Source: Com pany reports/Coresight Research

Source: Com pany reports/Coresight Research

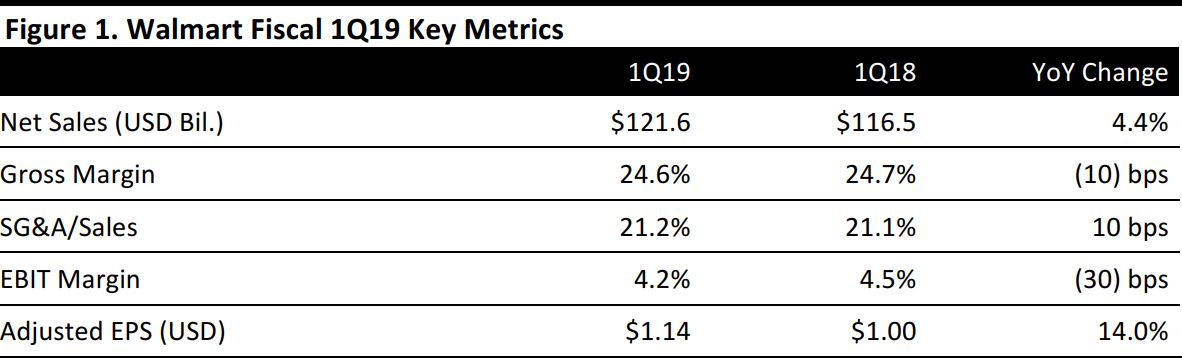

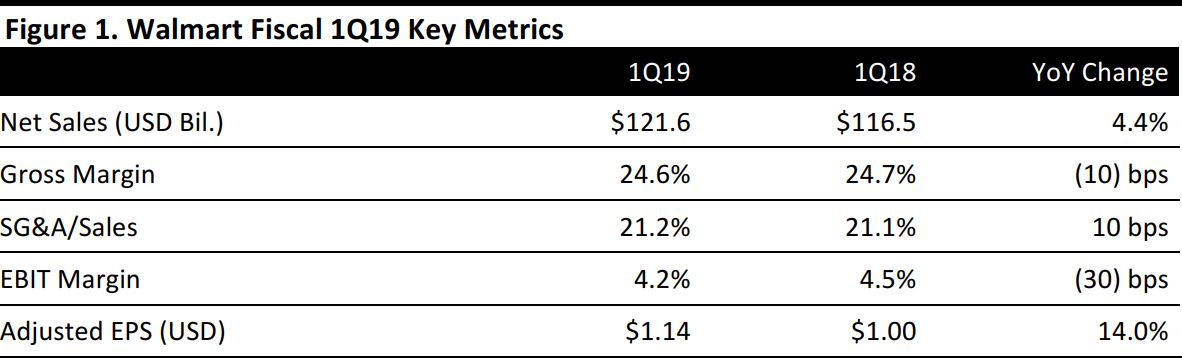

Fiscal 1Q19 Results

Walmart reported fiscal 1Q19 net sales of $121.6 billion, up 4.4% year over year and beating the $119.3 billion consensus estimate. Total revenues, which include membership and other income, were $122.7 billion, up 4.4% as reported and up 2.7% at constant currency.

At the core Walmart US segment, comparable sales increased by 2.1%, slowing from 2.6% growth in the prior quarter. Walmart US e-commerce sales increased by 33.0%, accelerating from 23.0% growth in the prior quarter.

Adjusted EPS was $1.14, compared with $1.00 in the year-ago quarter and beating the $1.12 consensus estimate. GAAP EPS was $0.72, below the $1.11 consensus estimate.

Segment Details

At Walmart US, net sales were $77.7 billion, up 3.1% year over year, driven by a 2.1% increase in comp sales (excluding fuel) that was, in turn, supported by a 0.8% traffic increase and a 1.3% ticket increase.

Walmart International reported net sales of $30.3 billion, up 11.7% year over year. At constant currency, the international segment grew sales by 4.5%.

Sam’s Club reported net sales of $13.6 billion, down 2.7% year over year in the context of store closures. Sam’s Club grew comp sales (excluding fuel) by 3.8%, helped by traffic growth of 5.6%, which was partially offset by a 1.8% ticket decline.

Outlook

Walmart is reshaping its portfolio of international businesses. On April 30, Walmart and Sainsbury’s announced the combination of supermarket operators Sainsbury’s and Asda (Walmart’s UK subsidiary). On May 9, Walmart became the largest shareholder in Indian e-commerce company Flipkart. Walmart also recently reached an agreement to disinvest its banking operations in Canada and Chile.

The company expects the investment in Flipkart to negatively impact its full-year EPS by approximately $0.25–$0.30. Walmart is likely to announce more detailed full-year guidance when it releases its fiscal 2Q19 results. The consensus estimate for full-year adjusted EPS is $4.77.

Source: Com pany reports/Coresight Research

Source: Com pany reports/Coresight Research