About This Deep Dive

Fung Global Retail & Technology is publishing its

Deep Dive: Warehouse Club Stores—Time to Take the Treasure Hunt Online in three installments.

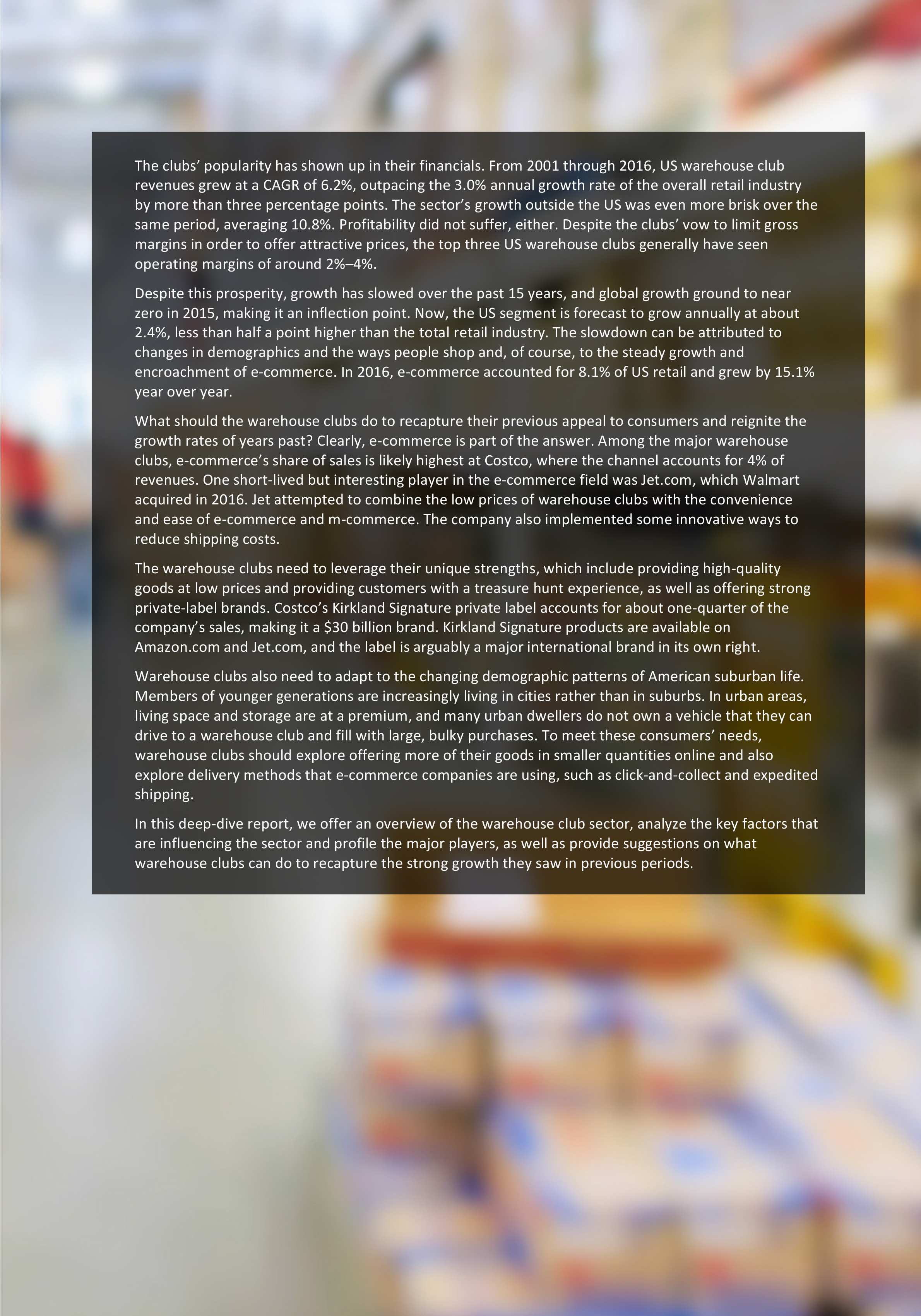

The Executive Summary outlines the spectacular rise of the sector over its 40-year history. From humble beginnings, warehouse clubs have grown into beloved shopping destinations for their members, who enjoy low prices as well as the chance to be surprised and delighted as they go on a treasure hunt through the stores. Yet the industry is at a crossroads, characterized by slowing growth, demographic changes, and the challenges presented by the convenience and appeal of e-commerce.

Part One Overview: Sector Overview

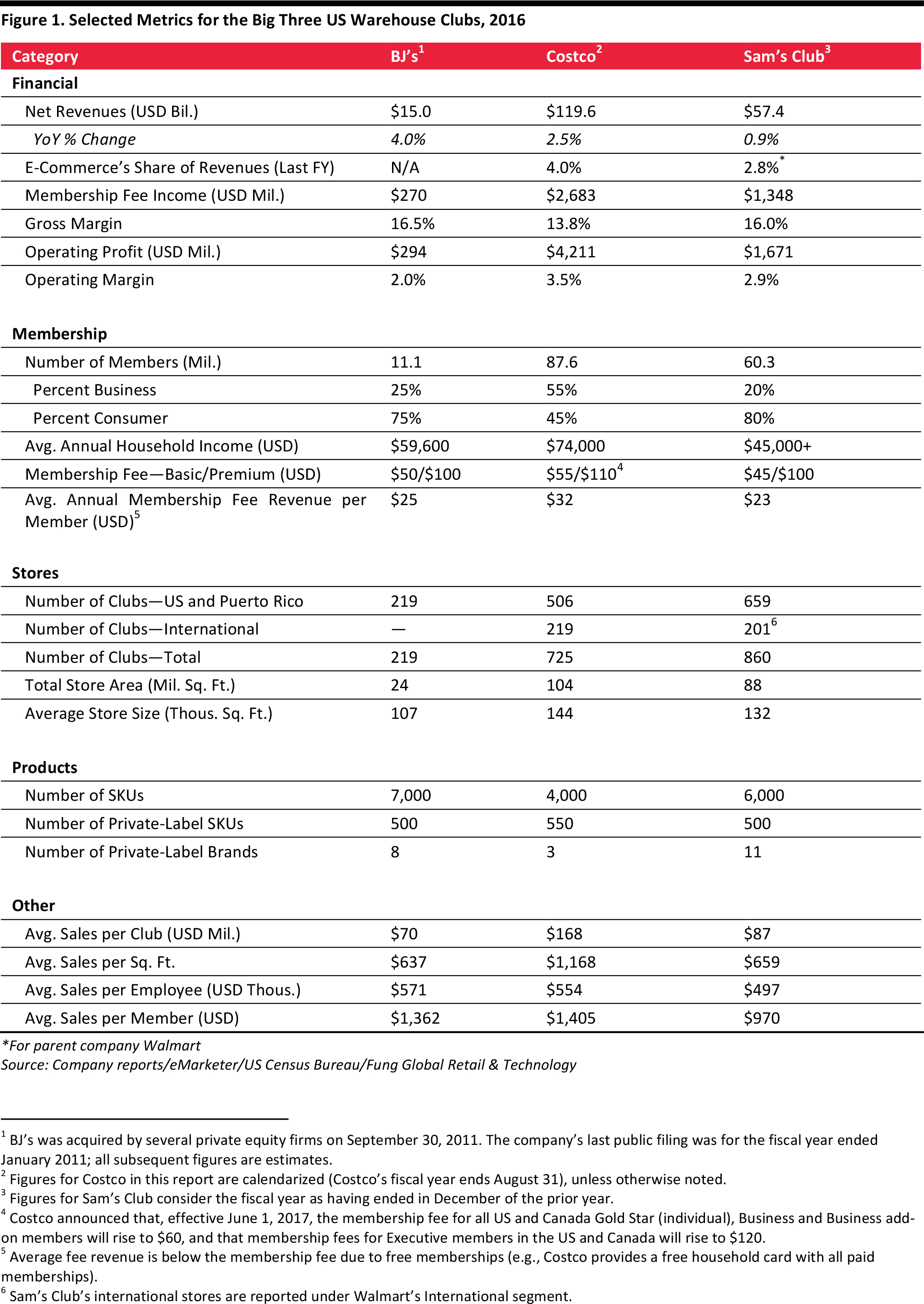

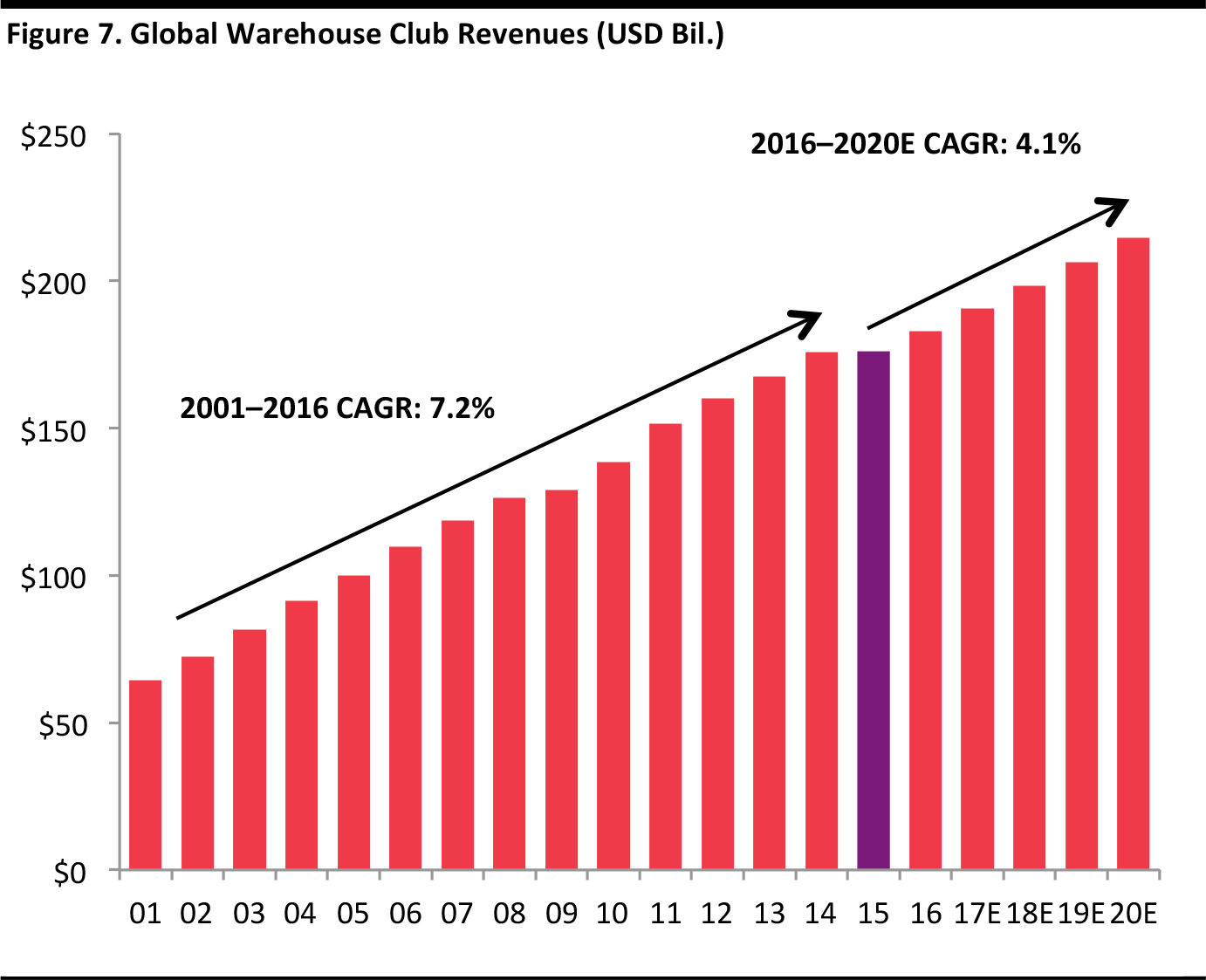

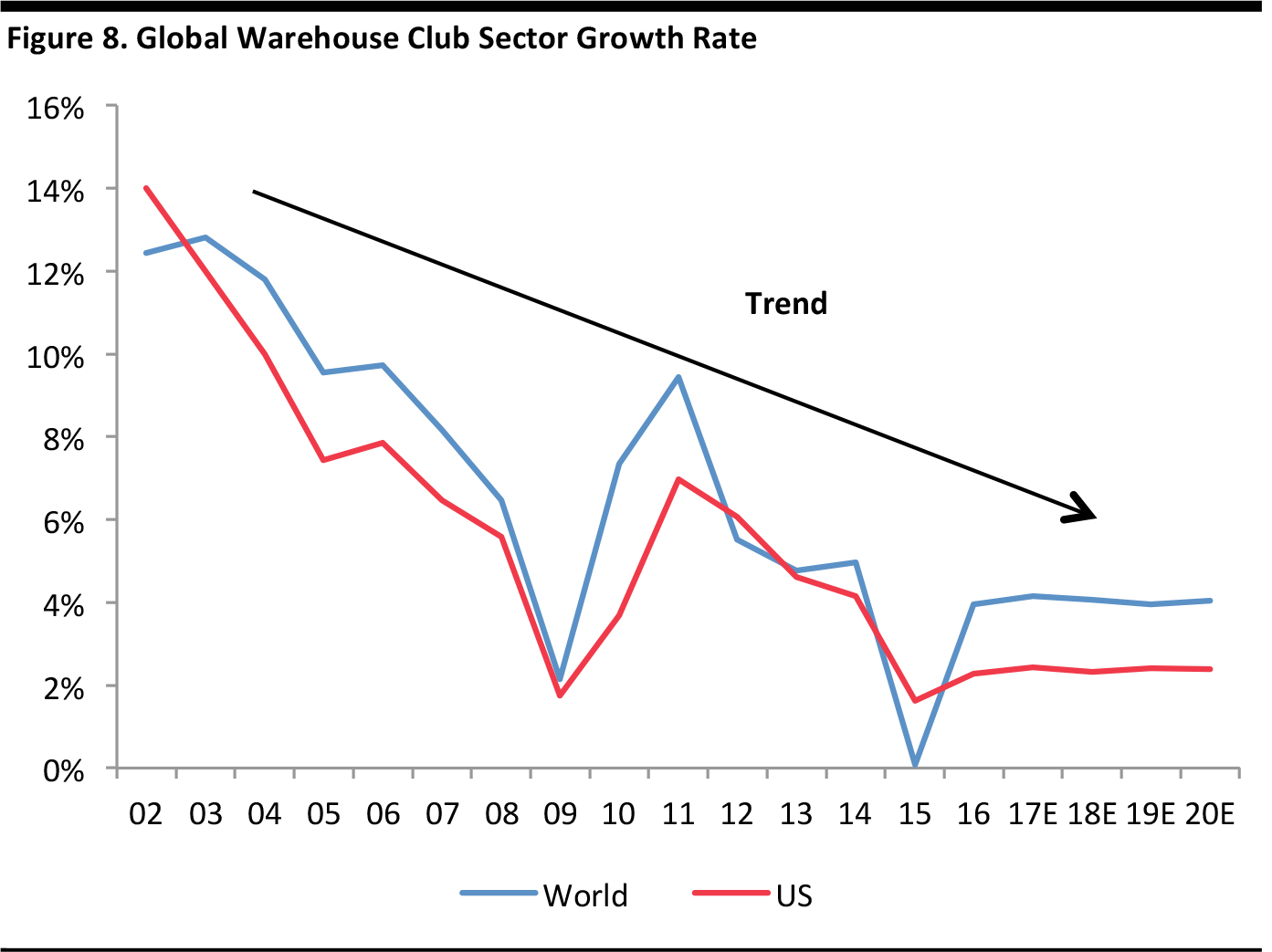

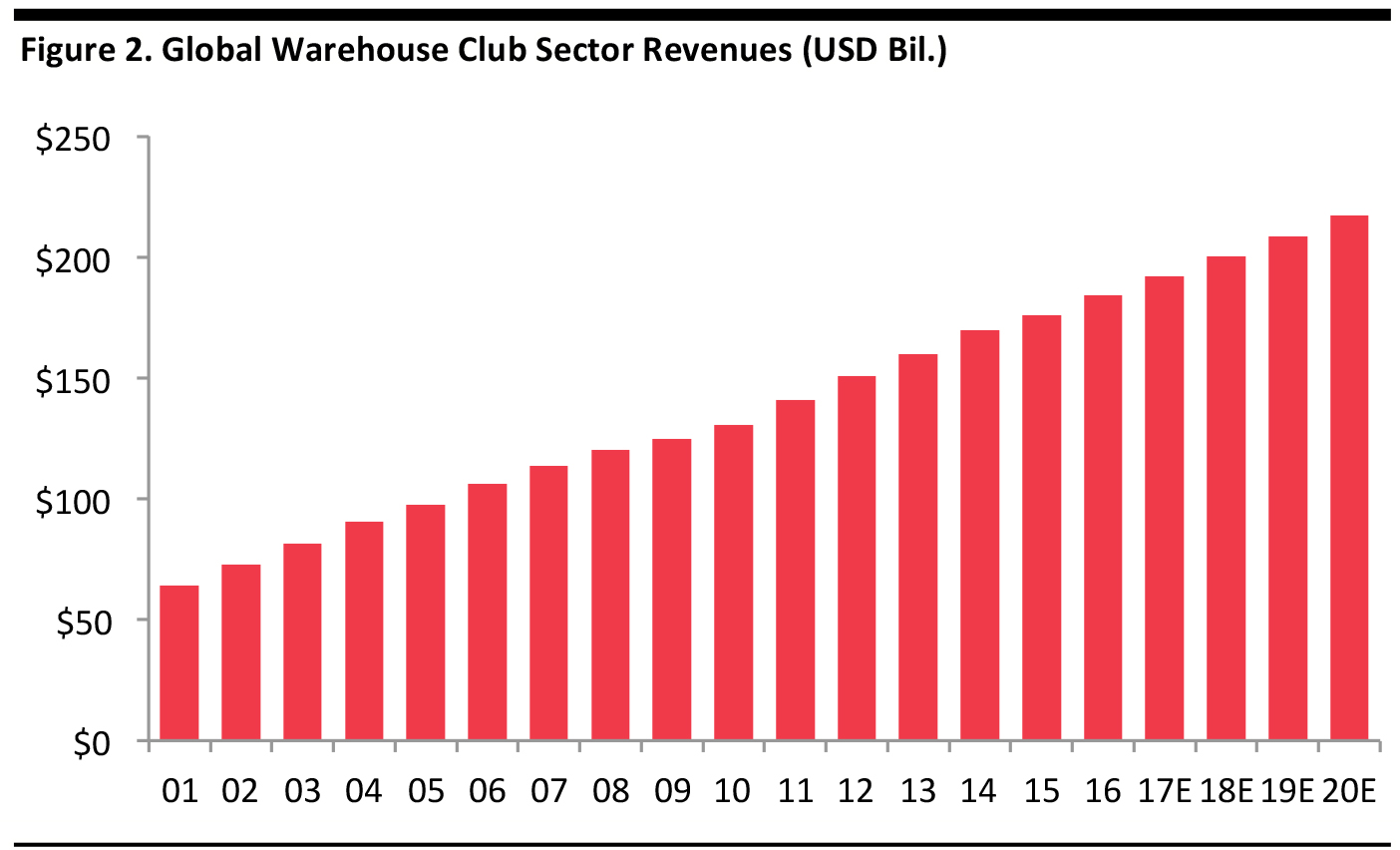

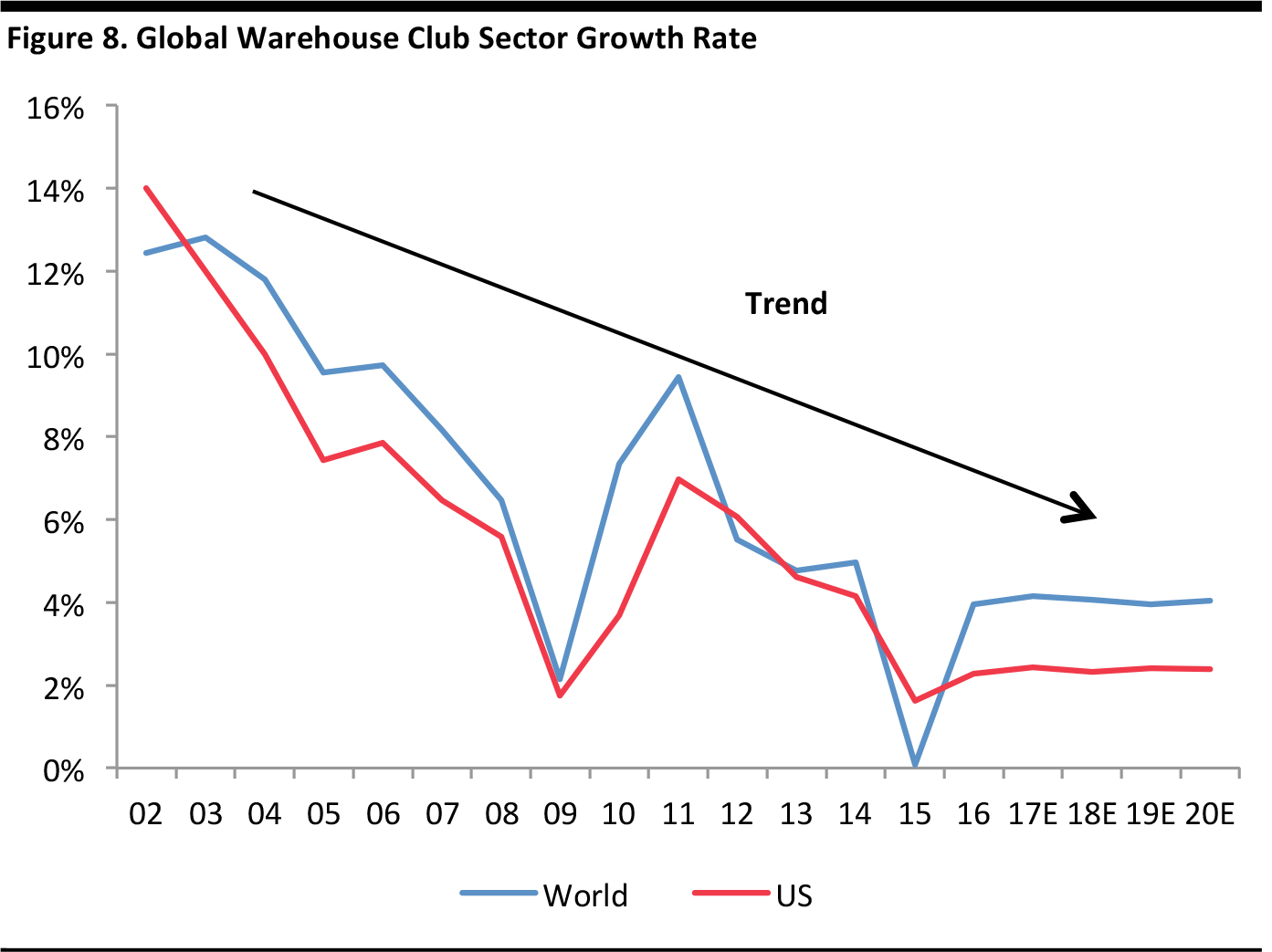

Part One of the report discusses the historical strong growth and performance of the warehouse club sector, its heavy concentration in the US and the top three companies in the space. The analysis reveals that the sector hit an inflection point in 2015 and has experienced a slowing growth trend in recent years that market researchers expect to continue through 2020.

The warehouse club sector features a unique business model, where membership fees are the primary contributor to profits and large volumes offset ultraslim margins. While the majority of warehouse club members are individual consumers, small businesses are also an important component of membership. Warehouse clubs’ growth has exceeded that of department stores and grocery stores. E-commerce, however, accounts for a smaller percentage of sales in the sector than it does for other retail sectors and the US retail industry overall. The sector is led by Costco, the largest club by revenue. Part One concludes with an analysis of warehouse clubs by region.

Part Two Overview: Warehouse Club Advantages and Challenges

Part Two of the report examines the advantages and challenges warehouse clubs face. The clubs benefit from economies of scale and their broad product mixes, which attract shoppers. They provide significant value pricing to their customers, a treasure hunt shopping experience that offers unexpected surprises and bargains, and a focus on organic products. Retailers such as Costco are located in the prosperous top third of the Weinswig Retail Hourglass, a model that illustrates how companies operating in the midmarket get squeezed.

Challenges the warehouse clubs face include shifting shopper preferences due to generational and demographic changes, the steady encroachment of e-commerce, and Amazon’s entry into multiple areas of commerce.

Part Three Preview: 10 Topics for Retail, Company Profiles and International Overview

Part Three discusses 10 topics affecting the warehouse club sector and retail in general: the changing grocery shopper, e-commerce, mobile commerce, robotics in retail, private labels, the sourcing revolution, ancillary products and services, US market saturation, international expansion, and the brief independence of Jet.com.

Part Three concludes with profiles of the top three US warehouse clubs and an analysis of the attractiveness of selected global markets.

The Fung Global Retail & Technology team hopes that you will find this Deep Dive interesting and informative!

Warehouse Club Companies at a Glance

Historically Strong Growth and Outperformance

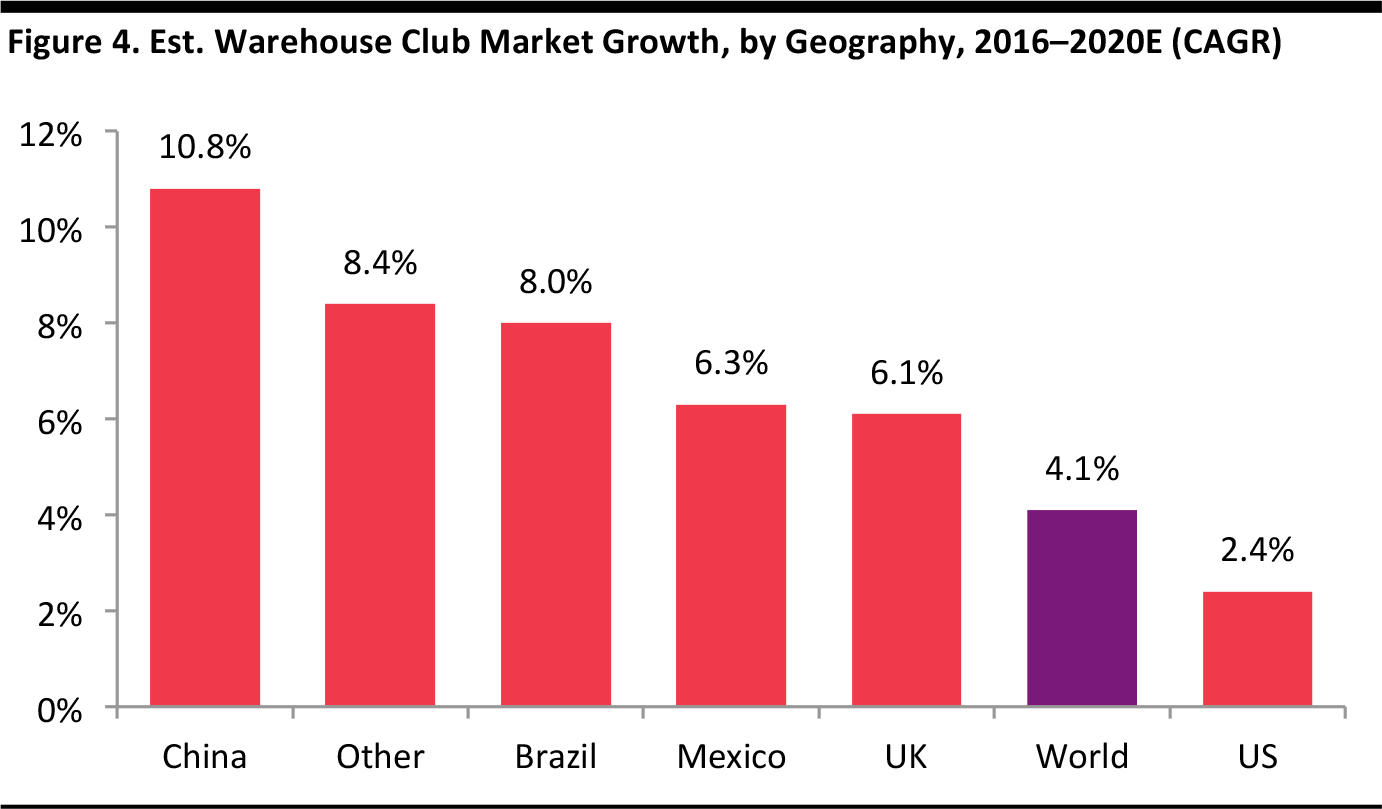

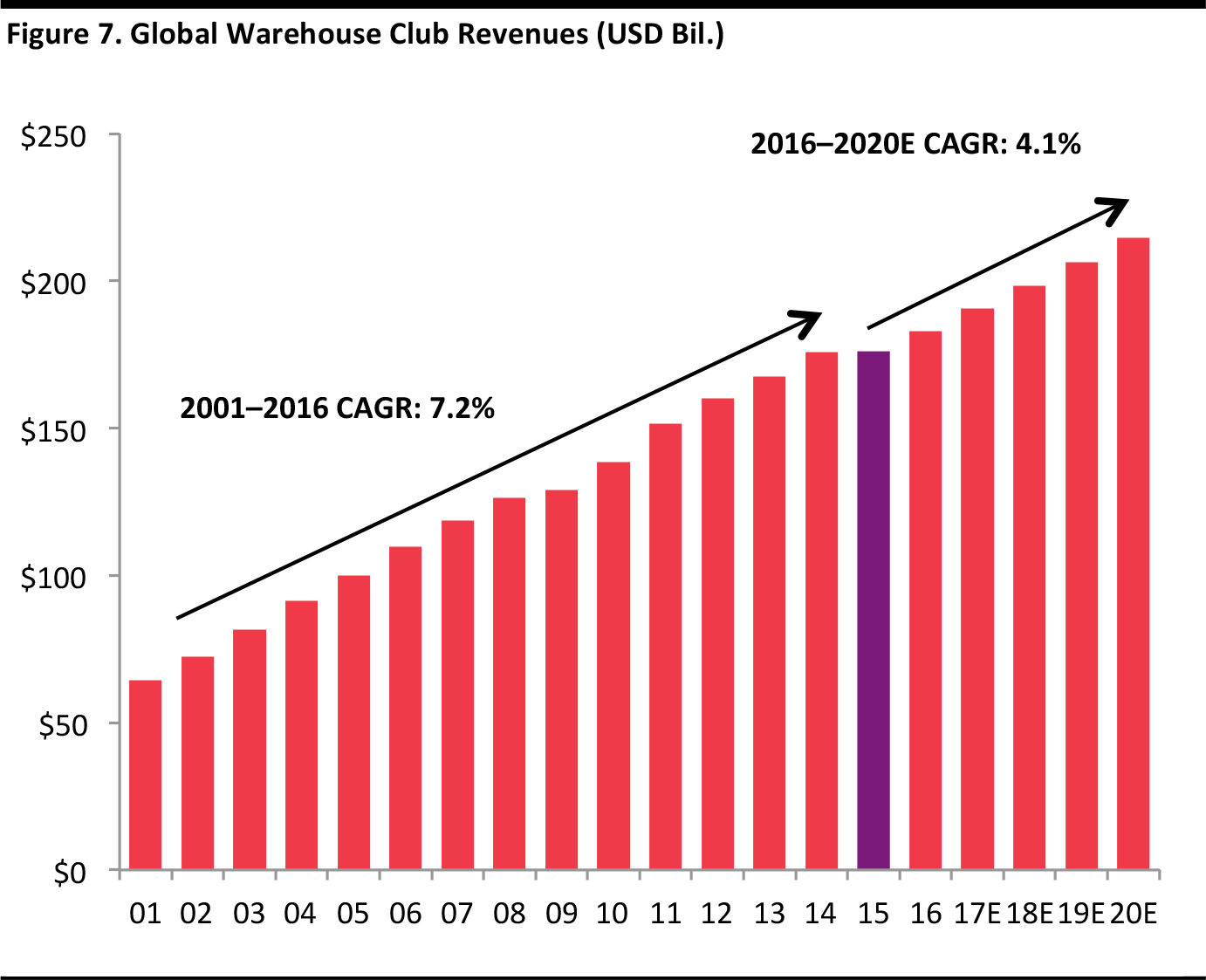

Total revenues for global warehouse clubs are estimated to hit a record $191 billion in 2017, according to Euromonitor International. The sector posted an exceptional CAGR of 7.2% in the US over the 15-year period from 2001 through 2016, and Euromonitor predicts that the global sector will grow at a 4.1% rate from 2016 through 2020.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology

