Event

On October 20, 2016, Walmart and JD.com announced a series of initiatives that extends their cooperation on cross-border e-commerce and logistics. In our view, the joint initiatives will be a win win for both companies, and effectively combine the strength of Walmart as a leading retailer with the same-day delivery capabilities of JD.com ahead of Singles’ Day.

Opportunities Brought about by the Collaboration

The goal is to provide Chinese consumers access to Walmart’s products and leverage JD.com’s nationwide logistics network. The joint initiatives offered by Walmart and

JD.com will cover three major areas:

- The launch of an exclusive Sam’s Club Flagship Store on JD.com on October 21.

- The launch of a Walmart Global store on JD Worldwide, JD.com’s cross-border platform.

- The provision of a two-hour delivery service from more than 20 Walmart stores in select Chinese cities.

Walmart: The benefits that Walmart will derive from the partnership are threefold:

- Strengthen its online presence in China: Walmart will be able to reach China’s online customers through the opening of a Sam’s Club Flagship Store and Walmart Global store on JD.com, which is consistent with the company’s online strategy to invest in and gain share in the global e-commerce market.

- Accelerate its China expansion on the back of JD’s logistics platform: To meet Chinese customers’ demand for quick delivery, a two-hour delivery service will be offered from more than 20 Walmart stores to customers on JD Daojia. This builds on the same- and next- day delivery service that Walmart has been offering to its customers since June 2016, which leveraged JD.com’s nationwide logistics network. Orders from Wal-Mart and Sam’s Club to rural areas can be delivered by drones, according to JD.com. The collaboration with JD.com enables Walmart to deliver its products to more than 90% of China’s consumers, according to Bloomberg.

- Increase its penetration into rural areas in China: With an online presence on JD.com, Walmart will now be able to sell products to Chinese consumers in rural areas where it does not operate physical stores. Walmart’s tie-up with JD is also complementary to its strategy of increasing its exposure to China, which Doug McMillon, CEO of Walmart, described as a “strategic market for the future”. Walmart accounts for 2.3% of the grocery market in China, according to Bloomberg. The company plans to open 20 more Sam’s Clubs locations by 2019.

