Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

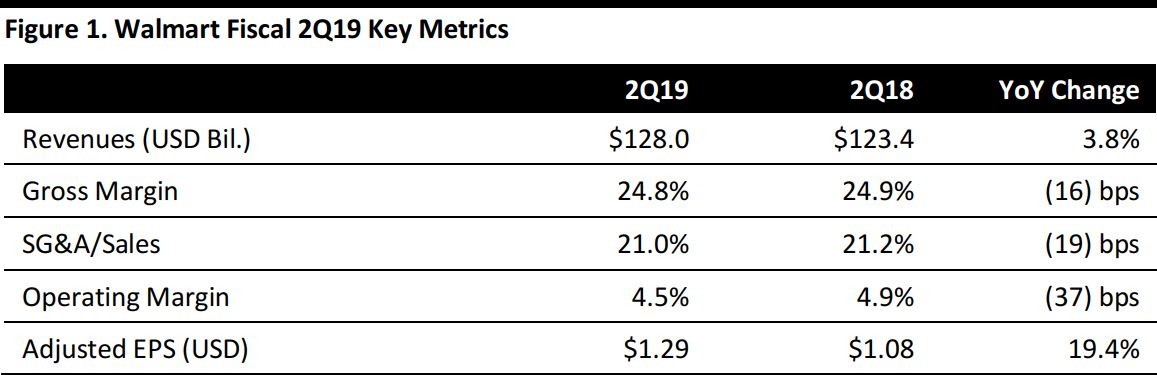

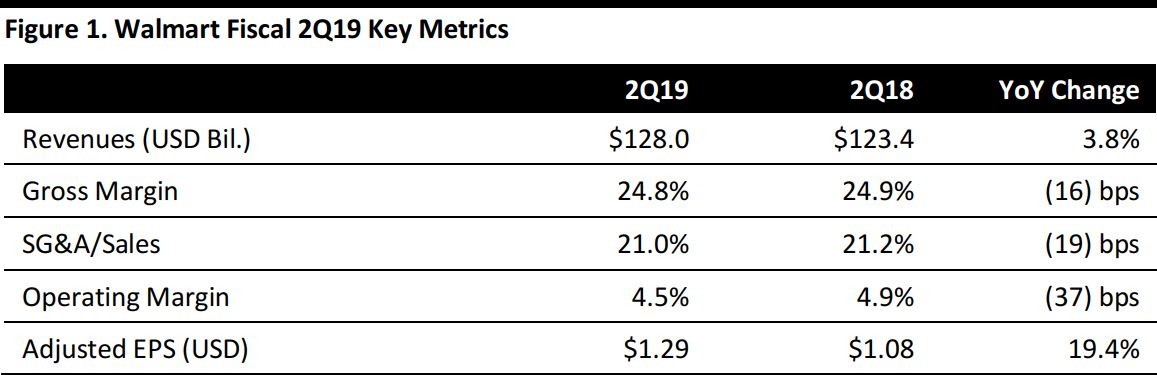

Fiscal 2Q19 Results

Walmart reported fiscal 2Q19 revenues of $128.0 billion, up 3.8% year over year and ahead of the consensus estimate of $126.0 billion.

E-commerce accelerated to 40% growth.

US comps increased by 4.5%, ahead of the 2.4% consensus estimate.

Adjusted EPS was $1.29, compared with $1.08 in the year-ago and beating the $1.22 consensus estimate. GAAP EPS was $(0.29), compared with $0.96 in the year-ago quarter. The GAAP figures includes a $1.51 net charge per share for a loss on the sale of a majority stake in Walmart Brazil, a $0.04 per share adjustment for tax reform and $0.03 per share adjustment in unrealized gains on the JD.com investment.

Segment Details

- Walmart US’s net sales were $82.8 billion, up 5.2% year over year, driven by a 4.5% increase in comp sales (excluding fuel) that was, in turn, driven by a 2.2% traffic increase and a 2.3% ticket increase.

- Walmart International reported net sales of $29.5 billion, up 4.0% year over year. Net sales in constant currency grew 3.1%.

- Sam’s Club reported net sales of $14.8 billion, down 0.6% year over year, on 5.0% comps (excluding fuel). A 6.7% increase in traffic was offset by a 1.7% decline in ticket.

Other Details from the Quarter

- Management commented that the 4.5% US comp was the best in a decade.

- International comps were positive in Walmart’s four largest markets—Mexico, the UK, Canada, China—and Walmex’s comps were 5%.

- Management reiterated the company’s four strategic objectives:

- Make every day easier for busy families—through innovation.

- Change how the company works—using diversity, inclusion, more digital technology and fighting bureaucracy and complacency.

- Operate with discipline—using capital efficiently and focusing on productivity.

- Be the most trusted retailer—Walmart was ranked as the #1 most-ethical brand.

- Management commented on strategic positioning through the proposed acquisition of a majority stake in Flipkart, the Asda-Sainsbury combination and the sale of 80% of the company’s Brazil business.

- In addition, management highlighted partnerships with Microsoft, Google Rakuten and JD.com

- The Walmart US team continues to focus on price leadership, merchandise assortment and improving the shopping experience.

- Fresh food sales were strong and offered the best grocery comp in nine years.

- General merchandise sales recovered from the weather-related headwinds in April, and momentum continued throughout 2Q, especially in seasonal and apparel.

- By the end of the year, Walmart will have 700 pickup towers and 1,800 locations with grocery pickup.

- The company has added 1,100 new brands to Walmart.com year to date, including The German Zwilling J. A. Henckels cutlery and cookware and Therm-a-Rest outdoor products, a dedicated Lord & Taylor shop and Steve Madden footwear.

Raised Guidance

For fiscal 2019, Walmart expects:

- Adjusted EPS of $4.90–$5.05, up from $4.75–$5.00 previously.

- Sales growth of 2.0% in constant currency, up from 1.5%–2.0% previously. The combination of the sale of the majority stake in Walmart Brazil, the wind-down of Brazil first-party e-commerce and the divestiture of Suburbia.

- US e-commerce sales growth of approximately 40% (unchanged).

- Comps of:

- Around 3.0% for Walmart US (excluding fuel), up from at least 2.0%.

- Around 3.0% for Sam’s Club (excluding fuel), up from down 1.0% to flat.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research