Source: Company reports/Fung Global Retail & Technology

3Q17 RESULTS

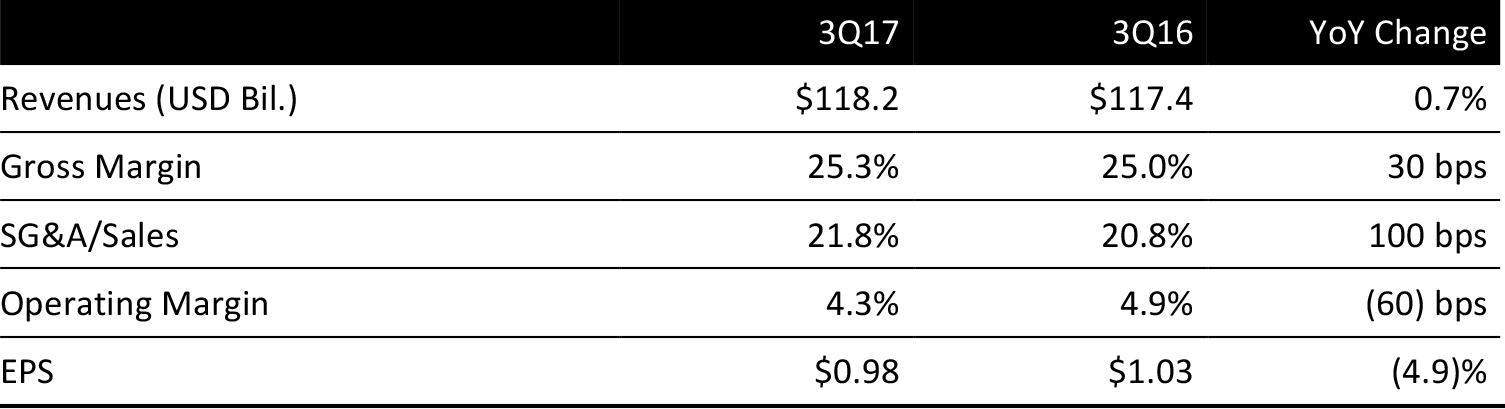

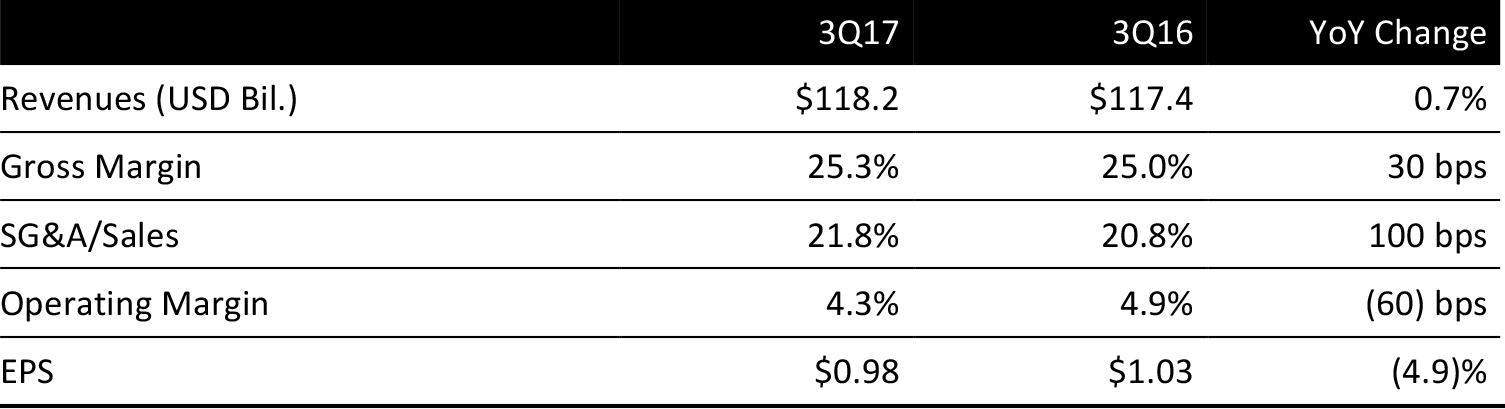

Walmart reported 3Q17 EPS of $0.98 versus the consensus estimate of $0.96.

Total revenue was $118.18 billion versus expectations of $118.59 billion. In constant currency, revenues were $120.32 billion. Sales at Walmart US totaled $74.55 billion; international sales were $28.39 billion, Sam’s Club sales were $14.24 billion and membership income was $1.00 billion.

Walmart US comps were up 1.2% versus consensus of 1.4% and guidance of 1.0%–1.5%. Traffic at Walmart US was up 0.7%, while average ticket increased by 0.5%. E-commerce added 50 basis points to comps, which was the channel’s largest contribution to date. Neighborhood Market comps were up 5.2%. The company experienced a favorable back-to-school season to start the quarter, although that strength was offset by unseasonably warm weather that impacted apparel, and cold weather categories in particular.

Sam’s Club comps excluding fuel were up 1.4% versus consensus of 0.6% and guidance of slightly positive. Traffic at Sam’s Club was down 0.5%, while average ticket increased by 1.9%. E-commerce added 60 basis points to comps. Stronger categories at Sam’s Club were health and wellness and home and apparel, both of which saw comp increases in the mid-single-digit range. The food and grocery category was the weakest segment, with comps down by mid-single digits due to continued commodity deflation.

Global e-commerce sales and gross merchandise volume increased by 20.6% and 16.8%, respectively. The US results were stronger than those of international markets, and were driven by the marketplace offering as well as by Jet.com’s contribution. Results in the e-commerce business have improved sequentially throughout the year.

Internationally, sales were led by Walmex, where comps in 10 of 11 markets were positive.

OUTLOOK

The company’s 4Q17 guidance calls for EPS of $1.18–$1.33, driven by a comp increase of 1.0%–1.5% at both Walmart US and Sam’s Club, versus consensus of 1.5% and 1.0% comp growth, respectively.

Full-year EPS guidance is now $4.20–$4.35, versus prior guidance of $4.15–$4.35 and consensus of $4.34.