Source: Company reports/Fung Global Retail & Technology

FY2Q17 Results

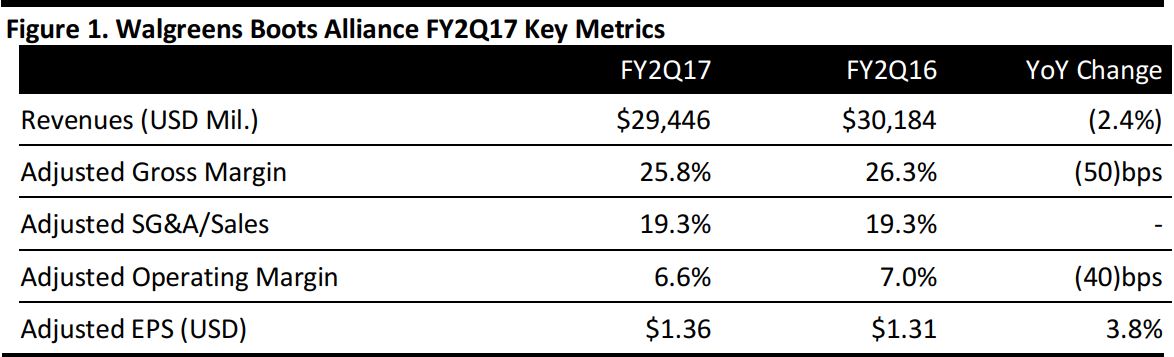

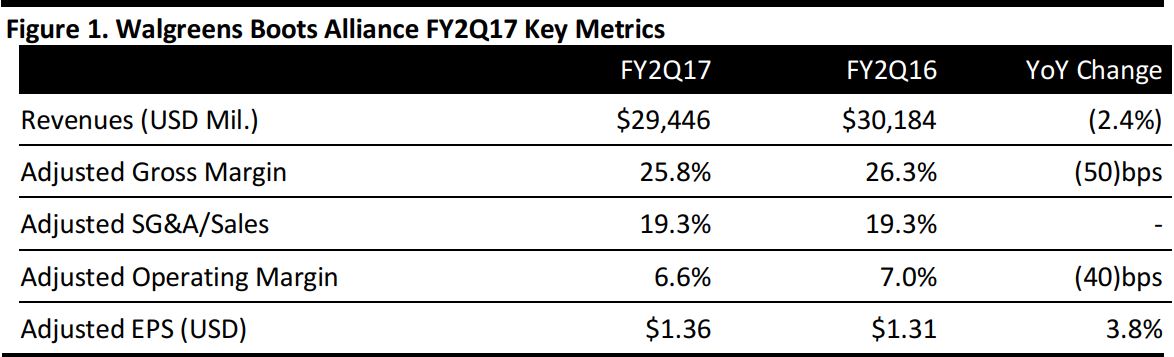

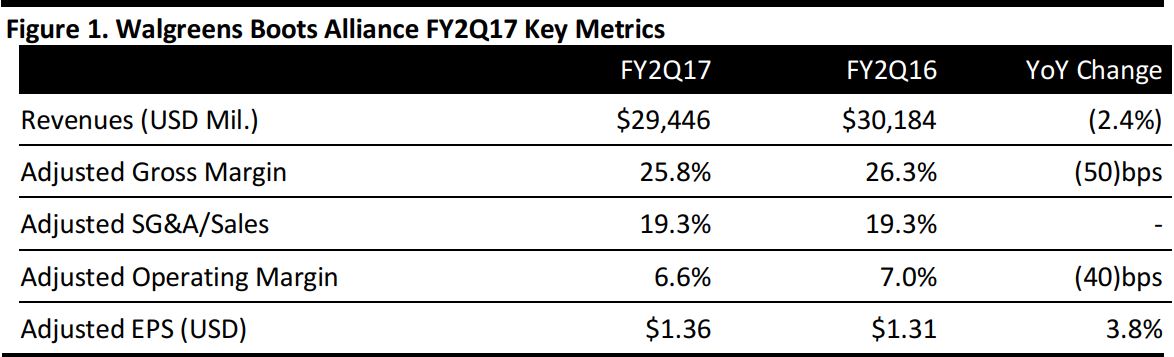

Walgreens Boots Alliance reported FY2Q17 EPS of $1.36 versus expectations of $1.37.

Total revenues were $29.45 billion, below consensus of $30.18 billion. In the US, revenues were $21.81 billion, below expectations of $22.00 billion, and comps were up 2.4%, better than consensus of 2.2%. Retail comps were down 0.8%, while pharmacy comps increased 4.2%. In international markets, revenues were $3.10 billion, below expectations of $3.25 billion, and comps were down 0.9%. Retail comps were up 0.6% and pharmacy comps were down 3.7%. Wholesale revenues were $5.03 billion below consensus of $5.69 billion.

The company achieved $1.5 billion in savings from its cost transformation program ahead of schedule. The program is on track to be completed by the end of fiscal 2017.

The company commented that it faced challenging conditions in the period in a number of markets it operates in. The growth in pharmacy volume and market share in the retail pharmacy segment were bright spots in the quarter.

Walgreens continues to work towards regulatory approval for the pending acquisition of Rite Aid Corporation by the end of July, consistent with the amended merger agreement announced in January.

2017 Outlook

Management reaffirmed its full-year EPS guidance of $4.90–$5.08; consensus is $5.00. As previously disclosed, the company no longer expects any material accretion from Rite Aid in fiscal 2017.