What We Know

On March 29,

The Wall Street Journal broke the story that Walmart“ was in preliminary talks to buy insurer Humana Inc., according to people familiar with the matter.” The article cited one of those people as saying that“the two companies are discussing a range of options, including an acquisition.” The

Journal commented further that “it isn’t clear what terms the companies may be discussing, and there is no guarantee they will strike a deal.”

The New York Times followed up on March 30 with its own take:

Now the two companies are exploring ways to strengthen their ties, people briefed on the matter said Friday, the latest sign of the disruptive pressure that is forcing new alliances in the health and retail industries.

Walmart is unlikely to end up taking over Humana, these people said, but the deal could result in a financial and operating partnership around prescription drug sales or insurance coverage.

In the days since those stories were published, neither Walmart nor Humana has made any announcement regarding a possible merger or partnership, a silence some industry watchers consider unusual given that other companies have quickly made official announcements following similar reports of deal talks.

Industry Background

The Walmart-Humana talks appear to be yet another indication that retailers and healthcare companies are seeking to partner up in advance of Amazon’s anticipated entry into the pharmacy space. In January, Amazon also announced a partnership with Berkshire Hathaway and JPMorgan Chase to create a venture that aims to reduce healthcare costs.

Other recent tie-ups include:

- CVS Health’s $69 billion offer to acquire Aetna.

- Cigna’s agreement to acquire Express Scripts for $54 billion.

- Albertsons’ announcement that it would buy the remainder of the Rite Aid drugstore chain.

