Source: Company reports/Fung Global Retail & Technology

Fiscal 3Q17 Results

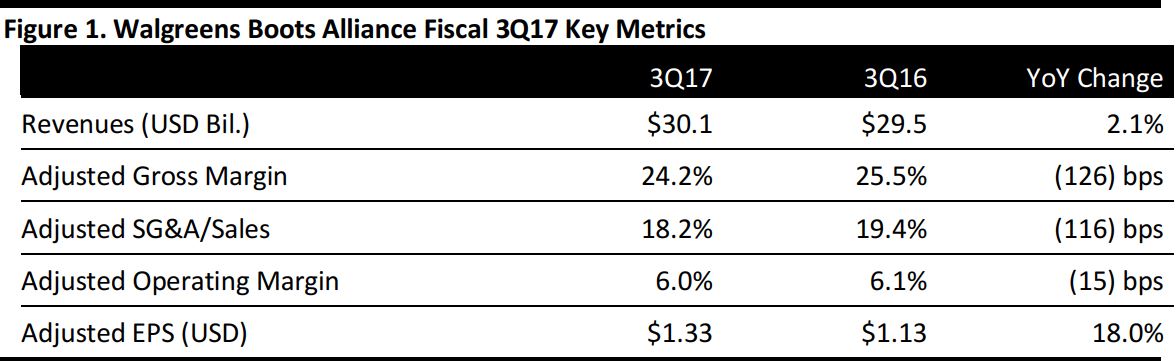

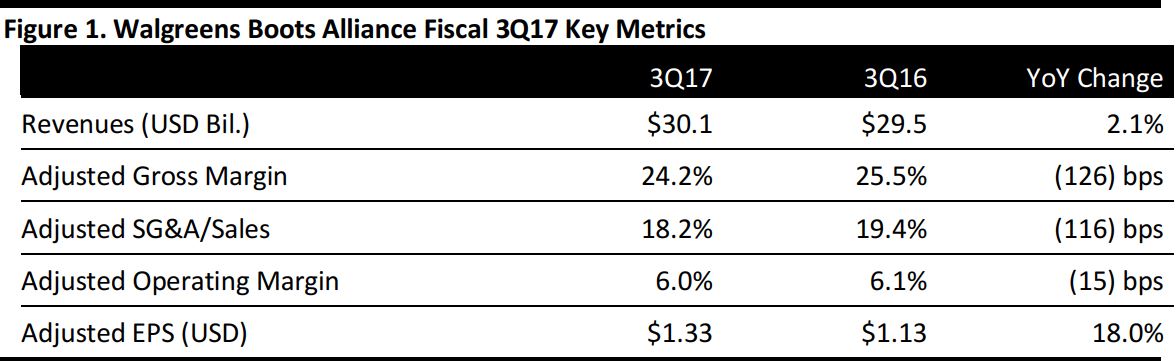

Walgreens Boots Alliance reported fiscal 3Q17 revenues of $30.1 billion, up 2.1% year over year and above the $29.7 billion consensus estimate. Total sales increased by 5.0% year over year on a constant-currency basis.

Adjusted EPS was $1.33, beating the $1.30 the consensus estimate. Adjusted EPS excludes expenses for a cost transformation, amortization, a LIFO provision, equity earnings in AmerisourceBergen, acquisition-related costs, asset impairment and other items. GAAP EPS was $1.07, compared with $1.01 a year ago.

Management commented that quarterly results met expectations, as strategic partnerships brought more patients to US pharmacies, leading the company to the highest reported quarterly retail prescription market share in the US. Moreover, the company’s ongoing cost transformation program continues to bear fruit.

Additional Details from the Quarter

- Retail Pharmacy: Sales were $22.5 billion, up 6.3% year over year. Comps increased by 3.7%.

- Pharmacy sales accounted for 69.9% of the division’s sales in the quarter and increased by 10.3% year over year, primarily due to higher prescription Comps increased by 5.8%, primarily due to higher volumes. The division filled an adjusted 255.2 million prescriptions in the quarter, up 8.5% year over year. IMS Health reported that the company’s retail prescription market share increased by approximately 110 basis points over the year-ago quarter, to 20.5%, the division’s highest reported US quarterly retail prescription market share.

- Retail sales, including the impact of the previously announced closure of certain e-commerce operations, decreased by 1.8% year over year in the quarter. Comps decreased by 0.4% in the quarter, with declines in consumables in the personal care category partially offset by growth in health and wellness and in beauty.

- Retail Pharmacy International: Sales were $2.8 billion, down 10.3% year over year mainly due to currency translation. Sales decreased by 0.2% on a constant-currency basis. Pharmacy comps decreased by 0.1% on a constant-currency basis, and retail comps increased by 0.4% on a constant-currency basis.

- Pharmaceutical Wholesale: Sales were $5.3 billion, down 7.9% year over year mainly due to currency translation. Comps increased by 3.7% on a constant-currency basis, with growth in emerging markets and the UK partially offset by challenging market conditions in continental Europe.

Changes to Rite Aid Acquisition Agreement

Walgreens Boots Alliance also announced a new definitive agreement with Rite Aid, terminating the prior acquisition agreement as well as the agreement to divest certain Rite Aid stores to Fred’s.

Under the new agreement, Walgreens Boots Alliance will purchase 2,186 stores, three distribution centers and related inventory from Rite Aid for $5.175 billion in cash, plus the assumption of related real estate leases and certain liabilities and the grant of an option to Rite Aid, exercisable through May 2019. The new transaction is expected to close within the next six months.

Raises Guidance

The company also raised the lower end of its FY17 guidance by $0.08 per share and now expects adjusted EPS of $4.98–$5.08, assuming current exchange rates for the rest of the fiscal year.