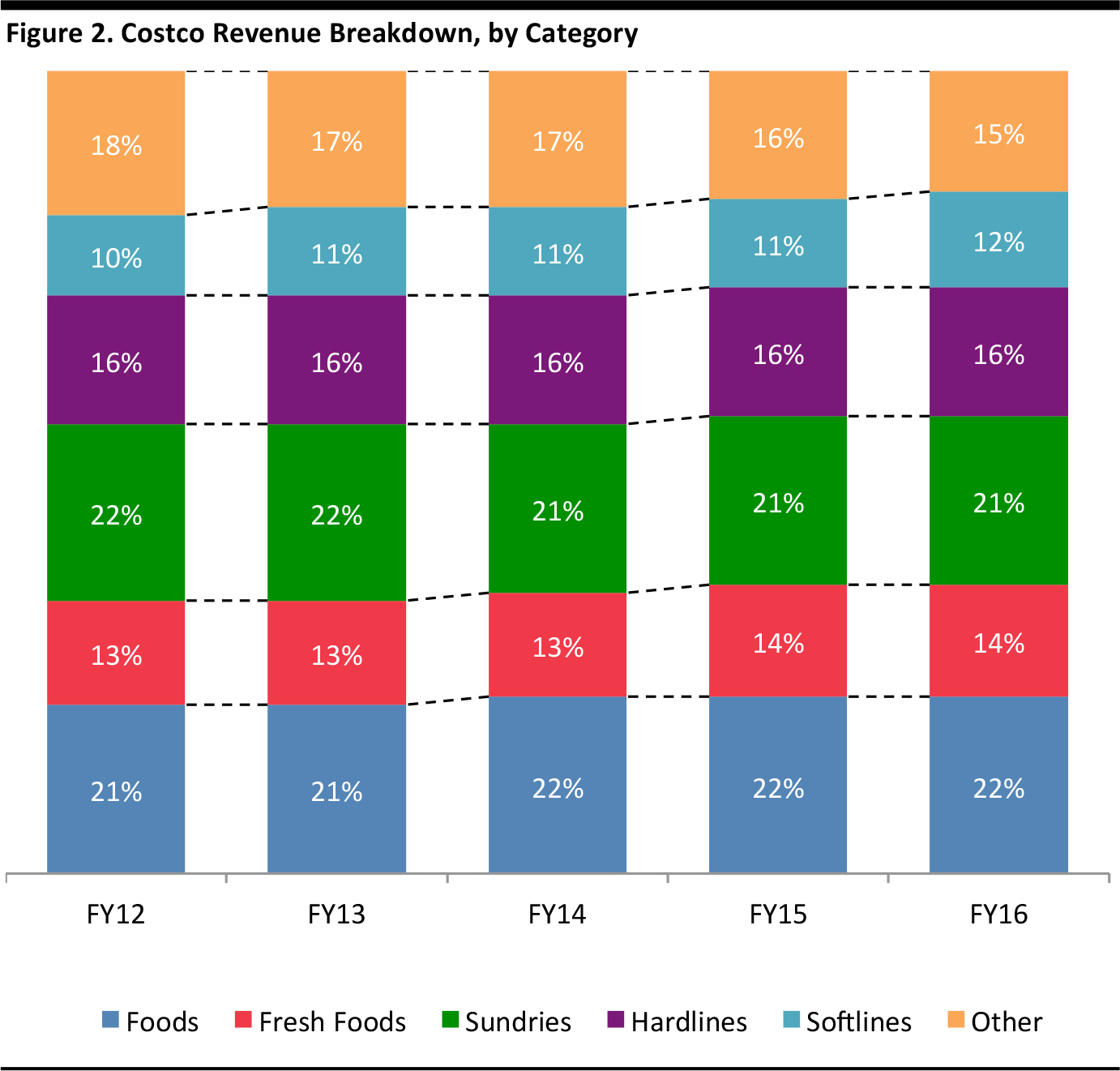

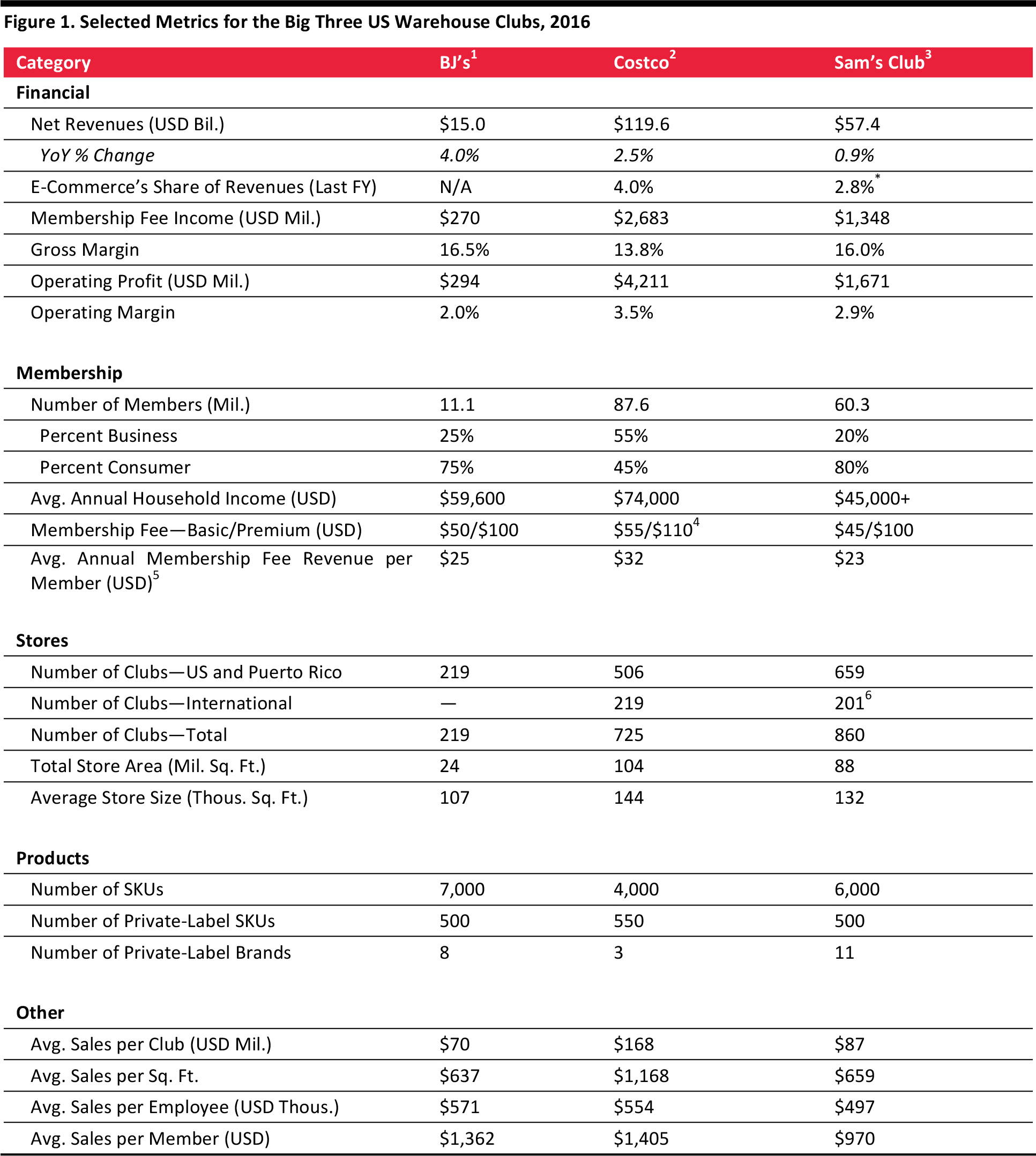

Warehouse Club Companies at a Glance

*For parent company Walmart

Source: Company reports/eMarketer/US Census Bureau/Fung Global Retail & Technology

Economies of Scale Maximize Efficiency

Warehouse clubs offer members the lowest possible retail prices, sometimes reaching wholesale levels. A large membership base enables the clubs to purchase large volumes at low cost. Beyond that, limiting the number of SKUs they purchase to just 4,000–8,000 enables warehouse clubs to purchase even larger volumes in fewer categories, which helps them maintain a cap on gross margins on behalf of their customers. In this way, the sector achieves economies of scale that competitors in other retail formats—including the mass merchandise, discount, consumer electronics and supermarket formats—cannot easily achieve, given their larger offerings of 25,000–100,000 SKUs. In many categories, consumers can find substantial savings at warehouse clubs. Compared with prices at local grocers, for example, the average savings can be 65% or more.

A limited merchandise selection also enables the clubs to maximize efficiency in product distribution, handling, stocking and merchandising. Fewer SKUs drive superior inventory turns, too. Since the narrow choice leads to sales of what is available, as long as the items are desirable, those sales drive inventory turns. While the clubs’ actual gross margin dollars may be below those of mass merchants or supermarkets, greater turns generate more in gross margin dollars per SKU.

Expanded Product Mix Attracts Shoppers

While selling national brands (in both food and nonfood categories) at very low prices is the clubs’ value proposition, the chains are increasingly selling private-label products and adding businesses, such as gas filling stations, pharmacies, auto maintenance services and optical centers.

