Web Developers

On Tuesday, Walmart announced plans to acquire plus-size direct-to-consumer clothing brand Eloquii for an undisclosed amount. Andy Dunn, SVP of Digital Consumer Brands for Walmart eCommerce in the US, said:

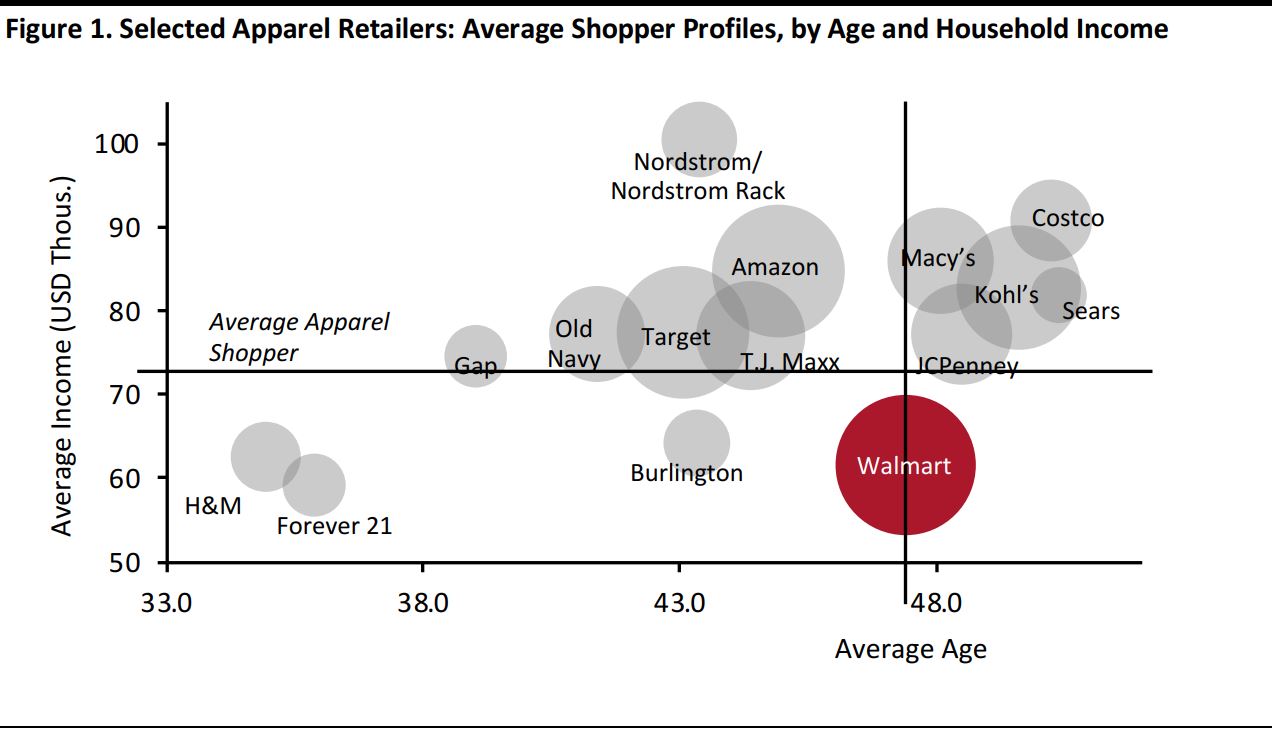

Known for its trend-driven, fashion-focused assortment, Eloquii is all about great-fitting and great-looking apparel specifically designed for women size 14 and up. Today, more than half of women age 18–65 in the US wear size 14+. We know they’re looking not just for basics, but also for on-trend pieces that allow them to express their individuality. This is a segment of the market that has been historically under served and neglected. We believe she deserves better.Eloquii was originally part of The Limited and relaunched in 2014 as an online-only retailer focused on trend-driven fashion with a fast-fashion element. Dunn characterized it as a “digitally native vertical brand.” The acquisition will strengthen Walmart’s position at the top of the US apparel market. Coresight Research data find that Walmart ranks number one in the clothing and footwear market by sales and by number of shoppers. The acquisition will help form a bulwark against Amazon’s ongoing encroachment into apparel (Amazon is the second-most-shopped retailer for clothing or footwear, per our survey data). Like the Bonobos acquisition and the ModCloth acquisition before that, this move should extend Walmart’s reach among nontraditional shoppers—namely, young consumers with higher disposable incomes than those of core Walmart shoppers. Coresight Research data indicate that the average Walmart apparel shopper is older and slightly less affluent than the average apparel shopper at comparable retailers such as Amazon and Target.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, surveyed in January 2018

Bubble size represents shopper numbers. Note that average age excludes shoppers under age 18, who were not surveyed. T.J.Maxx includes Marshalls.

Source: Coresight Research

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, surveyed in January 2018

Bubble size represents shopper numbers. Note that average age excludes shoppers under age 18, who were not surveyed. T.J.Maxx includes Marshalls.

