DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q20 Results

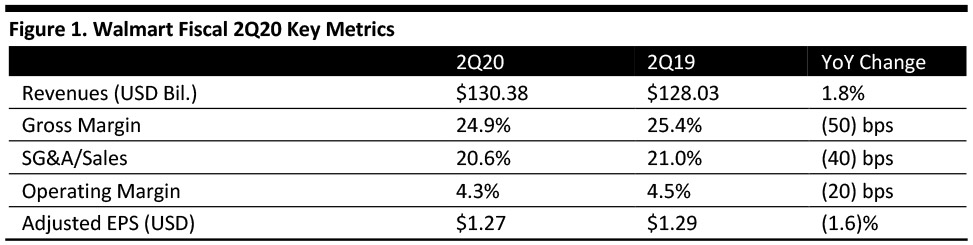

Walmart reported fiscal 2Q20 revenues of $130.38 billion, up 1.8% year over year and beating the $130.10 billion consensus estimate. Total revenues increased 2.9% at constant currency.

US comparable-store sales increased 2.8%. On a two-year stacked basis, the sales increased by 7.3%, the strongest growth in more than 10 years. And US e-commerce sales grew 37%, driven by the strength in online grocery.

Adjusted EPS was $1.27, down 1.6% year over year and beating the $1.22 consensus estimate.

Results by Segment

Walmart USSales were $85.2 billion, up 2.9% year over year. Comps increased by 2.8%, driven by a 2.2% increase in ticket and a 0.6% increase in transactions. E-commerce contributed 140 bps to comps growth.

During the quarter, Walmart closed a net two supercenters and nine neighborhood markets, in addition to remodeling 100 stores.Merchandise highlights:

- Grocery—Comps increased by mid-single digits. The momentum in food and consumables continued. The snack and beverages, fresh foods, pets and paper goods categories were especially strong. Food inflation was very low, but there was a modest increase in consumables inflation.

- Health and Wellness—Comps increased by mid-single digits. Pharmacy comps benefited from branded-drug inflation as well as from an increase in 90-day script counts.

- General Merchandise—Comps increased by low single digits. Home, toys and wireless delivered strong results, which were partially offsets by lawn and garden and apparel because they are weather-sensitive categories.

Sales were $29.1 billion, down 1.1% year over year. Comps were positive in four of the ten markets—Canada, China, Mexico and the UK. The deconsolidation of Brazil was partially offset by sales from Flipkart.

Results by market:

- Canada—Comps increased 1.2%, driven by a 2.9% increase in average ticket more than a 1.7% decline in the number of transactions. Comps benefited from strong sales of grocery and fresh products, partially offset by softer general-merchandise and apparel sales.

- China—Comps increased 3%, driven by a 0.7% increase in the number of transactions and a 2.3% increase in average ticket. Sam’s Club delivered double-digit comp sales growth and increased additional price investment in fresh categories.

- Walmex (which includes Mexico and Central America)—Comps increased 4.8%, driven by a 1.7% increase in the number of transactions and a 3.1% increase in average ticket. Comp sales in Mexico increased 5.5%. And the company opened 32 new stores across Mexico and Central America.

- UK—Comps increased 0.5%, driven by a 0.7% increase in average ticket, more than a 0.2% decline in the number of transactions, driven by the positive sales of the later timing of Easter. The uncertainty of Brexit continues to affect consumer behavior in the market.

Sales were $13.3 billion (ex fuel), up 1.2% year over year. Sales of $15.0 billion grew 1.8% year over year, including fuel. Comps increased by 1.8% including fuel, by 1.2% without fuel. Consumables were the strongest category, growing in the high single digits, driven by broad-based strength, including paper goods, laundry and home care and pet supplies.

Outlook

Management updated its FY20 guidance:

- Management updated consolidated net sales growth to be around 3% at constant currency, compared with a prior forecast of at least 3%.

- Walmart US comps are expected to grow 2.5%-3.0% and Sam’s Club comps are expected to grow 1%, excluding fuel.

- E-commerce growth of 37%.

- Adjusted EPS guidance was updated to range between a slight decrease to a slight increase, compared with a prior forecast that was calling for a low-single-digit percentage decline.