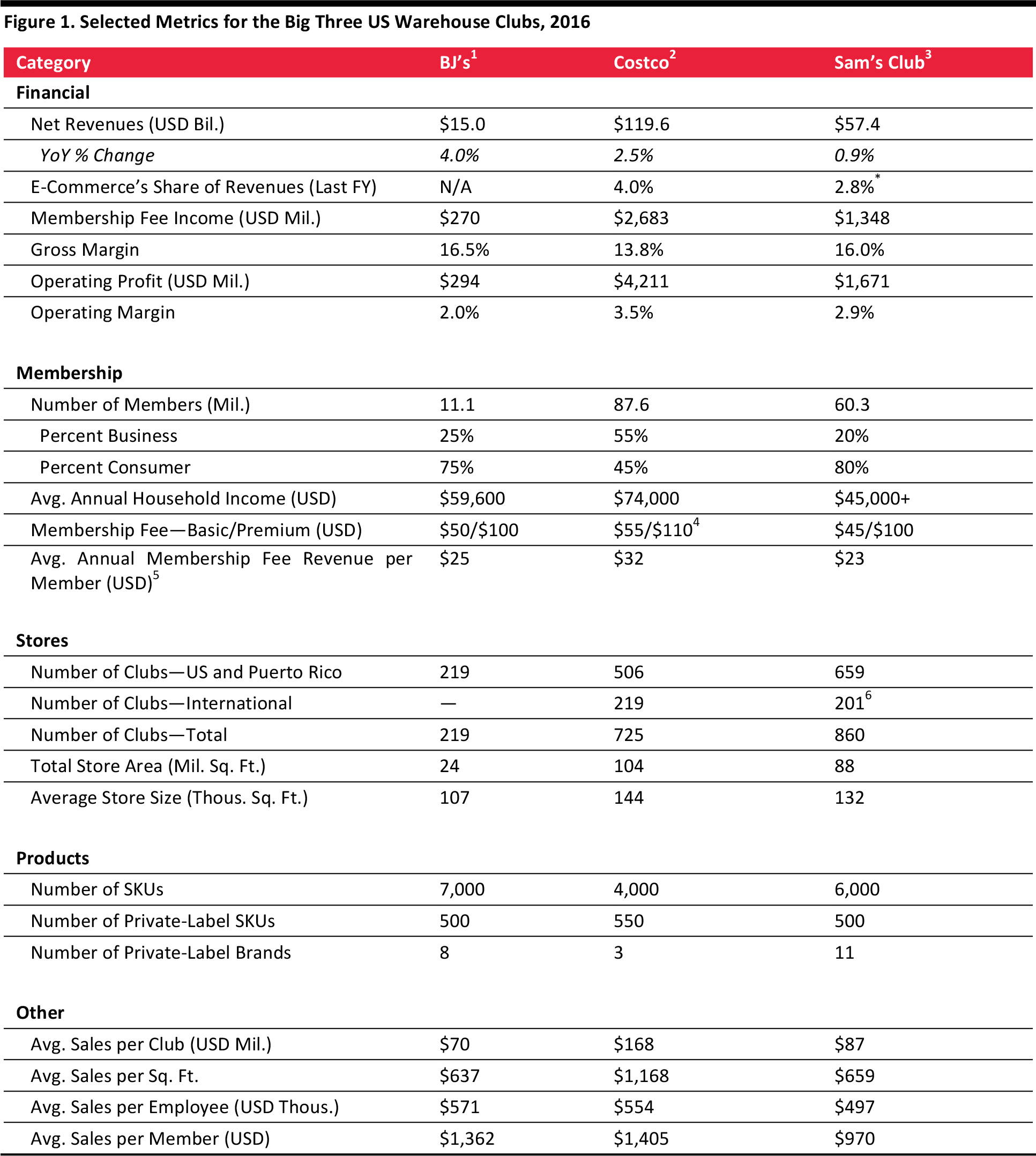

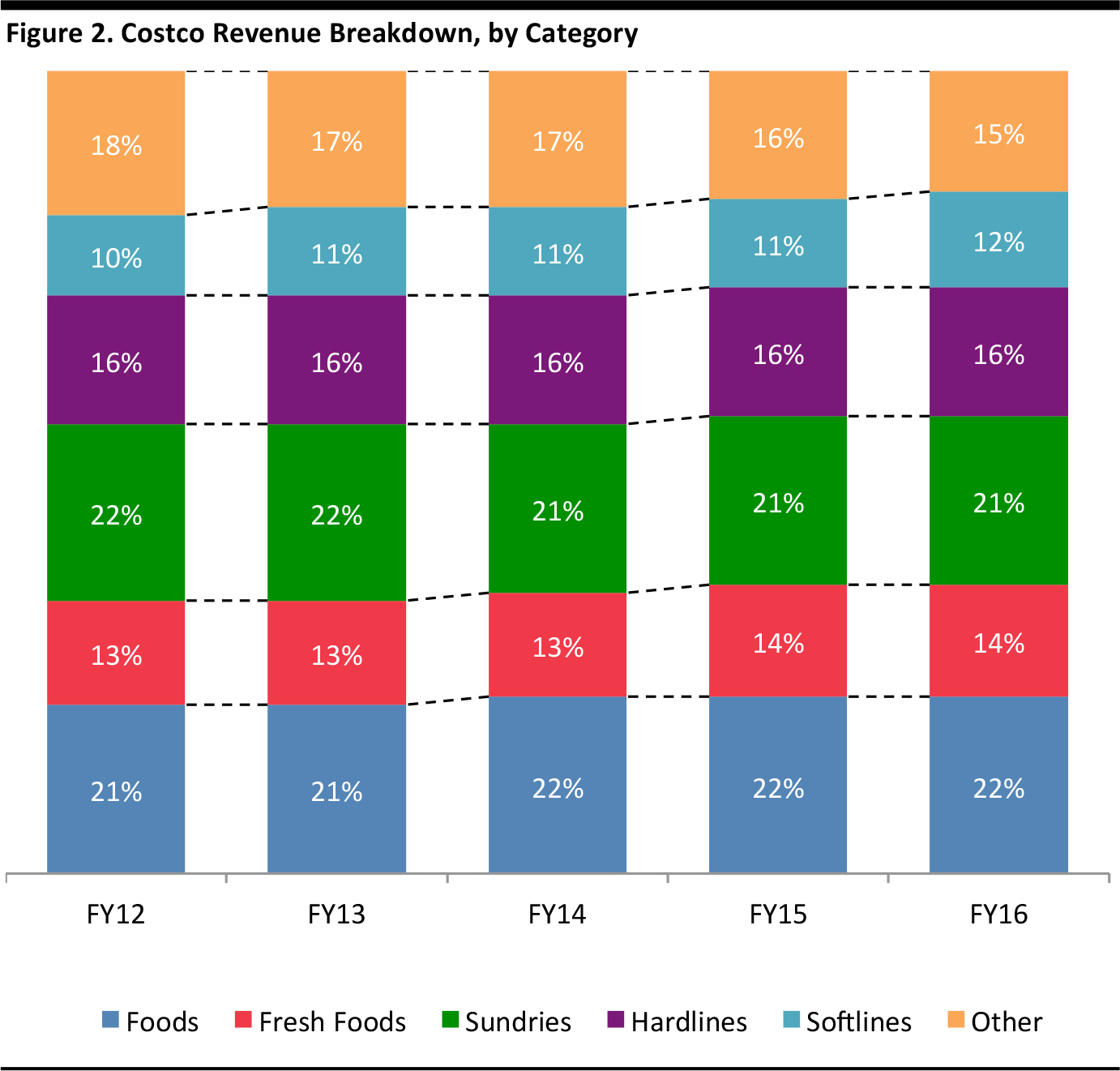

The figure below shows that Costco’s revenue share by category has remained fairly constant during the past five years, though foods, fresh foods and softline goods have experienced slight increases. Together, foods and fresh foods represent more than one-third of Costco’s revenues.

Source: Company reports

Value, Treasure Hunt and Organics Appeal to Consumers

Warehouse clubs appeal to consumers on a number of fronts aside from offering value. They also offer a shopping experience that has a treasure hunt aspect, as certain items may be available only during a single visit, rather than every time a shopper visits the store. In addition, the clubs appeal to their members by offering a range of organic items, which have grown in popularity over recent years.

The bargain: Warehouse club members enjoy knowing they are getting the best deal possible. The no-frills shopping environment of the clubs, along with their lack of advertising, communicates the value proposition to members—no unnecessary expenditures will threaten the savings passed along to members. (Multivendor mailers paid for by warehouse clubs are used for marketing, but these often contain coupons that make the deals even better.)