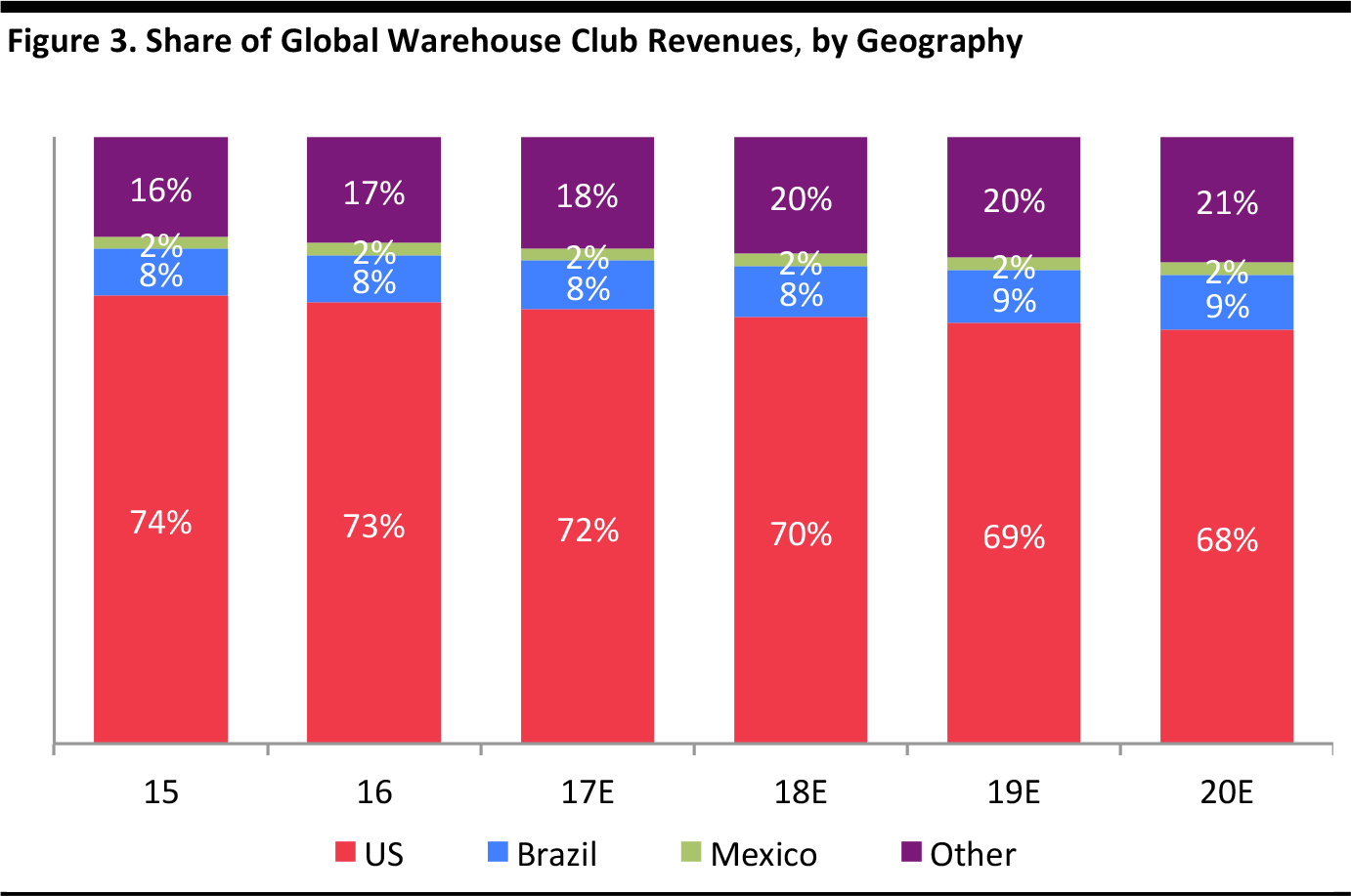

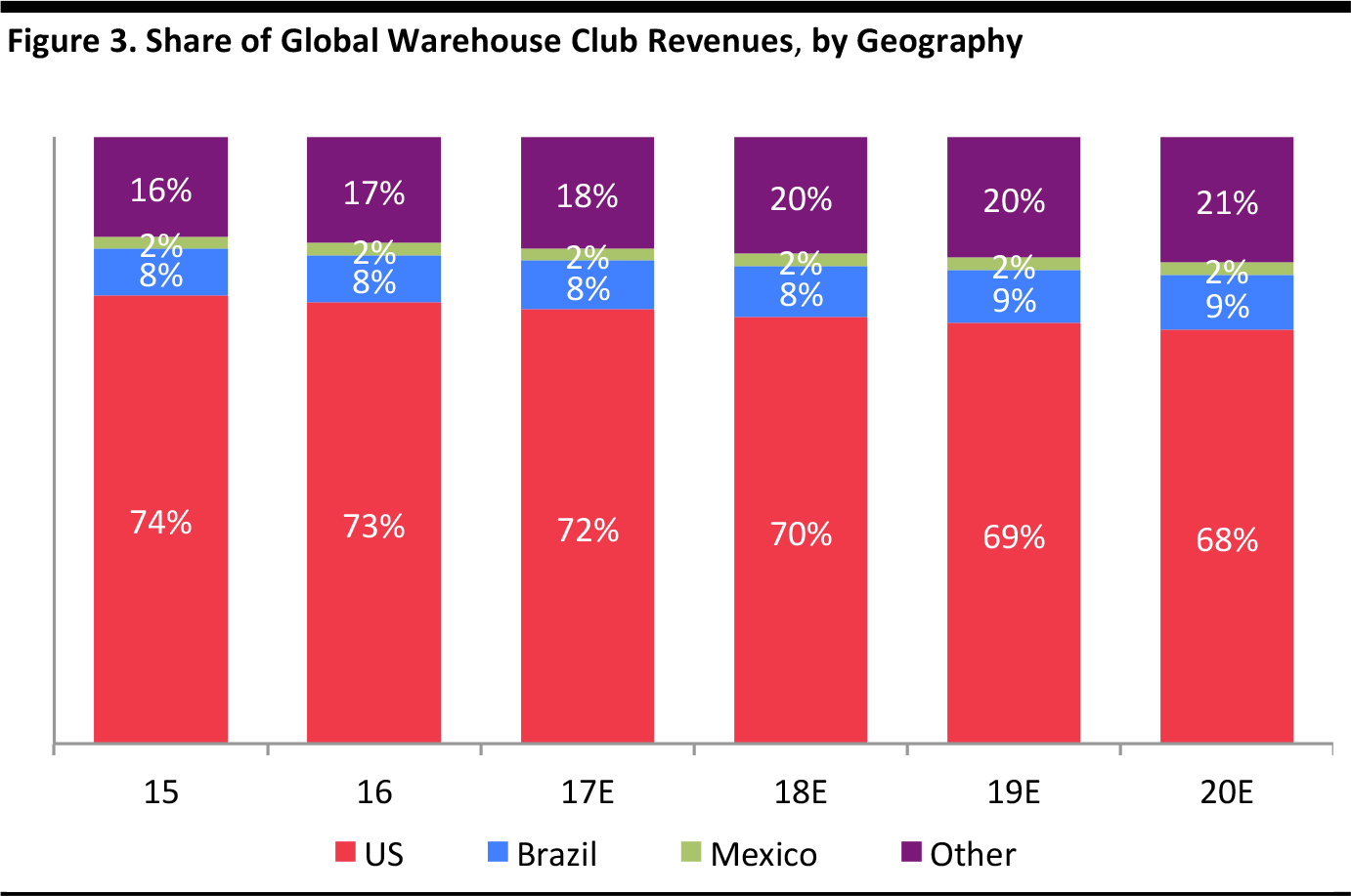

The warehouse club market is largely a US-centric phenomenon. The US represented 73% of the global market in 2016, but Euromonitor expects the country’s share to decrease to 68% by 2020.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology

Costco is the largest international warehouse club operator, with stores in Australia, Canada, Japan, Mexico, South Korea, Spain, Taiwan, the UK and the US. Sam’s Club operates warehouses in Brazil, China and Mexico as well as the US.

Apart from the “big three” US clubs (BJ’s, Costco and Sam’s Club), there are just a handful of other players in the sector. Cost-U-Less operates 13 stores in the Caribbean and South Pacific. Makro Cash & Carry Belgium is a cash-and-carry retailer operated by Germany’s Metro Group. Finally, PriceSmart is the largest operator of membership warehouse clubs in Central America and the Caribbean.

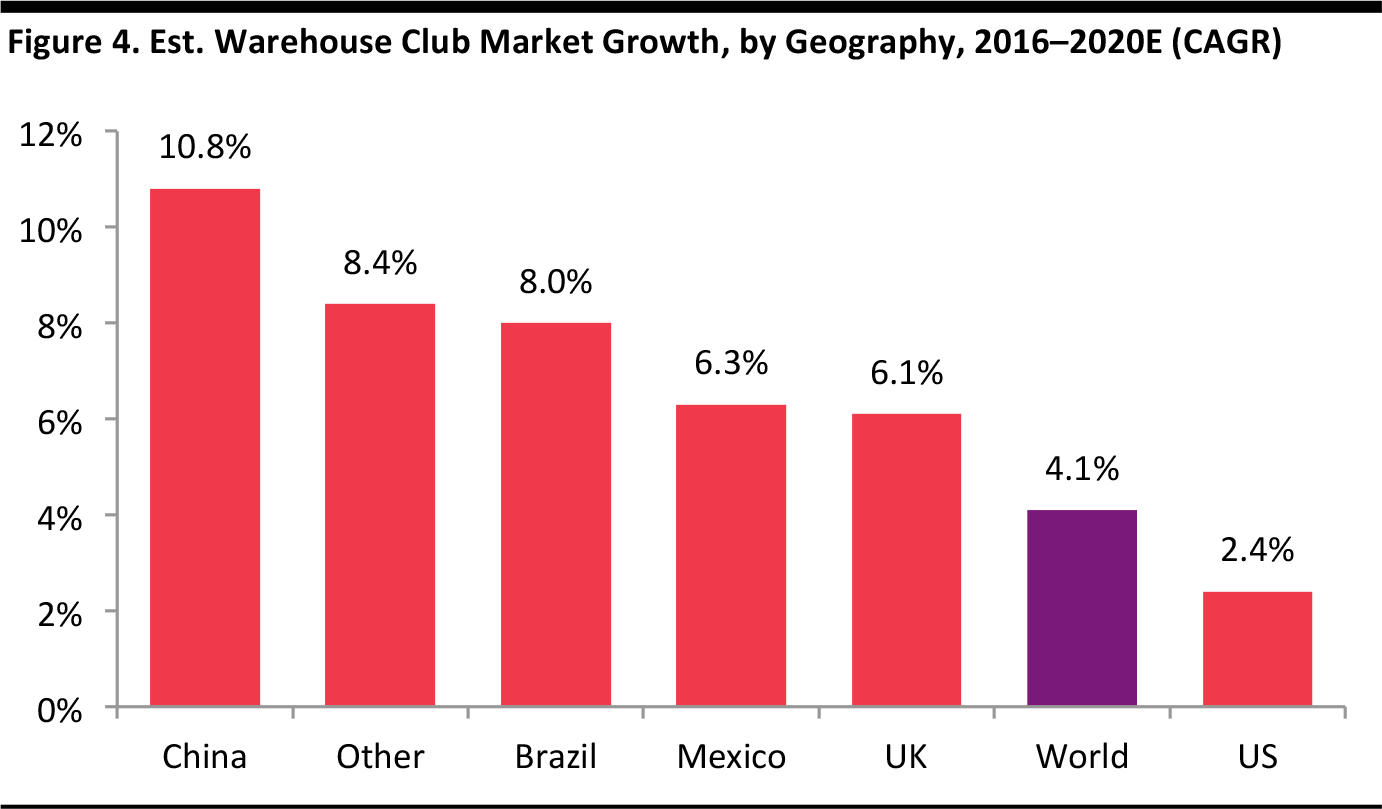

The predicted change in share within a growing market means that the warehouse club sector is growing faster in other geographies than it is in the US. Euromonitor predicts that the global market will grow at a 4.1% CAGR through 2020 and the US market at a 2.4% CAGR.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology

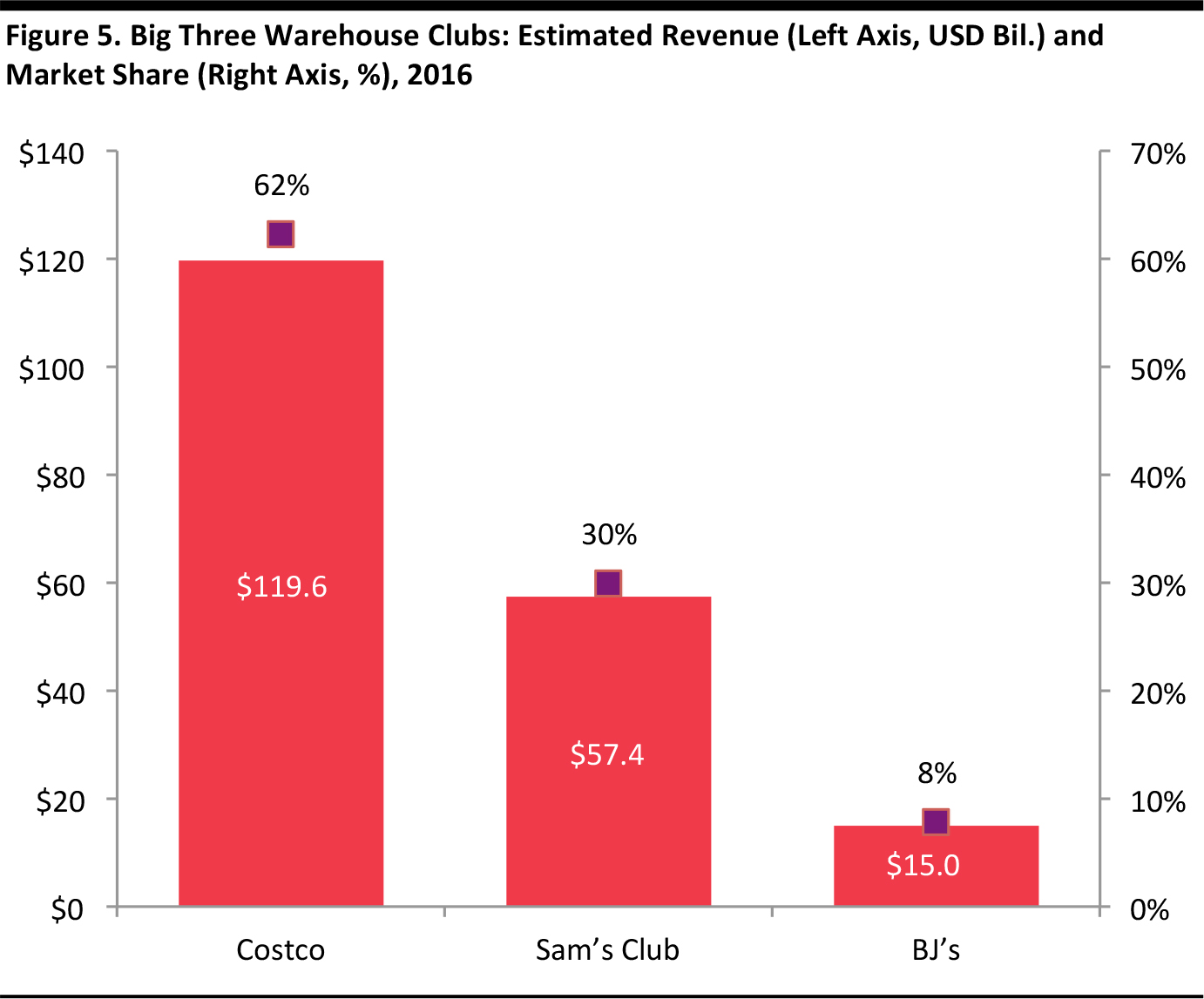

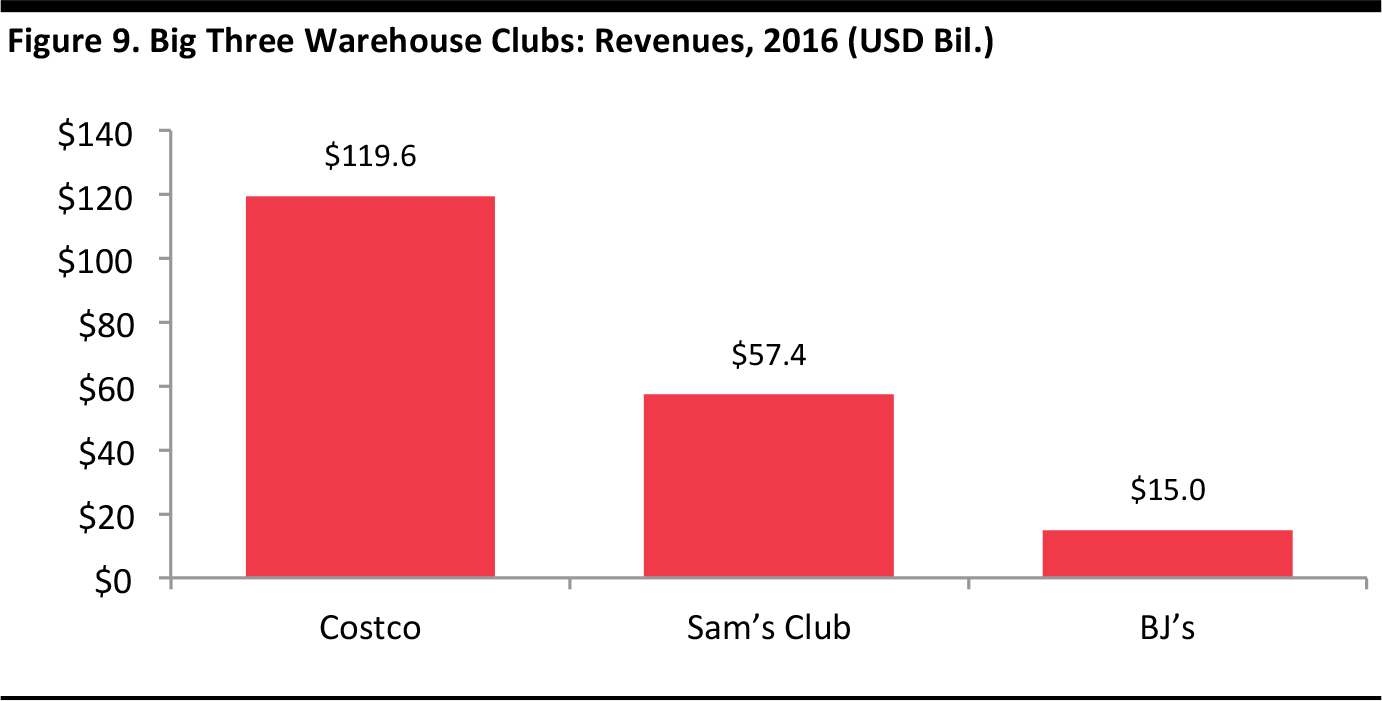

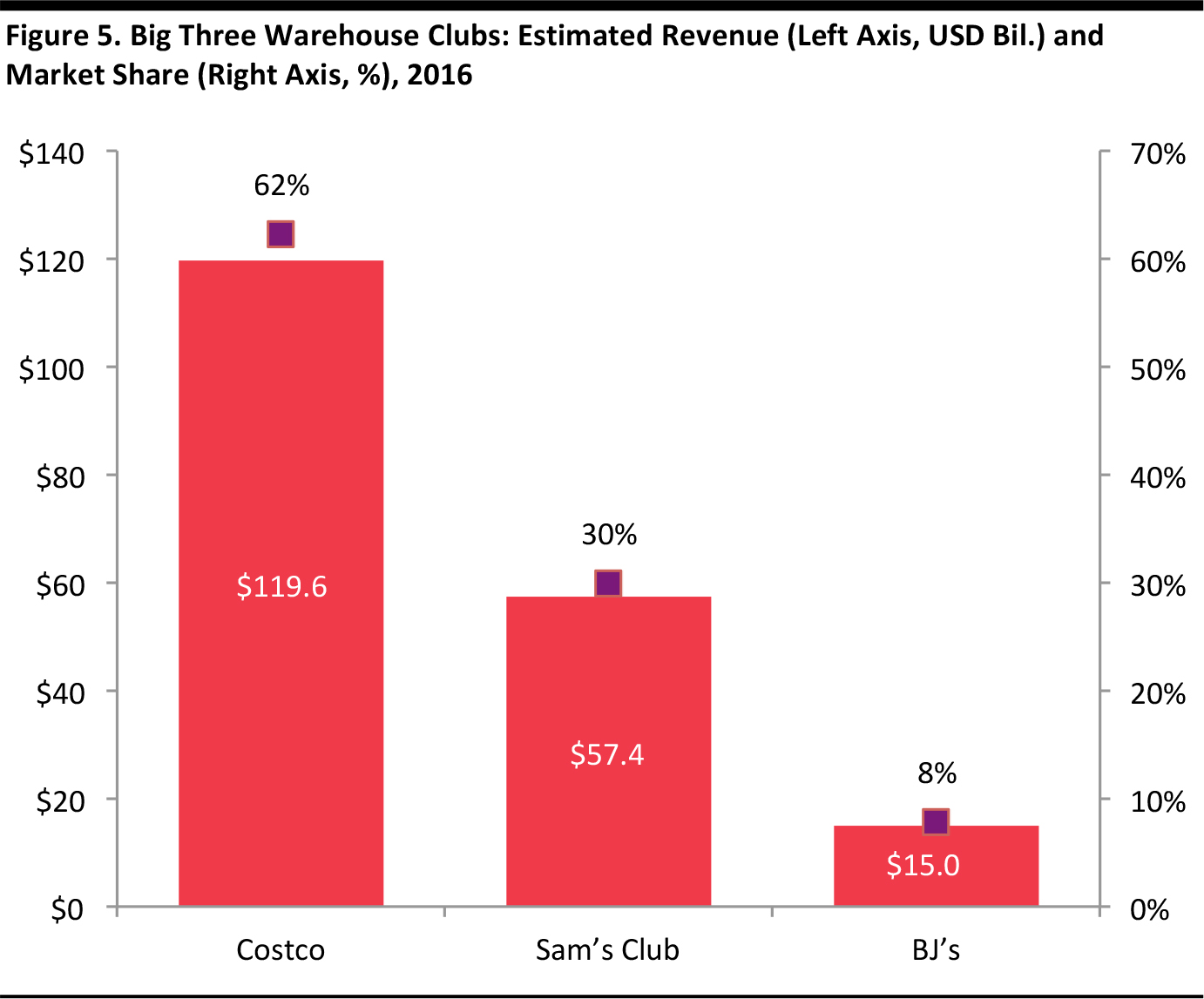

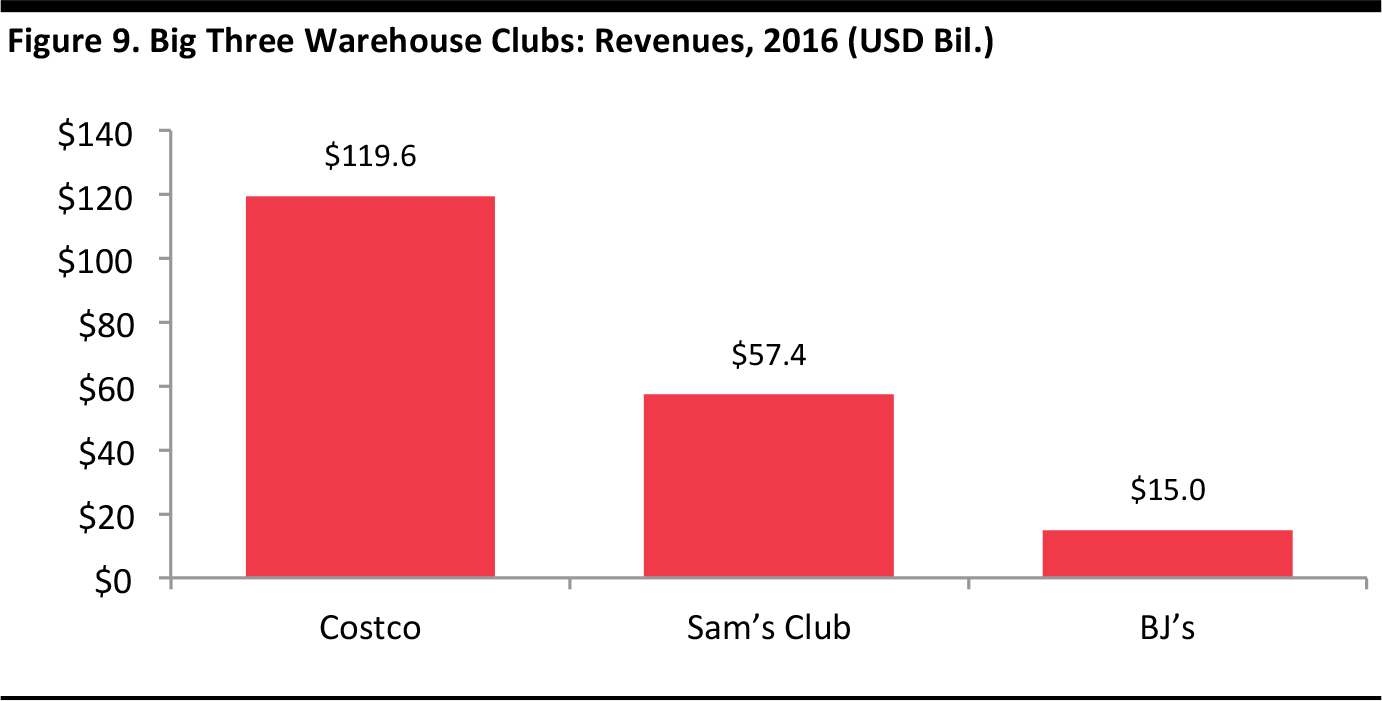

In the US, the sector is dominated by Costco, which represents about 65% of the market and generates more than twice the revenue of its nearest competitor, Sam’s Club.

