OUR TAKE ON THE MEETING

Walmart’s management team offered an upbeat view of its business, following last year’s guidance reduction and subsequent announcement of store closures. Since then, management has been busy fine-tuning the business by pruning the store fleet and acquiring new businesses such as Jet.com, while divesting noncore businesses. The company is undertaking a large number of initiatives to optimize its product assortment, improve customer relationships through associate training and technology, and create a seamless experience that maximizes the offering of low prices offered to its customers by leveraging the respective strengths of its physical stores, Walmart.com and its most recent acquisition, Jet.com.

In particular, Jet.com empowers customers to determine their own savings through the shipping and payment options offered by its “smart cart.” At the same time, Walmart continues to possess immense financial strength, and management has developed a disciplined framework for driving and maintaining profitable growth for shareholders.

Summaries of the meeting presentations follow.

DOUG MCMILLON, PRESIDENT AND CEO, WAL-MART STORES

Doug McMillon’s presentation centered on four main points:

- Walmart is seeing traction and moving faster.

- The company has plans to win with customers and to drive growth.

- Management will be disciplined with costs and capital.

- Its plan is to deliver shareholder value.

Source: Youtube

TRACTION AND MOVING FASTER

Walmart’s transformation and plan to win is designed around four goals:

Make every day easier for busy families — Walmart plans to accomplish this by being successful merchants; by saving customers time by accelerating e-commerce growth; and by connecting the dots between Walmart stores, Walmart.com, Jet.com and the company’s investment in China’s JD.com (on October 5, Walmart disclosed that it had doubled its stake in JD.com, to 10.8%), which should offer enhanced basket economics.

