albert Chan

[caption id="attachment_76835" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

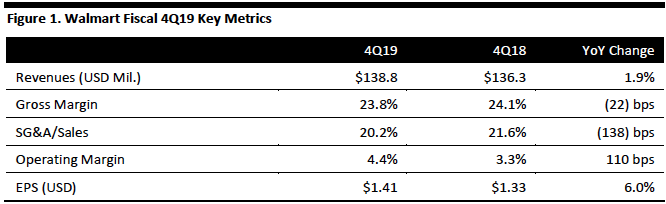

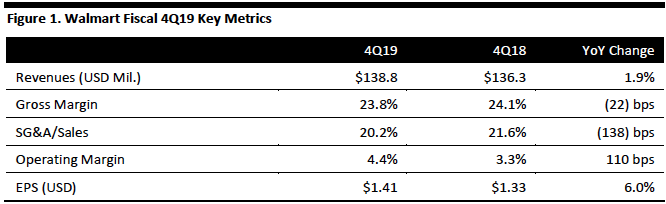

Walmart reported fiscal 4Q19 revenues of $138.8 billion, up 1.9% year over year and in line with the consensus estimate. Total revenues excluding foreign currency effects were $140.5 billion, up 3.1%. Membership and other income was $1.1 billion, down 6.0%.

Walmart U.S. e-commerce sales increased 43%, benefiting from strong online grocery sales.

U.S. comps increased 4.2%, ahead of the 3.1% consensus estimate.

Walmart showed substantial expense leverage in the quarter, with SG&A/sales declining 138 bps, offsetting a 22-bps decline in gross margins and driving the 110-bps operating margin increase.

Adjusted EPS was $1.41, compared with $1.33 in the year-ago period and beating the $1.33 consensus estimate. GAAP EPS was $1.27, up 73.2%. The adjusted figures exclude a $0.03 per share gain on the investment in JD.com and a $0.17 per share adjustment to the provision amount due to U.S. tax reform.

FY19 Results

Total FY19 revenues were $514.4 billion, up 2.8%. Revenues increased 3.0%, excluding foreign currency impact.

U.S. comps increased 3.6%.

U.S. e-commerce sales increased 40%.

Adjusted EPS was $4.91, up 11.1%. GAAP EPS was $2.26, up 70.3%.

Segment Details

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Walmart reported fiscal 4Q19 revenues of $138.8 billion, up 1.9% year over year and in line with the consensus estimate. Total revenues excluding foreign currency effects were $140.5 billion, up 3.1%. Membership and other income was $1.1 billion, down 6.0%.

Walmart U.S. e-commerce sales increased 43%, benefiting from strong online grocery sales.

U.S. comps increased 4.2%, ahead of the 3.1% consensus estimate.

Walmart showed substantial expense leverage in the quarter, with SG&A/sales declining 138 bps, offsetting a 22-bps decline in gross margins and driving the 110-bps operating margin increase.

Adjusted EPS was $1.41, compared with $1.33 in the year-ago period and beating the $1.33 consensus estimate. GAAP EPS was $1.27, up 73.2%. The adjusted figures exclude a $0.03 per share gain on the investment in JD.com and a $0.17 per share adjustment to the provision amount due to U.S. tax reform.

FY19 Results

Total FY19 revenues were $514.4 billion, up 2.8%. Revenues increased 3.0%, excluding foreign currency impact.

U.S. comps increased 3.6%.

U.S. e-commerce sales increased 40%.

Adjusted EPS was $4.91, up 11.1%. GAAP EPS was $2.26, up 70.3%.

Segment Details

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Walmart reported fiscal 4Q19 revenues of $138.8 billion, up 1.9% year over year and in line with the consensus estimate. Total revenues excluding foreign currency effects were $140.5 billion, up 3.1%. Membership and other income was $1.1 billion, down 6.0%.

Walmart U.S. e-commerce sales increased 43%, benefiting from strong online grocery sales.

U.S. comps increased 4.2%, ahead of the 3.1% consensus estimate.

Walmart showed substantial expense leverage in the quarter, with SG&A/sales declining 138 bps, offsetting a 22-bps decline in gross margins and driving the 110-bps operating margin increase.

Adjusted EPS was $1.41, compared with $1.33 in the year-ago period and beating the $1.33 consensus estimate. GAAP EPS was $1.27, up 73.2%. The adjusted figures exclude a $0.03 per share gain on the investment in JD.com and a $0.17 per share adjustment to the provision amount due to U.S. tax reform.

