Walmart Takes On the E-Commerce Challenge Through Acquisitions

Walmart is steadfastly executing its expansion strategy in the e-commerce space, amidst a difficult retail environment and growing pressure from Amazon. Since 2H16, the company has completed deals for Jet.com, ShoeBuy, Moosejaw and, most recently, ModCloth. This type of M&A activity has never been seen from the giant retailer, signaling, we believe, that Walmart has realized the urgency of staying on a par with the online players and has decided to shift away from an organic growth-driven strategy to one with its own online business segment.

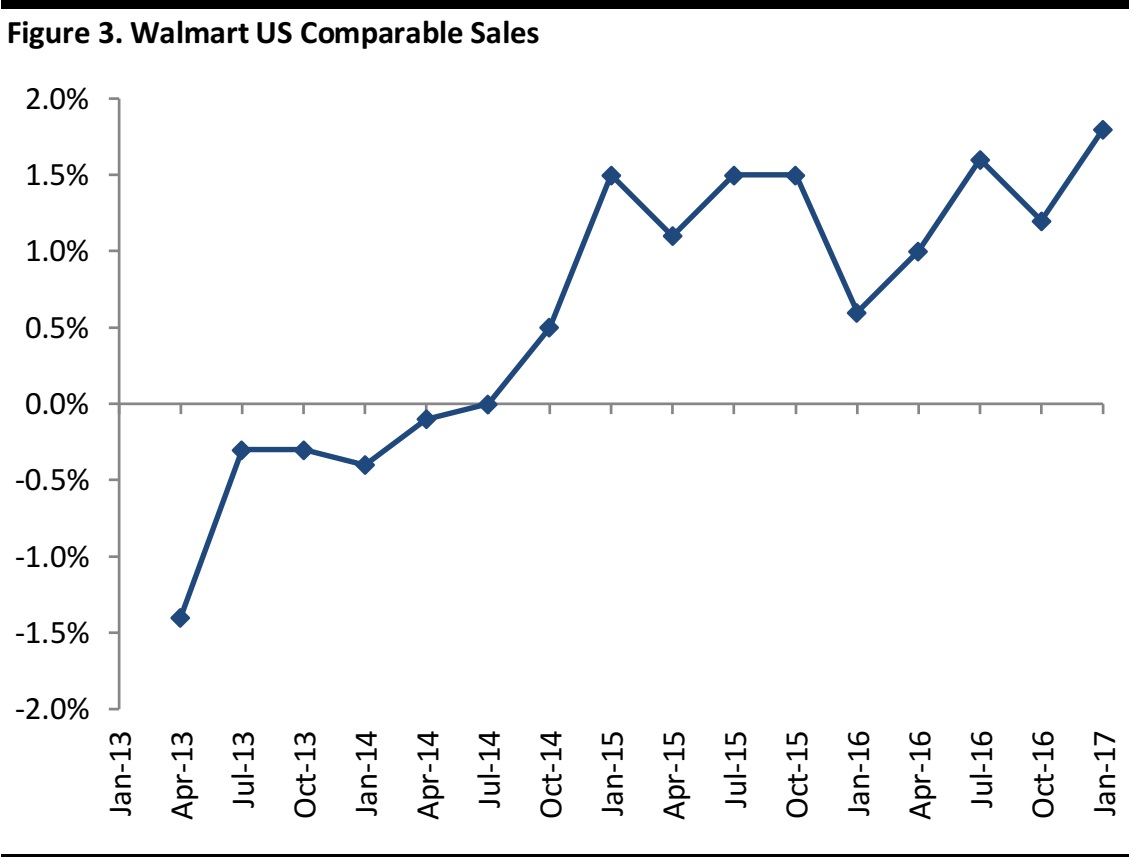

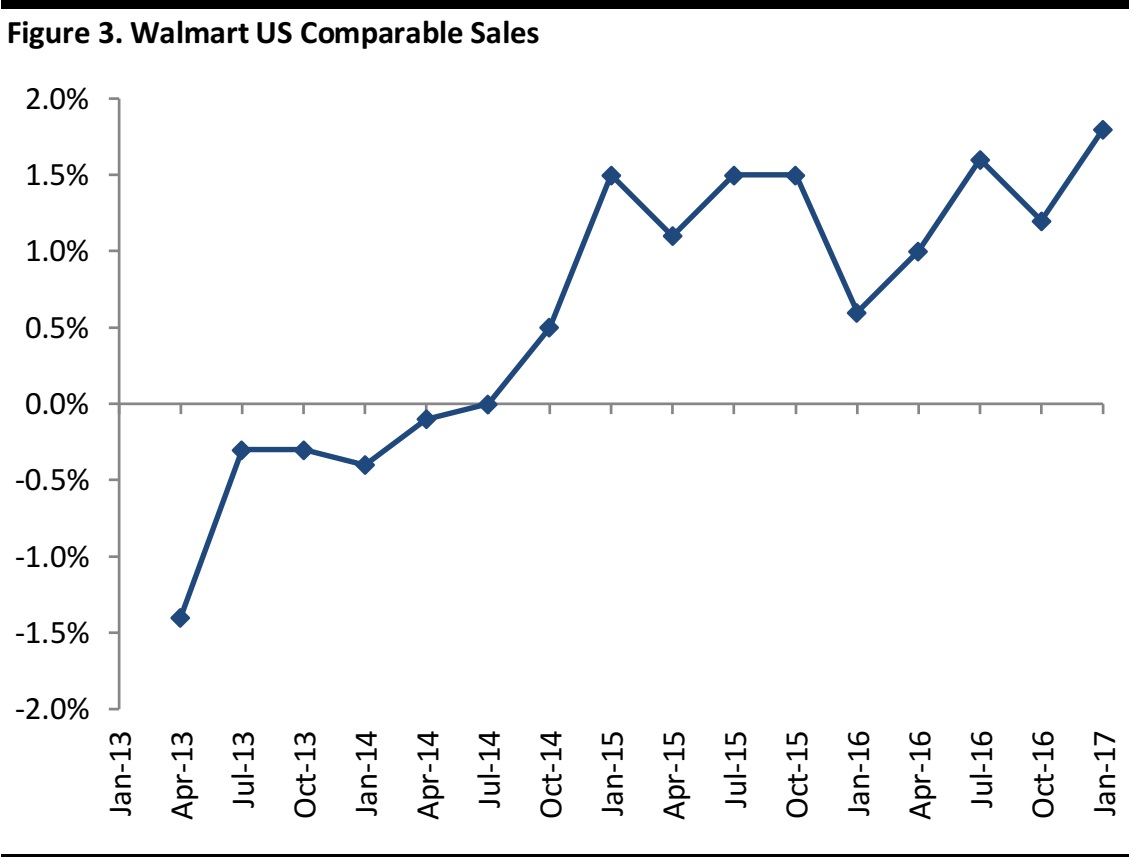

Source: Company reports/Fung Global Retail & Technology

These moves came at a time of sluggish e-commerce growth for Walmart. In the quarter ending April 2016, the US e-commerce market grew by about 15%, while Amazon’s online sales grew by 28%. Walmart’s own e-commerce sales, on the other hand, grew only 7%, and its online business remained loss-making.

* Overall revenue growth rate including all of Amazon’s businesses.

Source: Bloomberg/Fung Global Retail & Technology

Upside Potential

The recruitment of Jet.com’s founder Mark Lore as President and CEO of Walmart eCommerce US, and his capable team, will be a major plus for Walmart, although it did come at a hefty price tag. In addition, with Jet.com, Walmart has gained a platform that offers a wide product assortment and healthy online traffic.

To complement this, Walmart acquired online players Moosejaw, ModCloth and ShoeBuy, which all have more specialized product offerings that are tailored to a different customer base and help Walmart reach a broader demographic. The strategy is akin to building an online retail network, extending outward with Jet.com in the center, and supported by Walmart’s strong inventory and distribution capabilities. As Walmart continuously makes inroads into e-commerce through this new strategy, we believe more acquisitions of online brands and portals are still to come.

The upside potential from these acquisitions remains moderate in the short term, but we believe they will become more positive over the medium to long term. The major rationale behind this assessment is that the acquired companies still fall short in terms of profitability, and thus will not be able to generate any significant financial return for Walmart in the near term.