Figures are in US dollars, converted based on year-over-year exchange rates.Source: Euromonitor International/Fung Global Retail & Technology

Figures are in US dollars, converted based on year-over-year exchange rates.Source: Euromonitor International/Fung Global Retail & Technology

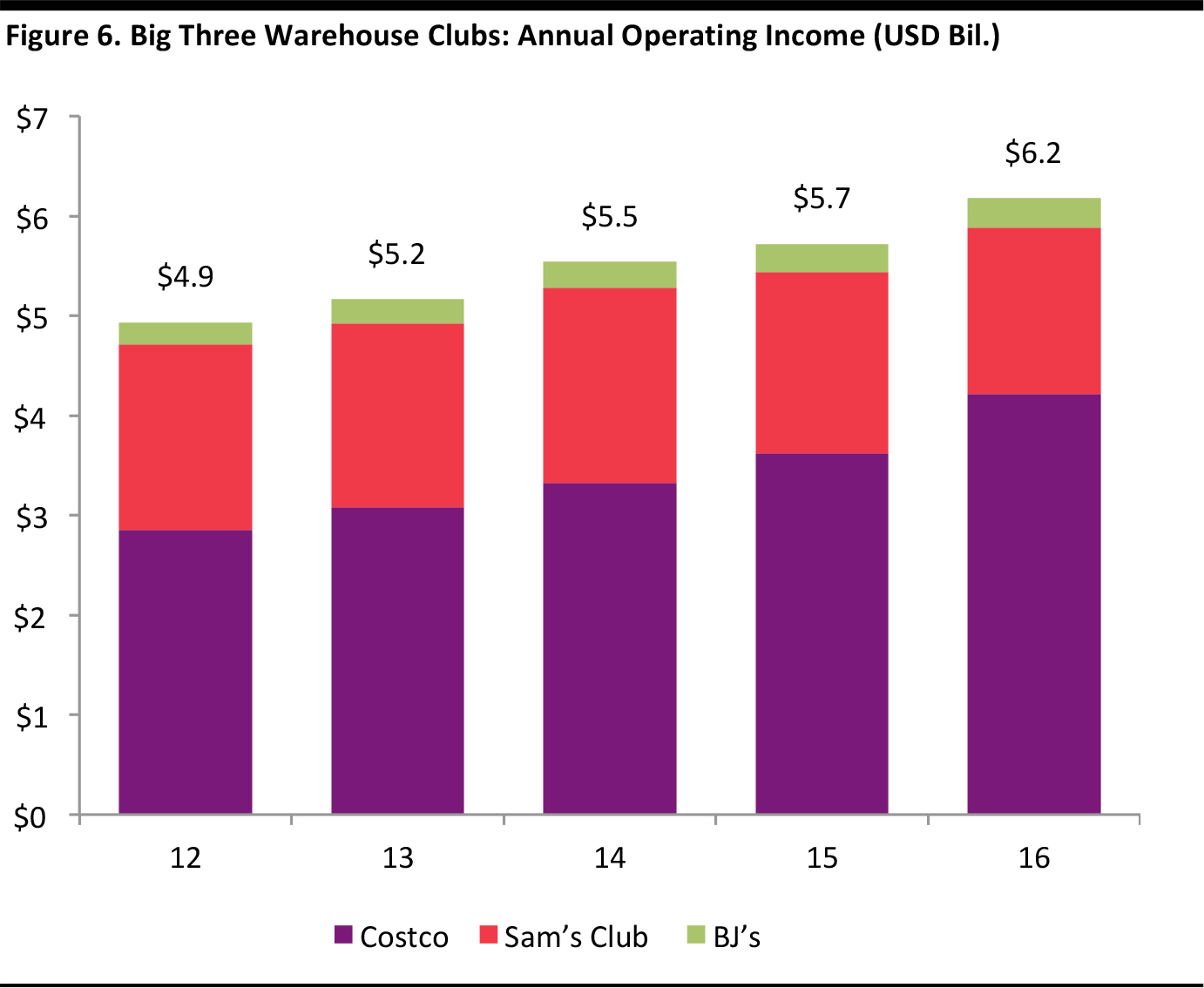

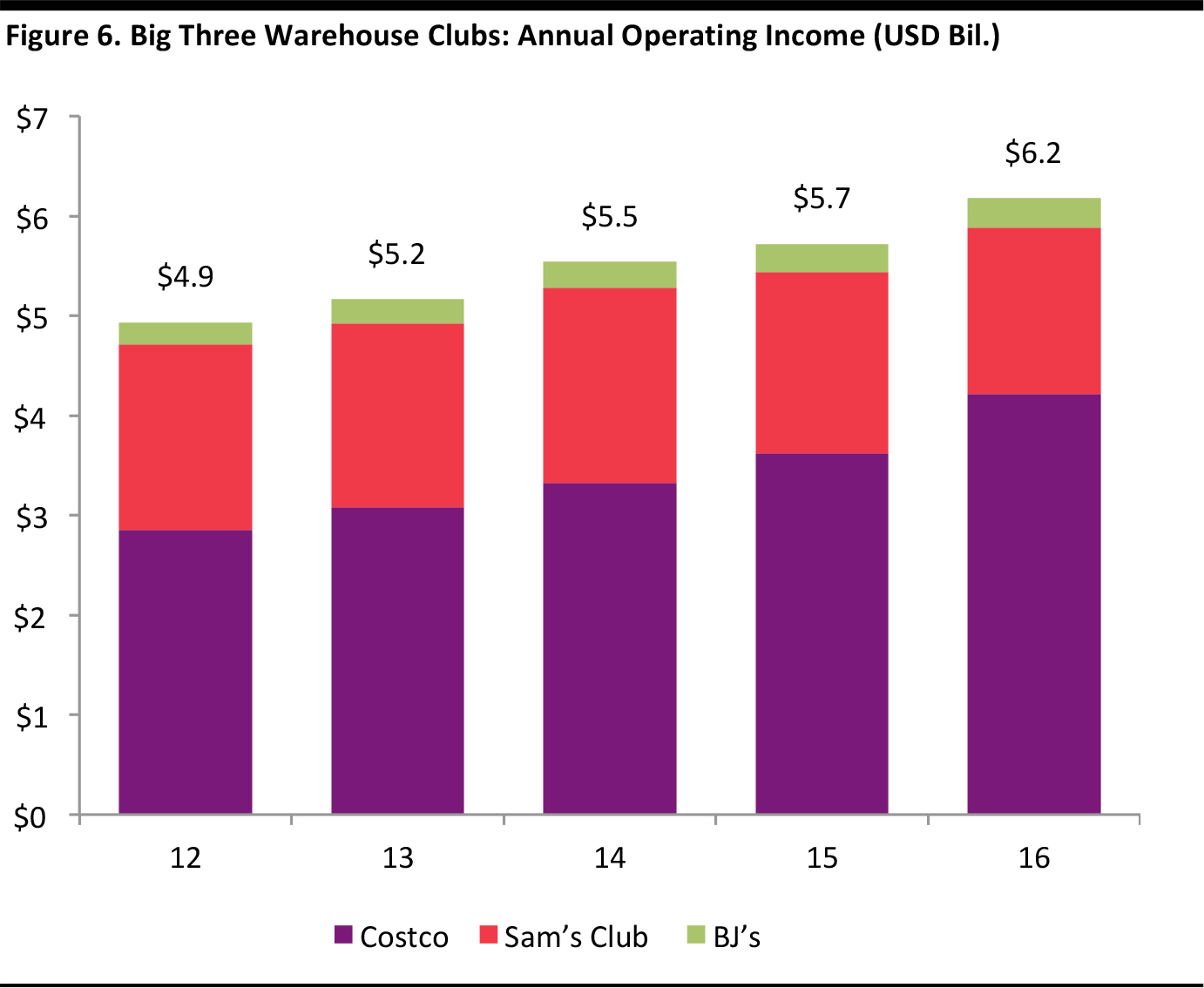

In addition, the sector has remained nicely profitable, with the big three US players posting solid and growing profits in recent years.

Source: Company reports/Bloomberg/National Retail Federation (NRF)/Kantar Worldpanel/Fung Global Retail & Technology

Source: Company reports/Bloomberg/National Retail Federation (NRF)/Kantar Worldpanel/Fung Global Retail & Technology

Sector Inflection Point in 2015

The warehouse club sector has enjoyed many years of strong growth, and it appears to have many more years of growth ahead of it. But as the graph below shows, sector revenue growth was 4.0% in 2016.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology

The figure below shows that warehouse club sector growth slowed over the 2002–2015 period, even hitting near-zero growth in 2015.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology

Warehouse Club Characteristics

Business Model

Warehouse clubs sell paid memberships to consumers and small business customers that provide access to a wide selection of goods, often in bulk, at discounted prices in large-store formats. Grocery products are a major driver of foot traffic, but shoppers can purchase everything from apparel to appliances to seasonal goods to eyeglasses at warehouse clubs. At the heart of the warehouse club business model are memberships and economies of scale. The clubs’ large membership bases enable them to purchase items from suppliers in large volumes at low cost, which, in turn, helps them attract more members. Clubs can price products with just enough markup to cover costs and operating expenses and, in some cases, a sliver extra to contribute to the bottom line.

At their inception, warehouse clubs sold items geared toward small business owners, generally the more affluent demographic in a region. As the business model evolved, the clubs added great-quality merchandise at bargain prices for nonbusiness use, and the treasure hunt aspect of shopping in the clubs, which delights consumers, gained traction and became integral to the clubs’ operations. Today, general consumers represent a greater portion of the clubs’ membership base than business owners do.

The warehouse club sector has enjoyed resilient growth through most economic cycles, offering value pricing on brand-name staples and discretionary “luxuries” when the economy stalls, as well as high-end items that appeal to shoppers in a robust economy. On a recent trip to warehouse stores in Connecticut, our team found items available from a variety of well-known brands, including Bose sound systems, Apple iPads and iPhones, Charisma sheets, Dockers khakis, Speedo swimsuits and Fitbit activity trackers. While Costco had luxurious diamond rings for sale at $16,999, Sam’s Club offered an aspirational handbag collection featuring Coach, Kate Spade, Michael Kors and Tory Burch. In addition to well-priced national brands, warehouse clubs are increasingly offering private-label items and ancillary services that range from gas stations to pharmacies.

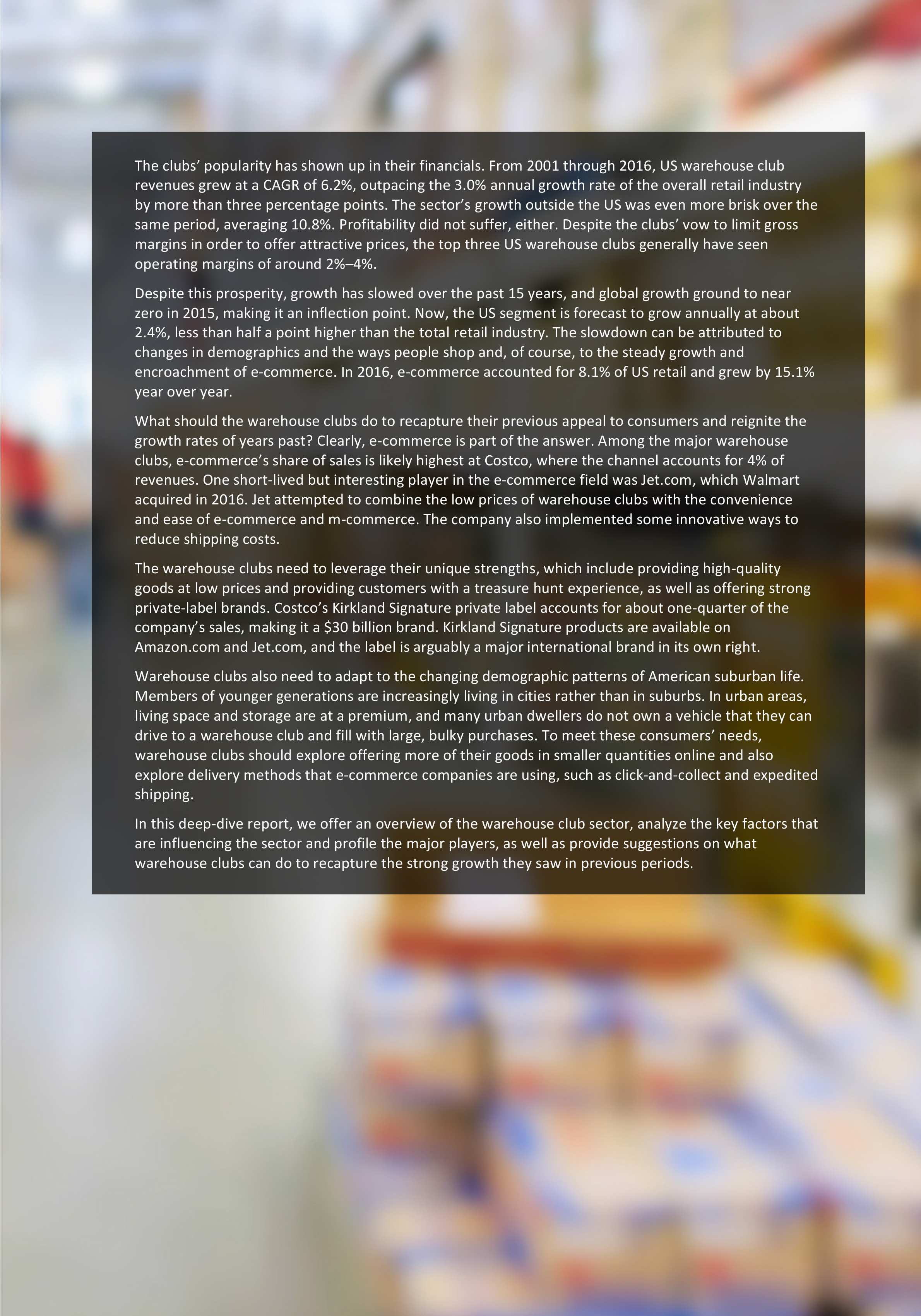

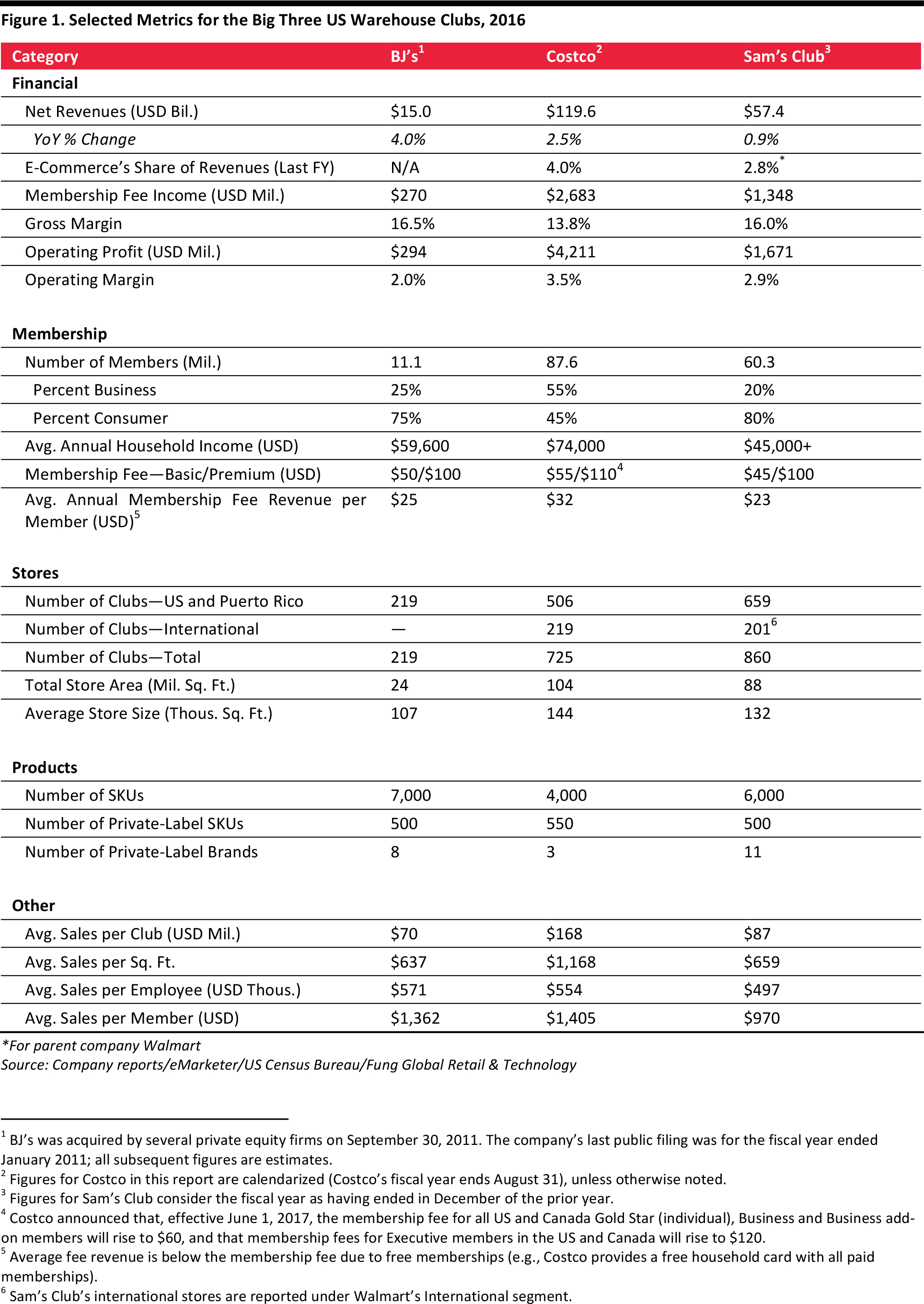

BJ’s, Costco, Sam’s Club—the Big Three

The US, which comprises the majority of the global warehouse club market, is home to three main warehouse club companies, known as the big three: BJ’s, Costco and Sam’s Club (a division of Walmart).

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

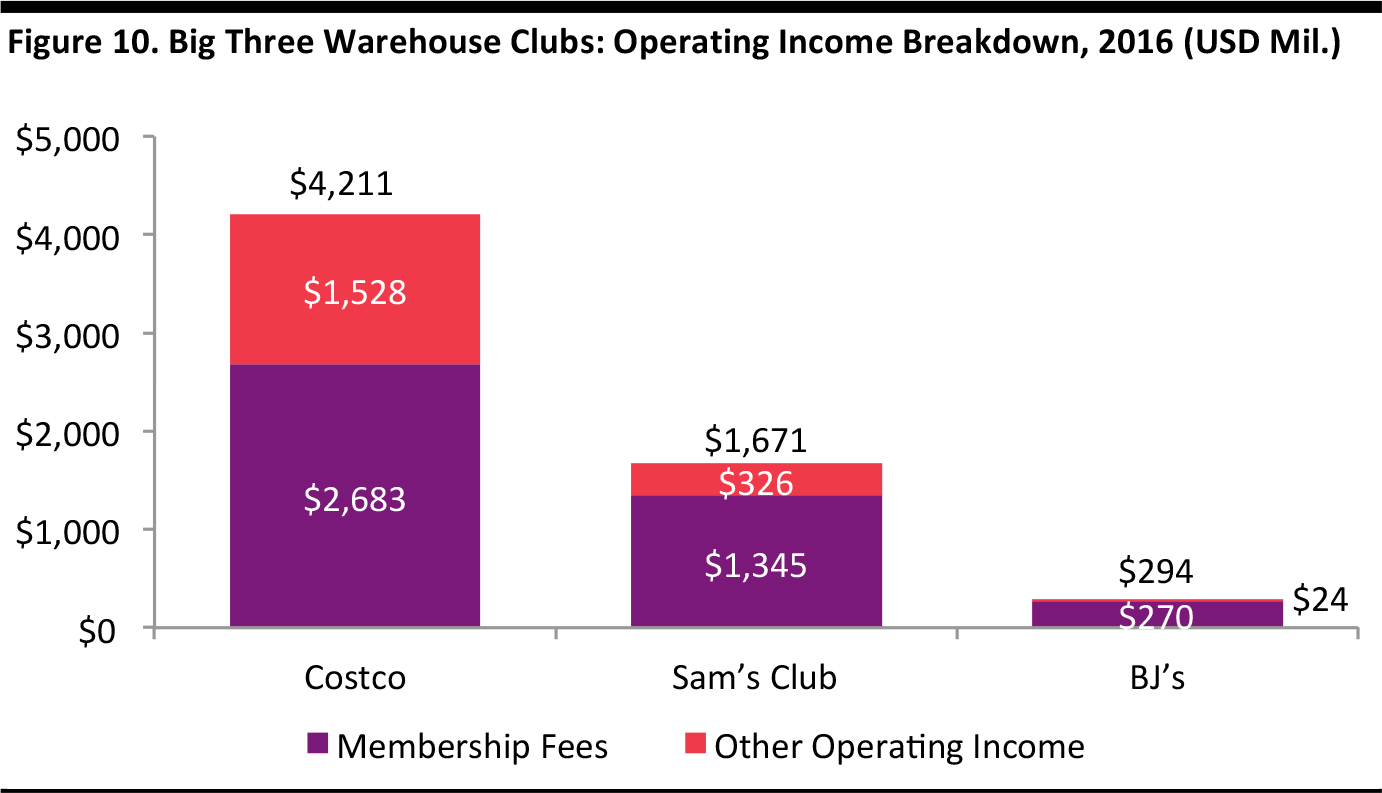

Membership Fees Are the Main Profit Driver

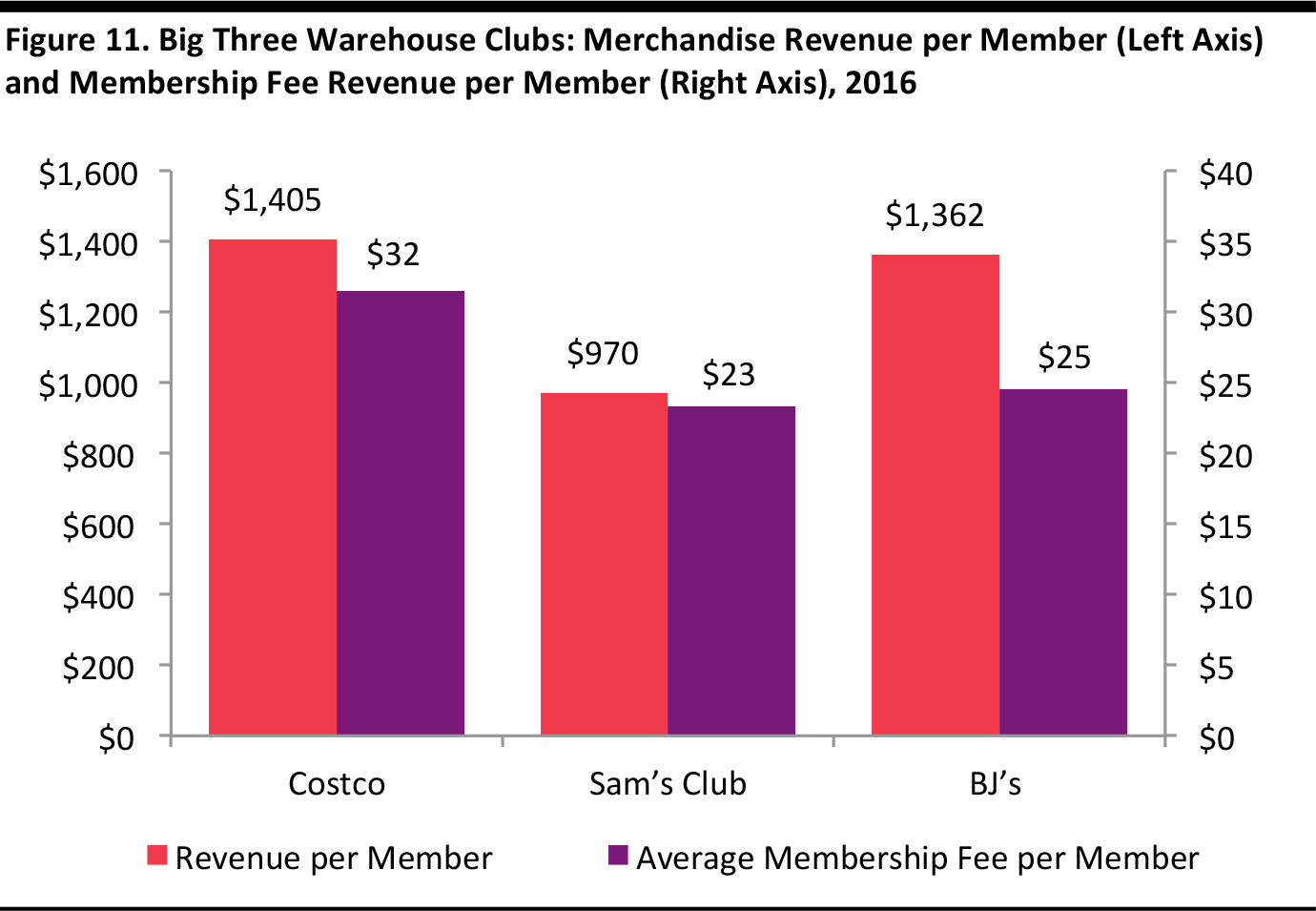

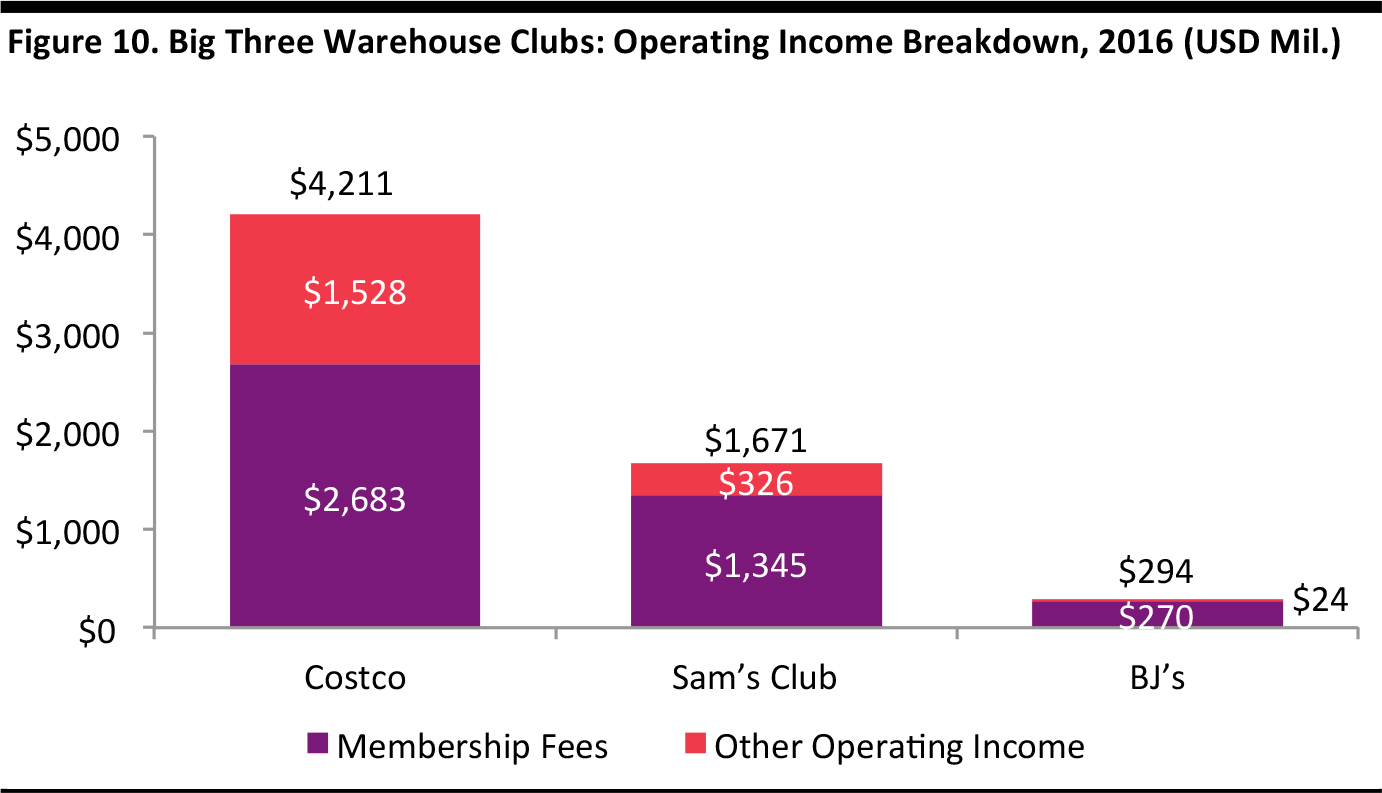

While sales per member drive revenue at warehouse clubs, membership fees are what expand profits. Over time, membership revenue exceeds net income and accounts for a substantial portion of pretax operating profits. We estimate that total membership fees contributed 70% of the big three’s operating income in 2016.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

At Costco, membership fees exceeded net income every fiscal year from 2004 through 2016, and fell within a range of 69%–86% of operating income, averaging 75% during the period. Given the importance of membership fees, attracting and retaining members is a priority for the company. In fiscal 2016, Costco’s renewal rate was 90% in the US and Canada and 88% worldwide.

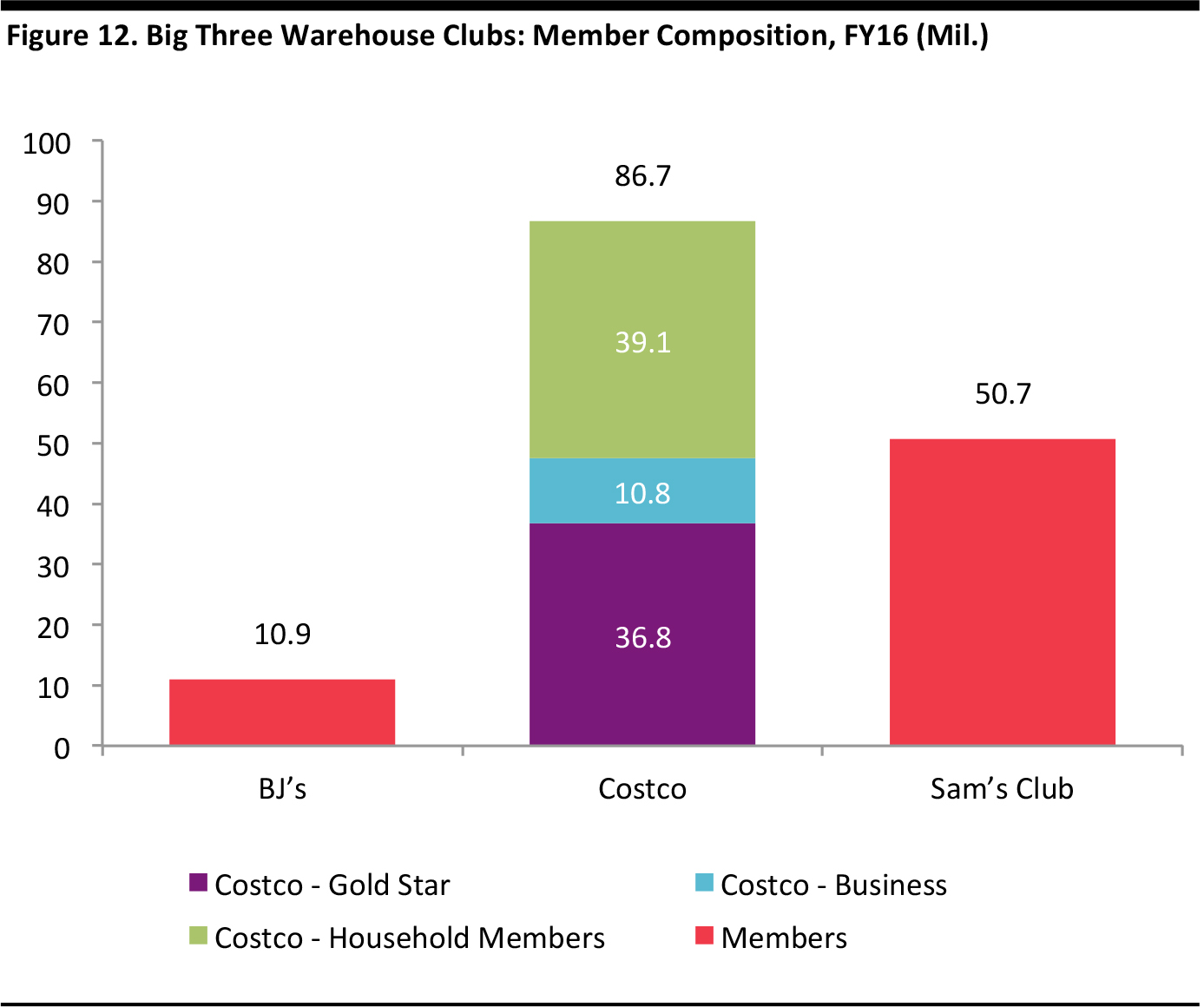

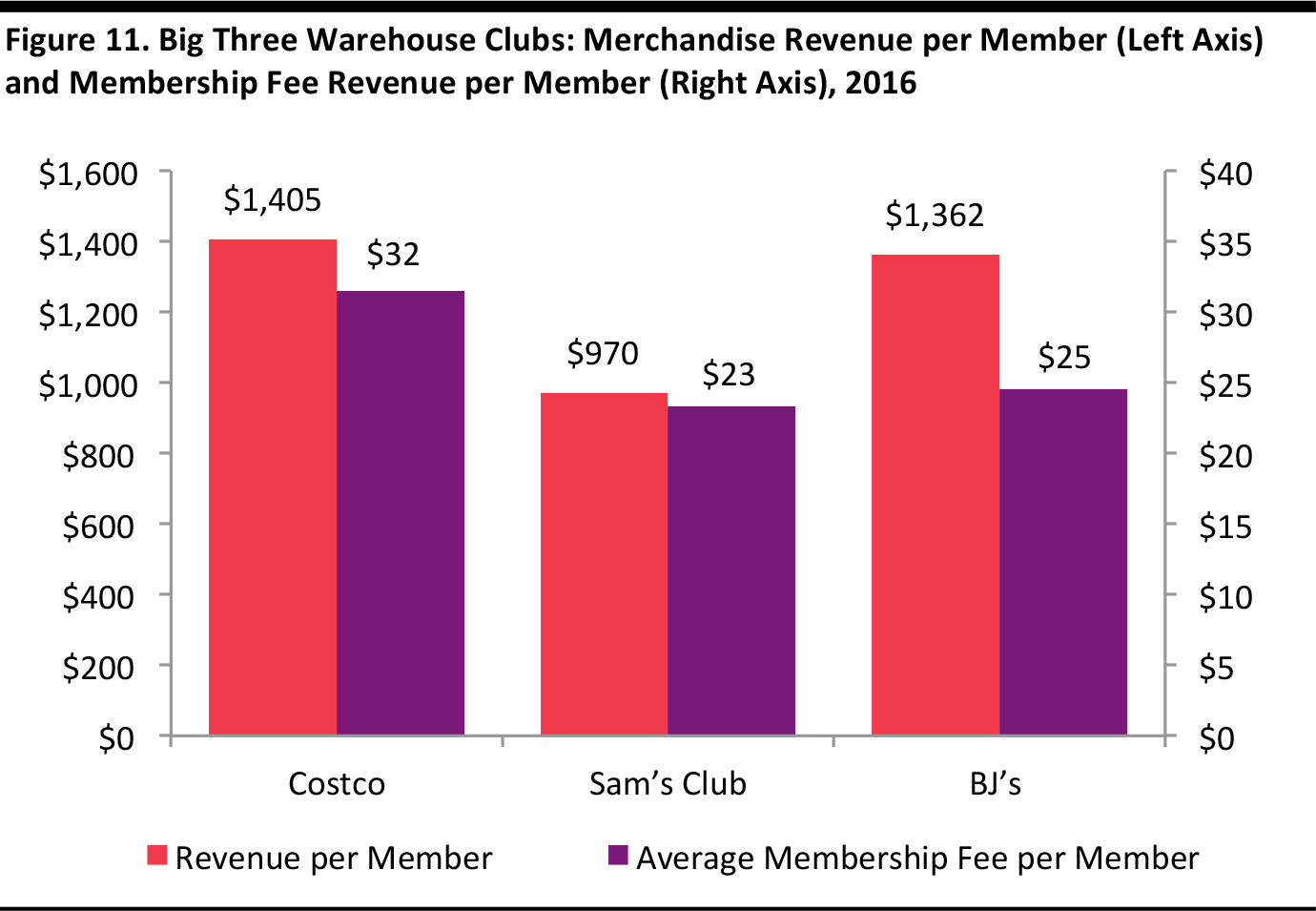

Costco runs on lean operating margins to ensure member savings, and leads the sector in sales per member. The company generated 45% higher sales per member than Sam’s Club did in 2016. Costco also maintains a large and growing membership base that drives profits.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

