Continues

Walgreens Boots Alliance, the US’s largest drugstore chain and a global health and beauty retailer, has extended and amended its merger agreement to acquire the third-largest retail pharmacy chain in the US, Rite Aid. The acquisition would allow Walgreens to enter the drug benefits management business for insurers and employers, where its competitor, CVS Health, currently leads.

The merger deal was initially announced in October 2015 and has run into legal hurdles and delays, mainly in terms of gaining regulatory approval from the FTC. When Walgreens first announced the proposed $9.4 billion equity (and $7.75 billion of net debt) takeover deal, it offered $9 per Rite Aid share. Walgreens had initially expected to divest between 500 and 1,000 stores in order to address FTC antitrust concerns.

Walgreens operates nearly 8,175 stores in the US, while Rite Aid has 4,600 stores in the country. Even if the maximum number of 1,200 stores were divested, the combined Walgreens and Rite Aid store count would be greater than that of the US’s second-largest pharmacy chain, CVS, whose retail network includes more than 9,600 US stores.

In December 2016, Walgreens and Rite Aid announced an agreement to sell 865 US stores to Fred’s for $950 million in order to satisfy antitrust concerns. However, CVS expressed concerns to the FTC that the store divestments to Fred’s would not be enough to safeguard competition. The FTC is still assessing the store sales to Fred’s.

Under the terms of the amendment, Walgreens has reduced its offer price for Rite Aid shares from $9.00 per share to a minimum of $6.50 per share and a maximum of $7.00 per share. The final price per share will be determined based on the number of stores Walgreens will be required to divest in order to receive approval for the deal. The FTC has not communicated a preferred number of stores to be divested. However, store divestitures could now be as high as 1,200, compared with the initial target of up to 1,000 stores. The price will be set at $7.00 per share if 1,000 stores or fewer are divested and at $6.50 per share if 1,200 stores are divested. If the required divestitures fall between 1,000 and 1,200 stores, then there will be a pro-rata share price adjustment.

The amended deal provides scope for a greater number of store divestitures and reflects the weakening fundamentals of the Rite Aid business since the merger was originally announced. The new deal will decrease the original transaction equity value of $9.4 billion by at least $2.1 billion, as Walgreens will now pay between $6.82 billion and $7.35 billion. Rite Aid shareholders still have to vote on the lower share price offer and deal terms.

The FTC continues to assess the proposed deal, and the agency itself is in transition. President Donald Trump has nominated Commissioner Maureen Ohlhausen as Acting Chairman of the FTC following the planned departure of the existing chair, Edith Ramirez, in February 2017.

The Scale of the Merger

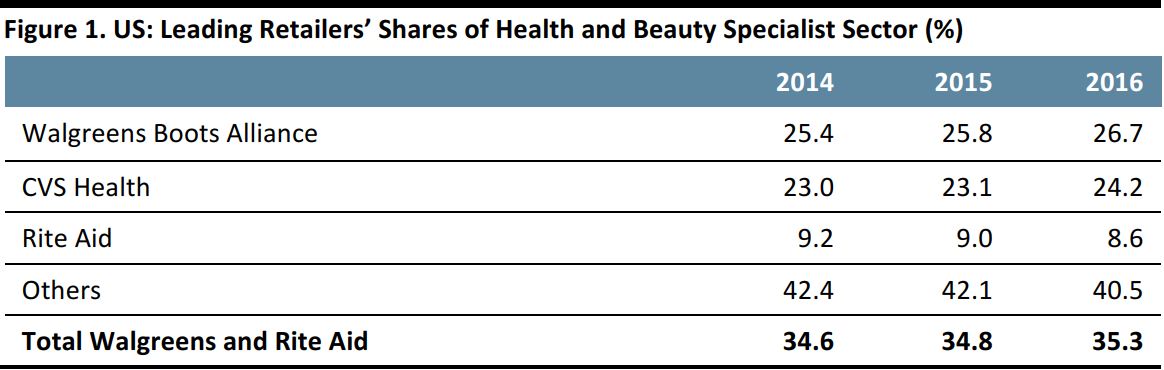

On the basis of zero store divestments, the combined company would enjoy a 35% share of the overall health and beauty specialist sector, we estimate, based on Euromonitor International data.

Source: Euromonitor International/Fung Global Retail & Technology

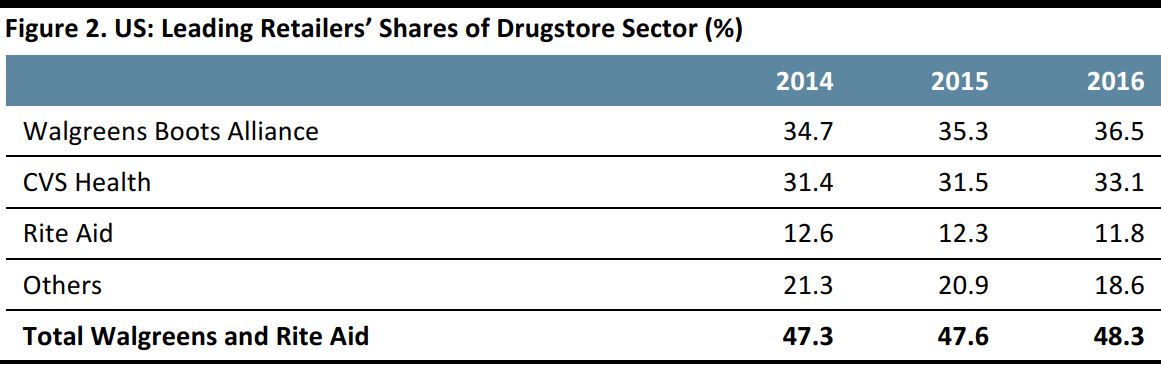

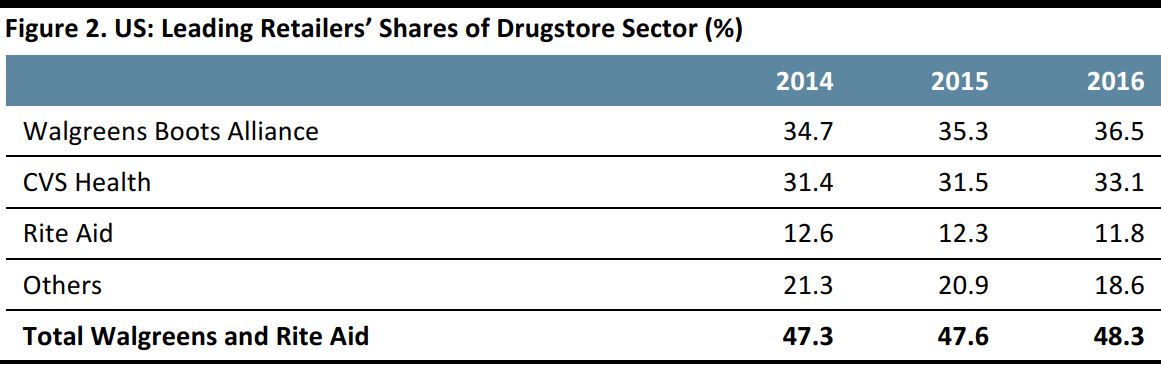

Within the drugstore subsector, the share captured by the combined Walgreens-Rite Aid entity would be even greater, at almost half. Again, this assumes no impact from store divestments. These data underline why the FTC is likely to require substantial divestment of stores.

Source: Euromonitor International/Fung Global Retail & Technology