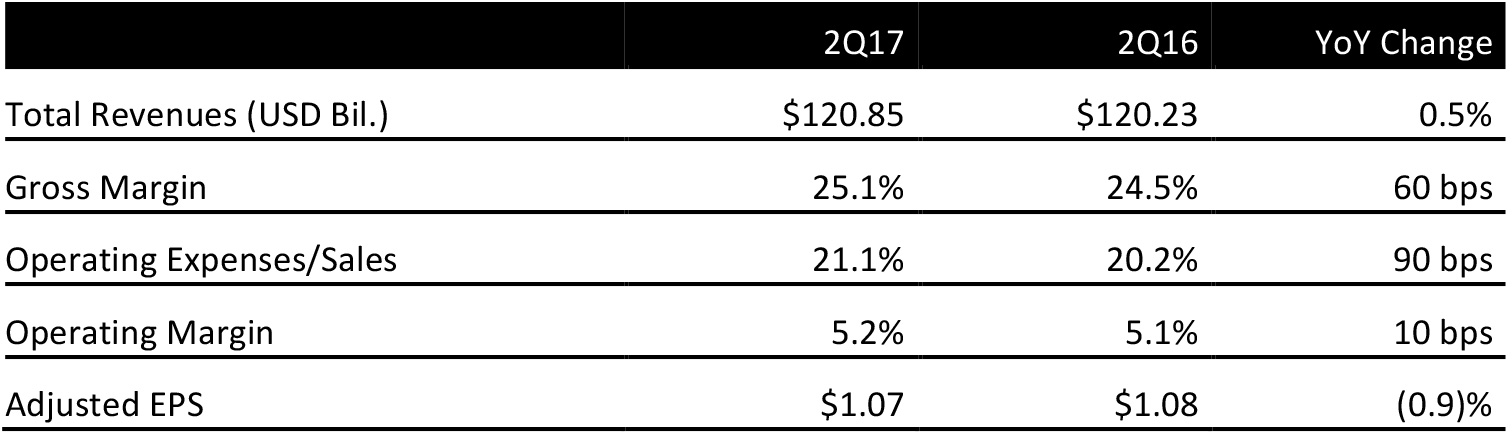

Source: Company reports

2Q17 RESULTS

Walmart reported fiscal 2Q17 adjusted EPS of $1.07 versus the consensus estimate of $1.02.

Total revenues were $120.85 billion versus expectations of $120.17 billion. On a constant-currency basis, sales were up 2.8%, totaling $123.60 billion.

Walmart US comps were up 1.6%, driven by a 1.2% increase in traffic and a 0.4% increase in average ticket. Walmart US results were led by the health and wellness category, with home, toys, sporting goods and OTC contributing strongly.

Sam’s Club comps (excluding fuel) were up 0.6% versus consensus of (0.1)% and guidance of “slightly positive.” Stronger categories included health and wellness, followed by home and apparel and consumables. The fresh, freezer and cooler category posted negative comps, as did the technology, office and entertainment category.

Walmart International sales were up 2.2% on a constant-currency basis. Nine of the 11 international markets posted positive comps, led by Walmex. The UK and China posted negative comps.

Neighborhood Market comps increased by 6.5% in the quarter.

E-commerce benefited comps by 40 basis points, and sales in the channel were up 11.8%. US e-commerce markets were stronger than international e-commerce markets. The channel’s results were driven by growth in the US marketplace offering, the continued rollout of online grocery and growth of order pickup from stores and clubs. According to Walmart, the Jet.com acquisition was appealing because Jet.com has the technology to reward customers in real time with lower prices, based on the basket of items they choose.

This marked the eighth consecutive quarter of positive comps for the company and the seventh consecutive quarter of positive traffic.

2017 OUTLOOK

For fiscal 3Q17, the company guided for EPS of $0.90–$1.00 based on Walmart US comp growth of 1.0%–1.5% versus consensus of 1.0%. Sam’s Club comps (excluding fuel) are expected to be “slightly positive” versus consensus of 0.6%.

Management raised its full-year EPS guidance from $4.00–$4.30 to $4.15–$4.35, which includes a $0.05 negative impact (primarily in the fourth quarter) related to expected operating losses from the planned acquisition of Jet.com. Consensus calls for full-year EPS of $4.27.