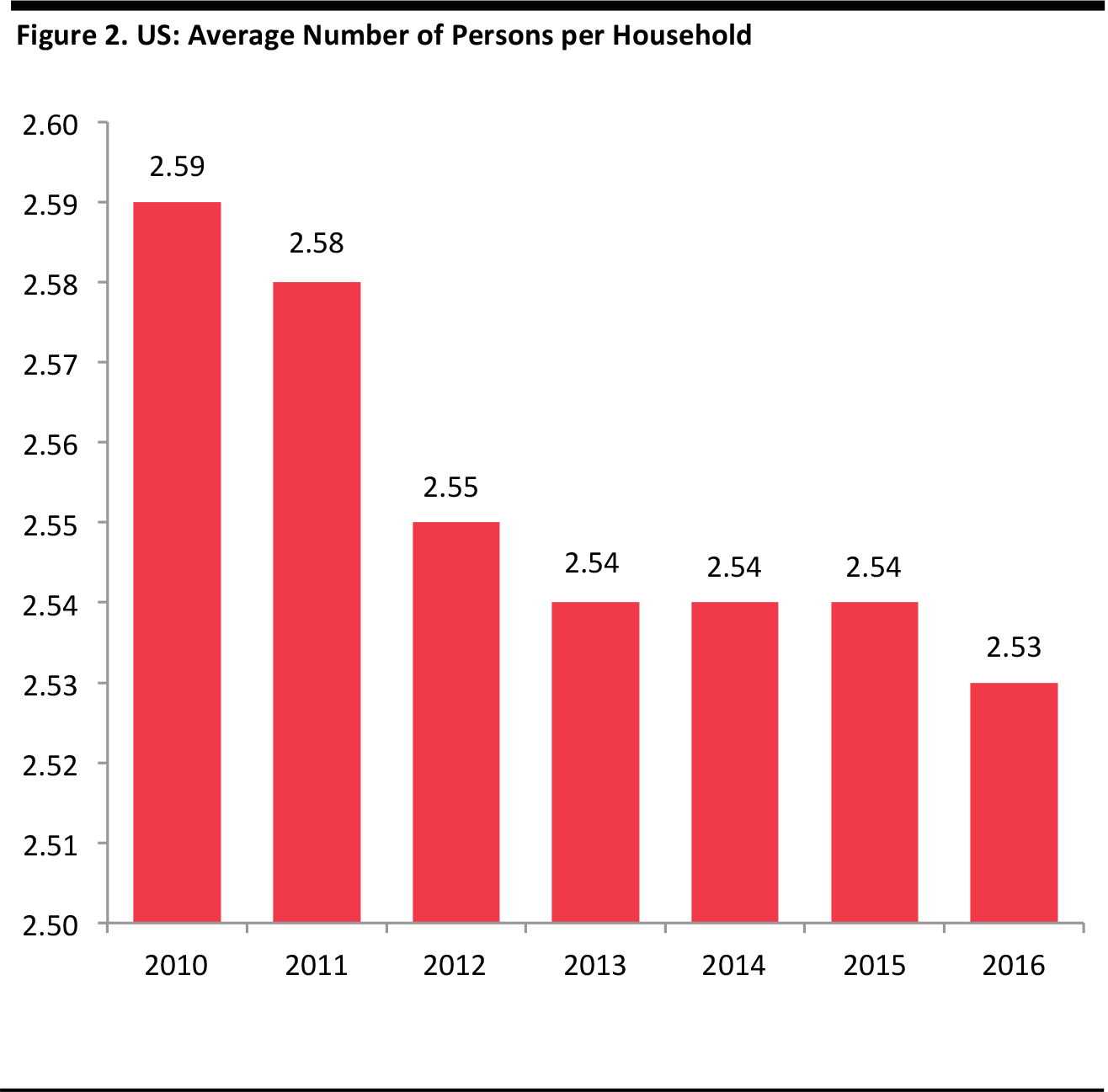

Warehouse clubs are enjoying the success of their business model, but changing demographics and consumer preferences are altering shopping patterns. Younger consumers are increasingly shopping online for the convenience of home delivery, and many millennials and empty nesters alike are choosing to live in more densely populated urban centers that are not conducive to bulk shopping. Plus, as society ages and the number of single-person households rises, the routine of the big weekly or occasional grocery shop will likely decline.

These demographic changes will boost the number of customers looking to buy “little and often,” and small stores close to home are the most obvious choice for such purchases. If this trend continues, warehouse clubs may need to adjust to smaller basket sizes, especially in the grocery category; work harder than ever to bring compelling nonfood ranges to their customers; and leverage technical advances to maintain a large customer base.

Source: US Census Bureau

Fragmented Grocery Shopping Presents New Challenges

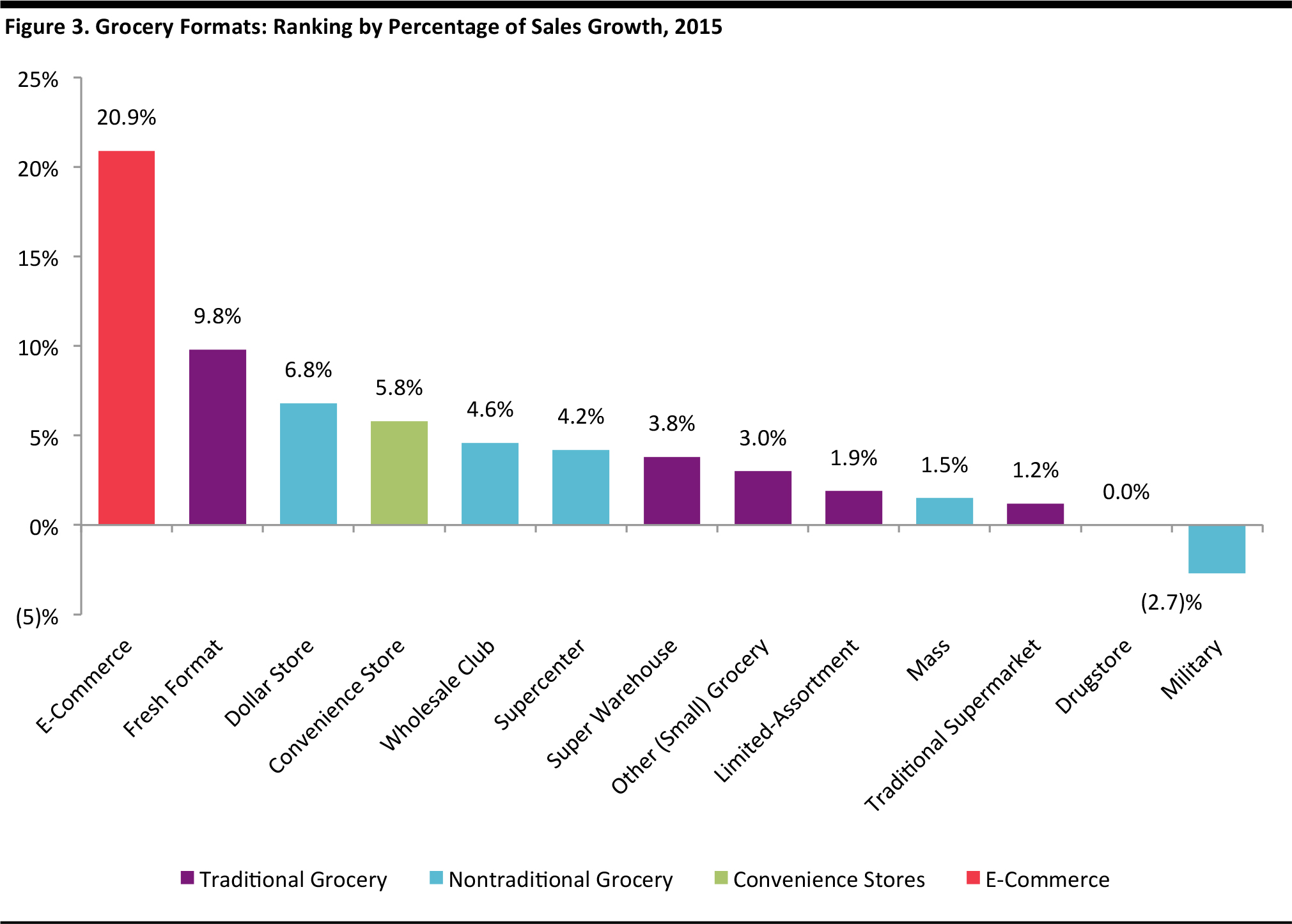

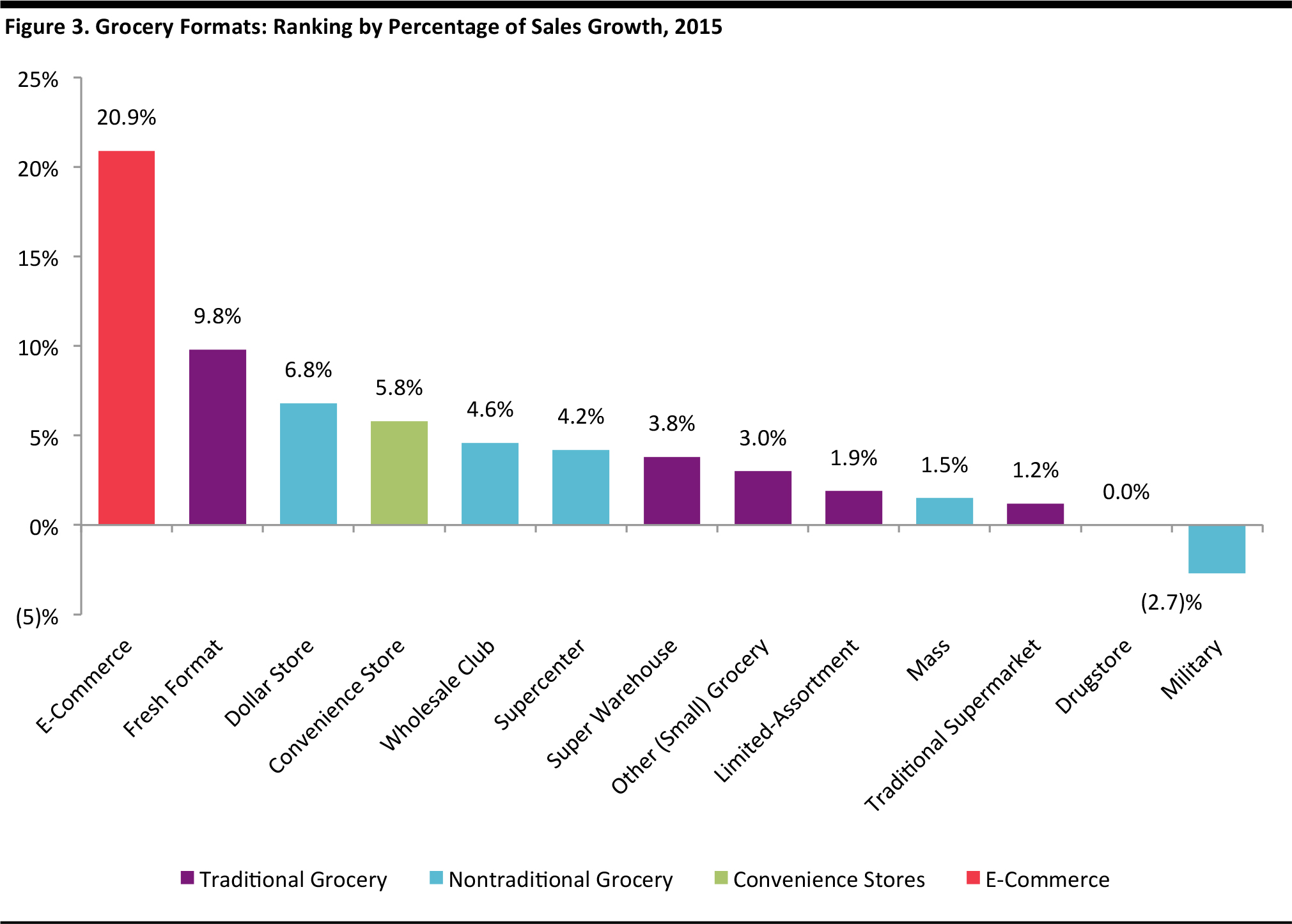

With grocery shoppers migrating away from large-basket shops and weekly trips to big-box stores, repertoire shopping is the order of the day. Fung Global Retail & Technology’s 2015

Global Grocery Retailing report identifies discounters, smaller grocery store formats and e-commerce grocers as the top three competitors in the shifting grocery landscape.

Source: Willard Bishop, The Future of Food Retailing (2016)

Discounters, Small Grocers and E-Grocers Compete with Warehouse Clubs

Discounters: Discount retailers are well positioned to serve the large, low-cost, bulk-purchase grocery needs of consumers, making them direct competitors of the warehouse clubs. During the economic downturn, price-sensitive shoppers in a number of markets turned to hard discounters such as Germany’s Aldi and Lidl. Seizing the recession-era opportunity, these discount retailers expanded rapidly, gaining share across Europe—causing major headaches for British supermarket chains and, to a lesser extent, for chains in the US and Australia. In the US, Aldi jumped from the 45th-largest retailer in 2010 to the 19th largest in 2016, according to the NRF. Lidl has signaled that it plans to launch in the US in 2018, although some say it may be sooner.

Even though warehouse clubs face heightened competition in the budget grocery segment, the hard discounters are also benefiting the segment overall by bringing more shoppers into it. The challenge for warehouse clubs is to convert some of these discount shoppers to the club format and convince them that buying from the likes of Costco and Sam’s Club is the natural next step after shopping at discount stores such as Aldi and Lidl.

Small grocers: Shoppers in some markets—including some where discounters have grabbed share—are turning away from big stores in favor of shopping closer to home at smaller stores. Big-name retailers are cultivating this trend by pushing into small store formats. Walmart and Target in the US, Carrefour in France and all the biggest grocery retailers in the UK are opening small supermarkets and convenience stores.

These formats offer a strong complement to occasional, bulk grocery

e-commerce purchases, which currently account for only a minor share of total grocery sales but are becoming more common. Small grocery stores also offer a fit with demographic changes in developed countries, notably an aging society, where a greater proportion of shoppers will undertake small-basket shopping trips. Such shifts away from bulk grocery purchases at large stores in favor of shopping for fewer items more often have the potential to hit sales at warehouse clubs.

E-grocers: Grocery e-commerce is growing fast across virtually all markets. Traditionally, the convenience of one-stop shopping has been a major draw for warehouse club members, but with the rise of grocery e-commerce and efficient delivery services, shoppers now have a convenient alternative. Customer data firm Dunnhumby estimates that year-over-year growth in more established Internet grocery markets, such as the UK and France, averages 31%, and IGD forecasts that the US market will grow at a CAGR of 21% from 2015 through 2020. In emerging Internet grocery markets, the figure is likely much higher.

In the US, store-based chains are playing catch-up to pure plays that have gained unusually strong footholds in e-grocery. The slowness with which store-based grocers have moved to multichannel offerings has left the field open for online-only retailers AmazonFresh, Peapod and Netgrocer to establish market niches. Warehouse clubs in the US have experienced growth in e-commerce, but the competitive platform is shifting and threatening their core category.

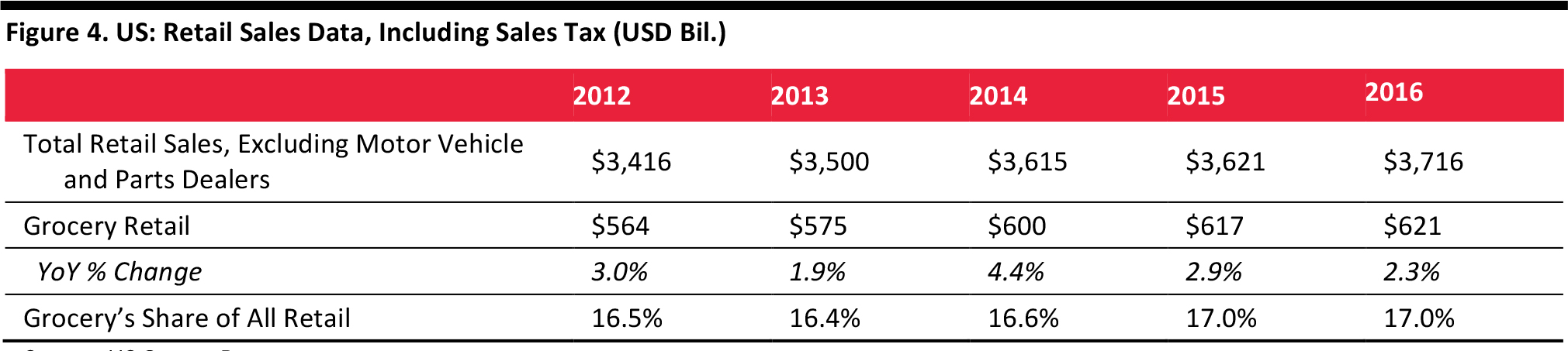

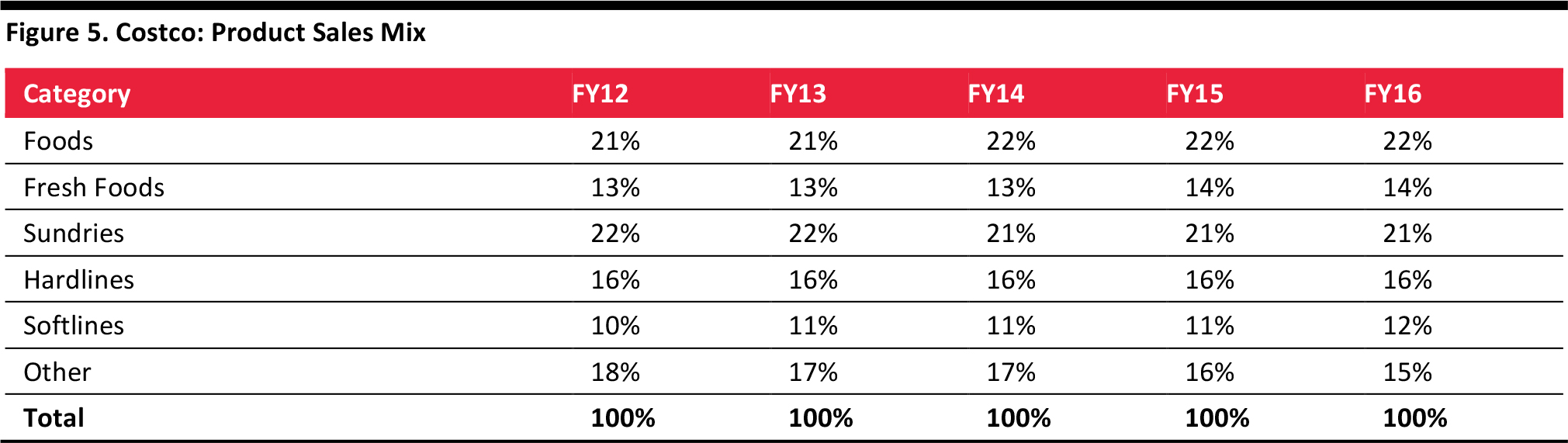

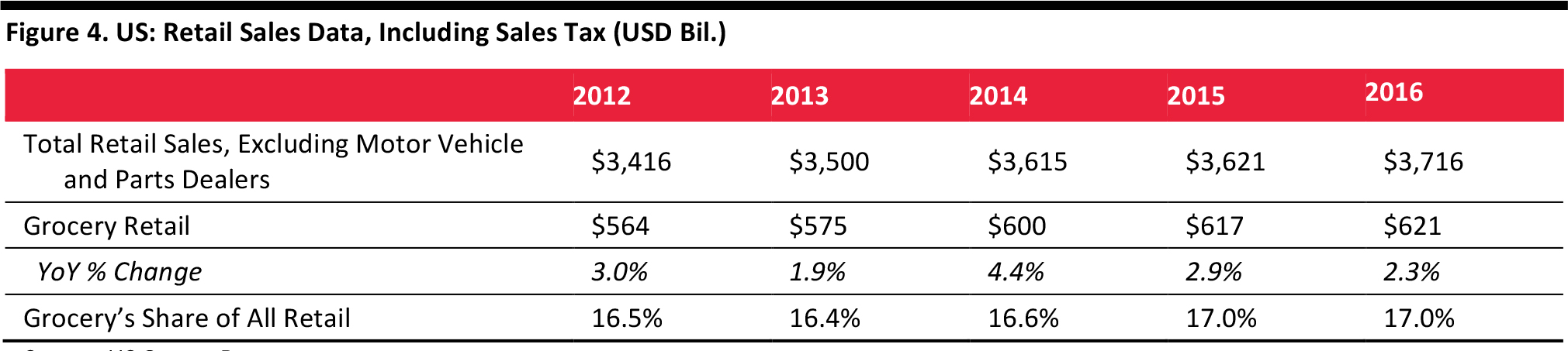

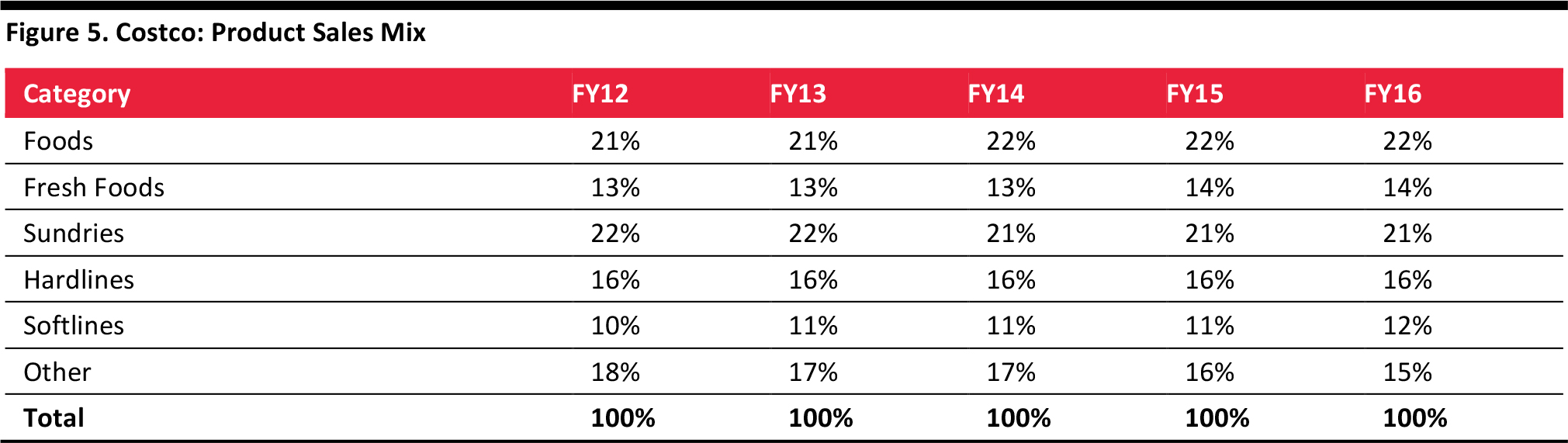

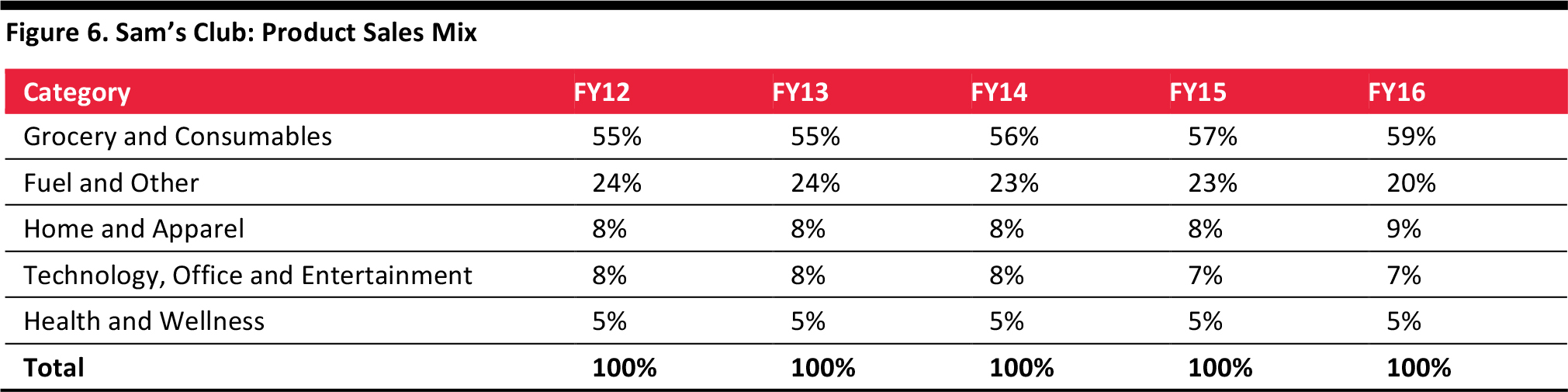

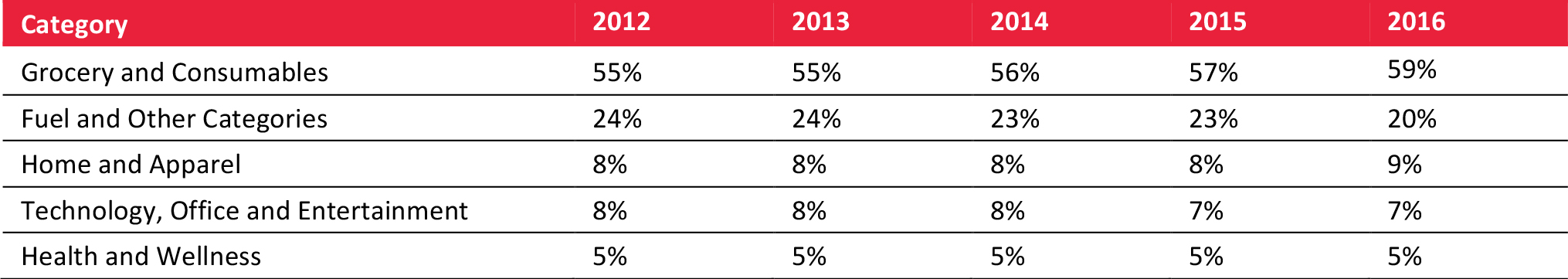

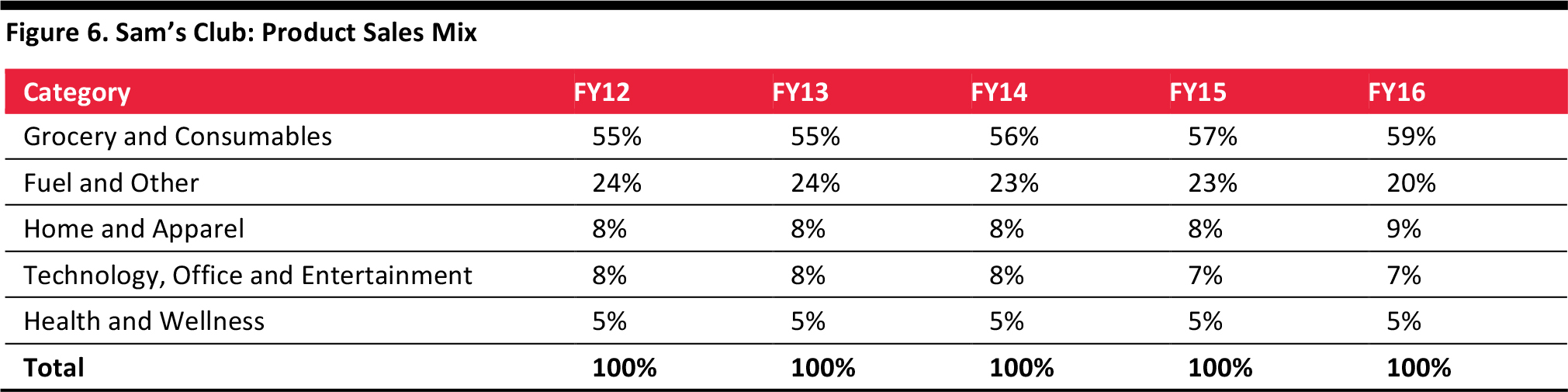

Warehouse Clubs Can Still Grow Grocery

Total grocery sales in the US have grown steadily, and there is ample room for warehouse clubs and traditional grocery players to increase their sales and expand their geographic reach. Over the past five years, the grocery category has accounted for 55%–57% of total revenue for both Costco and Sam’s Club (foods, fresh foods and sundries combined for Costco). Costco has seen growth contributions from the food and fresh food segments, while Sam’s Club has seen grocery revenues increase as a share of total sales. Despite these upward trends, underlying shifts in consumer behavior and channel shifts are keeping the clubs on their toes.

Whether or not the clubs will alter the number of SKUs they offer as consumer behavior shifts remains to be seen. BJ’s has varied its grocery offering substantially over time. Starting from 2,421 SKUs in 2004, the company sharply decreased its assortment over the next four years before increasing it again over the next six years. Costco, the wholesale club with the fewest SKUs overall, has been the most disciplined in containing the breadth of its food offering, carrying no more than 1,200 food SKUs in its clubs over the past five years.

