Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

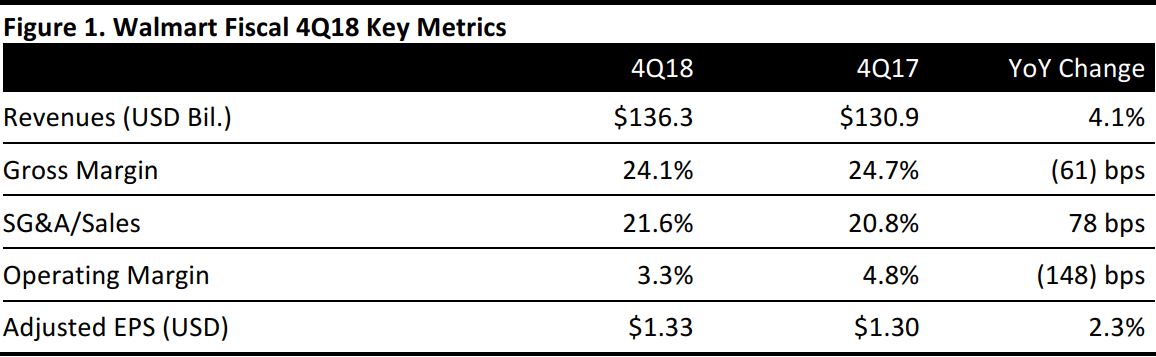

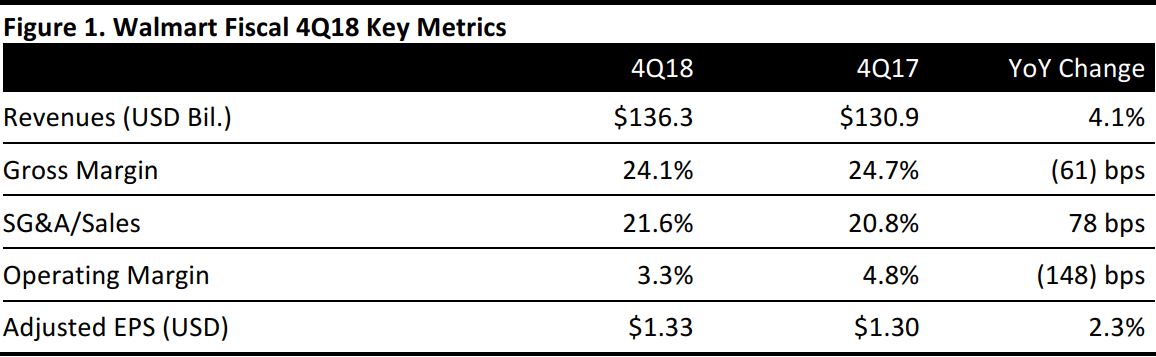

Fiscal 4Q18 Results

Walmart reported fiscal 4Q18 revenues of $136.3 billion, up 4.1% year over year and beating the $134.9 billion consensus estimate. Total revenues excluding currency effects were $135.1 billion, up 3.1%.

US comps increased by 2.6%, ahead of the 2.2% consensus estimate, on a 1.6% traffic increase.

E-commerce sales and GMV increased by 23% and 24%, respectively.

Adjusted EPS was $1.33, compared with $1.30 in the year-ago quarter and missing the $1.37 consensus estimate. This figure excludes a total of $0.60 per share in charges for restructuring, extinguishment of debt, asset write-offs, bonus, US tax reform and a legal settlement. GAAP EPS was $0.73, compared with $1.22 in the year-ago quarter.

Segment Details

- Walmart US’s net sales were $86.6 billion, up 3.4% year over year, driven by a 2.6% increase in comp sales (excluding fuel) that was, in turn, driven by a 1.6% traffic increase and a 1.0% ticket increase.

- Walmart International reported net sales of $33.1 billion, up 6.7% year over year. Net sales in constant currency were $31.9 billion, an increase of 2.8%.

- Sam’s Club reported net sales of $15.5 billion, up 3.3% year over year, on 2.4% comps (excluding fuel). A 4.3% increase in traffic contributed to comp growth, while a 1.9% ticket decline detracted.

Other Details from the Quarter

- Strength was broad-based across merchandise categories, formats and regions, and holiday sales were solid. In addition, comp store inventory declined for the eleventh consecutive quarter.

- In the International segment, nine of 11 markets posted positive comp sales.

- The slowdown in US e-commerce sales was largely expected due to the anniversary of the Jet.com acquisition, and management said it is creating a healthier long-term foundation for the holiday season. A smaller portion of the slowdown was unexpected, as the company experienced some operational challenges that negatively impacted growth.

- Recent successes include improvements in mobile and leveraging digital capabilities to improve in-store experiences, including pharmacy and money services. Walmart has also enabled easy reordering online and is making the checkout experience easier with Scan & Go in addition to digitizing the returns process.

- The company also made acquisitions to improve its online assortment and is partnering with other companies, such as Google and JD.com, in new ways.

- Walmart is expanding its online grocery business in the US and around the world and broadening its delivery capabilities in the US, China and other international markets. The company plans to nearly double its number of online grocery locations this year.

- The company plans to use the proceeds from the recently enacted US tax reforms to offer better wages and benefits for more than a million US hourly associates as well as to continue to lower prices for customers, improve technology and accelerate grocery delivery in the US.

Full-Year Results

Walmart reported fiscal 2018 revenues of $500.3 billion, up 3.0% year over year. Total revenues excluding currency effects were $500.9 billion, up 3.1%.

E-commerce sales and GMV increased by 44% and 47%, respectively.

Adjusted EPS was $4.42, compared with $4.32 in the prior year. GAAP EPS was $3.28 versus $4.38 in the prior year

Outlook

For fiscal 2019, Walmart expects:

- Adjusted EPS of $4.75–$5.00, which includes a $0.05 currency benefit. The midpoint of the EPS guidance range is $4.88, below the $4.99 consensus estimate.

- Sales growth of 1.5%–2.0% in constant currency, negatively impacted by the closure of certain Sam’s Club stores and the curtailment of tobacco sales from certain clubs, the winding down of first-party e-commerce in Brazil, and the divestiture of Suburbia. These figures translate to revenues of $507.8–$510.3 billion, below the $512.0 billion consensus estimate.

- US e-commerce sales growth of approximately 40%.

- Comps of:

- 0% for Walmart US (excluding fuel).

- 3.0%–4.0% for Sam’s Club (excluding fuel).

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research