Source: Coresight Research

Walmart Strengthens Reach and Capabilities Through Acquisitions

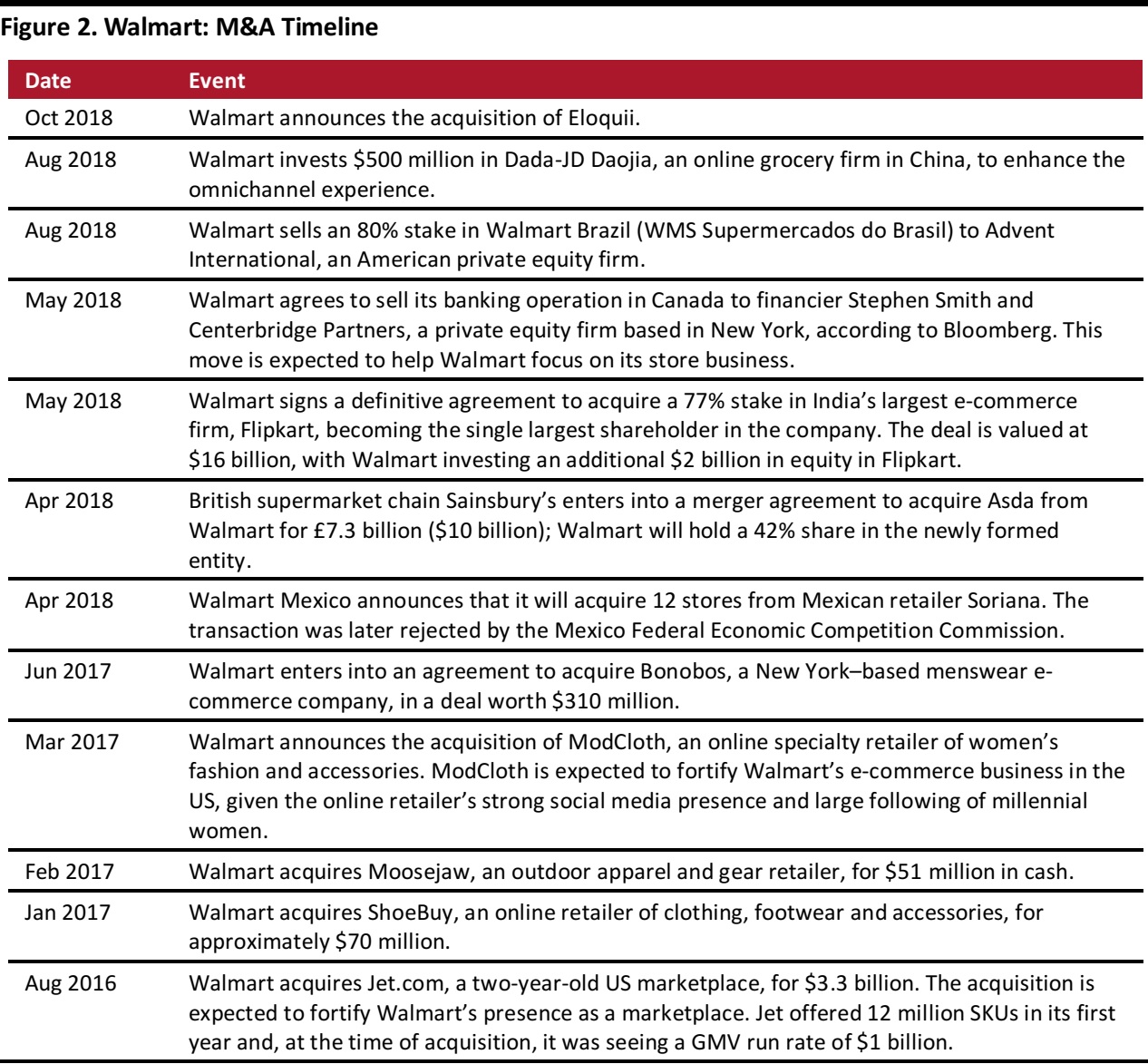

Since the second half of 2016, Walmart has undertaken a number of acquisitions. In international markets, the company’s acquisition strategy has focused on strengthening its position through digital channels. In the US, Walmart’s efforts have been designed to accelerate its e-commerce capabilities while also building out a suite of brands—mainly apparel brands—that resonate with younger, more affluent customers than would typically shop at Walmart. In apparel, Walmart has acquired Moosejaw, ModCloth and Bonobos. In Tuesday’s press release, Walmart noted two parts to its acquisition strategy:- First, acquiring companies that strengthen Walmart.com and Jet.com by enhancing their category expertise and assortment.

- Second, acquiring digital brands that are unique and differentiated and offer products and experiences that shoppers cannot get elsewhere. The Eloquii acquisition fits into this part of the strategy.

Source: Company reports

Source: Company reports