Source: US Census Bureau

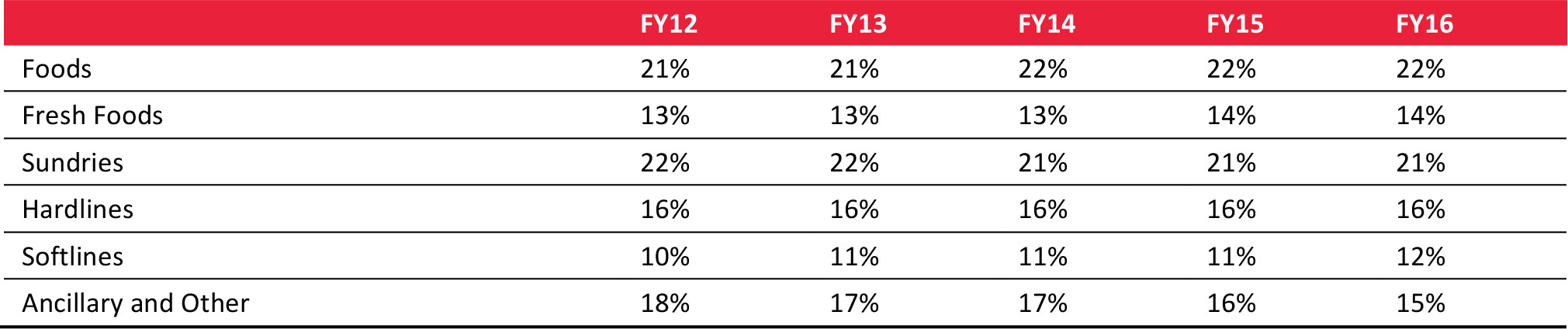

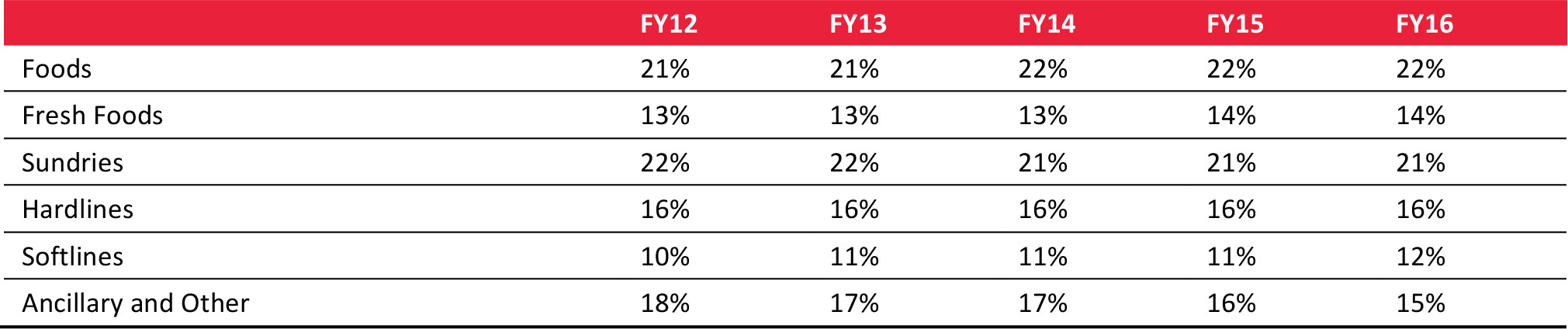

At Costco, the share of revenues from foods and fresh foods increased from 34% in fiscal year 2012 to 36% in fiscal 2016.

Source: Company reports

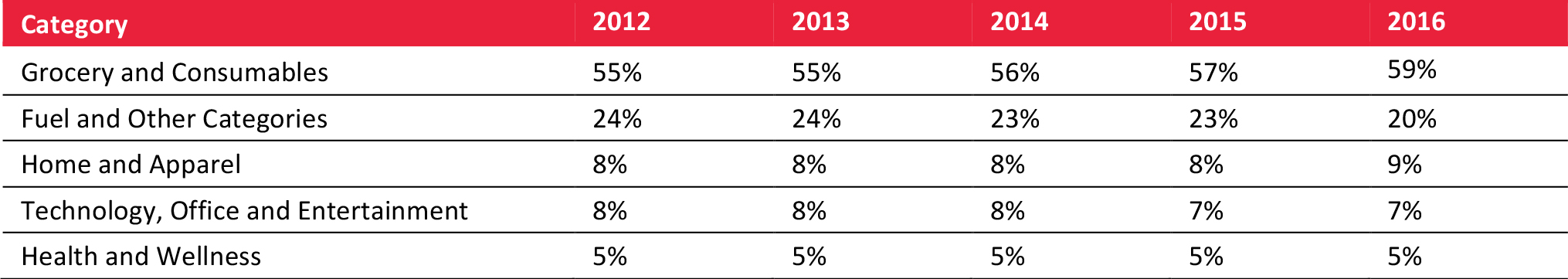

At Sam’s Club, the grocery and consumables category accounts for a higher percentage of sales, but the category’s share of total revenues has also increased, growing from 55% in fiscal 2012 to 59% in fiscal 2016.

Source: Company reports

E-Commerce

E-Commerce

Click-and-Collect Can Minimize E-Commerce Fulfillment Costs

Fulfilling online orders while keeping costs low is a major challenge for warehouse clubs and one that has significantly deterred their online expansion. The cost of Internet order fulfillment could wipe out either the retailers’ profits or their customers’ price savings. Some big international budget chains, such as Aldi and Lidl in grocery and Primark in clothing, continue to eschew Internet retailing.

For warehouse clubs, click-and-collect—where customers order online and pick up their purchases at the store—may be a sensible online fulfillment solution. The click-and-collect model is relatively underdeveloped in the US compared with the UK. According to a 2014 survey by Planet Retail, about 35% of UK shoppers currently use click-and-collect, while just 13% do in the US.

Both Sam’s Club and Costco offer versions of click-and-collect. Since 2007, Sam’s Club has offered a Club Pickup service (formerly called Click ’n’ Pull). The service is available today in the US and Puerto Rico. Costco offers no such service in the US, but does offer click-and-collect in the UK. Other big names in US retail, such as Kohl’s and Walmart, are now either rolling out or ramping up collection services. We expect Costco to follow suit and that the opportunity to sell online with lower fulfillment costs will prompt a blossoming of in-store collection in the sector overall.

The current model of retailers offering free in-store collection but charging for home delivery could change. In the UK, premium department store chain John Lewis recently announced plans to apply a collection fee on Internet orders under £30 (US$46). For warehouse clubs built on low margins and high volumes, collection fees—or offering free collection only with premium-level memberships—could be a way to mitigate the costs of fulfilling online orders.

Subscription Programs Help Build Shopping Frequency and Loyalty

The boom in e-commerce has put many competitive pressures on established retailers, and for the warehouse clubs, one of these is the subscription model. Online subscription services—where customers order products for routine, scheduled deliveries—could end up providing major competition to warehouse club operators. But they might bring opportunity, too. The subscription market is estimated to be worth $3 billion and, currently, most subscription services are focused on snacks, beauty products, apparel and gifts. That suggests that there is huge market potential in offering subscriptions to businesses, providing office supplies, snacks, beverages and other consumables such as paper towels and toilet paper.

Sam’s Club launched its My Subscriptions program in 2014, offering delivery of about 700 product lines, including grocery, health, office, baby, pet, personal care, cleaning supplies and paper products. Costco does not offer subscriptions, but may in the future, particularly to serve the routine needs of small business customers.

Amazon launched its Subscribe & Save program back in 2007, offering a 15% discount for recurring shipments of products every one to six months. It recently launched the Dash Button, a gadget dedicated to a single brand, such as Tide detergent, that allows customers to reorder the product with just a push of the device’s single button.

Elsewhere, subscription-based retail is often niche and product specific. New York–based Birchbox offers subscriptions for weekly deliveries of cosmetics and personal grooming products, and Blue Apron, also based in New York, offers weekly subscriptions for ingredients and recipes for make-at-home meals. The premium, niche positioning of these kinds of services means they likely pose little threat to the warehouse clubs. They may even help habituate consumers to online subscription services. In the end, though, it is the big generalists such as Amazon and grocery retailers that will put stress on the clubs.

Mobile Commerce

Mobile Commerce

Warehouse Clubs Must Adopt a Mobile-First Strategy

The smartphone has become the ubiquitous portal for us to communicate with each other and our surrounding environment. Mobile apps are playing a prominent role in the way we shop and engage with the retail world not only in developed markets, but also in developing markets, where many consumers have adopted smartphones as their primary Internet and e-commerce devices

.

Warehouse clubs must continue to find ways to embrace the global wave of smartphone usage in order to maintain their appeal among the generation for which smartphones are key to almost every aspect of life. We think location-based services and mobile payments hold particular potential in terms of shaping the future shopping experience.

Mobile devices make it much easier for shoppers to browse and buy whenever and wherever they want, and mobile commerce (m-commerce) is booming as a result. Mobile transactions are replacing desktop e-commerce, and they have the potential to significantly impact in-store shopping, too. Market research company eMarketer estimated that m-commerce would account for 24.1% of all e-commerce transactions in 2016.

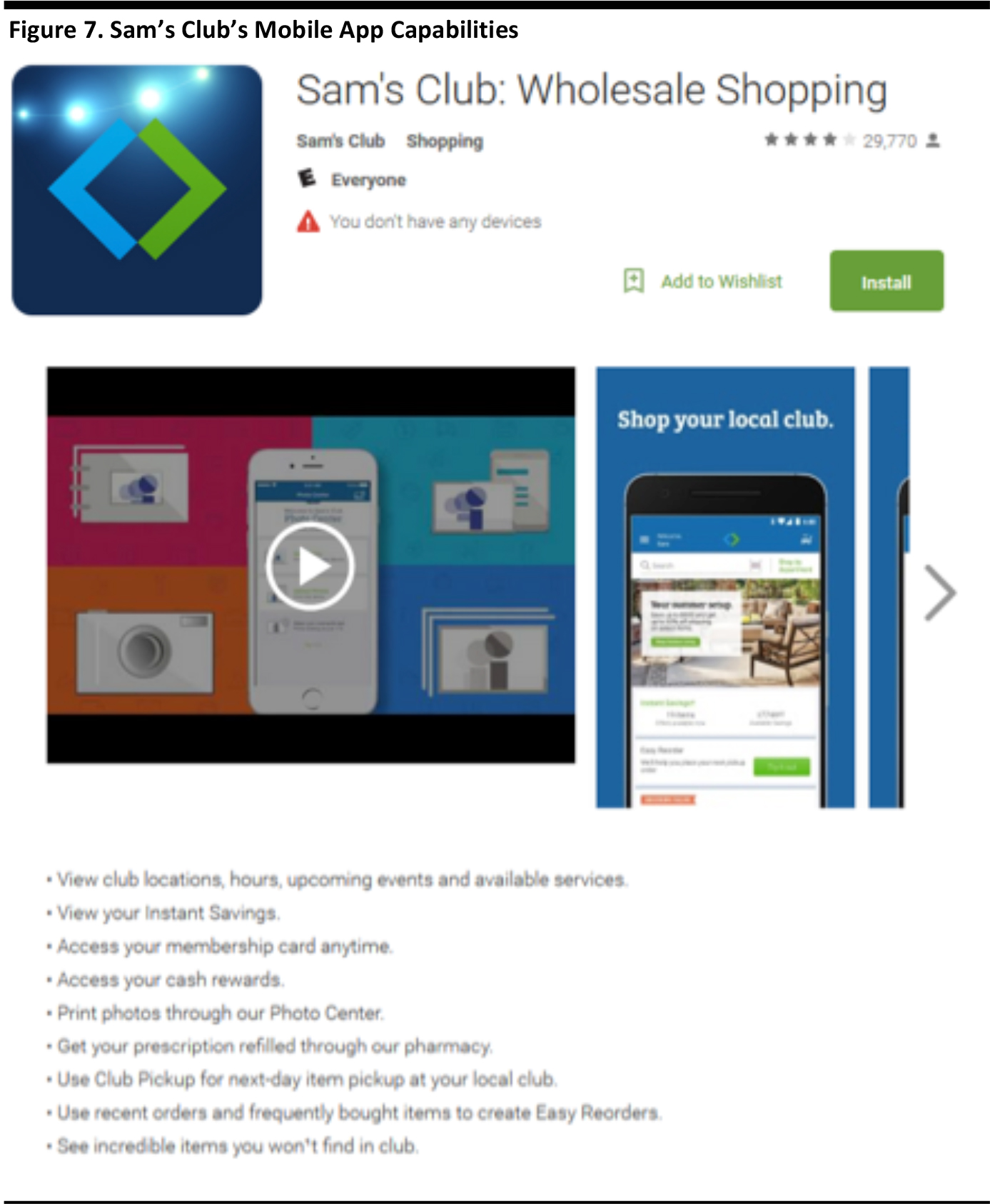

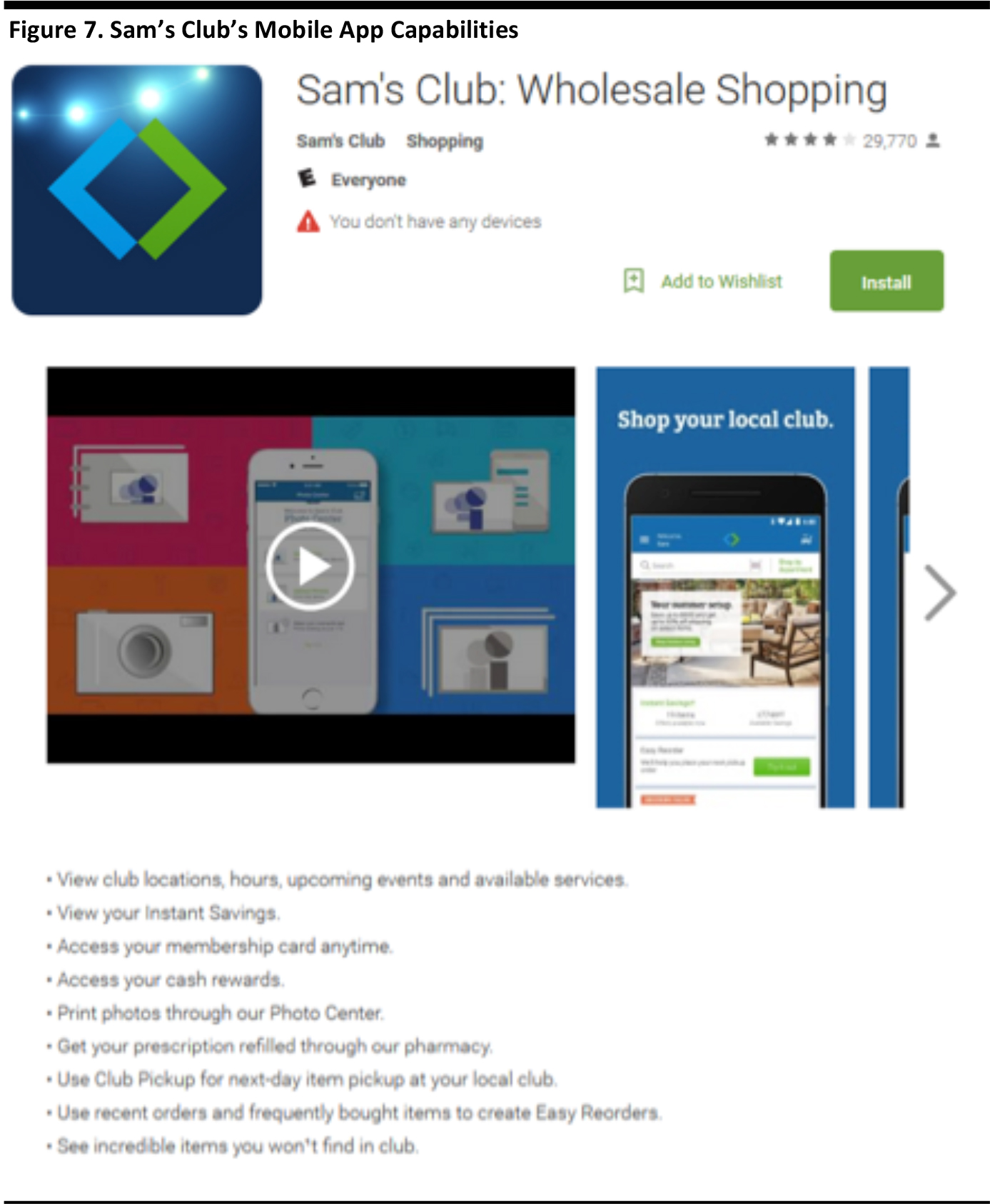

Sam’s Club is leading the US warehouse club sector in m-commerce. Its mobile app offers online shopping for items unavailable in the company’s physical locations, access to personalized savings coupons, a photo center for printing pictures and click-and-collect capabilities. In addition, the app features a barcode and QR code scanner that allows shoppers to view detailed product information on their smartphone by scanning a product’s tag while shopping in a Sam’s Club.

Source: Play.Google.com

Recently, Sam’s Club announced a mobile-based platform that allows the company to improve its click-and-collect experience. After a customer places a click-and-collect order, a mobile phone notification prompts the customer to “check in” to say when she or he expects to pick up the order. This increases efficiency, as workers can assemble special items such as chilled or frozen food just prior to the customer’s arrival.

Costco has also developed a mobile app, but one with fewer capabilities. For example, the app does not feature a barcode scanner or a click-and-collect option. BJ’s is chasing the pack, as it currently has no mobile app.

�Mobile Payments Reduce Friction in Checkout Process

While many retailers have launched mobile apps that enable shoppers to browse products and view prices, payment apps that enable mobile purchases are still an emerging category. Apple Pay is so far the highest-profile launch in mobile payments, integrating contactless payments with smartphones. With the demise of the CurrentC smartphone payment system, the current leading payment systems in the US are Apple Pay and Samsung Pay (Chase Pay is a more recent market entrant). Chains such as Kohl’s, Target and Walmart have integrated mobile payment systems into their shopping apps.

In the medium term, there will be more innovation that takes devices beyond in-store payment. Eventually, in-store checkout could be completed entirely on a mobile device: shoppers will be able to use their smartphones first as scanners to total the items in their cart and then as payment devices that debit their mobile money accounts automatically.

Location-Based Services Drive Personalization and Relevance

In addition to smartphones, other wireless technologies are poised to enhance the customer experience. Short-distance wireless connections provided by technologies such as beacons can deliver location-based services to shoppers. Beacons are compact, inexpensive Bluetooth transponders that can be installed throughout stores and other spaces to provide continuous connectivity with consumers, transmit data to devices used by consumers and associates, and track activity on the shopping floor. Additionally, beacons can alert retailers to the number of consumers with smartphones entering their stores and the paths they take within stores, as well as how often those consumers visit and how long they stay.

Many top retail chains, including Lord & Taylor and American Eagle Outfitters, already use beacons to blend the e-commerce experience with the in-store experience. In-store retail applications using beacons include:

- Proximity marketing: pushing contextual notifications with offers and content to shoppers based on their location in a store.

- Indoor navigation: directing shoppers within a certain venue.

- Collection and analysis of consumer behavioral data: such information can be used to improve store layouts and staffing.

- Seamless payments: mobile apps allow for simpler, easier transactions.

Proximity-marketing service Proxbook estimates that 11.8 million proximity sensors were deployed globally as of the third quarter of 2016, up 42% sequentially. Of these, 7 million were beacons, indicating that the retail sector is well on track to hit the 400 million beacons that ABI Research forecasts will be deployed by 2020. As beacons become more widely used, warehouse clubs may integrate them into communications with members to help cross-promote products or services and to ensure members are maximizing the benefits of their membership packages.

Robotics in Retail

Robotics in Retail

Robotics Automates Processes for Efficient Fulfillment

Robotics technology has helped companies in the electronics and automotive industries improve quality and reduce labor costs, and it could provide retailers with similar benefits. Currently, retailers are not heavy users of robots, but that could change, with Amazon leading the way. The e-commerce giant deployed robots, robotic arms and a slew of other leading-edge technologies in its fulfillment centers just in time for the 2014 holiday season. Amazon is now testing flying drones for aerial package delivery. Several other companies are developing robotics technology for use in warehouses, too. Continuous price and performance improvements in robotics have reached an inflection point, leading many industries to adopt the technology.

Supply Chain Digest

Supply Chain Digest reported that Amazon is using at least 15,000 warehouse robots for its own operations, which the company estimates could achieve savings of $400–$900 million. Amazon’s acquisition of Kiva Systems for $775 million in May 2012 was instrumental to its deployment of robotics. Kiva’s robots zip along a warehouse floor, retrieve items from shelves/pallets, and transfer them to cartons and totes. Kiva reportedly had more than $100 million in revenue in 2010, and a Kiva startup kit costs $1–$2 million. Setting up and programming a Kiva system requires six months of planning and testing, as well as logistics training for employees. Prior to the acquisition, Kiva’s customer list included Crate and Barrel, Gap, Office Depot, Staples and Walgreens.

In addition to Kiva’s robots, Amazon uses Robo-Stow, a robotic arm it developed, as well as machine-vision systems that can unload and register a trailer full of goods in half an hour (instead of hours) and a graphically oriented software package for order fulfillment.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business, as well as to tape and stamp shipping labels on packages. Using an algorithm developed at Walmart Labs in Silicon Valley, the company has been able to locate and sort items more efficiently and reduce delivery time by 15%. Walmart’s distribution centers still employ human labor, too, and robots increasingly work side by side with humans.

Robotics Startups Improve Warehousing

In addition to Kiva, there are many other startups that are developing automated warehousing technology. According to the website TheRobotReport.com, these include Adept Technology, Bastian Robotics, Cimcorp, Dematic, Fetch Robotics, Grenzebach, GreyOrange, Hi-Tech Robotic Systemz, KUKA (acquired by China’s Midea), Swisslog and Vanderlande. Hardware represents just one part of the solution, though. eBay has developed software for optimizing shipments without the need for distribution centers, and Jet.com is using software to minimize pricing and shipping costs.

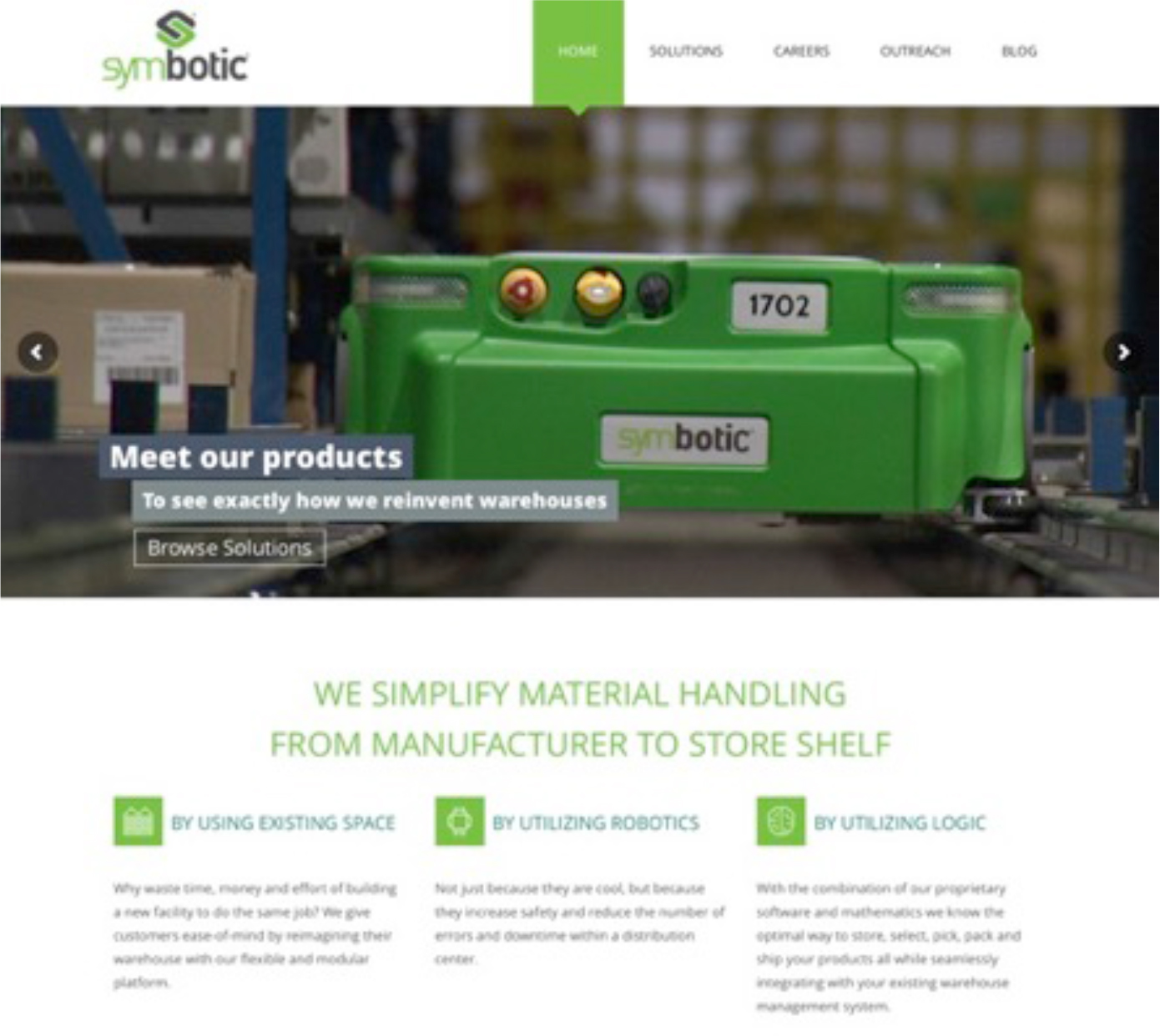

Symbotic (formerly known as CasePick Systems), located in Wilmington, MA, is a private company developing warehouse robots that can optimize fulfillment, transportation and logistics. The company claims its system is easy to configure and can be configured using existing warehouse assets, which minimizes logistics costs. The company serves two industries: general merchandise and retail, and grocery and food service. The platform’s two main offerings are its storage solution and its internal software. In terms of storage, its robot—the Matrix Rover—can access any pick location (based on SKU) and sort items without requiring any additional hardware, offering increased storage density, modularity, extensibility and high-speed throughput. The software in Symbotic’s robots employs a massively parallel, distributed approach to handling items, and promises world-class accuracy combined with optimized storage and robust supply chain integration

Source: symbotic.com

Private Labels

Private Labels

Private Labels Offer Differentiation and Increased Margins

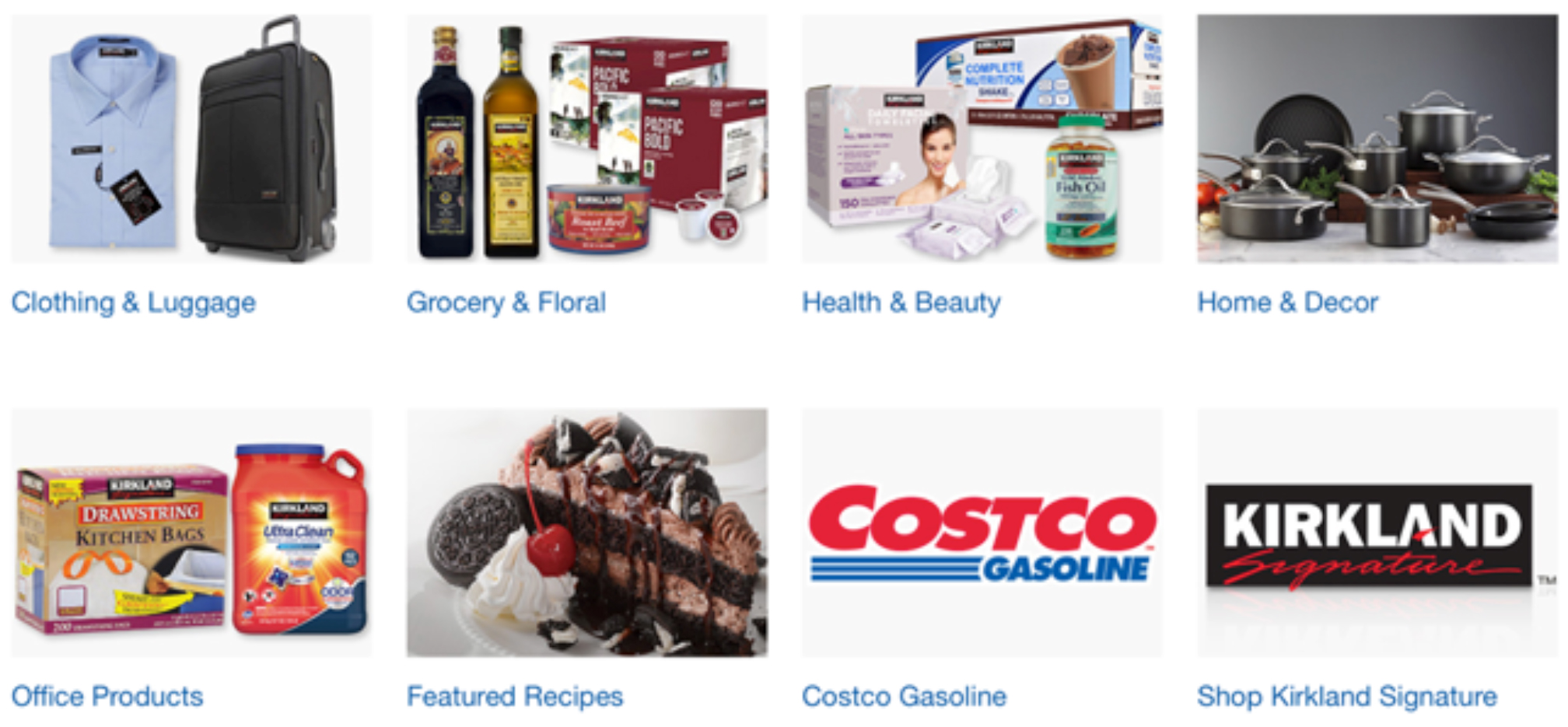

Selling well-known national brands at low prices has been the core of the warehouse club business, but private-label programs are a growing and lucrative part of the clubs’ merchandising strategies. Costco’s Kirkland Signature private label, a strong, multibillion-dollar brand, accounted for about a quarter of the company’s product sales in 2014. Costco’s management expects private-label products to continue to account for an ever-larger share of the company’s business. Meanwhile, Sam’s Club is consolidating its private-label brands and pushing out new ones. In June 2015, website Talkbusiness.net quoted Sam’s Club CEO Rosalind Brewer as stating, “Working toward an elite private-label brand will be one of the levers you see us pull.”