Walmart More Aggressive in the Apparel Space

The majority of Walmart’s recent acquisitions have focused on apparel retailers—ShoeBuy specializes in footwear and apparel, while Moosejaw specializes in outdoor wear and ModCloth in women’s apparel. This is primarily due to the growing pressure it has faced since Amazon’s successful inroads in the sector. Clothing and footwear sales made through Amazon US totaled $13 billion in 2016, up $9 billion from five years ago, according to Euromonitor.

Another concern for apparel brands and retailers is Amazon’s private-label foray, with the recent launch of intimate apparel, as an example. The extensive sales channel provided by Amazon’s e-commerce platform, coupled with the company’s data analytics that can help predict and adjust to ever-changing consumer demands, almost ensures that Amazon’s private labels have a real shot at eroding the market share of established players. Nonetheless, Walmart, leading the pack with over $23 billion in apparel sales in 2017, understands the threat presented by Amazon, and has decided to take action to stem the continuous loss of market share.

Details of Major Acquisitions

Jet.com (August 2016)

Jet.com (August 2016)

Walmart acquired online retailer Jet.com for $3.3 billion in August 2016. The company felt that Jet.com would be a good acquisition target to regain the much-needed growth momentum to jumpstart its e-commerce business and narrow the gap with Amazon. While Jet.com was not profitable, its gross merchandise volume (GMV) reached around $1 billion and experienced healthy topline growth around the time of the acquisition.

More importantly, Walmart was able to bring on board Mark Lore, the Founder and CEO of Jet.com and a renowned e-commerce expert, to take the helm of Walmart’s online business.

The acquisition signaled at least a minor shift, if not a complete overhaul, in Walmart’s e-commerce policy. Since the introduction of Walmart.com in the early 2000s, the company has relied on organic growth and internal development of its e-commerce arm. The Jet.com acquisition, thus, suggests that Walmart may now be pursuing a different strategy for its e-commerce business in the face of intensifying competition. This is further reinforced by other acquisitions since then, including ShoeBuy, Moosejaw and ModCloth.

Benefits

- Walmart acquired significant expertise: The addition of the Founder and CEO of Jet.com, Marc Lore, and his team to Walmart’s e-commerce business, is seen as the major reason behind the acquisition. Lore founded the Quidsi platform, which was known for its superb same-day delivery and warehouse optimization capability, and was eventually sold to Amazon. Walmart will very likely benefit with Lore as CEO of the e-commerce business.

- Expands Walmart’s customer reach and sales: Jet.com has been adding 400,000 shoppers on a monthly basis, according to Walmart. It also has access to a large group of urban millennials. With more than 2,400 retailers and brand partners, Jet.com can help broaden Walmart’s product offering and appeal to a bigger customer base.

- com has valuable pricing technology: Walmart now has access to the proprietary software that allows Jet.com to sell at a lower price by accounting for factors such as basket size and the proximity of the merchandize.

Source: Company reports/Fung Global Retail & Technology

In its most recent quarterly data ending January 2017, Walmart announced that US comparable sales grew by 1.8%, topping consensus estimates amid a difficult retail environment. The improved e-commerce business provided 40 basis points of support to comparable sales. E-commerce sales grew by 16% and GMV also grew by 18% in the quarter ending December 2016. The numbers point to the positive impact brought by the wider product assortment from Jet.com.

Source: Jet.com

ShoeBuy (January 2017)

ShoeBuy (January 2017)

In January 2017, Walmart’s subsidiary, Jet.com, acquired the online footwear and apparel seller ShoeBuy for around $70 million. ShoeBuy carries more than 800 brands and over 1 million products, including footwear, clothing and accessories.

This was the first of a series of moves to expand Walmart’s customer base and product offerings in the apparel and footwear business. Under strong pressure from Amazon in this particular segment, Walmart’s decision to acquire ShoeBuy should be seen as an encouraging move to compete with Amazon. ShoeBuy suppliers will now be able to sell their products on Jet.com, thus expanding the product offering and attracting more customers to the site.

Walmart struggled to grow its e-commerce revenue in early 2016, and has since made top-line growth a strategic priority. Therefore, we believe the ShoeBuy acquisition fits well with Walmart’s strategy and should be able to boost growth for Jet.com in the near term.