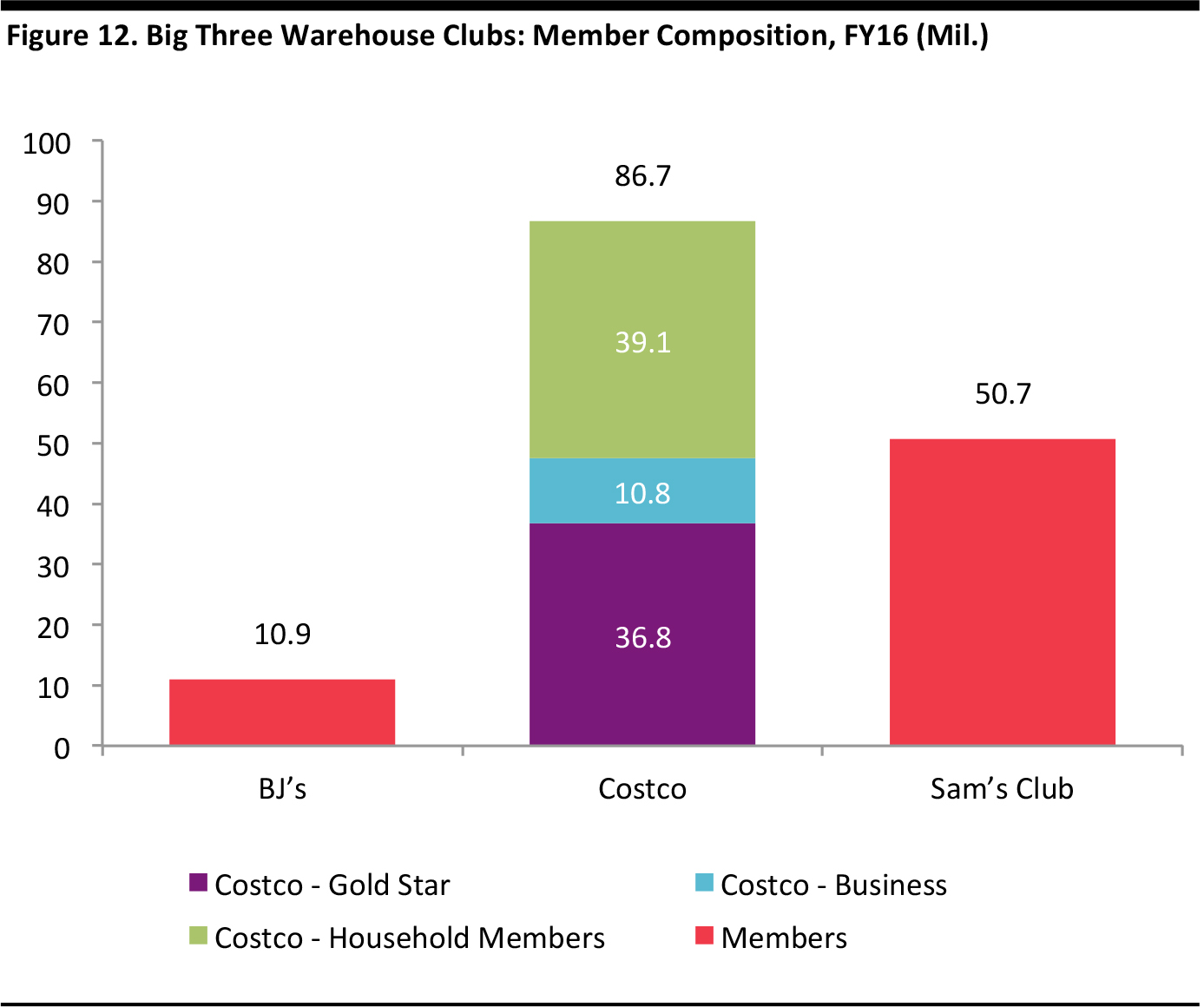

In fiscal year 2016, Costco had the highest membership of the big three warehouse clubs and only about 11% of its members had explicit business accounts.

BJ’s and Sam’s Club figures are estimates.Source: Company reports/Fung Global Retail & Technology

BJ’s and Sam’s Club figures are estimates.Source: Company reports/Fung Global Retail & Technology

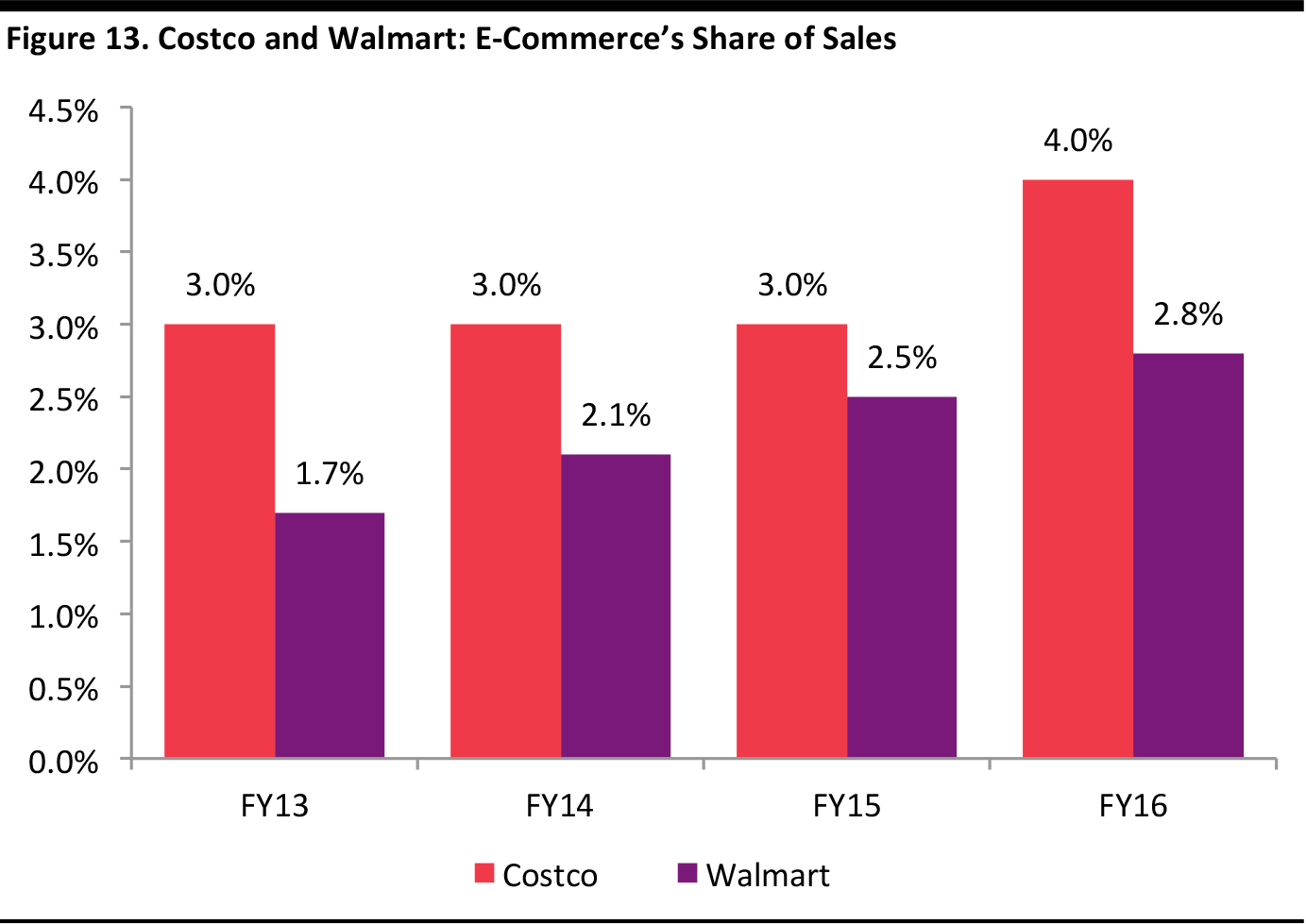

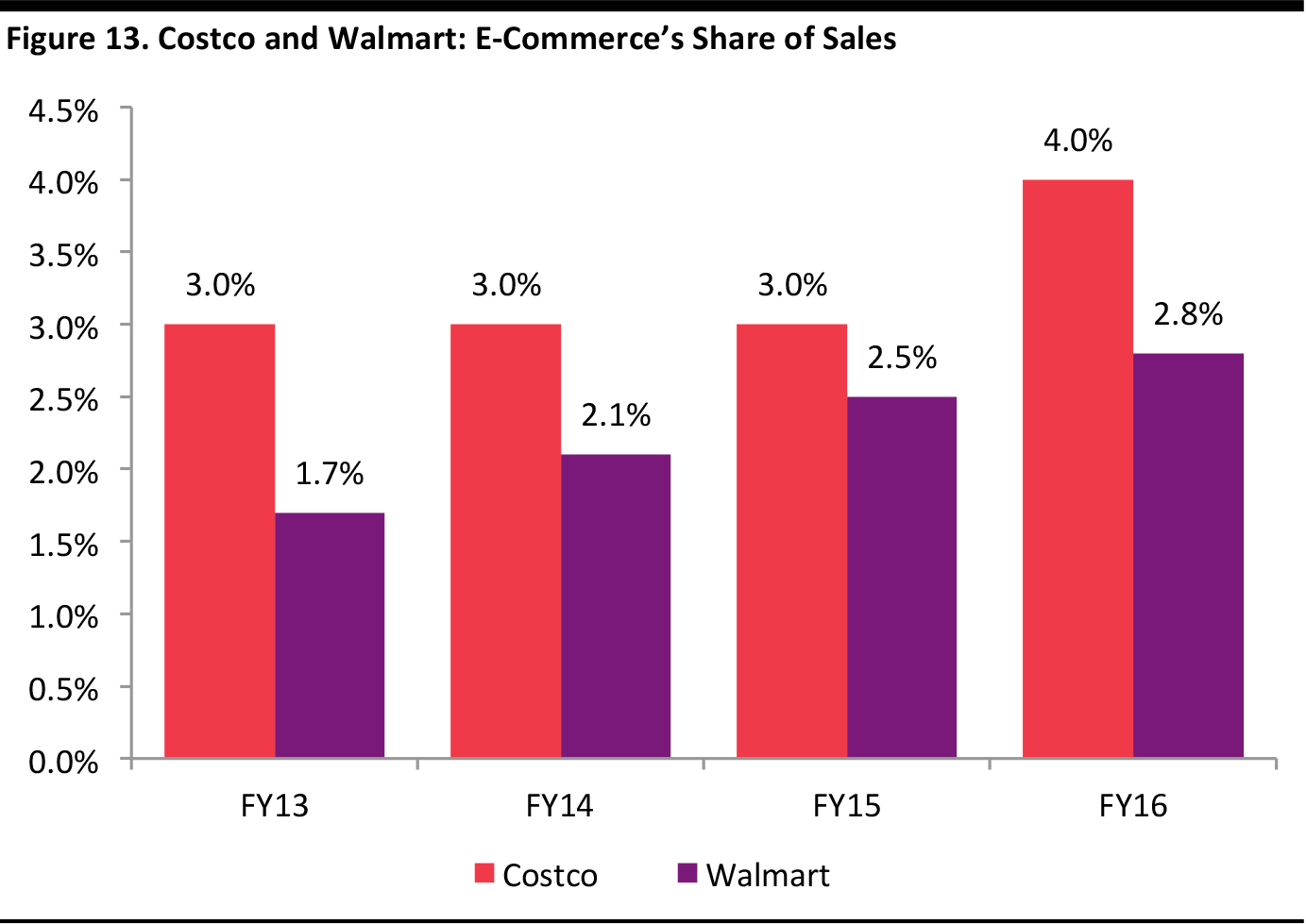

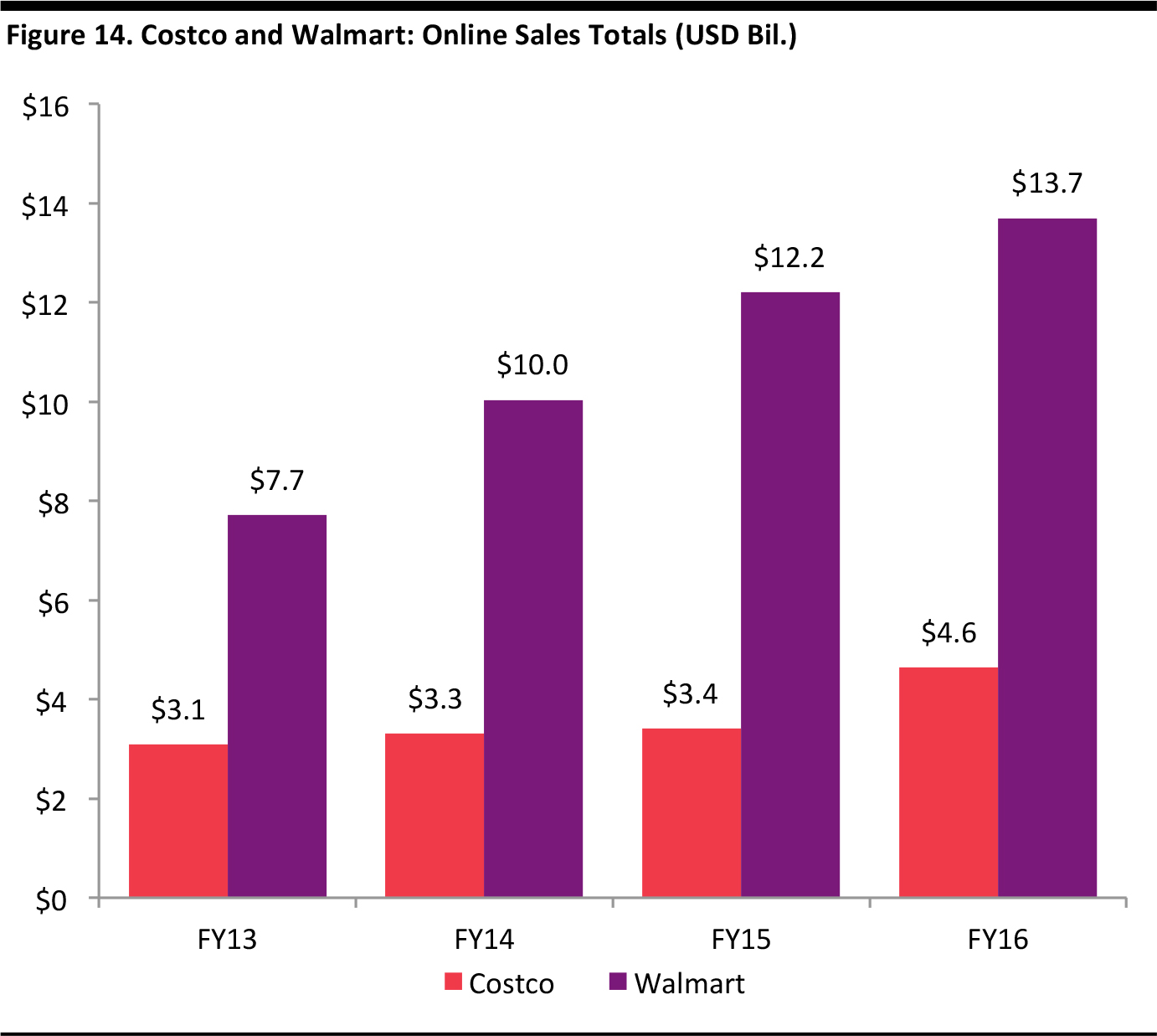

In recent years, Costco and Walmart (serving here as a proxy for Sam’s Club) both saw flattish growth in the percentage of their revenues deriving from

e-commerce. E-commerce accounts for a lower share of both companies’ sales than it does for the overall US retail industry: in 2016, e-commerce accounted for 8.1% of all retail sales in the US, and grew by 15.1% year over year.

Source: Company reports/Internet Retailer/Fung Global Retail & Technology

Source: Company reports/Internet Retailer/Fung Global Retail & Technology

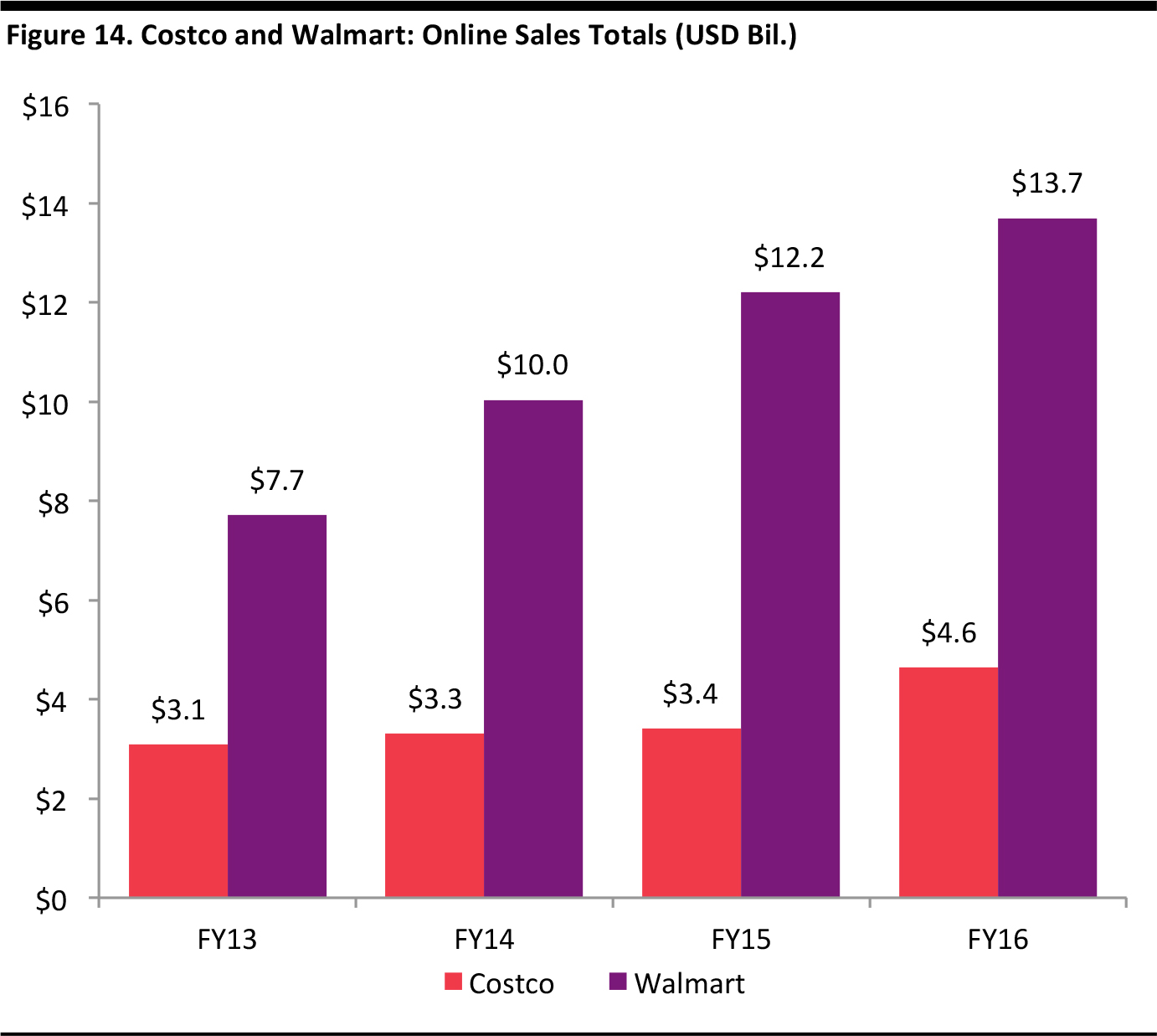

Although the figure above shows that Costco leads Walmart in terms of e-commerce revenue as a percentage of sales, the figure below shows that Walmart leads substantially in terms of e-commerce revenue in dollar terms. Walmart completed its acquisition of online retailer Jet.com on September 20, 2016, and a recent article published on tech news website Recode estimated Jet’s annual revenue at about $500 million.

Source: Company reports/Internet Retailer/Fung Global Retail & Technology

Source: Company reports/Internet Retailer/Fung Global Retail & Technology

Membership Composition Is Key

Membership Composition Is Key

Macroeconomic factors, including disposable income, employment and consumer sentiment, affect warehouse club membership growth. Currently, economic conditions in the US favor the sector. Unemployment continues to decline and consumer sentiment has increased. Locating stores in geographic areas likely to enjoy economic growth and withstand downturns is the key for increasing and sustaining club membership. Costco’s US locations are in states that are more affluent than its competitors’ stores are, and BJ’s has clusters of stores in affluent states. The locations of these stores likely benefit the companies.

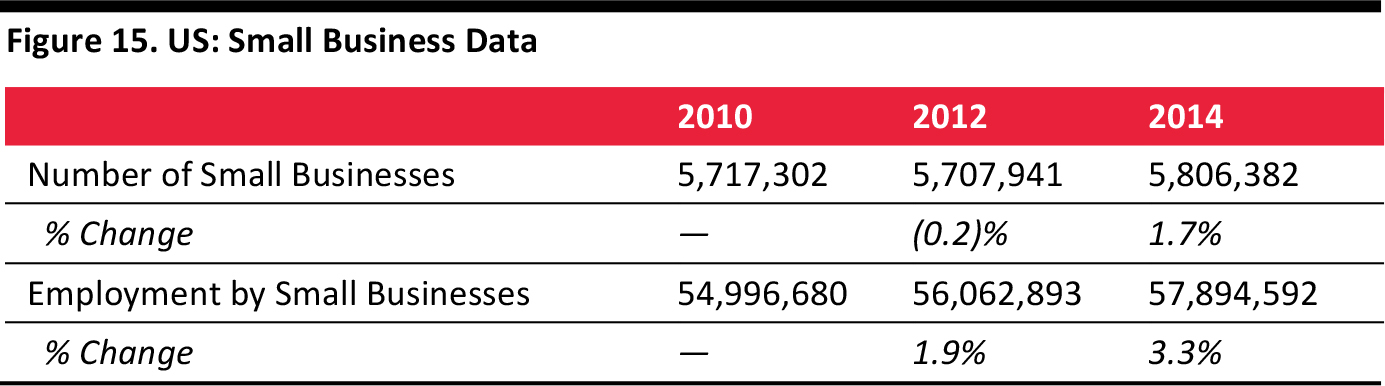

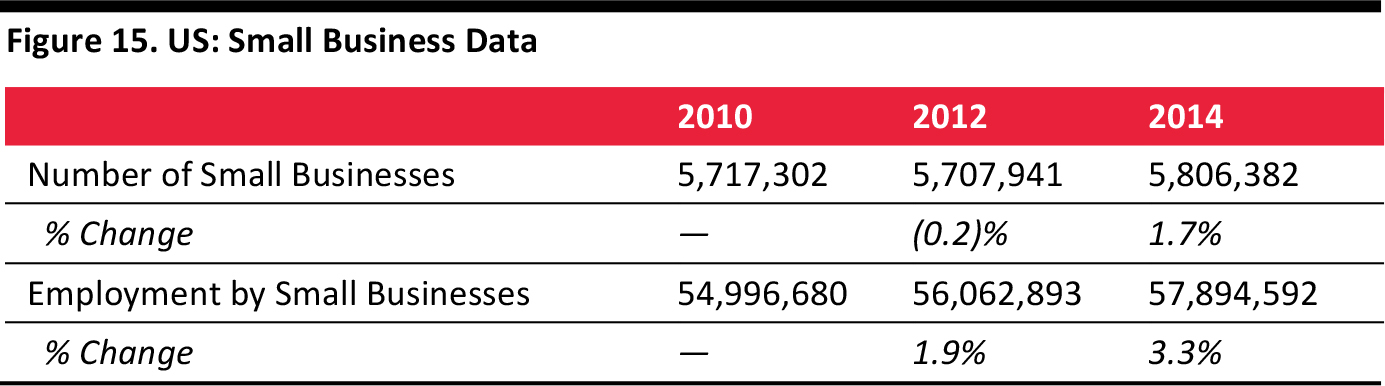

The majority of warehouse club members are consumers, but small businesses are also an important component of membership. The number of small businesses in the US grew by 1.7% between 2010 and 2014, and it is likely to increase as the US economy grows. Costco commands the largest percentage of business members among the big three warehouse clubs. In a strong economy, this is an advantage, but falling demand from small business customers in a weak economy could slow the chain’s growth.

2014 data were released on September 29, 2016.

Source: US Census Bureau

2014 data were released on September 29, 2016.

