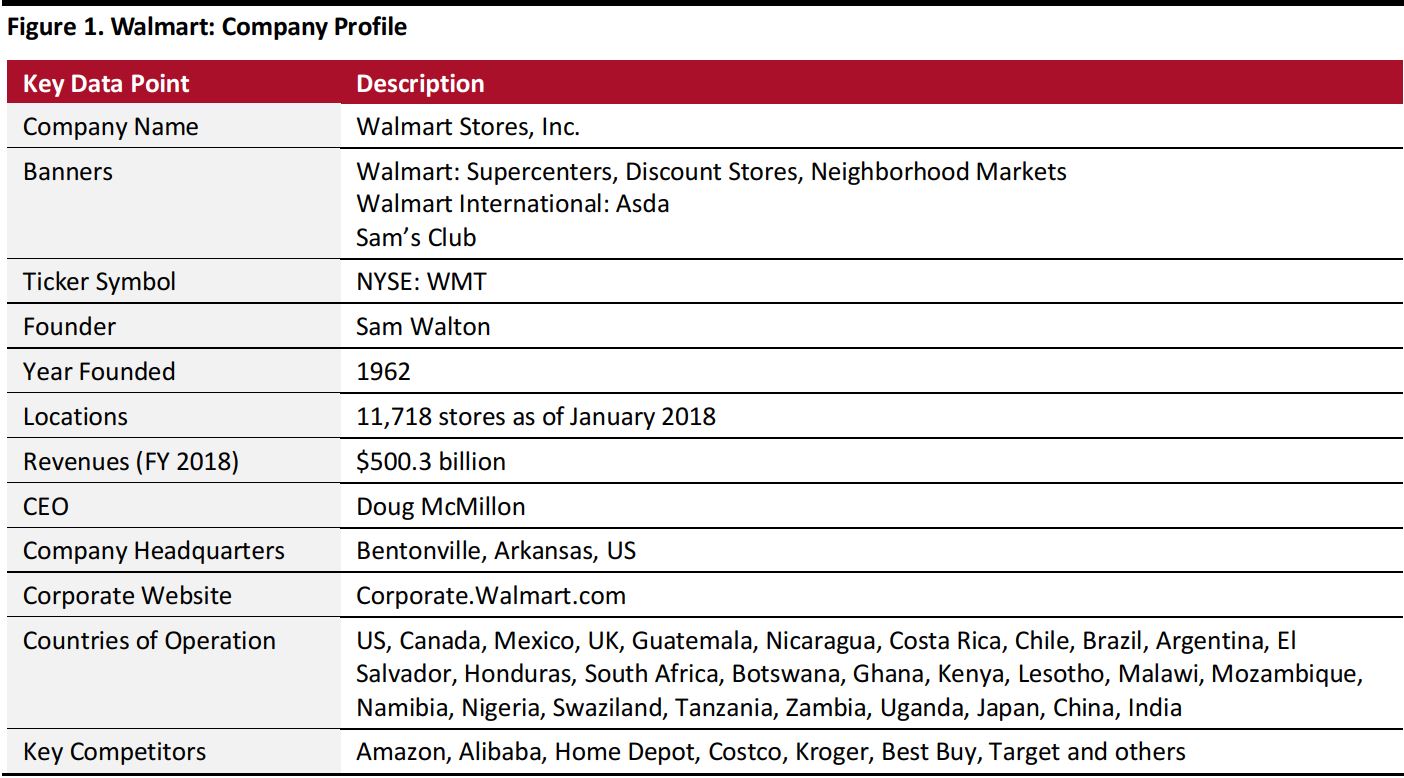

Walmart: Company Description

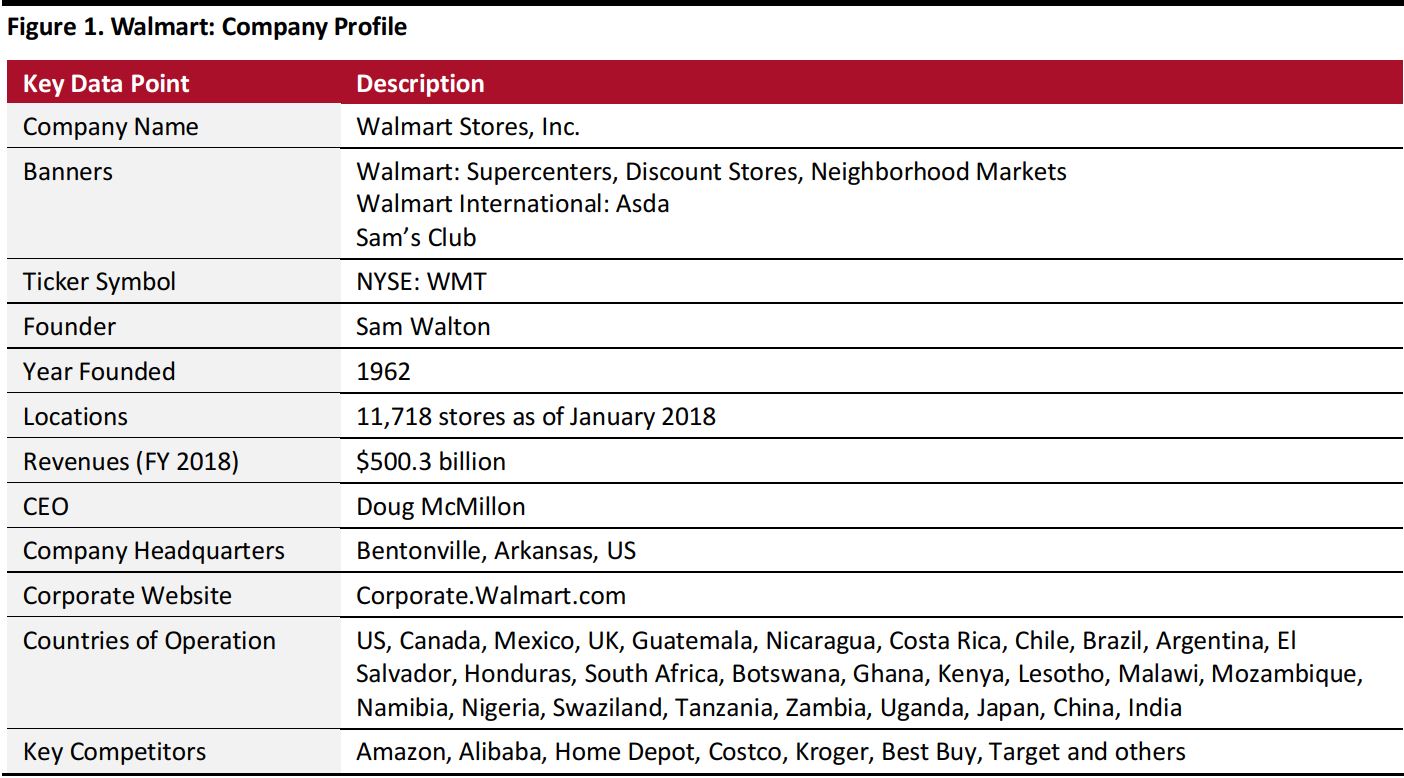

Walmart is an American mass merchandiser operating under various banners across 28 countries. It runs multiformat stores, including supercenters, membership-only warehouse clubs, cash-and-carry stores, discount stores, convenience stores and drugstores. The company’s long-term objective is to provide products at a discounted price and make shopping easier for its customers. Walmart is continually working on multichannel innovations, such as online grocery and mobile express checkouts.

