Source: Company reports/Fung Global Retail & Technology

Fiscal 1Q 2018 Results

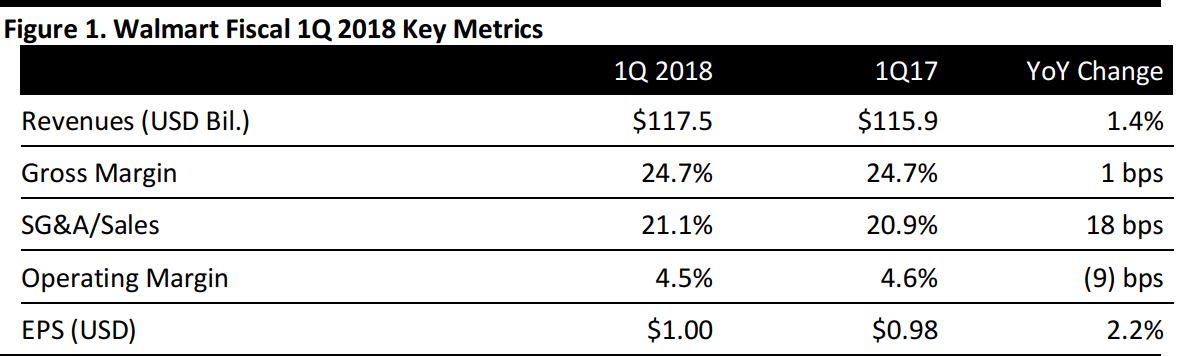

Walmart reported fiscal 1Q 2018 revenues of $117.5 billion, up 1.4% year over year, but slightly below the $117.7 billion consensus estimate. Total revenue excluding currency was $118.8 billion, up 2.5%.

US comps increased by 1.4%, in line with consensus, on a 1.5% traffic increase.

E-commerce sales and GMV increased by 63% and 69%, respectively, including the contribution from Jet.com (which was acquired in September 2016).

EPS was $1.00, compared with $0.98 in the year-ago quarter and beating the $0.96 consensus estimate.

Segment Details

- Walmart US’s net sales were $75.4 billion, driven by a 1.4% increase in comp sales (excluding fuel) that was, in turn, driven by a 1.5% traffic increase. E-commerce added about 80 basis points to comps, and Neighborhood Market sales grew by 6.2% year over year.

- Walmart International reported net sales of $27.1 billion, a decrease of 3.5%. In constant currency, net sales were $28.3 billion, an increase of 0.8%.

- Sam’s Club reported net sales of $14.0 billion, up 2.8% year over year, on 1.6% comps (excluding fuel), which were driven by a 1.1% traffic increase and a 0.5% ticket increase. E-commerce contributed about 80 basis points to comps, up from about 60 basis points in the year-ago quarter.

Other Details from the Quarter

Management commented that Walmart is moving faster to combine its digital and physical assets to make shopping simple and easy for customers and that its plan is gaining traction.

- Grocery experienced a low-single-digit increase in comps, as traffic in food and consumables accelerated throughout the quarter. The business saw a strong Easter performance.

- Health and wellness experienced a low-single-digit increase in comps due to continued solid comp traffic across pharmacy and OTC.

- General merchandise experienced a low-single-digit decrease in comps, with sluggish sales at the beginning of the quarter due to delayed consumer income tax refund checks. However, sales improved throughout the quarter, which finished with a strong Easter.

- Last year’s first quarter results benefited by 100 basis points due to the leap year.

- Food price deflation did not impact comps, excluding price investments.

- Strength in grocery partially offset softness in general merchandise categories that was due in part to delays in consumers receiving income tax refunds.

- In the quarter, Walmart opened 12 Supercenters (net), remodeled 55 stores and closed two Neighborhood Markets.

- As of the end of the quarter, Walmart offered online grocery in nearly 670 locations.

Outlook

For 2Q18, Walmart expects:

- EPS of $1.00–$1.08, which excludes $0.05 from the sale of the company’s Suburbia apparel format in Mexico. The $1.04 EPS midpoint is below the $1.07 consensus estimate.

- Comps of:

- 5%–2.0% for Walmart (excluding fuel)

- 0%–1.5% for Sam’s Club (excluding fuel)