Source: US Census Bureau

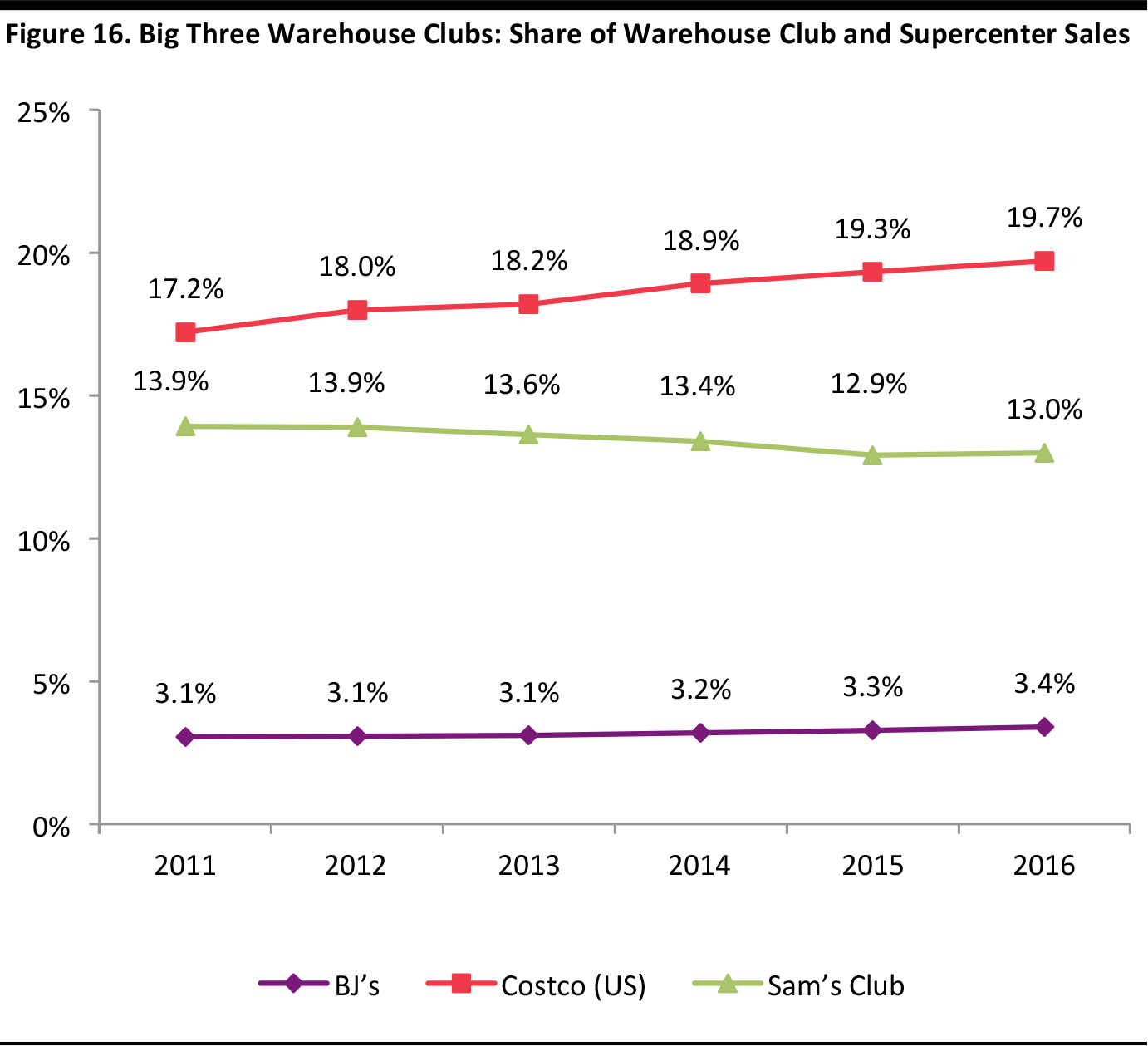

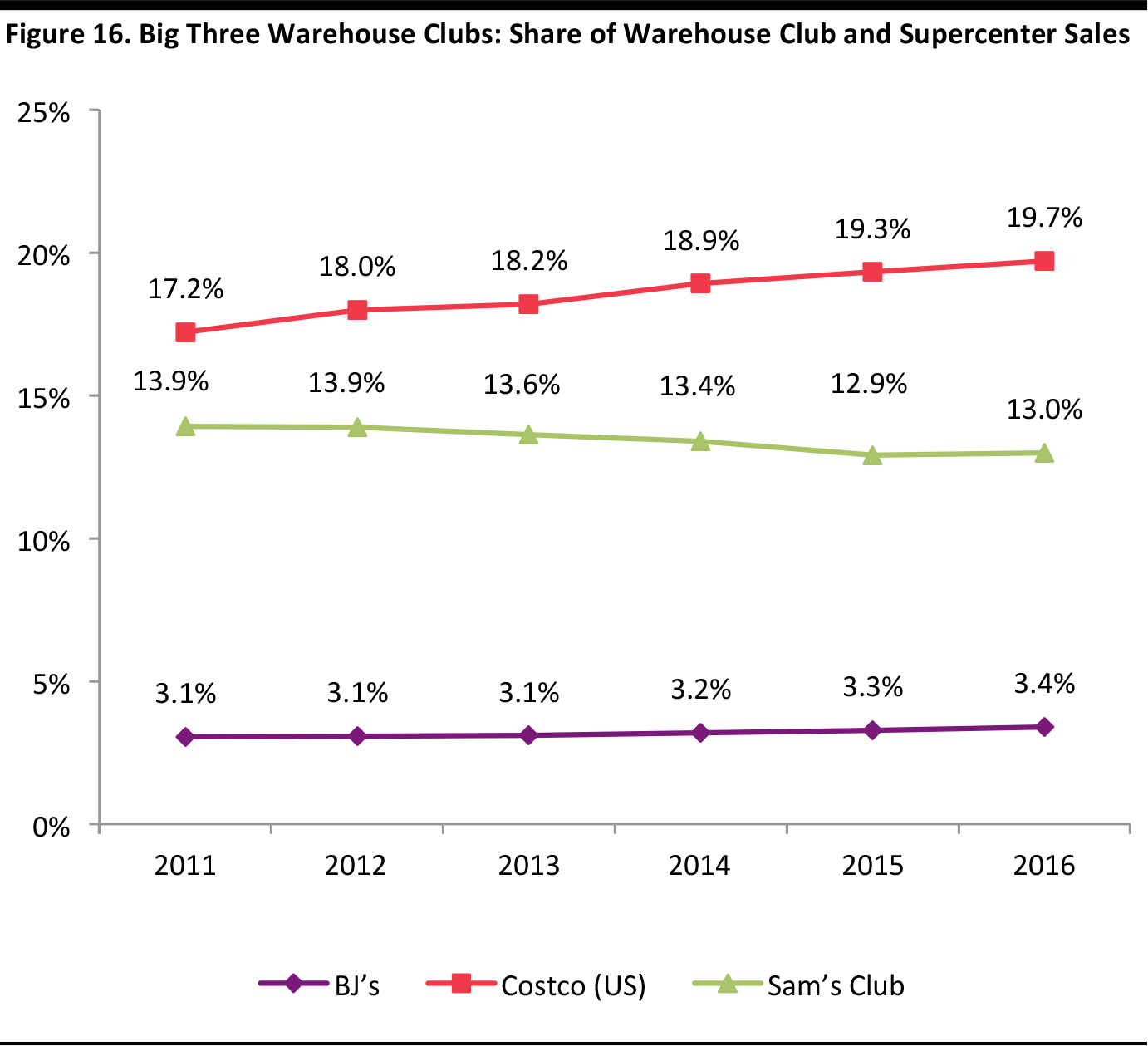

Sector Performance

The US continues to dominate the warehouse club sector, as it is the only international market with a substantial number of major club chains. The US is also the only major economy whose statistics office routinely reports sector data for warehouse clubs. These sector data are bundled with data on predominantly nonfood supercenters, such as those operated by Walmart. In this section, we examine figures for both the warehouse club sector and the warehouse club and supercenter sectors combined. Costco has led the gains in the US sector. In five years, the company gained more than two percentage points of share of the broader, combined warehouse club and supercenter sector.

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

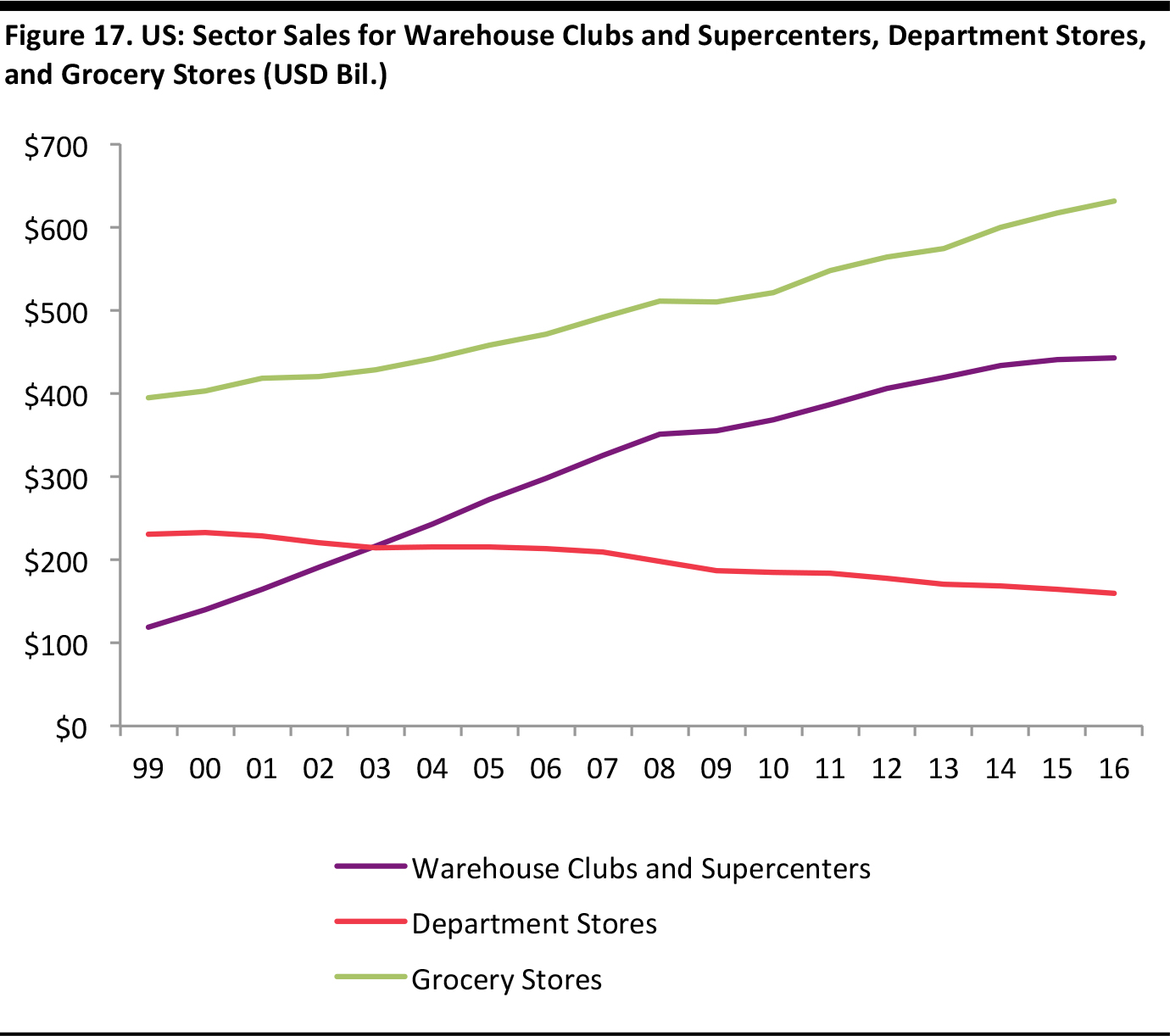

The Warehouse Club Sector Has Enjoyed Robust Growth

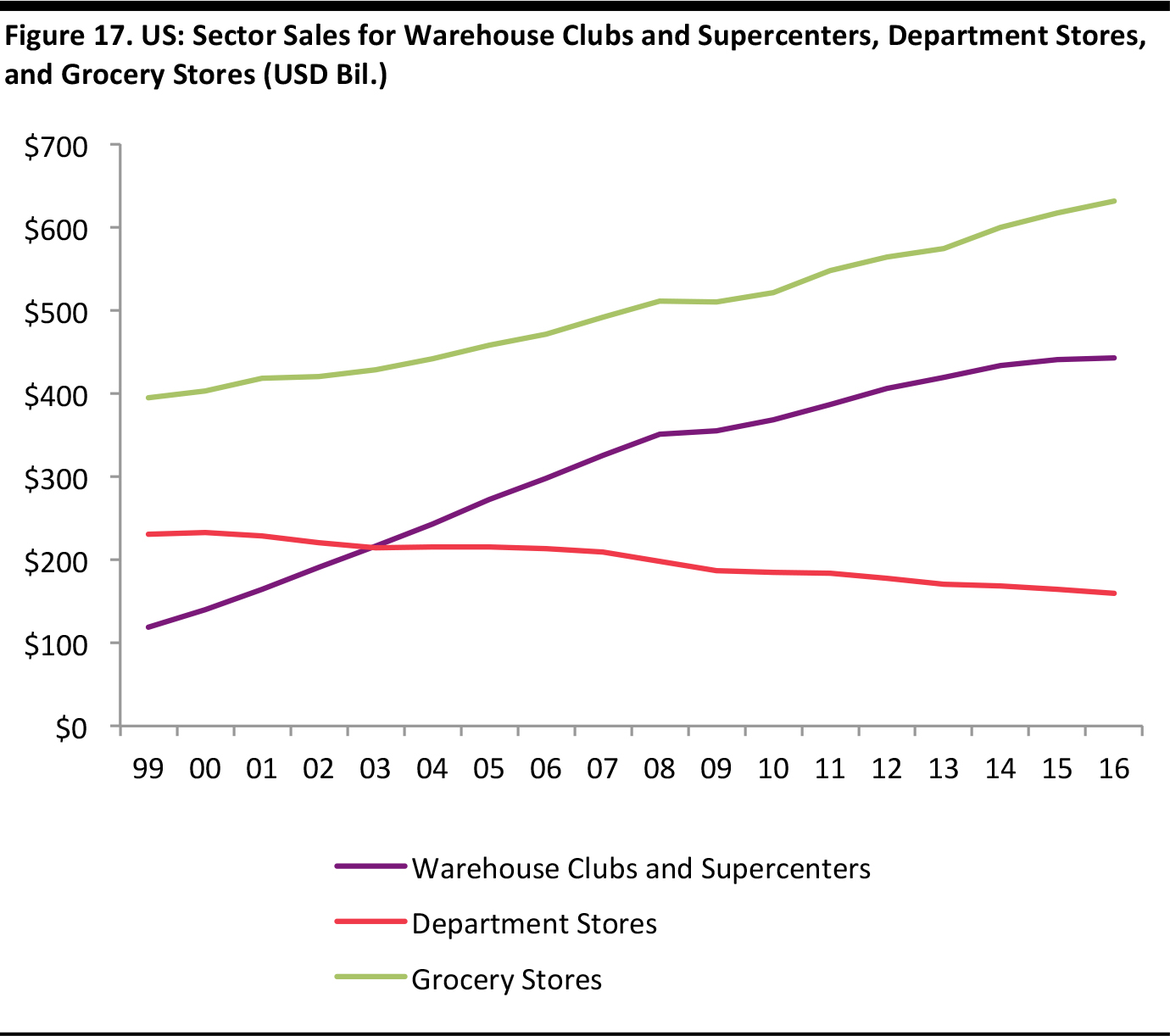

In the face of competition from discount channels, Internet pure plays and specialists, some nonspecialized retail sectors are faltering. Warehouse clubs, though, remain strong, even compared with rival grocery and department stores.

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Based on US Census Bureau data, grocery was the fastest-growing sector of the three in 2016, with sales increasing by 2.3%, followed by warehouse clubs and supercenters, which grew by 0.6%. The department store sector declined for the eleventh consecutive year in 2016, shrinking by 3.1%.

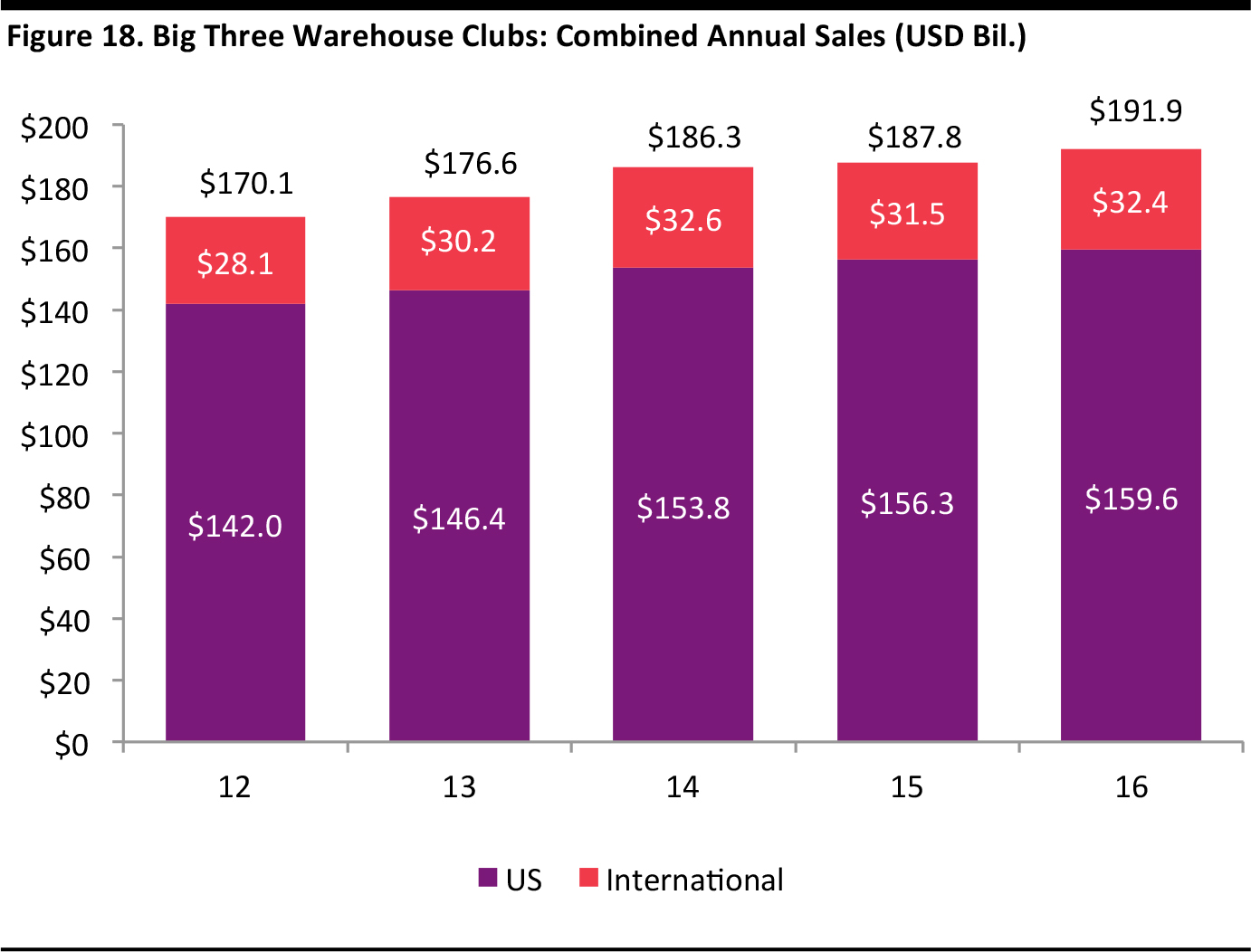

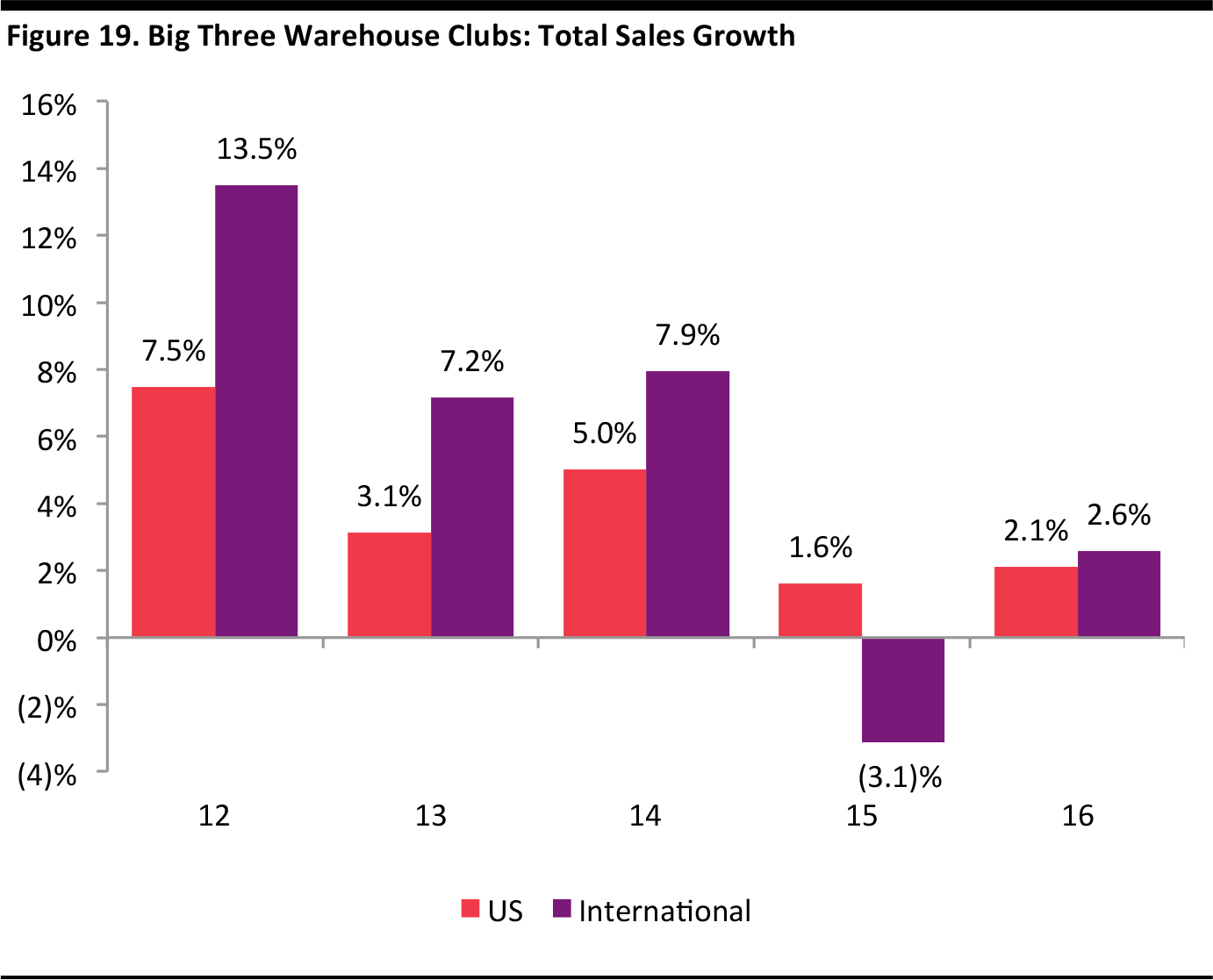

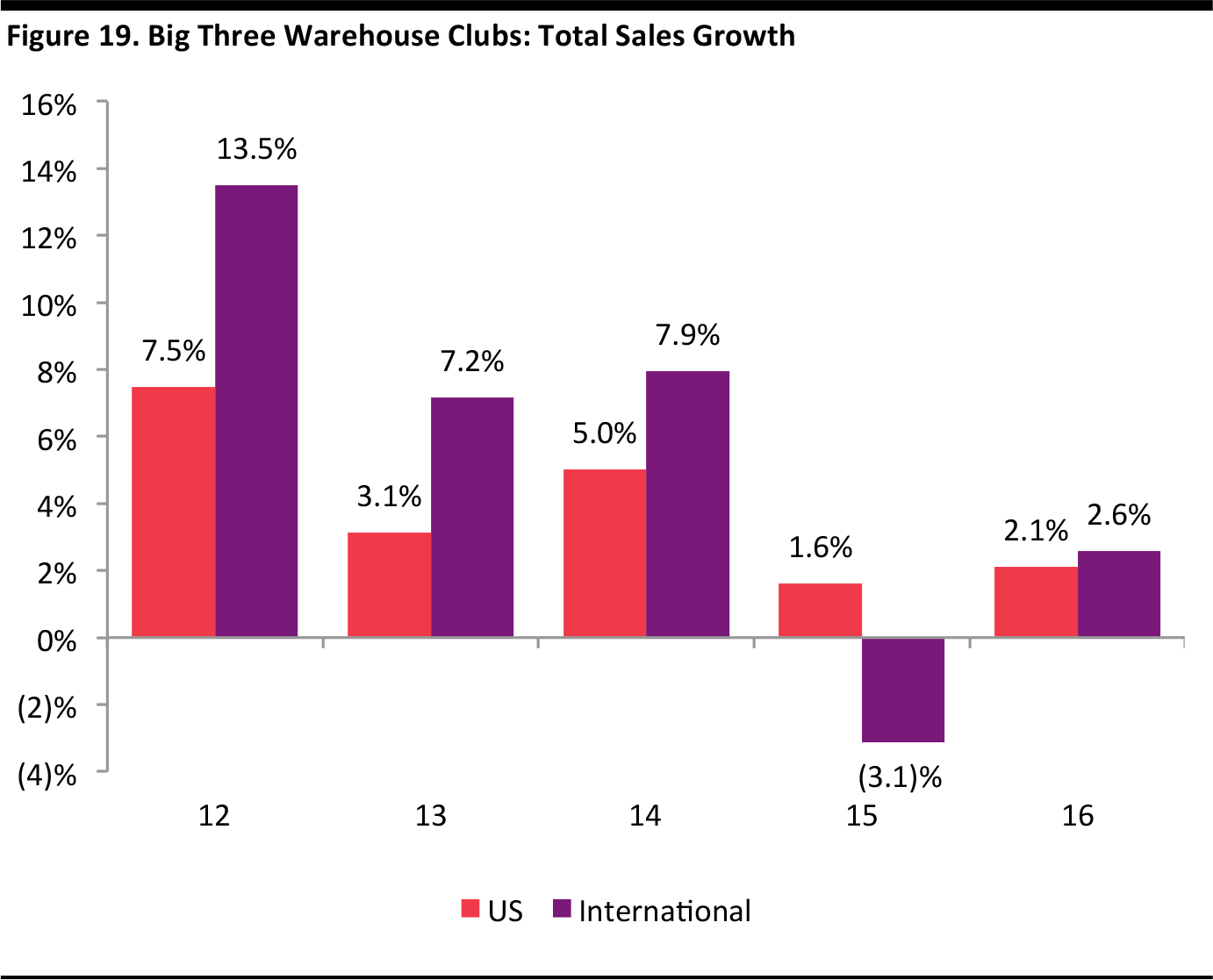

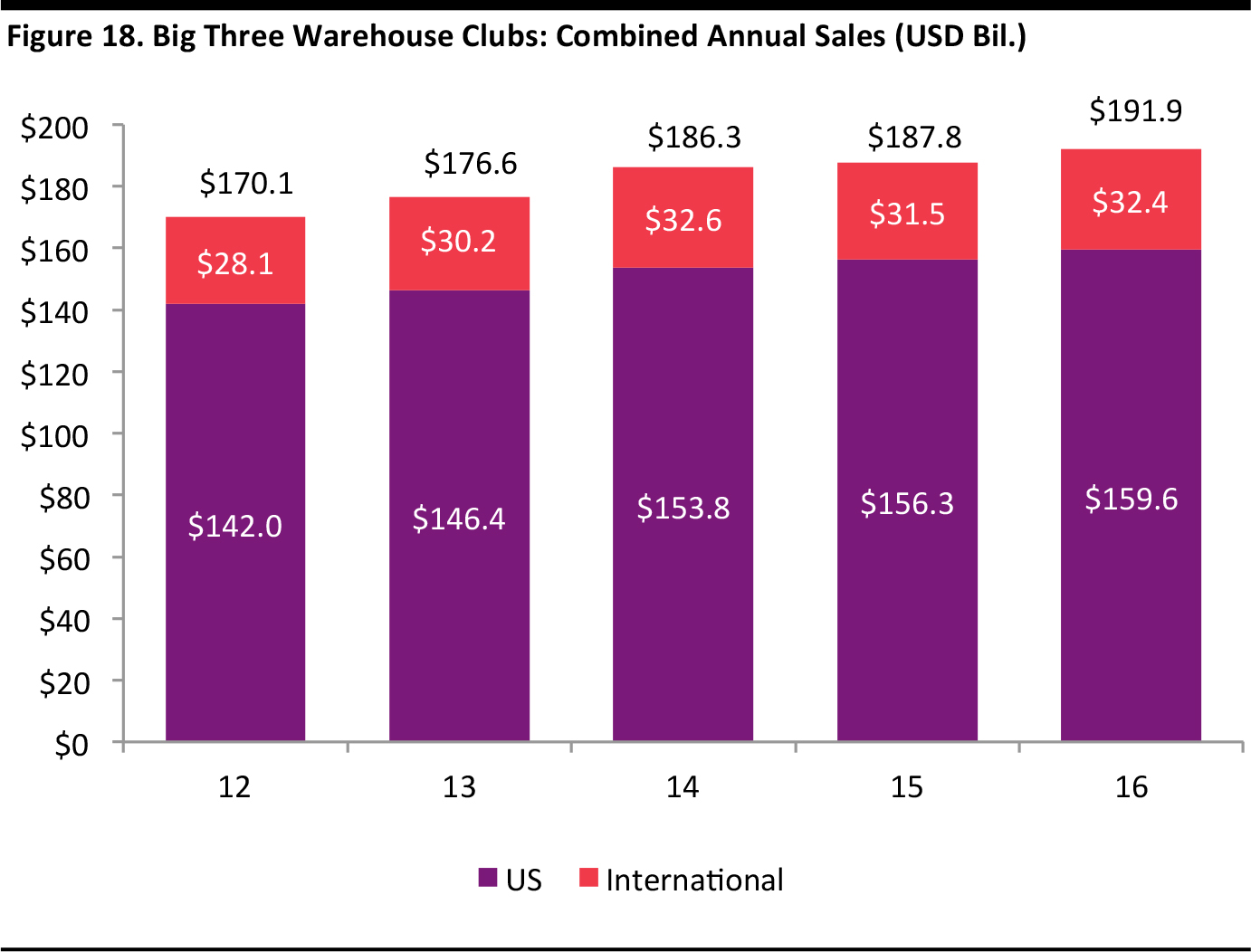

The figure below breaks down the big three warehouse clubs’ combined revenue in terms of domestic and international sales. Sales in both market segments grew from 2012 through 2016.