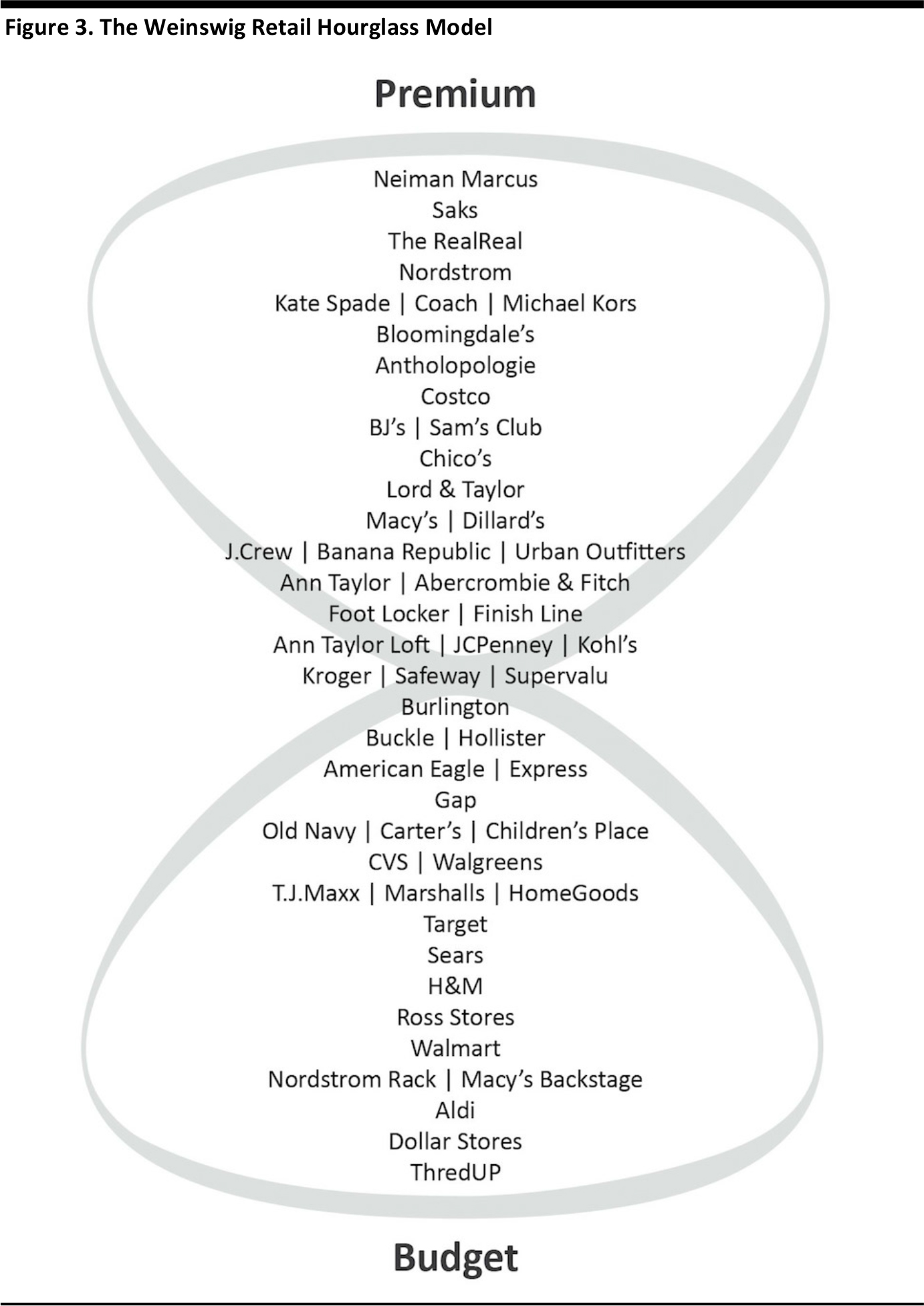

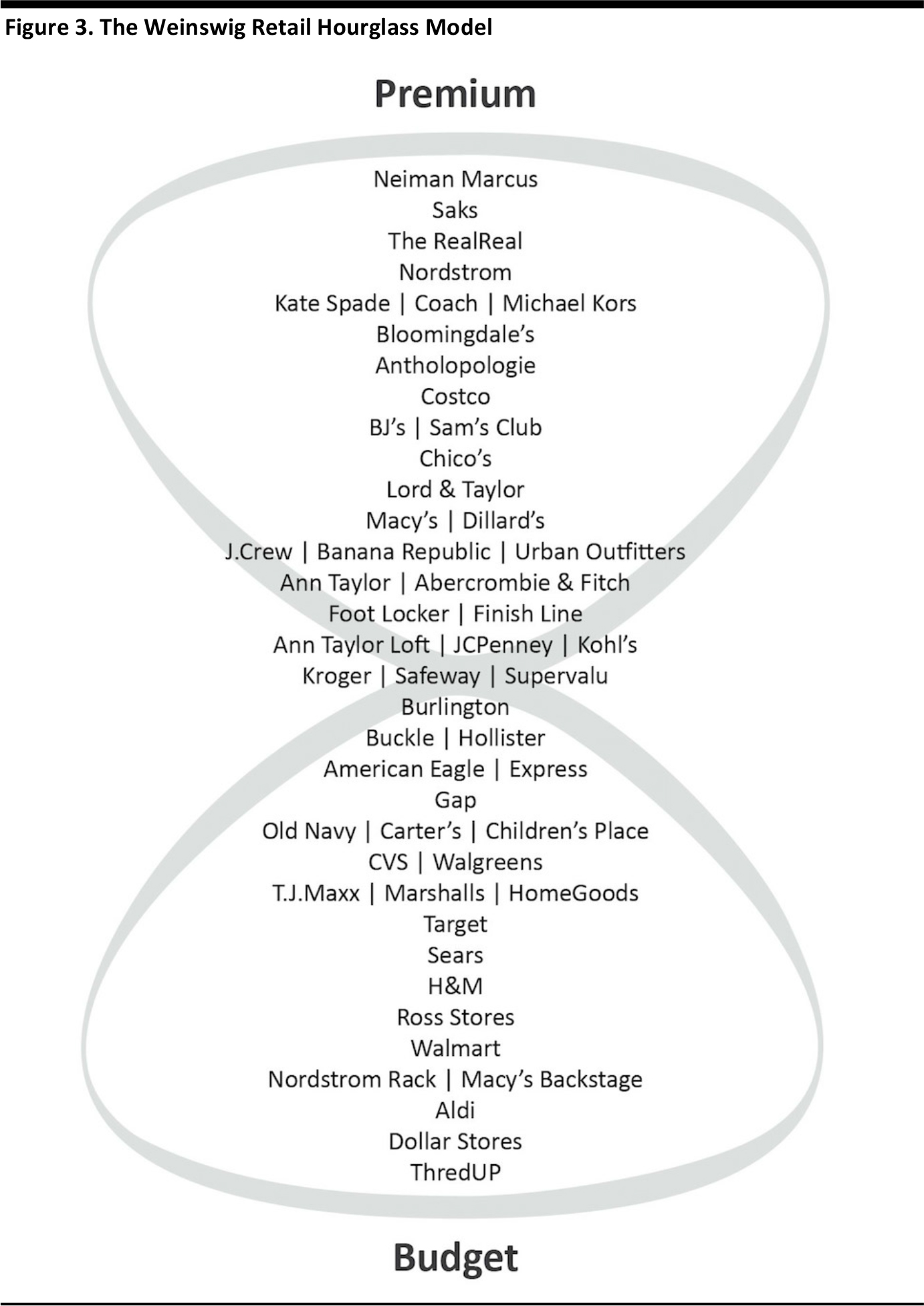

Little luxuries and big luxuries: Frugal warehouse club shoppers still want luxuries, and the club format offers those at very competitive prices. The combination of high-end and low-end products makes warehouse clubs even more of a destination for shopping. As the Weinswig Retail Hourglass model below illustrates, high- and low-end retailers are enjoying success, while those in the midmarket are not faring as well. Warehouse club members can afford to splurge on a few luxury items by trading down on other items in their shopping cart.

The treasure hunt: A steady flow of high-end, unique merchandise is a constant at warehouse clubs, creating a treasure-hunt experience for shoppers. This merchandising strategy includes a “buy it now” factor, as a product may not be in stock on the member’s next visit. Moreover, saving money by shopping in a warehouse club allows consumers to justify the reward of a value-priced treasure. Treasures at Costco include a changing assortment of fine jewelry and the Polish Stoneware collection in housewares. At Sam’s Club, a KitchenAid grill was recently offered at a 30% discount to its original, $1,299.99 price tag. About 25% of Costco’s revenues derive from treasure-hunt items, according to a recent Forbes article.

Organics: Warehouse clubs pride themselves on discovering new items that will interest their affluent membership and generate sales. “Organic” is the new buzzword in food and health and beauty aids and, for warehouse club operators, organics represent their core sector tenets, combining quality and the fun of a treasure hunt with exclusive and hard-to-find products. Costco more than doubled its number of organic offerings from 50 a few years ago to more than 130 in 2016. The company recently exceeded $4 billion in annual organics sales, bypassing Whole Foods Market to take the number-one spot in terms of organics sales. Generally, organics have a higher price point and higher profit margin than do nonorganics, driving up the average transaction value.

�In the Sweet Spot of the Weinswig Retail Hourglass

Although performance varies by chain, budget-friendly warehouse clubs have benefited from the bifurcation in US retail, characterized by Fung Global Retail & Technology’s Weinswig Retail Hourglass model. The model illustrates that premium stores at the top end, such as Nordstrom, and budget retailers at the value end, such as Walmart, are flourishing. Meanwhile, midmarket department stores, such as JCPenney and Kohl’s, are languishing.

