Source: Company reports/Fung Global Retail & Technology

4Q16 RESULTS

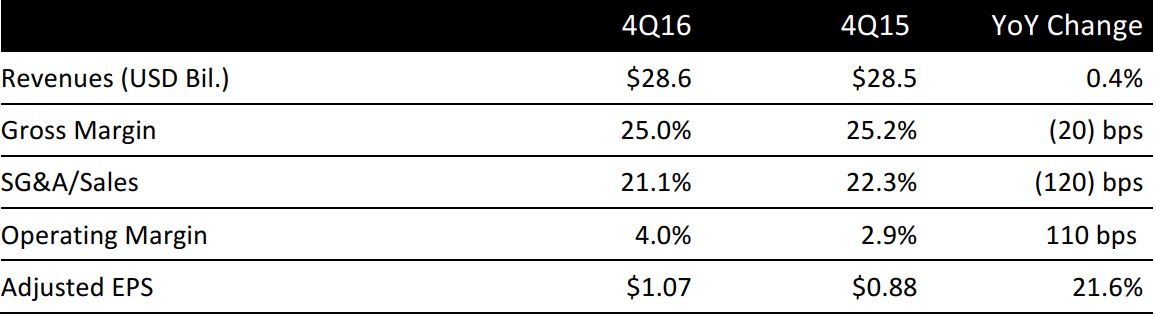

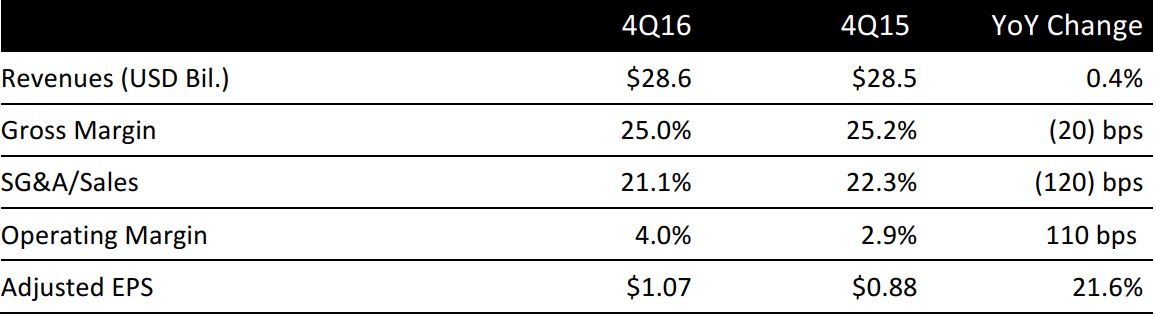

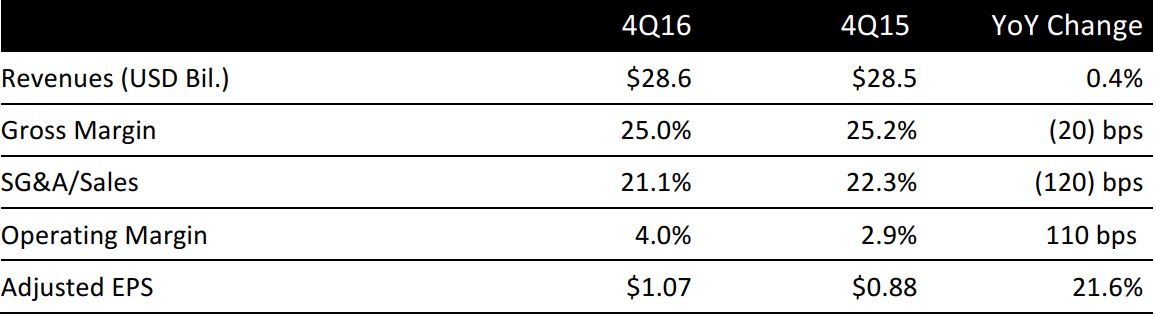

Walgreens reported fiscal 4Q16 revenues of $28.64 billion, up 0.4% year over year and below the consensus estimate of $29.11 billion. Sales increased by 2.5% on a constant-currency basis. Adjusted EPS was $1.07, ahead of the $0.99 consensus estimate and up 21.6% year over year.

The company continues to assume accretion of $0.05–$0.12 from Rite Aid, based on the disclosed store divestitures and deal-closing expectations.

The Retail Pharmacy USA division reported 4Q16 revenues of $20.7 billion, up 4% year over year. Comps were 3.2% for the period, slightly below expectations of 3.4%. US pharmacy sales were up 6.2%, driven by increased prescription volume and improved specialty sales. The company’s reported share of the retail prescription market was 19.3%, up 40 basis points from the year-ago period. The health and wellness beauty categories performed well. Walgreens’ new beauty offerings have reached more than 1,600 stores across the US. The company is deploying well-trained beauty consultants to offer high-quality consultations to customers.

The Retail Pharmacy International division saw 4Q16 sales of $3 billion, down 10.9% year over year, due to negative currency impact. On a constant-currency basis, sales increased by 1.4%. Reported comps were (0.6)% for the segment versus the expected (1.3)%.

On the wholesale side, 4Q16 reported revenues were $5.4 billion, down 6.2% year over year. On a constant-currency basis and excluding acquisitions and dispositions, comps were up 2.9%, slightly below the company’s estimate of market growth.

OUTLOOK

Management now expects its pending acquisition of Rite Aid to close in early 2017, versus the previously stated end of 2016. The company continues to expect that the Federal Trade Commission will require the parties to divest 500–1,000 stores. Walgreens management is confident that it will be able to execute the divestiture by the end of 2016.

Walgreens and Rite Aid also announced that they have agreed to extend the end date of their merger agreement from October 27, 2016, to January 2017, in anticipation of the new projected closing time of the transaction.

Walgreens Boots Alliance Executive Vice Chairman and CEO Stefano Pessina commented that the exercise of the AmerisourceBergen warrants in August was an opportunity to deploy capital. He also said that the agreements reached with Prime Therapeutics and Express Scripts showed the company’s collaborative and partnership-oriented approach.

For fiscal year 2017, the company expects adjusted EPS of $4.85–$5.20, in line with the consensus estimate of $5.03. This guidance assumes accretion of $0.05–$0.12 from Rite Aid, based on the expected store divestitures and timing of closing.