Source: Company reports/Fung Global Retail & Technology

Revenue growth for the big three warehouse clubs was much lower in 2015 than in the immediately preceding years, and international growth uncharacteristically lagged that of the US in 2015, largely owing to declines in Brazil and Mexico.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

Warehouse Club Growth Exceeds Supercenter Growth

Historical Results

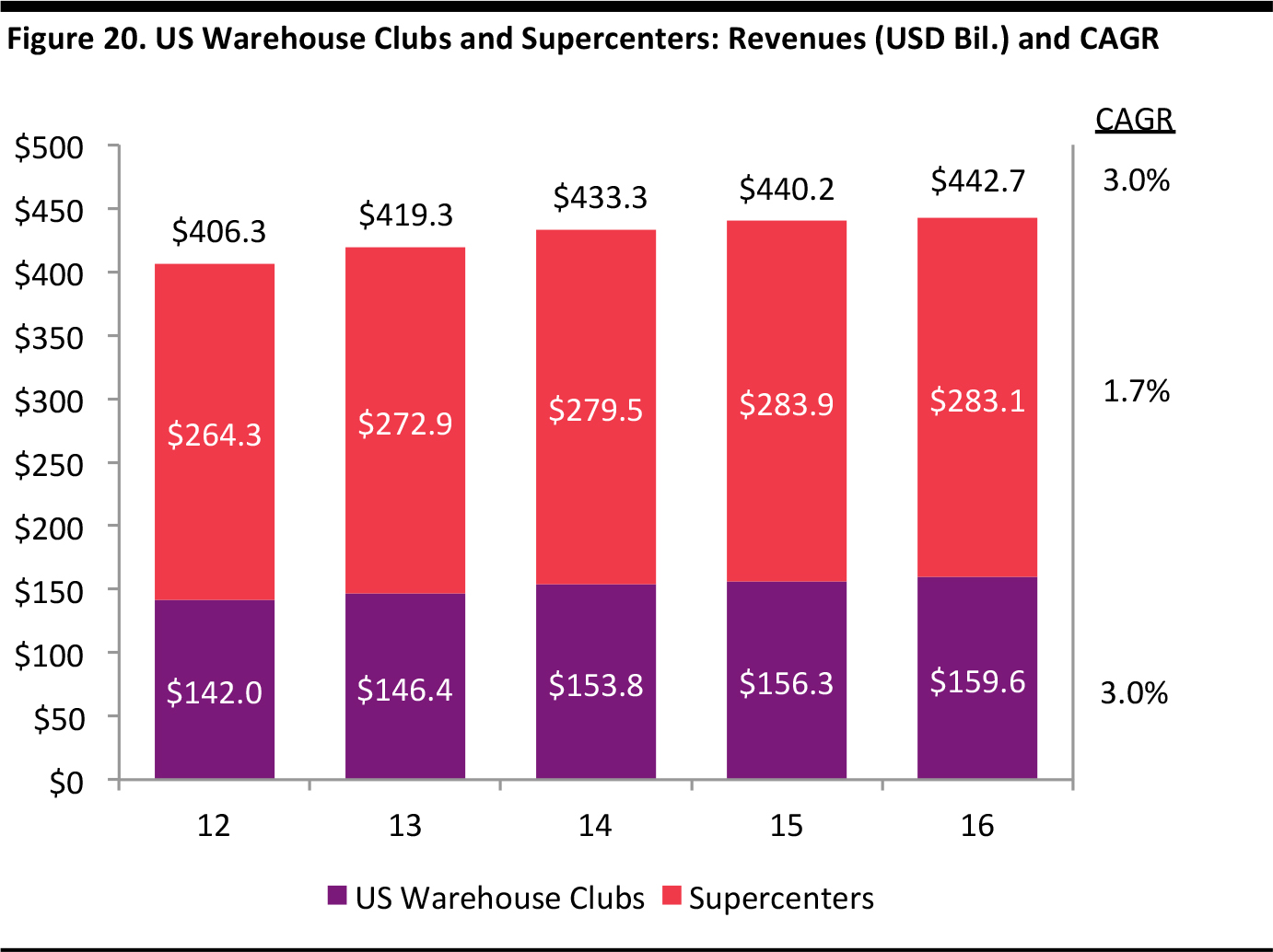

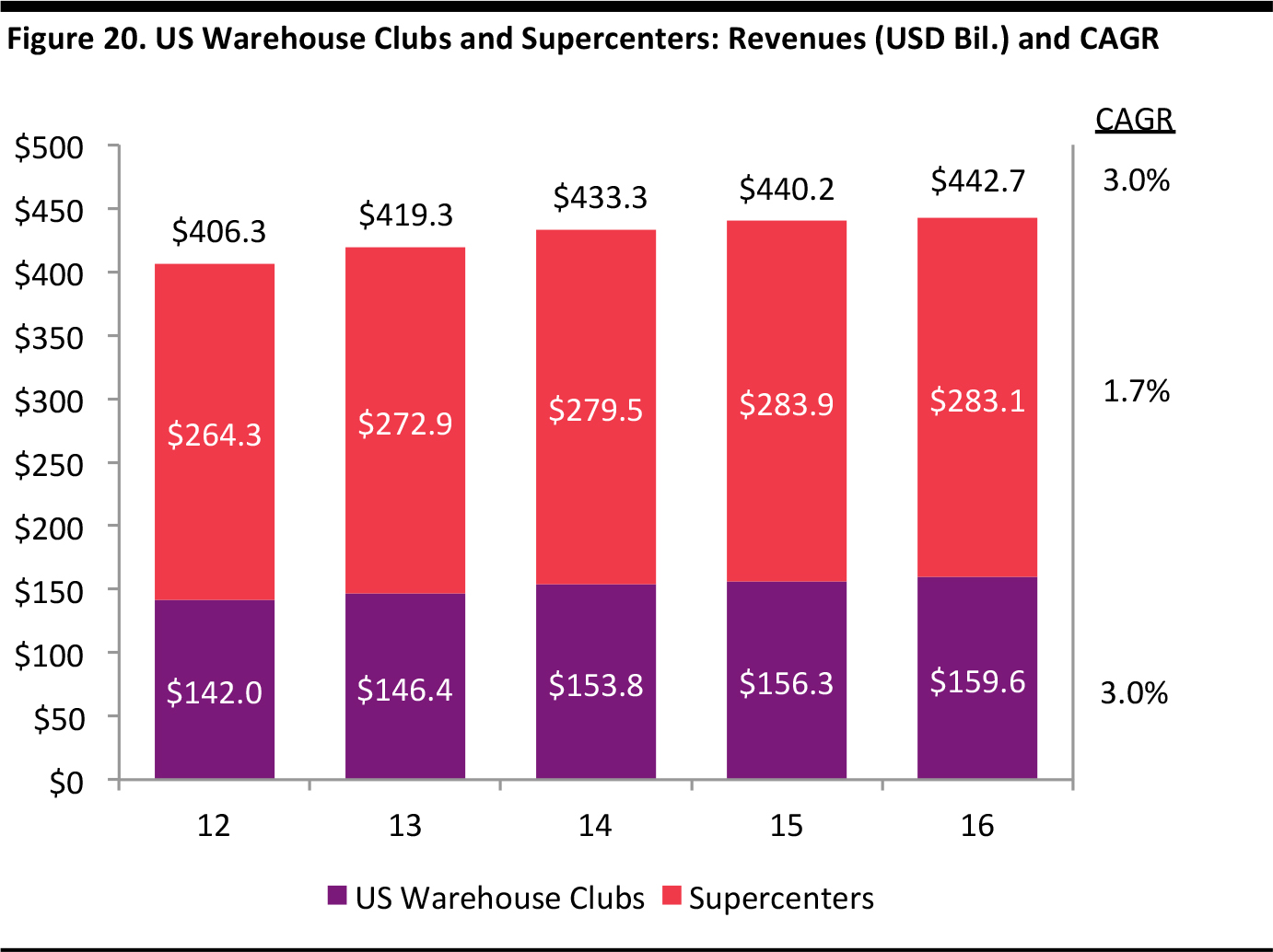

From 2012 through 2016, US warehouse club revenues grew at a 3.0% CAGR, while revenues for supercenters grew more slowly, at a 1.7% CAGR, we estimate, based on US Census Bureau data.

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

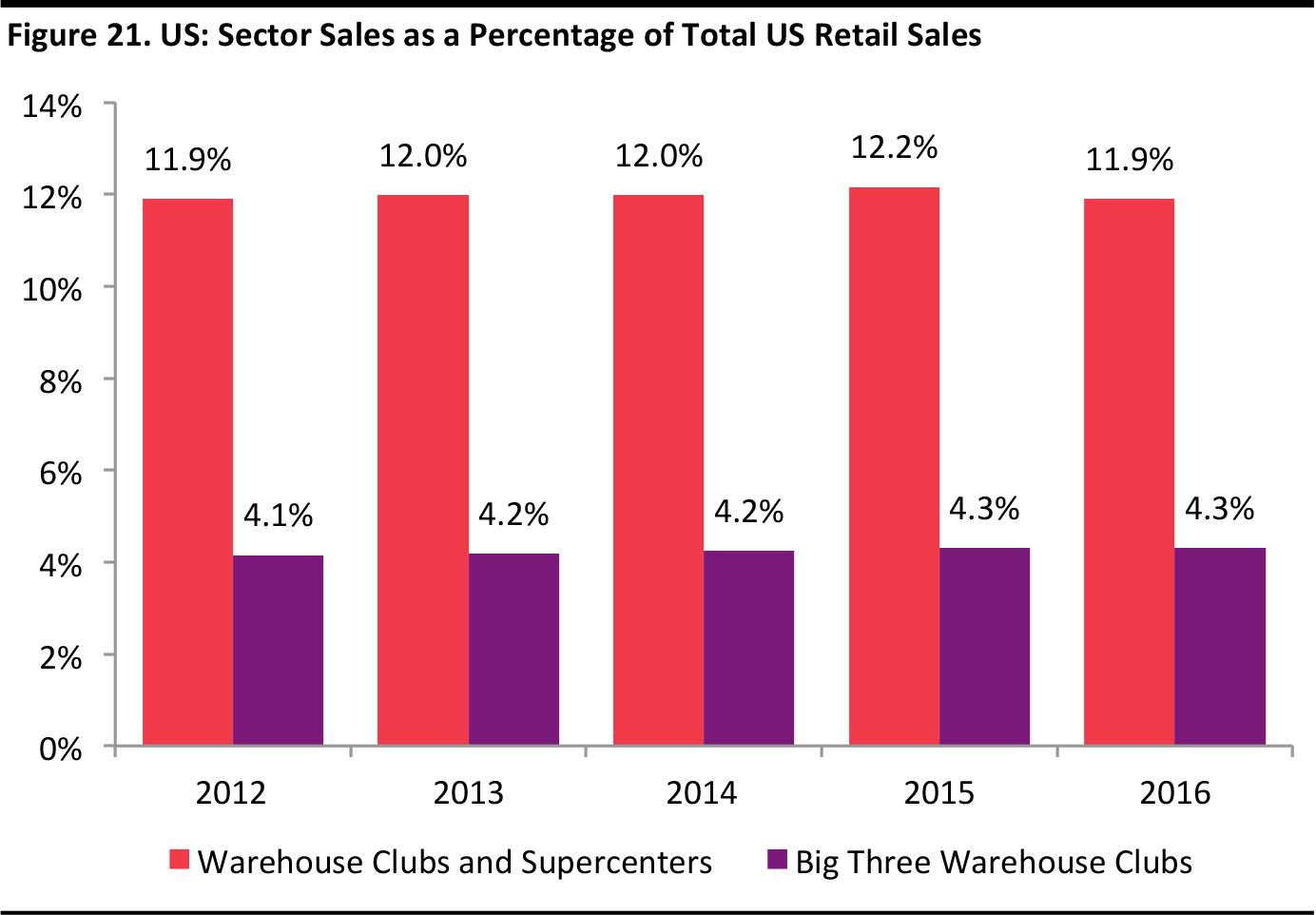

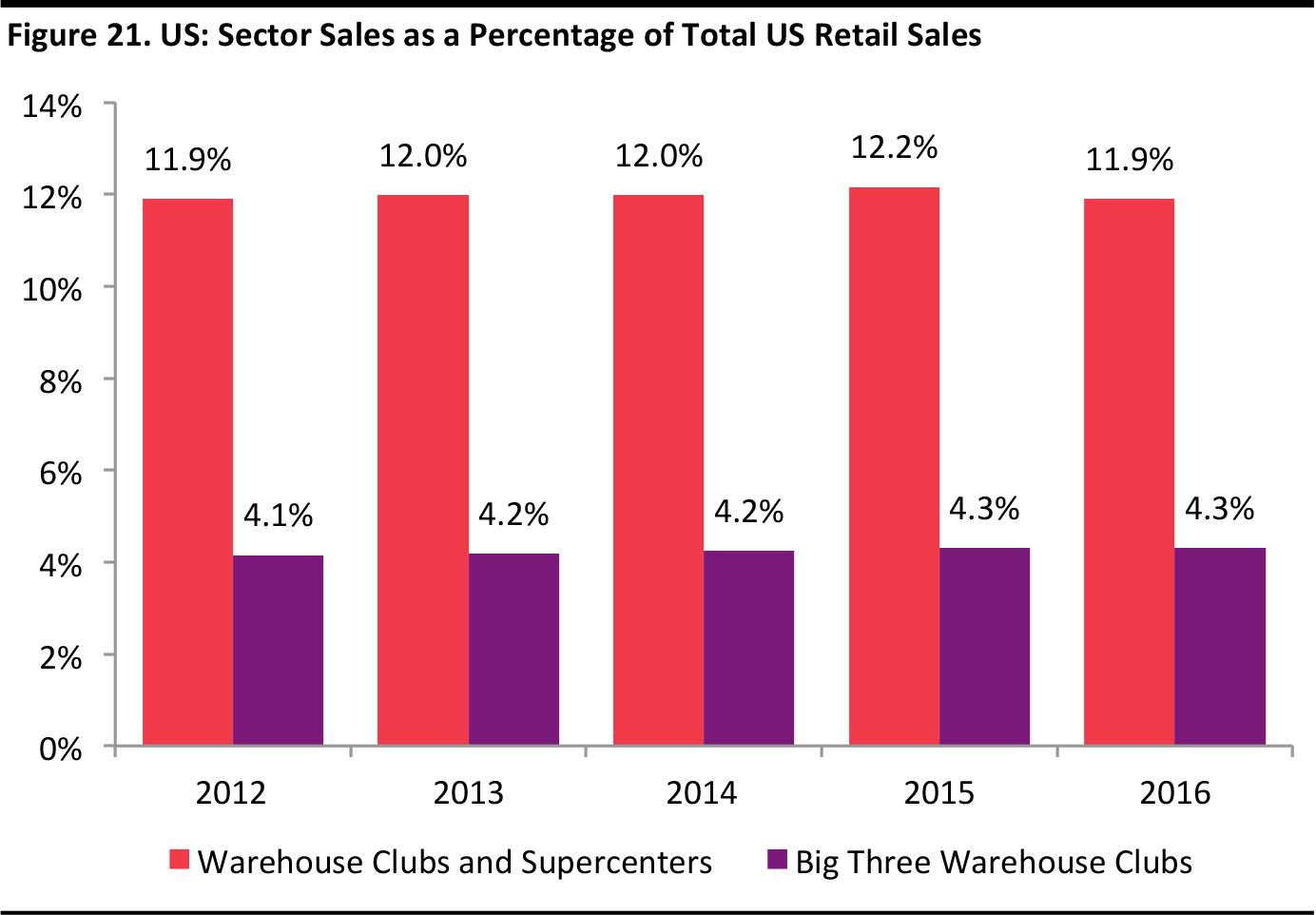

In terms of percentage of total US retail sales (excluding gasoline and auto parts), the warehouse club and supercenter combined sector remained flat from 2012 through 2016, whereas the big three warehouse clubs gained just 0.2 percentage points of share.

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Recent Results

During the 2016 calendar year, Costco posted revenues of $119.6 billion, up 2.5% year over year. Comparable store sales for the year excluding gasoline increased by 2.8%. Consensus estimates call for revenues of $126.7 billion in fiscal year 2017, up 6.7%, and for EPS of $5.91, up 10.9%.

In its fiscal second quarter of 2017, Costco reported a total comp increase of 3%, comprising a 3% increase in the US, an 8% increase in Canada and a 2% decrease in other international regions.

In fiscal 2017, Costco plans to open eight new warehouses, five in the US and three in Canada.

In March 2015, Costco announced that Visa would replace American Express as the company offering its rewards credit card beginning April 1, 2016, putting an end to a 16-year business relationship. This transition negatively impacted Costco’s fiscal first-quarter 2016 earnings by $15 million, or $0.02 a share. By the end of fiscal 2016, nearly 85% of 11.4 million American Express cards had been transferred and activated, and 730,000 new members had activated their cards; these figures were ahead of the company’s internal expectations.

In fiscal 2017, Sam’s Club reported revenues of $57.4 billion, up 0.9% year over year. In the year, comparable store sales increased by 0.2% including fuel and increased by 1.1% excluding fuel. For the fourth quarter of fiscal 2017, Sam’s Club reported comp sales growth (excluding fuel) of 2.4%. Including fuel, comps increased by 3.1%.

In October 2016, an SEC filing disclosed that Walmart had increased its stake in Chinese e-commerce company JD.com after selling its stake in the Yihaodian online marketplace to JD.com in June. In its fiscal third-quarter 2017 earnings call, Walmart announced that its Sam’s Club flagship store had launched on JD.com’s website, offering hundreds of millions of customers access to Sam’s Club’s products with same-day and next-day delivery service.

�

The Competitive Landscape

As stated earlier, the warehouse club sector is highly concentrated. There are only three big players, all of which are US-centric and headquartered in the US, which accounts for more than 70% of sector revenue, and concentration is likely to remain high given the substantial capital needed for new entrants or other rivals to be able to compete with these sector leaders. Nonetheless, warehouse club chains face heavy competition from each other and from other retail verticals, including specialty hardline, drugstore, department store, mass merchant and Internet retailers.

Revenues and Growth: Costco Leads the US Market

Costco is the leader of the big three warehouse clubs in terms of total sales, US sales and sales per store. Its scale is due in part to its substantial international presence, but high-volume, low-margin and limited-line trading is the company’s formula for success. The big three recorded an estimated total of $192 billion in revenues in 2016, up 2.2% from the prior year. Costco drove the sector’s growth in the year; the company’s $3.0 billion of growth exceeded an increase of $0.6 billion at BJ’s and an increase of $0.5 billion at Sam’s Club.

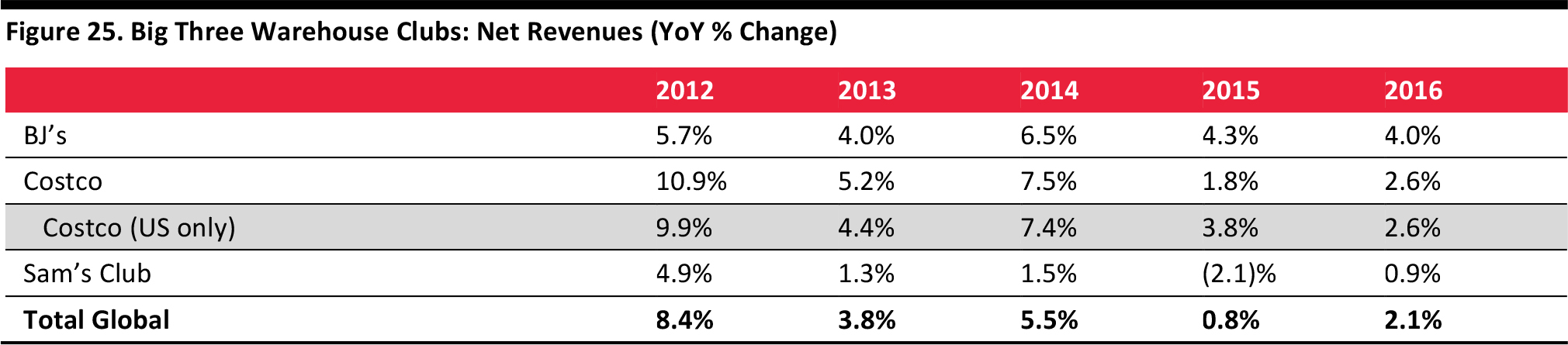

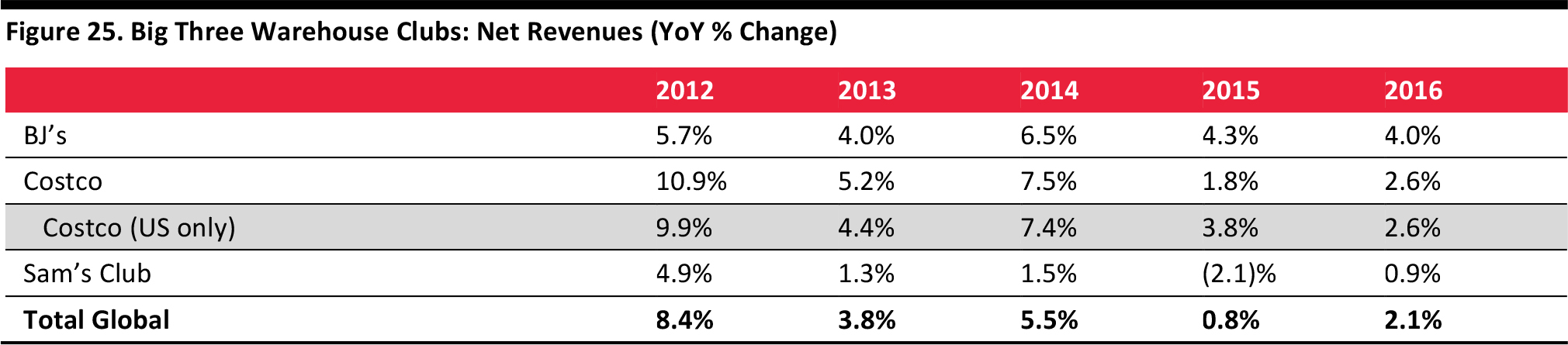

A drop in Sam’s Club revenue in 2015 stemmed from a near-30% decline in the company’s gasoline revenue, which decreased to $4.5 billion from $6.4 billion in the prior year, primarily due to lower fuel prices. Sam’s Club’s revenues excluding gas increased by 1.4% in 2015. The company’s retail square footage increased by 1.2% and its comparable store sales were flattish.

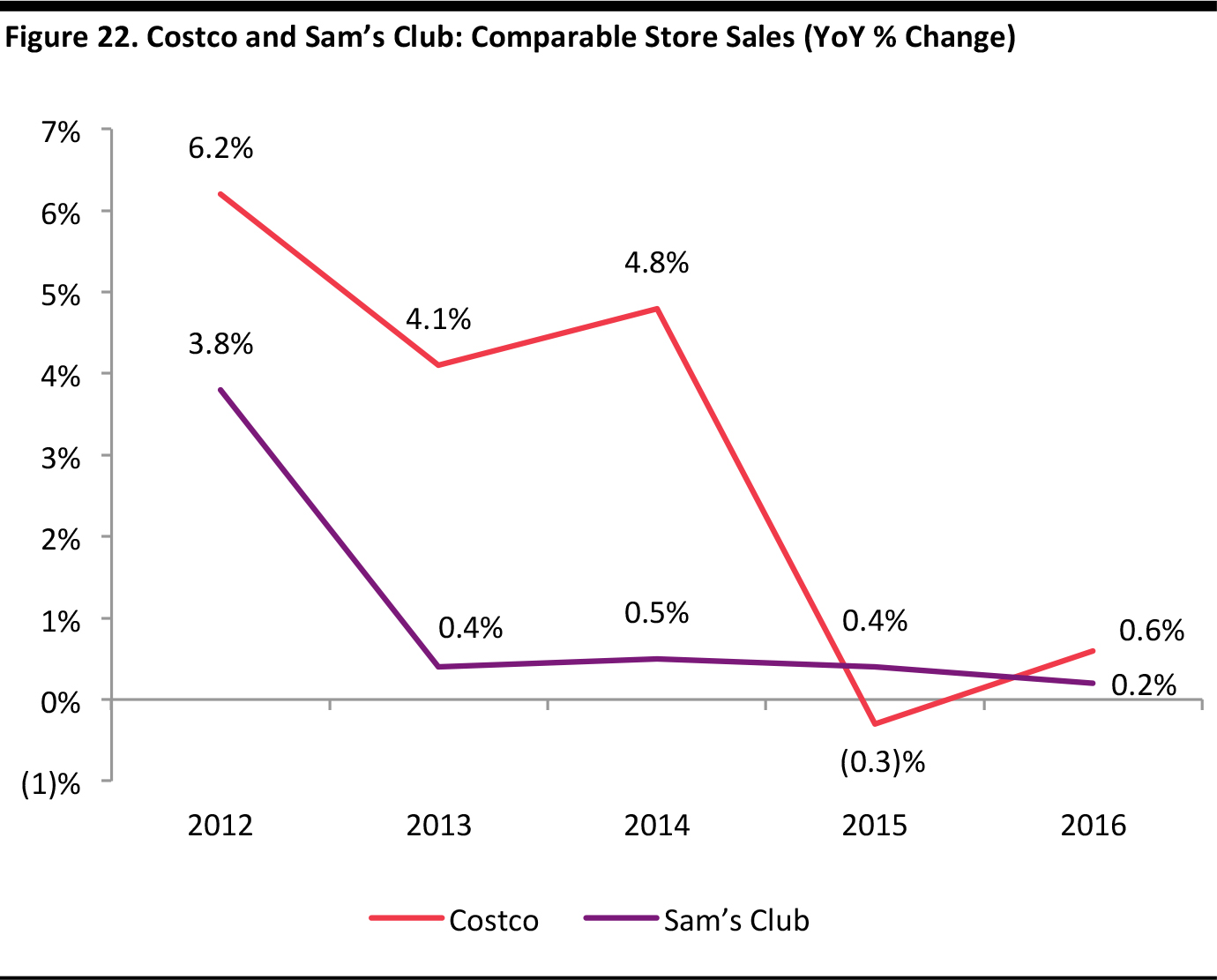

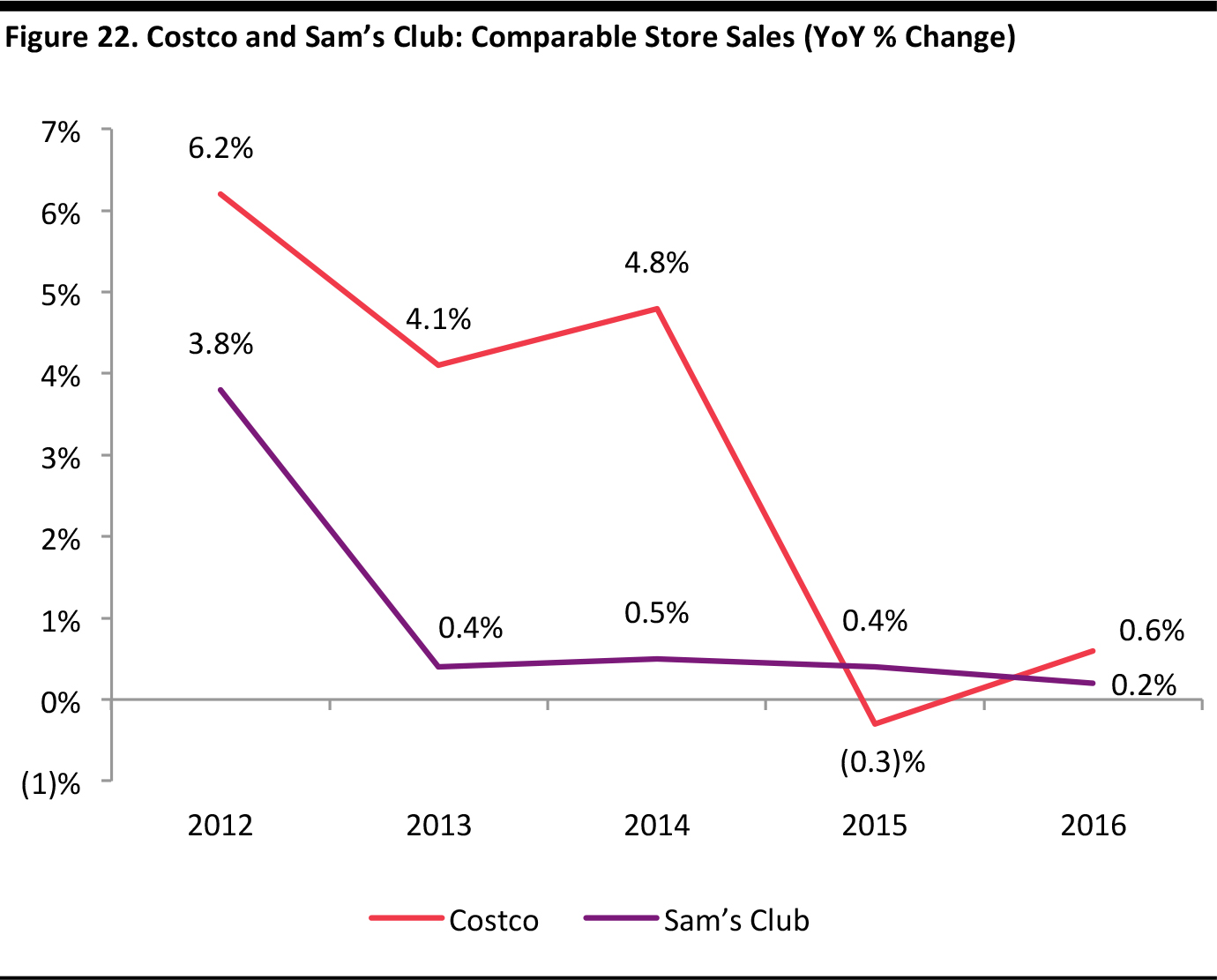

Comps weakened during the 2012–2015 period across the sector, reflecting tougher trading as the sector moved closer to maturity, if not saturation.

Source: Company reports/Fung Global Retail & Technology

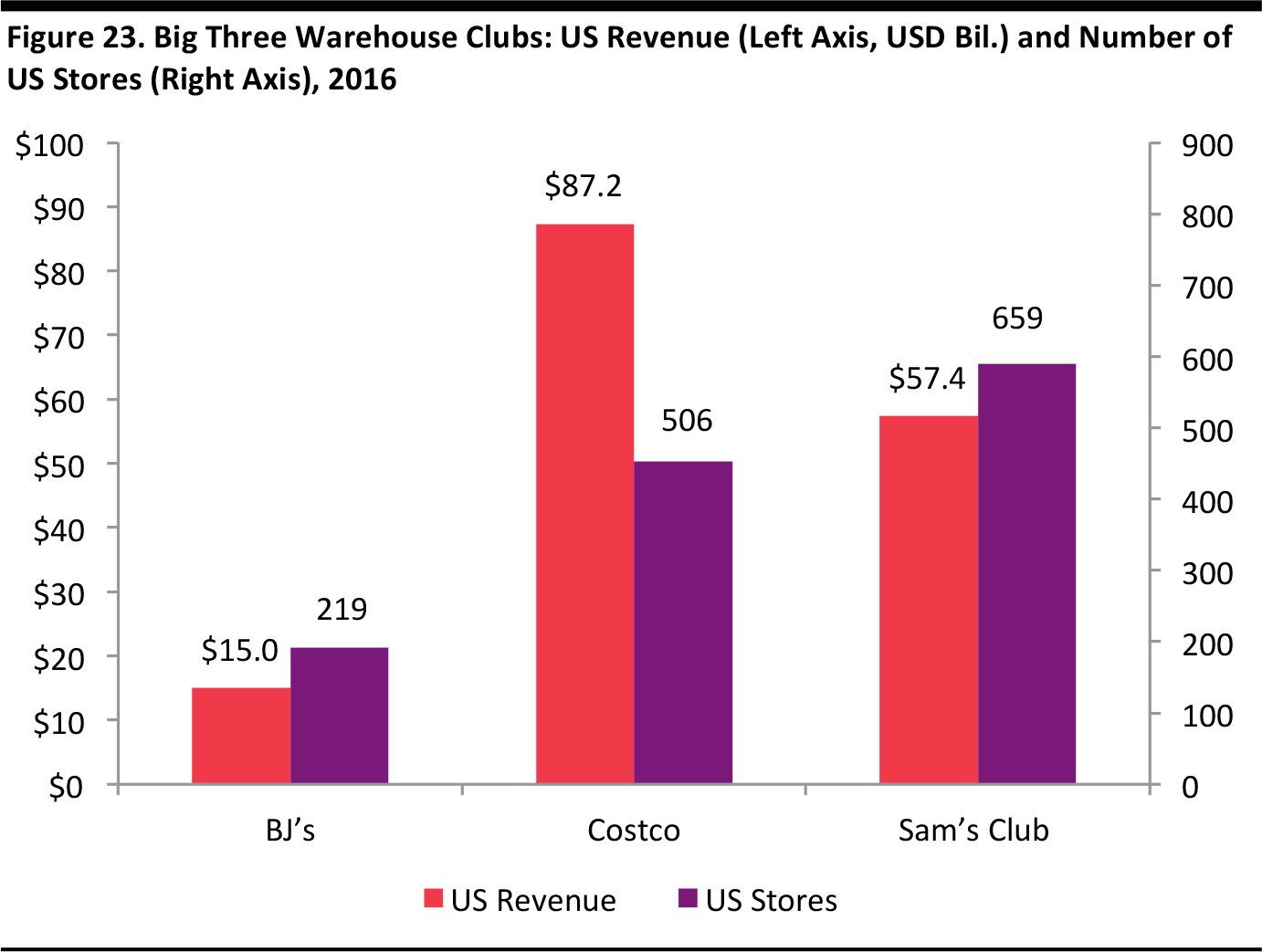

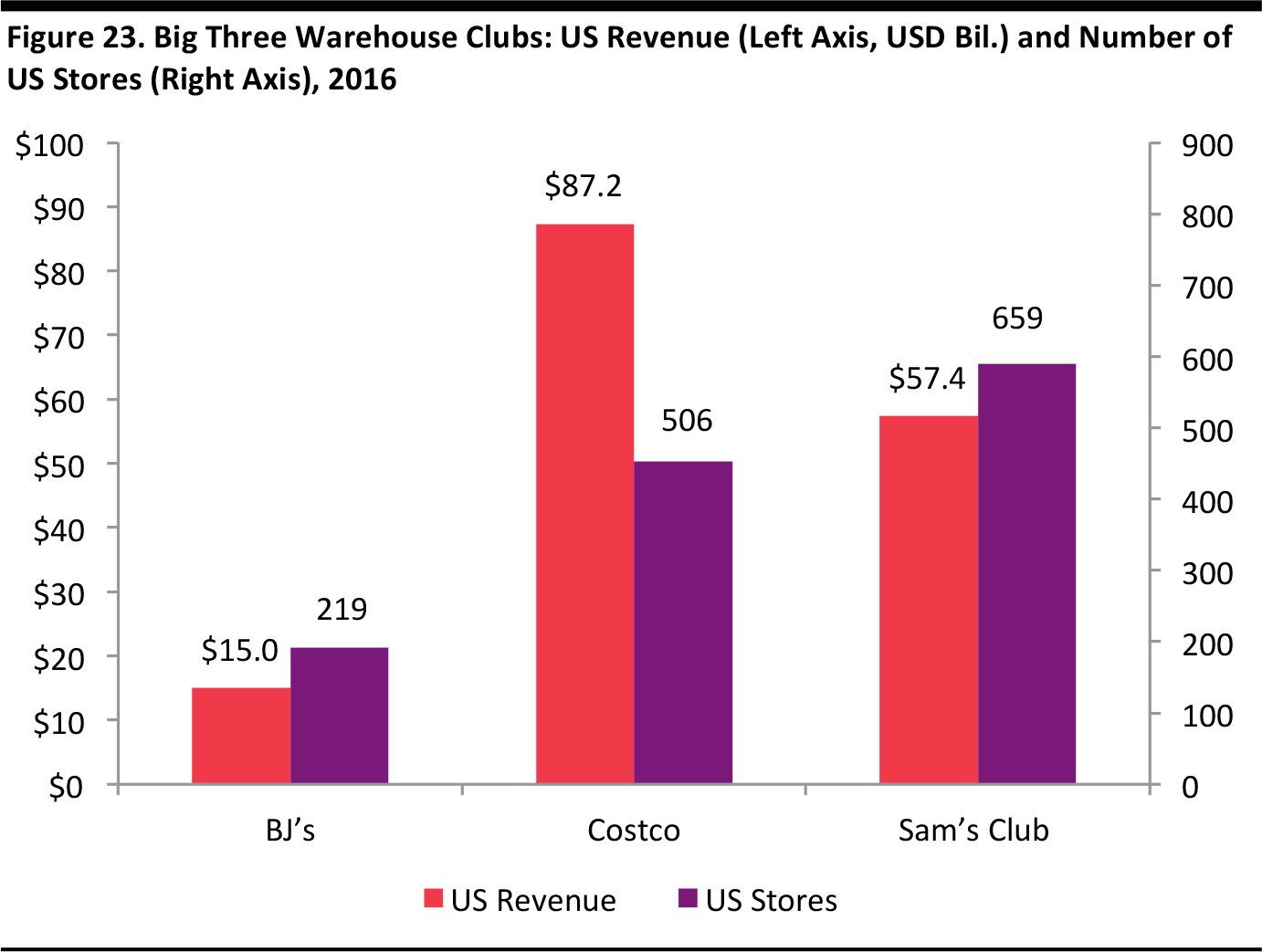

The figure below displays US store revenues and number of US stores for the big three warehouse clubs.

