albert Chan

Walmart

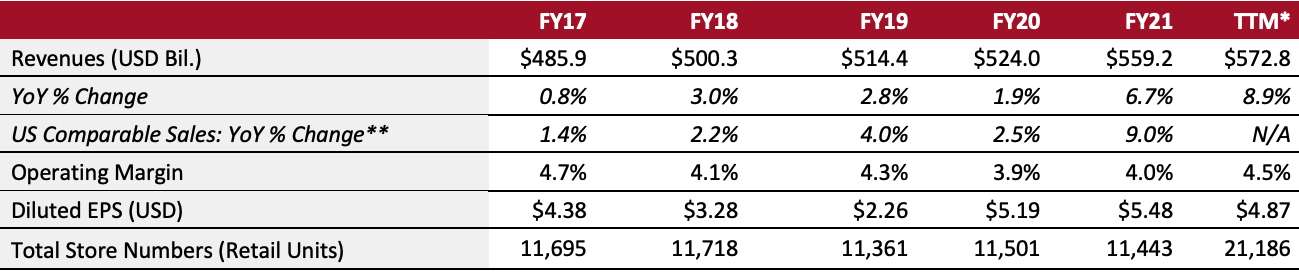

Sector: Food, drug and mass retailers Countries of operation: The US and 24 other countries Key product categories: Apparel, footwear, general merchandise and groceries Annual Metrics [caption id="attachment_147094" align="aligncenter" width="700"] Fiscal year ends on January 31 of the same calendar year

Fiscal year ends on January 31 of the same calendar year*Trailing 12 months ended October 31, 2021

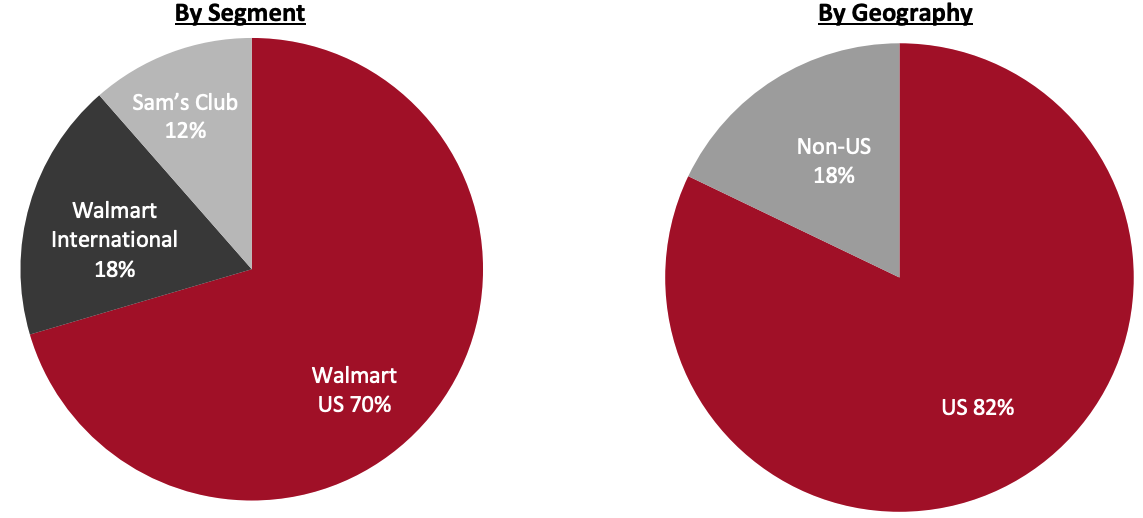

**Walmart US comparable sales excluding fuel[/caption] Summary Founded in 1962 and headquartered in Bentonville, Arkansas, Walmart is the world’s largest brick-and-mortar retailer. The company is a global mass merchandiser and warehouse club operator. Walmart is pioneering in offering its customers both a large assortment and low prices. The company operates stores in a variety of formats, including cash-and-carry stores, convenience stores, discount stores, drugstores, membership-only warehouse clubs and supercenters. The company operates in four major segments: Sam’s Club, Walmart International and Walmart US. As of April 30, 2022, Walmart operates more than 10,500 stores under 46 banners in 24 countries, with 2.3 million employees (almost 1.6 million in the US alone), catering to 240 million customers worldwide every day. Company Analysis Coresight Research insight: Over the past several years, Walmart has been greatly expanding its omnichannel solutions, aiming to directly compete with Amazon, which has been threatening to supplant Walmart as the largest retailer in all major segments (including clothing and grocery) and has already taken the lead on some categories. In 2021, Walmart began to unveil a long-term plan to bring e-commerce and brick-and-mortar stores together by optimizing the interflow between the two entities. A Walmart-backed fintech unit has bought two fintech startups to create the “One” platform, aiming to strengthen the company’s digital payment and loan platform. The retailer has also begun expanding its use of radio-frequency identification (RFID) to further facilitate inventory flow and to better control supply chains, and has been incorporating third-party vendors into its e-commerce site. For fiscal 2022 (ended on January 31, 2022), the company spent $7.1 billion, or 54% of its total $13 billion in capital expenditures, on supply chains and omnichannel solutions, up from $5.6 billion a year earlier. Walmart defines e-commerce sales as sales initiated digitally, regardless of whether they are fulfilled online or in store. Walmart’s omnichannel focus helped the company better position itself during the pandemic, which saw its comparable growth and digital sales further expand—with US comparable sales up 9.0% year over year and e-commerce sales up 79% in fiscal 2021 (ended January 31, 2021). However, the company remains largely a brick-and-mortar presence, complemented by e-commerce capabilities. E-Commerce contributed about 0.7% and 5.4% to comparable sales to its US segment for fiscal 2022 and 2021, respectively. Of its 157 distribution facilities, Walmart dedicated 31 to e-commerce fulfillment, using 3,500 stores to fulfill online orders.

| Tailwinds | Headwinds |

|

|

- Provide a broad assortment of quality merchandise and services at everyday low prices (“EDLP”).

