DIpil Das

[caption id="attachment_88256" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

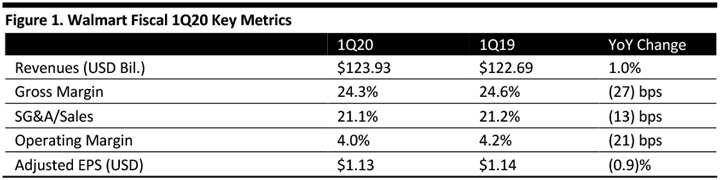

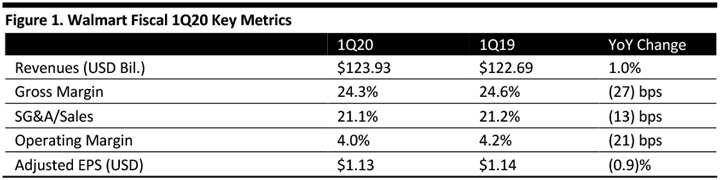

Fiscal 1Q20 Results

Walmart reported fiscal 1Q20 revenues of $123.93 billion, up 1.0% year over year and below the $125.28 billion consensus estimate. Total revenues increased 2.5% in constant currency.

US comparable-store sales increased 3.4%, in line with consensus, and US e-commerce sales grew 37%, driven by strength in online grocery, and the home and fashion categories.

Adjusted EPS was $1.13, down 0.9% year over year and beating the $1.02 consensus estimate. GAAP EPS was $1.33, compared with $0.72 in the year-ago quarter.

Results by Segment

Walmart US

Sales were $80.3 billion, up 3.3% year over year. Comps increased by 3.4%, the highest Q1 comp in nine years, driven by a 1.1% increase in transactions plus a 2.3% increase in ticket.

E-commerce contributed 140 bps to comps, up 40 bps year over year.

The change in government SNAP assistance helped Q1 comps by the same amount it hurt Q4 comps.

The company commented that sales trends improved throughout the quarter, which finished with strong Easter sales.

During the quarter, Walmart closed a net two supercenters and nine neighborhood markets, in addition to remodeling 100 stores. At the end of Q1, the company had 2,450 grocery pickup locations, nearly 1,000 stores with grocery delivery and more than 900 pickup towers.

Merchandise highlights:

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Walmart reported fiscal 1Q20 revenues of $123.93 billion, up 1.0% year over year and below the $125.28 billion consensus estimate. Total revenues increased 2.5% in constant currency.

US comparable-store sales increased 3.4%, in line with consensus, and US e-commerce sales grew 37%, driven by strength in online grocery, and the home and fashion categories.

Adjusted EPS was $1.13, down 0.9% year over year and beating the $1.02 consensus estimate. GAAP EPS was $1.33, compared with $0.72 in the year-ago quarter.

Results by Segment

Walmart US

Sales were $80.3 billion, up 3.3% year over year. Comps increased by 3.4%, the highest Q1 comp in nine years, driven by a 1.1% increase in transactions plus a 2.3% increase in ticket.

E-commerce contributed 140 bps to comps, up 40 bps year over year.

The change in government SNAP assistance helped Q1 comps by the same amount it hurt Q4 comps.

The company commented that sales trends improved throughout the quarter, which finished with strong Easter sales.

During the quarter, Walmart closed a net two supercenters and nine neighborhood markets, in addition to remodeling 100 stores. At the end of Q1, the company had 2,450 grocery pickup locations, nearly 1,000 stores with grocery delivery and more than 900 pickup towers.

Merchandise highlights:

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Walmart reported fiscal 1Q20 revenues of $123.93 billion, up 1.0% year over year and below the $125.28 billion consensus estimate. Total revenues increased 2.5% in constant currency.

US comparable-store sales increased 3.4%, in line with consensus, and US e-commerce sales grew 37%, driven by strength in online grocery, and the home and fashion categories.

Adjusted EPS was $1.13, down 0.9% year over year and beating the $1.02 consensus estimate. GAAP EPS was $1.33, compared with $0.72 in the year-ago quarter.