Source: Company reports/NRF/Fung Global Retail & Technology

Source: Company reports/NRF/Fung Global Retail & Technology

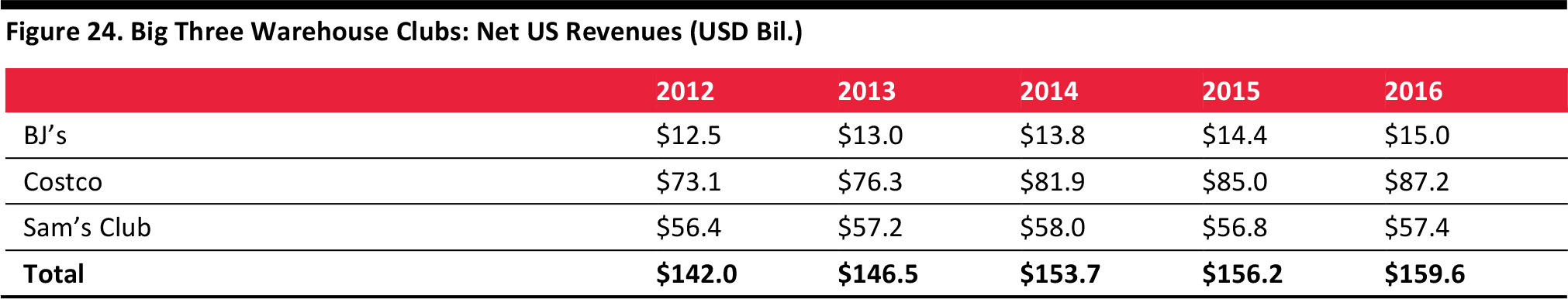

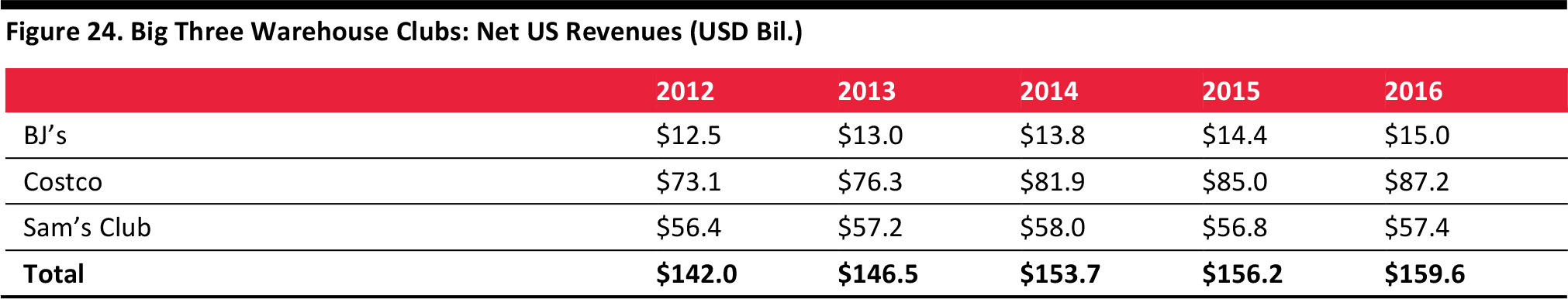

The table below lists net US revenues for the big three warehouse clubs.

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

The table below lists net revenue growth for the big three warehouse clubs.

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

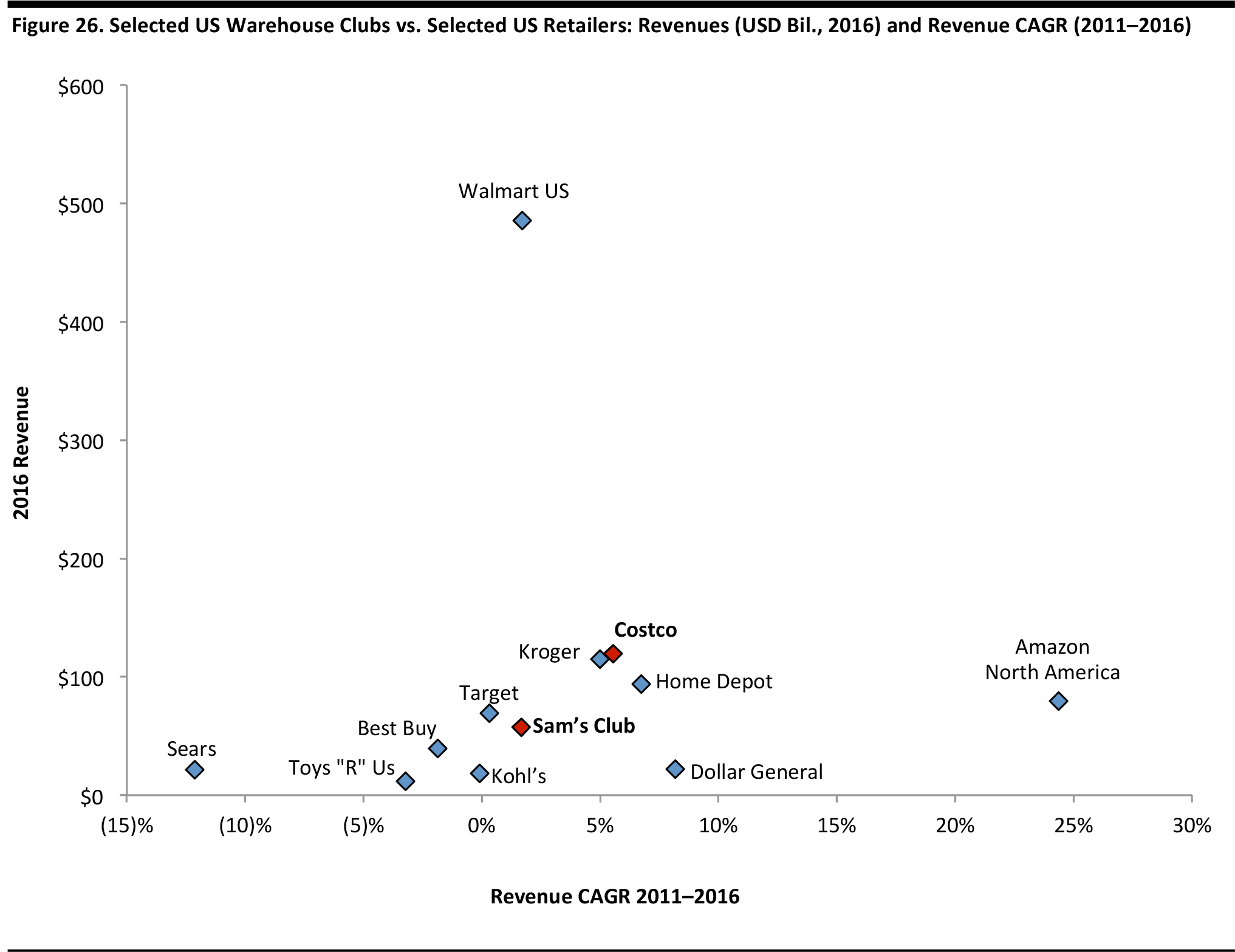

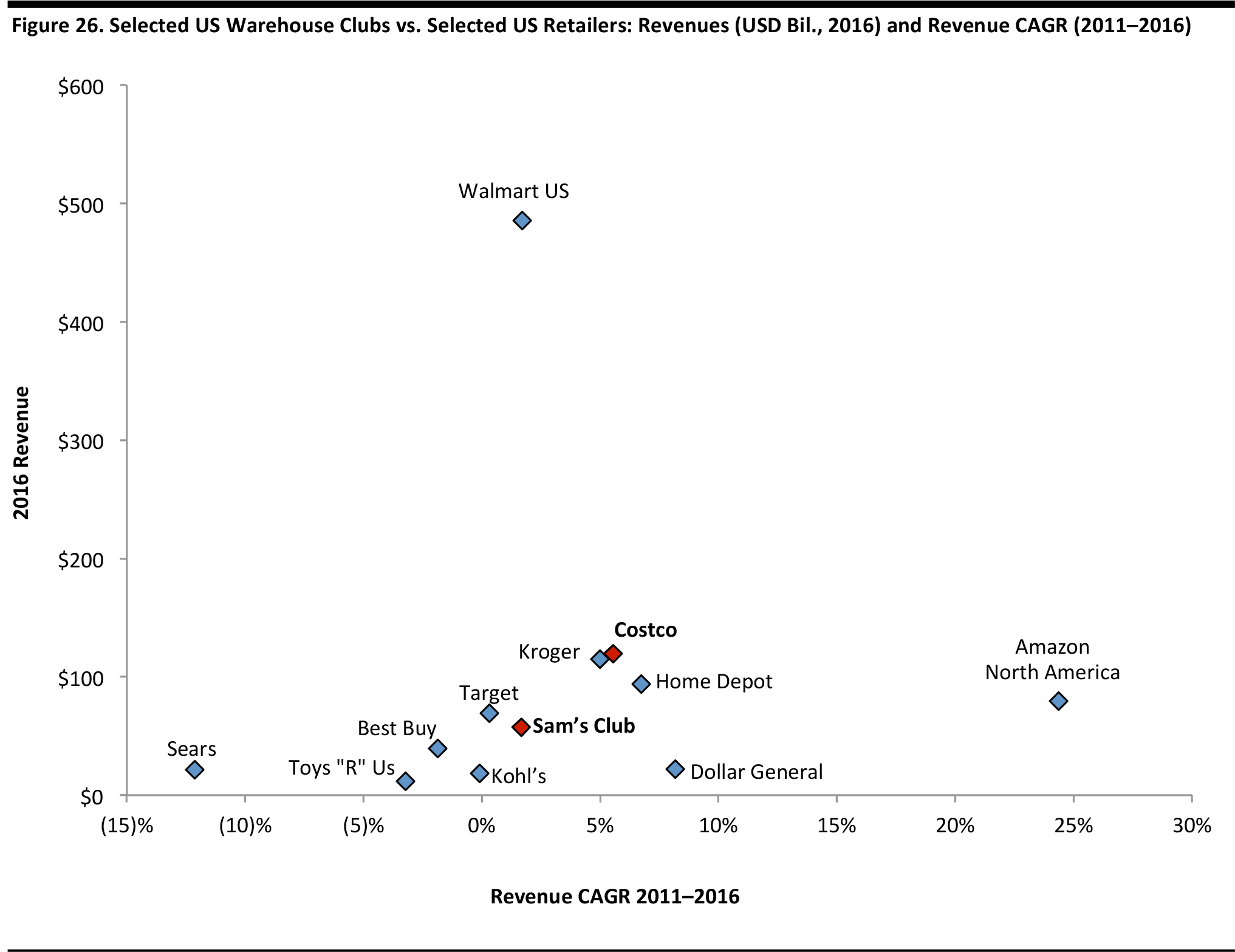

Warehouse Clubs Versus Other Large General Merchandisers

Warehouse clubs compete against specialists such as electronics and toy retailers, generalists such as Walmart and Sears, and Internet pure plays. So, how do the two biggest US warehouse clubs measure up against their primary competitors in terms of sales and growth?

- In scale, Costco and Sam’s Club rival large specialist retailers such as Kroger and Best Buy, respectively. Both clubs also are well ahead of big-name generalists, such as Kohl’s, Sears and Dollar General.

- Compared with many big store-based rivals, such as Walmart, Target, Best Buy and Sears, Costco and Sam’s Club have outperformed in terms of revenue growth. Costco grew at a 5.5% CAGR from 2011 through 2016 and Sam’s Club grew at a 1.3% CAGR from 2011 through 2016.

- Costco’s growth has rivaled Dollar General’s, confirming that both have benefited from the polarization in retail that has made discount channels the champion over midmarket players.

Source: Company reports/FactSet/Fung Global Retail & Technology

Source: Company reports/FactSet/Fung Global Retail & Technology

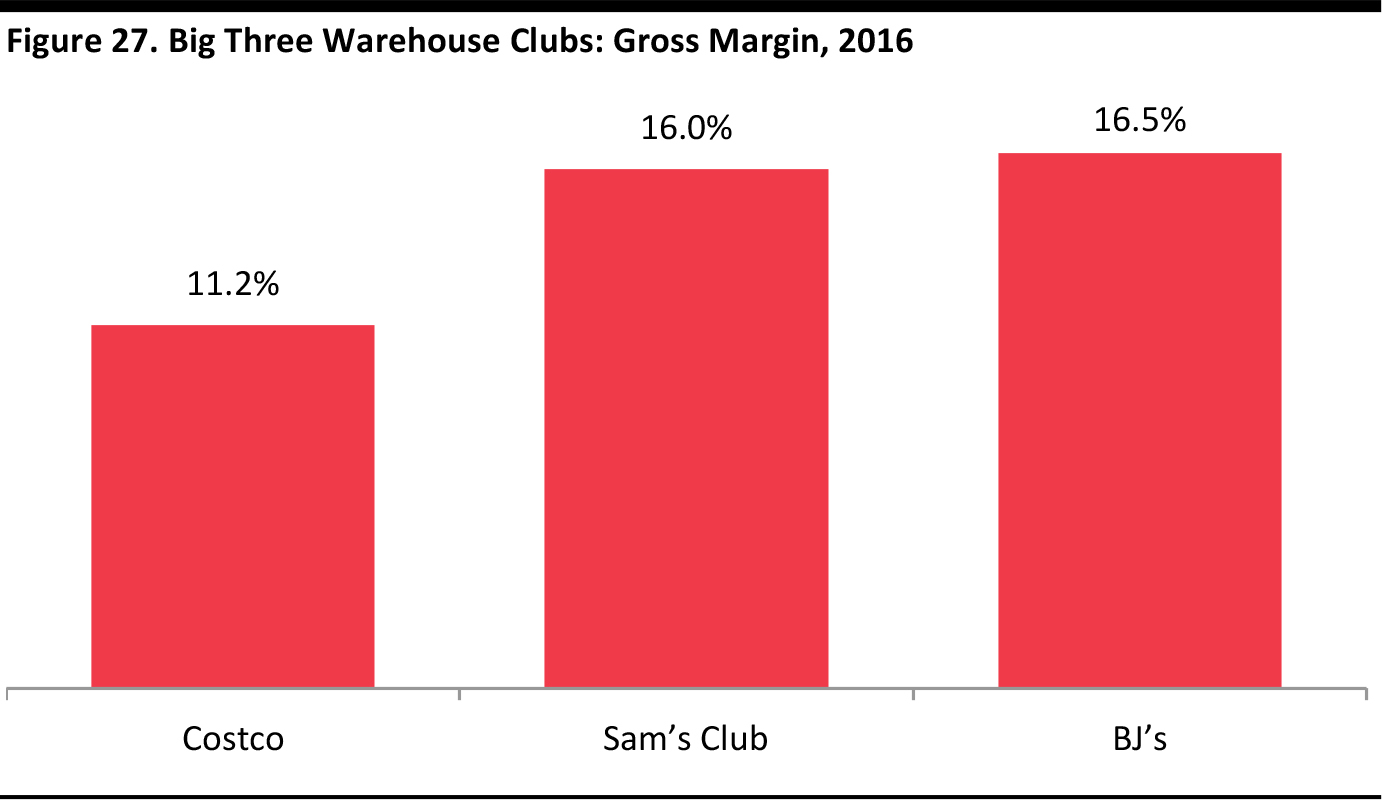

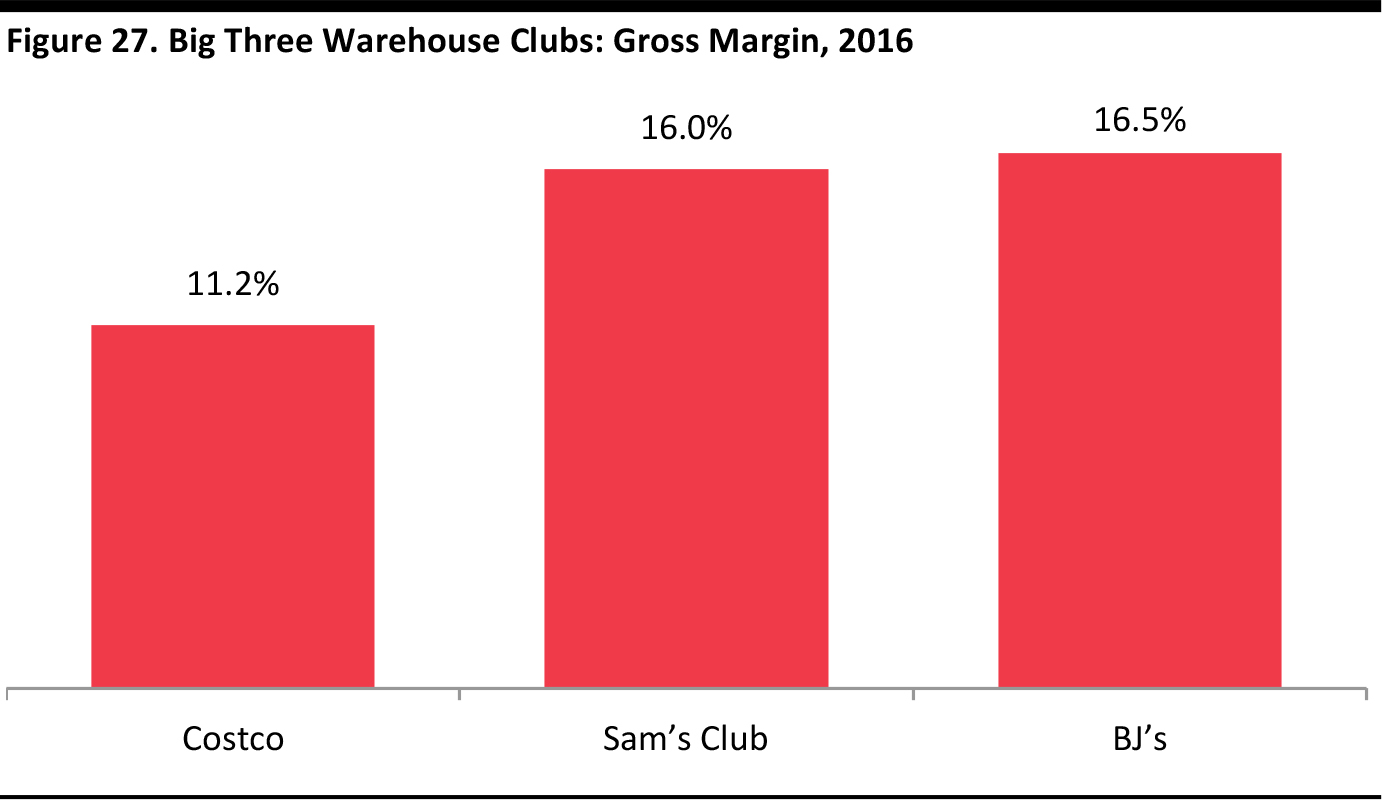

Large Volume Compensates for Ultraslim Margins

Warehouse clubs are inherently a low-gross-margin format: sector profits are driven by volume, even more so than in other forms of mass-market retail. Costco operates on especially lean gross margins, which feed through to ultraslim operating margins that are an inherent part of its value-for-money proposition. Membership fees contribute the bulk of profits. Membership revenues alone contributed 2.2% of Costco’s total revenues in fiscal 2016.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

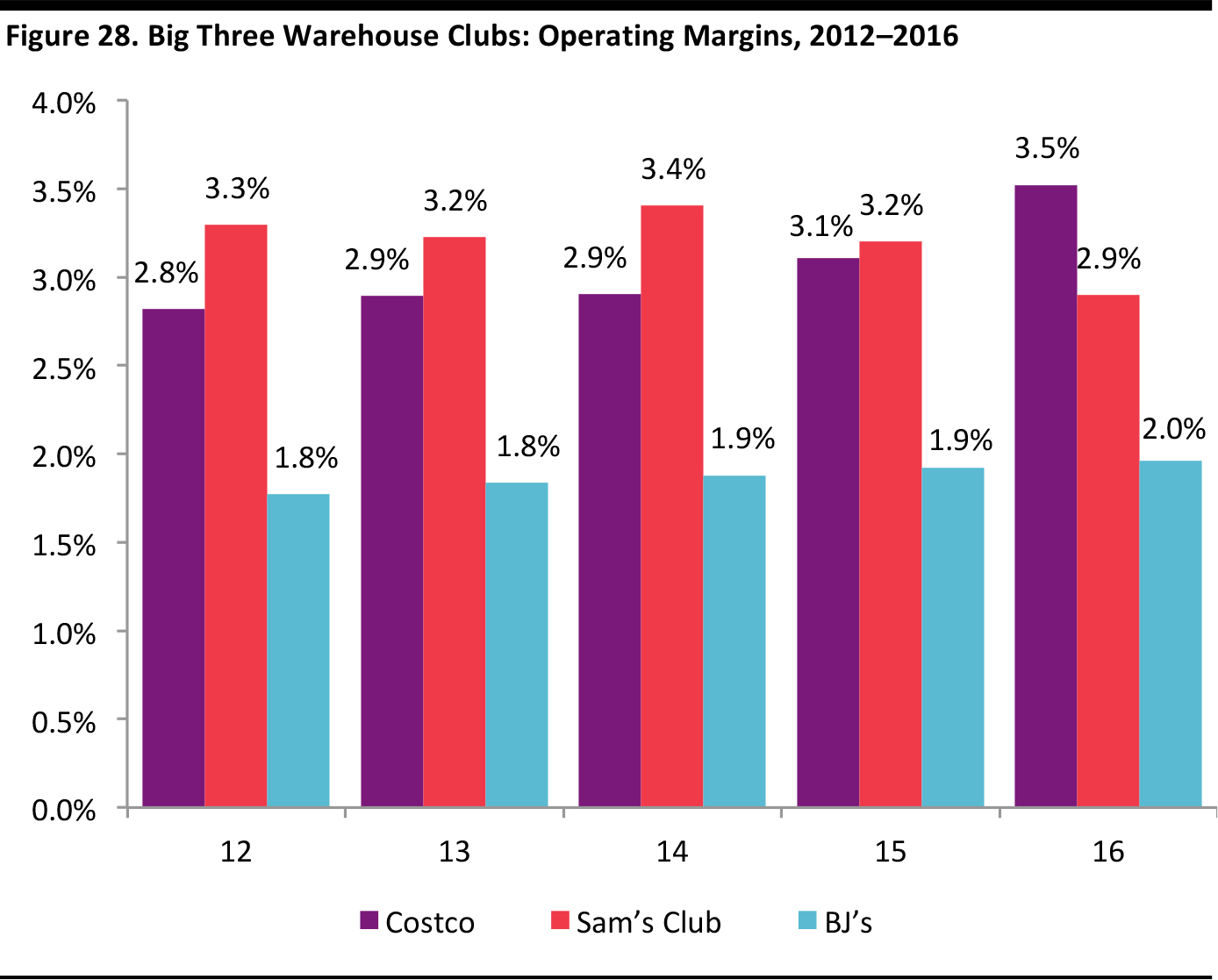

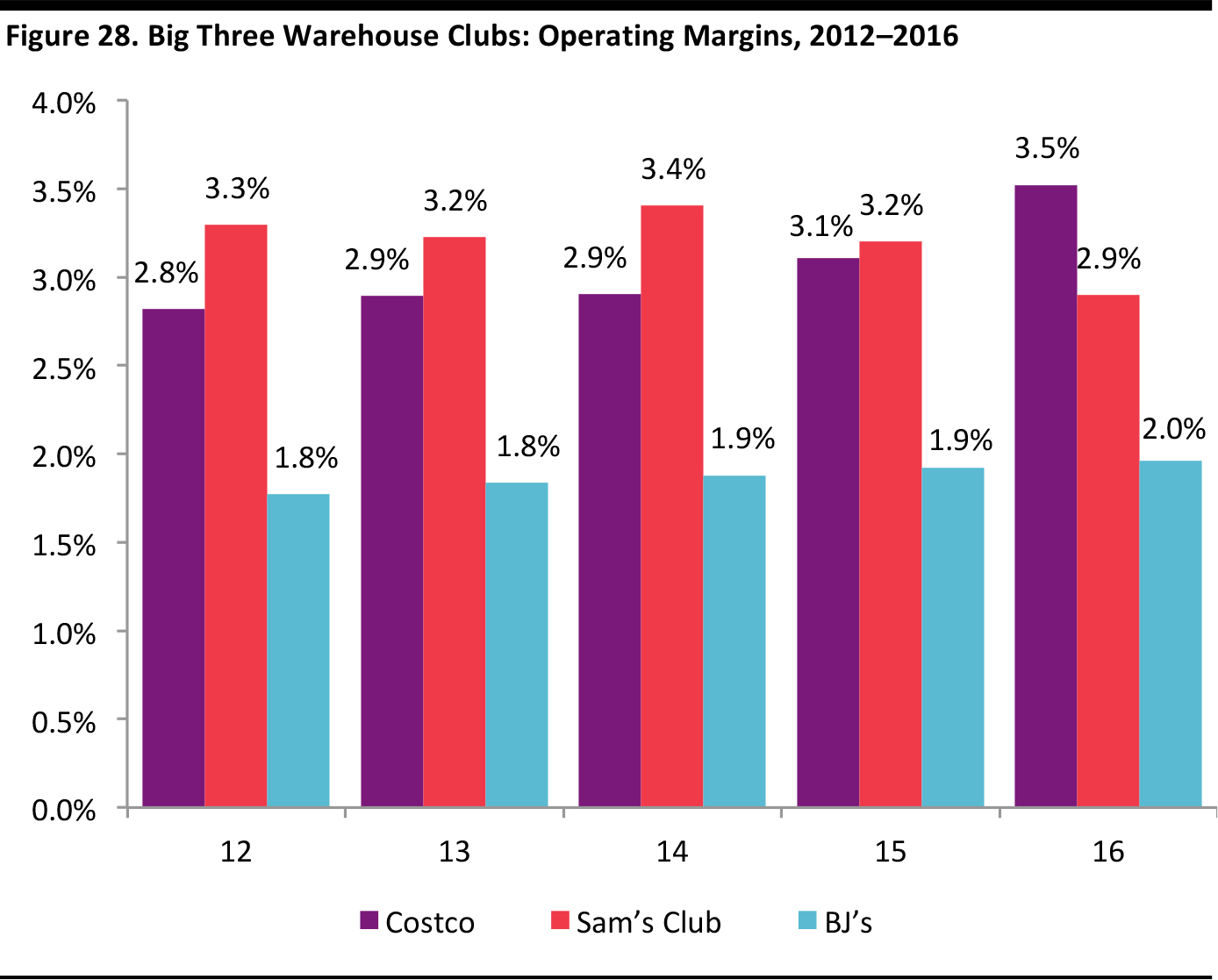

Costco’s reported and BJ’s estimated operating margins generally increased during the 2012–2016 period, but Sam’s Club’s margins declined in 2015 and 2016 due to higher costs from investment in people, payroll, technology, promotions and demos combined with costs for expanded payment options and real estate charges.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