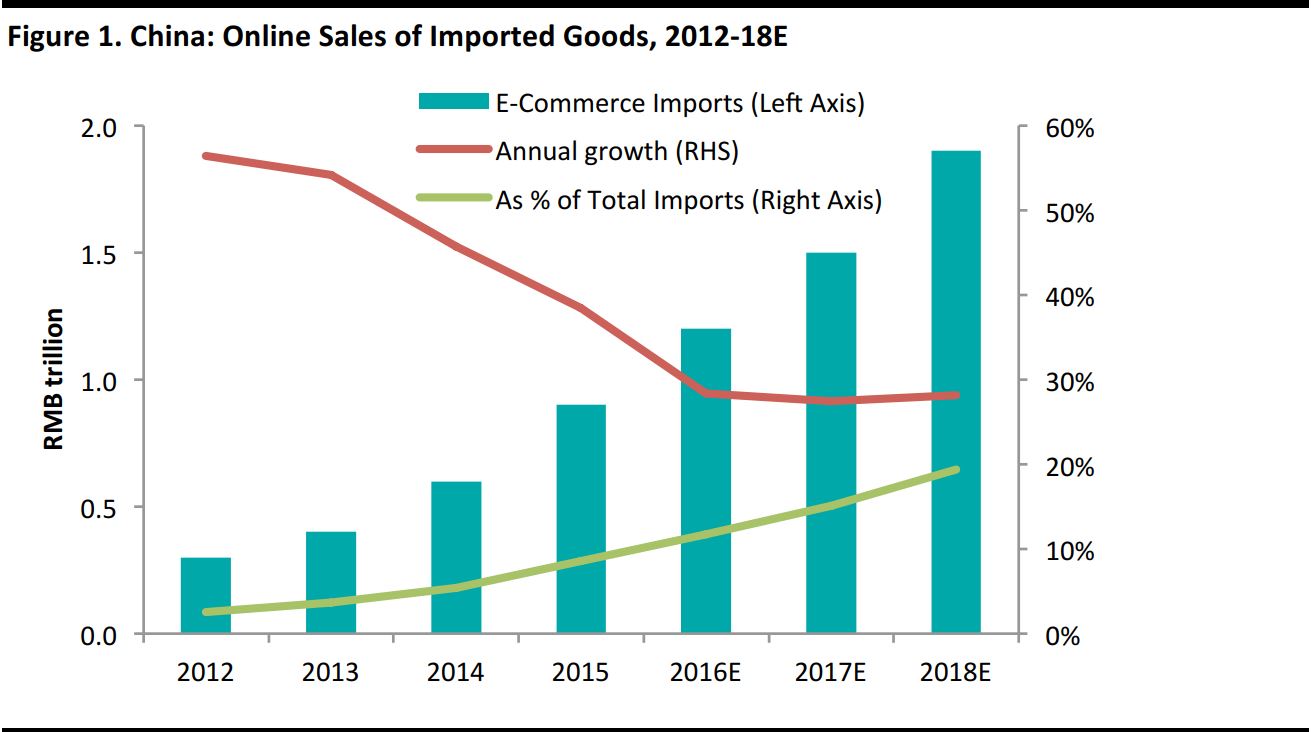

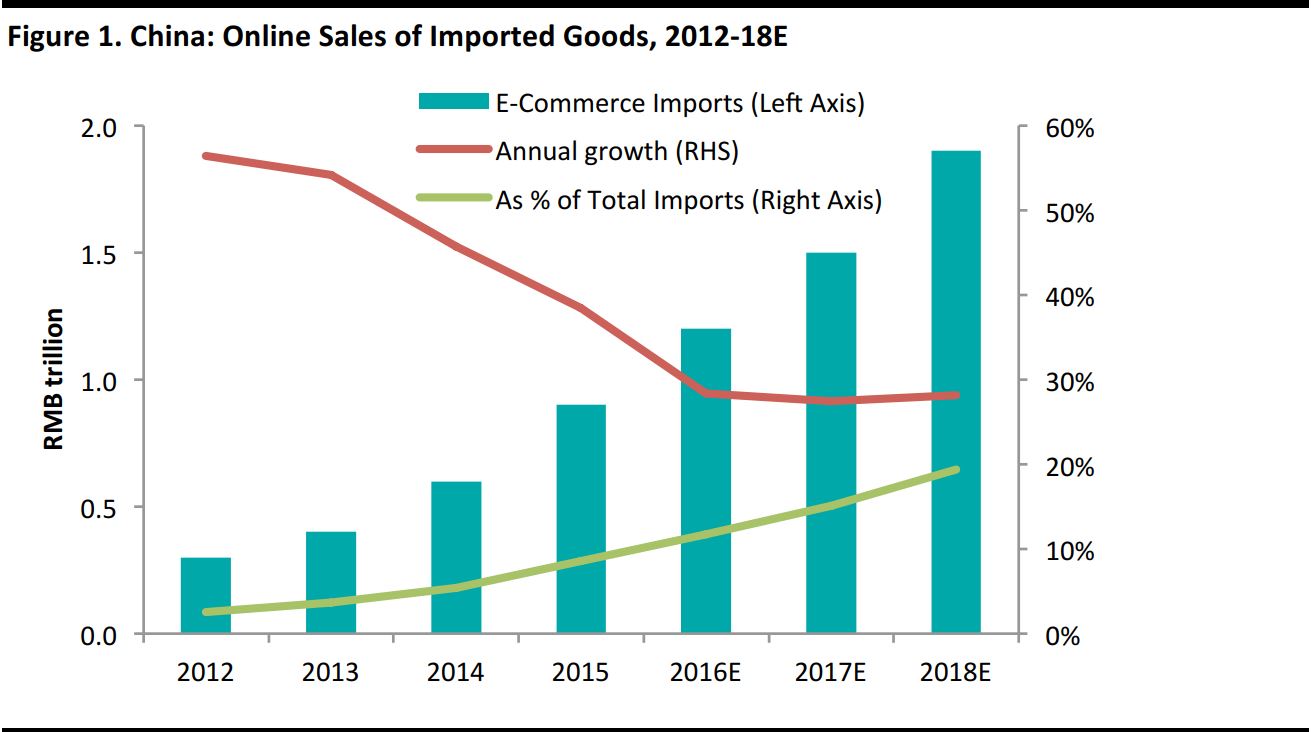

JD.com: The opening of a Sam’s Club store and a Walmart Global store on JD.com will introduce diverse overseas products to the Chinese market ahead of Singles’ Day 2016. The increased overseas product offering is expected to drive sales growth on the back of the strong growth potential of China’s cross-border e-commerce imports, which, according to iResearch, are expected to see close to 30% year-over-year growth in the next three years. The strong growth potential is primarily driven by the growing Chinese middle class and their increasing appetite for foreign products.

Source: iResearch/Fung Global Retail & Technology

Review of the Existing Strategic Alliance Between Walmart and JD.com

Walmart formed a strategic alliance with JD.com in June 2016, under which Walmart swapped the Yihaodian platform to JD.com for a 5.9% stake (subsequently increased to 10.8% in October). This partnership with JD.com allowed Walmart to gain access to JD.com’s logistics and warehousing networks, as well as its user base.

Conclusion

We are positive on the debut of Walmart Global and Sam’s Club on JD.com ahead of Singles’ Day 2016, and will track its sales performance in future reports.