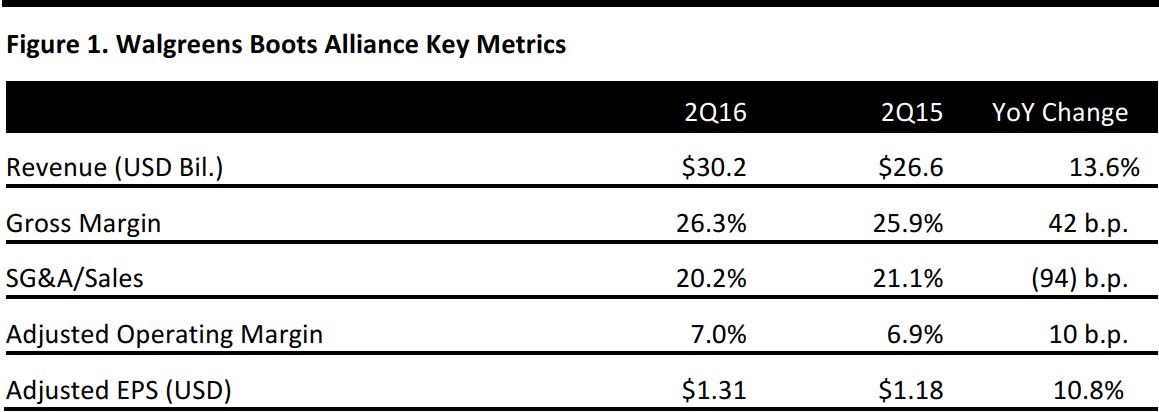

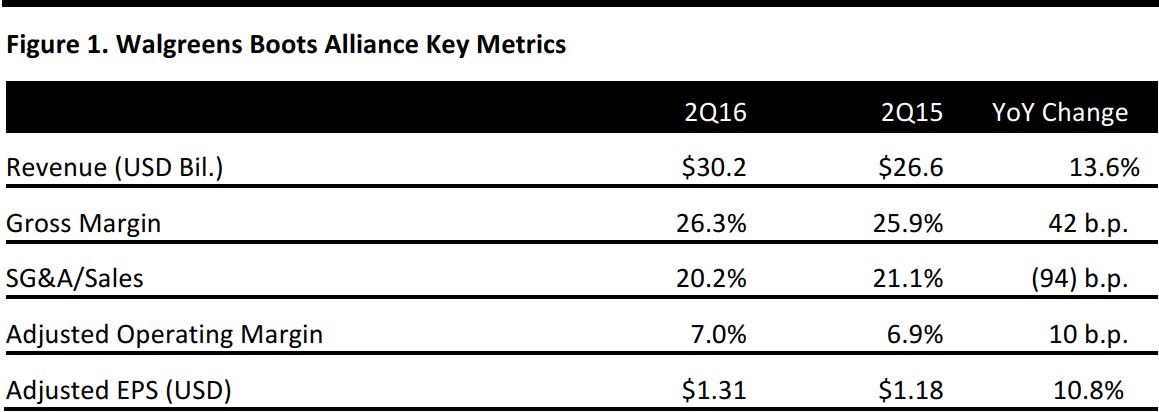

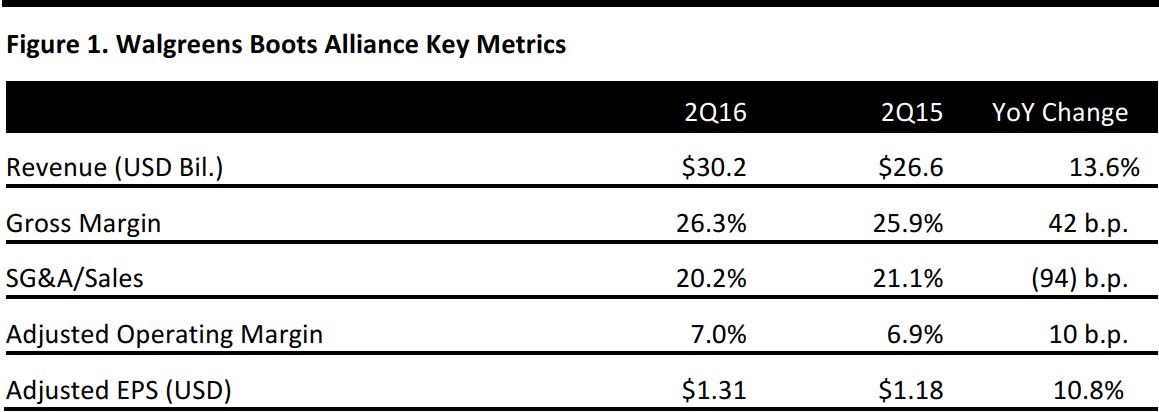

Source: Company reports

FISCAL 2Q16 Results

Walgreens Boots Alliance reported fiscal 2Q16 revenues of $30.2 billion, up 13.6% from the year-ago period and slightly below the consensus estimate of $30.7 billion.

The company reported quarterly total US comp growth of 2.2%, which was driven by a 0.3% increase from the retail side and a 3.7% increase from the pharmacy business. Walgreens’ pharmacy division currently accounts for 65% of its US business. The division filled 233 million prescriptions during the quarter, up 3.9% year over year. On the other hand, a weak flu season had a negative impact of 30 basis points on the business. Divisions that performed strongly included giftable items, wellness products and the company’s product brands, such as No7.

In geographic terms, the company’s international business reported comp growth of 2.3% and revenue of $3.7 billion, slightly above the consensus estimate of $3.5 billion. Growth in the international pharmacy division was led by strong performance in the UK and Ireland.

Fiscal 1H16 Results

Net sales were $59.2 billion for first half of fiscal year 2016, up 28.2% from the year-ago period, largely due to the inclusion of Alliance Boots in the total business. The company’s proposed acquisition of Rite Aid (RAD) is expected to close in the second half of calendar 2016.

Guidance

The company raised the lower end of its full-year EPS guidance range by five cents, and is now guiding for EPS of $4.35–$4.55. This narrowed range assumes that the timing of equity income from AmerisourceBergen (ABDC) will lag by two months, that there will be no material accretion from the agreement to acquire Rite Aid and that there will be no significant change in current exchange rates.