Nitheesh NH

What’s the Story?

This year’s iteration of Walmart’s annual Analyst Day was held virtually on February 18, 2021. In this report, we present insights from the event, covering the company’s new flywheel business model and its expansion strategies moving forward.Walmart Analyst Day 2021: Key Insights

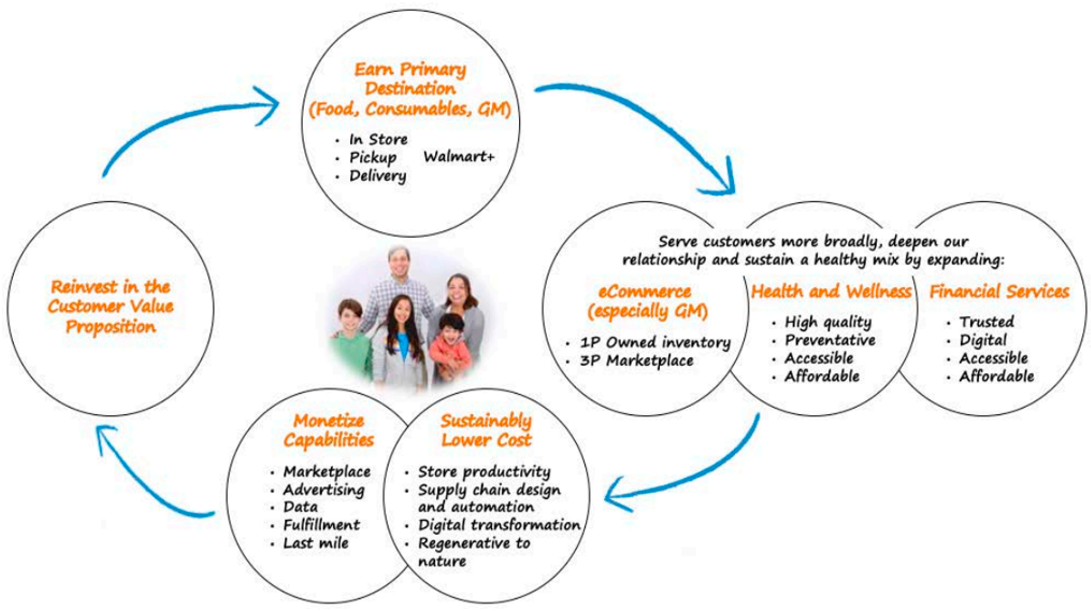

Hosting the Analyst Day, Doug McMillon, President and CEO of Walmart, was joined by Brett Biggs, CFO at Walmart, John Furner, President and CEO of Walmart US, Judith McKenna, President and CEO of Walmart International, and other senior leadership team members. Playing Offense with New Flywheel Strategy Walmart introduced its new flywheel business model, which guided much of the discussion during the event. The customer-centric flywheel highlights four main goals: earn status as consumers’ primary destination; serve customers more broadly; sustainably lower costs and monetize capabilities; and reinvest in the customer value proposition (see Figure 1). Figure 1. Walmart’s New Flywheel Business Transformation Model [caption id="attachment_124372" align="aligncenter" width="720"] Source: Walmart[/caption]

Plans To Scale Fulfillment Capabilities

At the center of Walmart’s strategy moving forward is the goal to cement itself as consumers’ primary destination. The retailer’s ability to attract shoppers looking to purchase food and other consumables amid the Covid-19 pandemic has helped it grow sales in other sectors, as consumers limited their trips to retailers and increased basket sizes at essential stores.

McMillon said that following the coronavirus outbreak last year, Walmart struggled to keep up with consumer demand for new fulfillment channels, such as pickup and delivery services. While he acknowledged that high demand is a good problem to have, McMillon emphasized that it needed to be addressed quickly in order to retain a committed customer base.

Source: Walmart[/caption]

Plans To Scale Fulfillment Capabilities

At the center of Walmart’s strategy moving forward is the goal to cement itself as consumers’ primary destination. The retailer’s ability to attract shoppers looking to purchase food and other consumables amid the Covid-19 pandemic has helped it grow sales in other sectors, as consumers limited their trips to retailers and increased basket sizes at essential stores.

McMillon said that following the coronavirus outbreak last year, Walmart struggled to keep up with consumer demand for new fulfillment channels, such as pickup and delivery services. While he acknowledged that high demand is a good problem to have, McMillon emphasized that it needed to be addressed quickly in order to retain a committed customer base.

