Source: Company reports/FGRT

Fiscal 2Q18 Results

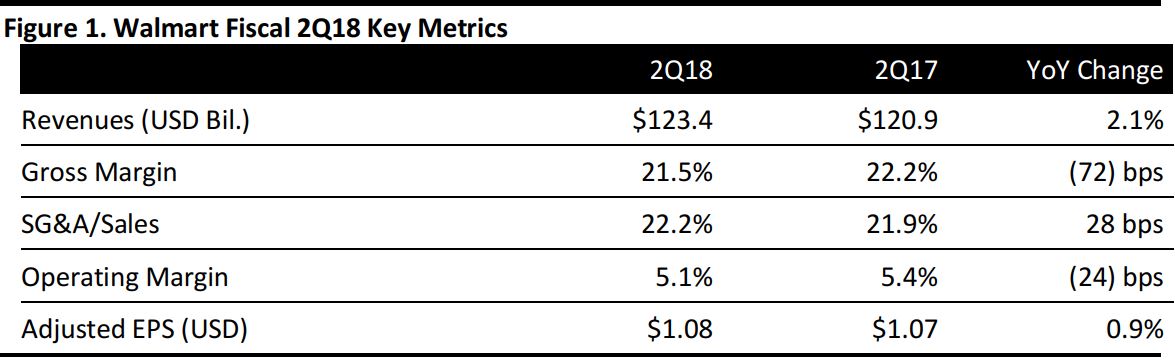

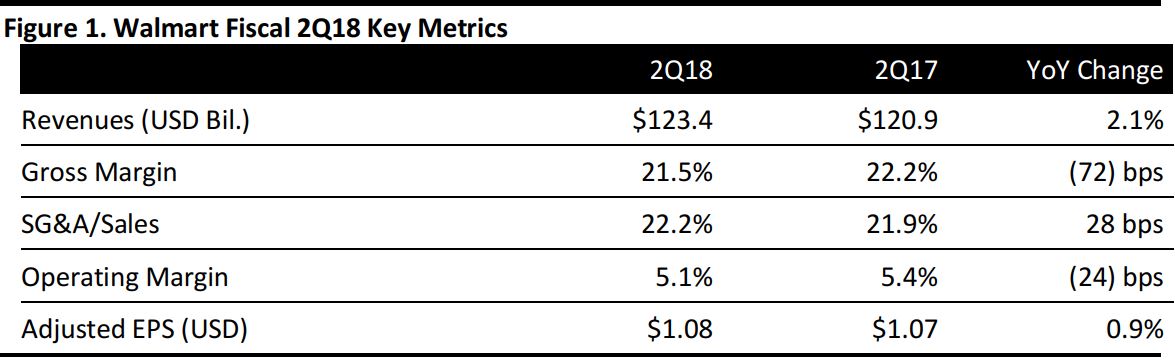

Walmart reported fiscal 2Q18 revenues of $123.4 billion, up 2.1% year over year and beating the $122.8 billion consensus estimate. Total revenues excluding currency effects were $124.4 billion, up 2.9%.

US comps increased by 1.8%, in line with the consensus estimate, on a 1.3% traffic increase.

E-commerce sales and GMV increased by 60% and 67%, respectively, including the contribution from Jet.com (which was acquired in September 2016). The majority of this growth was characterized as organic.

Adjusted EPS was $1.08, compared with $1.07 in the year-ago quarter and above the $1.07 consensus estimate. This figure excludes a loss of $0.17 per share from extinguishment of debt, which was partially offset by a gain of $0.05 per share from the sale of the Suburbia business in Mexico. GAAP EPS was $0.96, compared with $1.21 in the year-ago quarter.

Segment Details

- Walmart US’s net sales were $78.7 billion, up 3.3% year over year, driven by a 1.8% increase in comp sales (excluding fuel) that was, in turn, driven by a 1.3% traffic increase. E-commerce added about 0.7 percentage points to comps.

- Walmart International reported net sales of $28.3 billion, down 1.0% year over year. Net sales were $29.3 billion, an increase of 2.5%, in constant currency.

- Sam’s Club reported net sales of $14.9 billion, up 2.3% year over year, on 1.2% comps (excluding fuel). Comp growth was driven by a 2.1% traffic increase that was partially offset by a 0.9% average ticket decrease. E-commerce contributed about 80 basis points to comps, up from about 60 basis points in the year-ago quarter.

Other Details from the Quarter

Management reiterated its prior comments that the company is moving faster and becoming more creative—and that its customers are responding.

- Grocery experienced a low-single-digit increase in comps, as traffic in food and consumables was strong throughout the quarter, with solid unit growth. Food inflation hurt comps by 30 basis points.

- Health and wellness also experienced a low-single-digit increase in comps, benefiting from customer traffic, branded drug inflation and script growth, which helped both pharmacy and over-the-counter performance.

- General merchandise experienced a low-single-digit decrease in comps, owing to solid comp sales and traffic in hardlines and home. Entertainment sales were soft, but improved sequentially.

- Walmart continues to test associate delivery and plans to have 100 automated pickup towers installed by the end of the year.

- Technology projects undergoing testing include digital endless-aisle shopping, robotics and image analytics, in addition to using machine learning to support pricing. Sam’s Club customers have offered positive feedback for Scan & Go, and the company plans to expand its use within Walmart stores this year.

- The product assortment at Walmart.com expanded to 67 million SKUs, helped by the acquisitions of Moosejaw, Shoebuy and Bonobos.

- During the quarter, the company completed 16 net Supercenter openings, including conversions and relocations, and one Neighborhood Market net opening. As of the end of the quarter, online grocery was offered in more than 900 locations, up by about 230 locations from the first quarter.

Outlook

For fiscal 3Q18, Walmart expects:

- Adjusted EPS of $0.90–$0.98, whose $0.94 midpoint is below the $0.97 consensus estimate.

- Comps of:

- 5%–2.0% for Walmart (excluding fuel).

- 0%–1.5% for Sam’s Club (excluding fuel).

For FY18, Walmart expects:

- Adjusted EPS of $4.30–$4.40, up from prior guidance of $4.20–$4.40 and in line with the consensus estimate of $4.36. This figure includes a net gain of $0.12 per share from the adjustments mentioned earlier.

- GAAP EPS of $4.18–$4.28.