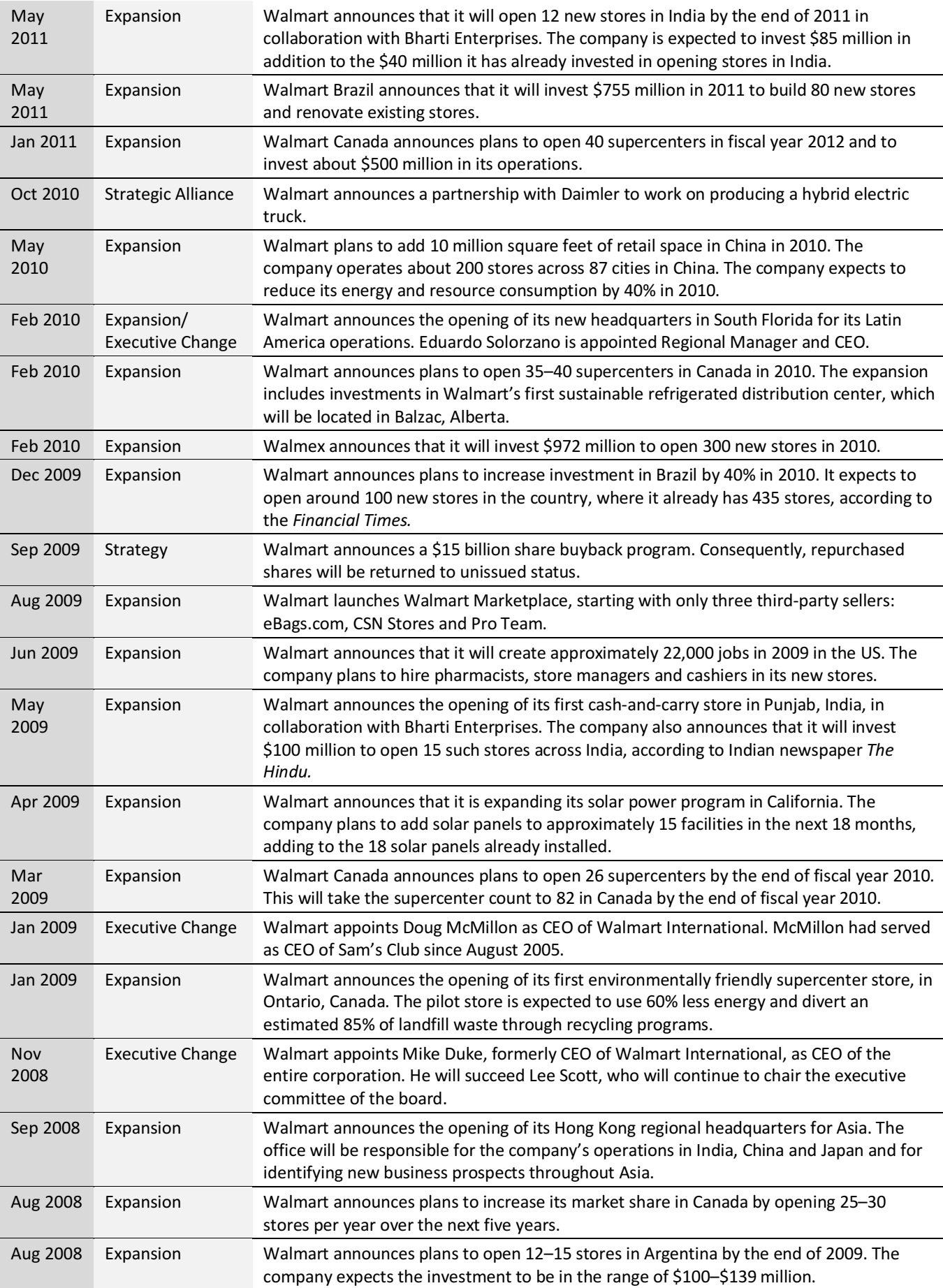

Source: Company press releases/company reports

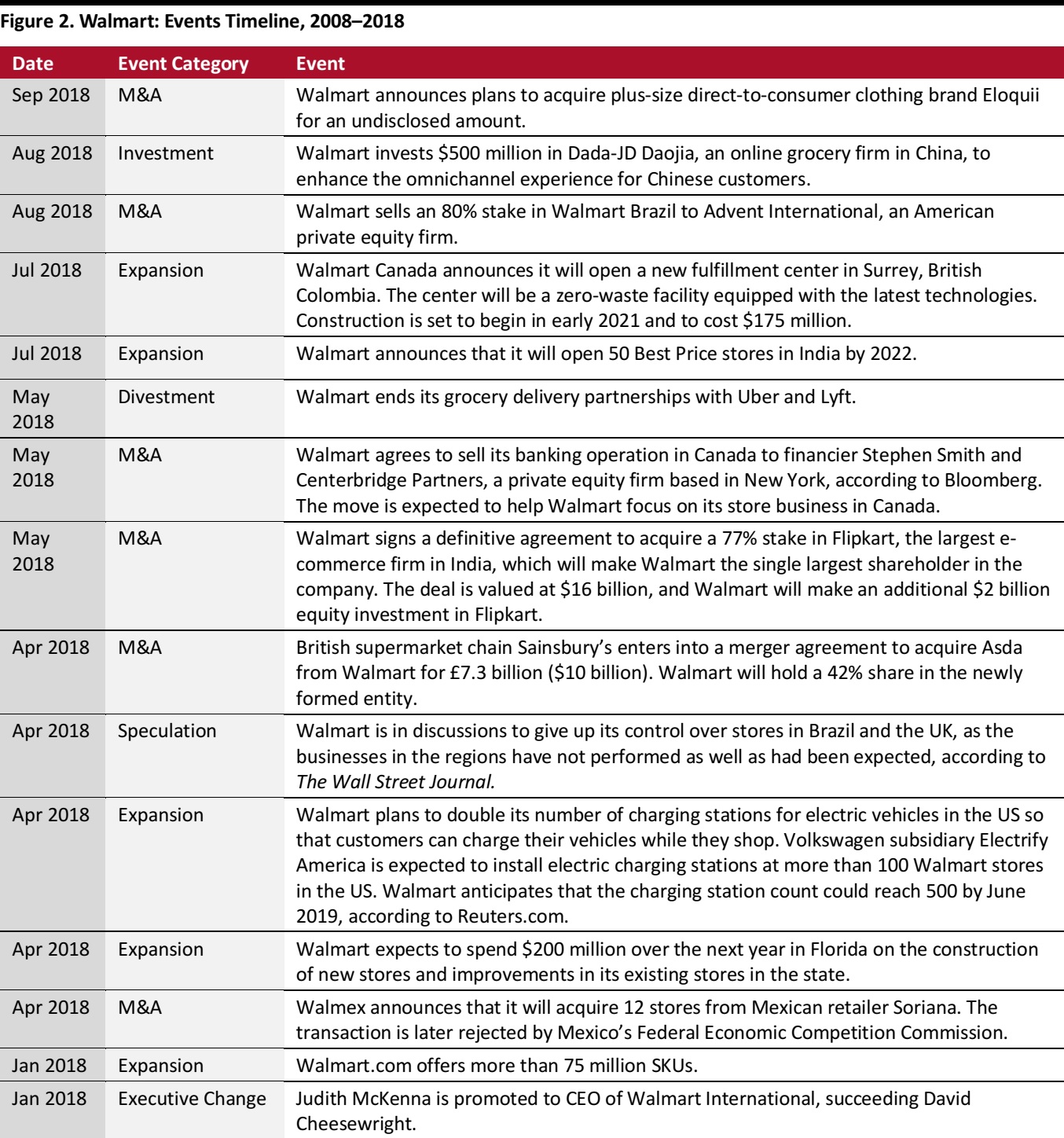

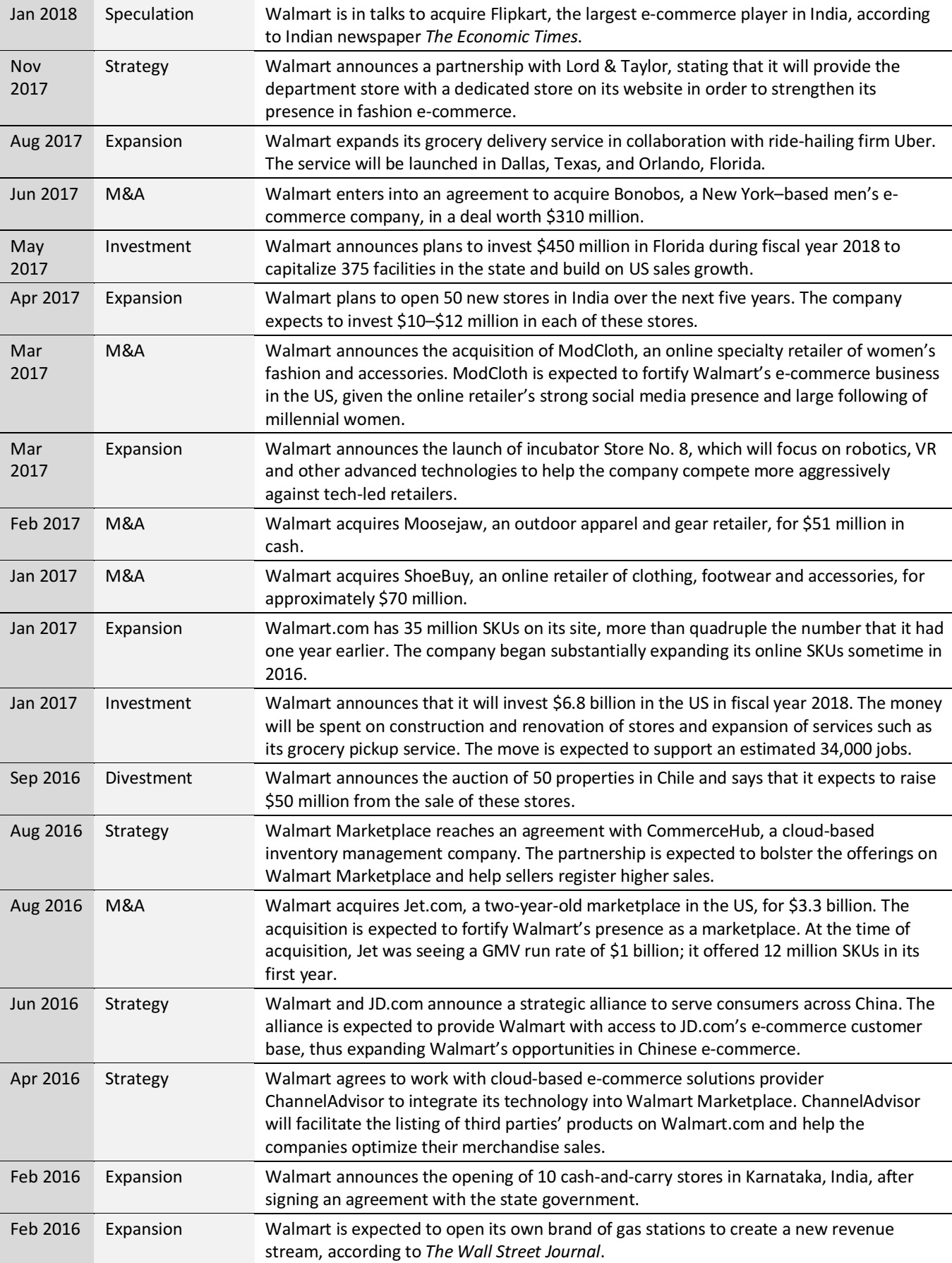

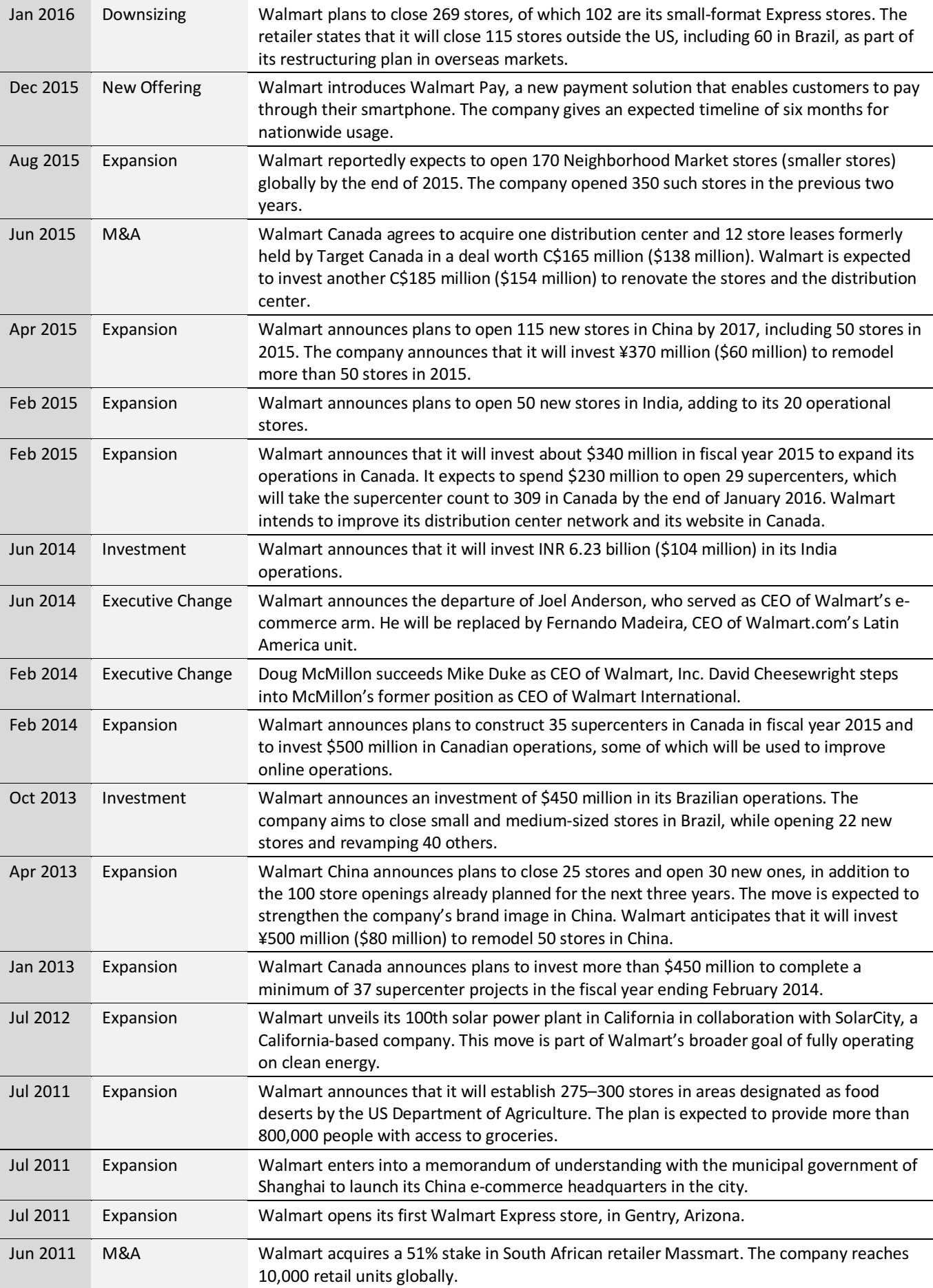

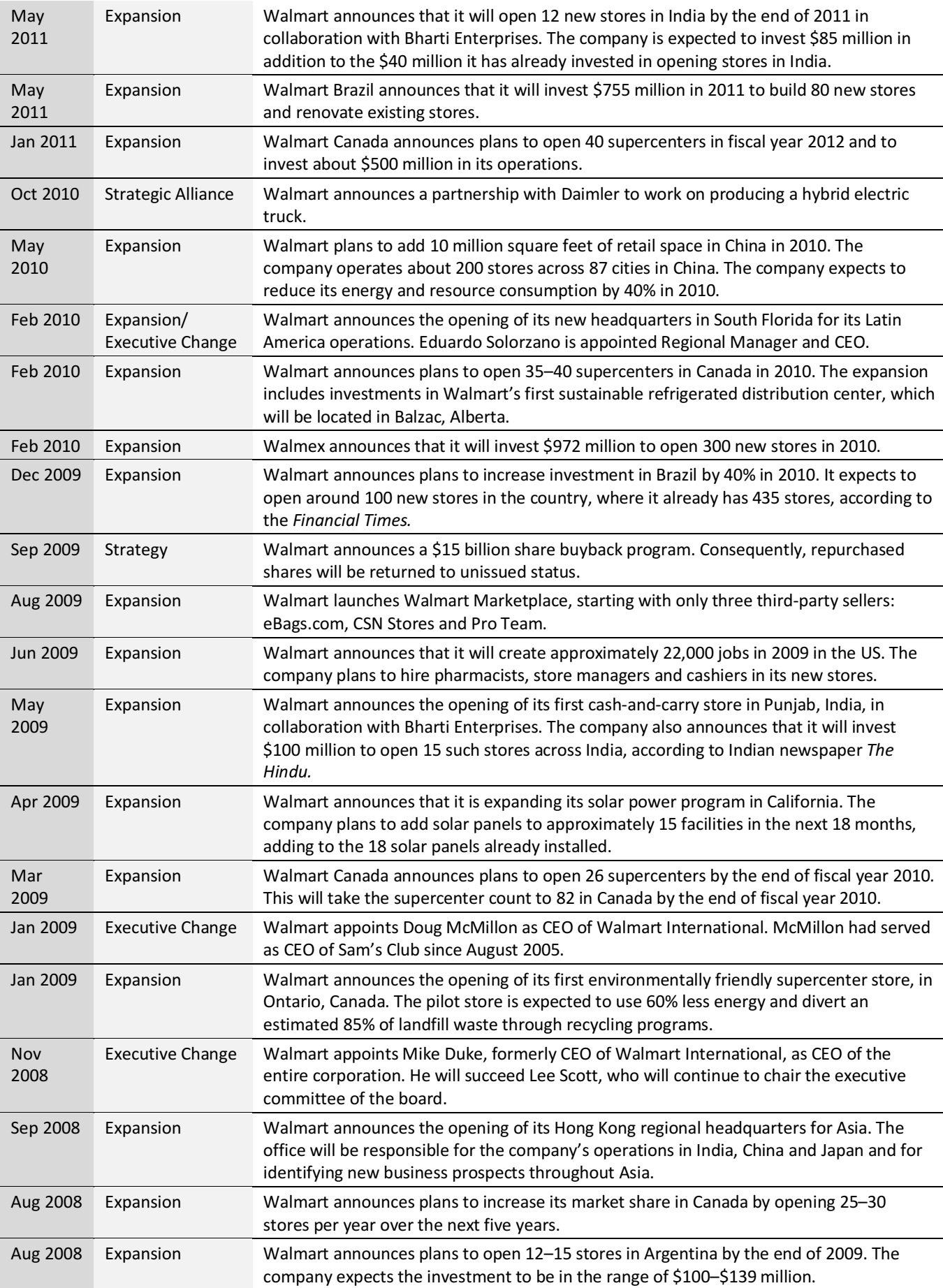

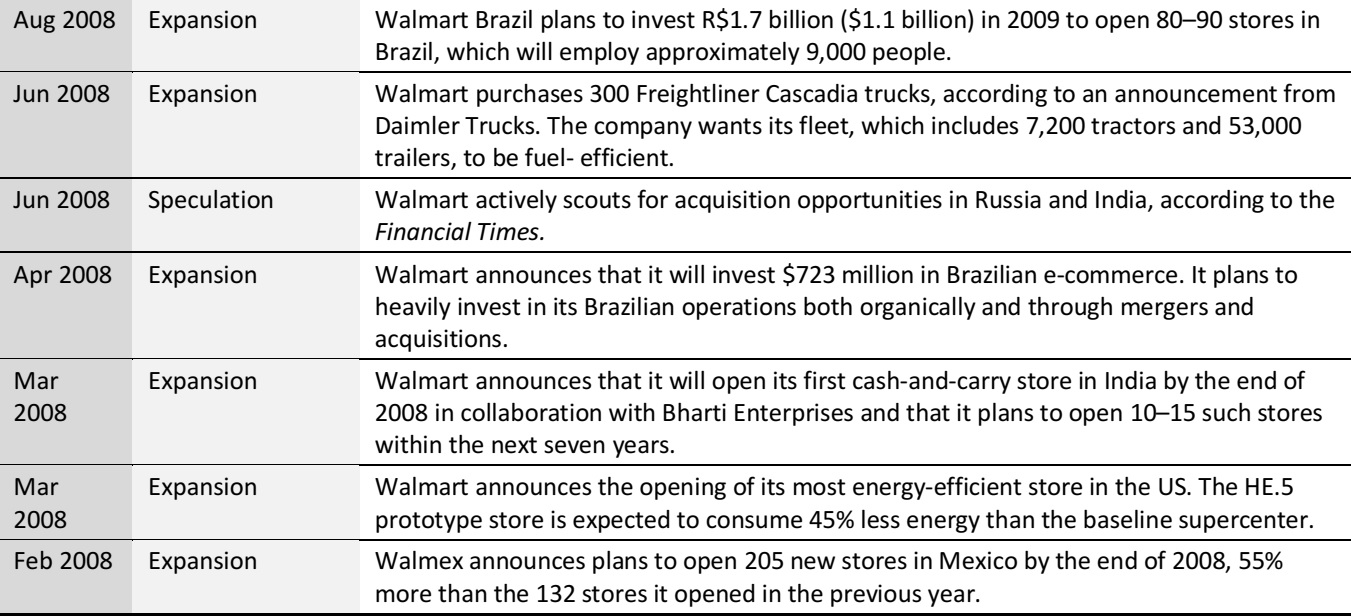

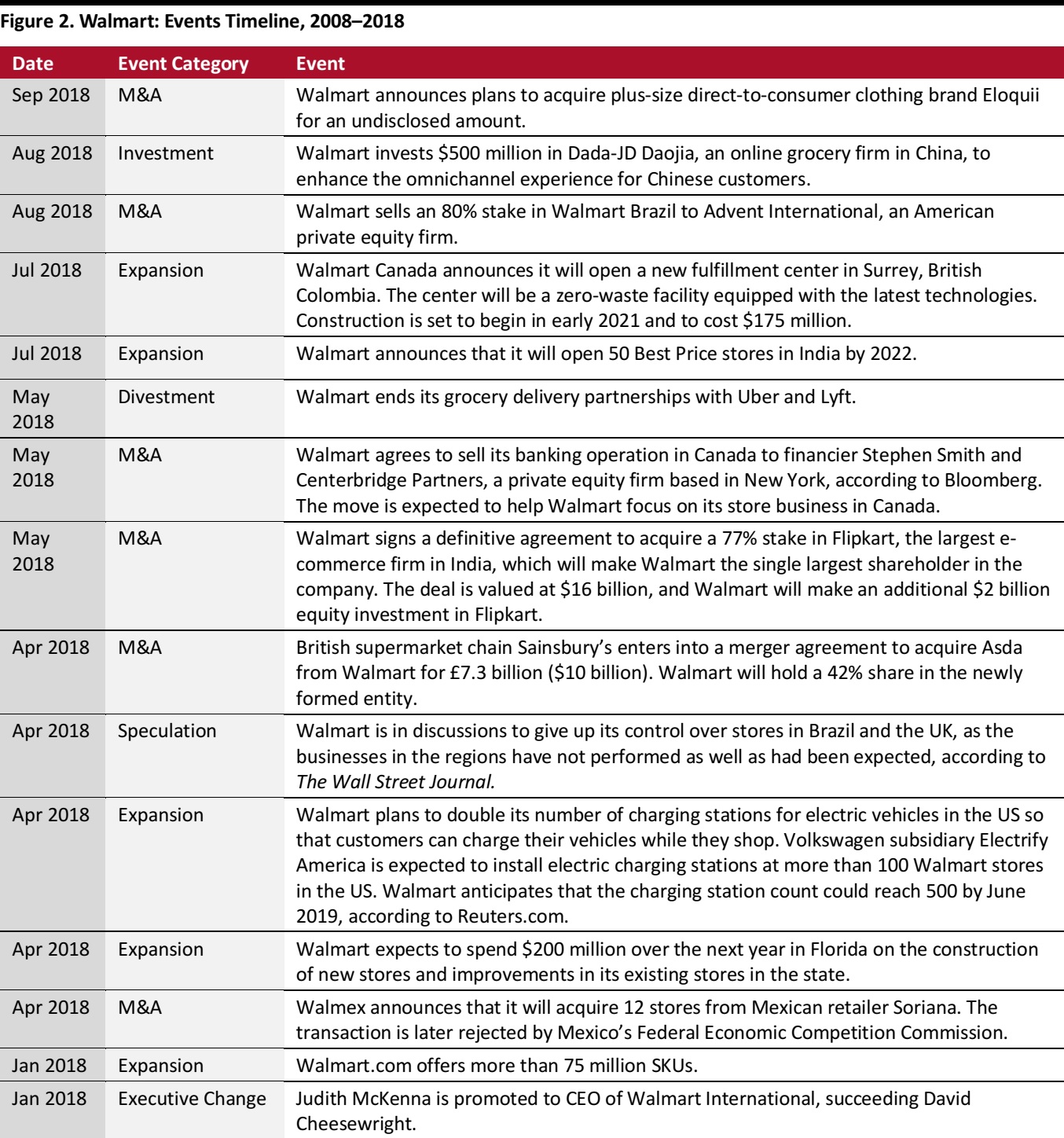

Key Events Overview: 2008–2018

1) 2016–2018: The last three years have defined Walmart’s strategy of managing its store fleet efficiently and strengthening its e-commerce business. Walmart recently divested its less successful store-based operations in Brazil and the UK. In Brazil, it sold 80% of its stake to Advent International. In the UK, it agreed to merge its local grocery segment, Asda, with British grocery retailer Sainsbury’s for £7.3 billion ($10.1 billion); Walmart will hold a minority stake in the combined Sainsbury’s-Asda entity. In the US, too, Walmart is rationalizing its store estate. In January this year, it abruptly announced the closure of 63 US Sam’s Club stores.