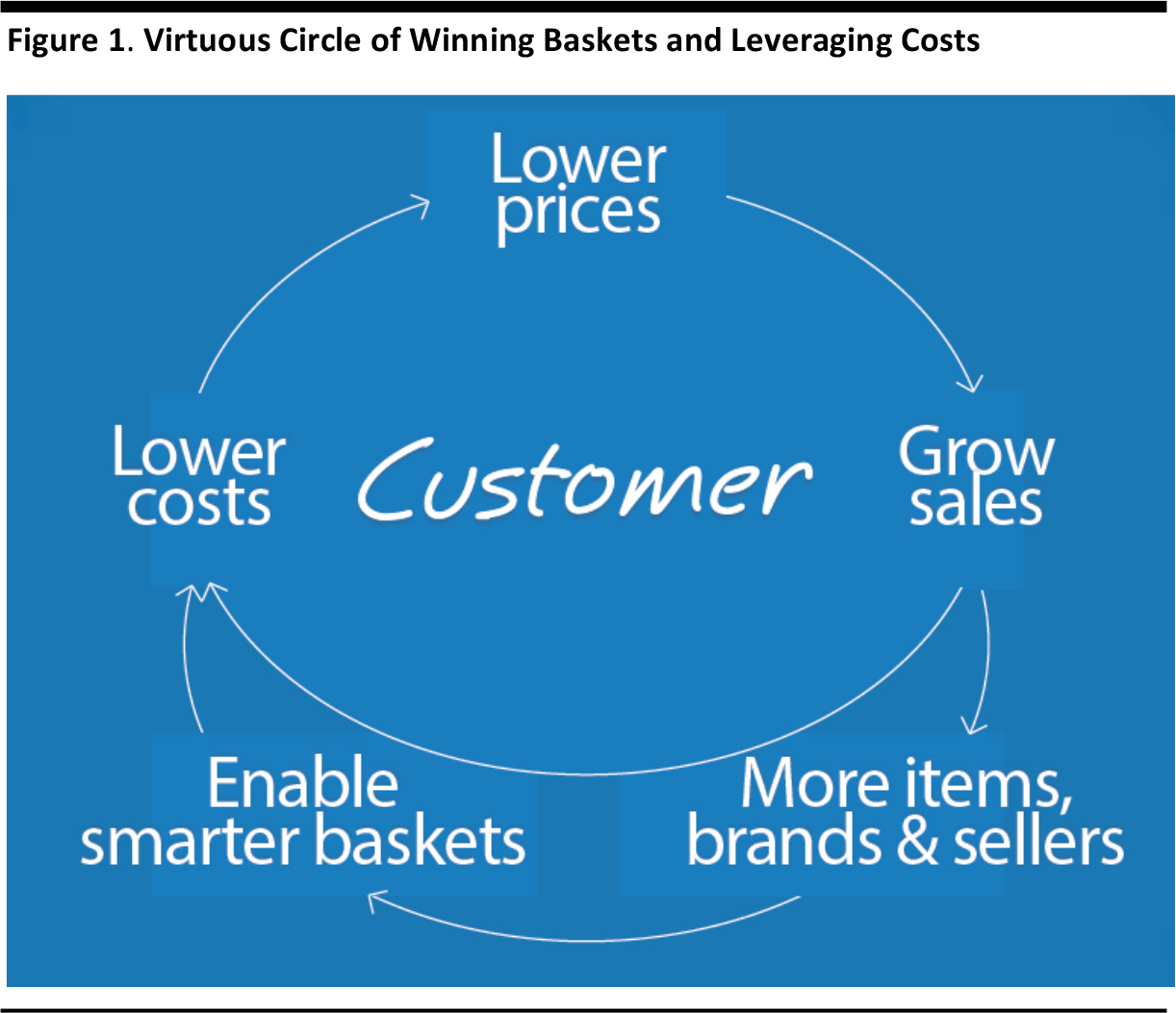

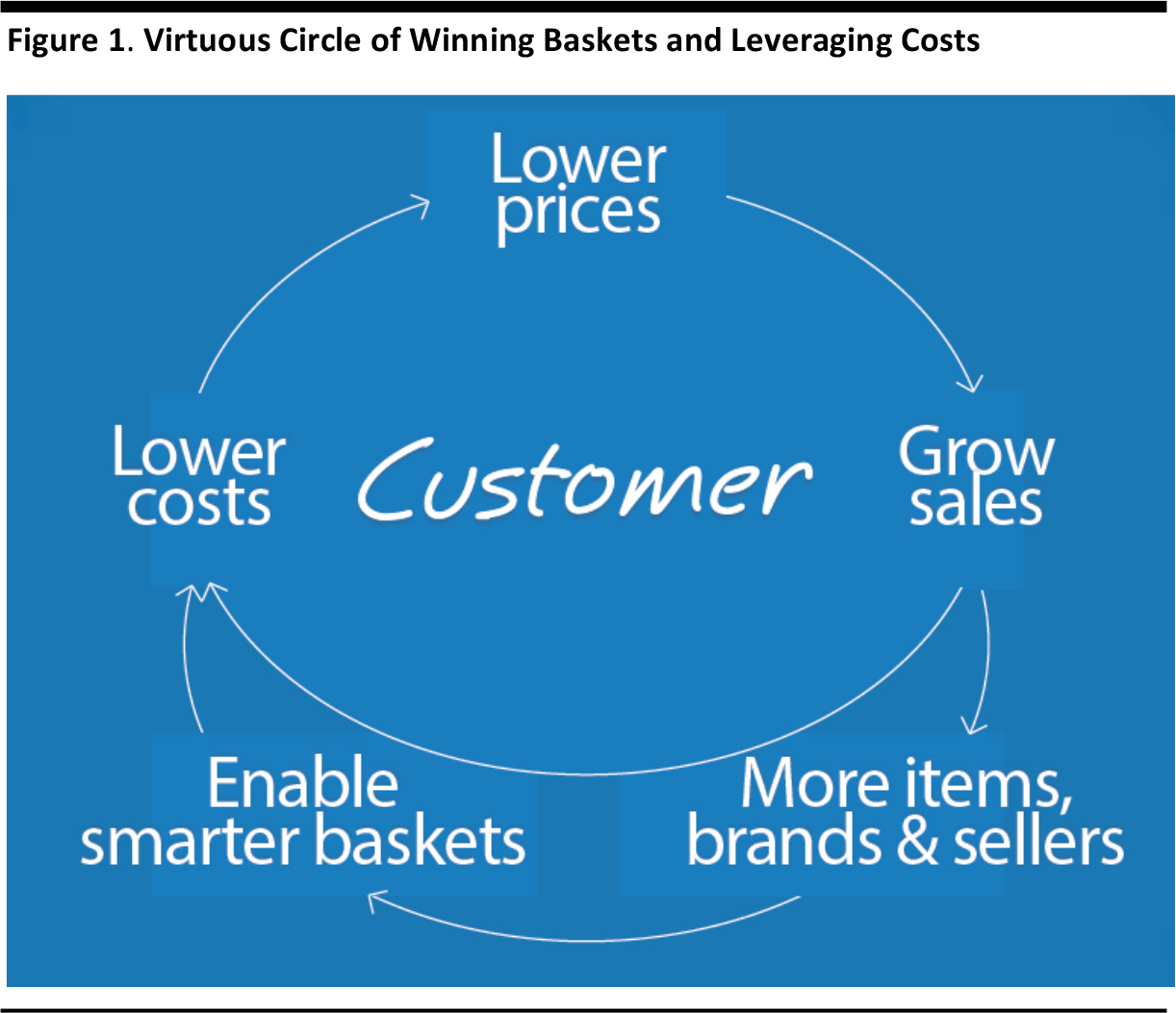

Operate with discipline — Management highlighted that Jet.com’s algorithms are designed to minimize shipping costs by bringing the customer into the buying equation and enabling higher sales at lower costs. The graphic below illustrates this virtuous circle.