Source: ShoeBuy

Moosejaw (February 2017)

Moosejaw (February 2017)

Walmart acquired Moosejaw in February 2017 for approximately $51 million. This is yet another move to strengthen Walmart’s e-commerce ability and to expand its product offerings to the active outdoor category. Moosejaw only has 10 physical stores, but is heavily focused on e-commerce, which works well with Walmart’s strategy. It features more than 400 outdoor brands including Patagonia, VF, North Face and Marmot.

Apparel is now the hotly contested battleground for both online and offline retailers. Amazon has been steadily increasing its online apparel sales and putting pressure on traditional retailers. Refusing to fall behind its competitors, the Moosejaw acquisition is seen as a move for Walmart to expand its current product offerings, absorb Moosejaw’s millennial customer base, as well as enlarge Walmart’s online presence. With the ShoeBuy acquisition the previous month, and the addition of Moosejaw to its umbrella, we believe Walmart has shown strong determination to battle Amazon on the online apparel and footwear front.

Source: Moosejaw

ModCloth (March 2017)

ModCloth (March 2017)

Walmart’s latest acquisition in the e-commerce space is online women’s apparel e-commerce site ModCloth. It paid around $50–$75 million for the company in March, which is slightly lower than ModCloth’s most recent round of financing for $78 million, according to TechCrunch. With its fun and expressive style, and tight customer community, ModCloth has managed to build a significant millennial customer base. One of the online retailer’s competitive advantages is the ability to connect with consumers, which is not an easy feat. It will continue to operate as a standalone and complementary brand to other e-commerce sites under Walmart.

Although the ModCloth acquisition will expand Jet.com’s, and subsequently Walmart’s, online presence and customer base, concerns remain about the synergy behind the move. ModCloth is well known for its stance on equal pay and equal representation for female employees, while Walmart has not been as vocal, and has in fact had recent legal issues related to these topics. A major reason that ModCloth was able to acquire a strong female millennial base is largely because of the values that the brand espouses. We remain skeptical about whether ModCloth can retain its customer base after the acquisition.

Source: ModCloth

Jet.com (August 2016)

Walmart acquired online retailer Jet.com for $3.3 billion in August 2016. The company felt that Jet.com would be a good acquisition target to regain the much-needed growth momentum to jumpstart its e-commerce business and narrow the gap with Amazon. While Jet.com was not profitable, its gross merchandise volume (GMV) reached around $1 billion and experienced healthy topline growth around the time of the acquisition.

More importantly, Walmart was able to bring on board Mark Lore, the Founder and CEO of Jet.com and a renowned e-commerce expert, to take the helm of Walmart’s online business.

The acquisition signaled at least a minor shift, if not a complete overhaul, in Walmart’s e-commerce policy. Since the introduction of Walmart.com in the early 2000s, the company has relied on organic growth and internal development of its e-commerce arm. The Jet.com acquisition, thus, suggests that Walmart may now be pursuing a different strategy for its e-commerce business in the face of intensifying competition. This is further reinforced by other acquisitions since then, including ShoeBuy, Moosejaw and ModCloth.

Jet.com (August 2016)

Walmart acquired online retailer Jet.com for $3.3 billion in August 2016. The company felt that Jet.com would be a good acquisition target to regain the much-needed growth momentum to jumpstart its e-commerce business and narrow the gap with Amazon. While Jet.com was not profitable, its gross merchandise volume (GMV) reached around $1 billion and experienced healthy topline growth around the time of the acquisition.

More importantly, Walmart was able to bring on board Mark Lore, the Founder and CEO of Jet.com and a renowned e-commerce expert, to take the helm of Walmart’s online business.

The acquisition signaled at least a minor shift, if not a complete overhaul, in Walmart’s e-commerce policy. Since the introduction of Walmart.com in the early 2000s, the company has relied on organic growth and internal development of its e-commerce arm. The Jet.com acquisition, thus, suggests that Walmart may now be pursuing a different strategy for its e-commerce business in the face of intensifying competition. This is further reinforced by other acquisitions since then, including ShoeBuy, Moosejaw and ModCloth.