To strengthen its global online proposition and compete with Amazon, Walmart undertook a series of strategic moves in the e-commerce space. It acquired Flipkart, India’s largest e-commerce player, in a deal valued at $16 billion in May 2018. In 2017, it acquired Bonobos, a US-based e-commerce company focused on men’s apparel, and Moosejaw, an outdoor apparel and gear retailer. News of the Bonobos acquisition emerged around the time Walmart announced strong, 63% e-commerce growth in the second quarter of 2017.

Walmart’s calculated market expansion moves in 2017 and 2018 followed its announcements of several acquisitions and alliances the previous year. In early 2017, Walmart acquired ModCloth, an online women’s clothing and accessories retailer. The acquisition came less than a year after Walmart bought online marketplace Jet.com in a deal valued at $3.3 billion.

In 2016, Walmart announced an alliance with JD.com, China’s largest e-commerce player by revenue. The partnership was aimed at expanding Walmart’s opportunities, both online and offline, given JD.com’s large consumer base in China and Walmart’s stagnant growth under its namesake banner in the country. Sam’s Club, a more successful division of Walmart in China, opened a flagship store on JD.com offering same-day and two-day delivery across China. The Walmart and JD.com alliance has flourished, and in August 2018, the companies announced an investment of $500 million in Dada-JD Daojia, a logistics services company that is partly owned by JD.com.

Walmart also indicated its ambitions to drive in-house retail technology innovation by establishing an incubator called Store No. 8 in 2017. The incubator nurtures startups focused on using artificial intelligence, machine learning and virtual reality in retail contexts.

2) 2012–2015: Between 2012 and 2014, Walmart invested heavily in expanding its store footprint across its international operations. At the start of fiscal year 2014, the company