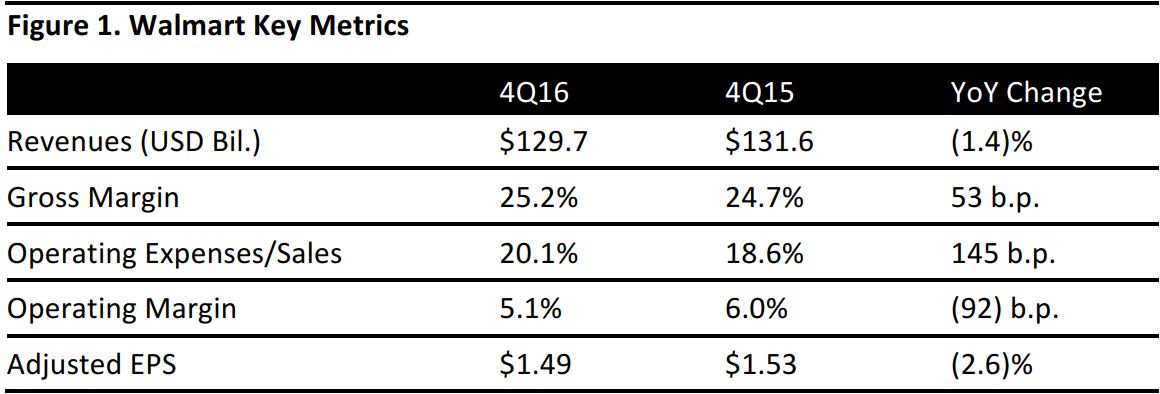

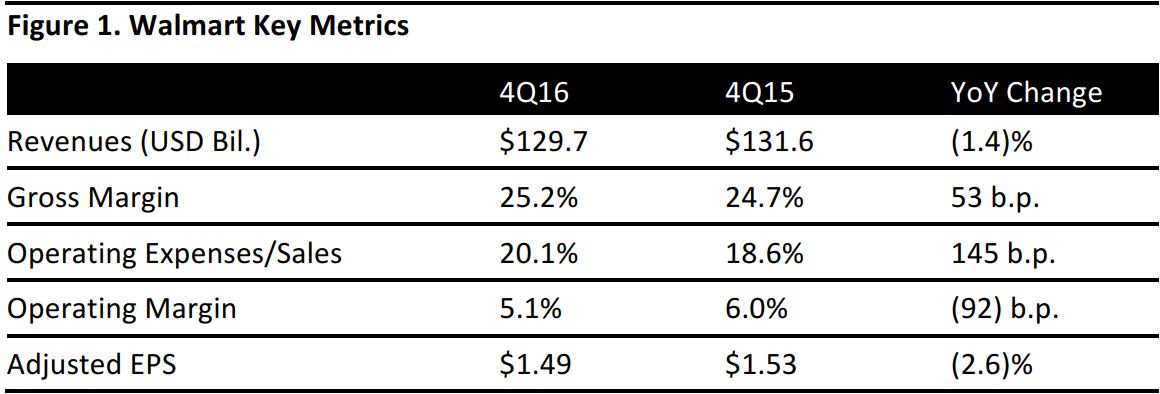

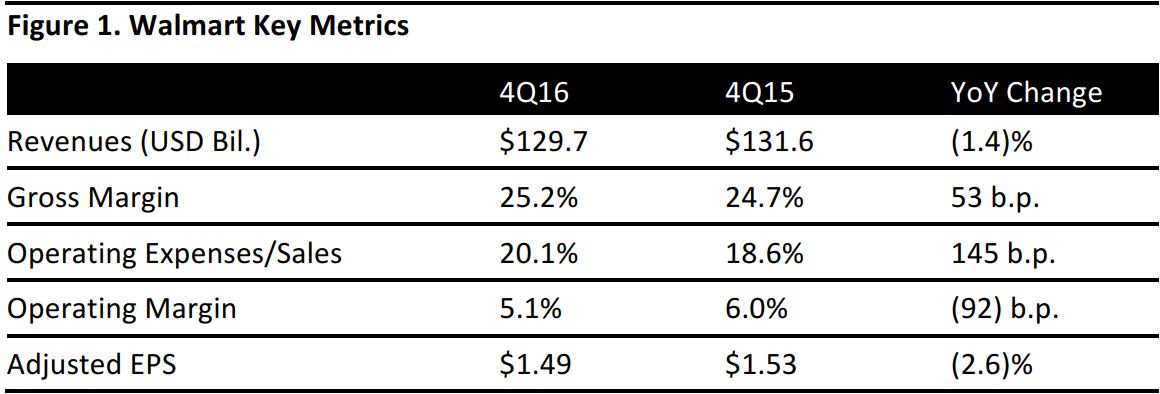

Source: Company reports

4Q16 Results

Adjusted for currency, Walmart’s fiscal 4Q16 revenues were $134.4 billion, up 2.2% from $131.6 billion a year ago.

US comps, at 0.6%, remained positive for the fifth consecutive quarter, and Neighborhood Market comps increased by 7%. The company noted that its customer-experience scores had increased. Fuel had a negligible impact on Walmart US’s comps, but hurt Sam’s Club comps by 2.2%. Sam’s Club comps declined by 2.7% during the quarter, although membership and other income increased by 7.4%.

Walmart’s global e-commerce revenue and gross merchandise volume (GMV) each increased by about 8%.

International net sales increased by 3.3%, to $37.4 billion, adjusted for currency, led by strength at Walmex and in Canada. Reported revenues from Walmart International were $32.7 billion, down 9.7%.

Reported diluted EPS was $1.43, which included a $0.20 charge for the closure of 269 stores globally that was partially offset by a $0.14 gain from discrete tax items, for a net charge of $0.06 per share.

FY16 Results

Revenues for FY16 were $482.1 billion, down 0.7%; adjusted for currency, revenues were $499.4 billion, up 2.8%.

Comps increased by 1.2% for Walmart US and decreased by 3.0% for Sam’s Club. Fuel had a negligible impact on Walmart US’s comps for the year, but hurt Sam’s Club’s comps by 3.4%.

Global e-commerce revenues were up 12%, to $13.7 billion, or 2.7% of constant-currency sales, and GMV increased by 13%.

Adjusted EPS was $4.59, compared to $5.07 last year. Full-year adjustments include the previously mentioned $0.06 charge, which was partially offset by a $0.04 accounting gain, for a net benefit of $0.02 per share.

Guidance

The company reduced its expectation for FY17 sales growth to flat from 3%–4% previously, owing to store closures and a strengthening US dollar, which management expects to hurt sales by $12 million. Management also guided for an increase in US comps of 50 basis points (compared to a 110 b.p. increase in FY16) and for flat sales for Sam’s Club excluding fuel (compared to a 40 b.p. increase).

FY17 EPS guidance is for $4.00–$4.30 (compared to $4.57 for FY16), which includes an impact of $0.30 per share for higher wages and $0.10 per share for currency (including $0.03 in 1Q17). The current consensus estimate is for EPS of $4.14.