Nitheesh NH

[caption id="attachment_82645" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

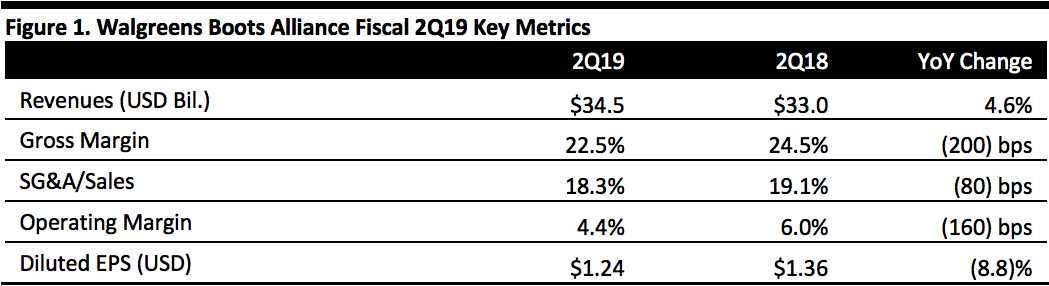

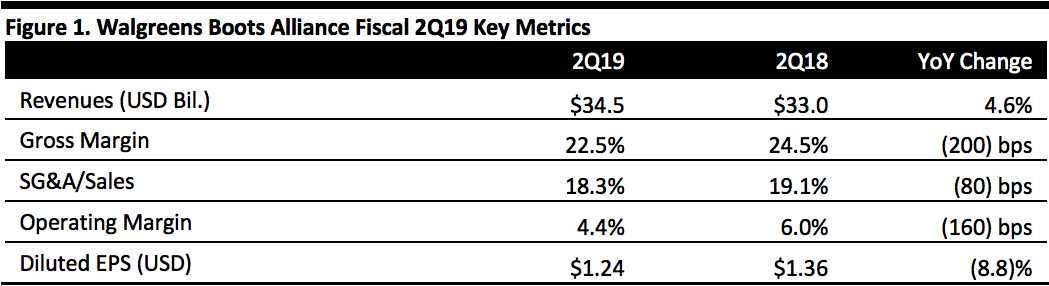

Fiscal 2Q19 Results

Walgreens Boots Alliance reported 2Q19 revenues of $34.5 billion, in line with the consensus estimate and up 4.6% as reported and up 6.7% at constant currency, year over . The gross margin fell 200 basis points mostly due to increased reimbursement pressure.

The operating margin declined 160 basis points, reflecting a 23% decline in operating income partly due to restructuring charges and an adjustment related to tax law changes in drug wholesale firm AmerisourceBergen with which Walgreens has a ten-year supply chain deal. Adjusted operating income fell 9.3% on a constant-currency basis, primarily due to a weak quarter in the Retail Pharmacy USA division.

Diluted EPS came in $1.24, down 8.8% year over year and below the consensus estimate of $1.50 recorded by S&P Capital IQ.

Details from the Quarter

Walgreens noted that there were “accelerated market challenges” during the quarter. Though Walgreens has been preparing for these challenges, they impacted performance significantly more quickly than expected, the company said. The key challenges were a combination of:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Walgreens Boots Alliance reported 2Q19 revenues of $34.5 billion, in line with the consensus estimate and up 4.6% as reported and up 6.7% at constant currency, year over . The gross margin fell 200 basis points mostly due to increased reimbursement pressure.

The operating margin declined 160 basis points, reflecting a 23% decline in operating income partly due to restructuring charges and an adjustment related to tax law changes in drug wholesale firm AmerisourceBergen with which Walgreens has a ten-year supply chain deal. Adjusted operating income fell 9.3% on a constant-currency basis, primarily due to a weak quarter in the Retail Pharmacy USA division.

Diluted EPS came in $1.24, down 8.8% year over year and below the consensus estimate of $1.50 recorded by S&P Capital IQ.

Details from the Quarter

Walgreens noted that there were “accelerated market challenges” during the quarter. Though Walgreens has been preparing for these challenges, they impacted performance significantly more quickly than expected, the company said. The key challenges were a combination of:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Walgreens Boots Alliance reported 2Q19 revenues of $34.5 billion, in line with the consensus estimate and up 4.6% as reported and up 6.7% at constant currency, year over . The gross margin fell 200 basis points mostly due to increased reimbursement pressure.

The operating margin declined 160 basis points, reflecting a 23% decline in operating income partly due to restructuring charges and an adjustment related to tax law changes in drug wholesale firm AmerisourceBergen with which Walgreens has a ten-year supply chain deal. Adjusted operating income fell 9.3% on a constant-currency basis, primarily due to a weak quarter in the Retail Pharmacy USA division.

Diluted EPS came in $1.24, down 8.8% year over year and below the consensus estimate of $1.50 recorded by S&P Capital IQ.

Details from the Quarter

Walgreens noted that there were “accelerated market challenges” during the quarter. Though Walgreens has been preparing for these challenges, they impacted performance significantly more quickly than expected, the company said. The key challenges were a combination of:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Walgreens Boots Alliance reported 2Q19 revenues of $34.5 billion, in line with the consensus estimate and up 4.6% as reported and up 6.7% at constant currency, year over . The gross margin fell 200 basis points mostly due to increased reimbursement pressure.

The operating margin declined 160 basis points, reflecting a 23% decline in operating income partly due to restructuring charges and an adjustment related to tax law changes in drug wholesale firm AmerisourceBergen with which Walgreens has a ten-year supply chain deal. Adjusted operating income fell 9.3% on a constant-currency basis, primarily due to a weak quarter in the Retail Pharmacy USA division.

Diluted EPS came in $1.24, down 8.8% year over year and below the consensus estimate of $1.50 recorded by S&P Capital IQ.

Details from the Quarter

Walgreens noted that there were “accelerated market challenges” during the quarter. Though Walgreens has been preparing for these challenges, they impacted performance significantly more quickly than expected, the company said. The key challenges were a combination of:

- Increased reimbursement pressure;

- generic deflation;

- Lower brand inflation; and

- Lower-than-expected benefits from investments in store and retail offerings.

- Retail Pharmacy USA: Sales increased 7.3% in the quarter. Pharmacy sales, which accounted for 71.9% of the segment’s sales in the quarter, grew 9.8% year over year, driven by increased prescription volumes from the acquisition of Rite Aid stores and strong growth in the pharmacy business which focuses on specialty medication, patient engagement and care. Comparable retail sales fell 3.8% mainly due to a weak flu season compared to 2Q18 and a continued de-emphasis on some products such as tobacco.

- Retail Pharmacy International: At constant currency, comparable sales fell 1.4% and total sales decreased 1.2% at constant currency, primarily due to a 1.3% decline in sales at Boots UK. The company said has taken decisive steps to reduce costs in the UK during the quarter and since the quarter ended, and is reviewing the store portfolio in the region with a focus on low-performing stores and identifying opportunities for consolidation.

- Pharmaceutical Wholesale: Sales in this segment rose 9.1% at constant currency, driven by growth in the emerging markets and the UK.