announced that it would invest $450 million in expanding its supercenters in Canada. The company’s strategy during these years focused on finding ways to generate higher sales by offering lower prices and discounts, a strategy the company still adheres to.

Walmart announced plans to open 30 stores in China in 2015 and said that it would invest $80.1 million to remodel 50 stores in the country. Additionally, Walmart announced that it would open stores in various other regions, including 22 stores in Brazil in 2014, 64 supercenters in Canada across fiscal years 2015 and 2016, and 50 stores under its Best Price Modern Wholesale brand in India in 2015.

3) 2008–2011: Walmart invested heavily in environmentally friendly initiatives between 2008 and 2011. For example, it undertook efforts to make its stores and distribution centers greener and to establish renewable energy generation centers. The company also expanded its business in Latin America during this period. Walmart announced investments in Brazil amounting to $723 million in 2008 and $1.1 billion in 2009 and announced that it would open 40 supercenters in Brazil by 2012. The company also announced that it would open 300 stores in Mexico in 2010.

To contribute to its goal of being completely supplied by renewable energy, Walmart announced the addition of 15 solar power–generating facilities in California between 2009 and 2010. The company also partnered with Daimler in 2010 to produce a hybrid electric truck.

This period was marked by several key management changes, including Mike Duke, formerly the head of Walmart International, replacing Lee Scott as CEO of Walmart Stores in November 2008. There were executive changes again within a few months, with Doug McMillon, formerly CEO of Sam’s Club, being named CEO of Walmart International in January 2009.

Walmart introduced Walmart Marketplace, an online third-party seller platform, in August 2009 with only three third-party sellers: eBags.com, CSN Stores and Pro Team.