Source: Company reports

Be the most trusted retailer — McMillon outlined Walmart’s progress in sustainability: the company has achieved 75% of its plan to create zero waste and 25% of its plan to be supplied completely by renewable energy, and it has eliminated 95% of high-priority chemicals from beauty and personal care product ranges carried by Walmart and Sam’s Club. McMillon also said the company was creating opportunities and making a difference socially: Walmart has hired 250,000 veterans, pledged to buy $250 billion in products that support American jobs, pledged to source $20 billion from women-owned businesses over five years, provided nearly $60 million in disaster relief, and is planning to provide 4 billion meals to people in need from 2015 through 2020.

Deliver results and position the company to win — Walmart has adopted a financial framework to achieve strong, efficient growth, exercise operating discipline and pursue a strategic allocation of capital.

GUIDANCE UPDATE

The morning before the meeting, Walmart issued a press release titled “Walmart Outlines Plan to Win with Customers, Including E-Commerce Acceleration, at Meeting for Investment Community Today” with the following key points:

- In fiscal 2018, the company expects continued momentum in its store business. Incremental US e-commerce operating investments, including Jet.com, are expected to accelerate e-commerce growth.

- Fiscal 2019 EPS is expected to grow by 5%, to $4.36–$4.57.

- The company expects to complete the remaining $11.7 billion of a $20 billion stock buyback around the end of fiscal 2018.

- The key points in fiscal 2018 capital spending plans are a moderation in new store openings, an acceleration in the pace of remodels, and investments in e-commerce and digital initiatives.

- Walmart expects to generate $80 billion in operating cash during fiscal 2017–2019

Source: Youtube

BRETT BIGGS, CFO OF WAL-MART STORES

Brett Biggs offered remarks on three areas of the company’s financial situation:

- Update on fiscal 2017–2019 expectations.

- Financial strength.

- Financial framework.

UPDATE ON FISCAL 2017–2019 EXPECTATIONS

Biggs shared financial highlights for the first half of fiscal 2017:

- Net sales increased by 3.1% (on a constant-currency basis).

- Comps were solid in most parts of the business.

- E-commerce growth accelerated.

- Operating cash flow was about $15 billion.

- The company returned about $8 billion to shareholders in the form of dividends and share repurchases.

For the full year, the company expects the following:

- Adjusted EPS of $4.15–$4.35 (which excludes the sale of Yihaodian).

- Net sales growth of about 3%, to about $493 billion (on a constant-currency basis).

- Capital spending of $11 billion.

Compared with the guidance offered in October 2015, the company is:

- On track in terms of sales growth, with a 3%–4% CAGR delivering $45–$60 billion over three years.

- On track in terms of EPS; expectations are for EPS to be down 6%–12% in fiscal 2017, higher in fiscal 2018 and up 5%–10% in fiscal 2019.

- On track in terms of operating cash flow of $80 billion over three years.

- Catching up in terms of e-commerce growth. Walmart expects to slightly lag its expectations of 20%–30% e-commerce sales growth in fiscal 2017, but to meet the target in fiscal 2018. The company expects to lag its EPS target of 5%–10% EPS growth in fiscal 2018–2019.

Source: Youtube

FINANCIAL STRENGTH

Biggs reminded investors of Walmart’s financial strength, highlighting that its operating cash flow was $27 billion in fiscal 2016, its website is the second-most-visited e-commerce site in the US, its credit rating is AA, it has seen 43 consecutive years of dividend increases and that it has a $20 billion share-repurchase program.

FINANCIAL FRAMEWORK

Biggs also outlined Walmart’s financial framework, which consists of three main parts:

Strong, efficient growth—Walmart plans to focus on the most productive opportunities by prioritizing comp growth over growth in new stores and by accelerating its e-commerce and marketplace businesses.

