DIpil Das

[caption id="attachment_92005" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

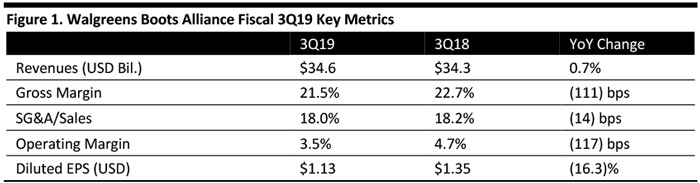

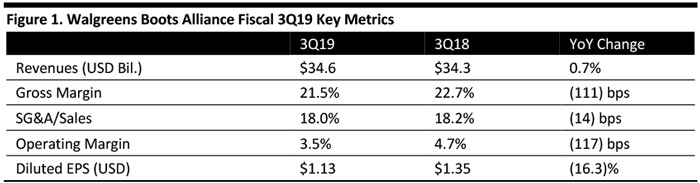

Walgreens Boots Alliance reported 3Q19 revenues of $34.6 billion, up 0.7% year over year as reported and up 2.9% year over year at constant currency. Revenues were in line with the consensus estimate reported by S&P Capital IQ. Growth in the Retail Pharmacy USA and Pharmaceutical Wholesale divisions drove performance.

The operating margin declined 117 basis points, reflecting a 24.7% fall in operating income, due to costs relating to implementing its three-year cost-management program launched in December 2018 and a lower contribution from AmerisourceBergen’s equity earnings. Walgreens has a 10-year supply chain deal with AmerisourceBergen, a drug wholesale firm.

Adjusted operating income declined 10.4% at constant currency, primarily due to a slow performance at Boots UK and lower pharmacy margins and retail sales in the US.

Diluted EPS was $1.13, down 16.3% year over year and below the consensus estimate of $1.19.

CEO Stefano Pessina remarked that performance in the third quarter had “been brought in line with (the company’s) expectations” after “what was a very disappointing second quarter.”

Performance by Business Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Walgreens Boots Alliance reported 3Q19 revenues of $34.6 billion, up 0.7% year over year as reported and up 2.9% year over year at constant currency. Revenues were in line with the consensus estimate reported by S&P Capital IQ. Growth in the Retail Pharmacy USA and Pharmaceutical Wholesale divisions drove performance.

The operating margin declined 117 basis points, reflecting a 24.7% fall in operating income, due to costs relating to implementing its three-year cost-management program launched in December 2018 and a lower contribution from AmerisourceBergen’s equity earnings. Walgreens has a 10-year supply chain deal with AmerisourceBergen, a drug wholesale firm.

Adjusted operating income declined 10.4% at constant currency, primarily due to a slow performance at Boots UK and lower pharmacy margins and retail sales in the US.

Diluted EPS was $1.13, down 16.3% year over year and below the consensus estimate of $1.19.

CEO Stefano Pessina remarked that performance in the third quarter had “been brought in line with (the company’s) expectations” after “what was a very disappointing second quarter.”

Performance by Business Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Walgreens Boots Alliance reported 3Q19 revenues of $34.6 billion, up 0.7% year over year as reported and up 2.9% year over year at constant currency. Revenues were in line with the consensus estimate reported by S&P Capital IQ. Growth in the Retail Pharmacy USA and Pharmaceutical Wholesale divisions drove performance.

The operating margin declined 117 basis points, reflecting a 24.7% fall in operating income, due to costs relating to implementing its three-year cost-management program launched in December 2018 and a lower contribution from AmerisourceBergen’s equity earnings. Walgreens has a 10-year supply chain deal with AmerisourceBergen, a drug wholesale firm.

Adjusted operating income declined 10.4% at constant currency, primarily due to a slow performance at Boots UK and lower pharmacy margins and retail sales in the US.

Diluted EPS was $1.13, down 16.3% year over year and below the consensus estimate of $1.19.

CEO Stefano Pessina remarked that performance in the third quarter had “been brought in line with (the company’s) expectations” after “what was a very disappointing second quarter.”

Performance by Business Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

Walgreens Boots Alliance reported 3Q19 revenues of $34.6 billion, up 0.7% year over year as reported and up 2.9% year over year at constant currency. Revenues were in line with the consensus estimate reported by S&P Capital IQ. Growth in the Retail Pharmacy USA and Pharmaceutical Wholesale divisions drove performance.

The operating margin declined 117 basis points, reflecting a 24.7% fall in operating income, due to costs relating to implementing its three-year cost-management program launched in December 2018 and a lower contribution from AmerisourceBergen’s equity earnings. Walgreens has a 10-year supply chain deal with AmerisourceBergen, a drug wholesale firm.

Adjusted operating income declined 10.4% at constant currency, primarily due to a slow performance at Boots UK and lower pharmacy margins and retail sales in the US.

Diluted EPS was $1.13, down 16.3% year over year and below the consensus estimate of $1.19.

CEO Stefano Pessina remarked that performance in the third quarter had “been brought in line with (the company’s) expectations” after “what was a very disappointing second quarter.”

Performance by Business Segment

- Retail Pharmacy USA: Sales increased 2.3% in the quarter, and, excluding the impact of store optimization after acquiring Rite Aid stores, organic growth was 2.9%. Pharmacy sales, which accounted for 73.9% of the segment’s sales in the quarter, grew 4.3% year over year, reflecting strong growth in the central specialty pharmacy business (which focuses on specialty medication, patient engagement and care), and increased brand inflation and prescription volume. Comparable retail sales fell 1.1% mainly due to a continued de-emphasis on tobacco.

- Retail Pharmacy International: Total sales decreased 1.6% at constant currency, mainly due to a 1.0% decline in sales at Boots UK. In the UK, comparable pharmacy sales grew 0.8% and comparable retail sales fell 2.6% with the company stating that Boots UK broadly gained retail market share amid weakness in some categories.

- Pharmaceutical Wholesale: Sales in this segment rose 8.3% at constant currency, driven by growth in emerging markets.