Source: Company reports/S&P Capital IQ/Coresight Research

Walmart in Charts

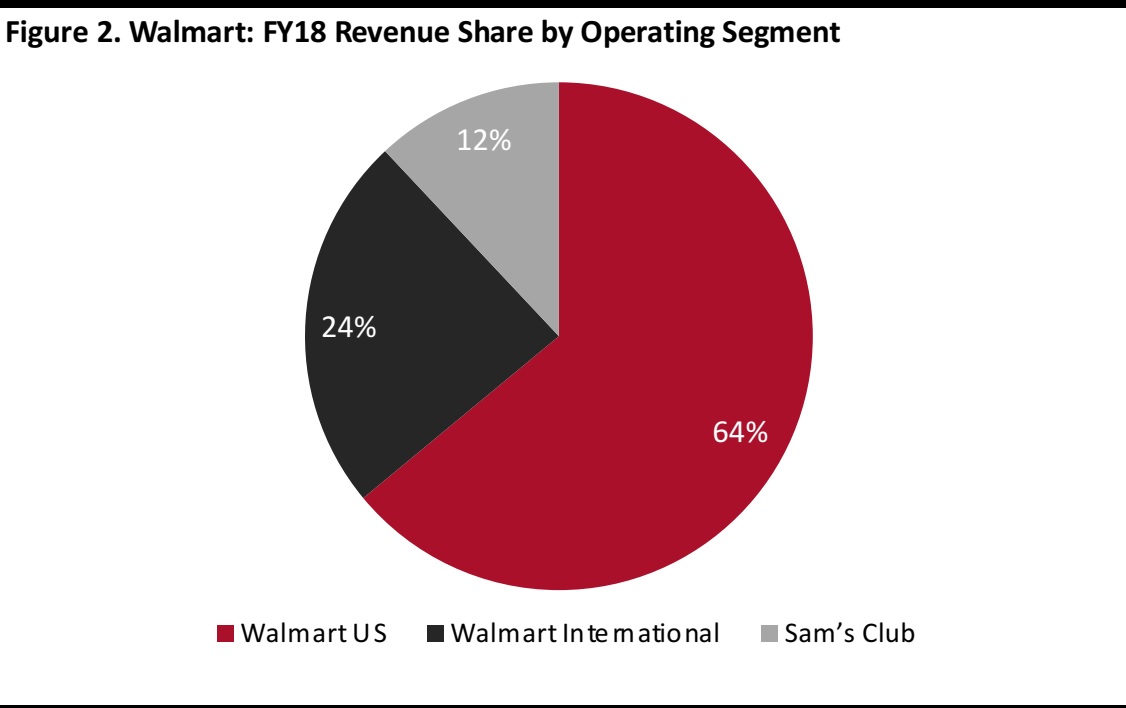

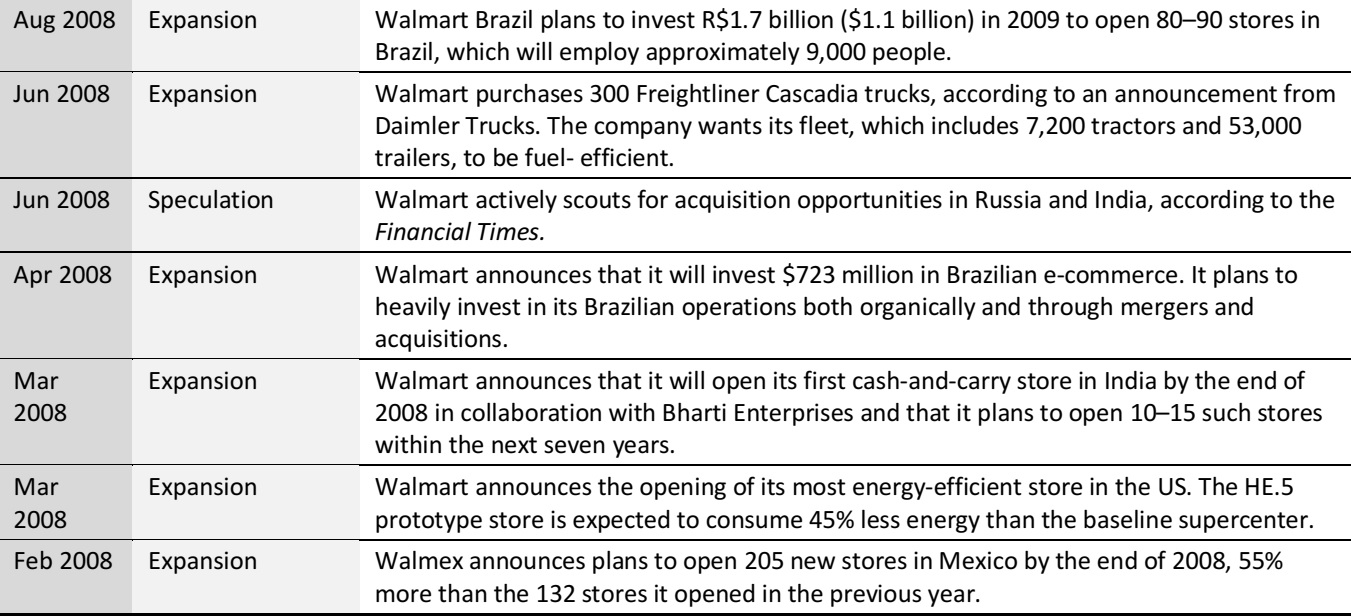

Source: Company reports/Coresight Research

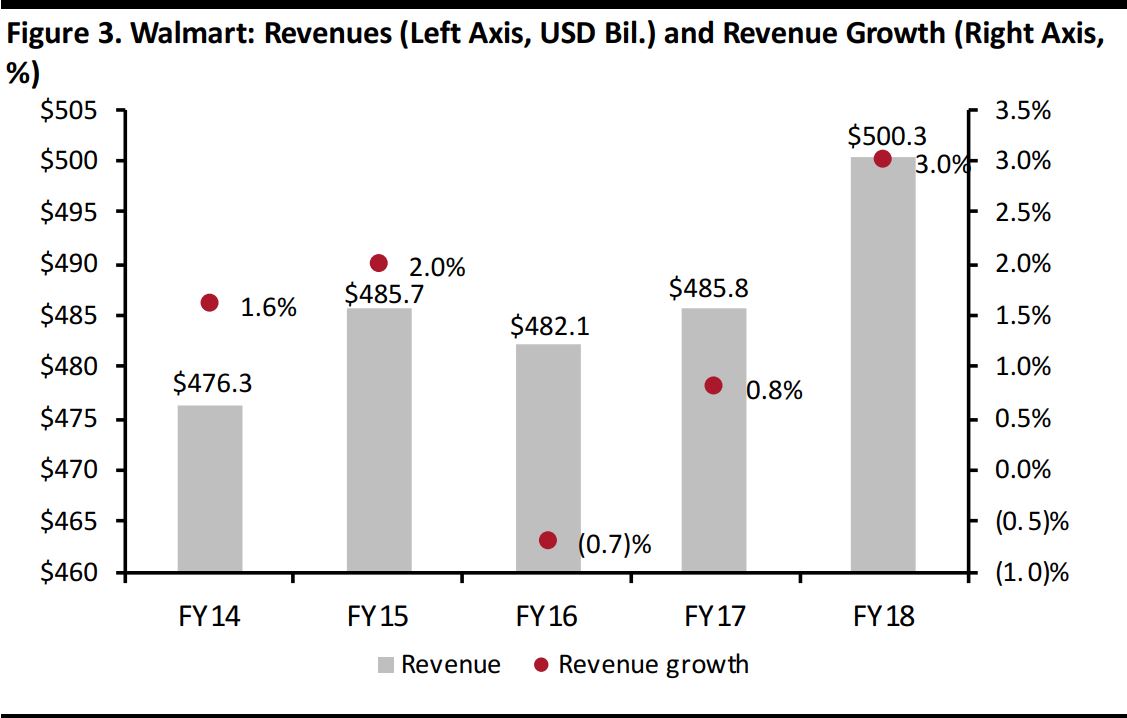

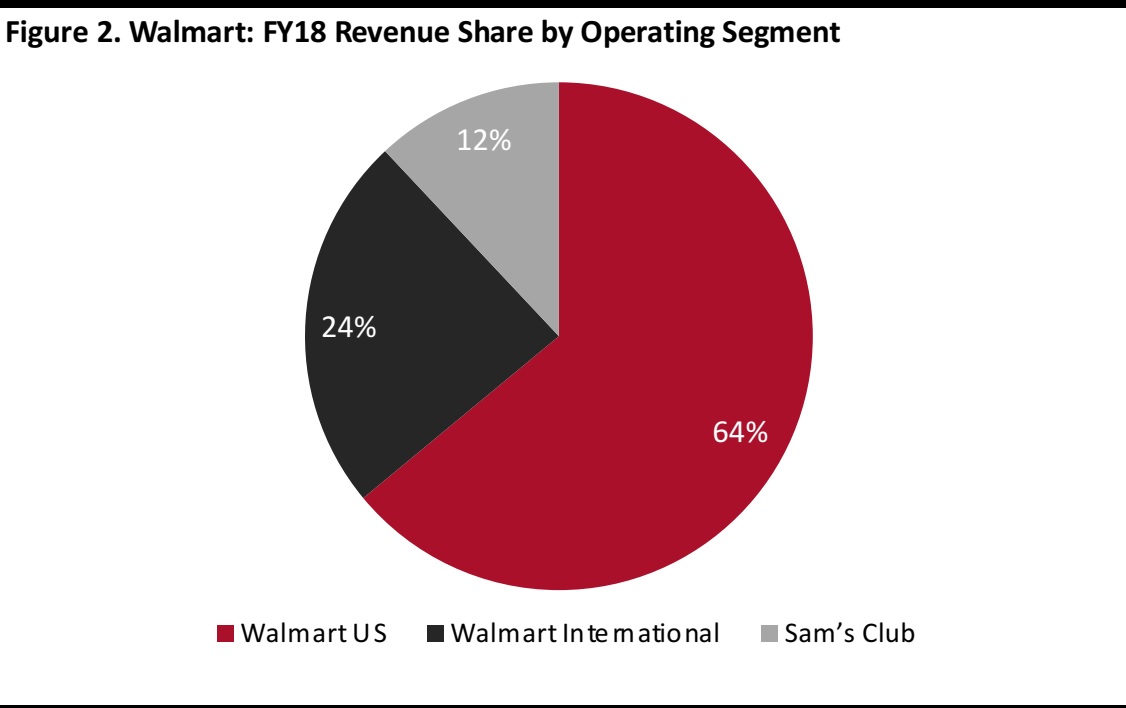

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Company Strategy

Walmart’s core strategy for fiscal year 2019 is to grow its e-commerce presence and develop its business through online sales rather than new store openings, while maintaining its price leadership. The company plans to employ the following key strategies:

1) Invest in omnichannel capabilities to achieve 40% e-commerce growth at Walmart US in fiscal year 2019

Walmart anticipates a shift in the way its customers shop, and it has expanded its omnichannel offerings, including establishing more than 1,100 online grocery pickup locations in the US. E-commerce revenues at Walmart US grew by 44% in fiscal year 2018. In its latest annual report, Walmart stated that its customers who shop both in stores and online spend nearly twice as much overall as those who shop through only a single channel.

2) Increase productivity and efficiency

Walmart aims to improve productivity throughout the organization through lower expenses on new store openings and an increased focus on customer initiatives, store remodeling and e-commerce. In fiscal year 2018, Walmart grew its store count by 23, the lowest number over the last five years. The decision to open fewer stores aligns with the company’s long-term goals of growing sales through lower prices and through multichannel retail.

3) Continue to innovate to keep pace with technological advancements

Walmart is deeply involved in progressing through innovation. Its e-commerce fulfillment centers in the US are strategically located to deliver products to customers in two days. The company Store No. 8 tech incubator is led by a team dedicated to driving new ideas to transform retail.

Company Outlook

Walmart posted strong financials in fiscal year 2018, with revenues exceeding the $500 billion threshold for the first time. Walmart’s scale of operations, e-commerce expansion and recent tech-led initiatives, such as establishing the Store No. 8 incubator, place it in strong position to compete against Amazon and Alibaba, which primarily operate online. To compete more aggressively against these players, Walmart has made several strategic acquisitions, including Jet.com, ModCloth, Bonobos and other millennial-focused brands.

With its acquisition of India’s largest e-commerce player, Flipkart, and the sale of its unprofitable Brazilian operations to Advent International, Walmart looks primed to streamline its operations in high-growth markets and gain further market share across the globe.