Operating discipline—Management is exercising disciplined expense management to “bend the [cost] curve,” optimize technology and services, evolve its ways of working and its supply chain, and enable its digital transformation.

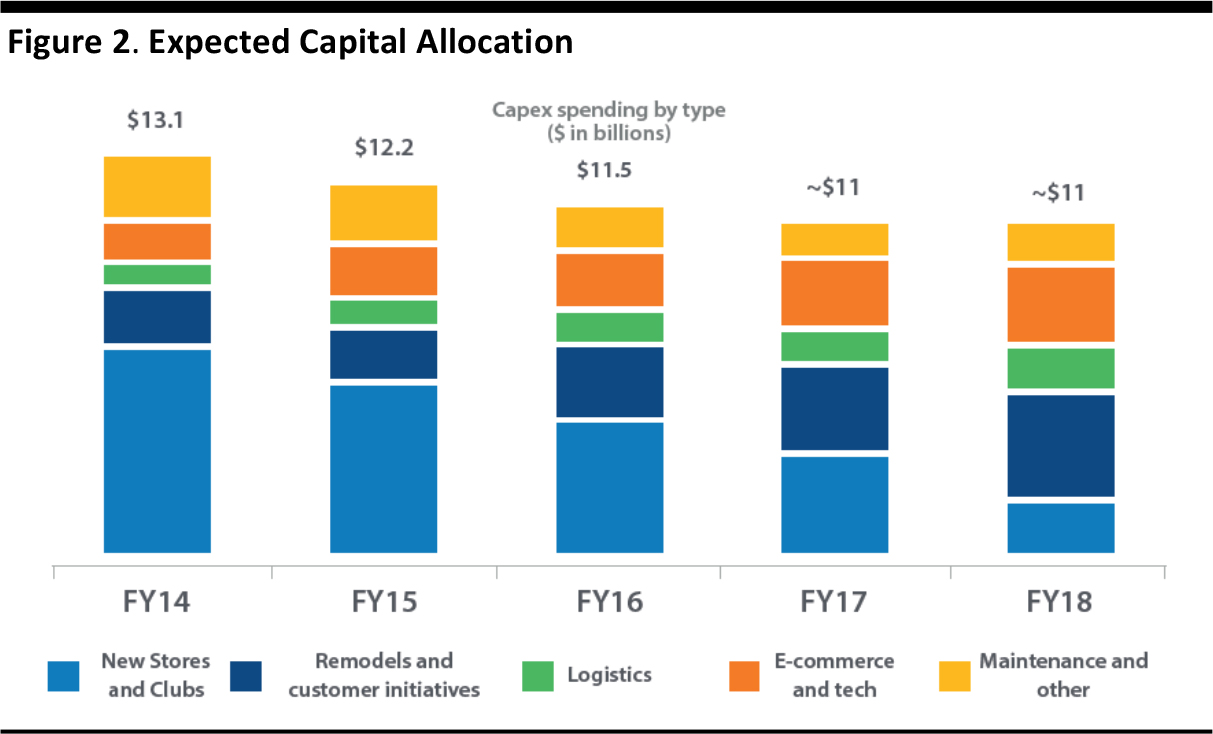

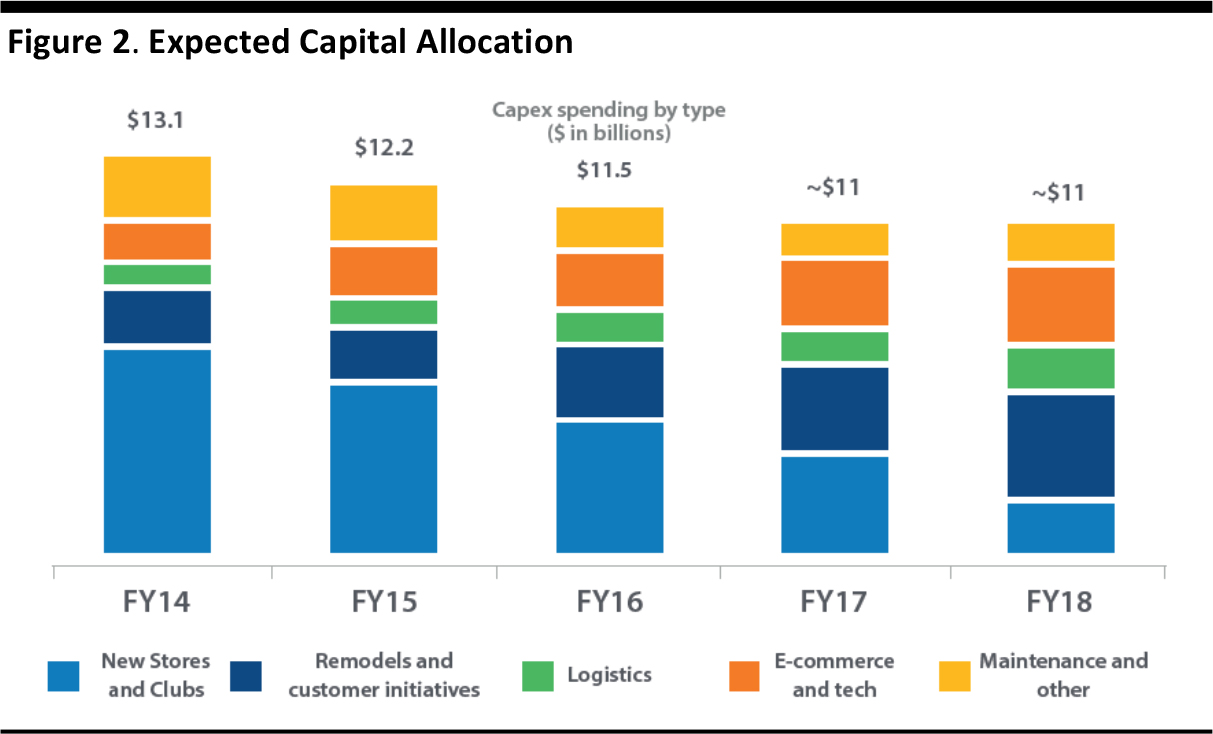

Strategic capital allocation—The figure below shows that the share of planned capital spending for new stores and clubs is expected to decrease, whereas the share for e-commerce and tech, and remodels and customer initiatives, is expected to increase.