FY19 Results

Total FY19 revenues were $514.4 billion, up 2.8%. Revenues increased 3.0%, excluding foreign currency impact.

U.S. comps increased 3.6%.

U.S. e-commerce sales increased 40%.

Adjusted EPS was $4.91, up 11.1%. GAAP EPS was $2.26, up 70.3%.

Segment Details

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Walmart reported fiscal 4Q19 revenues of $138.8 billion, up 1.9% year over year and in line with the consensus estimate. Total revenues excluding foreign currency effects were $140.5 billion, up 3.1%. Membership and other income was $1.1 billion, down 6.0%.

Walmart U.S. e-commerce sales increased 43%, benefiting from strong online grocery sales.

U.S. comps increased 4.2%, ahead of the 3.1% consensus estimate.

Walmart showed substantial expense leverage in the quarter, with SG&A/sales declining 138 bps, offsetting a 22-bps decline in gross margins and driving the 110-bps operating margin increase.

Adjusted EPS was $1.41, compared with $1.33 in the year-ago period and beating the $1.33 consensus estimate. GAAP EPS was $1.27, up 73.2%. The adjusted figures exclude a $0.03 per share gain on the investment in JD.com and a $0.17 per share adjustment to the provision amount due to U.S. tax reform.

FY19 Results

Total FY19 revenues were $514.4 billion, up 2.8%. Revenues increased 3.0%, excluding foreign currency impact.

U.S. comps increased 3.6%.

U.S. e-commerce sales increased 40%.

Adjusted EPS was $4.91, up 11.1%. GAAP EPS was $2.26, up 70.3%.

Segment Details

- Walmart’s U.S. net sales were $90.5 billion, up 4.6% year over year, driven by a 4.2% increase in comp sales (excluding fuel), including a 0.9% traffic increase and a 3.3% ticket increase.

- Walmart International reported net sales of $32.3 billion, down 2.3% year over year (sales increased 2.7% in constant currency). The deconsolidation of Brazil sales following the company’s sale of its 80% stake in Walmart Brazil, was offset by revenue from Flipkart in the quarter. Currency hurt sales by $1.7 billion.

- Sam’s Club reported net sales of $14.9 billion, down 3.7% year over year. Comps increased 3.3% (slightly missing the 3.4% consensus) on a 6.4% traffic increase offset by a 3.1% ticket decrease. Lower tobacco sales hurt comps by 200 basis points, however, the transfer of sales from closed clubs accounted for half of the comp increase, excluding fuel. E-commerce sales increased 21%.

- Walmart added 1,000 grocery pickup locations and reached nearly 800 grocery delivery locations.

- The company launched shelf-scanning robots (from Bossa Nova) and floor-cleaning robots (from Brain Corp.), in addition to the FAST Unloader conveyor system.

- Walmart remodeled 500 stores.

- The company raised U.S. starting average hourly compensation and benefits to $17.50 per hour.

- Walmart added new features to its Marketplace, such as free, two-day shipping on millions of items and the ability to return Marketplace items in stores.

- The company redesigned its Walmart.com and Jet.com websites and launched the Fanatics store, an Apple store, a Nike store and a Lord & Taylor store on its e-commerce platforms.

- Walmart acquired Bare Necessities (women’s fashion), ELOQUII (women’s fashion), a majority stake in Flipkart Group (India’s leading e-commerce business), as well as virtual reality studio Spatialand.

- The company also launched Allswell, a digitally native mattress brand.

- Walmart also proposed combining Sainsbury’s and Asda in the U.K. and divested an 80% stake in Walmart Brazil.

- Net sales growth of at least 3%, affected positively by the acquisition of Flipkart and negatively by the deconsolidation of Walmart Brazil and the planned reduction of tobacco sales at Sam’s Club.

- Walmart U.S. comps are expected to grow 2.5%–3.0% and Sam’s Club comps are expected to grow 1.0%, excluding fuel (3.0% excluding fuel and tobacco).

- E-commerce growth of 35% (in line with the figure provided in the most recent analyst meeting).

- An EPS decline in the low single digits from FY19 adjusted EPS of $4.91 to $4.77, based on a 3% decrease at the low end versus prior guidance of $4.75–$4.85 but above the consensus estimate of $4.72.

- Capital expenditures of $11 billion (up 6.3% from $10.3 billion in FY19).