Source: Company reports/Fung Global Retail & Technology

Fiscal 4Q17 Results

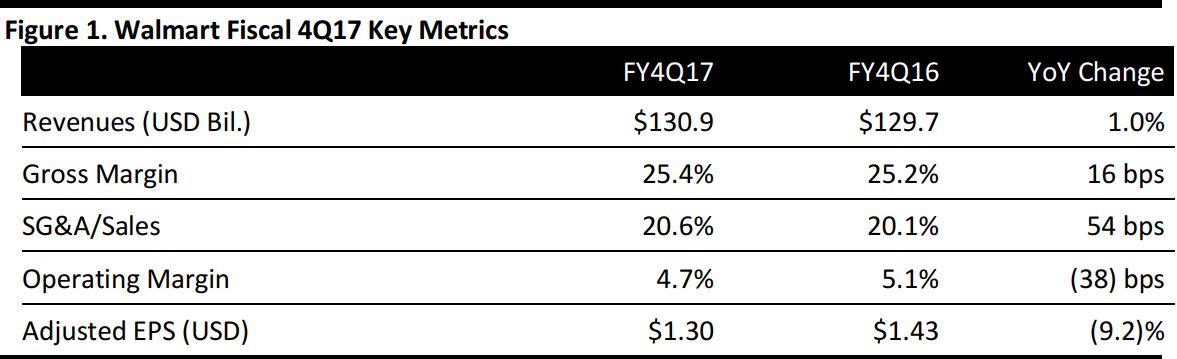

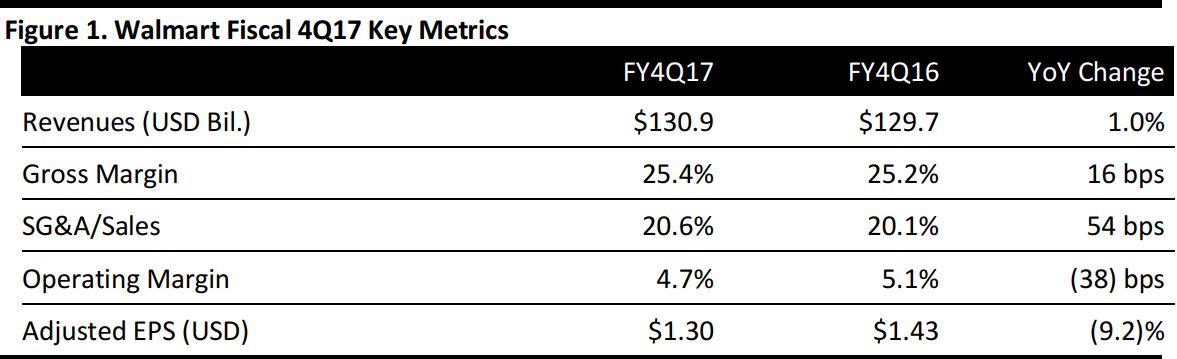

Walmart reported fiscal 4Q17 total revenues of $130.9 billion, up 1.0% year over year but slightly below the $131.1 billion consensus estimate. Total revenues excluding currency effects were $133.6 billion, an increase of 3.0%.

E-commerce sales and GMV increased by 29.0% and 36.1%, respectively, including contributions from Jet.com (which was acquired in September 2016) and online grocery.

Adjusted EPS was $1.30, compared with $1.43 in the year-ago quarter and above the $1.28 consensus estimate. GAAP EPS was $1.22, which includes a charge of $0.08 per share for discontinued real estate projects and severance in the US.

Segment Details

- Walmart US revenue was $83.7 billion, driven by a 1.8% increase in Walmart US comp sales, which exceeded the consensus estimate of a 1.3% increase. Comps were driven by a 1.4% traffic increase. Neighborhood Market comps increased by 5.3%.

- Walmart International reported net sales of $31.0 billion, a decrease of 5.1%. Net sales excluding currency effects were $33.7 billion, an increase of 3.0%.

- Sam’s Club reported net sales of $15.0 billion, up 1.0% year over year. Comp sales increased by 2.4%, driven by a 1.2% traffic increase and a 1.2% ticket increase.

FY17 Results

For FY17, Walmart’s revenues were $485.9 billion, up 0.8% from $482.1 billion the prior year. Total revenue excluding currency effects was $496.9 billion, an increase of 3.1%.

Adjusted EPS for the year was $4.32, compared with $4.57 the prior year. GAAP EPS, which includes a $0.14 per-share gain on the sale of Yihaodian in China and the aforementioned $0.08 charge, was $4.38. Membership and other income was $4.6 billion in the year, up 29.6%.

Outlook

For FY18, Walmart expects:

- EPS of $4.20–$4.40, in line with the $4.32 consensus estimate.

For fiscal 1Q18, Walmart expects:

- EPS of $0.90–$1.00, in line with the $0.96 consensus estimate.

- Comp sales growth of 1.0%–1.5% for Walmart US and 1.0% (excluding fuel) for Sam’s Club.