Source: Company reports

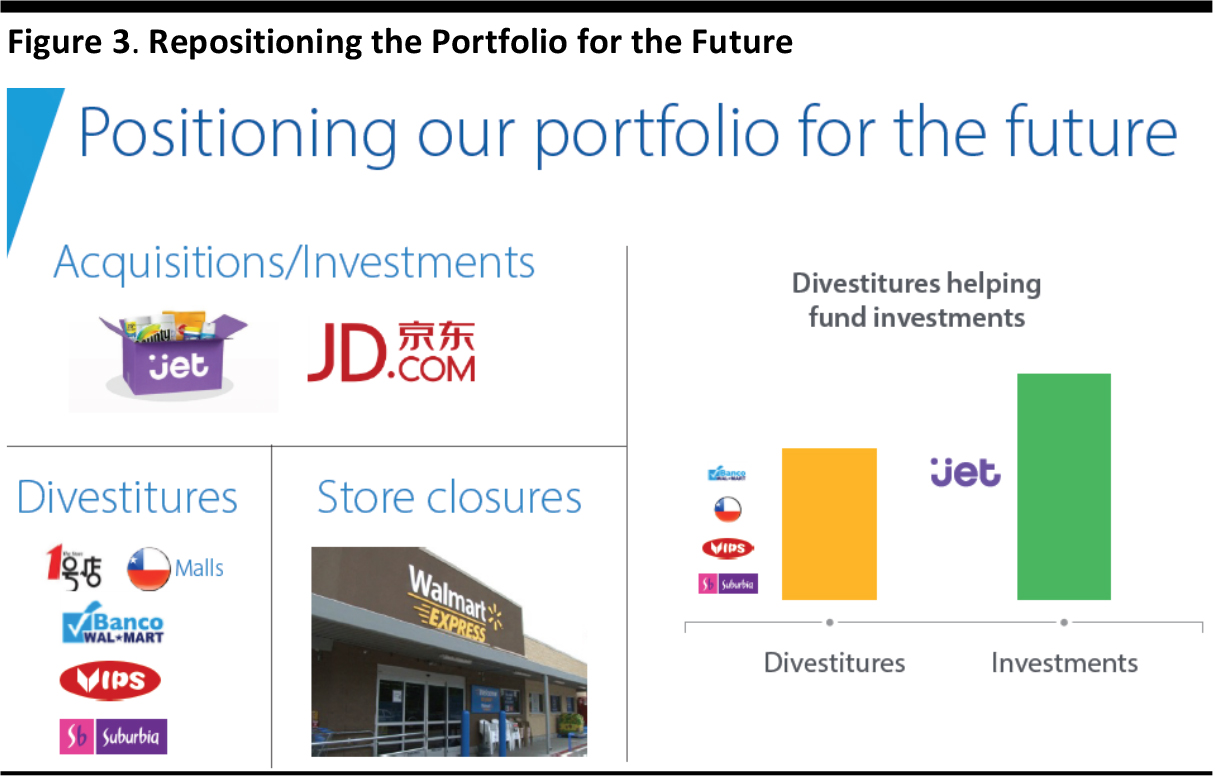

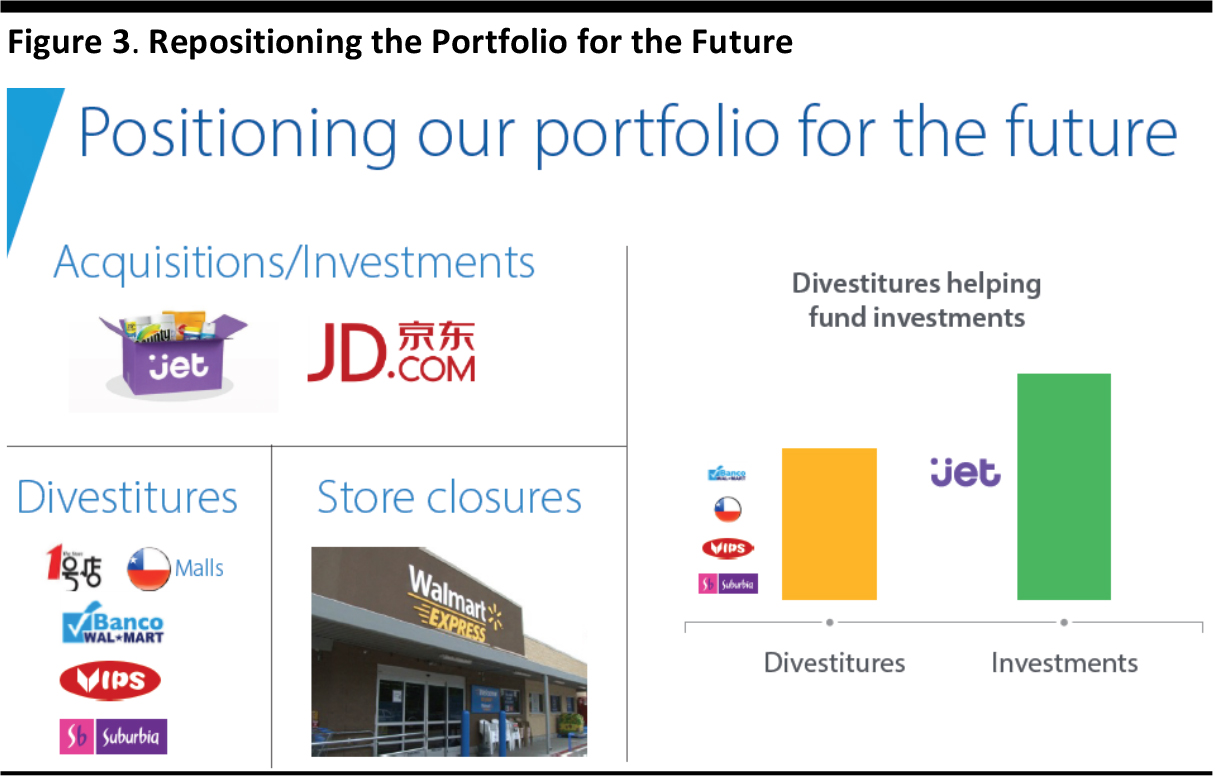

The graphic below illustrates the areas in which Walmart is divesting or reducing funding as well as where it is acquiring and investing.

Source: Company reports

Biggs summarized his remarks with three simple takeaways: the company expects a solid fiscal 2017 and it has financial strength and a sound financial framework.