Source: Fung Global Retail & Technology

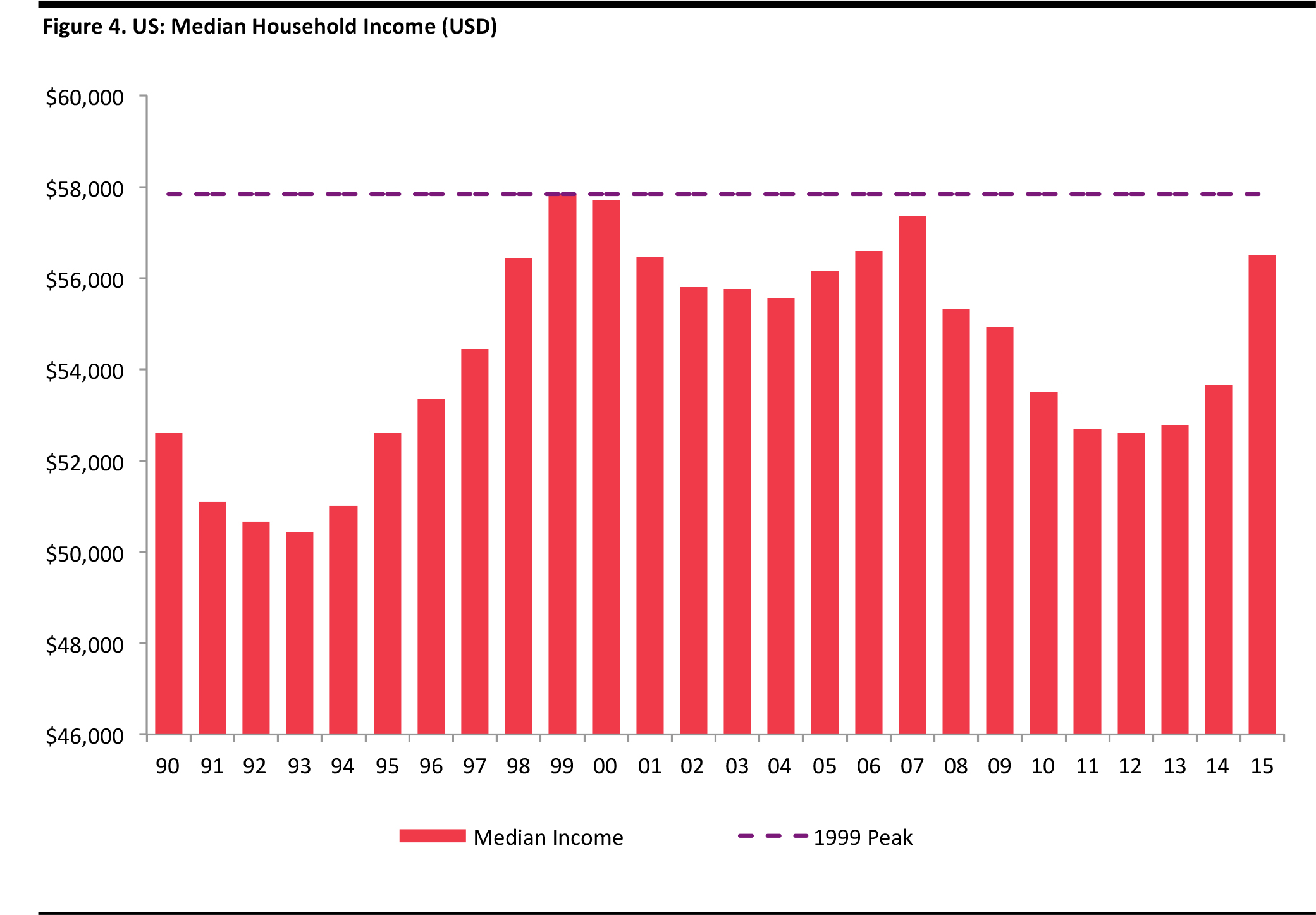

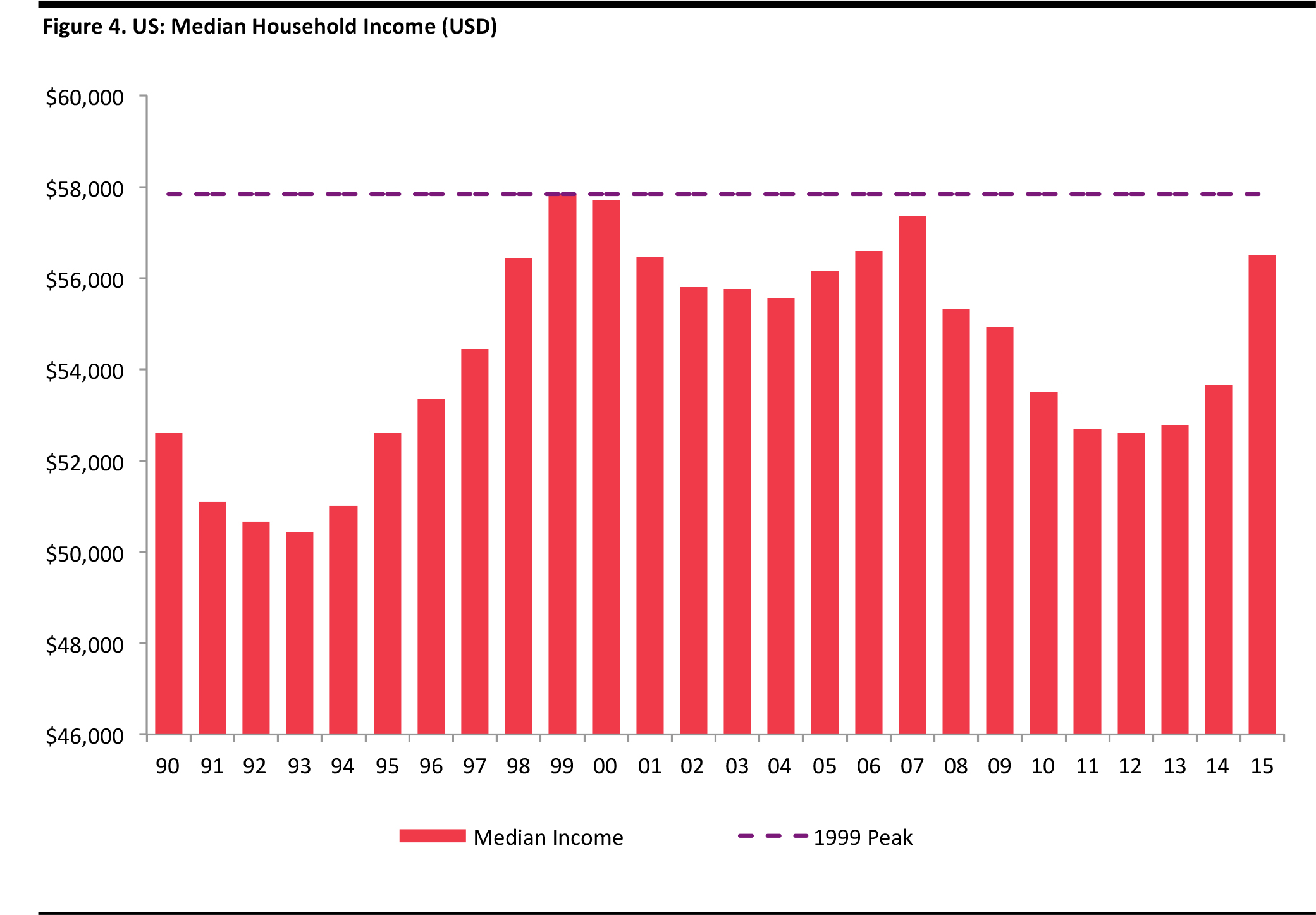

he hourglass model itself is representative of the shrinking middle class in the US. Median household income has resisted growth since hitting a peak of $57,843 in 1999. It nearly returned to its previous high in 2007 before falling to a recent low of $52,605 in 2012.

