DIpil Das

Walmart is developing a program called Walmart+, a move that could put it in competition with Amazon’s Prime. It should be clarified that Walmart has not confirmed any of the details of Walmart+, not even that it is indeed a loyalty program: A spokesman contacted by Coresight Research would confirm only that a program called Walmart+ is under development.

The program will reportedly start as a rebrand of the retailer’s existing Delivery Unlimited grocery service: The retailer can simply fold existing Delivery Unlimited members into Walmart+ then expand from there.

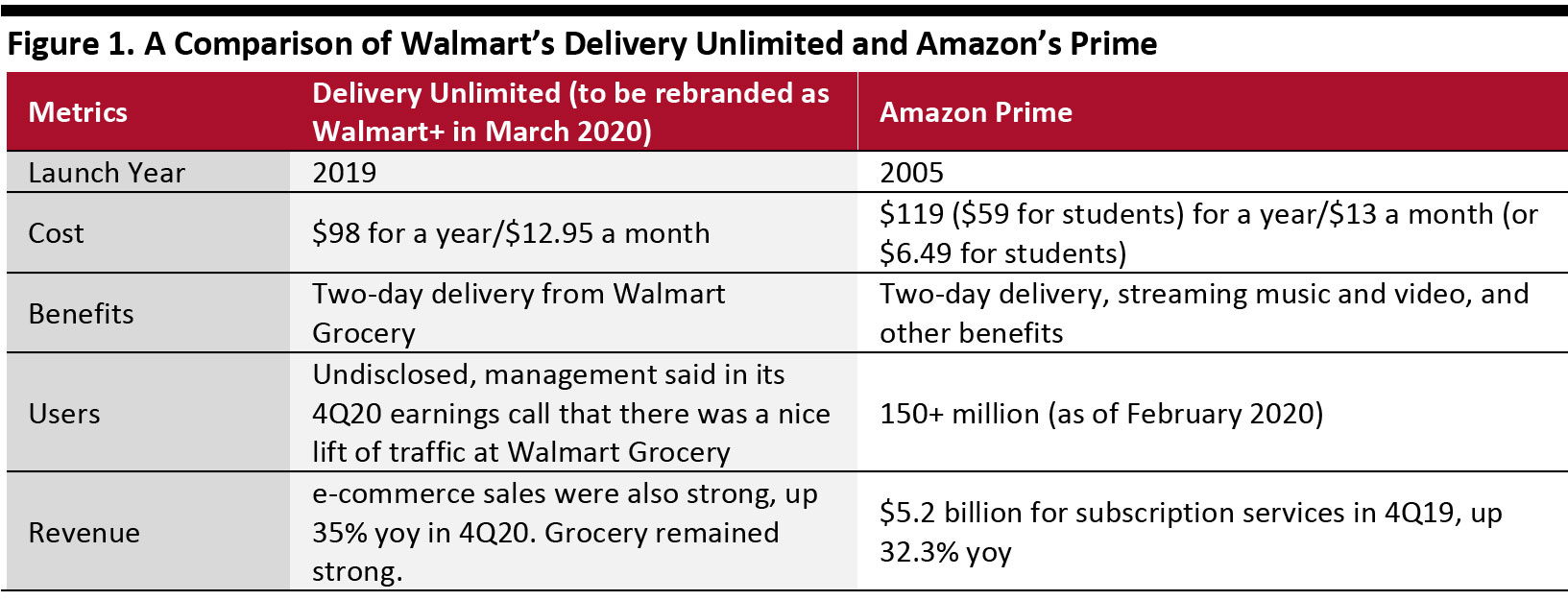

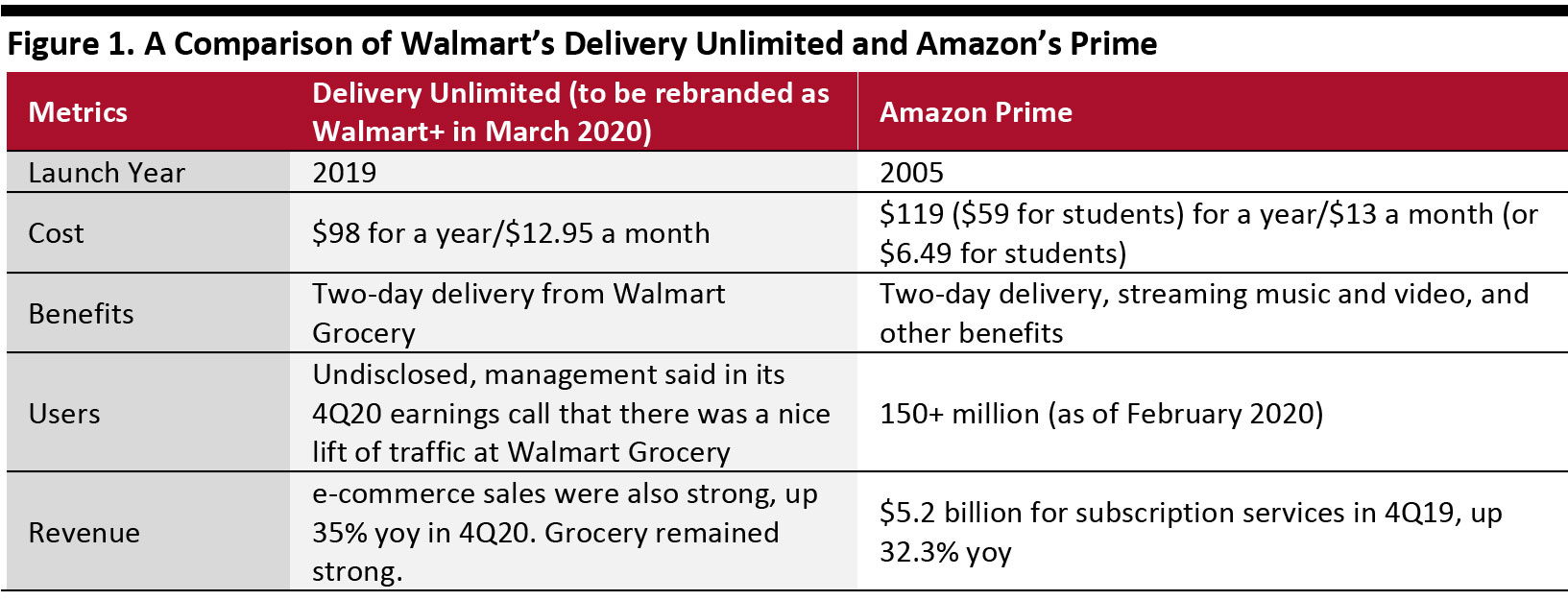

With Delivery Unlimited, customers pay $98 a year for unlimited, same-day delivery of groceries from one of the 1,600-plus stores in the US in which it’s available.

But Walmart+ may not remain a grocery delivery service for long: We expect the company will likely add perks, which could include discounts on prescription drugs, gasoline, a scan and go service so shoppers can check out without waiting in line, among others.

The company is also reportedly considering launching Walmart+ with a feature that would allow customers to use text messaging to place orders.

Taking on Amazon Prime

Walmart management will probably cringe at the comparison, but if Walmart+ is what we believe it will be, it will look a lot like a competitor to Amazon Prime, although probably with enough other features that comparisons may fail. For example, Amazon Prime costs $119 a year and includes perks such as unlimited next-day shipping on more than 10 million items, streaming music, TV shows and movies. Amazon has also taken steps to lure lower-income shoppers into Prime memberships by offering monthly membership rates.

If Walmart+ does indeed launch by folding existing Delivery Unlimited members into Walmart+ the membership will be a comparable $98 per year, and at launch will likely focus on grocery delivery (still a small portion of Amazon’s business). And additional perks are likely to focus on Walmart’s existing retail offering, likely quite different from what Amazon Prime members get.

[caption id="attachment_104434" align="aligncenter" width="700"] Source: Company reports [/caption]

In Walmart’s 4Q20 earnings call, management pointed out the company had been learning to sell memberships through its grocery delivery service, and indicated that results looked promising—possibly foretelling its plans for Walmart+.