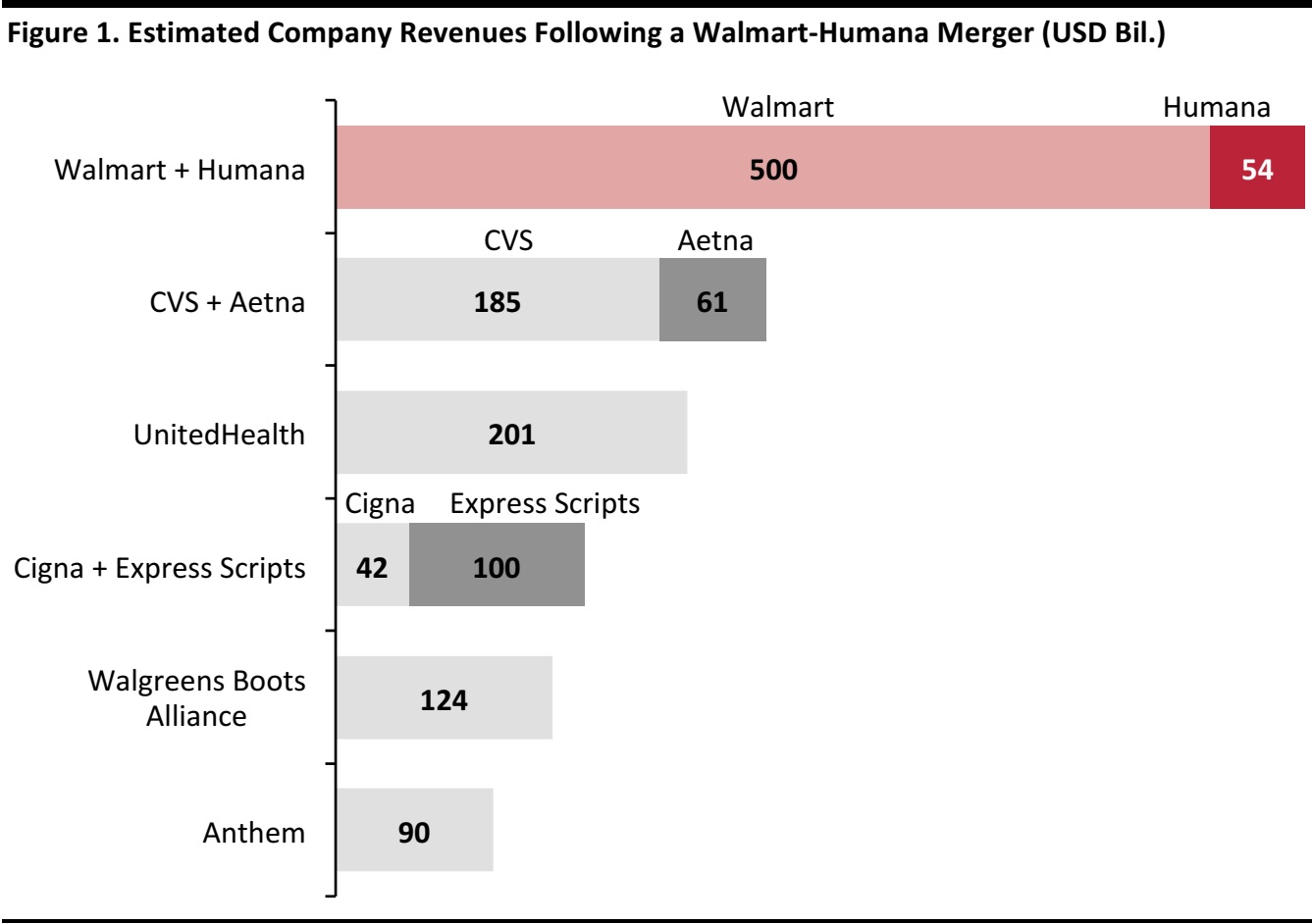

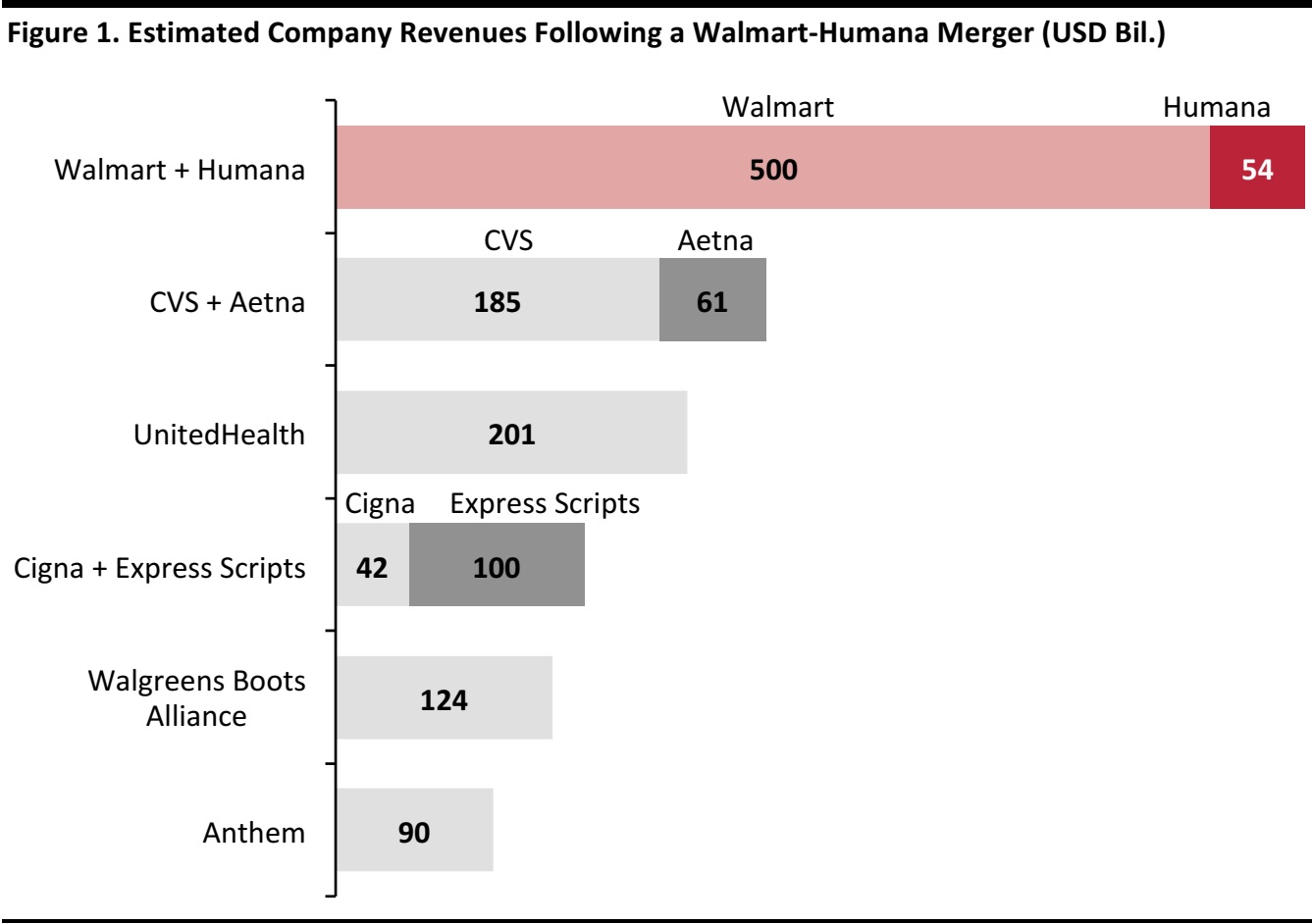

If Walmart were to acquire Humana, it would represent the retailer’s largest acquisition yet, exceeding its $10.8 billion takeover of Asda in 1999. Walmart already maintains pharmacies in more than 4,700 US Walmart and Sam’s Club locations, and a Walmart-Humana combination would dominate its peers in terms of revenue.

Source: The Wall Street Journal/S&P CapitalIQ

Rationale for the Transaction

In addition to creating an entity that could better withstand any threat from Amazon, Walmart’s acquisition of our partnership with Humana would provide a number of other benefits for Walmart:

- It would drive traffic to Walmart stores, making them a “one-stop shop” for all kinds of products and services. Walmart could also hold in-store events to provide information to customers and encourage them to sign up for Humana insurance plans.

- It would strengthen Walmart’s relationship with seniors, a very important demographic, as Humana is highly focused on Medicare recipients.

- It would allow the collection and use of a substantial amount of data on the two companies’ combined customer base.

In June 2017, a Walmart executive commented that the company was focused on providing accessible, affordable healthcare and that it was working to extend its offerings in order to make stores one-stop shops where customers could take care of all their everyday health and wellness needs.

A tie-up between Walmart and Humana could represent a vertical merger (as opposed to a horizontal merger) and, historically, the US Department of Justice has been relatively likely to approve such mergers.

About Humana

Humana generated $53.8 billion of revenue last year. It is the second-largest provider of Medicare Advantage plans, with 3.5 million participants, or 17% of the market, according to Wells Fargo. The company owns its own pharmacy-benefit manager, which had revenue of $21 billion last year, and Humana and Walmart have sold a co-branded prescription drug benefit program for Medicare drug plans since 2010.

Humana has about 4.9 million Medicare Part D enrollees. The company has stated that it wants to get deeper into managing its members’ healthcare, and it has expanded its partnerships with doctors. Humana also believes that by being involved in patients’ healthcare management earlier, it can help patients avoid more costly procedures later in their lives, effectively reducing the cost of healthcare.