DOUG MCMILLON, PRESIDENT AND CEO, WAL-MART STORES, AND MARC LORE, PRESIDENT AND CEO, WALMART E-COMMERCE US

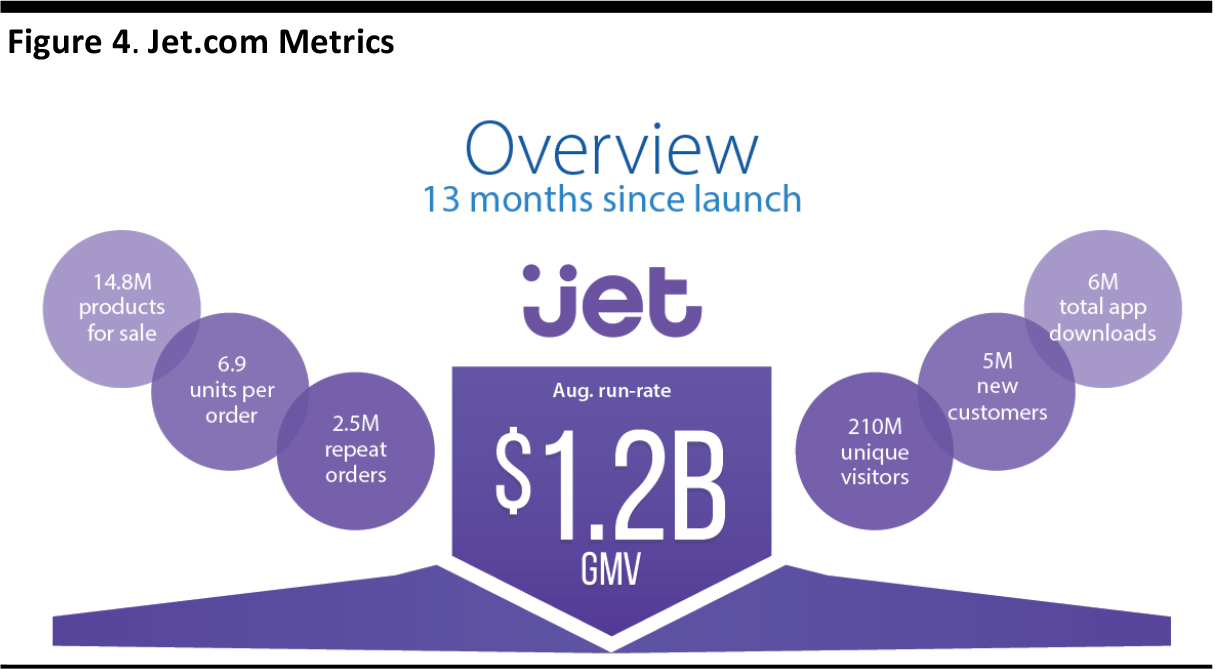

McMillon returned to the stage to join former Jet.com CEO Marc Lore. Lore has officially been with Walmart slightly more than two weeks (Walmart acquired Jet.com on September 19 for $3.3 billion in cash and stock). Lore introduced himself and gave a brief history of his experience, mentioning his seven years as an investment banker and the two e-commerce companies he founded prior to creating Jet.com.