Source: US Census Bureau

According to the Pew Research Center, the US wealth (net assets) gap between upper-income and middle-income families is now the widest on record since 1983, at 6.6 times, reflecting no wealth growth for middle- and lower-income families. Data from 2012 underline the three-decade saga of middle-class stagnation. Against this macroeconomic backdrop, it is no surprise that the middle ground in US retail is under pressure.

Fortunately for warehouse clubs, frugality has become the new normal in the postrecession recovery. While that frugality certainly plays to the competitive advantages of warehouse clubs, the clubs also benefit by touching upon the luxury end of the Weinswig Retail Hourglass, as they offer some luxury items at very competitive prices to indulge customers. The clubs’ ability to play at both the high and low ends of the retail market is powerful.

Generational and Demographic Changes in Shopper Preferences

Much has changed in retail in the 60-plus years since entrepreneur Sol Price opened his very first store, a FedMart, in an airplane hangar in San Diego, California. In the intervening decades, we have seen Walmart rise to prominence, the advent and expansion of the Internet and e-commerce, and significant changes in demographic and social trends. The rise of warehouse club stores seems predicated on the suburbanization in the US that picked up after World War II, which drove an increase in consumption and the consumer economy.

In recent years, it has become fashionable, particularly among twentysomethings, to move back to urban centers, which are characterized by small apartments rather than by the large houses common in suburbs. These younger consumers are more likely to share assets, such as cars, and to use public transportation—which makes transporting bulk quantities of goods from a warehouse store impractical and unwieldy. Moreover, the low prices and convenience offered through e-commerce, mobile commerce, and subscription and other services make it possible for shoppers to have goods easily shipped to their homes now, eliminating the need to drive and load a vehicle at a warehouse store. These are only some of the challenges that warehouse clubs face in terms of future growth.

