Source: Company reports/Coresight Research

3Q19 Results

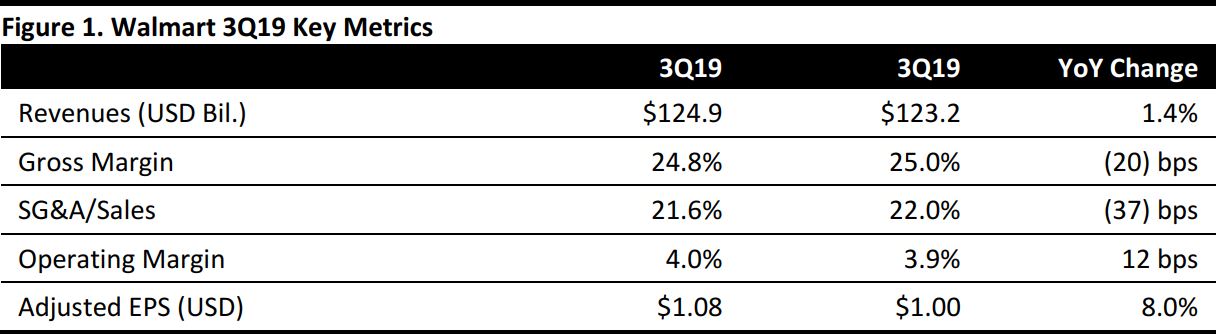

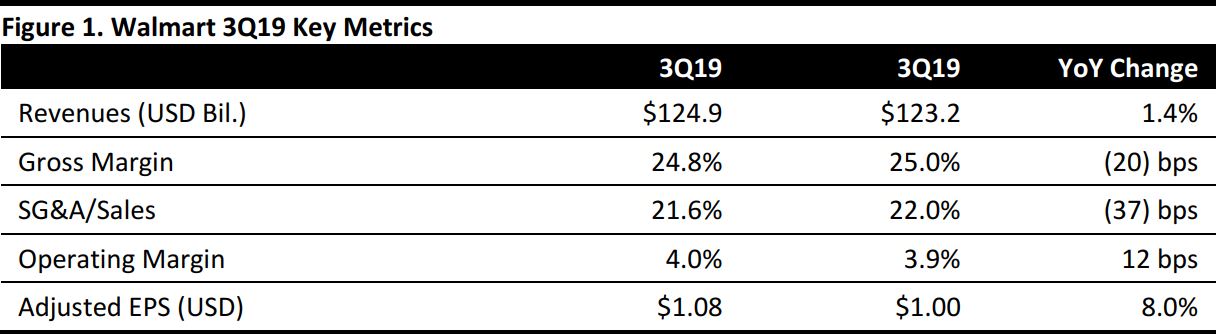

Walmart reported 3Q19 revenues of $124.9 billion, up 1.4% year over year and below of the consensus estimate of $125.4 billion. Total revenues excluding foreign currency effects were $126.1 billion, up 2.4%. Membership and other income was $1.0 billion, down 4.3%.

E-commerce accelerated to 43% growth.

US comps increased 3.4%, ahead of the 3.1% consensus estimate.

Adjusted EPS was $1.08, compared with $1.00 in the year-ago period and beating the $1.01 consensus estimate. GAAP EPS was $0.58, flat year over year. The adjusted figures exclude a $0.48 per share unrealized loss on the JD.com investment, a $0.03 loss per share on the sale of Walmart Brazil and a $0.01 per share gain due to recent changes in US tax rates.

Segment Details

- Walmart US net sales were $80.6 billion, up 3.7% year over year, driven by a 3.4% increase in comp sales (excluding fuel), including a 1.2% traffic increase and a 2.2% ticket increase.

- Walmart International reported net sales of $28.8 billion, down 2.6% year over year. The sale of a majority stake in Walmart Brazil hurt sales by $1.3 billion and foreign currency exchange rate changes hurt sales by $1.2 billion. Sales were up 7.2% at Walmex, up 4.3% in China, up 3.7% in the UK and up 2.8% in Canada.

- Sam’s Club reported net sales of $14.5 billion, down 2.3% year over year. Comps increased 5.3% on a 6.2% traffic increase. Lower tobacco sales hurt comps by 250 basis points. However, the transfer of sales from closed clubs accounted for half of the comp increase, excluding fuel.

Other Details from the Quarter

- Walmart finalized its Flipkart acquisition on August 18.

- Management characterized the quarter as solid, and claimed market share gains in food, consumables and many areas of general merchandise.

- Comp inventory was about flat at the end of the quarter.

- Walmart leveraged expenses, demonstrating productivity gains.

- The company continues to expand its reach from an omnichannel perspective, now with 2,100 grocery pickup locations and expects to have about 700 pickup towers by the end of the fiscal year.

- Grocery pick-up has consistently delivered higher Net Promotor Scores, which continued throughout the rollout in Q3. Learning how to handle in-store pickup has improved the company’s delivery capabilities, and Walmart aims to be able to reach about 40% of the US population with delivery through about 800 stores by the end of the year.

- E-commerce sales growth improved sequentially to 43%, and Walmart is continuing to leverage its innovations at its Store No 8 division.

- Walmart’s Customer Value Index score is running ahead of the aggressive plan it set for this year, led by progress on Have it and Deliver it metrics. The company is expanding same-day delivery options through omnichannel capabilities adding more digitally native brands to the portfolio at Jet.com. Management believes it can improve the margin mix of this business by expanding the tail of the assortment by adding party items and expanding the marketplace.

- The company recently announced new partnerships with Ellen DeGeneres and Advance Auto Parts, and, acquired specialty retailer Bare Necessities.

- Toys will be a focus for the holidays: 30% of the fall assortment in this category is new, and Walmart plans to offer 40% more toys online, aiming to offer the best prices on a broader assortment delivered through a seamless shopping experience.

Raised Guidance

Adjusted 2019 EPS guidance includes the impact of the following: (1) the sale of a majority stake in Walmart Brazil, (2) adjustments related to Tax Reform and (3) unrealized gains and losses on the investment in JD.com

For the year, Walmart expects:

- Adjusted EPS of $4.75–$4.85, up from $4.65–$4.80 previously.

- Comps of at least 3%. Up from previous guidance of “about 3%.”