Exclusive private labels provide clubs with differentiation and the opportunity for higher gross margins. The goal is for the private-label products to meet or exceed quality standards set by competing national brands, while still providing savings for members. The most successful private-label products are found in categories that lack a strong national brand. The control that warehouse clubs exercise over private-label production is also beneficial, as it enables the clubs to source in adequate volumes and to dictate pallet configuration to maximize SKU count per pallet and save on transportation.

Typical overall gross margins at warehouse clubs today hover between

11% and 16.5%. Gross margins for Costco’s successful Kirkland Signature label have run around 15%. Overall, Costco offers fewer SKUs than its warehouse club counterparts do: the company has 43% fewer overall SKUs in its warehouses than BJ’s and 33% fewer than Sam’s Club. And Costco offers 10% more private-label SKUs than both BJ’s and Sam’s Club.

In addition to its Kirkland Signature line, Costco cobrands other private labels with well-recognized and highly regarded national brands—such as Campbell’s, Keurig, Ocean Spray and Starbucks—for selected product offerings. These strong brand partners provide a halo effect for private-label offerings, extending quality and premium perceptions along with individual brand associations to the cobranded product.

In its 2016 annual report, Costco stated:

We believe that Kirkland Signature products are premium products, offered to our members at prices that are generally lower than those for similar national brand products and that they help lower costs, differentiate our merchandise offerings from other retailers and generally earn higher margins. We expect to continue to increase the sales penetration of our private-label items.

Source: Company reports

Private Labels Vary Across Product Categories

The mix of private-label merchandise at warehouse clubs varies across categories. Perishables account for the bulk of private-label products, followed by health and beauty aids, whereas the number of apparel and bed and bath private labels is relatively small. Moreover, sales volumes of private-label items can run higher than those of branded products. Sam’s Club leads in average private-label savings, and the greatest savings are offered in generic drugs.

Source: Costco.com

The Sourcing Revolution

The Sourcing Revolution

Shift to Reshoring Offers Tighter Control and Quality

Warehouse clubs depend on strong vendor relations to offer customers high-quality, low-cost products, and optimal sourcing strategies are therefore a priority. Given the broad assortment of product categories they offer, the clubs manage a complex network of relationships with local and international suppliers. Traditionally, warehouse clubs have sold both hardline (major appliances, hardware, office supplies) and softline (apparel, small appliances, home furnishings) products manufactured offshore by lower-cost Asian manufacturers. However, with rising labor costs in Asia, improving productivity at home due to automation, and lower energy prices due to shale oil and gas discoveries, reshoring production to the US is now a realistic option. Nearshoring—or moving production to countries close to one’s home market—is also a possibility, as it would allow the clubs to save on transportation costs, lower their carbon footprints and facilitate greater speed to market, which is especially important for categories such as apparel.

Many companies with annual sales of $1 billion or more are either already planning to shift or actively considering shifting production facilities back to the US. Walmart, the parent firm of Sam’s Club, has committed to buying $250 billion more in products from US factories by 2023. Darrell Rosen, who heads a consultancy for Walmart suppliers, says the strategy will save money for the retailer, according to The Washington Post. General Electric is also migrating some of its manufacturing of washing machines and heaters from China to a factory in Kentucky.

Reshored jobs in US manufacturing now broadly balance out the number of jobs lost to new offshoring, according to the Reshoring Initiative, a nonprofit group in favor of more US-based production. A striking reversal took place between 2003 and 2013 (the last year for which the group has released data), with new offshoring dwindling while onshoring boomed. “The bleeding has stopped,” the group noted.

Warehouse clubs are in a position to source more products from onshore or nearshore suppliers now. However, two major considerations could delay a more pronounced trend:

- The automation technology that enables cost-efficient reshoring is still in its infancy

for many industries. For example, garment manufacturing still relies on human labor, and emerging technologies such as machine vision systems that track stitching and maneuver materials are still a long way from being commercially viable on a large scale.

for many industries. For example, garment manufacturing still relies on human labor, and emerging technologies such as machine vision systems that track stitching and maneuver materials are still a long way from being commercially viable on a large scale.

- The decision to nearshore versus offshore production depends on more factors than just labor cost. Some of these factors—such as the regulatory environment, vendor relationships, the political environment in the sourcing country and the sustainability of production—can outweigh the importance of cost.

�Demand for Quality, Ethically Sourced Products Drives Vendor Transparency

Given the complexity of their supply chains, warehouse clubs must take extra care to ensure their customers are buying safe, reputable, high-quality products made the right way. The major warehouse clubs already have many years of experience with food safety, which will enable them to expand vendor traceability to other parts of their supply chains. As food and grocery retailers, the clubs have implemented shopper protection measures, such as supplier audits and rigorous recall processes. For example, Costco can notify, by telephone, members who have purchased an item included in a Class I recall within hours of an incident being announced, according to

Food Safety Magazine.

Today, the pressure to source transparently and ethically is mounting. Consumers in many parts of the world are demanding greater supply chain traceability, according to a 2014 Infosys white paper. The trend presents new challenges to global organizations that must manage the regulations and reporting requirements of many different governments around the world for multiple product categories.

Public projects, such as The Story of Stuff Project and Project JUST, a mobile app/platform that connects consumers and brands with the people who make their clothes, are starting to raise awareness, according to Sourcing Journal. Natalie Grillon, Cofounder and CEO of JUST, says that consumers soon will be choosing to buy items that come with supply chain information over those that do not.

In addition, legislation now requires greater disclosures regarding vendor sourcing. The Dodd-Frank Act (signed into law in July 2010), for instance, mandates that companies in the US file disclosures on their use of conflict minerals with the Securities and Exchange Commission. For now, some smaller companies unable to determine whether their products are conflict free are allowed to describe their products as “DRC conflict undeterminable.” But large companies with “undeterminable” products must describe them as having “not been found to be DRC conflict free” and detail their efforts to determine the products’ origin in a report audited by a third party.

Ancillary Products and Services

Ancillary Products and Services

New and Fun Offerings Increase Stickiness

The warehouse club sector will define a new set of offerings to keep customers coming into physical stores. In addition to well-priced products, clubs will likely offer a wider array of services that cannot be replicated online, such as automotive, optical, pharmacy, health screening and travel services; entertainment offerings; and beauty offerings such as brow salons.

The future of in-store retail is likely to focus on catering to shoppers who do not need to shop, but want to—those who enjoy searching for great deals and like using in-store services. Since they boost the perceived value of club membership and can drive traffic to stores, services are a powerful weapon against Internet-only retail competitors that may have a similar low-price positioning.

Warehouse clubs are adding multiple ancillary products and services, from in-store pharmacies to gas stations to one-hour photo shops. Costco leads the sector in the number of services offered. Meanwhile, Sam’s Club garnered 20% of its total sales from ancillary items in 2016, making it the sector leader in percent terms.

Source: Company reports

Clubs Benefit from Increased Offerings

Gasoline centers are likely the highest revenue producers of all the warehouse clubs’ ancillary businesses, and they frequently serve as loss leaders in order to drive traffic to the clubs. Costco’s 2015 annual report states:

Our investments in merchandise pricing can, from time to time, include reducing prices on merchandise to drive sales or meet competition and holding prices steady despite cost increases instead of passing the increases on to our members, all negatively impacting near-term gross margin as a percentage of net sales (gross margin percentage). We believe that our gasoline business draws members, but it generally has a significantly lower gross margin percentage relative to our non-gasoline business. A higher penetration of gasoline sales will generally lower our gross margin percentage.

Gas station products and services generate about 10% of Costco’s total merchandise sales (excluding membership fees). Pharmacy is the second-largest revenue generator among Costco’s ancillary businesses.

Bundled Services Add Value

More retailers, including warehouse clubs, will move to bundle value-added services in order to provide customers with convenient packages of products and services at a lower cost than they would pay if they bought the items separately. Amazon Prime is one example of bundled services sold as a subscription for loyal customers, and the retailer keeps adding extras to the service. Just as Amazon customers calculate the total value they get from Amazon’s movie streaming or free home delivery with its Prime service, warehouse club customers will view the wider offerings from the clubs and do the math to determine how much they might save with a membership. Club services encompass both in-store and out-of-store, and online and offline, offerings, and range from video-streaming and financial services to beauty treatments and healthcare.

Source: Amazon.com

Ultimately, warehouse clubs will likely shift to broader membership propositions that incorporate access to a suite of services and inexpensive products. For the clubs, this will open up opportunities for more targeted and stratified membership options, with memberships tailored with pick-and-mix packages. In short, the warehouse club proposition will move far beyond its historic focus on offering goods at low prices to providing customers with a real sense of valued membership.

US Market Saturation?

US Market Saturation?

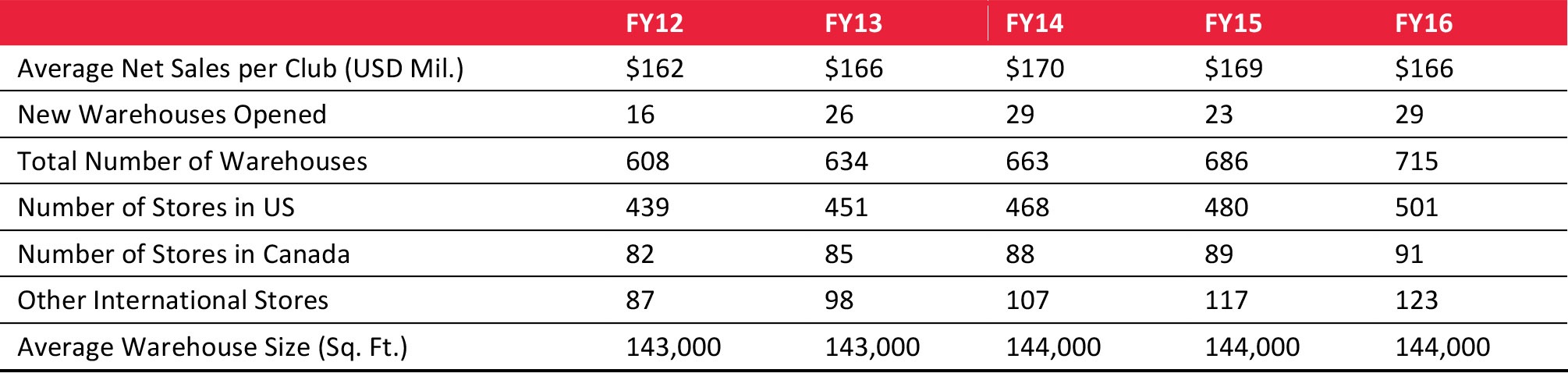

The warehouse club sector can be proud of its two-decade growth trajectory. Even the Great Recession and the soft consumer-spending environment that followed did not interrupt the sector’s steadily rising revenues. Costco alone plans to open 31 new warehouses in its 2017 fiscal year. This raises questions: Will the sector saturate US markets anytime soon? And will expansion into international markets become a more pressing and attractive avenue for growth?