Results by Segment

Walmart US

Sales were $80.3 billion, up 3.3% year over year. Comps increased by 3.4%, the highest Q1 comp in nine years, driven by a 1.1% increase in transactions plus a 2.3% increase in ticket.

E-commerce contributed 140 bps to comps, up 40 bps year over year.

The change in government SNAP assistance helped Q1 comps by the same amount it hurt Q4 comps.

The company commented that sales trends improved throughout the quarter, which finished with strong Easter sales.

During the quarter, Walmart closed a net two supercenters and nine neighborhood markets, in addition to remodeling 100 stores. At the end of Q1, the company had 2,450 grocery pickup locations, nearly 1,000 stores with grocery delivery and more than 900 pickup towers.

Merchandise highlights:

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Walmart reported fiscal 1Q20 revenues of $123.93 billion, up 1.0% year over year and below the $125.28 billion consensus estimate. Total revenues increased 2.5% in constant currency.

US comparable-store sales increased 3.4%, in line with consensus, and US e-commerce sales grew 37%, driven by strength in online grocery, and the home and fashion categories.

Adjusted EPS was $1.13, down 0.9% year over year and beating the $1.02 consensus estimate. GAAP EPS was $1.33, compared with $0.72 in the year-ago quarter.

Results by Segment

Walmart US

Sales were $80.3 billion, up 3.3% year over year. Comps increased by 3.4%, the highest Q1 comp in nine years, driven by a 1.1% increase in transactions plus a 2.3% increase in ticket.

E-commerce contributed 140 bps to comps, up 40 bps year over year.

The change in government SNAP assistance helped Q1 comps by the same amount it hurt Q4 comps.

The company commented that sales trends improved throughout the quarter, which finished with strong Easter sales.

During the quarter, Walmart closed a net two supercenters and nine neighborhood markets, in addition to remodeling 100 stores. At the end of Q1, the company had 2,450 grocery pickup locations, nearly 1,000 stores with grocery delivery and more than 900 pickup towers.

Merchandise highlights:

- Grocery—Comps increased by mid-single digits. The momentum in food and consumables continued, despite SNAP payments being pulled forward into Q4. The snack, pets and beverage categories were especially strong. Food inflation was very low, but there was a modest increase in consumables inflation.

- Health and Wellness—Comps increased by mid-single digits. Pharmacy comps benefited from branded-drug inflation as well as from a later cough, cold and flu season this year.

- General Merchandise—Comps increased by low single digits. Management commented that strong Easter holiday sales contributed to results, and the strongest categories were home, lawn and garden, toys and wireless.

- Walmex (which includes Mexico and Central America)—Comps increased 3.6%, driven by a 0.5% decline in the number of transactions more than offset by a 4.1% increase in average ticket. The company increased the number of stores offering online grocery by 41, bringing the total to 236. In addition, the company opened nine new stores in Mexico and three in Central America during the quarter.

- China—Comps increased 0.4%, driven by a 0.3% decline in the number of transactions more than offset by a 0.7% increase in average ticket. Sales were hurt by softness across the hypermarket format.

- Canada—Comps increased 1.2%, driven by a 0.5% decline in the number of transactions more than offset by a 1.7% increase in average ticket. Comps benefited from strong sales of grocery and fresh products, partially offset by softer general-merchandise and apparel sales.

- UK—Comps declined 1.1%, driven by a 0.5% increase in the number of transactions more than offset by a 1.6% decrease in average ticket. Sales of private-label and online grocery outpaced their respective markets. Walmart also improved the customer experience via better prices and higher shelf availability.

- Net sales growth of at least 3%, affected positively by the acquisition of Flipkart and negatively by the deconsolidation of Walmart Brazil and the planned reduction of tobacco sales at Sam’s Club.

- Walmart US comps are expected to grow 2.5%–3.0% and Sam’s Club comps are expected to grow 1.0%, excluding fuel (3.0% excluding fuel and tobacco).

- E-commerce growth of 35% (in line with the figure provided in the most recent analyst meeting).

- An EPS decline in the low single digits from FY19 adjusted EPS of $4.91 to $4.77, based on a 3% decrease at the low end versus prior guidance of $4.75–$4.85 but above the consensus estimate of $4.72.