Our Take

If the leaked deal details turn out to be accurate, Walmart is in talks to invest in or outright acquire e-commerce upstart Jet.com for a price of up to $3 billion. While Jet.com has breathtakingly increased its revenue run rate from near zero to $1 billion in just a year, it will take a great deal of additional capital to enable the company to hit its $20 billion annual revenue target. It is logical that the two companies would choose to combine forces, as Jet.com has capital and needs scale and Walmart has capital and wants to expand and accelerate its online business.

Details of the Deal Talks

This morning,

The Wall Street Journal broke the story that, according to a “person familiar with the matter,” Walmart is in talks to acquire online retailer Jet.com for up to $3 billion.

Jet had been contacting Walmart and other retailers to help it raise about $640 million (at a valuation of $1.7 billion), according to an afternoon article on Bloomberg.com. The article noted that the talks could result in a strategic investment rather than in an outright takeover.

In the deal, Walmart would gain access to Jet’s advanced Smart Cart pricing technology, its warehouses and its customer data, as well as its higher-income customers.

About Jet.com

Jet.com was founded by Marc Lore, who previously founded Quidsi (the operator of Diapers.com). Quidsi was acquired by Amazon for $545 million in 2010, and Lore stayed on at Amazon for two years after the acquisition. He founded Jet.com in 2014. The company is headquartered in Hoboken, New Jersey.

The company was initially founded as an online warehouse store. It planned to charge an annual membership fee and make a minimal profit on goods sold. However, the company dropped plans to charge the membership fee in October 2015, saying that it could achieve its financial targets and provide adequate savings to customers without charging a fee. Numerous surveys found that Jet’s prices were lower than Amazon’s, and the company’s plan incorporated gross-margin losses (through lower prices) along the way to generating $20 billion in annual revenue by 2020.

Jet offers additional opportunities for its customers to achieve savings, including:

- Free shipping on orders of $35 or greater

- Two-day shipping on “everyday essentials”

- “Smart items,” which can be combined with other smart items in the customer’s shopping cart to generate additional savings

- The option to forgo free returns to reduce prices even further

- A 1.5% discount when paying with a debit card

- Jet Anywhere, a service that enables customers to receive credits on goods not offered by Jet.com that they purchase from other selected retailers

Jet.com has raised a total of $565 million in four funding rounds, according to Crunchbase.com, and the most recent round raised $350 million, led by Fidelity Investments.

In February 2016, Jet.com acquired home goods e‐tailer Hayneedle, which offers a wide array of products in areas such as pet supplies and patio furniture. Hayneedle reportedly had annual revenues of more than $350 million.

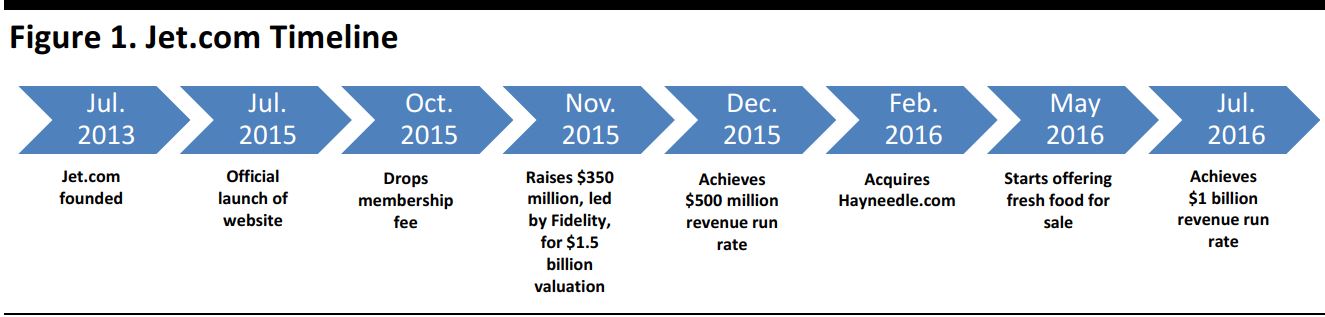

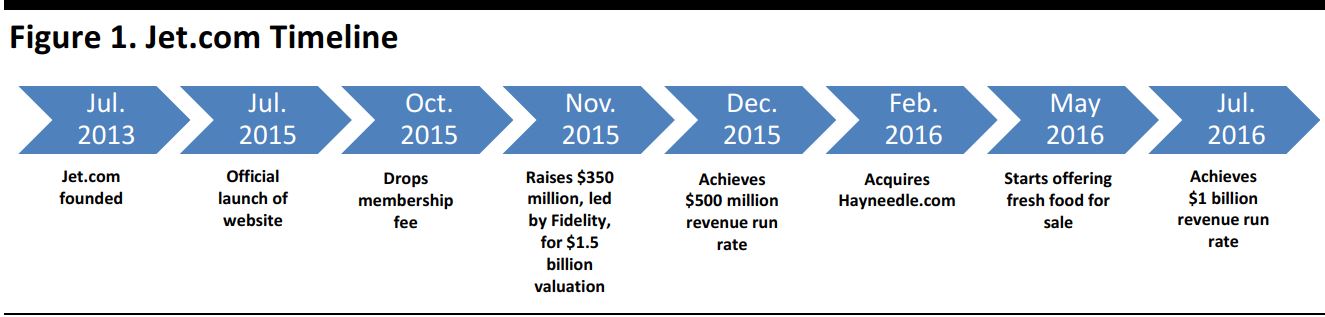

For further information, please refer to the Jet.com timeline at the end of this report.

About Walmart’s E-Commerce Business

Walmart has substantial spending plans for expanding its e-commerce and technology platform. This year, the company plans to spend $1.1 billion on e-commerce websites and mobile commerce applications that include technology, infrastructure and other elements of e-commerce operations. This figure represents just a fraction of the $4.0 billion earmarked this year for information systems, distribution, digital retail and other investments. And that $4.0 billion represents just 35% of Walmart’s $11.5 billion 2016 capital-spending budget.

In 2015, Walmart generated global e-commerce revenue of $13.7 billion, up 12% year over year and representing 2.8% of total revenue of $482.1 billion. This figure trails the US Census Bureau’s estimate of total e-commerce retail sales growth of 14.8% in 2015.

In the first quarter of 2016, Walmart reported that e-commerce sales and gross market value increased by 7.0% and 7.5%, respectively.

For Further Information

Please click

here to read our report Jet.com:

The Stealth Fighter with Amazon Squarely in Its Sights, published on July 20, 2015.

Please click

here to read our Jet.com Update report, published on March 22, 2016.

Figure 1. Jet.com Timeline

Source: Company reports/Fung Global Retail & Technology