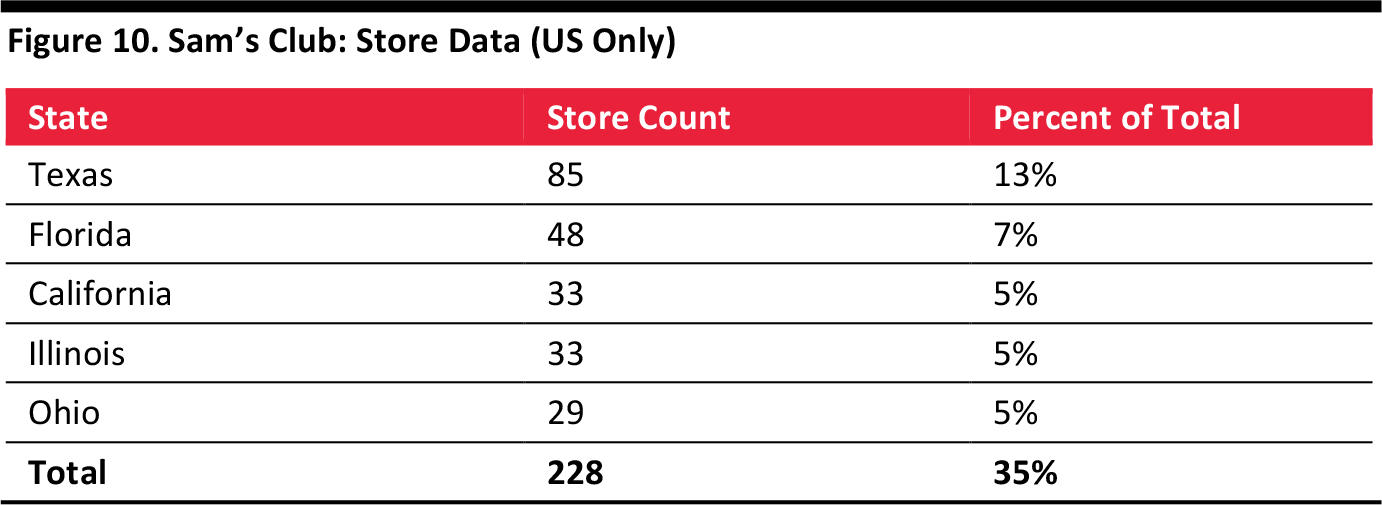

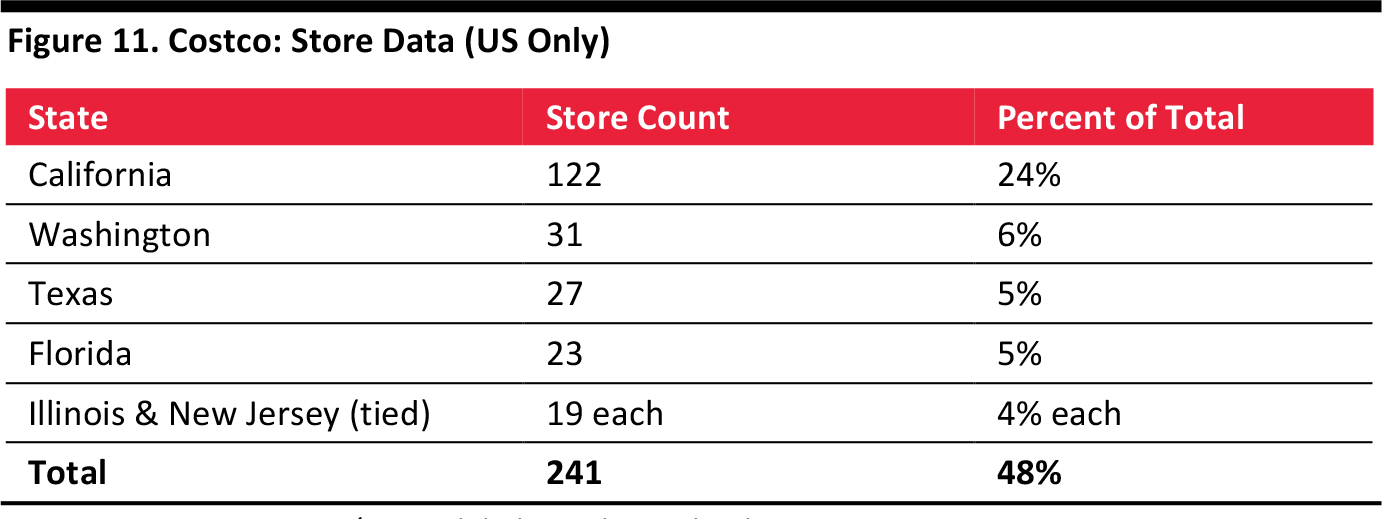

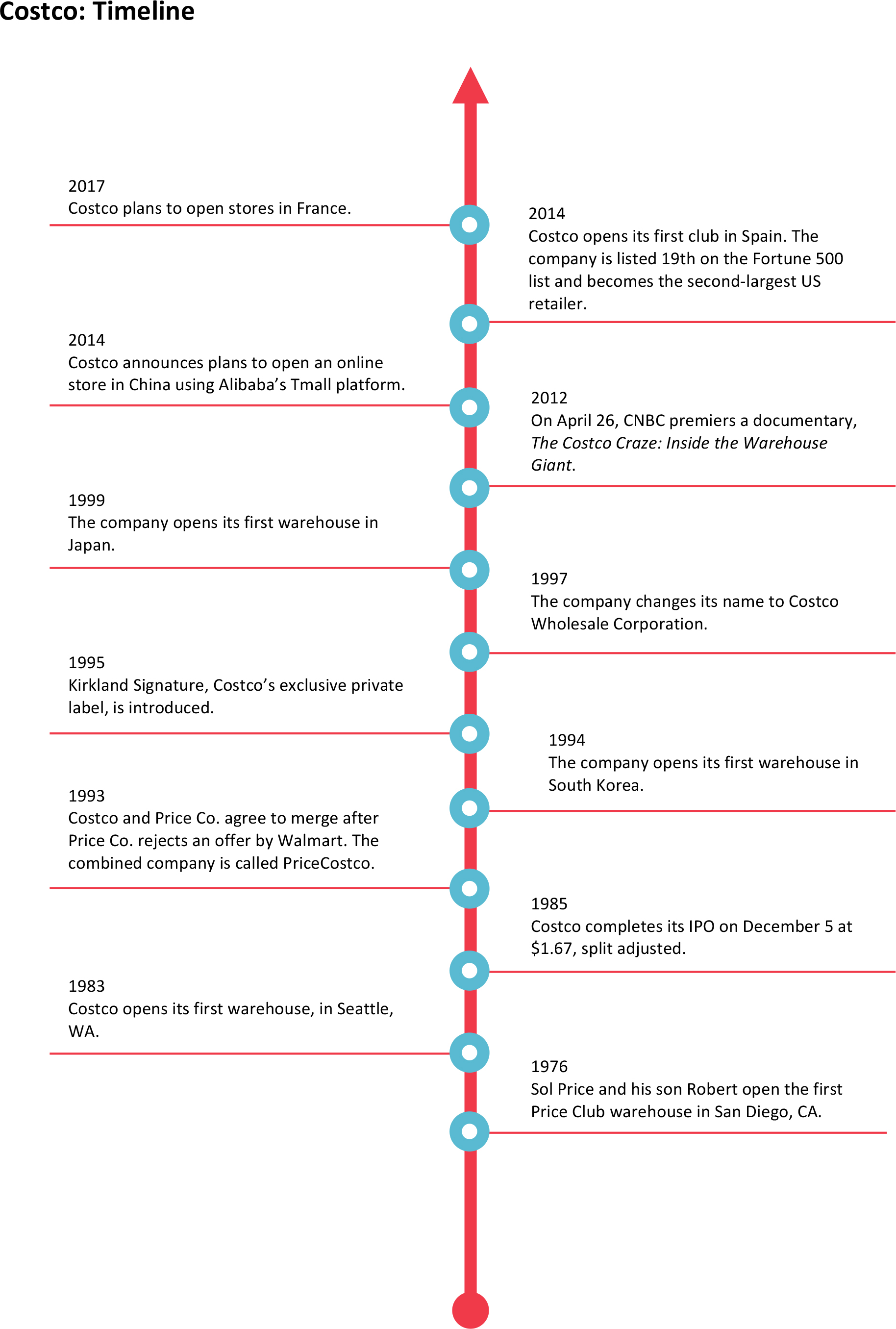

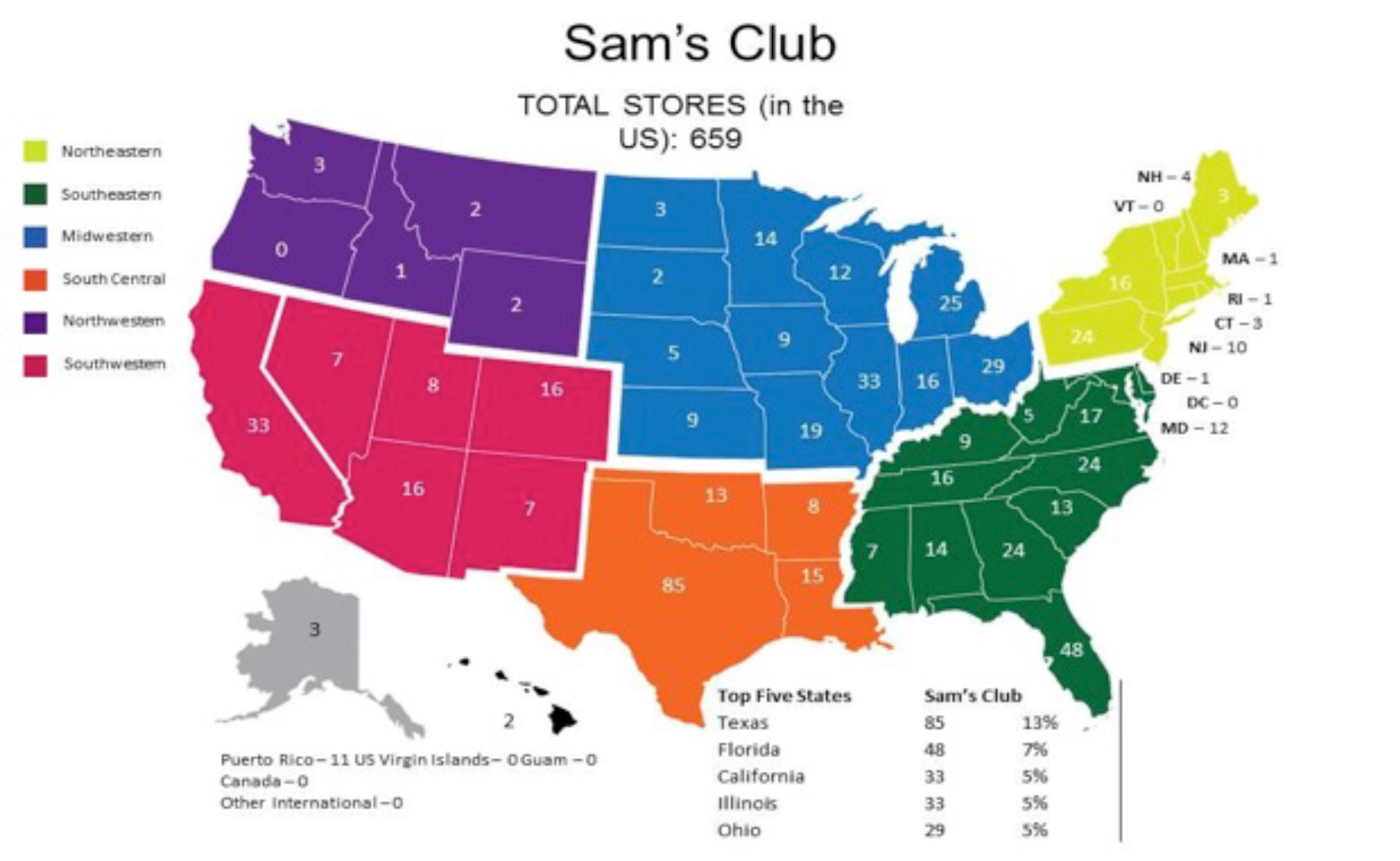

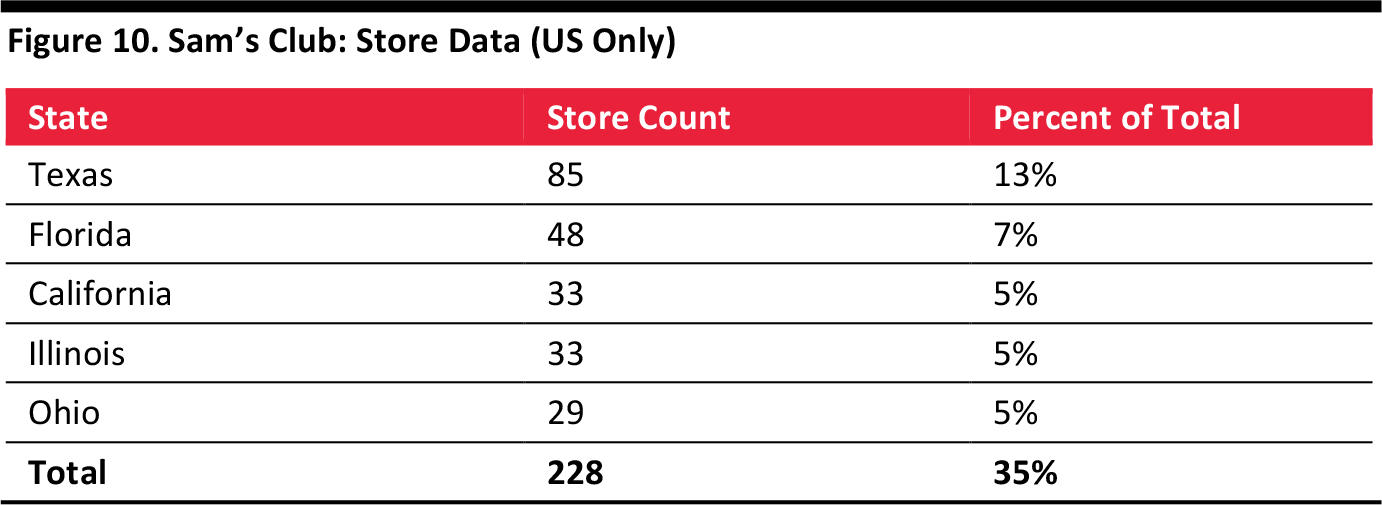

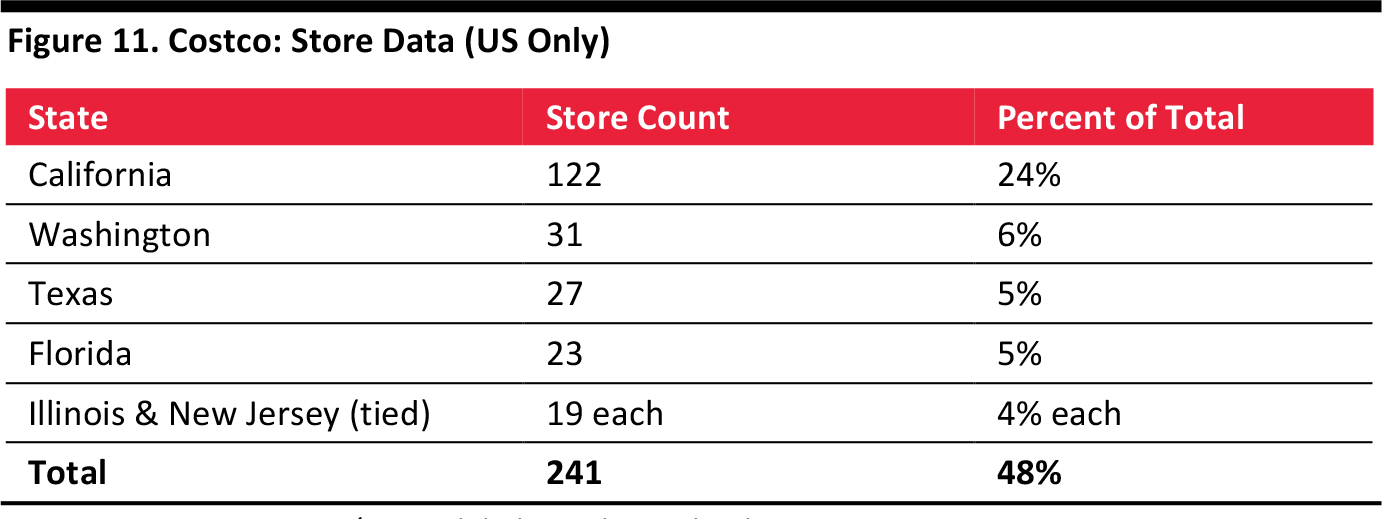

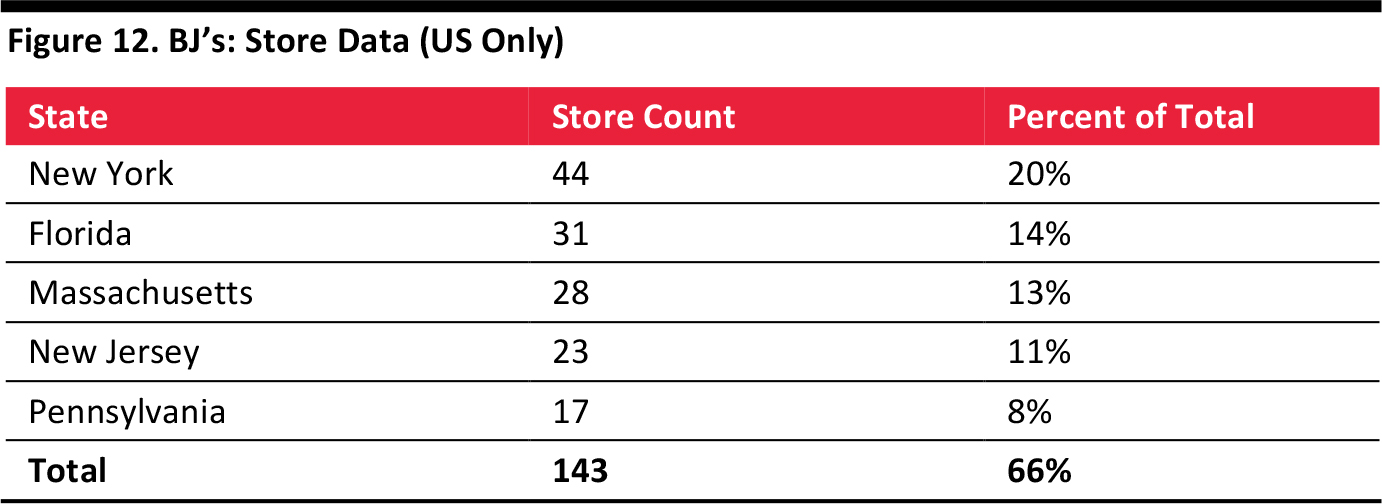

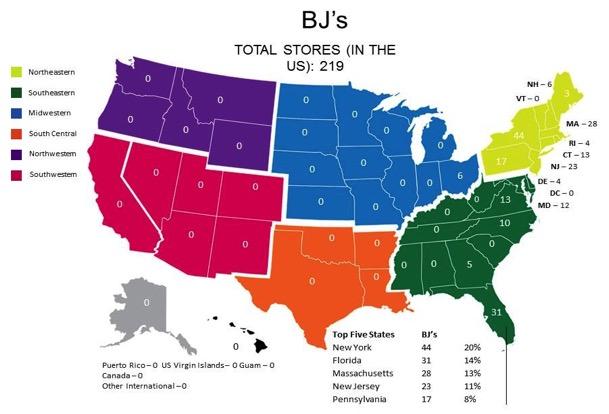

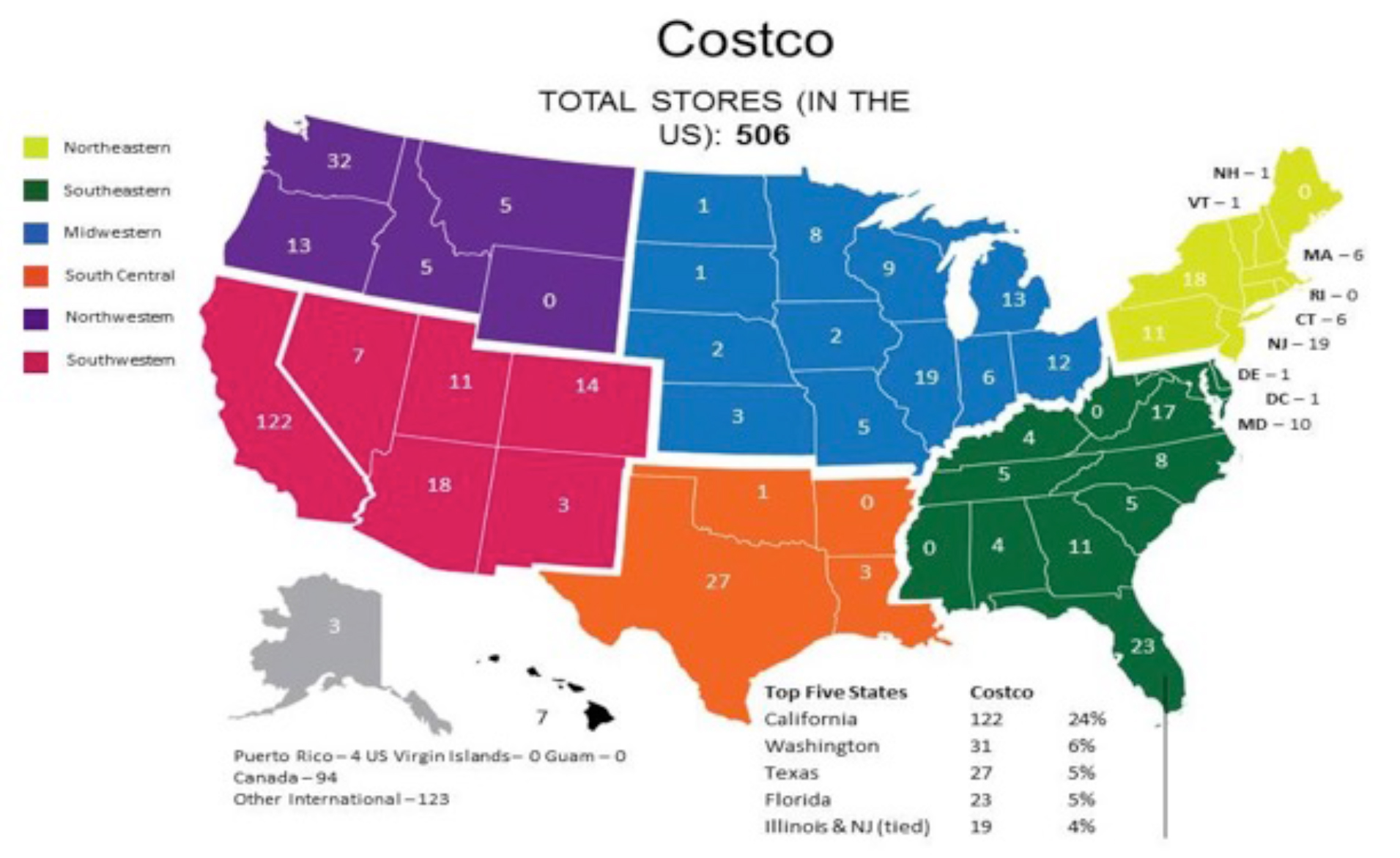

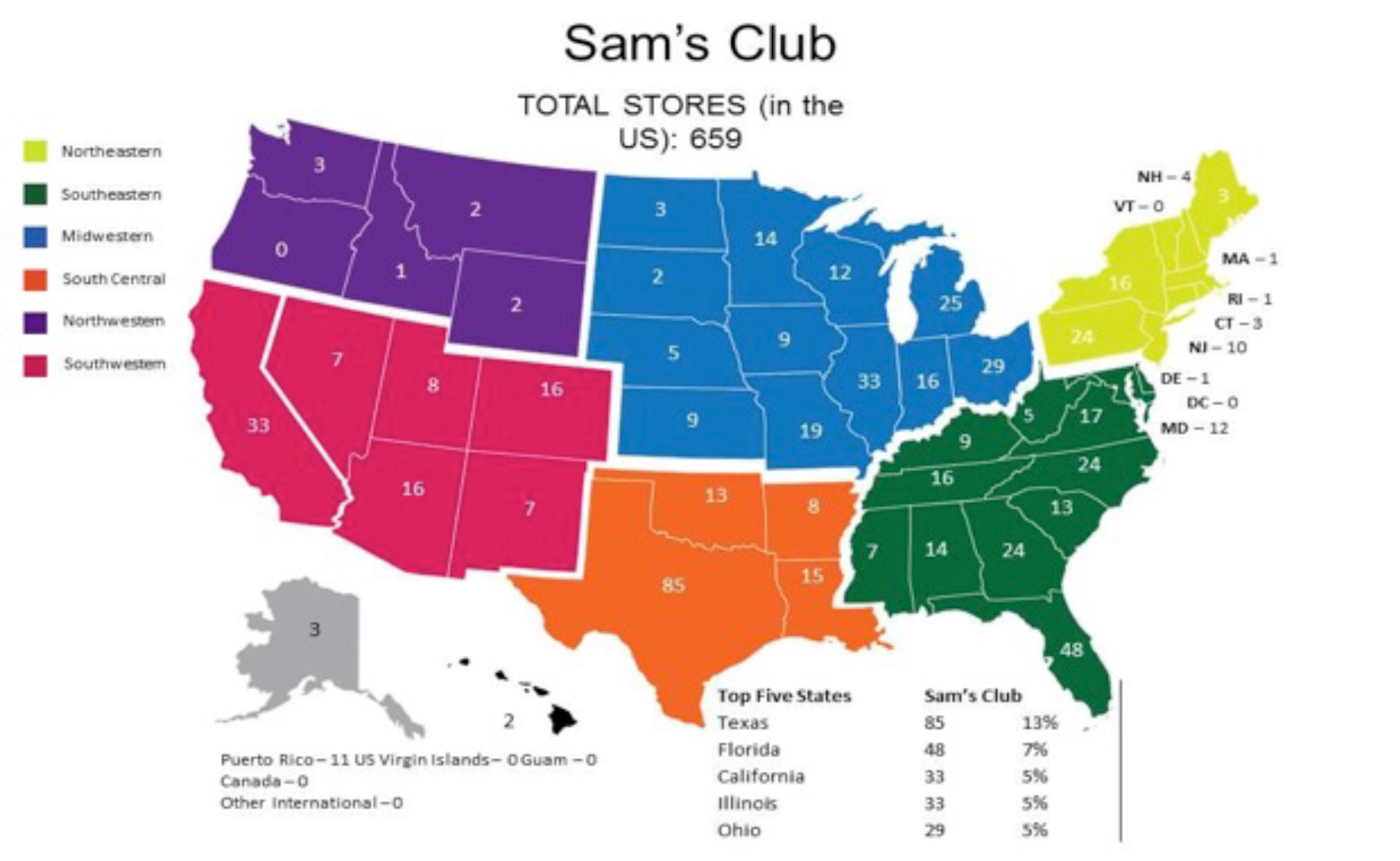

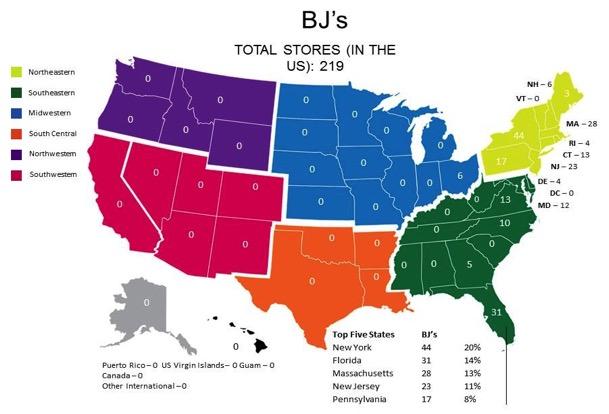

The three major warehouse chains operated 1,386 clubs in the US and Puerto Rico as of the time of writing: the Sam’s Club segment operates 659 locations, while Costco operates 508 locations and BJ’s 219. Each chain has followed a different expansion pattern. With the exception of its operations in Texas, Sam’s Club has expanded more widely across the US than has either Costco or BJ’s, both of which tend to cluster their clubs in certain areas/states. Today, some of the most notable clusters of warehouse clubs in the US are in California, where Costco has 122 stores, and Texas, where Sam’s Club has 85 stores and Costco has 27.

Clustering new clubs within existing markets offers several advantages. Stores in the cluster can achieve efficiencies in distribution and operations and pass on those savings to customers. By providing more locations for shoppers’ convenience, and thereby gaining market share, saturating existing markets also creates barriers to entry for new competitors. So far, we have seen little evidence of new clubs cannibalizing sales of older clubs. The incremental sales and membership revenue from the new clubs appear to be offsetting any sales losses suffered at older locations.

Clubs Take Different Expansion Approaches

Of the big three warehouse clubs, Sam’s Club has the largest number of US club locations. The retailer’s dispersed expansion approach means its store count exceeds 10% in only one of the 48 states in which it operates. The 228 Sam’s Clubs located in the top five states by concentration represent 35% of the company’s fleet. Texas is the state with the most Sam’s Clubs, yet those Texas stores represent only 13% of the chain’s total store count. In contrast to its usual expansion strategy, Sam’s Club did open 10 new locations in Texas over the last five years, which suggests it is taking advantage of some clustering in the state.

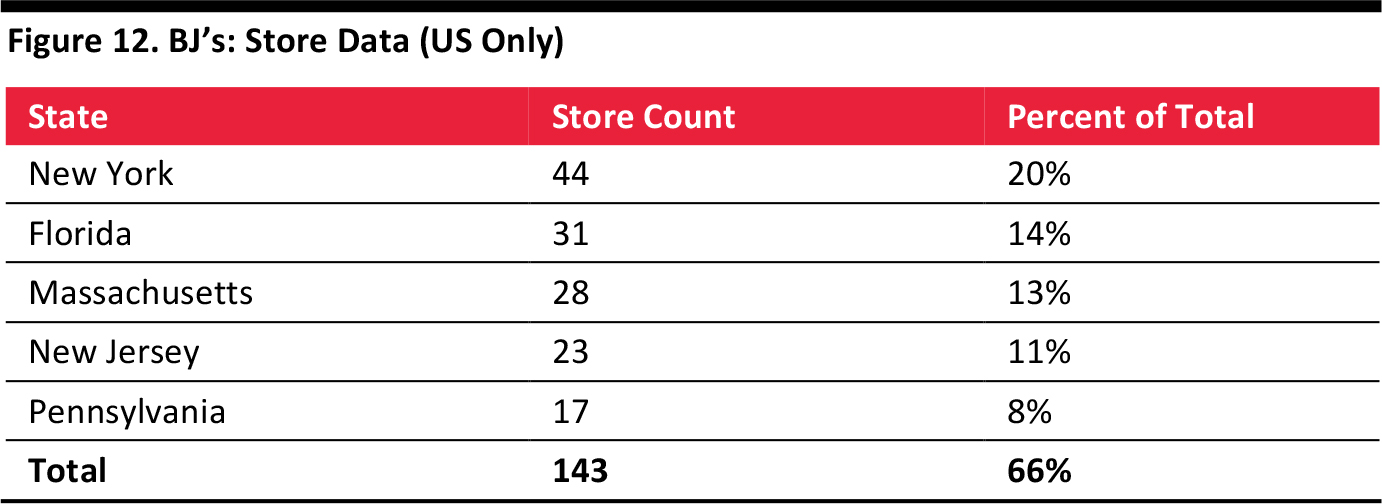

Costco and BJ’s follow more of a cluster approach across the board. In the US, Costco and BJ’s have continually opened locations in or close to existing markets. Costco is the standout, with 24% of all its stores concentrated in California. Over the last five years, Costco has continued to invest in saturating the California market by opening four new stores. At the same time, the chain has focused on expanding into Texas, boosting its store presence there by 47% during the period with eight new locations. BJ’s has located 66% of its clubs in five states, and has pursued an especially aggressive expansion in New York, opening 10 new stores in the state since 2010. The respective tables below list the top five states in which Sam’s Club, Costco and BJ’s operate, by store count.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

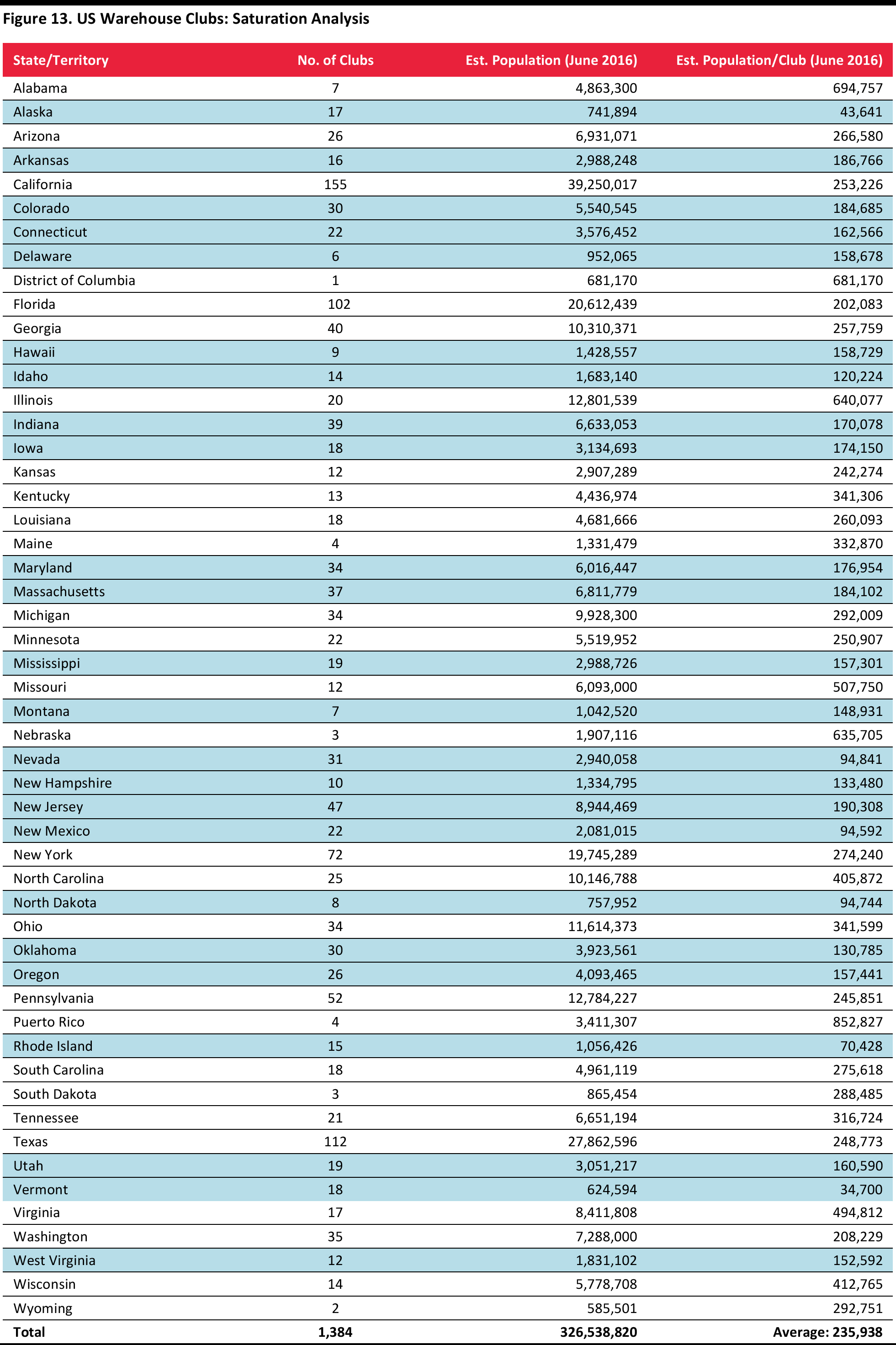

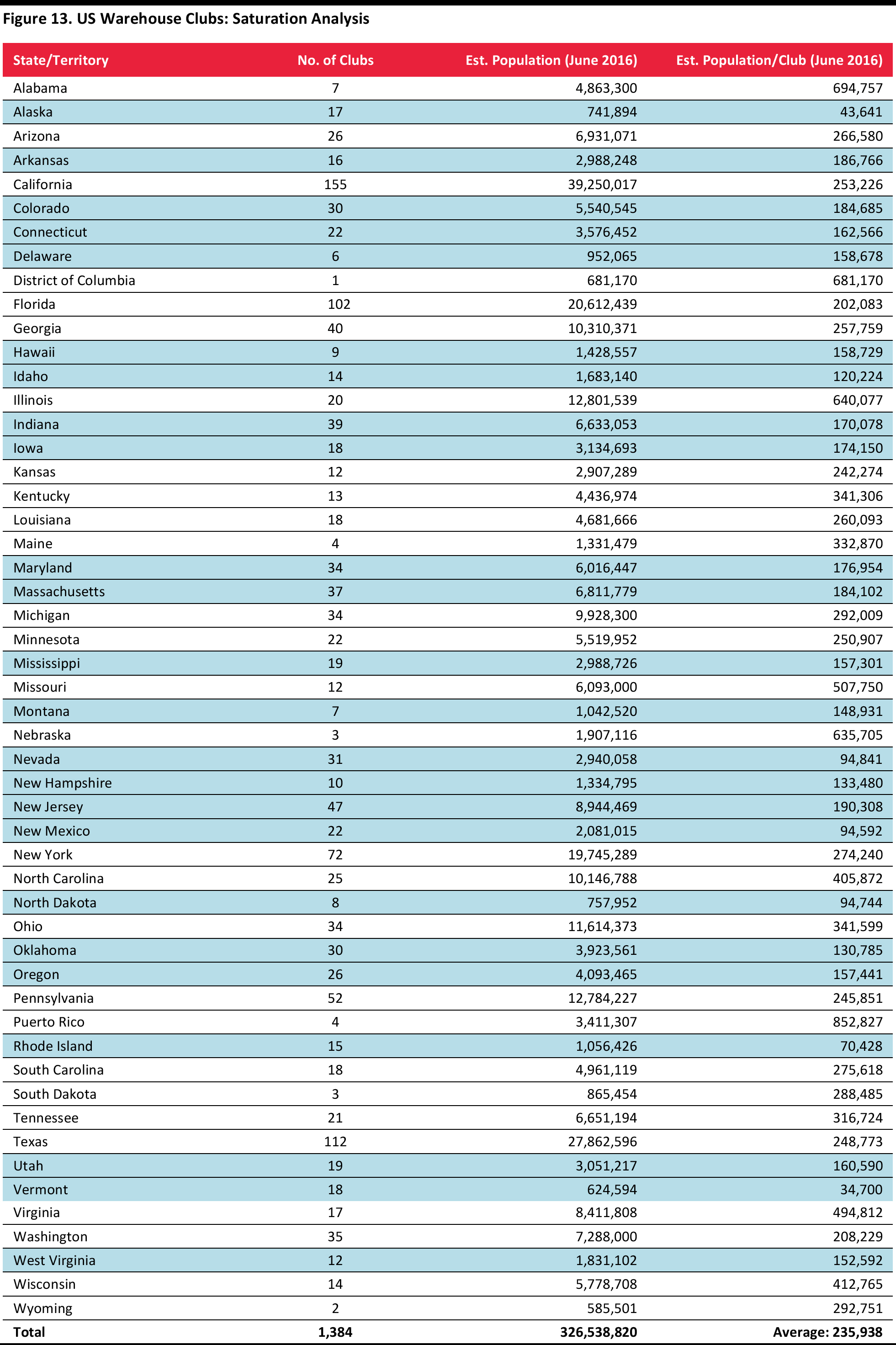

The Saturation Tipping Point

Fung Global Retail & Technology believes that the US warehouse club market is unlikely to become oversaturated in the near term, but that it may reach a tipping point in five years. A typical warehouse club requires a market population of around 200,000 consumers. The table below shows the number of clubs by US state, along with each state’s population and the average population per club in each state. States with populations per club that are well below 200,000 are likely to represent an opportunity (and are highlighted in the table below), whereas states and regions with higher populations per club are likely to be oversaturated. The total figures reveal that the US is well serviced by warehouse clubs.

�

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

International Expansion

International Expansion

Overseas Opportunities Fuel Growth

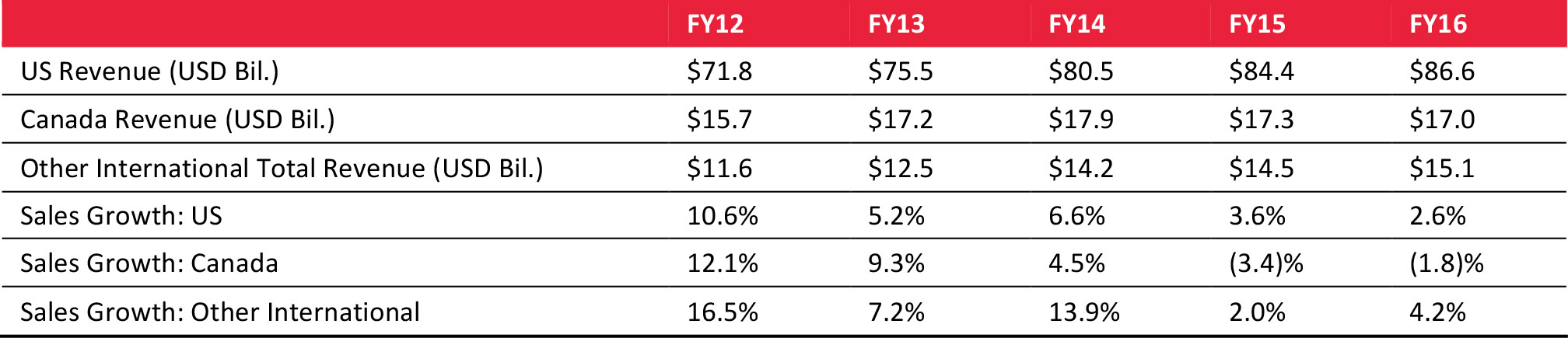

With US market saturation a medium-term possibility and a relatively light international presence, US-based warehouse clubs will look abroad for continued growth. Today, the US remains the only country with a substantial warehouse club sector. Even at Costco, a relatively internationalized club, US sales contributed nearly 73% of revenues in the company’s 2016 fiscal year. Given the boom in discount shopping in other regions, where chains such as Aldi, Lidl and Primark are flourishing, there are big opportunities for the clubs to develop their international portfolios and export the model more broadly overseas. In fast-growing developing markets, where larger family sizes are often common, warehouse clubs’ low-price, large-package offerings may be especially appealing.

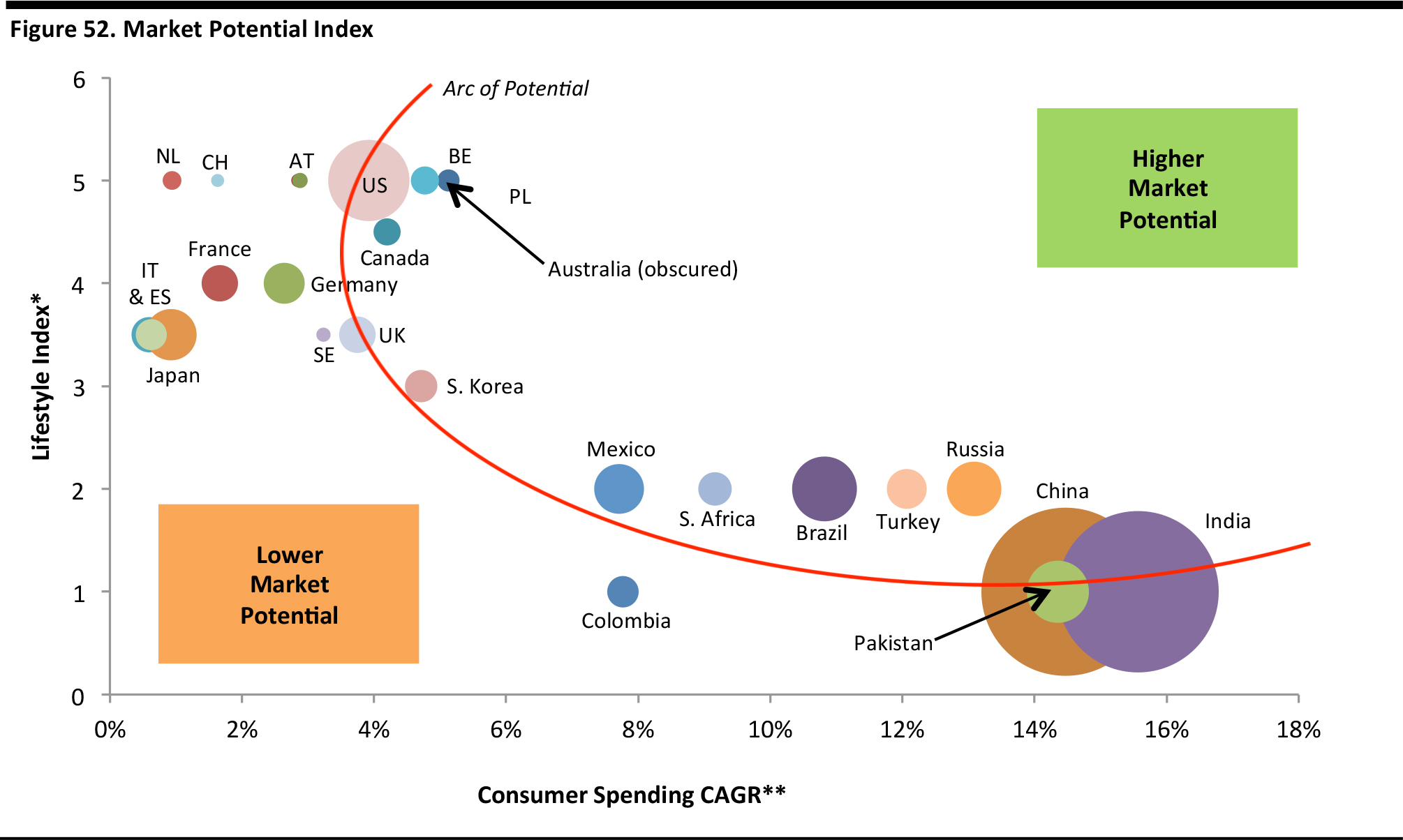

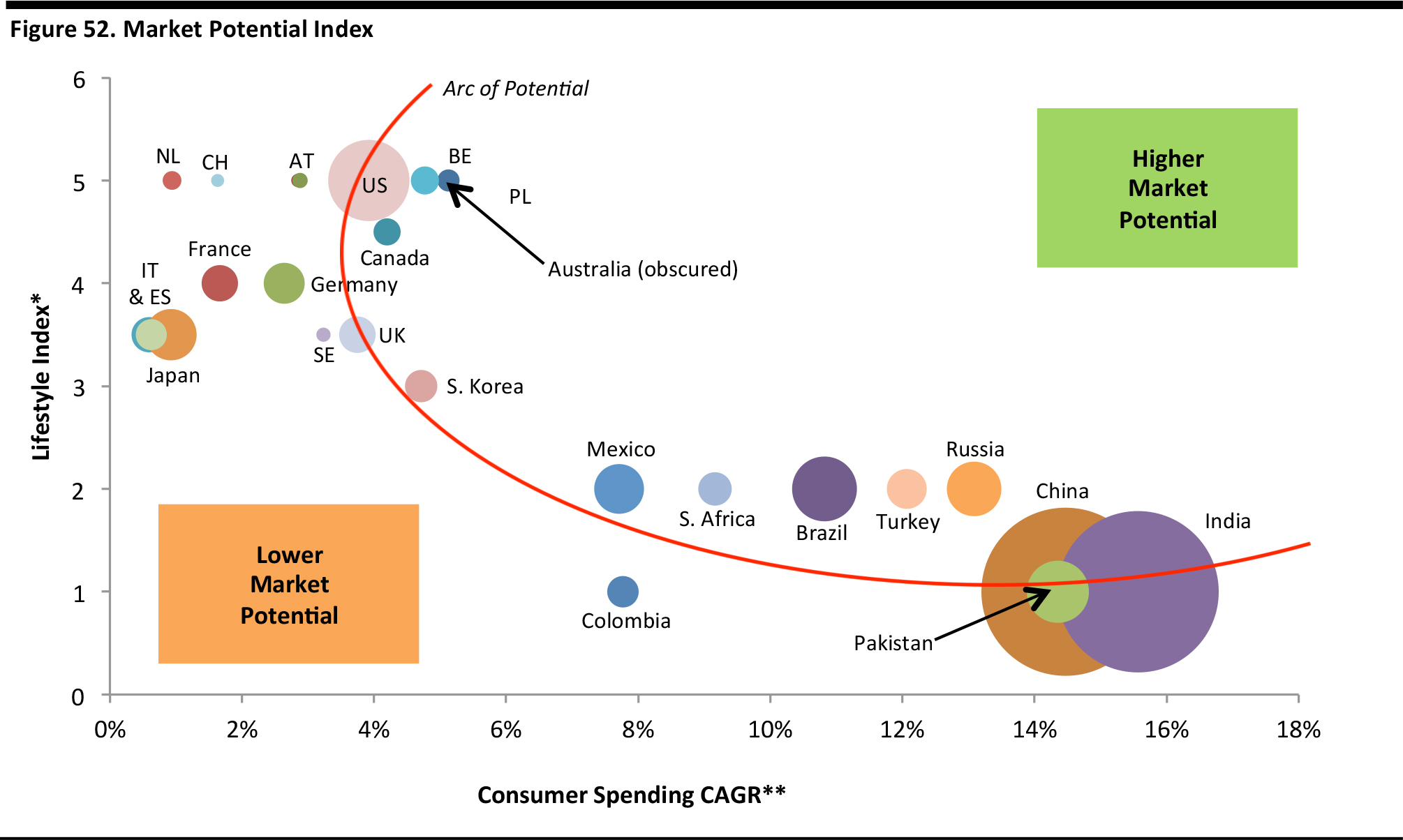

Looking at metrics for consumer spending growth, number of young families, access to personal transportation and average house size will help the clubs identify the most promising new markets. Based on our Market Potential Index (see page 81), Australia, Brazil, China, India, Mexico, Pakistan, South Africa and Turkey are among the strong candidates for international expansion by the warehouse clubs. Currently, Sam’s Club operates in Brazil, Mexico and China, and Costco is present in Canada and Mexico, as well as in several other countries.