Subsequently, on February 24, delivery service provider Skipcart ended its grocery delivery agreement with Walmart after just over a year, another possible indicator of the company’s plans for a new loyalty program. Walmart is also building its own delivery platform with independent contractors, including one provider called Spark. The service is now available in 31 states, making 30,000 deliveries a week.

Source: Company reports [/caption]

In Walmart’s 4Q20 earnings call, management pointed out the company had been learning to sell memberships through its grocery delivery service, and indicated that results looked promising—possibly foretelling its plans for Walmart+.

Subsequently, on February 24, delivery service provider Skipcart ended its grocery delivery agreement with Walmart after just over a year, another possible indicator of the company’s plans for a new loyalty program. Walmart is also building its own delivery platform with independent contractors, including one provider called Spark. The service is now available in 31 states, making 30,000 deliveries a week.

Source: Company reports [/caption]

In Walmart’s 4Q20 earnings call, management pointed out the company had been learning to sell memberships through its grocery delivery service, and indicated that results looked promising—possibly foretelling its plans for Walmart+.

Subsequently, on February 24, delivery service provider Skipcart ended its grocery delivery agreement with Walmart after just over a year, another possible indicator of the company’s plans for a new loyalty program. Walmart is also building its own delivery platform with independent contractors, including one provider called Spark. The service is now available in 31 states, making 30,000 deliveries a week.

Source: Company reports [/caption]

In Walmart’s 4Q20 earnings call, management pointed out the company had been learning to sell memberships through its grocery delivery service, and indicated that results looked promising—possibly foretelling its plans for Walmart+.

Subsequently, on February 24, delivery service provider Skipcart ended its grocery delivery agreement with Walmart after just over a year, another possible indicator of the company’s plans for a new loyalty program. Walmart is also building its own delivery platform with independent contractors, including one provider called Spark. The service is now available in 31 states, making 30,000 deliveries a week.