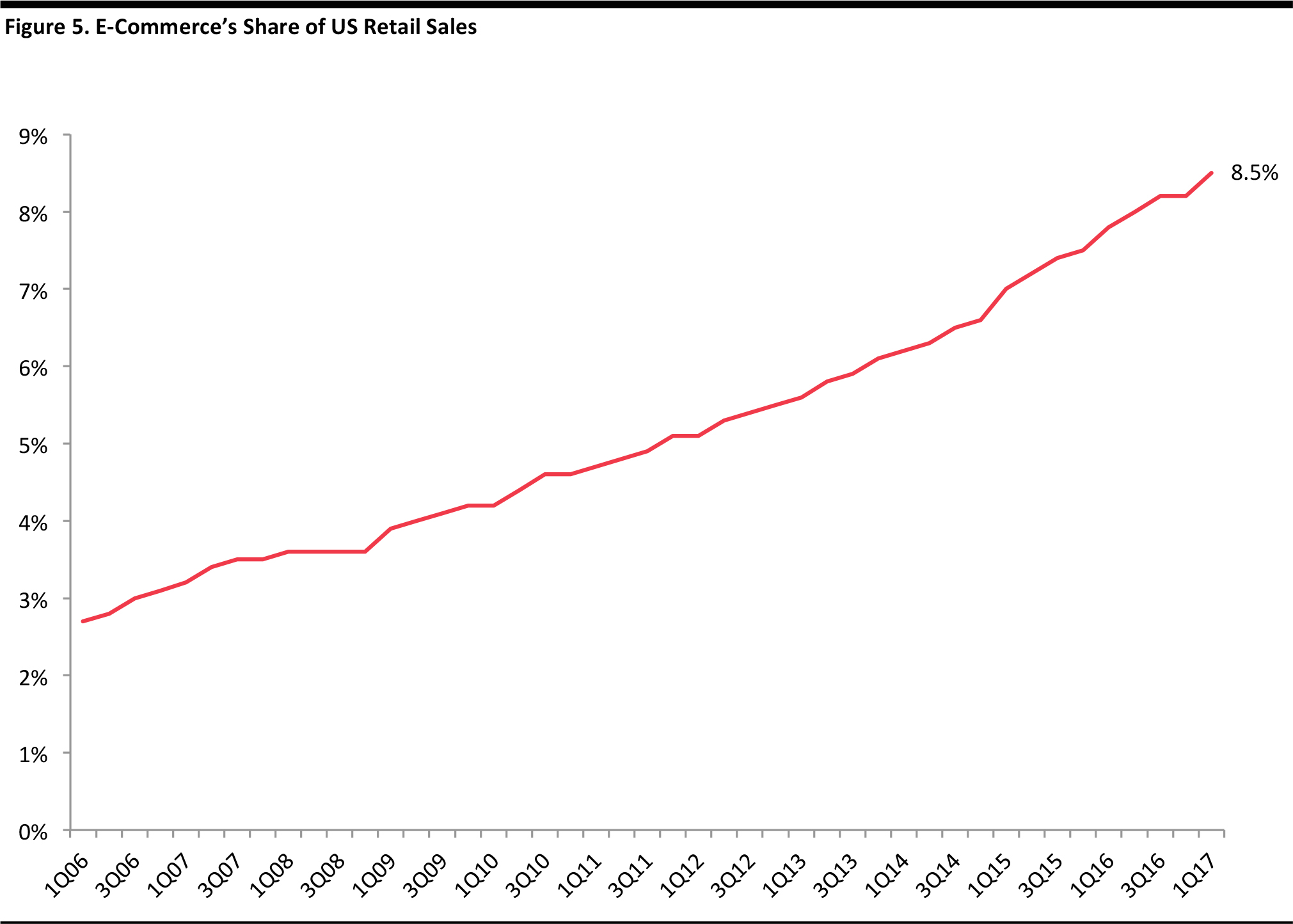

E-Commerce

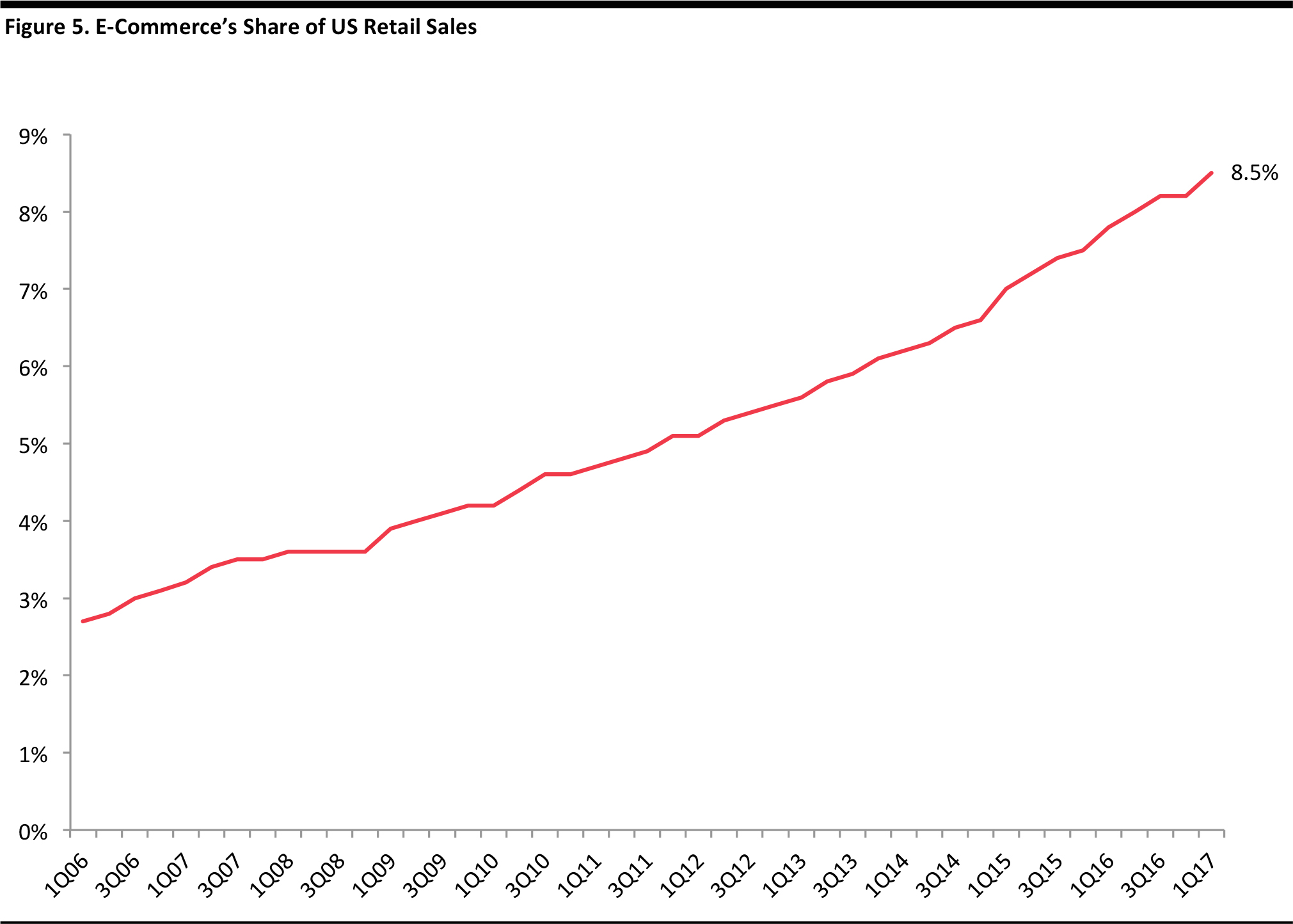

E-commerce continues to grow at a much faster rate than US retail overall, and to represent an ever-greater share of the market. In the first quarter of 2017, the e-commerce channel accounted for 8.5% of total US retail commerce, and grew at 14.7% year over year, on a seasonally adjusted basis.

Data are seasonally adjusted.

Source: US Census Bureau

In recent quarters, this curve has steepened, indicating an acceleration of ecommerce’s share gains at the expense of traditional brick-and-mortar stores.

Amazon Everywhere

Amazon is building on its early success in disrupting the markets for books and media by steadily continuing to move into new product categories, including grocery and apparel. The company is uniquely able to leverage both its IT infrastructure (through Amazon Web Services) and its continually developing delivery infrastructure, which serves to reduce its fulfillment costs but can also be employed for grocery delivery.

Source: Shutterstock

Amazon’s Prime membership program works similarly to a warehouse club membership: members pay an annual fee for access to the program and its benefits. Among other benefits, Amazon Prime members receive free two-day shipping, access to Amazon’s audio and video offerings, access to free books, and access to other exclusive services such as the Echo connected intelligent device, Dash reordering buttons, and the Amazon Prime Now smartphone app, which enables users to receive one- or two-hour delivery in selected cities.

AmazonFresh is a grocery delivery service that is exclusive to Prime members. The service costs an additional $14.99 a month on top of Amazon Prime, and deliveries are free for orders over $40. Members can order fresh produce and groceries, including specialties from local shops and markets, for same-day or next-day delivery, and can select a time for delivery.

Conclusion—Part Two

Part Two of the report examined the advantages and challenges warehouse clubs face. Advantages include the economies of scale while providing significant value pricing to customers and a treasure hunt shopping experience that offers unexpected surprises and bargains. Challenges the warehouse clubs face include shifting shopper preferences due to generational and demographic changes, the steady encroachment of e-commerce, and Amazon’s entry into multiple areas of commerce.

Part Three discusses 10 topics affecting the warehouse club sector and retail in general: the changing grocery shopper, e-commerce, mobile commerce, robotics in retail, private labels, the sourcing revolution, ancillary products and services, US market saturation, international expansion, and the brief independence of Jet.com. The report concludes with profiles of the top three US warehouse clubs and an analysis of the attractiveness of selected global markets.