Internationalization will likely work best when store offerings are tailored to local demand. Some non-club players have already struggled in various international markets. Walmart pulled out of Germany in 2006 and has performed less strongly in China than its rivals have, in large part because it did not adjust its proposition sufficiently to the demands of these markets. In short, global expansion is in, but retail imperialism is out.

�

International Presence Varies by Club

Costco and Sam’s Club are the only warehouse clubs with both US and international locations. They employ different global expansion strategies, which, interestingly, are the opposite of their respective domestic strategies.

Costco has done well in international expansion. Almost two-thirds of the products sold in the company’s international warehouse clubs originate in the same country in which a given club is located. Costco utilizes local suppliers and primarily local staff to integrate better within the sociocultural context of each country in which it operates. Given its track record, we think Costco is likely to continue to focus on its core international markets and to explore new ones, including France.

For Sam’s Club, the back-end and logistical support that Walmart’s large international presence can provide is a clear advantage in Brazil, China and Mexico. Sam’s Club will likely continue to build capacity in these markets. The table below shows the number of international stores operated by Costco and Sam’s Club, respectively.

*Costco sells in China through Alibaba’s Tmall and the Chinese press has reported that the company plans to open a warehouse in Wuhan in Hubei Province.

Source: Company reports

The Brief Independence of Jet.com

The Brief Independence of Jet.com

Jet.com was founded in 2014, made its public debut in July 2015, and was acquired by Walmart on September 19, 2016, for $3 billion in cash plus $300 million in Walmart shares, both to be paid over a period of time. Although Jet lived just a couple of years in the public sphere, warehouse clubs should follow its development within Walmart, as well as find elements of its business model to consider emulating, as Jet sought to combine warehouse club prices with the easy convenience of e-commerce.

Jet was founded by Marc Lore, who had previously founded Quidsi (the operator of Diapers.com). Quidsi was acquired by Amazon for $545 million in 2010, and Lore stayed on at Amazon for two years after the acquisition.

Jet was initially founded as an online warehouse store, and the company planned to charge an annual membership fee but make only a minimal profit on goods sold. However, Jet dropped plans to charge the membership fee in October 2015, saying that it could achieve its financial targets and provide adequate savings to consumers without charging a fee. Numerous surveys found that Jet’s prices were lower than Amazon’s, and Jet incorporated gross margin losses (through lower prices) as part of its plan to become a $20 billion company in 2020.

The company offers additional opportunities for its customers to achieve savings, including:

- Free shipping on orders of $35 or more.

- Two-day shipping on “everyday essentials.”

- “Smart items,” which customers can combine with other smart items in their shopping cart to generate additional savings.

- The option to forgo free returns in exchange for further price reductions.

- A 1.5% discount when paying with a debit card.

- “Jet Anywhere,” which enables customers to receive credits on goods not offered by Jet that they purchase from other selected retailers.

Jet raised a total of $565 million in four funding rounds, according to Crunchbase.com. Since the company’s launch, one major winner has been its customers, who receive warehouse club prices (which are magnified by Jet’s intentional gross margin losses to achieve scale) combined with

e-commerce convenience.

Source: Jet.com

Source: BJs.com

BJ’s

BJ’s

Fast Facts

- BJ’s was established in 1984.

- On September 30, 2011, BJ’s was acquired by Beacon Holding, an affiliate of Leonard Green & Partners, and funds advised by CVC Capital Partners.

- BJ’s operates warehouse membership clubs and gas stations on the East Coast of the US.

- Headquartered in Westborough, MA, the company has distribution centers in Uxbridge, MA; Jacksonville, FL; Rocky Hill, CT; Elkton, MD; and Burlington, NJ.

- As of December 2016, BJ’s operated 219 clubs in 15 US states.

- As of December 2016, the company had more than 25,000 employees.

- The company’s fiscal year ends January 31.

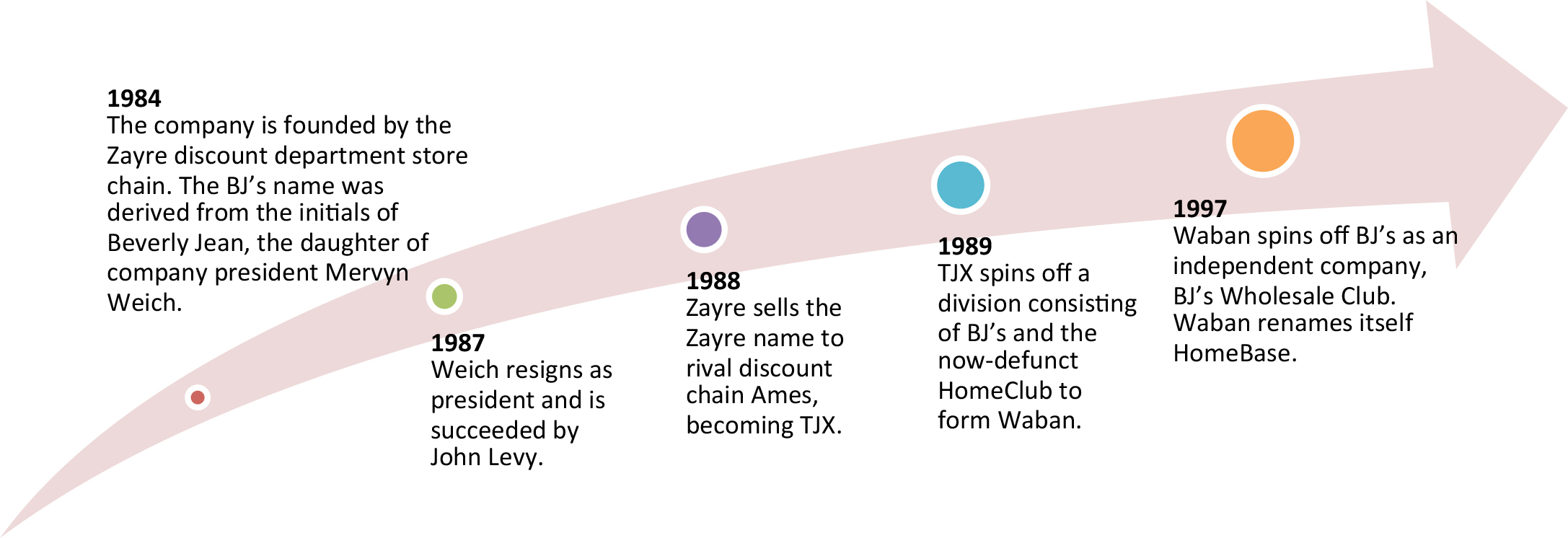

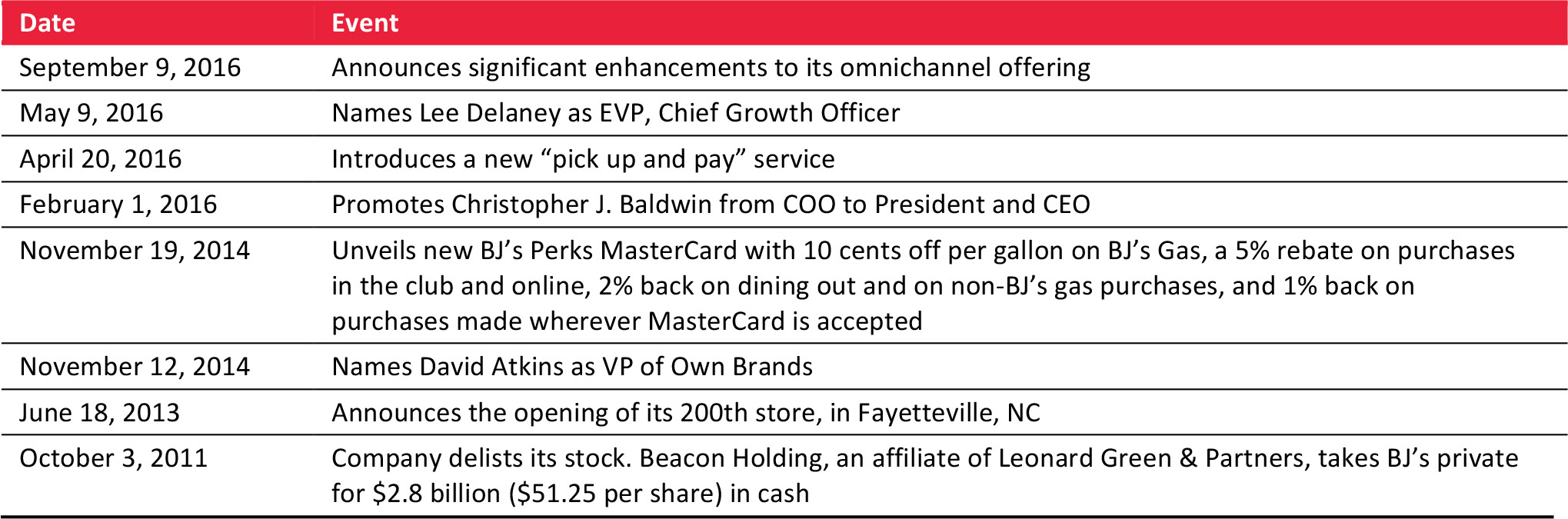

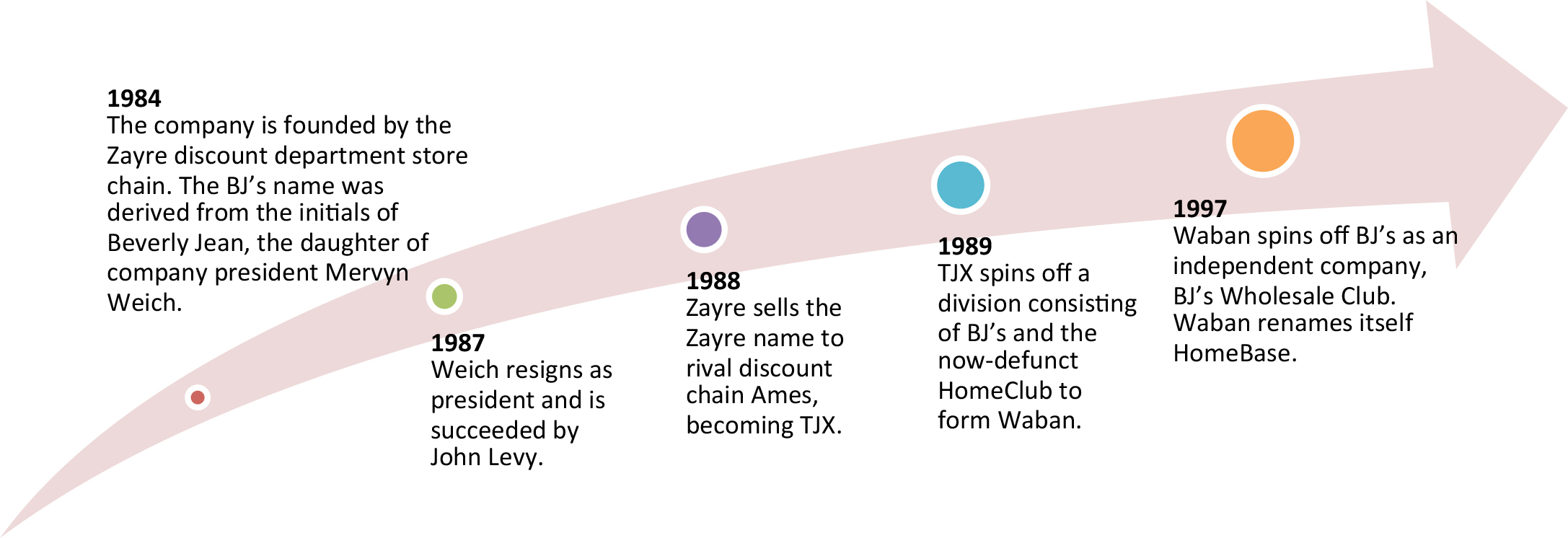

BJ’s: Timeline

BJ’s: Store Map (as of December 29, 2016)

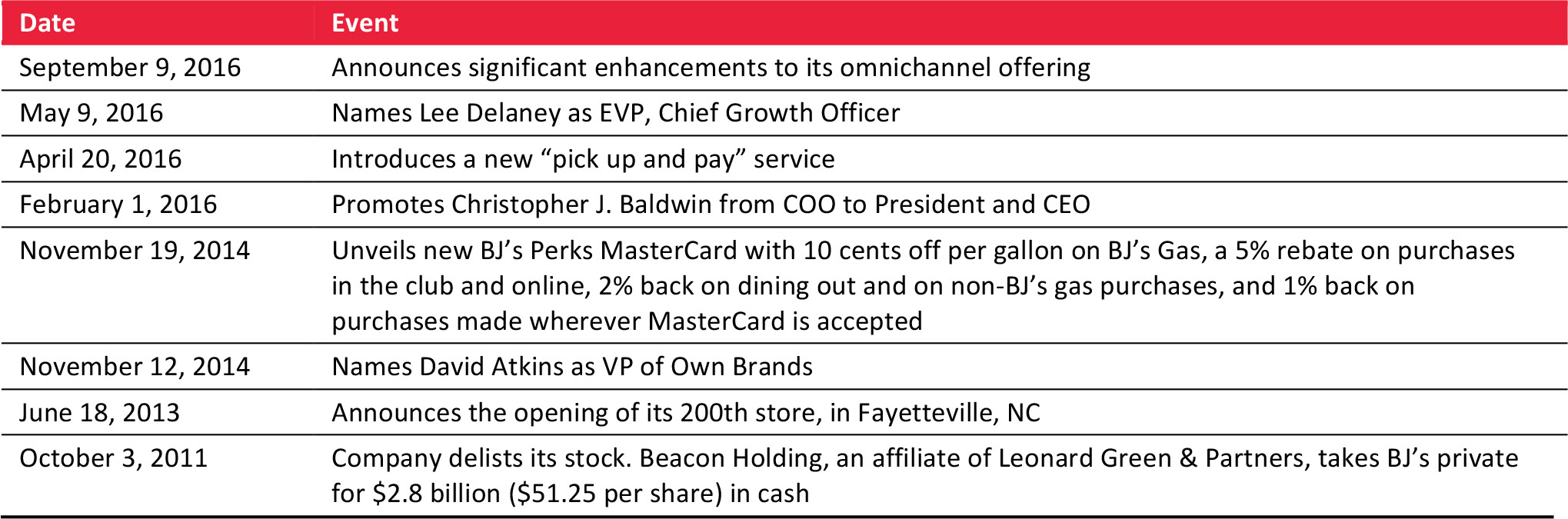

BJ’s: Key Recent Events

Source: Company reports and press releases

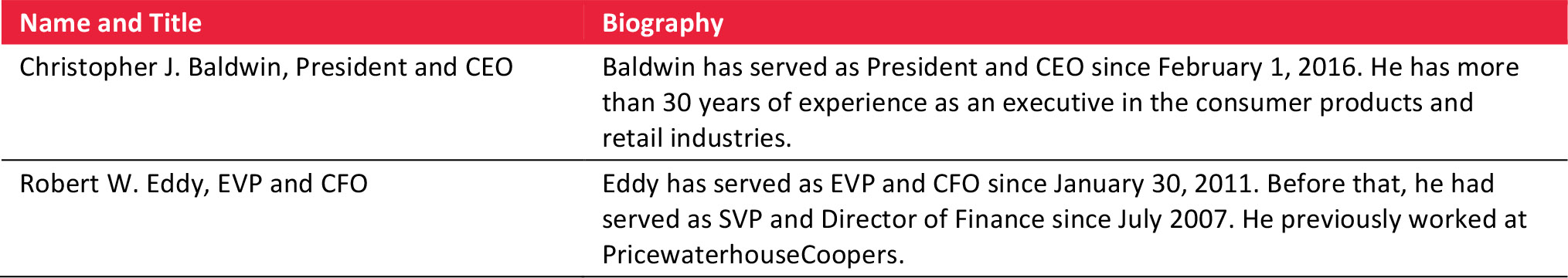

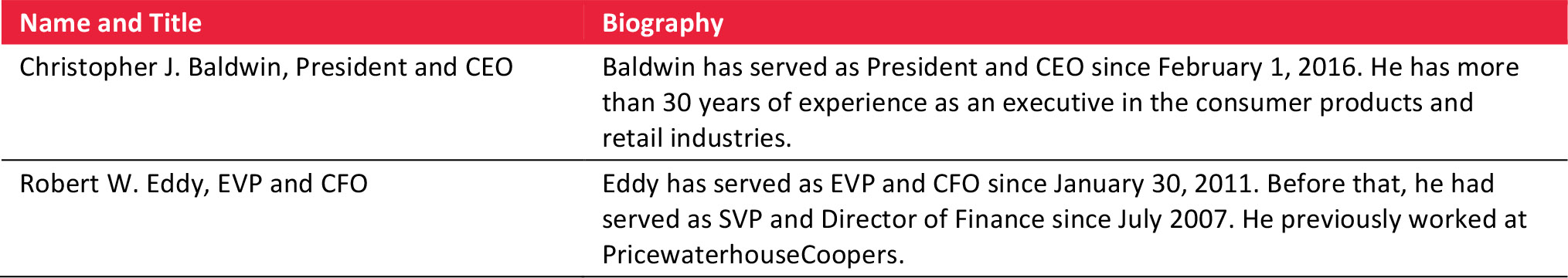

BJ’s: Key Management

BJ’s: SWOT (Strengths, Weaknesses, Opportunities and Threats) Analysis

Strengths

Loyalty programs: BJ’s offers Inner Circle memberships to individuals and Business memberships to organizations. To grow its membership, attract a broader range of customers and increase loyalty, the company introduced the BJ’s Perks MasterCard in November 2014. The card offers rewards and discounts for a wide range of BJ’s and non-BJ’s products and services.

Diverse product mix: BJ’s offers more than 7,000 items, including electronics, office supplies, home and seasonal products, organic foods and meat, sports equipment, toys, baby products, health and beauty supplies, and jewelry. In addition, BJ’s offers a wide range of services, including optical centers, food courts, Verizon Wireless centers, home improvement services, BJ’s Travel, a propane-tank filling service, an automobile-buying service, a car rental service, tire installation services, muffler and brake services, merchant payment-processing services, and electronics and jewelry protection plans. This combination allows customers to complete a significant portion of their shopping and errands conveniently in one place, adding value to their membership.

Weaknesses

Limited geographic presence: BJ’s operates more than 200 stores, but all are located in the US, exposing it to risks associated with the US economy. Lack of geographical diversification could put BJ’s at a disadvantage compared with competitors that have an international presence.

Opportunities

Private-label products: Private-label products account for nearly 10% of the company’s revenue, and their share is still growing. Such products can be a competitive advantage due to their exclusivity and typically lower prices.

Investment in technological infrastructure: As e-commerce becomes an increasingly preferred shopping channel, BJ’s may invest more in its website and technological infrastructure. The company recently collaborated with Toshiba, giving BJ’s better access to new technology that it can use to enhance members’ online shopping experience. BJ’s also needs to continue to develop its mobile apps, making them transactional in order to give members another way to shop. Currently, the apps can be used only to browse catalogs, circulars and publications.

International expansion: With stores in the US only, BJ’s can explore global expansion, particularly in regions such as Canada and Central and Latin America, where the warehouse club format has proven successful. By expanding internationally, BJ’s can diversify risk and tap higher-growth markets.

Threats

Fierce competition: BJ’s faces direct competition from local, regional and national wholesalers and retailers, including Costco and Sam’s Club. These peers have considerably better financial and marketing resources that allow them greater bargaining power with suppliers and the ability to offer merchandise at lower prices than BJ’s can. If BJ’s is unable to match its competitors on these fronts, its customer base could erode.

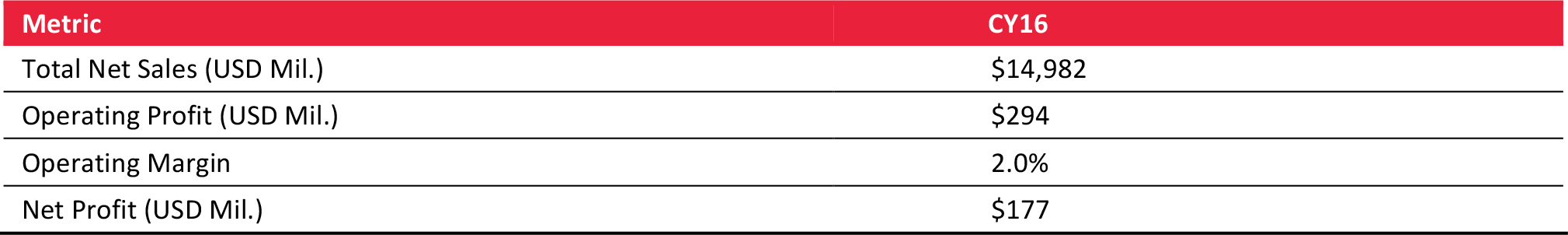

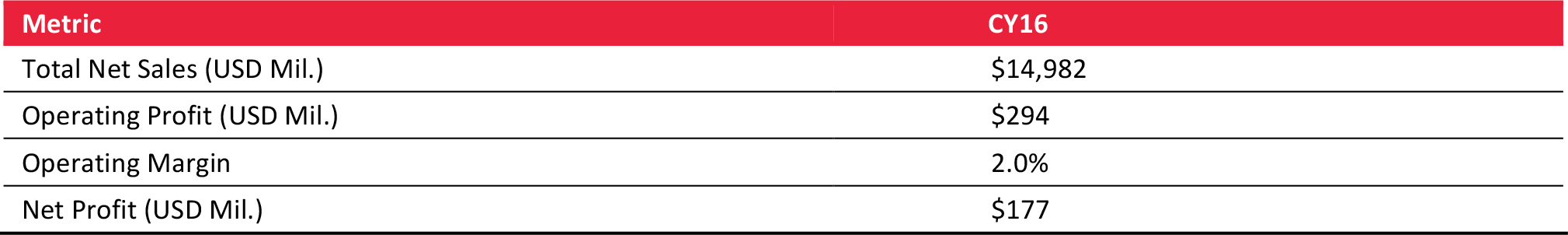

Financial Overview

BJ’s was taken private in 2011. No subsequent financial data have been made public. Recent articles have suggested that the company is on track for an initial public offering or an outright sale in the near future.

BJ’s: Key Metrics (Est.)

Source: NRF/Fung Global Retail & Technology

BJ’s: Revenues (Est.)