- Price items cheaply every day to build trust and keep customers assured that prices will not change under frequent promotional activity.

- Focus on three strategic merchandise units: grocery products, health and wellness products, and general merchandise including apparel, entertainment, hardline and home/seasonal goods.

- Invest to align e-commerce and brick-and-mortar capabilities.

- Make use of its strong distribution network. Approximately 79% of Walmart US’s purchases of store merchandise were shipped through its 162 distribution facilities in fiscal 2020.

- Invest in e-commerce. In recent years, Walmart has offered next-day delivery in select US regions as well as subscription services, in an attempt to compete with Amazon. In September 2020, the company introduced its subscription service in the US, Walmart+, to directly compete with Amazon’s Prime membership program. Walmart+ members have access to free shipping for eligible items, unlimited delivery from store, fuel discounts, and mobile scan and go services. Management expects that Walmart+ will improve customer retention and increase overall basket size. As of April 2022, Walmart has not disclosed the number of Walmart+ subscriptions.

- Invest in One, a new fintech platform to bring together e-commerce and brick-and-mortar operations.

Company Developments

Company Developments

| Date | Development |

| April 22, 2022 | Names John Rainey as CFO |

| March 15, 2022 | Announces that it will recruit 5,000 to its Global Tech team globally this fiscal year, and open new technology hubs in Atlanta and Toronto |

| March 10, 2022 | Expands its healthcare Wellness Hub, introducing support for caregivers—providing benefits including access to a caregiving community and live group coaching circles—and a new vitamin subscription plan |

| March 7, 2022 | Partners with British retailer Space NK to launch prestige beauty collection online and in 250 stores |

| February 17, 2022 | Plans share repurchases of up to $10 billion for fiscal |

| February 11, 2022 | Faces a gender and race discrimination lawsuit brought by the Equal Employment Opportunity Commission |

| January 18, 2022 | Faces probe in China over food-safety issues |

| January 16, 2022 | Announces plans to issue cryptocurrency and non-fungible tokens to enter the metaverse |

| January 5, 2022 | Unveils plans to hire more than 3,000 delivery drivers for an all-electric fleet of delivery vehicles |

| December 8, 2021 | Introduces sustainability-themed finance program for its supply chains |

| November 23, 2021 | Appeals federal ruling over its role in the opioid crisis in Ohio |

| March 1, 2021 | Finalizes its sale of Seiyu, their retail operations in Japan, to investment firm KKR and Japanese e-commerce company Rakuten; Walmart will maintain a 15% ownership stake |

| February 4, 2021 | Acquires the advertising software platform Thunder Industries |

| January 15, 2021 | Announces the retirement of Mark Lore as Executive Vice President and CEO of US E-Commerce |

| December 2, 2020 | Indian payments company PhonePe announces that it has raised $700 million in a funding round led by Walmart, with participation from some other investors |

| November 20, 2020 | Agrees to acquire food delivery app JoyRun |

| November 9, 2020 | Completes its sale of Walmart Argentina to retail group Grupo de Narváez |

| October 2, 2020 | Sells a majority stake in ASDA to the Issa brothers and TDR Capital, which values the UK supermarket chain at £6.8 billion ($8.8 billion) |

| September 22, 2020 | Pilots drone delivery of Covid-19 At-Home Self-Collection Kits |

| September 22, 2020 | Partners with Goldman Sachs to offer marketplace sellers access to capital |

| September 19, 2020 | Offers a statement about potential investment in and commercial agreements with TikTok global |

| September 1, 2020 | Introduces its subscription program, Walmart+ |

| July 20, 2020 | Announces a major $3.5 billion investment for growth and customer experience transformation in Walmart Canada |

| July 8, 2020 | Announces a plan to launch new subscription program Walmart+ |

| June 30, 2020 | Launches a new checkout experience to eliminate waiting and add more options at the register |

| June 16, 2020 | Partners with Shopify to expand its e-commerce marketplace |

| December 10, 2019 | Announces plans to test-drive autonomous grocery deliveries with robotics company Nuro |

| November 27, 2019 | Adds a store map function to its app to help customers find products amid the holiday season |

| November 11, 2019 | Introduces a new shortcut for online grocery using Apple’s virtual assistant Siri |

| November 4, 2019 | Generates an estimated $1 billion in total savings for consumers through branded money transfer services |

| October 29, 2019 | Extends relationship with Green Dot to form a Fintech accelerator |

- Doug McMillon—President and CEO

- John Furner—President and CEO of Walmart US

- Judith McKenna—President and CEO of Walmart International

- Kathryn Mclay—President and CEO of Sam’s Club

Source: Company reports/S&P Capital IQ/Coresight Research