Web Developers

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Fiscal 2Q18 Results

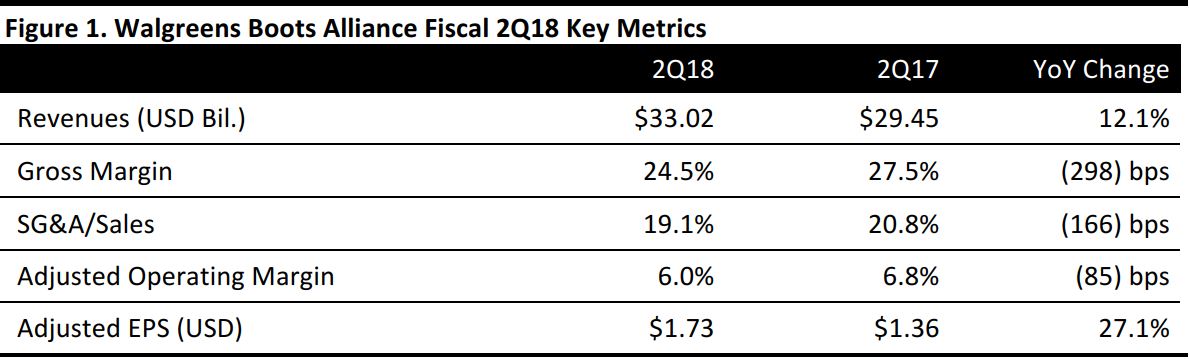

Walgreens Boots Alliance reported fiscal 2Q18 revenues of $33.02 billion, up 12.1% year over year and beating the consensus estimate of $32.20 billion. Adjusted EPS was $1.73, handily beating the $1.55 consensus estimate and up 27.1% year over year. GAAP EPS was $1.36, compared with $0.98 in the year-ago quarter.Details from the Quarter

- Walgreens has been investing considerably in its systems and has spent more than $500 million to date on building, testing and implementing new systems. In the next three years, the company plans to invest more than $500 million in transforming its business, which should generate further cost savings and efficiencies.

- The company is now running its Balance Rewards program as a data and customer insight tool as well as a marketing program. The program now has 88.6 million active users. Walgreens is still working to simplify the program, but the company now has nearly three years of excellent customer data and is updating other core retail systems to obtain a full suite of data that will enable it to better manage its business and provide a platform for future growth.

Pharmacy

- In the Pharmacy business, one of the top priorities has been to grow volume.

- In the quarter, prescription volumes grew and the company’s market share increased by 21.4%, a new record.

- Over the past three years, the company has grown market share by more than 200 basis points.

- Specialty growth can be seen in the quarterly performance, as Walgreens has continued to develop its AllianceRx partnership with Prime Therapeutics and has extended the number of community specialty pharmacies it operates to 23.

Retail Business

- Over the last three years, Walgreens has focused on driving profitable growth, and it has improved its adjusted gross margin by more than 300 basis points over the period. The company has seen progress through a combination of solid retail management in terms of focusing promotions and rigorous financial discipline.

- Through changes in merchandising and product mix, Walgreens has furthered its strategy of differentiation and increased penetration of owned brands while significantly improving margins.

- The company’s beauty rollout, in partnership with suppliers, was extended to around 2,900 stores, and Walgreens added more beauty brands, including more of its own. The company is improving employees’ skills and training to support these efforts. Following the completion of the rollout in the quarter, beauty differentiation stores outperformed non–beauty differentiation stores. This accounted for a margin differential of around two percentage points. Management intends to continue this initiative and add the beauty offering to more stores as well as add more categories.

- New store formats will bring together areas such as optical, hearing care and lab, and allow Walgreens to further test value, loyalty and supply chain initiatives. The company plans to launch pilot stores in the coming months. The new formats will provide a platform from which the company can deliver services, retail offerings and accessible healthcare in the future. The pilot stores will also provide a platform for existing initiatives such as the company’s strategic partnership with FedEx, whose services are available in almost all Walgreens and Duane Reade stores.

- The acquisition of Rite Aid has been completed, enabling Walgreens to accelerate the development of its network during this transitional phase. Management has commented that the acquisition will not improve earnings this fiscal year.

- In terms of the company’s digital strategy, the Walgreens app has been downloaded 50.6 million times and has a five-star customer rating on the US Apple App Store. During the quarter, approximately 21% of Walgreens’ retail refill scripts were initiated through digital channels, up almost three percentage points year over year.