Source: NRF

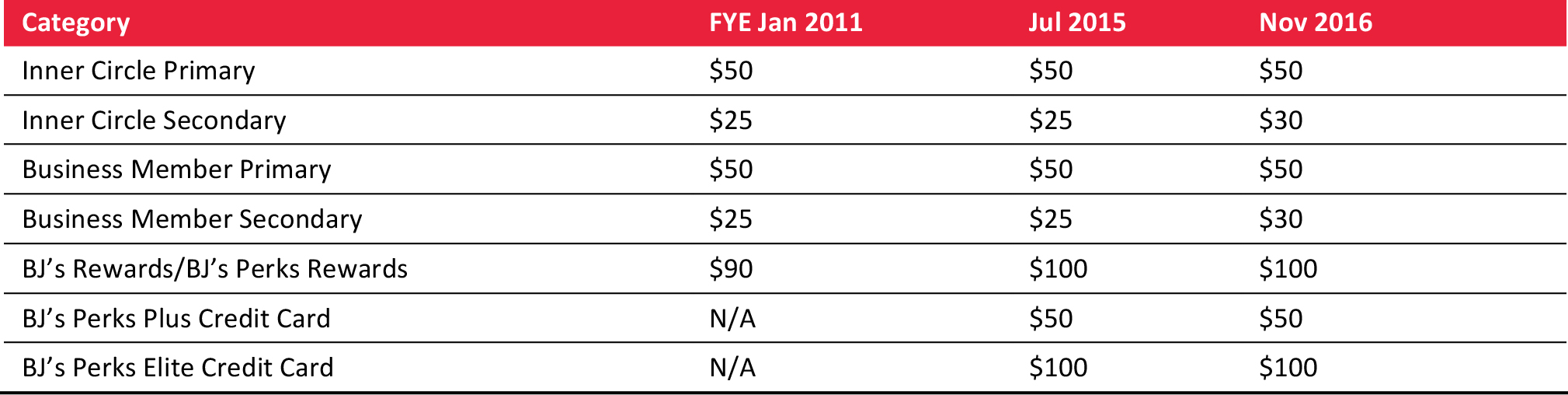

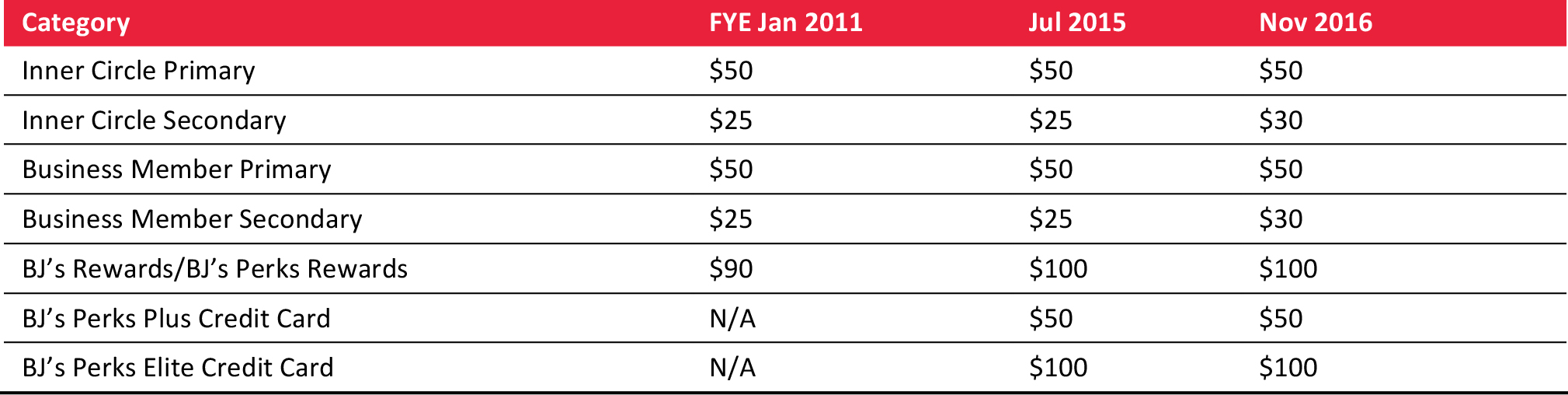

BJ’s: Membership Data

*For fiscal year ended January 2011

Source: Company reports/Fung Global Retail & Technology

BJ’s: Membership Fees

Source: Company reports

BJ’s: Outlet Data

Source: Company reports

BJ’s: Breakdown of Product Sales

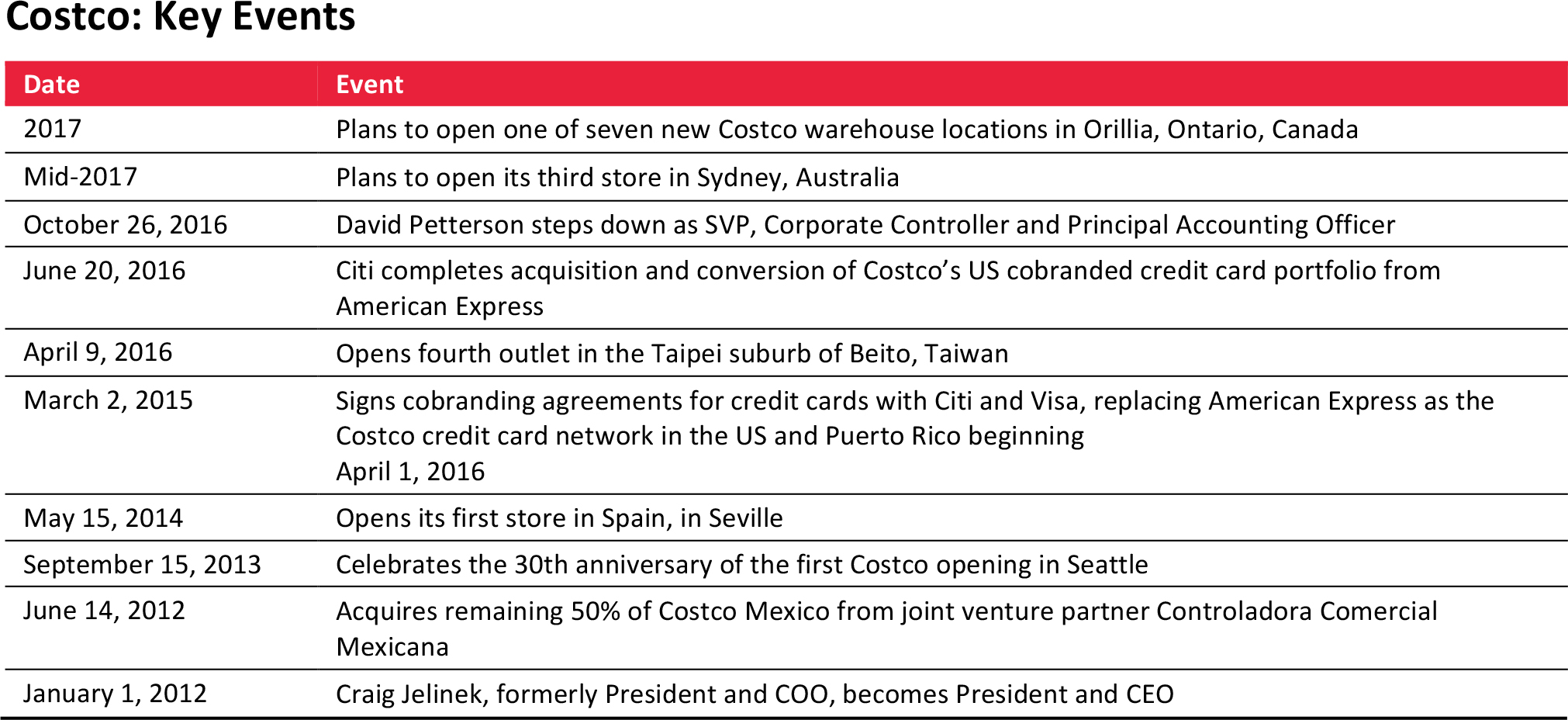

Costco

Costco

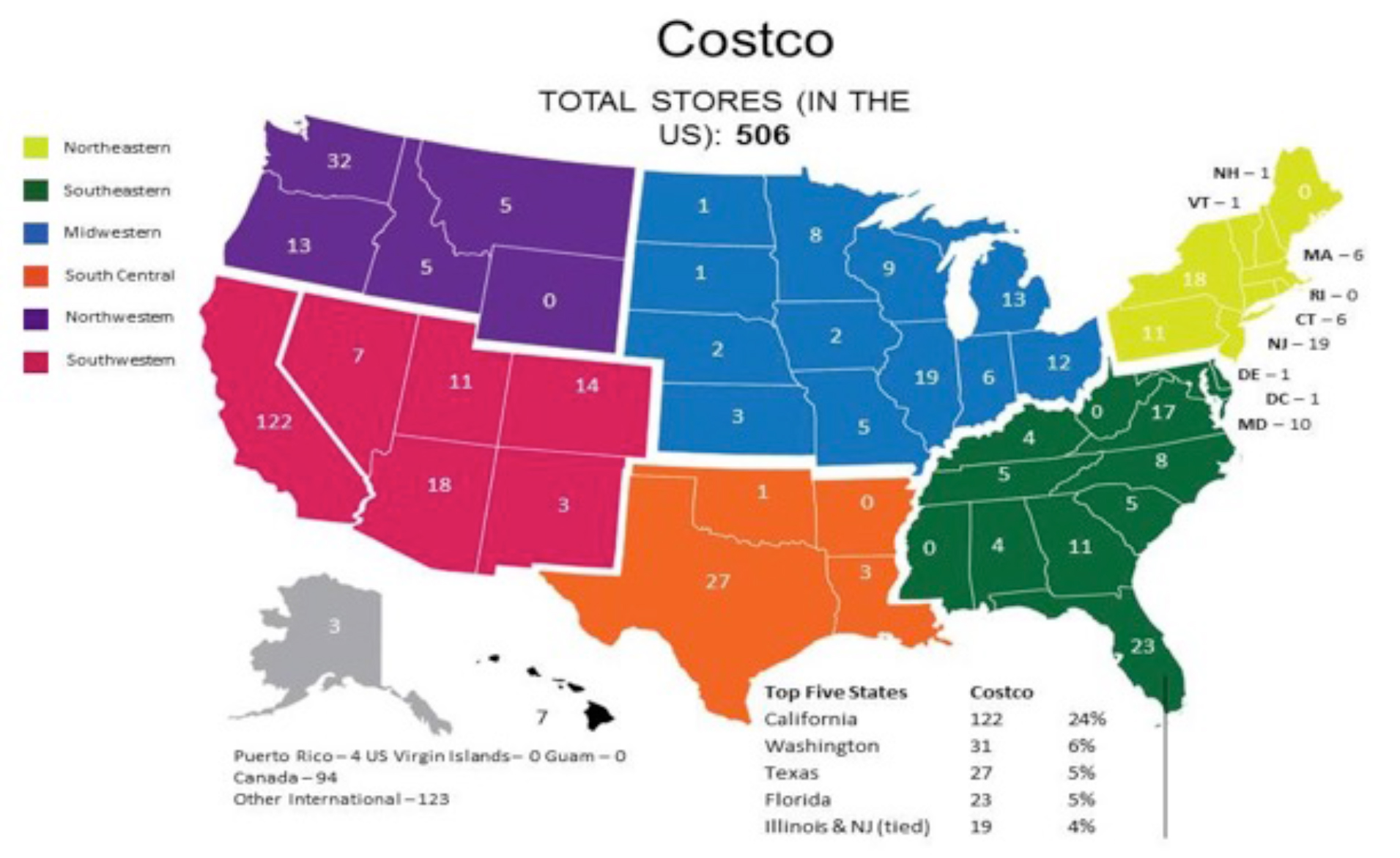

Fast Facts

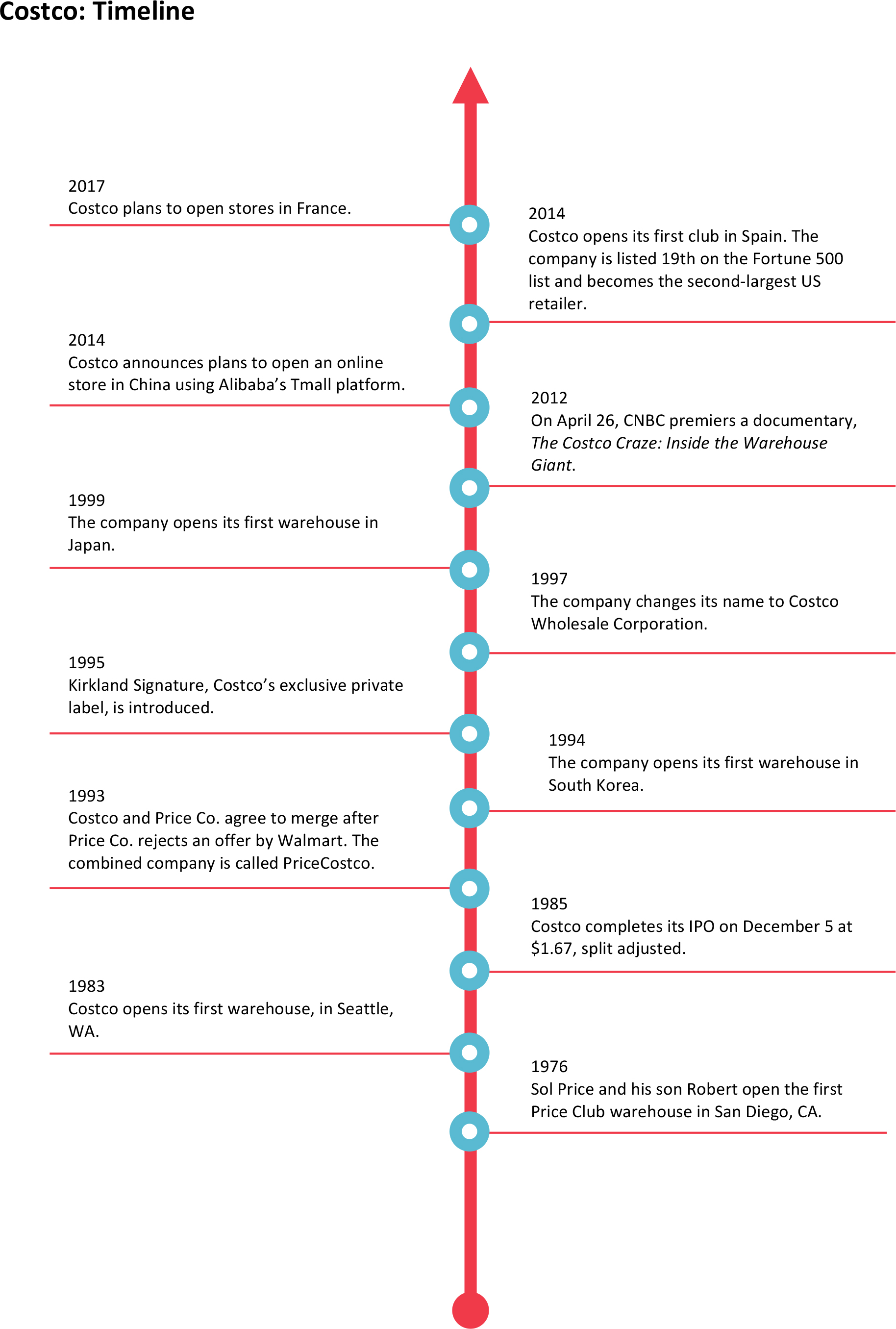

- The company was established in 1976 as Price Club; the first Costco warehouse opened in 1983.

- Costco is headquartered in Issaquah, WA.

- As of December 7, 2016, the company operated 723 warehouses globally: 506 in the US and Puerto Rico, 94 in Canada, 36 in Mexico, 28 in the UK, 25 in Japan, 12 in South Korea, 12 in Taiwan, eight in Australia, and two in Spain. Costco expects to open eight additional warehouses in its fiscal 2017 year.

- As of August 2016, Costco had 126,000 full-time employees and 92,000 part-time employees, for a total of 218,000.

- Costco’s fiscal year ends August 31.

- The company trades on the Nasdaq Stock Exchange under the symbol COST.

Costco: Store Map (as of August 31, 2016)

Source: Company reports and press releases

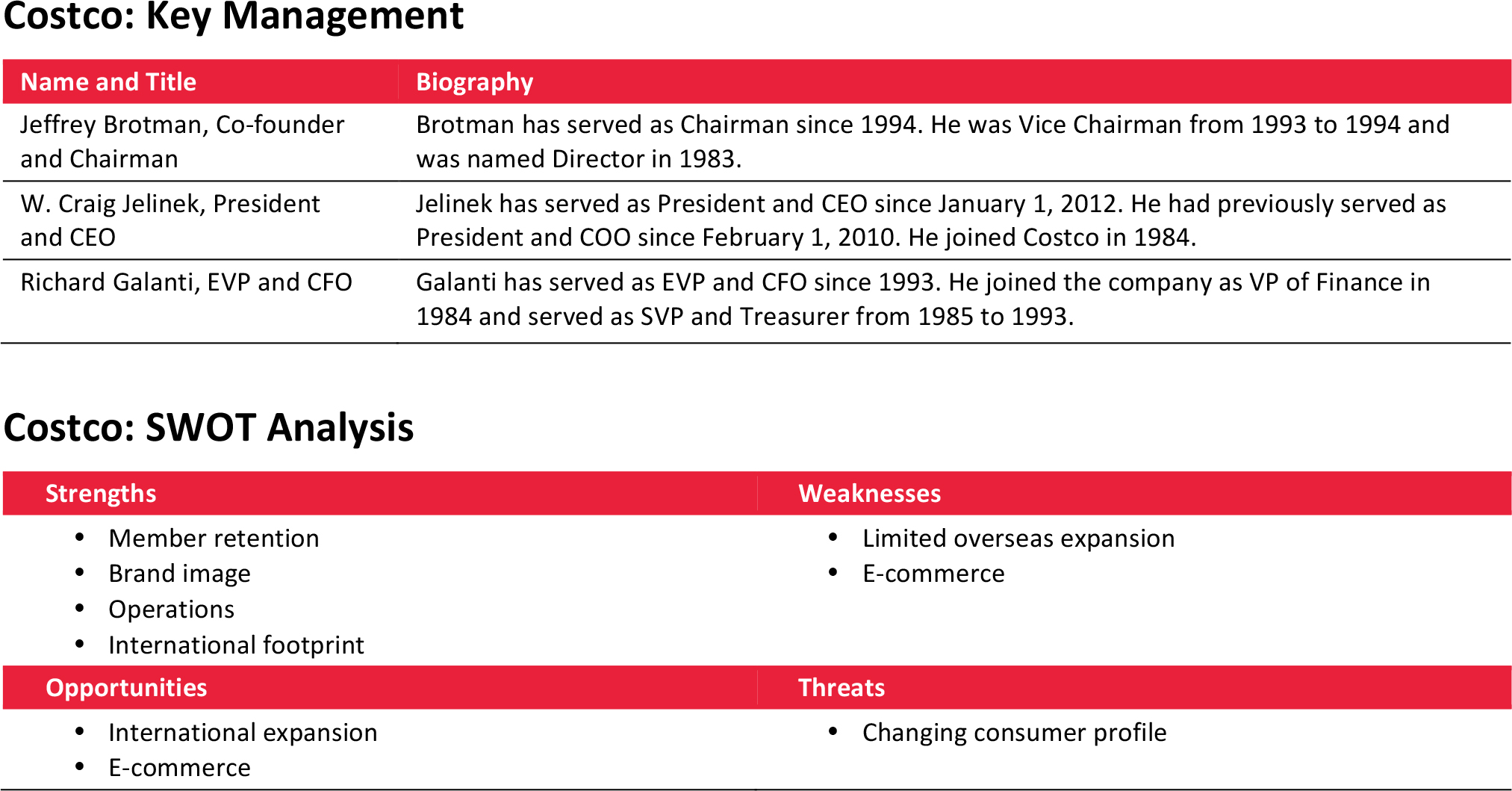

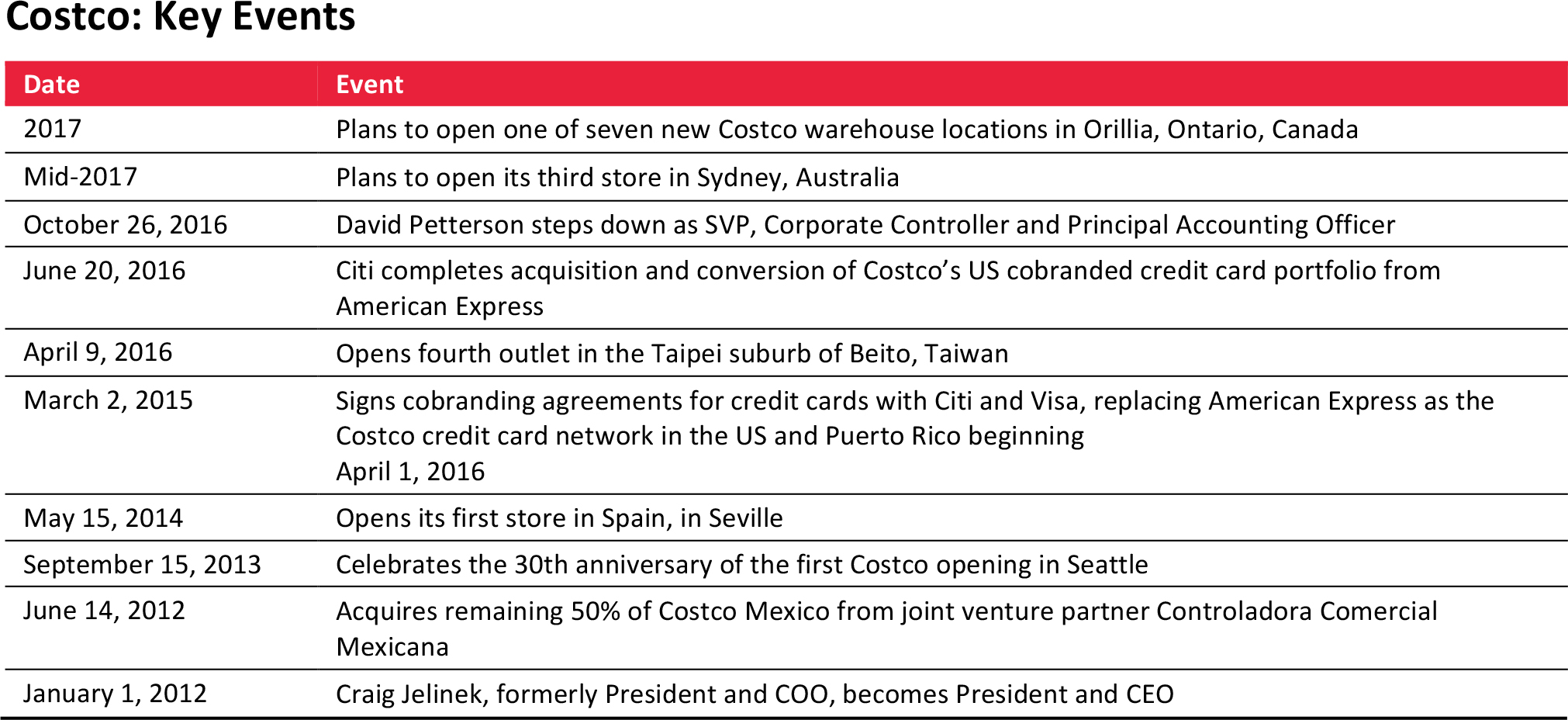

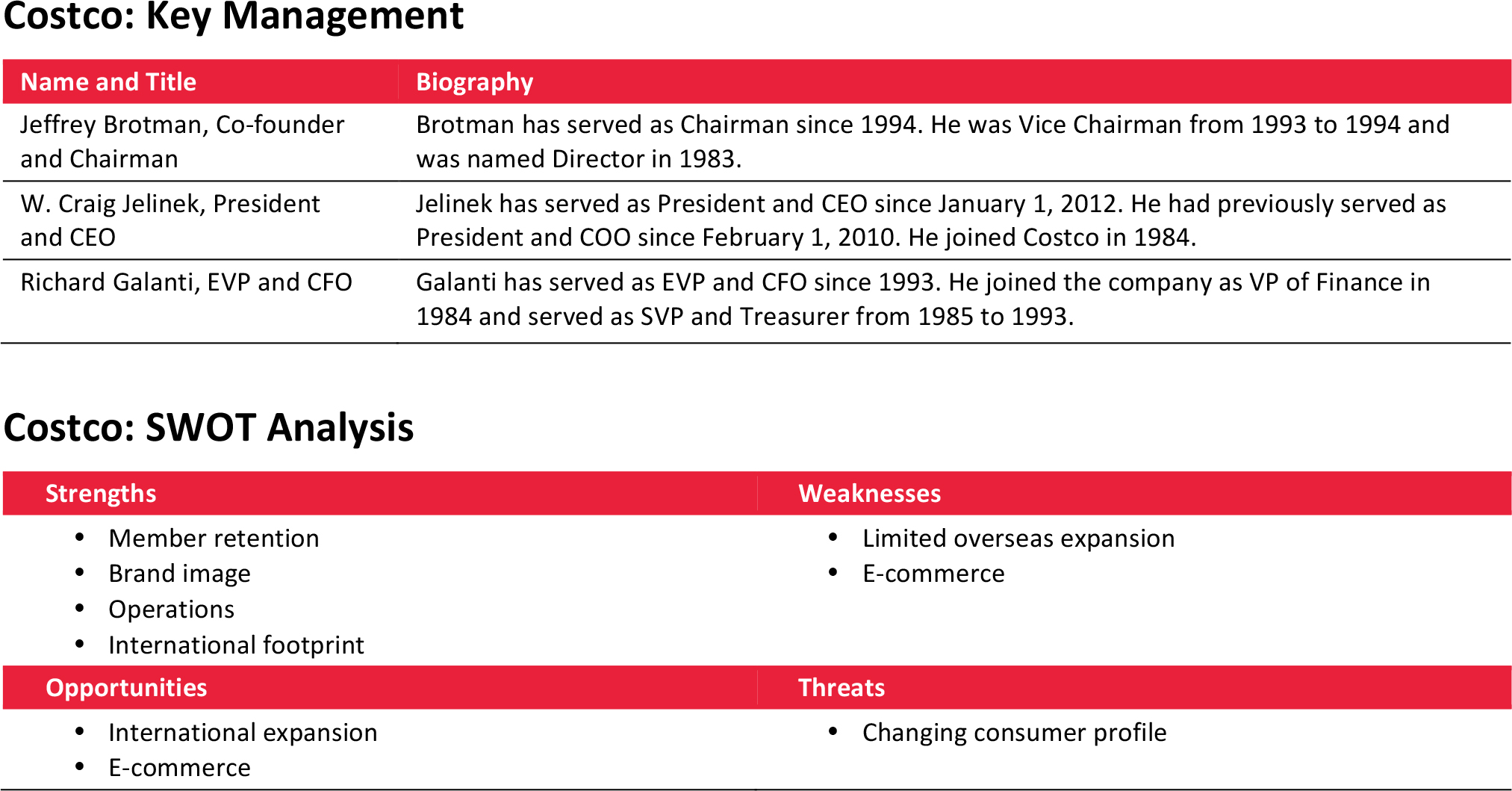

Strengths

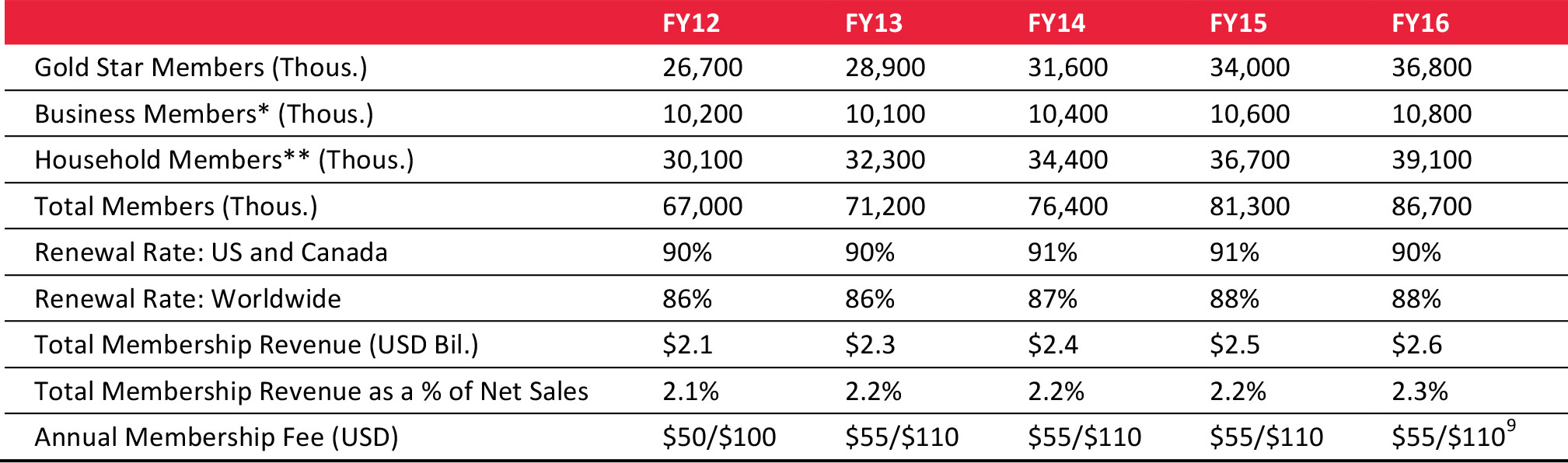

Member retention: Costco leads the sector in membership renewal rates, which stood at 90% in the US and 88% worldwide in fiscal year 2016. The company enjoyed solid year-over-year membership growth of 9.3% in 2014, up from 8.2% growth in 2013.

Brand image: Costco’s Kirkland Signature private label is well established and has a reputation for high quality.

Operations: Costco’s operational efficiency allows it to offer lower prices than other players in the sector. Costco’s employees receive some of the highest salaries and best medical insurance in the sector, and there is a much smaller wage gap between CEO and employees at Costco than there is at most other Fortune 500 companies.

International footprint: Costco is ahead of other US-based warehouse clubs in terms of international expansion. The company already has locations in Australia, Canada, Japan, Mexico, South Korea, Taiwan and the UK.

Weaknesses

Limited overseas expansion: Although ranked by the NRF in 2015 as the second-largest retailer in the world and the largest warehouse club in the US, Costco still has a limited presence outside North America. The company has opened locations in developed economies in Europe and Asia, such as the UK and Japan, and these locations accounted for 12.62% of the company’s 2014 revenues, the highest in the sector. Yet untapped emerging markets may better suit Costco’s positioning in low-price, high-quality products, since family size is generally larger and customers more price-sensitive in these markets.

E-commerce: Costco’s e-commerce business significantly lags that of rivals such as Walmart.

Opportunities

International expansion: Costco has an opportunity to expand its geographical footprint. The company has entered new markets such as Spain in the past two years, and is on track to open its first location in France in 2017. It could also seek opportunities in emerging economies in Asia and Latin America.

E-commerce: E-commerce is a promising channel for Costco. Its traditional, attractive price proposition and wide product range can be strong differentiating factors online.

Threats

Changing consumer profile: In mature markets, the currently profitable membership-based model may not gain the same traction with younger shoppers as it has with older shoppers, as younger consumers are increasingly turning to e-commerce and multichannel retailers.

Financial Overview

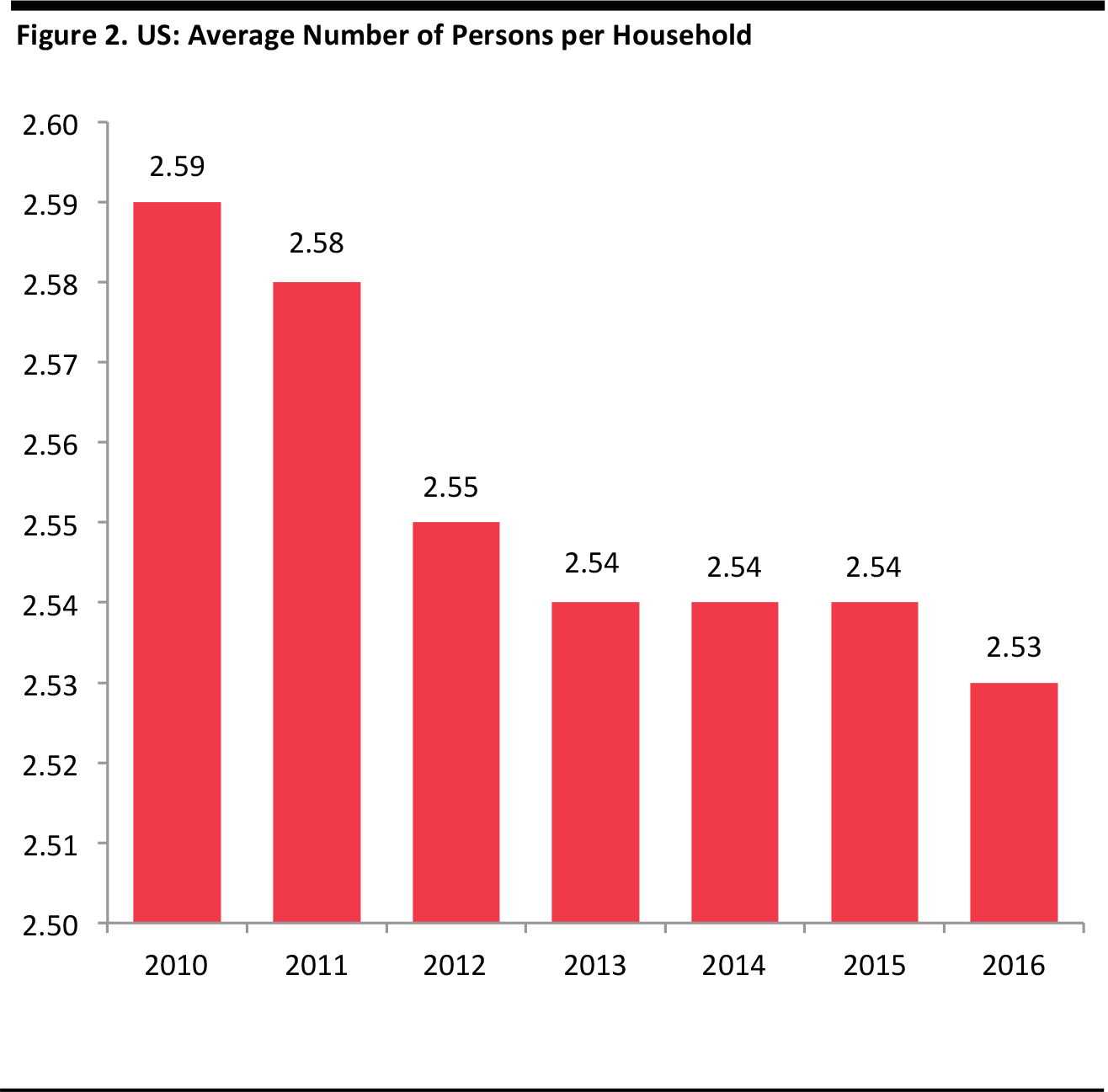

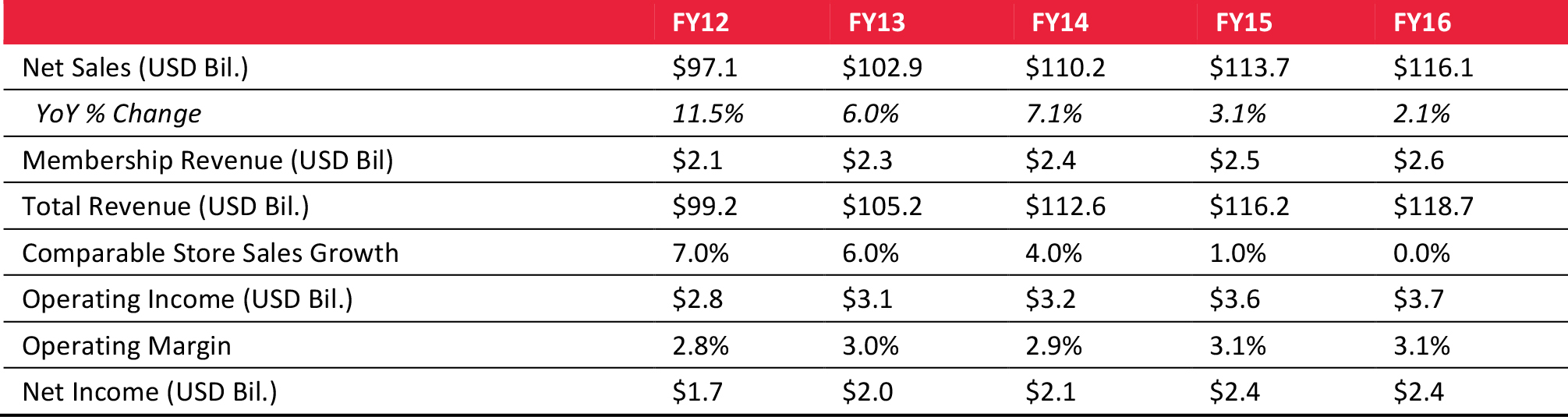

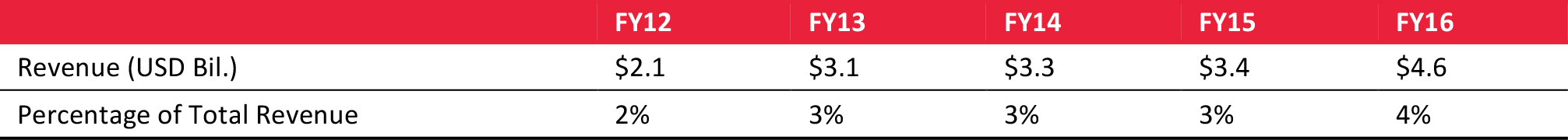

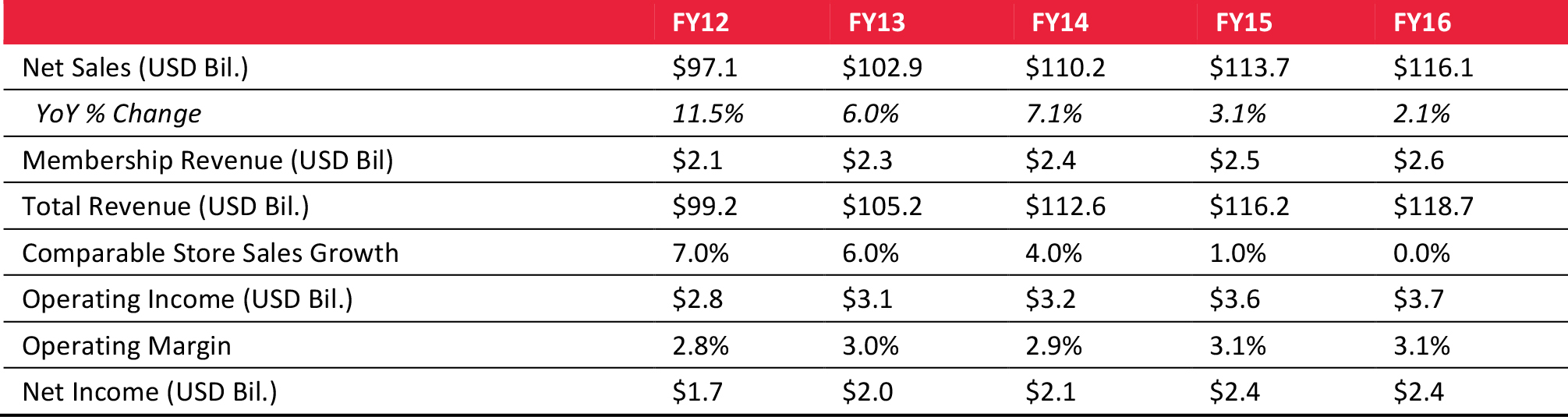

Costco: Key Metrics

Source: Company reports/Fung Global Retail & Technology

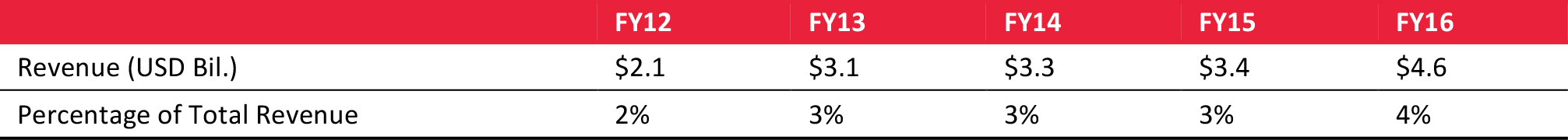

Costco: E-Commerce

Source: Company reports/Fung Global Retail & Technology

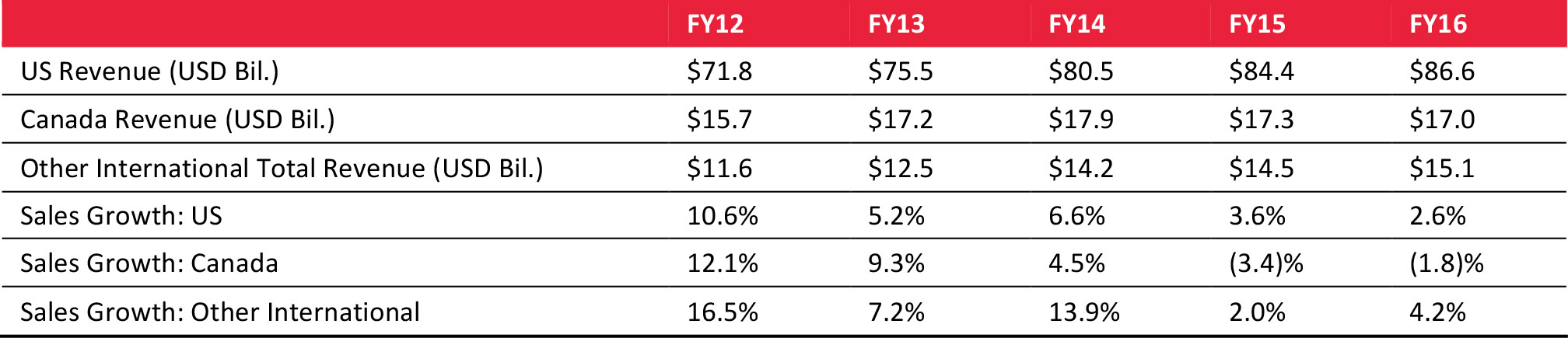

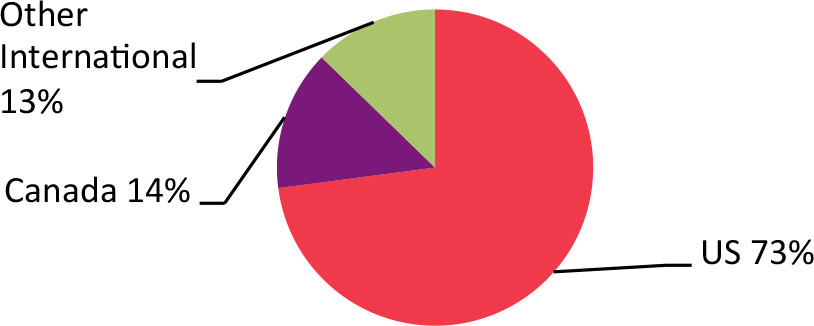

Costco: Geographic Sales Mix

Source: Company reports/Fung Global Retail & Technology

Costco: Geographic Sales Mix (FY16)

Costco: Product Sales Mix

Source: Company reports

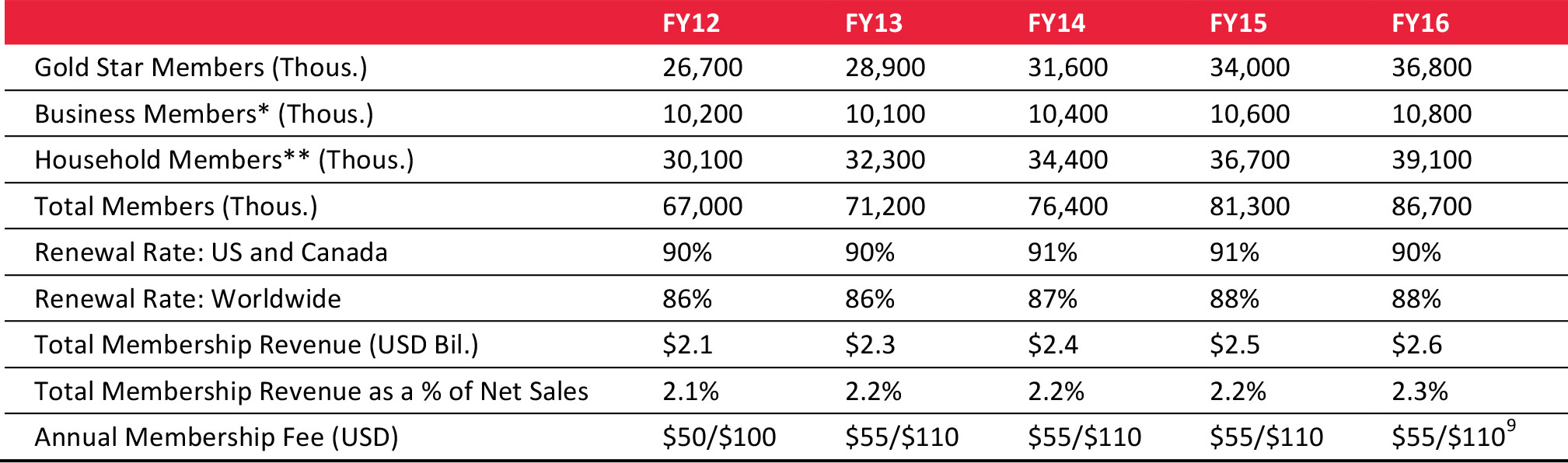

Costco: Membership Data

*Including additional cardmembers (add-ons)**Costco renamed additional members as household members in its financial statements starting in FY15.

Source: Company reports

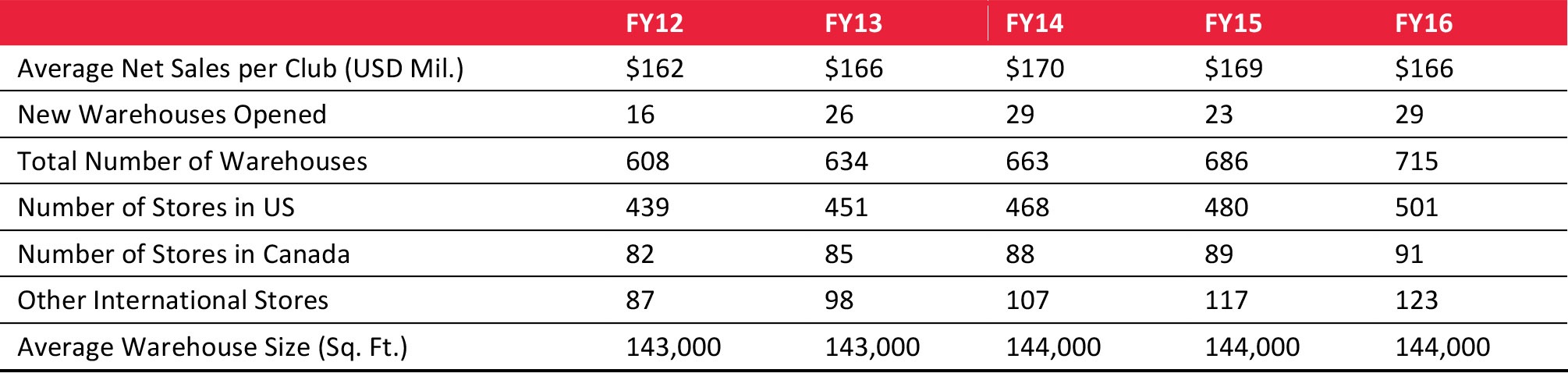

Costco: Outlet Data

Source: Company reports/Fung Global Retail & Technology

Sam’s Club

Sam’s Club

Fast Facts

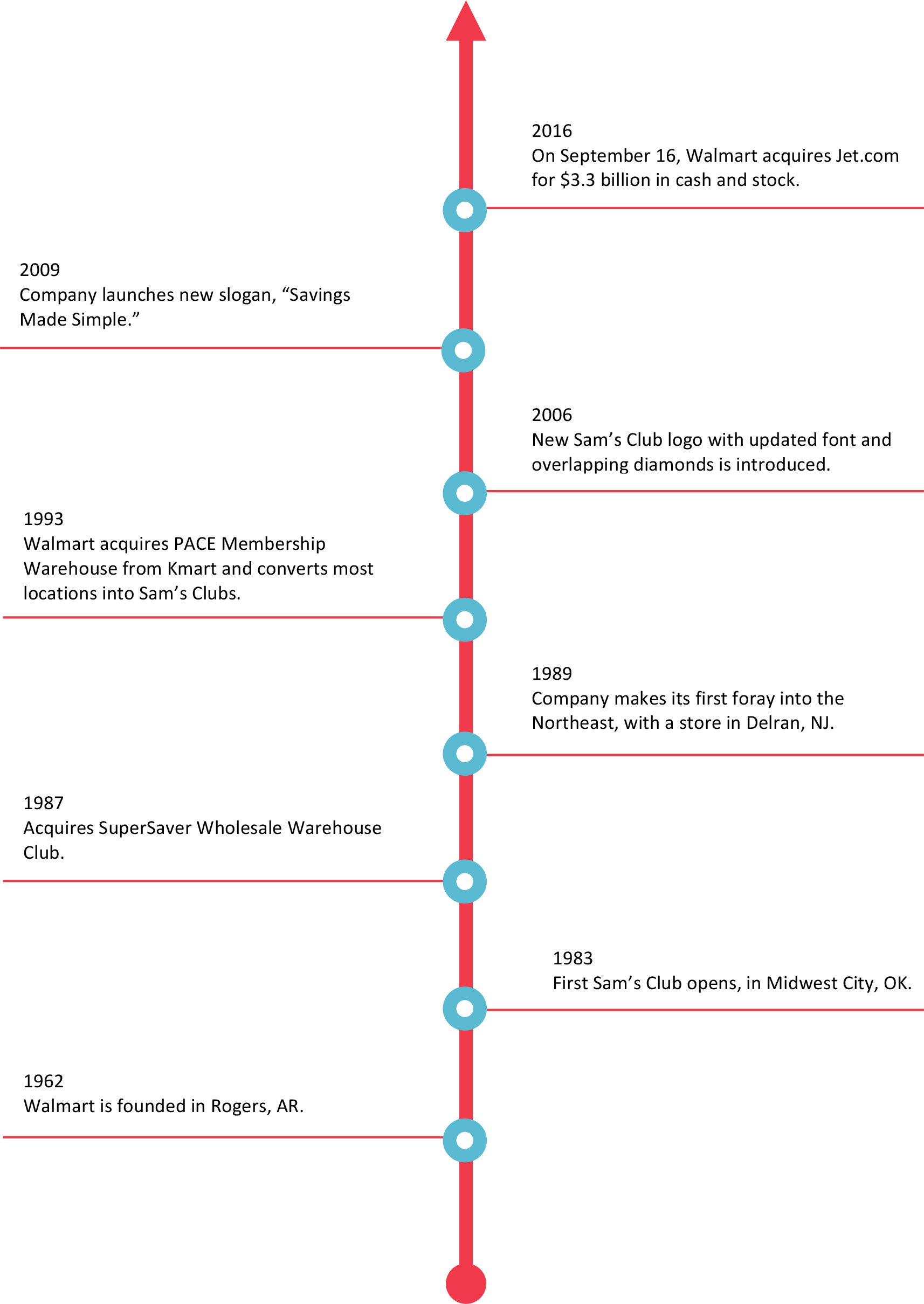

- Sam’s Club was established in 1983.

- The company operates a US-based chain of membership-only retail warehouse clubs owned by Walmart.

- The company is headquartered in Bentonville, AR.

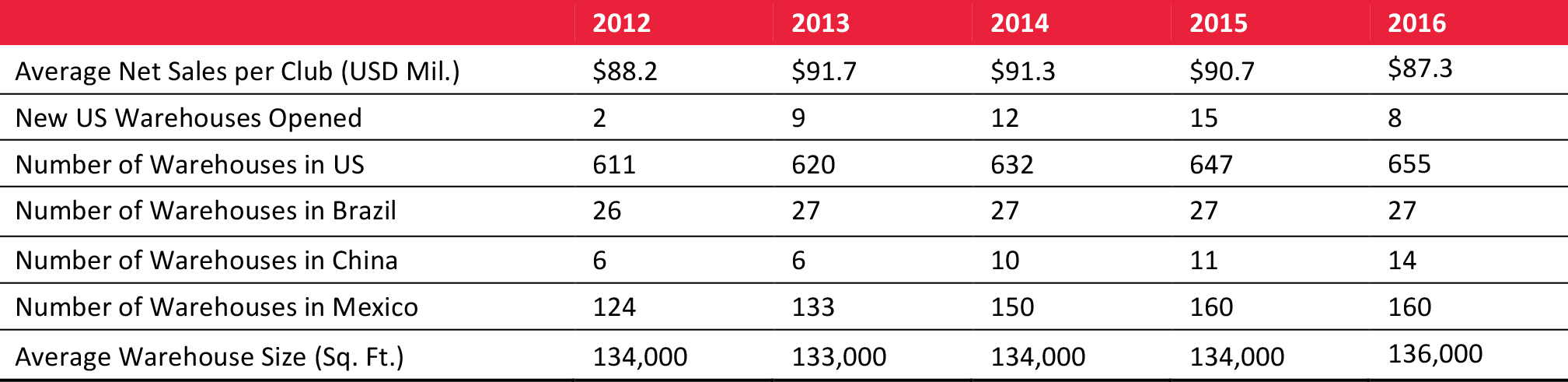

- As of December 1, 2016, the company operated 659 clubs across the US and Puerto Rico, 160 in Mexico, 14 in China and 27 in Brazil.

- Gasoline sales totaled $4.5 billion in fiscal year 2016, at just a 1.6% operating margin.

- The company had more than 110,000 employees as of April 2016.

- Sam’s Club’s fiscal year ends January 31.

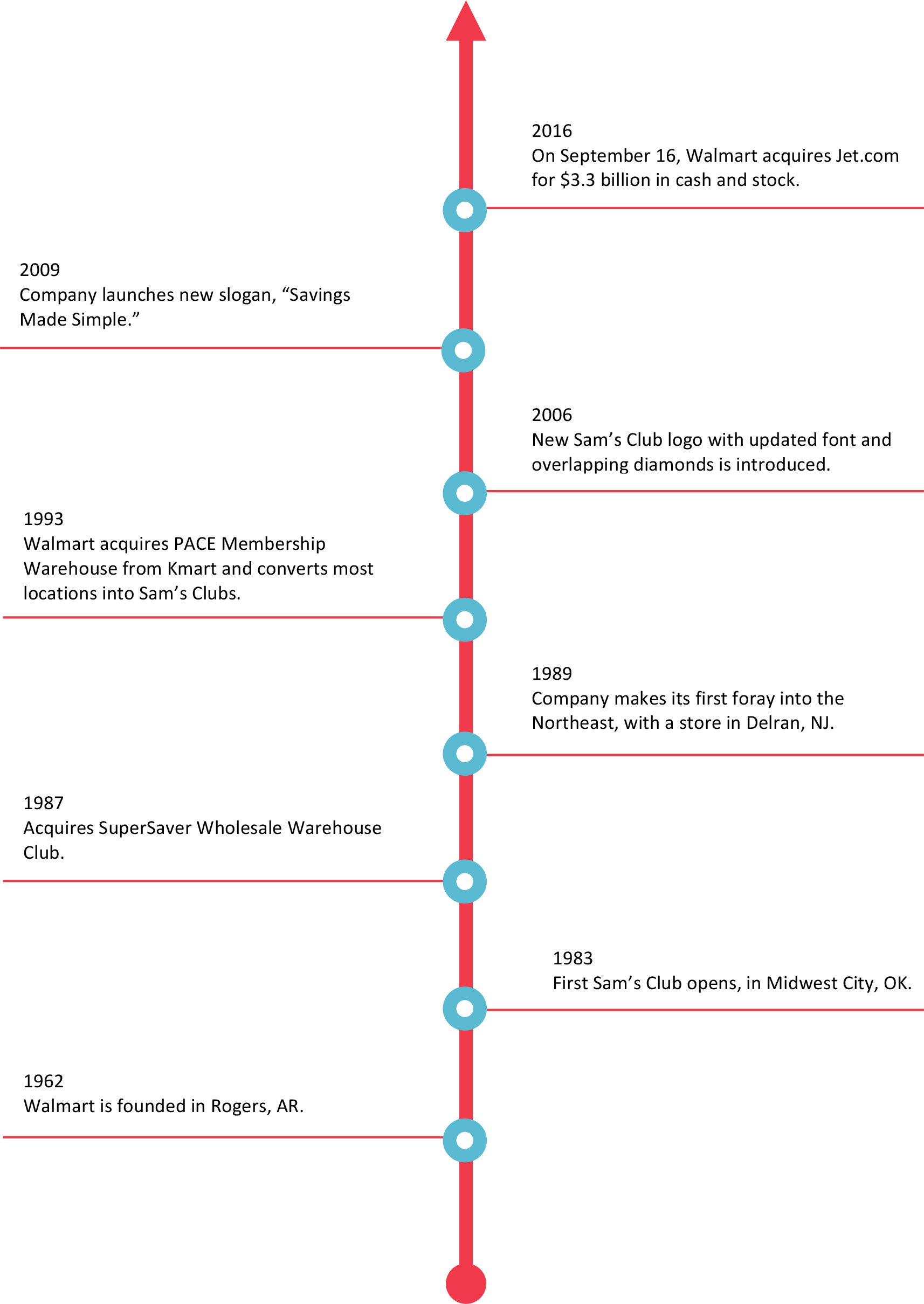

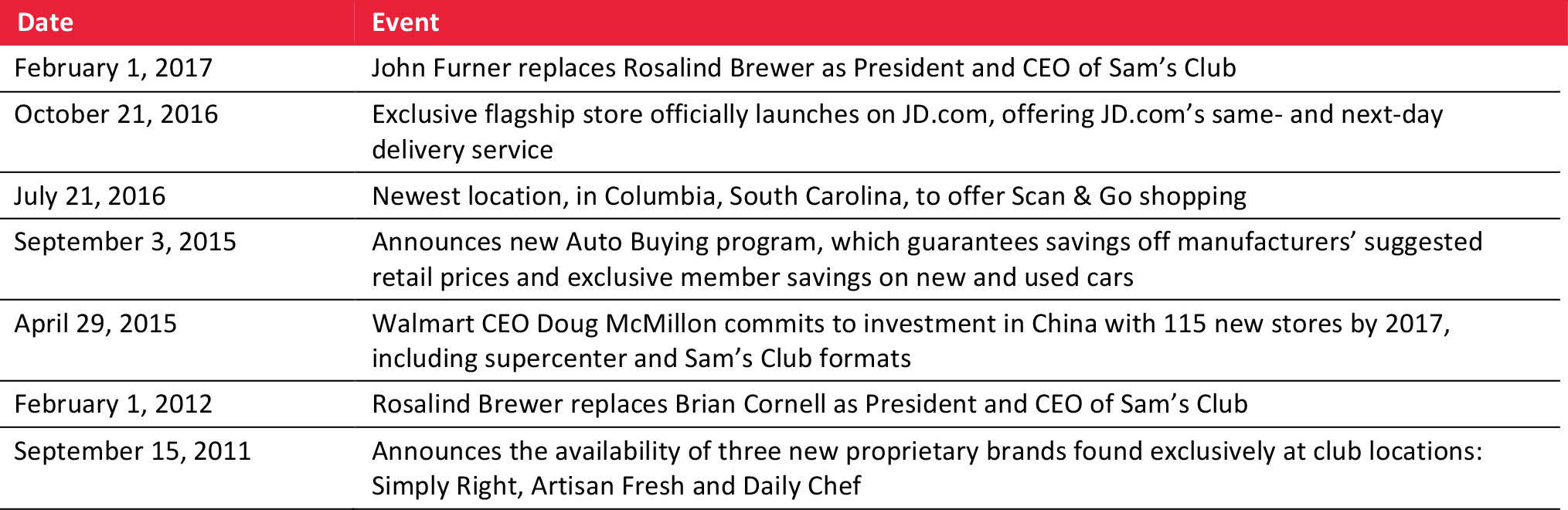

Sam’s Club: Timeline

Source: Company reports

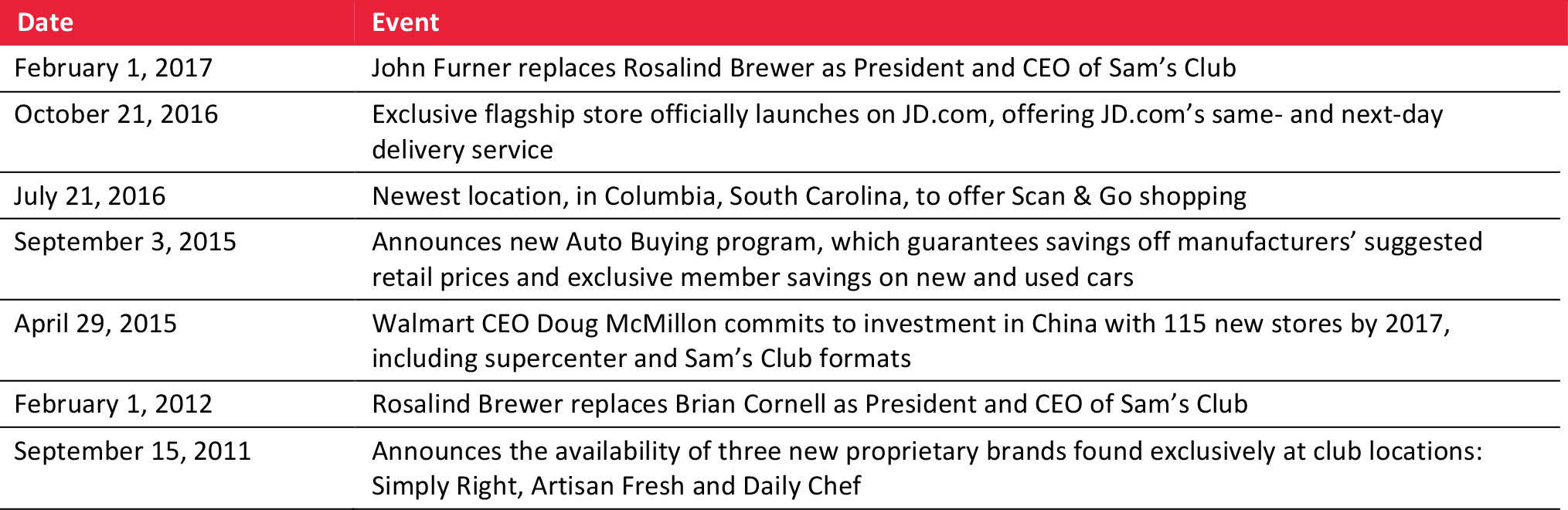

Sam’s Club: Key Recent Events

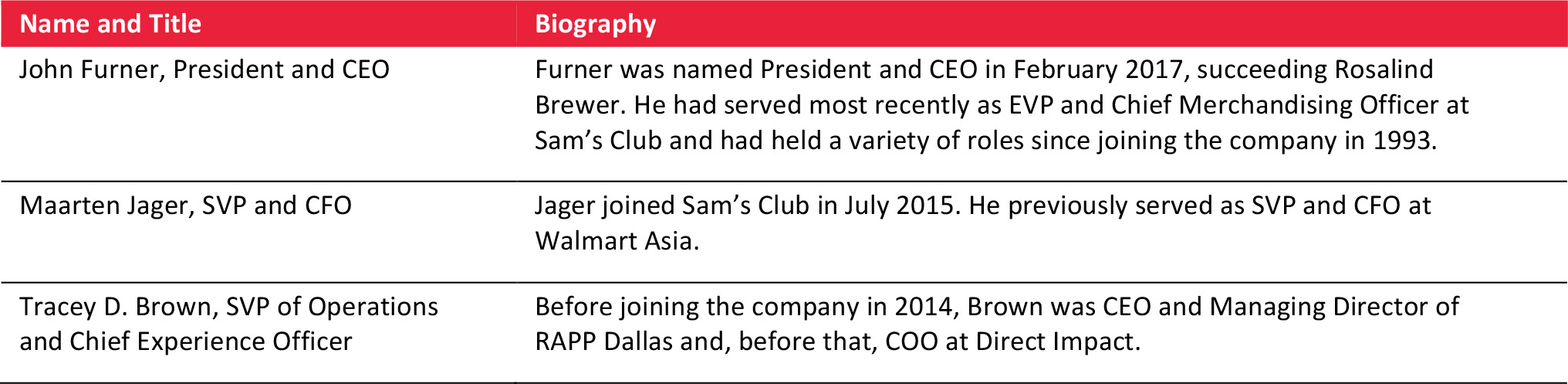

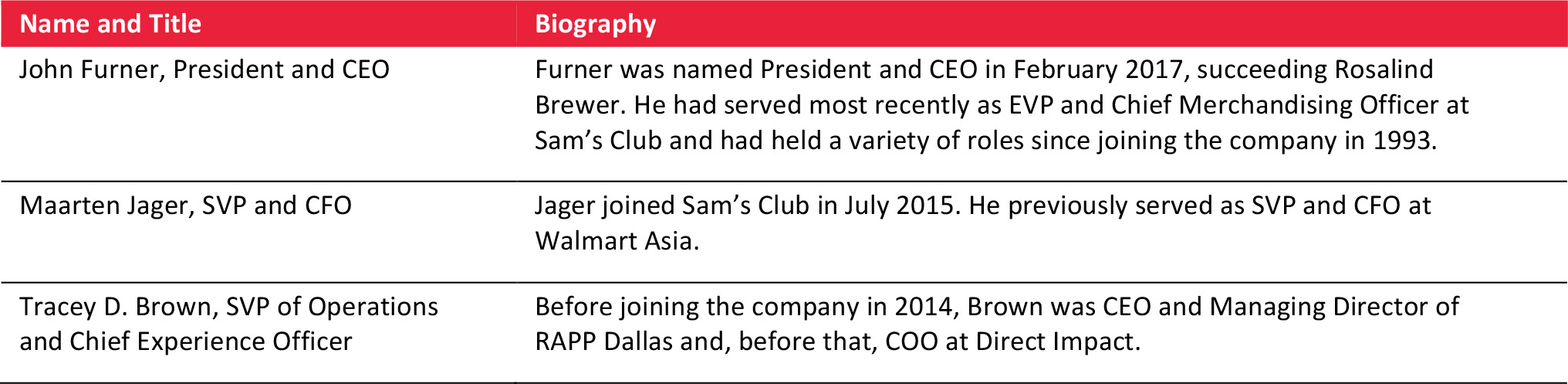

Sam’s Club: Key Management

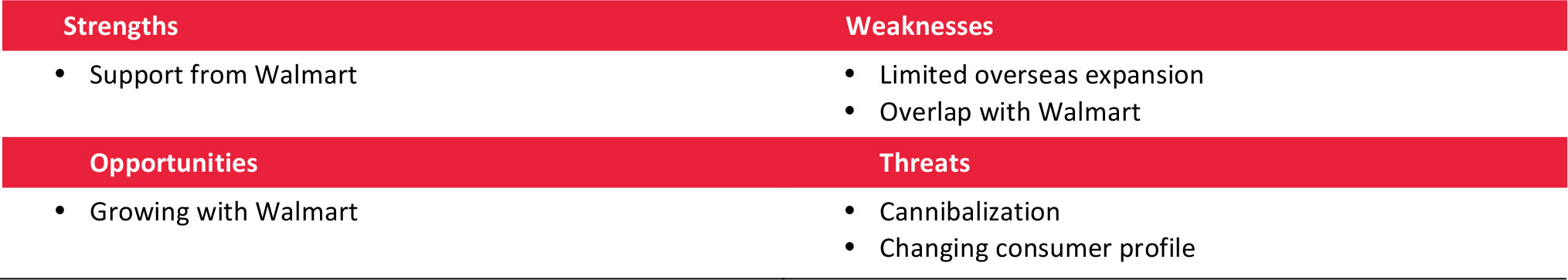

Sam’s Club: SWOT Analysis

Strengths

Support from Walmart: As a subsidiary of Walmart, Sam’s Club benefits from the scale and scope of Walmart’s capabilities as well as from its reputation as the leading global retailer. For example, Sam’s Club can utilize Walmart’s global distribution system and network of suppliers, which gives it an edge over competitors. Sam’s Club is also the first and only warehouse club that has entered the Chinese market.

Weaknesses

Limited overseas expansion: Sam’s Club’s overseas expansion has been limited. The company has 160 stores in Mexico, 27 in Brazil and 14 in China. Walmart CEO Doug McMillon revealed a plan on April 29, 2015, to add to Sam’s Club’s existing fleet of 11 stores in China.

Overlap with Walmart: As a stand-alone concept, Sam’s Club offers a product range that overlaps with Walmart’s supercenter offerings, limiting the club’s expansion opportunities.

Opportunities

Growing with Walmart: Sam’s Club can leverage the experience and scale of Walmart to hone its overseas expansion strategy, especially in China, and to maximize its e-commerce potential through the @WalmartLabs platform. Sam’s Club is the only warehouse club that offers Apple products, and it can apply this strong differentiating factor when expanding in China.

Threats

Cannibalization: In many locations, Sam’s Club and Walmart share a common parking lot, and many higher-income members of Sam’s Club end up shopping at Walmart. This is a well-recognized issue, and Sam’s Club must manage encroachment from Walmart with very tight price comparisons (some of which can be as tight as one cent per unit) and a larger package size. When a larger package size at Sam’s Club does not offer a significantly lower price, it should be cause for alarm.

Changing consumer profile: Big families and small businesses may find Sam’s Club attractive, but smaller, Gen Y families may see Walmart as more suitable for their needs. E-commerce also has introduced new multichannel rivals and online pure plays, including AmazonSupply by Amazon, which directly competes with Sam’s Club for small business customers.

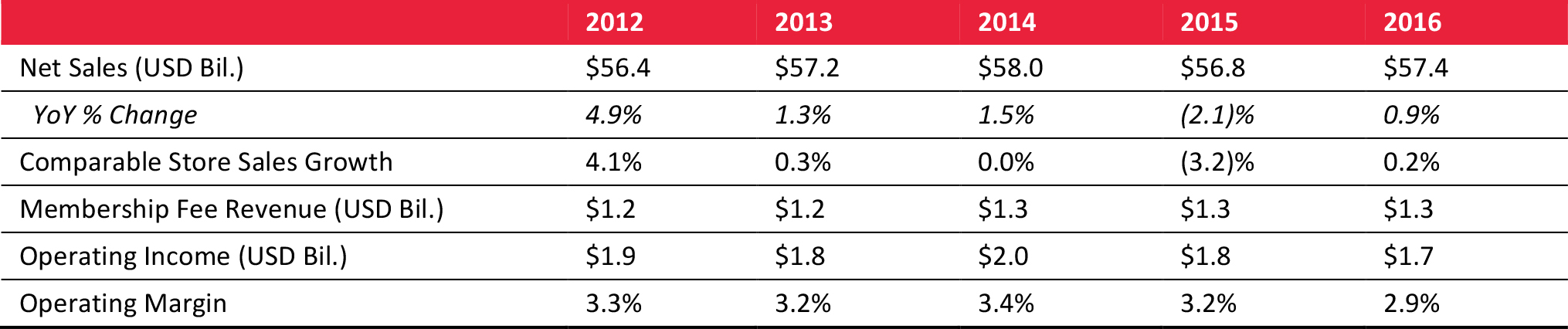

Financial Overview

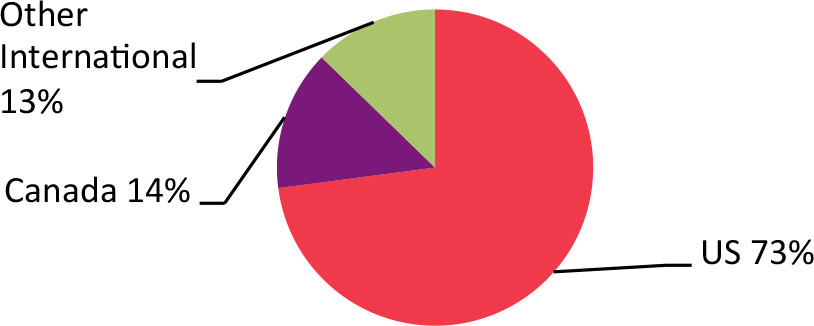

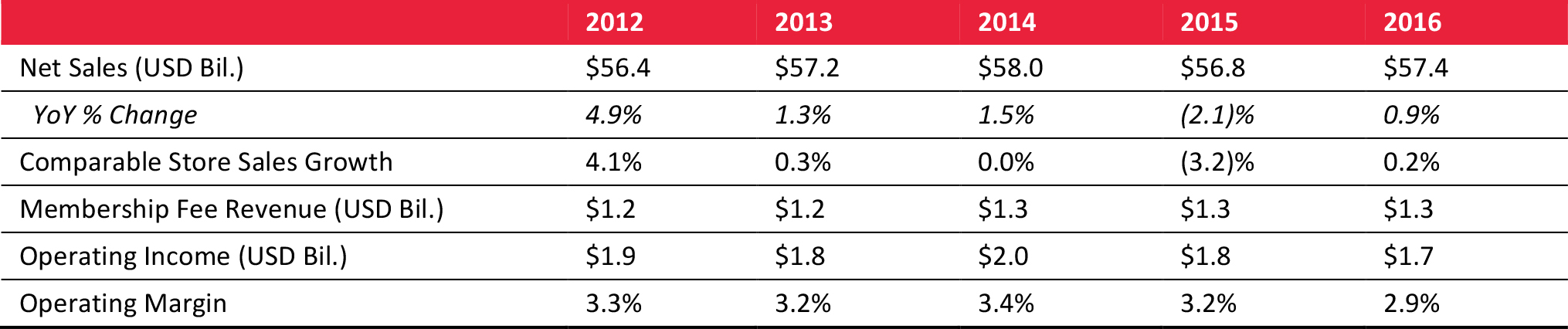

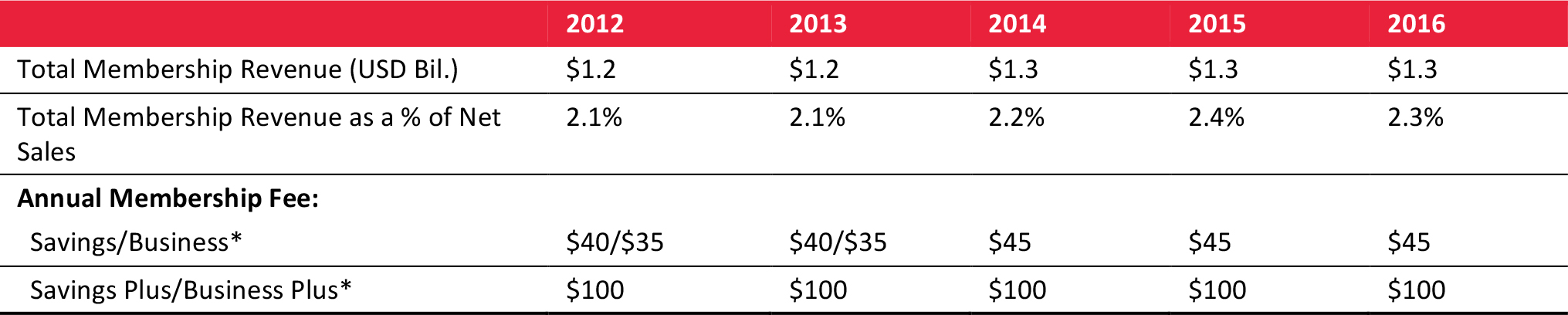

Sam’s Club: Key Metrics

Source: Company reports/Fung Global Retail & Technology

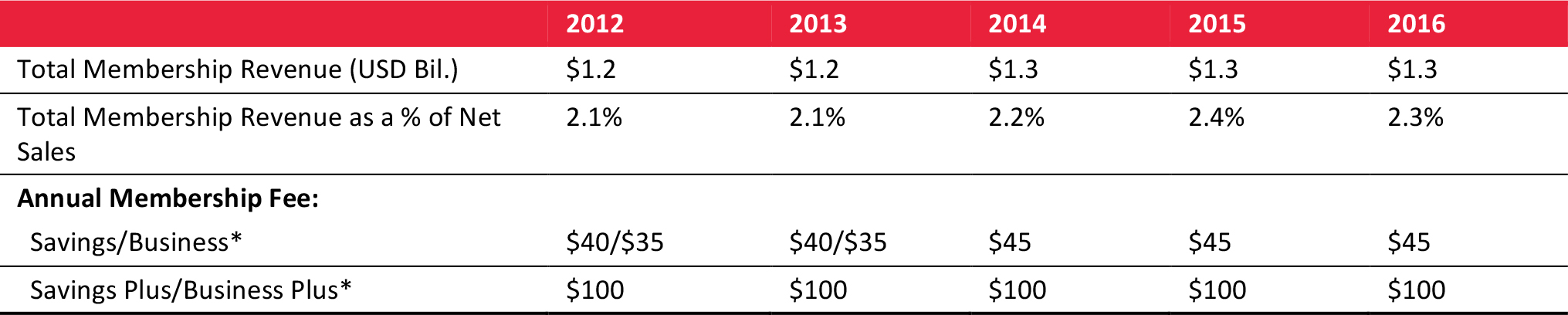

Sam’s Club: Membership Data

*Individual membership was known as Advantage membership until 2013, and its fee was higher than that for a business membership. The name

was changed to Savings membership in 2014 and the annual fee became the same as for Business membership.

Source: Company reports/Fung Global Retail & Technology

Sam’s Club: Product and Service Sales Mix

Source: Company reports

Sam’s Club: Outlet Data

Source: Company reports/Fung Global Retail & Technology

Other Warehouse Clubs

Cost-U-Less

Cost-U-Less operates 13 stores in the South Pacific and Caribbean regions. The chain’s parent company, The North West Company, commented that Cost-U-Less delivered exceptional year-over-year growth in 2015 and that the outlook is favorable in the regions in which Cost-U-Less operates due to tourism and lower energy costs. The 13 stores average 28,406 square feet, for a total sales area of 369,278 square feet. The company had revenues of $225 million in 2007, prior to its acquisition. Presuming the company grew in line with the US sector’s growth rates in the intervening years, it would have had revenues of more than $315 million in 2015, we calculate.

Source: CostULess.com

Makro Belgium

Makro Belgium is a cash-and-carry chain operated by Germany’s Metro Group. Unlike its parent company’s cash-and-carry operations, Makro Belgium’s stores are open to the public; other European Makro stores and all Metro Cash & Carry stores serve only trade customers. In 2014, Metro Group’s six Makro stores and nine Metro-branded cash-and-carry stores in Belgium posted revenues of €1.1 billion (US$1.48 billion), down 5.9% year over year.

PriceSmart

PriceSmart is the largest operator of membership warehouse clubs in Central America and the Caribbean, with more than 1 million cardholders across 36 owned-and-operated warehouse clubs in 12 countries and one US territory. In contrast to other warehouse clubs, PriceSmart operates smaller stores (of 50,000–75,000 square feet), has lower membership fees (averaging $35 per year), and offers merchandise tailored to local preferences and retail and wholesale customers.

Source: PriceSmart.com

Boxed.com

Boxed.com, founded in August 2013, is a startup that appears to be following a similar path to the one taken by Jet.com. Boxed enables customers to order groceries and household goods in large quantities similar to those available at a warehouse club store via a web browser or smartphone app. The company is headquartered in Edison, NJ, and has raised a total of $132.6 million in venture funding. Its most recent, Series C round was for $100 million in January 2016.

Other International Entrants

Warehouse clubs in the US already see competition from traditional retailers and e-commerce, but they will soon face aggressive expansion by German discounters Aldi and Lidl, too. These discounters are well positioned to serve the large, low-cost, bulk-purchase grocery needs

of consumers, making them direct competitors of warehouse clubs. Aldi already operates in the US and Lidl plans to launch in the US in 2018, if not sooner. Lidl has reportedly already been advertising US-based jobs and contacting suppliers to see which can serve US stores. One positive effect of their expansion is that these hard discounters also bring more shoppers into this sector. However, the challenge for warehouse clubs will be to convert some of these discount shoppers to the club format by convincing them that buying from BJ’s, Costco and Sam’s Club is the natural alternative to shopping at discount stores such as Aldi and Lidl.

Identifying Global Market Potential

The US is home to the biggest warehouse club sector in the world, but as the domestic market approaches maturity, where should these retailers look to expand?

To answer that, we created the Market Potential Index, shown below, which charts the attractiveness of 25 major markets that saw at least

$200 billion in total consumer spending in the latest year for which data are available. The index takes as its indicators consumer spending growth (CAGR, 2009–2014) and a lifestyles index based on average home size and access to passenger vehicles. Expanding warehouse clubs will need to decide whether to tap fast-growing markets with relatively low lifestyle suitability or lower-growth mature markets, where big houses and car ownership offer a better fit with the big-box store format.

The “Arc of Potential” in the graphic below identifies countries such as Australia, Brazil, South Africa, Mexico, Turkey, India, Pakistan and China as the strongest candidates for warehouse club expansion. Bearing out our conclusions, Sam’s Club operates in Brazil and Mexico, while Costco is present in Canada, Mexico and Brazil, among other countries. At the same time, our Market Potential Index suggests that there are no easy territories to capture. The top-right corner of the graphic, where very strong candidates for warehouse club expansion would sit, is empty.

Bubble sizes reflect total populations. Russia is also included within the Arc of Potential, based on its historical growth in consumer spending through 2013. However, given the country’s current recession and increasing isolation, the short-term prospects are not as promising as its position along the arc suggests.

NL = Netherlands, CH = Switzerland, AT = Austria, BE = Belgium, PL = Poland, IT = Italy, ES = Spain, SE = Sweden

*The average of a 1–5 index based on passenger cars per 1,000 residents and (where available) average home size, where 5 indicates greater access to passenger cars and larger home sizes.

**Consumer spending CAGR is for 2009–2013 for China, Japan, Poland, Russia, Switzerland and the US; the date range is 2009–2014 for all other countries shown.

Source: OECD/World Bank/national statistics offices of countries shown/Indexmundi.com/Shrinkthatfootprint.com/Fung Global Retail & Technology

Drilling Deeper to Find High-Growth Markets

Consumer spending levels and growth rates: These are helpful metrics for retailers in search of new markets, although high growth does not always directly translate into high demand. Taken in isolation, the spending growth in Asian countries suggests opportunity in those markets, but the strongest growth has been from low base figures.

For discount operators, including warehouse clubs, consumers’ sluggish economic circumstances can create stronger demand. Forced to reassess their shopping activity, consumers in the US and parts of Europe have flocked to the discount channel in recent years, benefiting dollar stores, grocery discounters and warehouse clubs.

Consumer spending per capita: Affluent countries have the highest per-capita spending, but it remains exceptionally low in several emerging markets. This underscores the major scope for warehouse clubs’ long-term growth as well as the likelihood of a boom in middle-class shoppers.

Lifestyle measures: Just because people are spending does not mean they will spend at warehouse clubs. Consumers need access to personal transportation to carry bulk purchases home from the clubs. Because of this, high-growth markets such as India, Pakistan and China look less attractive. In these countries, only a small portion of consumers will be able to easily make the trip to a warehouse club.

Consumers also need space to store bulk purchases if they are going to shop at warehouse clubs. Those in small, city-center apartments or houses require small packages of goods and more frequent shopping trips because they do not have much room to store goods at home. Based on new-construction house sizes, Australia and Canada may be good locations for warehouse club expansion.

Increasing Global Presence

Because warehouse clubs rely on shoppers with cars and large houses to transport and store bulk purchases, not all international markets are suitable. In its fiscal 2016 year, Costco opened eight international warehouses, two each in Canada and Japan and one each in the UK, Taiwan, Australia and Spain. In fiscal 2017, the company plans to open seven warehouses in Canada and one each in Taiwan, South Korea, Japan, Australia, Mexico, France and Iceland. The company also operates e-commerce businesses in the US, Canada and the UK. Costco has a much wider global presence than its biggest rivals do, but the company provides little commentary on the performance of regional markets.

The Pursuit of Global Shoppers: Pros and Cons

Warehouse clubs will face benefits and challenges as they seek to expand or further expand internationally. The pros include the following:

- There are opportunities for warehouse clubs to piggyback on the discount-culture trend. From fashion to grocery, shoppers in countries such as the US and the UK are flocking to off-price and hard-discount retailers. Warehouse clubs need to present themselves as the next step up from discount stores.

- Online retailing provides opportunities to tap a wider audience and serve customers who may be wary of shopping at a physical warehouse store. E-commerce can be a means to draw consumers into the sector, converting them to in-store shoppers once they become more familiar with the club proposition.

- Warehouse clubs are able to change their product mix in response to consumer demand, margin pressures or heightened competition, which is critical for international expansion.

- In developing markets such as China, India and parts of Latin America, the clubs can participate in the consolidation of the retail sector. In India, foreign direct investment is permitted in cash-and-carry wholesale to an extent not allowed in general retail. As a consequence, companies such as Walmart and Metro Group have opened B2B wholesale stores in India.

The cons that warehouse clubs will face include the following:

- The rapid growth of rival discount retail chains—including grocery discounters Aldi and Lidl and dollar/euro/pound stores such as Family Dollar and Poundland—heaps competitive pressure on warehouse clubs.

- The ability to gain traction is dependent on external factors, such as average house size and car ownership. In markets such as the UK and China, where smaller homes are typical, there are limited opportunities for expansion.

- Big-store retailers are already struggling in some markets. Out-of-town hypermarket formats are faltering in some countries, including the UK and China, as shoppers are opting for proximity shopping. In addition, some nonfood retailers are opening smaller store formats closer to urban centers in order to provide convenience that complements the near-endless choice offered by e-commerce. Consumer travel to big-box stores out of town may decrease.

- Competition in general merchandise is hotter than ever.

E-commerce has increased choice for consumers and pushed down prices, so the warehouse clubs’ unique selling proposition of offering bargain-basement prices on categories ranging from furniture to fitness is not so unique any more.

High-growth, developing markets will tend to see business sectors consolidate in the coming years. As small firms lose out to big companies in these markets, we expect the pool of trade customers at warehouse clubs and cash-and-carries to decline.

�

In their 40-year history, warehouse club stores have established a new sector, increased the level of price competition for established retailers, and offered surprise and delight as well as substantial savings for customers, posting a phenomenal run. The clubs benefited particularly from the postwar expansion of the suburbs in the US and from Americans’ desire for savings and mass consumption.

While the clubs were hardly affected by the Year 2000 Internet 1.0 boom, the retail environment in the US and in other countries is changing rapidly with today’s Internet 2.0, and the clubs now face many of the same challenges from e-commerce that other retailers face. While hardly out of the game, the warehouse club sector is expected to see its growth slow, and the clubs have not embraced e-commerce at the same rate as other retailers. Moreover, demographic changes are favoring moves out of the suburbs and into smaller dwellings. Like many other types of retailers, the clubs need to reinvent themselves to adapt to consumers’ increasing reliance on e-commerce, and on m-commerce in particular, in order to reignite growth rates that are faster than the aggregate retail industry’s.

Part One of the report discussed the historical strong growth and performance of the warehouse club sector, its heavy concentration in the US and the top three companies in the space. The analysis revealed that the sector hit an inflection point in 2015 and has experienced a slowing growth trend in recent years that market researchers expect to continue through 2020.

Part Two of the report examined the advantages and challenges warehouse clubs face. Advantages include the economies of scale while providing significant value pricing to customers and a treasure hunt shopping experience that offers unexpected surprises and bargains. Challenges the warehouse clubs face include shifting shopper preferences due to generational and demographic changes, the steady encroachment of e-commerce, and Amazon’s entry into multiple areas of commerce.

Part Three discussed 10 topics affecting the warehouse club sector and retail in general: the changing grocery shopper, e-commerce, mobile commerce, robotics in retail, private labels, the sourcing revolution, ancillary products and services, US market saturation, international expansion, and the brief independence of Jet.com. The report concluded with profiles of the top three US warehouse clubs and an analysis of the attractiveness of selected global markets.

In this section, we analyze the key topics that are influencing the warehouse club sector and explore how the warehouse clubs might best respond and position themselves in order to benefit from shifting trends.

In this section, we analyze the key topics that are influencing the warehouse club sector and explore how the warehouse clubs might best respond and position themselves in order to benefit from shifting trends.

The Changing Grocery Shopper

The Changing Grocery Shopper Demographic Shifts Alter Consumer Behavior

Demographic Shifts Alter Consumer Behavior

E-Commerce

E-Commerce The current model of retailers offering free in-store collection but charging for home delivery could change. In the UK, premium department store chain John Lewis recently announced plans to apply a collection fee on Internet orders under £30 (US$46). For warehouse clubs built on low margins and high volumes, collection fees—or offering free collection only with premium-level memberships—could be a way to mitigate the costs of fulfilling online orders.

The current model of retailers offering free in-store collection but charging for home delivery could change. In the UK, premium department store chain John Lewis recently announced plans to apply a collection fee on Internet orders under £30 (US$46). For warehouse clubs built on low margins and high volumes, collection fees—or offering free collection only with premium-level memberships—could be a way to mitigate the costs of fulfilling online orders.

Mobile Commerce

Mobile Commerce Warehouse clubs must continue to find ways to embrace the global wave of smartphone usage in order to maintain their appeal among the generation for which smartphones are key to almost every aspect of life. We think location-based services and mobile payments hold particular potential in terms of shaping the future shopping experience.

Mobile devices make it much easier for shoppers to browse and buy whenever and wherever they want, and mobile commerce (m-commerce) is booming as a result. Mobile transactions are replacing desktop e-commerce, and they have the potential to significantly impact in-store shopping, too. Market research company eMarketer estimated that m-commerce would account for 24.1% of all e-commerce transactions in 2016.

Sam’s Club is leading the US warehouse club sector in m-commerce. Its mobile app offers online shopping for items unavailable in the company’s physical locations, access to personalized savings coupons, a photo center for printing pictures and click-and-collect capabilities. In addition, the app features a barcode and QR code scanner that allows shoppers to view detailed product information on their smartphone by scanning a product’s tag while shopping in a Sam’s Club.

Warehouse clubs must continue to find ways to embrace the global wave of smartphone usage in order to maintain their appeal among the generation for which smartphones are key to almost every aspect of life. We think location-based services and mobile payments hold particular potential in terms of shaping the future shopping experience.

Mobile devices make it much easier for shoppers to browse and buy whenever and wherever they want, and mobile commerce (m-commerce) is booming as a result. Mobile transactions are replacing desktop e-commerce, and they have the potential to significantly impact in-store shopping, too. Market research company eMarketer estimated that m-commerce would account for 24.1% of all e-commerce transactions in 2016.

Sam’s Club is leading the US warehouse club sector in m-commerce. Its mobile app offers online shopping for items unavailable in the company’s physical locations, access to personalized savings coupons, a photo center for printing pictures and click-and-collect capabilities. In addition, the app features a barcode and QR code scanner that allows shoppers to view detailed product information on their smartphone by scanning a product’s tag while shopping in a Sam’s Club.

Robotics in Retail

Robotics in Retail Supply Chain Digest reported that Amazon is using at least 15,000 warehouse robots for its own operations, which the company estimates could achieve savings of $400–$900 million. Amazon’s acquisition of Kiva Systems for $775 million in May 2012 was instrumental to its deployment of robotics. Kiva’s robots zip along a warehouse floor, retrieve items from shelves/pallets, and transfer them to cartons and totes. Kiva reportedly had more than $100 million in revenue in 2010, and a Kiva startup kit costs $1–$2 million. Setting up and programming a Kiva system requires six months of planning and testing, as well as logistics training for employees. Prior to the acquisition, Kiva’s customer list included Crate and Barrel, Gap, Office Depot, Staples and Walgreens.

In addition to Kiva’s robots, Amazon uses Robo-Stow, a robotic arm it developed, as well as machine-vision systems that can unload and register a trailer full of goods in half an hour (instead of hours) and a graphically oriented software package for order fulfillment.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business, as well as to tape and stamp shipping labels on packages. Using an algorithm developed at Walmart Labs in Silicon Valley, the company has been able to locate and sort items more efficiently and reduce delivery time by 15%. Walmart’s distribution centers still employ human labor, too, and robots increasingly work side by side with humans.

Supply Chain Digest reported that Amazon is using at least 15,000 warehouse robots for its own operations, which the company estimates could achieve savings of $400–$900 million. Amazon’s acquisition of Kiva Systems for $775 million in May 2012 was instrumental to its deployment of robotics. Kiva’s robots zip along a warehouse floor, retrieve items from shelves/pallets, and transfer them to cartons and totes. Kiva reportedly had more than $100 million in revenue in 2010, and a Kiva startup kit costs $1–$2 million. Setting up and programming a Kiva system requires six months of planning and testing, as well as logistics training for employees. Prior to the acquisition, Kiva’s customer list included Crate and Barrel, Gap, Office Depot, Staples and Walgreens.

In addition to Kiva’s robots, Amazon uses Robo-Stow, a robotic arm it developed, as well as machine-vision systems that can unload and register a trailer full of goods in half an hour (instead of hours) and a graphically oriented software package for order fulfillment.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business, as well as to tape and stamp shipping labels on packages. Using an algorithm developed at Walmart Labs in Silicon Valley, the company has been able to locate and sort items more efficiently and reduce delivery time by 15%. Walmart’s distribution centers still employ human labor, too, and robots increasingly work side by side with humans.

Private Labels

Private Labels

The Sourcing Revolution

The Sourcing Revolution for many industries. For example, garment manufacturing still relies on human labor, and emerging technologies such as machine vision systems that track stitching and maneuver materials are still a long way from being commercially viable on a large scale.

for many industries. For example, garment manufacturing still relies on human labor, and emerging technologies such as machine vision systems that track stitching and maneuver materials are still a long way from being commercially viable on a large scale. Ancillary Products and Services

Ancillary Products and Services

US Market Saturation?

US Market Saturation?

International Expansion

International Expansion The Brief Independence of Jet.com

The Brief Independence of Jet.com

BJ’s

BJ’s

Costco

Costco

Sam’s Club

Sam’s Club