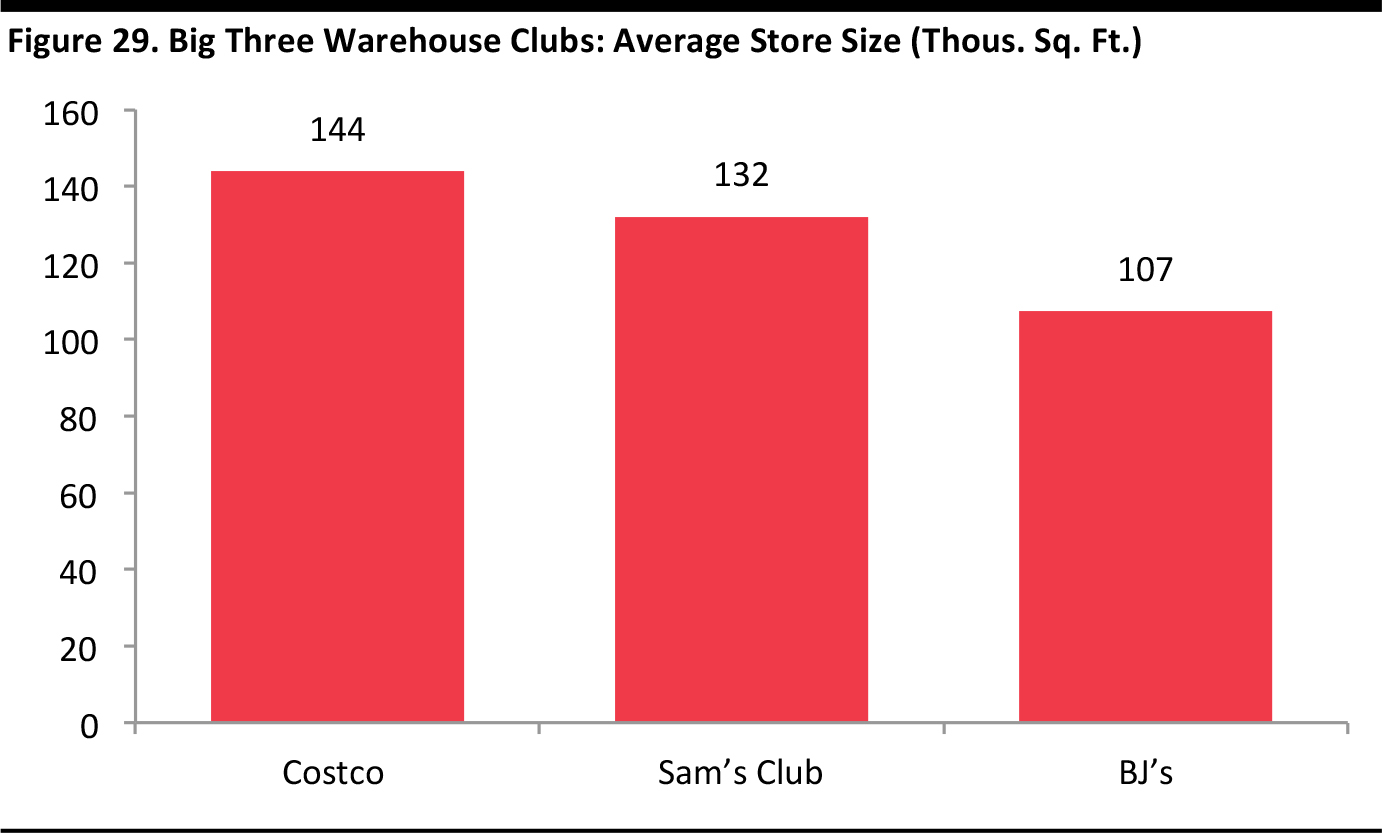

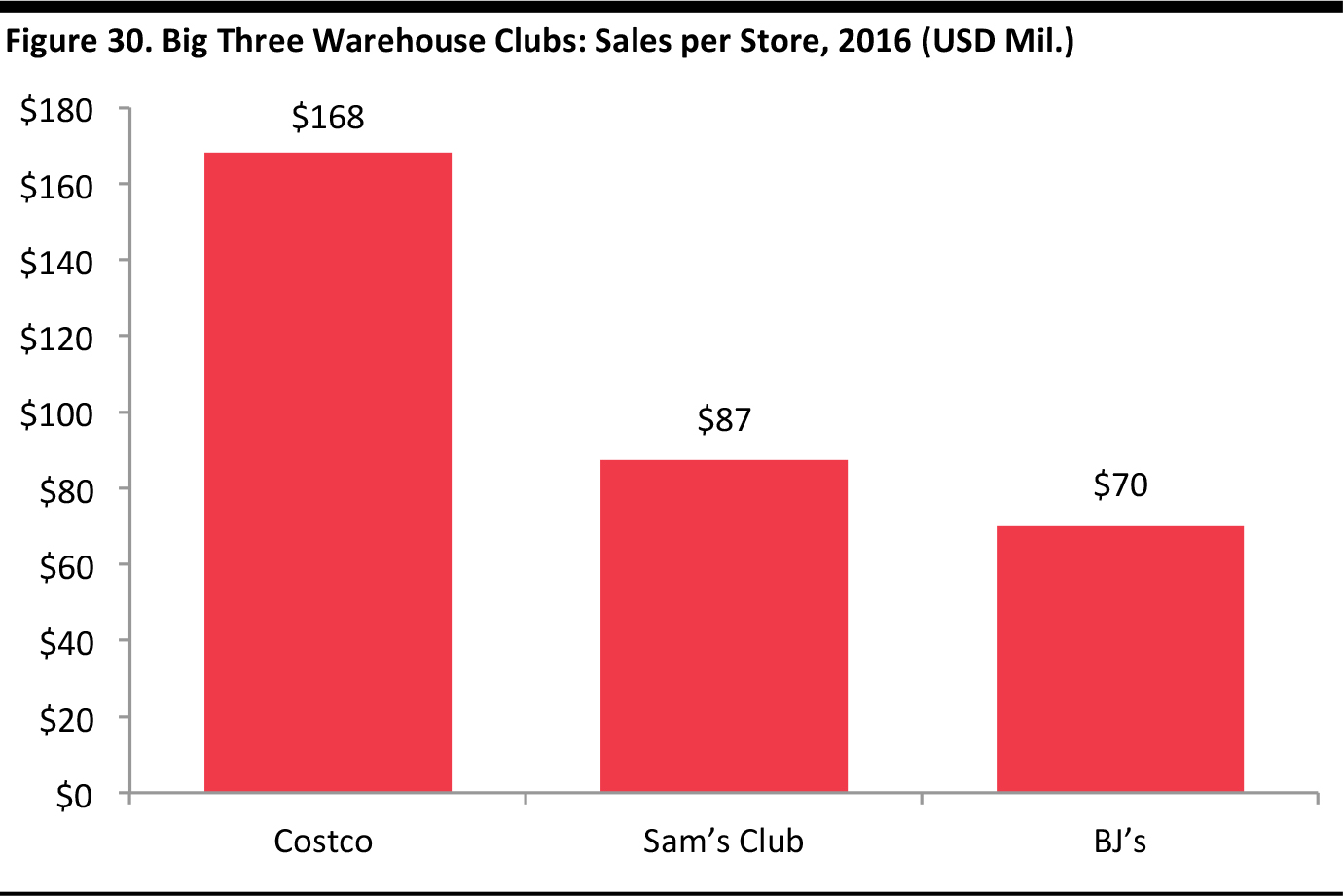

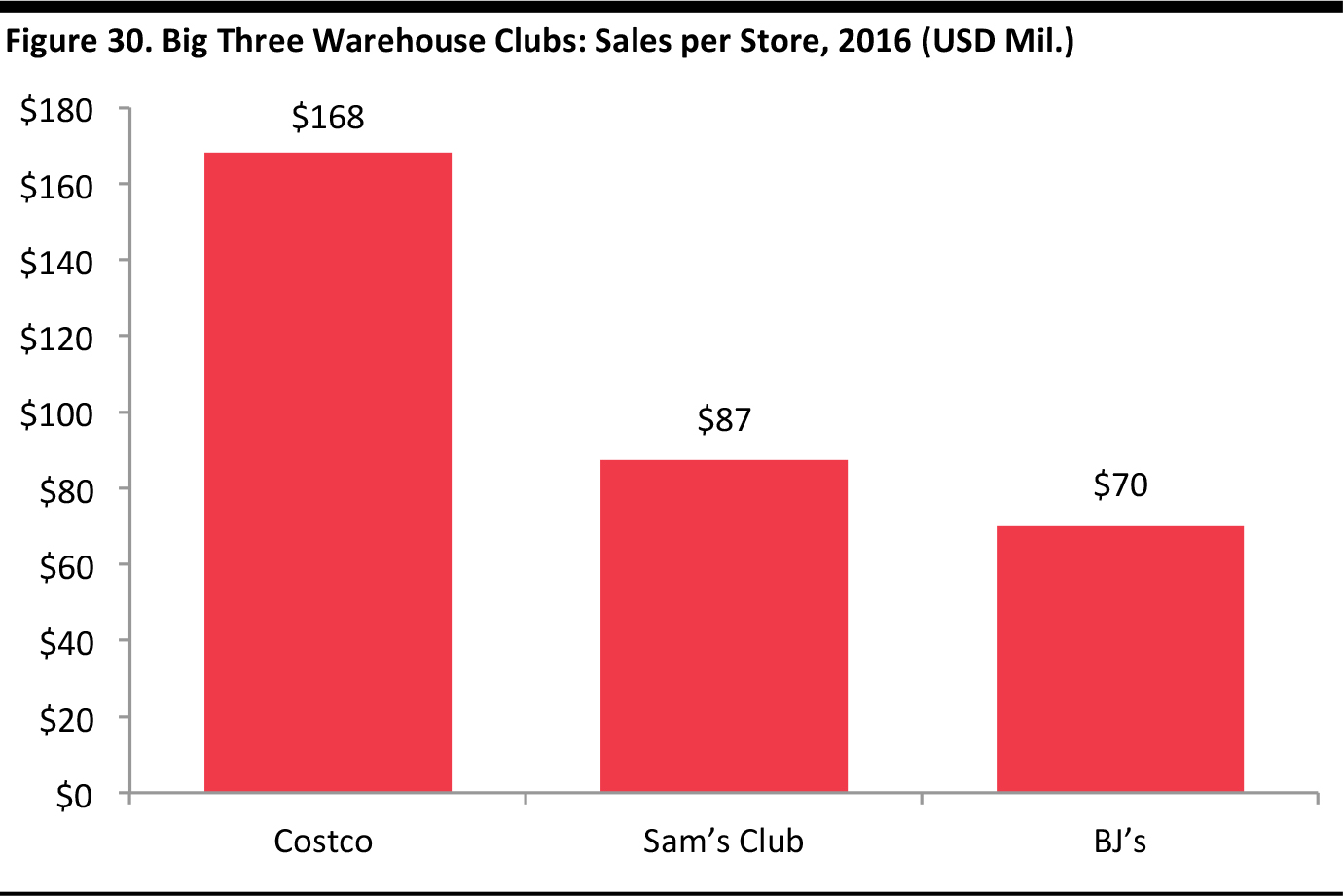

Costco Leads in Sales per Store and Store Size

Sales per store is one of Costco’s most impressive metrics and helps explain its market leadership. The company’s average annual sales per outlet are almost double those of its closest competitor. Costco said that 165 of its stores generated revenues exceeding $200 million each in fiscal year 2014. Of those, two generated revenues of more than $400 million that year.

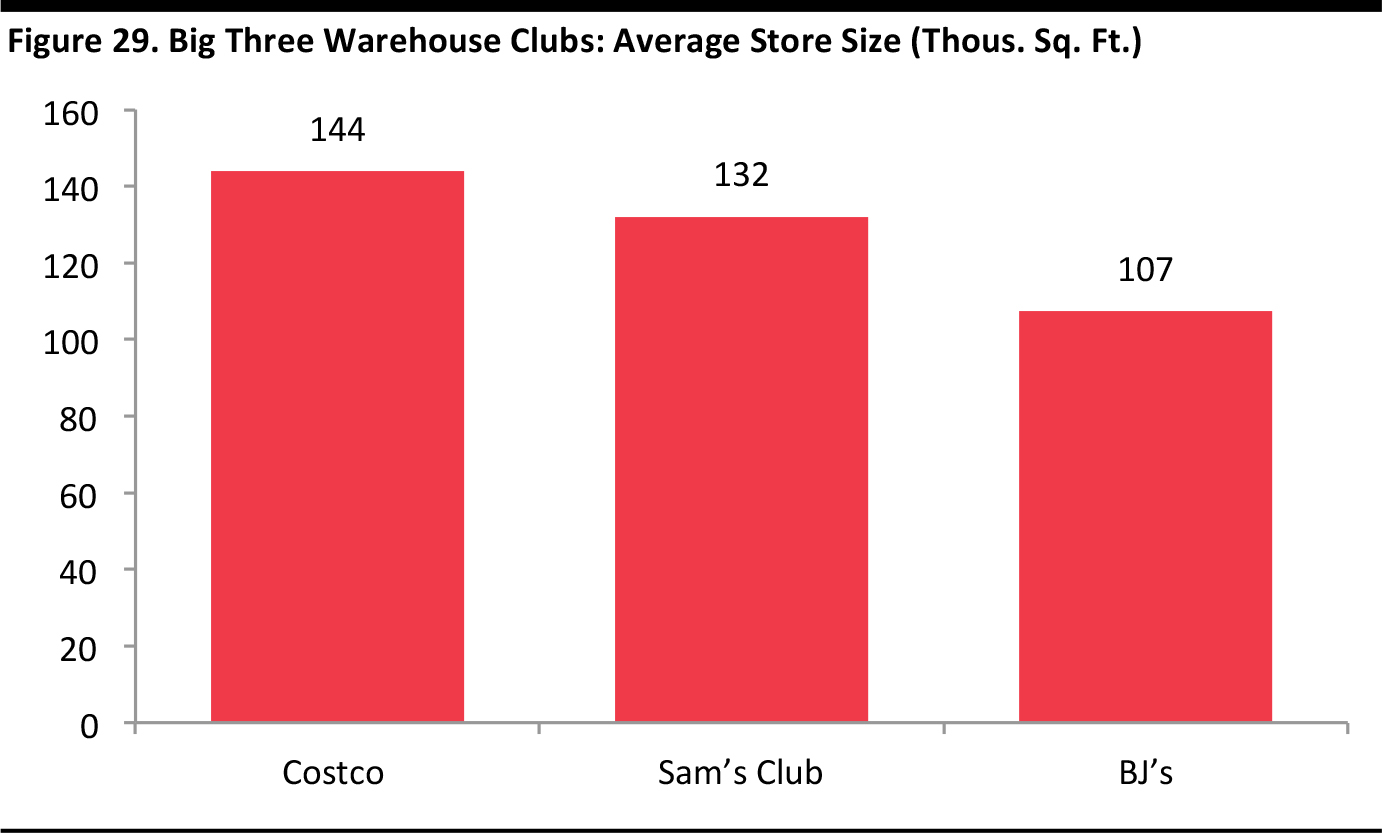

The average Costco store is 7% larger than the average Sam’s Club, and much larger than the average BJ’s (BJ’s reportedly stays small in order to have a higher density of clubs). Costco does benefit from larger store sizes, but that alone does not account for the disparity in sales per outlet between the chains. Because Costco and Sam’s Club have close to the same number of stores, on average, Costco’s dominance is likely due to its impressive sales density coupled with its larger store sizes.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

The average Costco store produces nearly twice the revenue of the average Sam’s Club store, and much higher revenue than the average BJ’s store.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

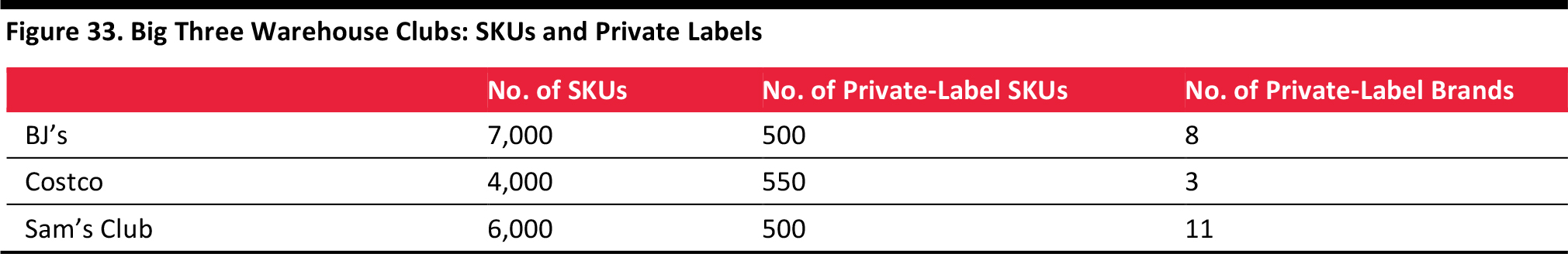

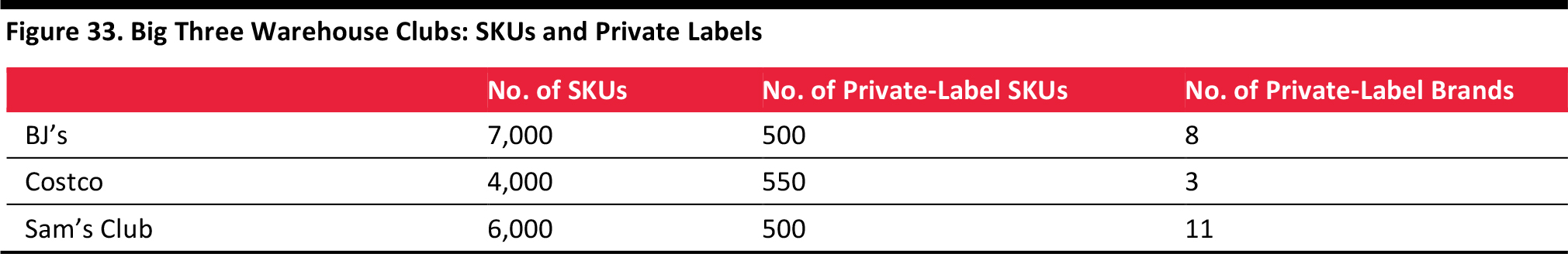

Costco is the leader in sales density (i.e., in sales per square foot), despite offering fewer SKUs than either Sam’s Club or BJ’s, indicating that Costco achieves exceptionally strong sales volume per SKU. This allows Costco to get better buying prices, which it passes on to shoppers. This is the epitome of narrow-range, deep-discount retailing, and Costco’s performance on this measure suggests that rivals (especially Sam’s Club) have significant potential to drive up sales densities and boost profitability per store.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

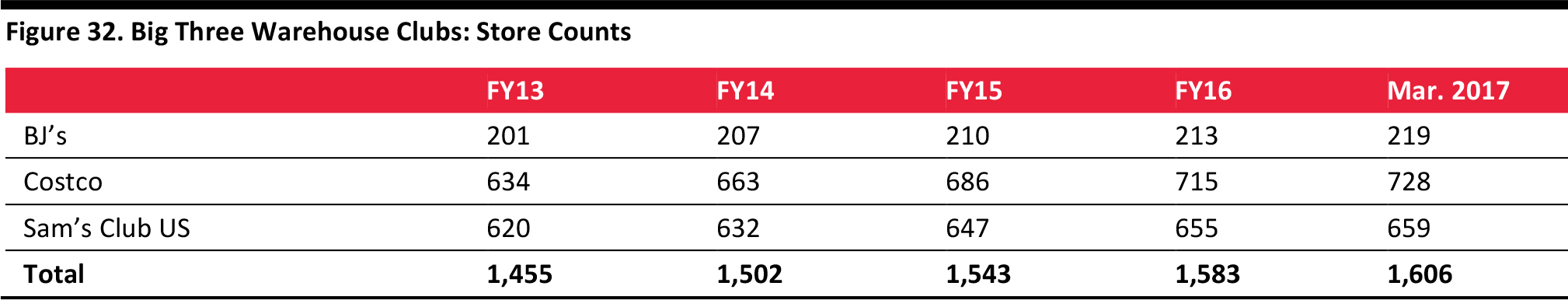

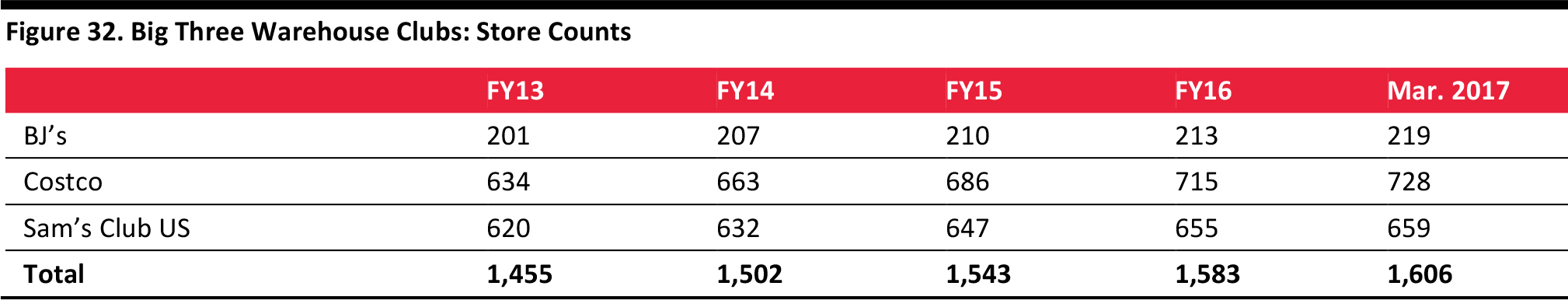

The table below shows that the big three warehouse clubs have been steadily growing their store counts in recent years.

Source: Company reports/Fung Global Retail & Technology

Number of Product SKUs Does Not Differentiate

Offering members wide choice does not really offer a competitive advantage in the warehouse club sector. With fewer product lines than its US rivals, Costco has achieved leadership and impressive growth. This underscores that Costco sells very high volumes of the SKUs it stocks, which allows the company to buy at very attractive prices. Plus, large stores and limited ranges mean substantial on-shelf presence, driving down costs of replenishment.

By these metrics, Costco is effectively a hard discounter akin to European grocery discounters Aldi and Lidl, whose ultranarrow ranges and high volumes translate into low prices, and turn wafer-thin margins into a profitable business.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

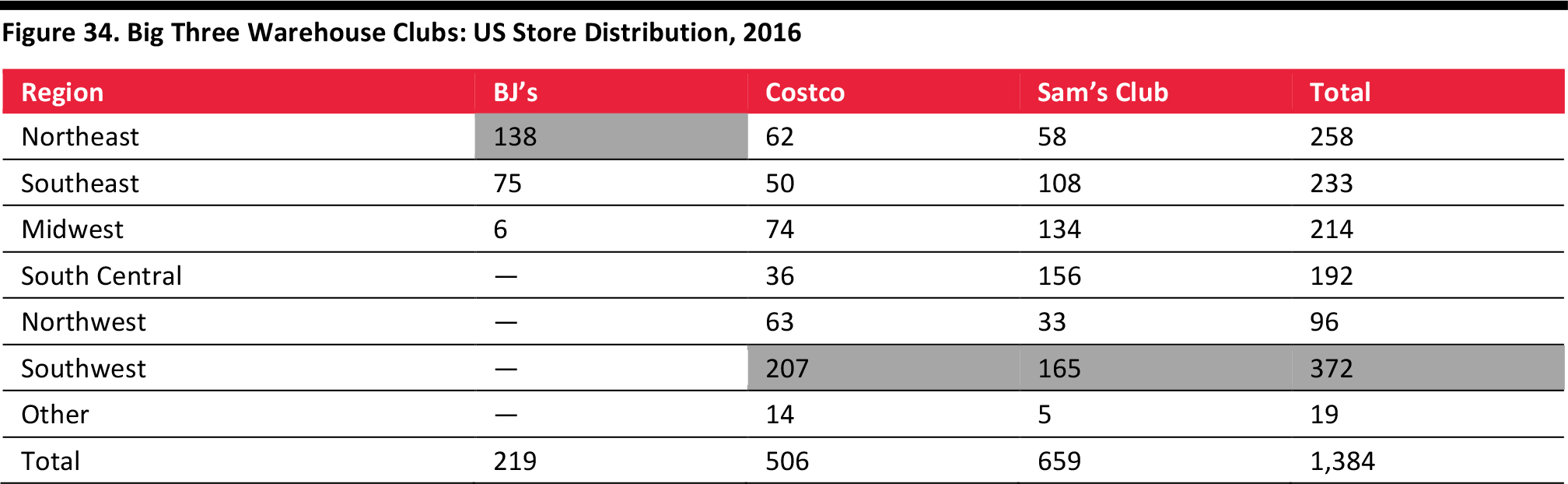

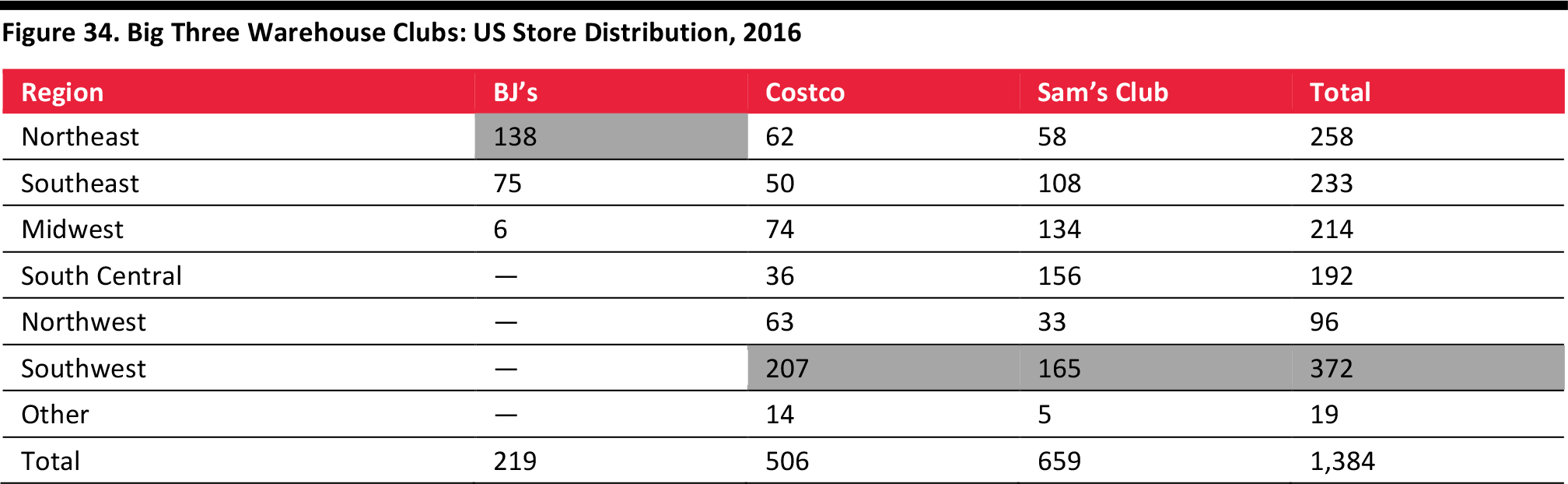

US Warehouse Clubs Have Varying Regional Focuses

In terms of geography, BJ’s focuses primarily on the Northeastern US, while Costco’s stores are most common in the Southwest. Sam’s Club stores are primarily located in the Southwest, Midwest and South-Central US. The regions with the highest number of stores are highlighted in the table below.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

Conclusion—Part One

Part One of the report discussed the historical strong growth and performance of the warehouse club sector, its heavy concentration in the US and the top three companies in the space. The analysis revealed that the sector hit an inflection point in 2015 and has experienced a slowing growth trend in recent years that market researchers expect to continue through 2020.

Part Two of the report examines the advantages and challenges warehouse clubs face. Advantages include the economies of scale while providing significant value pricing to customers and a treasure hunt shopping experience that offers unexpected surprises and bargains. Challenges the warehouse clubs face include shifting shopper preferences due to generational and demographic changes, the steady encroachment of e-commerce, and Amazon’s entry into multiple areas of commerce.

Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology Figures are in US dollars, converted based on year-over-year exchange rates.Source: Euromonitor International/Fung Global Retail & Technology

Figures are in US dollars, converted based on year-over-year exchange rates.Source: Euromonitor International/Fung Global Retail & Technology Source: Company reports/Bloomberg/National Retail Federation (NRF)/Kantar Worldpanel/Fung Global Retail & Technology

Source: Company reports/Bloomberg/National Retail Federation (NRF)/Kantar Worldpanel/Fung Global Retail & Technology Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology Source: Euromonitor International/Fung Global Retail & Technology

Source: Euromonitor International/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology BJ’s and Sam’s Club figures are estimates.Source: Company reports/Fung Global Retail & Technology

BJ’s and Sam’s Club figures are estimates.Source: Company reports/Fung Global Retail & Technology Source: Company reports/Internet Retailer/Fung Global Retail & Technology

Source: Company reports/Internet Retailer/Fung Global Retail & Technology Source: Company reports/Internet Retailer/Fung Global Retail & Technology

Source: Company reports/Internet Retailer/Fung Global Retail & Technology Membership Composition Is Key

Membership Composition Is Key 2014 data were released on September 29, 2016.

Source: US Census Bureau

2014 data were released on September 29, 2016.

Source: US Census Bureau Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology Source: Company reports/US Census Bureau/Fung Global Retail & Technology

Source: Company reports/US Census Bureau/Fung Global Retail & Technology In fiscal 2017, Sam’s Club reported revenues of $57.4 billion, up 0.9% year over year. In the year, comparable store sales increased by 0.2% including fuel and increased by 1.1% excluding fuel. For the fourth quarter of fiscal 2017, Sam’s Club reported comp sales growth (excluding fuel) of 2.4%. Including fuel, comps increased by 3.1%.

In October 2016, an SEC filing disclosed that Walmart had increased its stake in Chinese e-commerce company JD.com after selling its stake in the Yihaodian online marketplace to JD.com in June. In its fiscal third-quarter 2017 earnings call, Walmart announced that its Sam’s Club flagship store had launched on JD.com’s website, offering hundreds of millions of customers access to Sam’s Club’s products with same-day and next-day delivery service.

In fiscal 2017, Sam’s Club reported revenues of $57.4 billion, up 0.9% year over year. In the year, comparable store sales increased by 0.2% including fuel and increased by 1.1% excluding fuel. For the fourth quarter of fiscal 2017, Sam’s Club reported comp sales growth (excluding fuel) of 2.4%. Including fuel, comps increased by 3.1%.

In October 2016, an SEC filing disclosed that Walmart had increased its stake in Chinese e-commerce company JD.com after selling its stake in the Yihaodian online marketplace to JD.com in June. In its fiscal third-quarter 2017 earnings call, Walmart announced that its Sam’s Club flagship store had launched on JD.com’s website, offering hundreds of millions of customers access to Sam’s Club’s products with same-day and next-day delivery service.

Source: Company reports/NRF/Fung Global Retail & Technology

Source: Company reports/NRF/Fung Global Retail & Technology Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

Includes membership fees for BJ’s and Costco

Source: Company reports/NRF/Fung Global Retail & Technology

Source: Company reports/FactSet/Fung Global Retail & Technology

Source: Company reports/FactSet/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology