Source: Company reports/FGRT

Fiscal 3Q18 Results

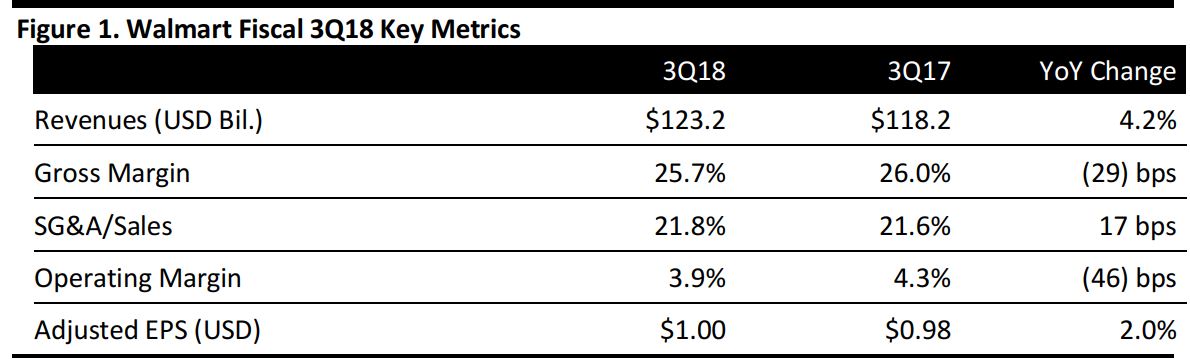

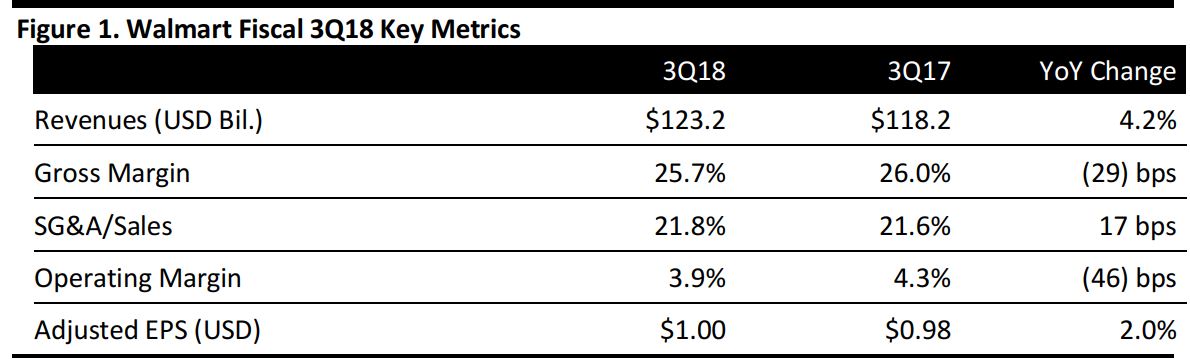

Walmart reported fiscal 3Q18 adjusted EPS of $1.00, up 2% from the year-ago quarter and beating the $0.97 consensus estimate. Total revenues were $123.2 billion, up 4.2% year over year and beating the consensus estimate of $121.05 billion. Total revenues excluding currency effects were $122.7 billion, up 3.8%.

US e-commerce sales continued to grow strongly, increasing by 50% from the year-ago quarter, driven by acquisitions and a larger number of offerings. Walmart does not break out quarterly e-commerce figures, but expects full year e-commerce sales to hit $17.5 billion. US GMV increased by 54% year over year.

Segment Details

- Walmart US’s net sales were $77.7 billion, up 4.3% year over year, driven by a 2.7% increase in comp sales (excluding fuel) that was, in turn, driven by a 1.5% traffic increase and a 1.2% increase in average ticket. E-commerce added about 80 basis points to comps.

- Walmart International reported net sales of $29.5 billion, up 4.1% year over year. Net sales were $29.1 billion in constant currency, an increase of 2.5%.

- Sam’s Club reported net sales of $14.9 billion, up 4.4% year over year, on 2.8% comps (excluding fuel). Comp growth was driven by a 3.8% traffic increase that was partially offset by a 0.8% average ticket decrease. E-commerce contributed about 80 basis points to comps.

The growth in quarterly comps was largely driven by an increase in food sales, and Walmart management noted that quarterly food sales were the best in almost six years. The grocery business benefited from the company’s expansion of its online grocery pickup service (buy online, pick up in-store) and hurricane-related sales. Walmart plans to double its number of curbside grocery pickup locations to 2,000 by next year.

Outlook

The company raised its FY18 adjusted EPS guidance range to $4.38–$4.46 versus $4.30–$4.40 previously and the consensus estimate of $4.37. Walmart expects US comps (excluding fuel) to grow by 1.5%–2.0% versus the 1.7% consensus estimate. Sam’s Club comps (excluding fuel) are expected to grow by 1.5%–2.0%, ahead of the 0.9% consensus estimate.