To meet customer expectations, Walmart will continue to expand its fulfillment capacity by leveraging supply chain technology advancements and automation in 2021. Walmart’s reaffirmation of its commitment to automation comes just months after ending its relationship with Bossa Nova, which had provided the retailer with in-store robotics solutions for five years. McMillon’s comments during the Analyst Day confirm suspicions that the termination of that agreement was down to Walmart considering alternative solutions rather than backing away from automation altogether.

[caption id="attachment_124373" align="aligncenter" width="720"] Doug McMillon, President and CEO of Walmart, emphasized the importance of being customers’ primary destination

Doug McMillon, President and CEO of Walmart, emphasized the importance of being customers’ primary destinationSource: Walmart[/caption] Targeting Healthcare, Fintech for Expansion

Discussing how Walmart can expand the ways in which it makes daily life better for its customers, McMillon explicitly highlighted financial services and healthcare. He pointed to the company’s formation of a new fintech startup in January, which the company established in partnership with fintech investment firm Ribbit Capital. Walmart also recently hired two leading Goldman Sachs bankers, focused on fintech, to guide its nascent business—although McMillon did not mention these new hires during the Analyst Day.

The retailer may be able to capitalize on its high store traffic and large customer base to start a successful financial services business: Company leadership noted that customer acquisition is typically one of the highest costs that fintech startups must contend with, but this would be a nonissue for Walmart, since the company already has millions of customers. McMillon explained that the retailer’s timely expansion into healthcare is a key way in which it is serving its customers beyond selling merchandise. He said that Walmart will expand its portfolio of explicitly healthcare-centric businesses—such as pharmacy, optical, hearing and OTC (over-the-counter) businesses—as well as its core food business. McMillion noted that consumers are focusing on health and wellness when making purchasing decisions for a wide variety of products¬¬: Walmart can capitalize on this trend by highlighting the health benefits of products more tangentially related to healthcare, most notably in food categories. Looking to Mexico and India for Digital Expansion Walmart leadership highlighted the opportunities for digital growth in the company’s two main international markets, Mexico and India. According to the company, it grew e-commerce sales in Mexico by 171% in 2020 and has grown its digital business in India with Flipkart, despite continued low e-commerce penetration in the country. Parallel to its US expansion of digital commerce and new modes of fulfillment, Walmex (the company’s Mexican business) added more than 1,300 pickup locations and built three new distribution centers in 2020. The company also rolled out the “Spark” last-mile delivery program to nearly 30 stores in Mexico. These innovations helped overall Walmex sales climb by 8%, despite challenges faced in the region, including those posed by natural disasters throughout Central America in 2020.In India, majority-Walmart-owned Flipkart saw strong sales growth during the pandemic. Kalyan Krishnamurthy, CEO of Flipkart, highlighted India’s large, young market as a key reason why online commerce is poised to take off in the country. India has a population of about 1.4 billion people, 34% of which Krishnamurthy said are millennials. He said that millennials and Gen Z may make up 75% of the total population by 2030, boding well for strong e-commerce growth in the near future.

The pandemic accelerated the digital retail transformation in India. Krishnamurthy said that a few years ago, analysts predicted that the e-commerce market in India would total $50–60 billion in 2025; today, that number is projected to be $90–100 billion. Krishnamurthy believes that Flipkart’s Indian roots put the company in pole position to capitalize on e-commerce growth. In addition, Walmart is planning to take advantage of digital growth in India through PhonePe, a digital wallet and payment platform in which Walmart recently invested $700 million. Walmart aims to scale PhonePe, which was spun off from Flipkart, to be used by 25 million small business across the country. The platform already has users in over 90% of area codes across India, according to Walmart. [caption id="attachment_124374" align="aligncenter" width="720"] Judith McKenna, President and CEO at Walmart International, highlights growth at Flipkart and PhonePe in India in 2020

Judith McKenna, President and CEO at Walmart International, highlights growth at Flipkart and PhonePe in India in 2020Source: Walmart[/caption] Expanding Digital Avenues Remains a Priority Walmart highlighted three ways it is expanding its digital presence and monetization:

- Growing its marketplace. The company is now a nearly $100 billion e-commerce business and operates one of the largest online marketplaces in the world. In 2021 and beyond, Biggs said that Walmart will work to improve fulfillment capabilities to enable the marketplace business to grow even faster.

- Growing its advertising platform. Biggs indicated that this will be a multibillion-dollar industry in the “very near future.” While still an early-stage business for Walmart, the company did recently acquire Paper G, the digital advertising services of Thunder Industries, positioning it well to focus on expanding into the rapidly growing realm of digital advertising.

- Monetizing data more effectively. While McMillon did not provide much detail on how the company plans to monetize data moving forward, he did indicate that the days of Walmart providing much of its data for free may be over.