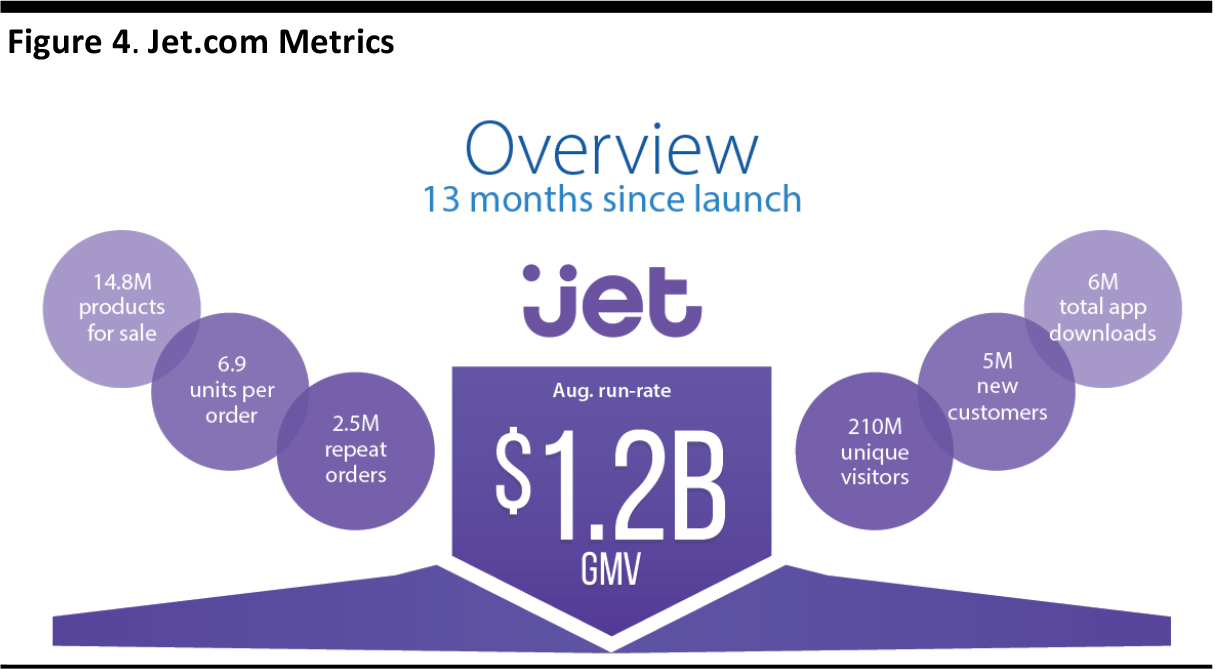

The graphic below summarizes Jet.com’s achievements in the 13 months since its launch.

Source: Company reports

McMillon discussed Jet.com in more detail during his remarks. Jet.com is expected to help Walmart “win on baskets” and strengthen the connection between stores and e-commerce—and McMillon believes that e-commerce needs to be a basket business as much as possible. Walmart’s opportunities to offer low prices based on product mix were previously quite different at its superstores; the Internet has changed this. The acquisition of Jet.com enables Walmart to scale its e-commerce business faster while empowering customers to save even more money by using Jet’s smart cart feature.

ROSALIND BREWER, PRESIDENT AND CEO, SAM’S CLUB

To start, Rosalind Brewer provided some key figures regarding Sam’s Club’s performance in fiscal 2016:

- Net sales were $56.8 billion (including fuel).

- Operating income was $1.8 billion (including fuel).

- The company ended the fiscal year with 655 clubs in the US and Puerto Rico.

- Sam’s Club employs more than 100,000 sales associates.

Brewer’s key message was that the member must win, and that Sam’s Club must elevate the experience by transforming merchandise, growing membership and leading in digital.

Transform merchandise—Sam’s Club aims to transform its merchandise offerings by growing talent, elevating its assortment, delivering on the price/value relationship and growing its private-brand business (through its Member’s Mark brand).

Grow membership—Methods to grow membership include deploying a new sales team and sales tools and developing personalized relationships with customers.

Lead in digital—Sam’s Club plans to introduce more innovation in its clubs, such as its Scan & Go smartphone app; provide better tools to its sales associates; and create a seamless shopping experience.

Source: Youtube

Sam’s Club plans to take a balanced approach to growth, comprising strategic capital investments, focused member growth and the creation of an efficient supply chain.

In terms of capital allocation, Sam’s Club is planning flat capital spending of about $700 million in fiscal 2018. The company plans to allocate a higher proportion of spending to e-commerce and tech ads, as well as remodels and member initiatives, and a lower proportion to new clubs.

Brewer summarized her remarks in five points, saying that Sam’s Club is focused on:

- Offering a leading digital experience in the club channel.

- Accelerating the price/value relationship.

- Doing its part to win in food in the US.

- Elevating the shopping experience.

- Providing a strong, profitable business.

DAVID CHEESEWRIGHT, PRESIDENT AND CEO, WALMART INTERNATIONAL

David Cheesewright commented that Walmart’s international goal and strategy remain consistent: to be the world’s leading digitally enabled food retailer by innovating to help its customers save money so as to live better.

The strategy to accomplish this consists of actively managing the business portfolio (in terms of simplification, repositioning and capital allocation) to:

- Achieve differentiated growth through a differentiated customer proposition.

- Be the lowest-cost operator.

- Build strong foundations for the business.

In terms of geography, Walmart’s focus are on Canada and Mexico (core markets), China (a big opportunity), the UK and Japan (mature markets), as well as emerging markets. The graphic below illustrates Walmart’s respective strategies in its four main international markets.

Source: Company reports

GREG FORAN, PRESIDENT AND CEO, WALMART US

Greg Foran revisited the first-half business highlights, discussed improvements in comp sales and traffic as well as customer experience scores and net promoter scores, and reiterated the productivity loop discussed above. He outlined the four main elements comprising Walmart’s plan to win:

Source: Youtube

- Running great stores—By focusing on developing sales associates and concentrating on retail fundamentals.

- Delivering value—Using EDLC (“everyday low costs”) to deliver EDLP (“everyday low prices”).

- Being great merchants—Improving product assortment through data and analytics and managing inventory, including private brands and fresh merchandise.

- Providing convenience—Through seamless shopping, online grocery and supercenter reinvention.

He offered three takeaways:

- Walmart is executing its plan.

- It is investing wisely.

- It is confident in its strategy.

Please click

here to read the report we published on Walmart’s 2015 Investment Community Meeting.